The coronavirus outbreak has affected the global economy, including almost all businesses and end-use industries. The rapidly spreading virus and its negative impact on field service management market have caused major disruption. Manufacturers operating in the field service management market are focusing on recovering from the losses caused by COVID-19 pandemic. Since field service management technologies are showing potential to help various businesses to create revenue streams, there is an increasing demand for field service management software and services globally to cater various sectors such as IT & telecom, healthcare, construction, manufacturing, BFSI, transport, etc. Key companies in the market are overcoming the challenges caused during global pandemic by re-establishing their businesses by adopting innovative solutions. Digitalization, technological advancement in AI, and VR are being increasingly adopted by field service management market players to efficiently track business operations and inventory management.

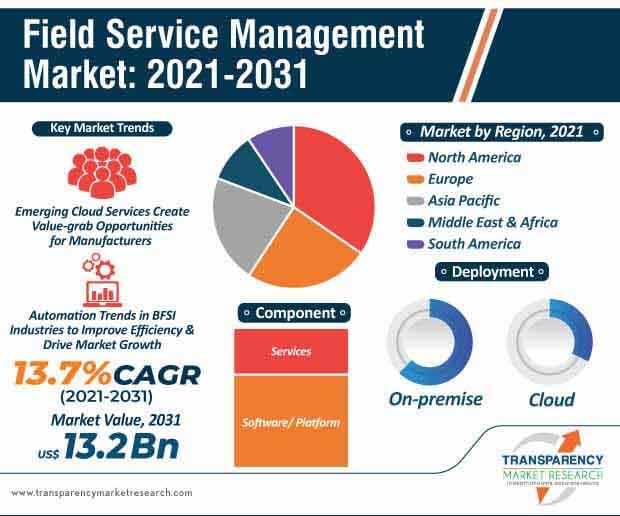

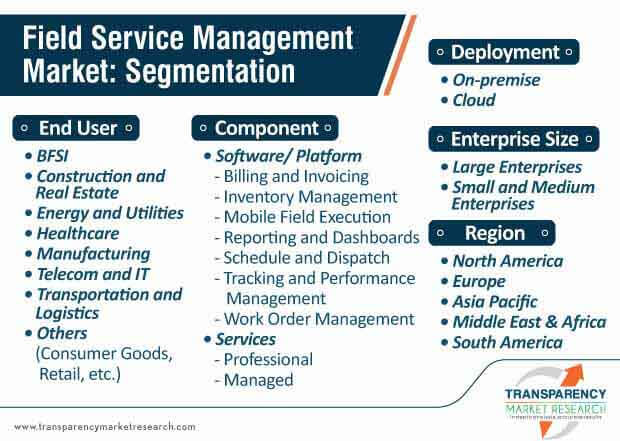

The field service management market is expected to reach US$ 13.2 Bn by 2031. Digitalization and increasing adoption of automation in the field service management market help business leaders to track and monitor workforce, manage inventory, billing records, vehicle tracking, dispatching, and invoicing. It is important for manufacturers to improve customer satisfaction by ensuring quality services and software. There is an increasing demand for field service management software from small and medium scale organization to ensure data security, enhance customer experience by providing remote assistance. The adoption of advanced technologies such as cloud services, AI, and ML creating value-grab opportunities for the manufacturers. The increasing demand and popularity of cloud services across enterprises is projected to boost the global field service management market in the upcoming years.

After the disruption caused by threatening COVID-19 pandemic, businesses are gaining momentum with the help of innovative strategies and sustainable business plans. Market players in the field service management are providing beneficial services and resource management software for the various end-use industries. These software and services ensure productivity of the organization, which has positively influenced the field service management market growth. With the increasing demand of improved efficiency to generate more revenue opportunities, field service management (FIS) market contributors are targeting strategic collaborations and merger & acquisition activities with technology partners to improve their offerings and market reach. The increasing awareness and adoption of field service management services and software is due to simplified workflow automation processes.

