The emergence of advanced technologies is not only reshaping the finance industry but is also making it vulnerable to severe financial threats such as identity theft, cyber stalling, card skimming, and phishing. In addition, the younger generation of investors is showing proclivity for digital or cashless transactions, and this is pressing financial institutions even more to arm themselves with efficient financial crime and fraud management solutions.

FinTech breakthroughs, while they facilitate online financial transactions, are indicating an upsurge in the adoption of next-generation technologies, including artificial intelligence, data science, and machine learning, to fight financial crime and frauds. This is laying the groundwork for innovations in the financial risk management landscape, creating immense sales potential for financial crime and fraud management solutions in today’s finance industry.

Transparency Market Research’s (TMR) recent study sheds light on the developments in financial crime and fraud management solutions, and how technology is becoming the biggest catalyst for market players to fetch profits in this landscape. The study can arm decision-makers with value-based insights to meet the dynamic needs of various end users, and eventually upscale their position in this highly-competitive market space.

Financial institutions, including banks, have always been reeling under the pressure of regulations and security concerns. However, in the Information Age, sophisticated fraudsters have found new ways of attacking banking systems with technologically-advanced tools. Financial institutions, today, are under tremendous pressure to accelerate digital transformation and combat financial crimes and frauds, and meet customer demand for immediacy and personalized experience, ultimately to boost business.

As the introduction to digital banking services has created opportunities for fraudsters to digitally attack the finance industry, the demand for more efficient solutions for managing financial frauds and crimes has surged significantly in the past few years. The global market for financial crime and fraud management solutions reached the ~ US$ 1 billion mark in 2018, and is expected to witness healthy growth in the coming decade.

The demand for tech-driven crime and fraud prevention solutions is increasing exponentially across the finance industry. However, financial service providers are struggling to achieve both, efficiency and effectiveness in their financial crime and fraud management frameworks, failing to sync with the rise in demand.

In addition, introducing a fraud management solution that can be compatible with the traditional banking system, while limiting the production cost, is one of the biggest challenges for financial crime and fraud management solution firms. Furthermore, the constantly changing regulatory environment and tightening rules in the finance industry are likely to make it more challenging for financial risk management companies to launch a solution that updates with changing legislation around the world.

Loss of customer trust can be costly, especially in the finance industry, and the convergence of technology with the industry is amplifying the need for a reliable and efficient financial crime and fraud management solution among financial institutions. Traditional banking organizations as well as specialty finance bodies are making a rapid shift from conventional financial risk management protocols to advanced fraud management technologies.

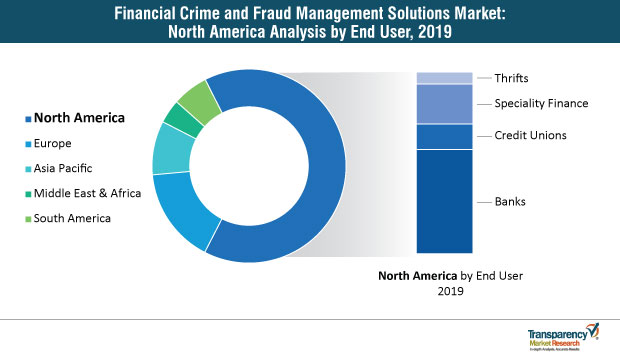

As the customer is at the forefront of banks’ business policies, increasing concerns of customers about secure banking, especially with mobile or Internet banking, are triggering banks to adopt robust fraud detection and prevention solutions. In 2018, banks accounted for ~ 60% revenue share of the global financial crime and fraud management solutions market. Stakeholders in the market are targeting banking institutions to offer their state-of-the-art financial fraud management services tailored to the requirements of the banking sector.

In addition, the rise of financing activities in the specialty finance sector is expected to create new opportunities for financial crime and fraud management solution companies in this category. In the coming years, market leaders are likely to expand their presence beyond the traditional customer base of conventional banking institutions, and tap into the sales potential in specialty finance businesses.

With the intensifying competition in the financial crime and fraud management space, market players are introducing more efficient solutions for the earlier detection and prevention of multichannel and complex frauds. In addition, reducing reputational risk while improving customer protection capabilities with more effective risk management frameworks is expected to remain the top priority for stakeholders in this landscape.

