Companies in the fiber based packaging market are taking additional efforts to keep transport packaging flowing to support stakeholders in food, medical, and other essential industries during the COVID-19 crisis. Tissue, hygiene, and pharmaceutical products have triggered the demand for corrugated box packaging. Manufacturers in the fiber based packaging market are expected to follow the guidelines of the Center for Disease Control and Prevention (CDC) and the Occupational Safety and Health Administration (OSHA) to prevent the spread of the novel coronavirus.

The box industry continues to operate and deliver needed packaging to end use customers linked with grocery stores, hospitals, pharmacies, and the food industry, among others. Corrugated cardboard packaging is emerging as the backbone for the U.S. supply chain.

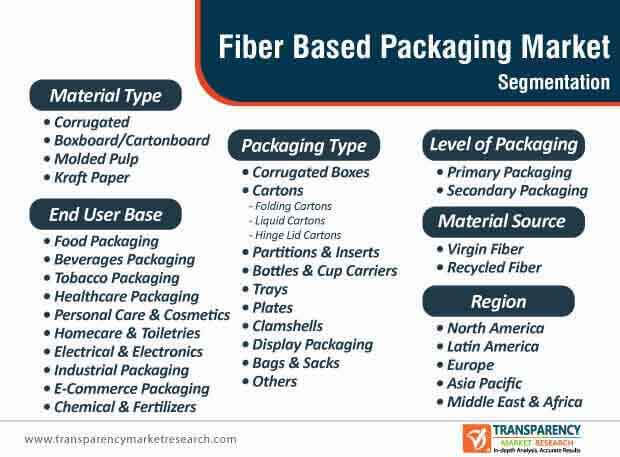

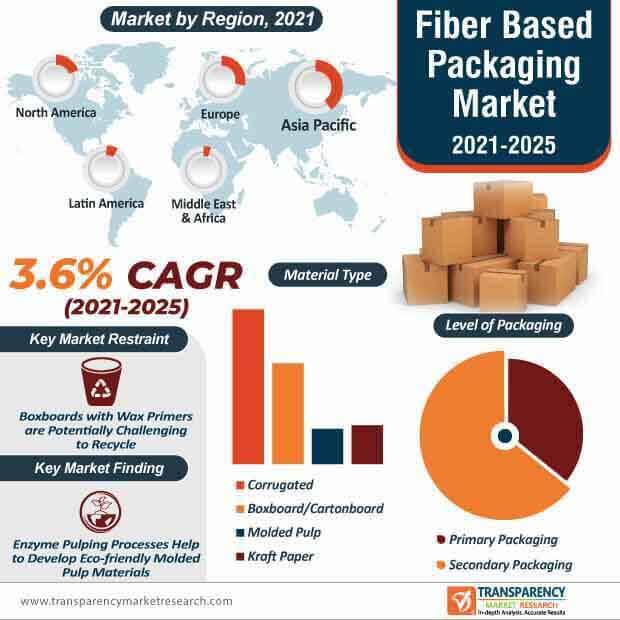

The fiber based packaging market is predicted to grow at a modest CAGR of 3.6% during the assessment period. This is explained since certain materials used in packaging may not be eligible for recycling. For instance, boxboard is recyclable, but the same material used for packaging beer and frozen food may not be recyclable, as they are often waxed for refrigeration. Hence, manufacturers need to boost their R&D capabilities to develop easily recyclable materials that support frozen food, beer, and soda packaging.

Reinventing corrugated cardboard has become the need of the hour in the fiber based packaging market. Thus, manufacturers are working closely with producers to target new and improved product functionality.

Corrugated boxes are anticipated to dictate the highest share among all packaging types in the fiber based packaging market. However, ensuring innovations in corrugated boxes is a capital-intensive strategy for the already expensive supply chains, thus preventing development of new materials. Hence, manufacturers are boosting their research efforts and establishing close interactions with product manufacturers in the food, beverages, personal care, and eCommerce industries to steer innovations in corrugated box materials.

Small entrepreneurs such as GreenBox are gaining recognition in the fiber based packaging market for their innovative designs in existing corrugated boxes to create value proposition for stakeholders in the value chain. As such, reusable plastic containers are posing a threat to corrugates box sales.

Companies in the fiber based packaging market are developing new apps to ensure transparency in business operations. S N Paper Co. based in Delhi, India, has developed a mobile app to help its clients place orders online and track the orders for deliveries. The Digital India movement is benefitting app developers who are allowing customers to check rates of materials in real-time, check updated statements, and receive rate change information via SMS. Kraft paper manufacturers are taking cues from such companies to introduce new technologies in the market landscape.

Transparency and fast delivery of kraft paper packaging have become crucial to gain a competitive edge between wholesalers and retailers. Companies in the fiber based packaging market are addressing challenges of customers for difficulty in purchasing inventory with the help of mobile apps that give real-time information.