Microsoft, IFS AB, ServiceMax, Salesforce, Oracle, and IBM Corporation are some of the key players operating in the global field service management market. The growing competition among these players create profitable opportunities for business. The increasing demand for field service management tools drives the global market in Asia Pacific and North America. Market players are introducing new technologies such as cloud services, artificial intelligence, and augmented reality to stay ahead of the competition by improving business efficiency and productivity with the help of field service management software. Lack of awareness of using advance technologies, along with scarcity of skilled professionals to operate on field service management can hamper the market growth. Market players should focus on improving customer satisfaction by ensuring quality services.

Analysts’ Viewpoint

Field service management services help maximize the operational performance of business in various end-use industries, which, in turn, boost the demand and popularity of these software and services. Advancements in emerging technologies such as AI, ML, and cloud, etc. for improving customer experience drives the global field service management market. Digitalization and technological advancement have created a number of opportunities for market players. Real-time monitoring in the field service management help solve client’s problems efficiently. Technicians can remotely operate machines with the help of smart technologies used in field service management. This offers various organizations to gain better control on field operations remotely, hence used by numerous end-use industries.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 3.3 Bn |

|

Market Forecast Value in 2031 |

US$ 13.2 Bn |

|

Growth Rate (CAGR) |

13.7% |

|

Forecast Period |

2021-2031 |

|

Market Analysis |

It includes market size assessment for the historic period 2016-2019, along with base year and forecast period, in terms of value (US$ Mn). It also provides insights such as regional analysis, opportunity assessment, product development and innovation, and ecosystem analysis, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Field Service Management Market is projected to reach US$ 13.2 Bn by 2031

Key players operating in the global field service management market are Salesforce, IFS AB, Microsoft, Oracle, SAP SE, ServiceMax, IBM Corporation, ServiceNow, ServicePower, and Syncron AB.

The Field Service Management Market is expected to grow at a CAGR of 13.4% during 2021-2031

The growing need to improve efficiency in field service management is anticipated to have a high impact on the growth of the field service management market throughout the forecast period

The Medical Mattress Market is studied from 2021-2031

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global Field Service Management Market

4. Market Overview

4.1. Market Definition

4.2. Market Factor Analysis

4.2.1. Forecast Factors

4.2.2. Ecosystem/ Value Chain Analysis

4.2.3. Market Dynamics (Growth Influencers)

4.2.3.1. Drivers

4.2.3.2. Restraints

4.2.3.3. Opportunities

4.2.3.4. Impact Analysis of Drivers and Restraints

4.3. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East and Africa/ South America)