Market players are more inclined towards implementing Robotics Process Automation (RPA) techniques to replace time-consuming and expensive processes in the traditional fraud detection and prevention fundamentals of the finance industry. With the increasing prevalence of machine learning, Artificial Neural Networks (ANN), and Natural Language Processing (NPL), RPA is expected to reach its renaissance in the financial crime and fraud management solutions market with real-time fraud detection and prevention capabilities.

Stakeholders are also increasing their focus on ensuring regulatory and internal policy compliance while implementing state-of-the-art RPA tools in financial fraud management solutions. In order to remain ahead of the competition, market leaders are achieving expertise at balancing the RPA features with compliance with anti-fraud laws and regulations, such as the Foreign Corrupt Practices Act (FCPA) and Foreign Account Tax Compliance Act (FACTA), in financial crime and fraud management solutions.

Leading finance service providers such as IBM Corporation, Capgemini SE, Oracle Corporation, and Fiserv, Inc., hold one-third revenue share, and their leading competitors, including SAS Institute, Inc., ACI Worldwide, Fidelity National Information Services, Inc. (FIS), and Dell EMC, account for close to half the revenue share in the market. Frontrunners have maintained their stronghold in the landscape with technological expertise and their reach spread worldwide.

Emerging players in the financial crime and fraud management solutions landscape are still struggling to establish a strong position, as high initial outlay in creating a major barrier for entry for start-ups and small businesses. In addition, customers’ loyalty towards solutions by big brands is hampering the growth of new entrants in the financial risk management industry. However, increasing foreign investments in developing countries in Asia Pacific, where large companies have a low presence, is expected to create sales opportunities for emerging players in the coming years.

Analysts’ Viewpoint

Authors of TMR’s study on the financial crime and fraud management solutions market are of the opinion that, the growth of this landscape will mainly depend upon the purchasing capabilities of buyers, and financial service providers’ skill of introducing efficient and effective fraud management solutions.

Though the demand is likely to surge, the high initial installation cost of financial risk management tools is restricting the target customer base for market players. In addition, market players are struggling to offer efficiency, resilience, and a better customer experience while keeping the cost of financial crime and fraud management solutions under a certain limit.

Stakeholders in the financial crime and fraud management solutions market will have to increase the adoption of next-generation technologies such as NPL, ANN, and AI, to automate real-time fraud detection and prevention solutions. Significant investments in research & development will help market players tap into the sales potential for innovative and more efficient fraud management solutions in the coming years.

The report provides in-depth segment analysis of the global financial crime and fraud management solutions market, thereby providing valuable insights at macro as well as micro levels. Analysis of major countries that hold growth opportunities or account for significant shares has also been included as part of the geographic analysis for the financial crime and fraud management solutions market.

The research study includes profiles of the leading companies operating in the global financial crime and fraud management solutions market. Key players profiled in the report include

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modeling

3. Executive Summary: Global Financial Crime and Fraud Management Solutions Market

4. Market Overview

4.1. Introduction

4.2. Global Market - Macro Economic Factors Overview

4.2.1. World GDP Indicator - For Top Economies

4.2.2. Global ICT Spending (US$ Mn), 2013, 2019, 2023 and 2027

4.3. Technology/Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. PESTEL Analysis

4.4.3. Eco System Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers & Restraints

4.5. Regulations and Policies

4.6. Global Financial Crime and Fraud Management Solutions Market Analysis and Forecast, 2017 - 2027

4.6.1. Market Revenue Analysis (US$ Mn)

4.6.1.1. Historic Growth Trends, 2013-2018

4.6.1.2. Forecast Trends, 2019-2027

4.7. Global Financial Crime and Fraud Management Solutions Market Opportunity Assessment

4.7.1. By Component

4.7.2. By End-users

4.7.3. By Region

4.8. Competitive Scenario and Trends

4.8.1. Financial Crime and Fraud Management Solutions Market Concentration Rate

4.8.1.1. List of Emerging, Prominent and Leading Players

4.8.2. Mergers & Acquisitions, Expansions

4.9. Market Outlook

5. Global Financial Crime and Fraud Management Solutions Market Analysis and Forecast, by Component

5.1. Overview and Definitions

5.2. Key Segment Analysis

5.3. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

5.3.1. Hardware

5.3.2. Software

5.3.3. Services

6. Global Financial Crime and Fraud Management Solutions Market Analysis and Forecast, by End-user

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by End-user, 2017 - 2027

6.3.1. Banks

6.3.2. Credit Unions

6.3.3. Specialty Finance

6.3.4. Thrifts

7. Global Financial Crime and Fraud Management Solutions Market Analysis and Forecast, by Region

7.1. Overview

7.2. Key Segment Analysis

7.3. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East & Africa

7.3.5. South America

8. North America Financial Crime and Fraud Management Solutions Market Analysis and Forecast

8.1. Key Findings

8.2. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

8.2.1. Hardware

8.2.2. Software

8.2.3. Services

8.3. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by End-user, 2017 - 2027

8.3.1. Banks

8.3.2. Credit Unions

8.3.3. Specialty Finance

8.3.4. Thrifts

8.4. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

8.4.1. U.S.

8.4.2. Canada

8.4.3. Rest of North America

9. Europe Financial Crime and Fraud Management Solutions Market Analysis and Forecast

9.1. Key Findings

9.2. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

9.2.1. Hardware

9.2.2. Software

9.2.3. Services

9.3. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by End-user, 2017 - 2027

9.3.1. Banks

9.3.2. Credit Unions

9.3.3. Specialty Finance

9.3.4. Thrifts

9.4. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Country& Sub-region, 2017 - 2027

9.4.1. Germany

9.4.2. France

9.4.3. U.K.

9.4.4. Rest of Europe

10. Asia Pacific Financial Crime and Fraud Management Solutions Market Analysis and Forecast

10.1. Key Findings

10.2. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

10.2.1. Hardware

10.2.2. Software

10.2.3. Services

10.3. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by End-user, 2017 - 2027

10.3.1. Banks

10.3.2. Credit Unions

10.3.3. Specialty Finance

10.3.4. Thrifts

10.4. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Country& Sub-region, 2017 - 2027

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. Rest of Asia Pacific

11. Middle East & Africa (MEA) Financial Crime and Fraud Management Solutions Market Analysis and Forecast

11.1. Key Findings

11.2. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

11.2.1. Hardware

11.2.2. Software

11.2.3. Services

11.3. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by End-user, 2017 - 2027

11.3.1. Banks

11.3.2. Credit Unions

11.3.3. Specialty Finance

11.3.4. Thrifts

11.4. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

11.4.1. GCC

11.4.2. South Africa

11.4.3. Rest of MEA

12. South America Financial Crime and Fraud Management Solutions Market Analysis and Forecast

12.1. Key Findings

12.2. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

12.2.1. Hardware

12.2.2. Software

12.2.3. Services

12.3. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by End-user, 2017 - 2027