4.3.1. By Component

4.3.2. By Deployment

4.3.3. By End-user

4.3.4. By Enterprise Size

4.4. Competitive Scenario and Trends

4.4.1. List of Emerging, Prominent and Leading Players

4.4.2. Mergers & Acquisitions, Expansions

4.5. Impact Analysis of COVID-19 on Field Service Management Market

4.5.1. End-user Sentiment Analysis: Comparative Analysis on Spending

4.5.1.1. Increase in Spending

4.5.1.2. Decrease in Spending

4.5.2. Short Term and Long Term Impact on the Market

5. Global Field Service Management Market Analysis and Forecast

5.1.1. Market Revenue Analysis (US$ Mn), 2016-2031

5.1.1.1. Historic Growth Trends, 2016-2020

5.1.1.2. Forecast Trends, 2021-2031

6. Global Field Service Management Market Analysis, by Component

6.1. Key Segment Analysis

6.2. Field Service Management Market Size (US$ Mn) Forecast, by Component, 2018 - 2031

6.2.1. Software/ Platform

6.2.1.1. Billing and Invoicing

6.2.1.2. Inventory Management

6.2.1.3. Mobile Field Execution

6.2.1.4. Reporting and Dashboards

6.2.1.5. Schedule and Dispatch

6.2.1.6. Tracking and Performance Management

6.2.1.7. Work Order Management

6.2.2. Services

6.2.2.1. Professional

6.2.2.1.1. Consulting

6.2.2.1.2. Implementation

6.2.2.1.3. Training & Support

6.2.2.2. Managed

7. Global Field Service Management Market Analysis, by Deployment

7.1. Key Segment Analysis

7.2. Field Service Management Market Size (US$ Mn) Forecast, by Deployment, 2018 - 2031

7.2.1. On-premise

7.2.2. Cloud

8. Global Field Service Management Market Analysis, by End-user

8.1. Key Segment Analysis

8.2. Field Service Management Market Size (US$ Mn) Forecast, by End-user, 2018 - 2031

8.2.1. BFSI

8.2.2. Construction and Real Estate

8.2.3. Energy and Utilities

8.2.4. Healthcare

8.2.5. Manufacturing

8.2.6. Telecom and IT

8.2.7. Transportation and Logistics

8.2.8. Others (Consumer Goods, Retail, etc.)

9. Global Field Service Management Market Analysis, by Enterprise Size

9.1. Key Segment Analysis

9.2. Field Service Management Market Size (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

9.2.1. Small and Medium Enterprises

9.2.2. Large Enterprise

10. Global Field Service Management Market Analysis and Forecast, By Region

10.1. Key Findings

10.2. Field Service Management Market Size (US$ Mn) Forecast, by Region, 2018 - 2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East and Africa