12.3.1. Banks

12.3.2. Credit Unions

12.3.3. Specialty Finance

12.3.4. Thrifts

12.4. Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2017 - 2027

12.4.1. Brazil

12.4.2. Rest of South America

13. Competition Landscape

13.1. Market Player – Competition Matrix

13.2. Market Revenue Share Analysis (%), by Company (2018)

14. Company Profiles (Details – Business Overview, Geographical Presence, Revenue, Business Strategies)

14.1. Dell EMC

14.1.1. Business Overview

14.1.2. Geographical Presence

14.1.3. Revenue

14.1.4. Business Strategies

14.2. ACI Worldwide

14.2.1. Business Overview

14.2.2. Geographical Presence

14.2.3. Revenue

14.2.4. Business Strategies

14.3. Experian Information Solutions, Inc.

14.3.1. Business Overview

14.3.2. Geographical Presence

14.3.3. Revenue

14.3.4. Business Strategies

14.4. Oracle Corporation

14.4.1. Business Overview

14.4.2. Geographical Presence

14.4.3. Revenue

14.4.4. Business Strategies

14.5. Fiserv, Inc.

14.5.1. Business Overview

14.5.2. Geographical Presence

14.5.3. Revenue

14.5.4. Business Strategies

14.6. SAS Institute

14.6.1. Business Overview

14.6.2. Geographical Presence

14.6.3. Revenue

14.6.4. Business Strategies

14.7. Capgemini SE

14.7.1. Business Overview

14.7.2. Geographical Presence

14.7.3. Revenue

14.7.4. Business Strategies

14.8. Polaris FT.

14.8.1. Business Overview

14.8.2. Geographical Presence

14.8.3. Revenue

14.8.4. Business Strategies

14.9. NICE Ltd.

14.9.1. Business Overview

14.9.2. Geographical Presence

14.9.3. Revenue

14.9.4. Business Strategies

14.10. IBM Corporation

14.10.1. Business Overview

14.10.2. Geographical Presence

14.10.3. Revenue

14.10.4. Business Strategies

15. Key Takeaways

List of Tables

Table 1: North America ICT Spending (US$ Mn)

Table 2: Europe ICT Spending (US$ Mn)

Table 3: Asia Pacific ICT Spending (US$ Mn)

Table 4: MEA ICT Spending (US$ Mn)

Table 5: South America ICT Spending (US$ Mn)

Table 6: Global Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 7: Global Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Hardware, 2017 - 2027

Table 8: Global Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Software, 2017 - 2027

Table 9: Global Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Services, 2017 - 2027

Table 10: Global Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by End-user, 2017 - 2027

Table 11: Global Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Bank, 2017 - 2027

Table 12: Global Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Credit Unions, 2017 - 2027

Table 13: Global Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Specialty Finance, 2017 - 2027

Table 14: Global Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Thrifts, 2017 - 2027

Table 15: Global Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Region, 2017 - 2027

Table 16: North America Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 17: North America Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Hardware, 2017 - 2027

Table 18: North America Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Software, 2017 - 2027

Table 19: North America Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Services, 2017 - 2027

Table 20: North America Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by End-user, 2017 - 2027

Table 21: North America Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Bank, 2017 - 2027

Table 22: North America Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Credit Union, 2017 - 2027

Table 23: North America Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Specialty Finance, 2017 - 2027

Table 24: North America Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Thrifts, 2017 - 2027

Table 25: North America Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 - 2027

Table 26: Europe Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 27: Europe Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Hardware, 2017 - 2027

Table 28: Europe Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Software, 2017 - 2027

Table 29: Europe Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Services, 2017 - 2027

Table 30: Europe Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by End-user, 2017 - 2027

Table 31: Europe Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Bank, 2017 - 2027

Table 32: Europe Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Credit Unions, 2017 - 2027

Table 33: Europe Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Specialty Finance, 2017 - 2027

Table 34: Europe Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Thrifts, 2017 – 2027

Table 35: Europe Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Country, 2017 – 2027

Table 36: Asia Pacific Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, 2017 - 2027

Table 37: Asia Pacific Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Hardware, 2017 - 2027

Table 38: Asia Pacific Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Software, 2017 - 2027

Table 39: Asia Pacific Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by Component, Services, 2017 - 2027

Table 40: Asia Pacific Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, by End-user, 2017 - 2027

Table 41: Asia Pacific Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Bank, 2017 - 2027

Table 42: Asia Pacific Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Credit Unions, 2017 - 2027

Table 43: Asia Pacific Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Specialty Finance, 2017 - 2027

Table 44: Asia Pacific Financial Crime and Fraud Management Solutions Market Revenue (US$ Mn) Forecast, By End-user, Thrifts, 2017 - 2027

List of Figures

Figure 1: Global Financial Crime and Fraud Management Solutions Market Size (US$ Mn) Forecast, 2017–2027

Figure 2: Global Top 3 Regions, Market Share Analysis, 2017 & 2026 (%)

Figure 3: Global Top 5 Countries – CAGR (2018-2026) Analysis

Figure 4: Global Top 3 End-user Market Share Analysis, 2026

Figure 5: Global Segment market Share Analysis

Figure 6: Global Top 3 Solution Market Share Analysis, 2026

Figure 7: GDP (US$ Bn), Top Economies (2012-2017)

Figure 8: Top Economies GDP Landscape

Figure 9: Gross Domestic Product (GDP) per Capita; Analysis (1/2) (US$ Tn), By Major Countries, 2012-2017

Figure 10: ICT Spending (US$ Mn) Trend

Figure 11: Global Financial Crime and Fraud Management Solutions Market Size (US$ Mn) and Forecast, 2012 – 2026