10.2.5. South America

11. North America Field Service Management Market Analysis

11.1. Regional Outlook

11.2. Field Service Management Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

11.2.1. By Component

11.2.2. By Deployment

11.2.3. By End-user

11.2.4. By Enterprise Size

11.3. Field Service Management Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

11.3.1. U.S.

11.3.2. Canada

11.3.3. Mexico

12. Europe Field Service Management Market Analysis and Forecast

12.1. Regional Outlook

12.2. Field Service Management Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

12.2.1. By Component

12.2.2. By Deployment

12.2.3. By End-user

12.2.4. By Enterprise Size

12.3. Field Service Management Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Spain

12.3.5. Italy

12.3.6. Rest of Europe

13. APAC Field Service Management Market Analysis and Forecast

13.1. Regional Outlook

13.2. Field Service Management Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

13.2.1. By Component

13.2.2. By Deployment

13.2.3. By End-user

13.2.4. By Enterprise Size

13.3. Field Service Management Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

13.3.1. China

13.3.2. India

13.3.3. Japan

13.3.4. ASEAN

13.3.5. Rest of Asia Pacific

14. Middle East and Africa (MEA) Field Service Management Market Analysis and Forecast

14.1. Regional Outlook

14.2. Field Service Management Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

14.2.1. By Component

14.2.2. By Deployment

14.2.3. By End-user

14.2.4. By Enterprise Size

14.3. Field Service Management Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

14.3.1. United Arab Emirates

14.3.2. South Africa

14.3.3. Rest of Middle East and Africa (MEA)

15. South America Field Service Management Market Analysis and Forecast

15.1. Regional Outlook

15.2. Field Service Management Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

15.2.1. By Component

15.2.2. By Deployment

15.2.3. By End-user

15.2.4. By Enterprise Size

15.3. Field Service Management Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

15.3.1. Brazil

15.3.2. Argentina

15.3.3. Rest of South America

16. Competition Landscape

16.1. Market Competition Matrix, by Leading Players

16.2. Market Revenue Share Analysis (%), by Leading Players (2020)

17. Company Profiles

17.1. Astea International Inc.

17.1.1. Business Overview

17.1.2. Product Portfolio

17.1.3. Geographical Footprint

17.1.4. Revenue and Strategy

17.2. Axonator

17.2.1. Business Overview

17.2.2. Product Portfolio

17.2.3. Geographical Footprint

17.2.4. Revenue and Strategy

17.3. FieldEZ

17.3.1. Business Overview

17.3.2. Product Portfolio

17.3.3. Geographical Footprint

17.3.4. Revenue and Strategy

17.4. Fieldpoint Service Applications, Inc.

17.4.1. Business Overview

17.4.2. Product Portfolio

17.4.3. Geographical Footprint

17.4.4. Revenue and Strategy

17.5. Google LLC

17.5.1. Business Overview

17.5.2. Product Portfolio

17.5.3. Geographical Footprint

17.5.4. Revenue and Strategy

17.6. IBM Corporation

17.6.1. Business Overview

17.6.2. Product Portfolio

17.6.3. Geographical Footprint

17.6.4. Revenue and Strategy

17.7. IFS AB (Industrial and Financial Systems)

17.7.1. Business Overview

17.7.2. Product Portfolio

17.7.3. Geographical Footprint

17.7.4. Revenue and Strategy

17.8. Microsoft Corporation

17.8.1. Business Overview

17.8.2. Product Portfolio

17.8.3. Geographical Footprint

17.8.4. Revenue and Strategy

17.9. Nexent Innovations Inc.

17.9.1. Business Overview

17.9.2. Product Portfolio

17.9.3. Geographical Footprint

17.9.4. Revenue and Strategy

17.10. Oracle Corporation

17.10.1. Business Overview

17.10.2. Product Portfolio

17.10.3. Geographical Footprint

17.10.4. Revenue and Strategy

17.11. Praxedo

17.11.1. Business Overview

17.11.2. Product Portfolio

17.11.3. Geographical Footprint

17.11.4. Revenue and Strategy

17.12. Retriever Communications Pty Ltd.

17.12.1. Business Overview

17.12.2. Product Portfolio

17.12.3. Geographical Footprint

17.12.4. Revenue and Strategy

17.13. Salesforce.com, Inc.

17.13.1. Business Overview

17.13.2. Product Portfolio

17.13.3. Geographical Footprint

17.13.4. Revenue and Strategy

17.14. SAP SE

17.14.1. Business Overview

17.14.2. Product Portfolio

17.14.3. Geographical Footprint

17.14.4. Revenue and Strategy

17.15. Service Fusion

17.15.1. Business Overview

17.15.2. Product Portfolio

17.15.3. Geographical Footprint

17.15.4. Revenue and Strategy

17.16. ServiceMax, Inc.

17.16.1. Business Overview

17.16.2. Product Portfolio

17.16.3. Geographical Footprint

17.16.4. Revenue and Strategy

17.17. ServicePower, Inc.

17.17.1. Business Overview

17.17.2. Product Portfolio

17.17.3. Geographical Footprint

17.17.4. Revenue and Strategy

17.18. Syncron AB

17.18.1. Business Overview

17.18.2. Product Portfolio

17.18.3. Geographical Footprint

17.18.4. Revenue and Strategy

17.19. The simPRO Group Pty Ltd.

17.19.1. Business Overview

17.19.2. Product Portfolio

17.19.3. Geographical Footprint

17.19.4. Revenue and Strategy

17.20. Zuper Inc.

17.20.1. Business Overview

17.20.2. Product Portfolio

17.20.3. Geographical Footprint

17.20.4. Revenue and Strategy

18. Key Takeaways

List of Tables

Table 1: Acronyms Used

Table 2: North America Field Service Management Market Revenue Analysis, by Country, 2021 - 2031 (US$ Mn)

Table 3: Europe Field Service Management Market Revenue Analysis, by Country, 2021 - 2031 (US$ Mn)

Table 4: Asia Pacific Field Service Management Market Revenue Analysis, by Country, 2021 - 2031 (US$ Mn)

Table 5: Middle East & Africa Field Service Management Market Revenue Analysis, by Country, 2021 and 2031 (US$ Mn)

Table 6: South America Field Service Management Market Revenue Analysis, by Country, 2021 - 2031 (US$ Mn)

Table 7: Impact Analysis of Drivers

Table 8: Mergers & Acquisitions, Expansions, Partnerships, and Developments (1/3)

Table 9: Mergers & Acquisitions, Expansions, Partnerships, and Developments (2/3)

Table 10: Mergers & Acquisitions, Expansions, Partnerships, and Developments (3/3)

Table 11: Global Field Service Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 12: Global Field Service Management Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 13: Global Field Service Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 14: Global Field Service Management Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 15: Global Field Service Management Market Volume (US$ Mn) Forecast, by Region, 2018 – 2031

Table 16: North America Field Service Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 17: North America Field Service Management Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 18: North America Field Service Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 19: North America Field Service Management Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 20: North America Building Information Modelling (BIM) Extraction Software Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 21: U.S. Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 22: Canada Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: Mexico Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: Europe Field Service Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 25: Europe Field Service Management Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 26: Europe Field Service Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 27: Europe Field Service Management Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 28: Europe Field Service Management Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 29: Germany Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: U.K. Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: France Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: Spain Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: Italy Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Asia Pacific Field Service Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 35: Asia Pacific Field Service Management Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 36: Asia Pacific Field Service Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 37: Asia Pacific Field Service Management Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 38: Asia Pacific Field Service Management Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 39: China Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: India Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 41: Japan Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: ASEAN Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: Middle East & Africa Field Service Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 44: Middle East & Africa Field Service Management Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 45: Middle East & Africa Field Service Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 46: Middle East & Africa Field Service Management Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 47: Middle East & Africa Field Service Management Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 48: The United Arab Emirates Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 49: South Africa Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 50: South America Field Service Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 51: South America Field Service Management Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 52: South America Field Service Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 53: South America Field Service Management Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 54: South America Field Service Management Market Revenue (US$ Mn) and Forecast, by Country 2018 – 2030

Table 55: Brazil Emirates Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 56: Argentina Field Service Management Market Revenue CAGR Breakdown (%), by Growth Term

List of Figures

Figure 1: Global Field Service Management Market Size (US$ Mn) Forecast, 2018–2031

Figure 2: Global Field Service Management Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2021E

Figure 3: Top Segment Analysis of Field Service Management Market

Figure 4: Global Field Service Management Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Field Service Management Market Attractiveness Assessment, by Component

Figure 6: Global Field Service Management Market Attractiveness Assessment, by Deployment

Figure 7: Global Field Service Management Market Attractiveness Assessment, by End-user

Figure 8: Global Field Service Management Market Attractiveness Assessment, by Enterprise Size

Figure 9: Global Field Service Management Market Attractiveness Assessment, by Region

Figure 10: Global Field Service Management Market Revenue (US$ Mn) Historic Trends, 2015 - 2020

Figure 11: Global Field Service Management Market Revenue Opportunity (US$ Mn) Historic Trends, 2015 - 2020

Figure 12: Global Field Service Management Market Value Share Analysis, by Component, 2021

Figure 13: Global Field Service Management Market Value Share Analysis, by Component, 2031

Figure 14: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Software, 2021 – 2031

Figure 15: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 16: Global Field Service Management Market Value Share Analysis, by Deployment, 2021

Figure 17: Global Field Service Management Market Value Share Analysis, by Deployment, 2031

Figure 18: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Cloud-based, 2021 – 2031

Figure 19: Global Field Service Management Market Absolute Opportunity (US$ Mn), by On-premise, 2021 – 2031

Figure 20: Global Field Service Management Market Value Share Analysis, by End-user, 2021

Figure 21: Global Field Service Management Market Value Share Analysis, by End-user, 2031

Figure 22: Global Field Service Management Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 23: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Construction and Real Estate, 2021 – 2031

Figure 24: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Energy and Utilities, 2021 – 2031

Figure 25: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 26: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 27: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Telecom and IT, 2021 – 2031

Figure 28: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Transportation and Logistics, 2021 – 2031

Figure 29: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Others (Consumer Goods, Retail, etc.), 2021 – 2031

Figure 30: Global Field Service Management Market Value Share Analysis, by Enterprise Size, 2021

Figure 31: Global Field Service Management Market Value Share Analysis, by Enterprise Size, 2031

Figure 32: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Small and Medium Enterprises, 2021 – 2031

Figure 33: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2021 – 2031

Figure 34: Global Field Service Management Market Opportunity (US$ Mn), by Region

Figure 35: Global Field Service Management Market Opportunity Share (%), by Region, 2021–2031