Figure 12: Global Financial Crime and Fraud Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 13: Global Financial Crime and Fraud Management Solutions Market Attractiveness Analysis, by Component, (2019)

Figure 14: Global Financial Crime and Fraud Management Solutions Market Attractiveness Analysis, by End-user, (2019)

Figure 15: Global Financial Crime and Fraud Management Solutions Market Attractiveness Analysis, by Region, (2019)

Figure 16: Global Financial Crime and Fraud Management Solutions Market Value Share (Value %), by Component, 2019 & 2027

Figure 17: Global Financial Crime and Fraud Management Solutions Market Value Share (Value %), by End-user, 2019 & 2027

Figure 18: Global Financial Crime and Fraud Management Solutions Market Value Share (Value %), by Region, 2019 & 2027

Figure 19: Global Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2019)

Figure 20: Global Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2027)

Figure 21: Global Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2019)

Figure 22: Global Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2027)

Figure 23: Global Financial Crime and Fraud Management Solutions Market Share Analysis, by Region (2019)

Figure 24: Global Financial Crime and Fraud Management Solutions Market Share Analysis, by Region (2027)

Figure 25: North America Financial Crime and Fraud Management Solutions Market Size (US$ Mn) and Forecast, 2017 – 2027

Figure 26: North America Financial Crime and Fraud Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 27: North America Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2019)

Figure 28: North America Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2027)

Figure 29: North America Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2019)

Figure 30: North America Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2027)

Figure 31: North America Financial Crime and Fraud Management Solutions Market Share Analysis, by Country (2019)

Figure 32: North America Financial Crime and Fraud Management Solutions Market Share Analysis, by Country (2027)

Figure 33: Europe Financial Crime and Fraud Management Solutions Market Size (US$ Mn) and Forecast, 2017 – 2027

Figure 34: Europe Financial Crime and Fraud Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 35: Europe Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2019)

Figure 36: Europe Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2027)

Figure 37: Europe Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2019)

Figure 38: Europe Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2027)

Figure 39: Europe Financial Crime and Fraud Management Solutions Market Share Analysis, by Country (2019)

Figure 40: Europe Financial Crime and Fraud Management Solutions Market Share Analysis, by Country (2027)

Figure 41: Asia Pacific Financial Crime and Fraud Management Solutions Market Size (US$ Mn) and Forecast, 2017 – 2027

Figure 42: Asia Pacific Financial Crime and Fraud Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 43: Asia Pacific Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2019)

Figure 44: Asia Pacific Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2027)

Figure 45: Asia Pacific Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2019)

Figure 46: Asia Pacific Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2027)

Figure 47: Asia Pacific Financial Crime and Fraud Management Solutions Market Share Analysis, by Country (2019)

Figure 48: Asia Pacific Financial Crime and Fraud Management Solutions Market Share Analysis, by Country (2027)

Figure 49: Middle East & Africa Financial Crime and Fraud Management Solutions Market Size (US$ Mn) and Forecast, 2017 – 2027

Figure 50: Middle East & Africa Financial Crime and Fraud Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 51: Middle East & Africa Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2019)

Figure 52: Middle East & Africa Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2027)

Figure 53: Middle East & Africa Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2019)

Figure 54: Middle East & Africa Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2027)

Figure 55: Middle East & Africa Financial Crime and Fraud Management Solutions Market Share Analysis, by Country (2019)

Figure 56: Middle East & Africa Financial Crime and Fraud Management Solutions Market Share Analysis, by Country (2027)

Figure 57: South America Financial Crime and Fraud Management Solutions Market Size (US$ Mn) and Forecast, 2017 – 2027

Figure 58: South America Financial Crime and Fraud Management Solutions Market Opportunity Analysis, 2017 – 2027

Figure 59: South America Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2019)

Figure 60: South America Financial Crime and Fraud Management Solutions Market Share Analysis, by Component (2027)

Figure 61: South America Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2019)

Figure 62: South America Financial Crime and Fraud Management Solutions Market Share Analysis, by End-user (2027)

Figure 63: South America Financial Crime and Fraud Management Solutions Market Share Analysis, by Country (2019)

Figure 64: South America Financial Crime and Fraud Management Solutions Market Share Analysis, by Country (2027)