Figure 36: Global Field Service Management Market Size (US$ Mn), by Region, 2021 & 2031

Figure 37: Global Field Service Management Market Value Share Analysis, by Region, 2021

Figure 38: Global Field Service Management Market Value Share Analysis, by Region, 2031

Figure 39: North America Field Service Management Market Absolute Opportunity (US$ Mn), 2021 – 2031

Figure 40: Europe Field Service Management Market Absolute Opportunity (US$ Mn), 2021 – 2031

Figure 41: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), 2021 – 2031

Figure 42: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), 2021 – 2031

Figure 43: South America Field Service Management Market Absolute Opportunity (US$ Mn), 2021 – 2031

Figure 45: North America Field Service Management Revenue Opportunity Share, by Deployment

Figure 47: North America Field Service Management Revenue Opportunity Share, by Enterprise Size

Figure 44: North America Field Service Management Revenue Opportunity Share, by Component

Figure 46: North America Field Service Management Revenue Opportunity Share, by End-user

Figure 48: North America Field Service Management Revenue Opportunity Share, by Country

Figure 49: North America Field Service Management Market Value Share Analysis, by Component, 2021

Figure 50: North America Field Service Management Market Value Share Analysis, by Component, 2031

Figure 51: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Software, 2021 – 2031

Figure 52: Global Field Service Management Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 53: North America Field Service Management Market Value Share Analysis, by Deployment, 2021

Figure 54: North America Field Service Management Market Value Share Analysis, by Deployment, 2031

Figure 55: North America Field Service Management Market Absolute Opportunity (US$ Mn), by Cloud-based, 2021 – 2031

Figure 56: North America Field Service Management Market Absolute Opportunity (US$ Mn), by On-premise, 2021 – 2031

Figure 57: North America Field Service Management Market Value Share Analysis, by End-user, 2021

Figure 58: North America Field Service Management Market Value Share Analysis, by End-user, 2031

Figure 59: North America Field Service Management Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 60: North America Field Service Management Market Absolute Opportunity (US$ Mn), by Construction and Real Estate, 2021 – 2031

Figure 61: North America Field Service Management Market Absolute Opportunity (US$ Mn), by Energy and Utilities, 2021 – 2031

Figure 62: North America Field Service Management Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 63: North America Field Service Management Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 64: North America Field Service Management Market Absolute Opportunity (US$ Mn), by Telecom and IT, 2021 – 2031

Figure 65: North America Field Service Management Market Absolute Opportunity (US$ Mn), by Transportation and Logistics, 2021 – 2031

Figure 66: North America Field Service Management Market Absolute Opportunity (US$ Mn), by Others (Consumer Goods, Retail, etc.), 2021 – 2031

Figure 67: North America Field Service Management Market Value Share Analysis, by Enterprise Size, 2021

Figure 68: North America Field Service Management Market Value Share Analysis, by Enterprise Size, 2031

Figure 69: North America Field Service Management Market Absolute Opportunity (US$ Mn), by Small and Medium Enterprises, 2021 – 2031

Figure 70: North America Field Service Management Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2021 – 2031

Figure 71: North America Field Service Management Market Value Share Analysis, by Country, 2021

Figure 72: North America Field Service Management Market Value Share Analysis, by Country, 2031

Figure 73: U.S. Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 74: Canada Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 75: Mexico Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 76: Europe Field Service Management Revenue Opportunity Share, by Component

Figure 77: Europe Field Service Management Revenue Opportunity Share, by Deployment

Figure 78: Europe Field Service Management Revenue Opportunity Share, by Industry

Figure 79: Europe Field Service Management Revenue Opportunity Share, by Enterprise Size

Figure 80: Europe Field Service Management Revenue Opportunity Share, by Country

Figure 81: Europe Field Service Management Market Value Share Analysis, by Component, 2021

Figure 82: Europe Field Service Management Market Value Share Analysis, by Component, 2031

Figure 83: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Software, 2021 – 2031

Figure 84: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 85: Europe Field Service Management Market Value Share Analysis, by Deployment, 2021

Figure 86: Europe Field Service Management Market Value Share Analysis, by Deployment, 2031

Figure 87: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Cloud-based, 2021 – 2031

Figure 88: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by On-premise, 2021 – 2031

Figure 89: Europe Field Service Management Market Value Share Analysis, by End-user, 2021

Figure 90: Europe Field Service Management Market Value Share Analysis, by End-user, 2031

Figure 91: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 92: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Construction and Real Estate, 2021 – 2031

Figure 93: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Energy and Utilities, 2021 – 2031

Figure 94: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 95: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 96: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Telecom and IT, 2021 – 2031

Figure 97: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Transportation and Logistics, 2021 – 2031

Figure 98: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Others (Consumer Goods, Retail, etc.), 2021 – 2031

Figure 99: Europe Field Service Management Market Value Share Analysis, by Enterprise Size, 2021

Figure 100: Europe Field Service Management Market Value Share Analysis, by Enterprise Size, 2031

Figure 101: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Small and Medium Enterprises, 2021 – 2031

Figure 102: Europe Field Service Management Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2021 – 2031

Figure 103: Europe Field Service Management Market Value Share Analysis, by Country, 2021

Figure 104: Europe Field Service Management Market Value Share Analysis, by Country, 2031

Figure 105: Germany Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 106: U.K. Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 107: France Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 108: Spain Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 109: Italy Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 110: Asia Pacific Field Service Management Revenue Opportunity Share, by Component

Figure 111: Asia Pacific Field Service Management Revenue Opportunity Share, by Deployment

Figure 112: Asia Pacific Field Service Management Revenue Opportunity Share, by Industry

Figure 113: Asia Pacific Field Service Management Revenue Opportunity Share, by Enterprise Size

Figure 114: Asia Pacific Field Service Management Revenue Opportunity Share, by Country

Figure 115: Asia Pacific Field Service Management Market Value Share Analysis, by Component, 2021

Figure 116: Asia Pacific Field Service Management Market Value Share Analysis, by Component, 2031

Figure 117: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Software, 2021 – 2031

Figure 118: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 119: Asia Pacific Field Service Management Market Value Share Analysis, by Deployment, 2021

Figure 120: Asia Pacific Field Service Management Market Value Share Analysis, by Deployment, 2031

Figure 121: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Cloud-based, 2021 – 2031

Figure 122: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by On-premise, 2021 – 2031

Figure 123: Asia Pacific Field Service Management Market Value Share Analysis, by End-user, 2021

Figure 124: Asia Pacific Field Service Management Market Value Share Analysis, by End-user, 2031

Figure 125: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 126: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Construction and Real Estate, 2021 – 2031

Figure 127: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Energy and Utilities, 2021 – 2031

Figure 128: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 129: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 130: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Telecom and IT, 2021 – 2031

Figure 131: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Transportation and Logistics, 2021 – 2031

Figure 132: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Others (Consumer Goods, Retail, etc.), 2021 – 2031

Figure 133: Asia Pacific Field Service Management Market Value Share Analysis, by Enterprise Size, 2021

Figure 134: Asia Pacific Field Service Management Market Value Share Analysis, by Enterprise Size, 2031

Figure 135: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Small and Medium Enterprises, 2021 – 2031

Figure 136: Asia Pacific Field Service Management Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2021 – 2031

Figure 137: Asia Pacific Field Service Management Market Value Share Analysis, by Country, 2021

Figure 138: Asia Pacific Field Service Management Market Value Share Analysis, by Country, 2031

Figure 139: China Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 140: India Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 141: Japan Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 142: ASEAN Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 144: Asia Pacific Field Service Management Revenue Opportunity Share, by Deployment

Figure 146: Asia Pacific Field Service Management Revenue Opportunity Share, by Enterprise Size

Figure 143: Asia Pacific Field Service Management Revenue Opportunity Share, by Component

Figure 145: Asia Pacific Field Service Management Revenue Opportunity Share, by Industry

Figure 147: Middle East & Africa Field Service Management Revenue Opportunity Share, by Country

Figure 148: Middle East & Africa Field Service Management Market Value Share Analysis, by Component, 2021

Figure 149: Middle East & Africa Field Service Management Market Value Share Analysis, by Component, 2031

Figure 150: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Software, 2021 – 2031

Figure 151: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 152: Middle East & Africa Field Service Management Market Value Share Analysis, by Deployment, 2021

Figure 153: Middle East & Africa Field Service Management Market Value Share Analysis, by Deployment, 2031

Figure 154: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Cloud-based, 2021 – 2031

Figure 155: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by On-premise, 2021 – 2031

Figure 156: Middle East & Africa Field Service Management Market Value Share Analysis, by End-user, 2021

Figure 157: Middle East & Africa Field Service Management Market Value Share Analysis, by End-user, 2031

Figure 158: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 159: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Construction and Real Estate, 2021 – 2031

Figure 160: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Energy and Utilities, 2021 – 2031

Figure 161: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 162: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 163: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Telecom and IT, 2021 – 2031

Figure 164: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Transportation and Logistics, 2021 – 2031

Figure 165: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Others (Consumer Goods, Retail, etc.), 2021 – 2031

Figure 166: Middle East & Africa Field Service Management Market Value Share Analysis, by Enterprise Size, 2021

Figure 167: Middle East & Africa Field Service Management Market Value Share Analysis, by Enterprise Size, 2031

Figure 168: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Small and Medium Enterprises, 2021 – 2031

Figure 169: Middle East & Africa Field Service Management Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2021 – 2031

Figure 170: Middle East & Africa Field Service Management Market Value Share Analysis, by Country, 2021

Figure 171: Middle East & Africa Field Service Management Market Value Share Analysis, by Country, 2031

Figure 172 The United Arab Emirates Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 173: South Africa Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 175: South America Field Service Management Revenue Opportunity Share, by Deployment

Figure 177: South America Service Management Revenue Opportunity Share, by Enterprise Size

Figure 174: South America Field Service Management Revenue Opportunity Share, by Component

Figure 176: South America Field Service Management Revenue Opportunity Share, by Industry

Figure 178: South America Field Service Management Revenue Opportunity Share, by Country

Figure 179: South America Field Service Management Market Value Share Analysis, by Component, 2021

Figure 180: South America Field Service Management Market Value Share Analysis, by Component, 2031

Figure 181: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Software, 2021 – 2031

Figure 182: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 183: South America Field Service Management Market Value Share Analysis, by Deployment, 2021

Figure 184: South America Field Service Management Market Value Share Analysis, by Deployment, 2031

Figure 185: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Cloud-based, 2021 – 2031

Figure 186: South America Field Service Management Market Absolute Opportunity (US$ Mn), by On-premise, 2021 – 2031

Figure 187: South America Field Service Management Market Value Share Analysis, by End-user, 2021

Figure 188: South America Field Service Management Market Value Share Analysis, by End-user, 2031

Figure 189: South America Field Service Management Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 190: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Construction and Real Estate, 2021 – 2031

Figure 191: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Energy and Utilities, 2021 – 2031

Figure 192: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 193: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 194: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Telecom and IT, 2021 – 2031

Figure 195: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Transportation and Logistics, 2021 – 2031

Figure 196: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Others (Consumer Goods, Retail, etc.), 2021 – 2031

Figure 197: South America Field Service Management Market Value Share Analysis, by Enterprise Size, 2021

Figure 198: South America Field Service Management Market Value Share Analysis, by Enterprise Size, 2031

Figure 199: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Small and Medium Enterprises, 2021 – 2031

Figure 200: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2021 – 2031

Figure 201: South America Field Service Management Market Absolute Opportunity (US$ Mn), by Large Enterprise, 2021 – 2031

Figure 202: South America Field Service Management Market Value Share Analysis, by Country, 2021

Figure 203: South America Field Service Management Market Value Share Analysis, by Country, 2031

Figure 204: Brazil Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 205: Argentina Field Service Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031