Highly efficient manufacturing equipment are increasing production levels in the fiber based packaging market. Deluxe— a specialist in eco-friendly sustainable development is providing designing plans and technology for the blowdown systems meant for molded pulp. Better equipment ensures better capacity, efficiency, and quality in molded pulp packaging products. Companies in the fiber based packaging market are seeking design, planning, and technical support from consultant firms to manage pulp providing equipment and sewage treatment.

Manufacturers are taking efforts to gain patent in enzyme pulping processes to develop eco-friendly molded pulp materials. They are setting new production targets with eco-friendly molded pulp materials to boost their credibility.

Analysts’ Viewpoint

Companies such as the Antalis Packaging have flagged supply shortages for cardboard boxes and corrugated boards due to delays in facilitating pulp fibers back into the recycling chain, owing to the coronavirus crisis. Corrugated cardboard is gaining popularity, as it can be recycled several times before it degrades into sludge waste. However, food safe and plant-based bioplastic materials are emerging as an alternative to corrugated cardboard and kraft paper materials. Hence, companies in the fiber based packaging market should increase their interaction with producers to innovate in fiber materials and introduce solutions including environment-friendly molded pulp products to diversify their production, revenue, and supply chains.

Rising Focus on Eco-friendly Products by Consumers to Aid in Favor of Fiber based Packaging Market

The increasing number of fiber-based packaging from different end user industries are likely to aid in expansion of the global fiber based packaging market in the years to come. The rise in consumer inclination towards eco-friendly packaging solutions, coupled with the availability of raw materials at cost efficient rates will also promote the growth of this market. Fiber based packaging items have diverse visual allure contrasted with customary adaptable packaging. Fiber based packaging can oppose mugginess and different solvents, and looks after respectability.

The fiber based packaging market is anticipated to become influenced by the flooding demand from end-use ventures, like, food and refreshments, individual consideration and beauty care products, which are enlisting huge development in a few areas because of expanded utilization. The brightening surface of conveying units with fiber based packaging is probably going to propel growth of the market in the coming years.

The rising utilization of reasonable assets is driving the creation rate satisfied by maker and eco-friendly buyers around the globe. This imposed a positive impact on the utilization of biodegradable, ecofriendly packaging materials among different cost-efficient food organizations and retailers, such as QSRs, (MC Donald's, Walmart, and others.) These organizations tie up with multi-partners, for example, Environmental Defense Fund, WWF with an aspiration to decrease various sorts of ecological risks, which suggest the necessary changes in packaging materials to underscore and broaden the utilization of paper based packaging. These paper based items help in lessening the expense of the maker organizations at the underlying level, which at last causes the shopper to purchase more practical bundled items. Inexpensive food organizations and retailer are getting profited broadly with the assistance of utilizing paper and paperboard packaging. This pattern of utilizing paper and paper board packaging has made a monstrous pay of income across the world.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Fiber Based Packaging Market Overview

3.1. Introduction

3.2. Global Fiber Based Packaging Market Overview

3.3. Macro-economic Factors – Correlation Analysis

3.4. Forecast Factors – Relevance & Impact

3.5. Fiber Based Packaging Market Value Chain Analysis

3.5.1. Exhaustive List of Active Participants

3.5.1.1. Manufacturers

3.5.1.2. Distributors/Retailers

3.5.1.3. End Users

3.5.2. Profitability Margins

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Current Economic Projection – GDP/GVA and Probable Impact

4.3. Comparison of SAARs and Market Recovery, for Key Countries

4.4. Comparison to 2008 Financial Crisis and Market Recovery, for Key Countries

4.5. Impact of COVID-19 on Fiber Based Packaging Market

5. Fiber Based Packaging Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections By Region

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. Fiber Based Packaging Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

7. Global Fiber Based Packaging Market Analysis and Forecast, By Packaging Type

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Packaging Type

7.1.2. Y-o-Y Growth Projections, By Packaging Type

7.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Packaging Type

7.2.1. Corrugated Boxes

7.2.2. Cartons

7.2.2.1. Folding Cartons

7.2.2.2. Liquid Cartons

7.2.2.3. Hinge Lid Cartons

7.2.3. Partitions & Inserts

7.2.4. Bottles & Cup Carriers

7.2.5. Trays

7.2.6. Plates

7.2.7. Clamshells

7.2.8. Display Packaging

7.2.9. Bags & Sacks

7.2.10. Others

7.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Packaging Type

7.3.1. Corrugated Boxes

7.3.2. Cartons

7.3.2.1. Folding Cartons

7.3.2.2. Liquid Cartons

7.3.2.3. Hinge Lid Cartons

7.3.3. Partitions & Inserts

7.3.4. Bottles & Cup Carriers

7.3.5. Trays

7.3.6. Plates

7.3.7. Clamshells

7.3.8. Display Packaging

7.3.9. Bags & Sacks

7.3.10. Others

7.4. Market Attractiveness Analysis, By Packaging Type

8. Global Fiber Based Packaging Market Analysis and Forecast, By Material Type

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Material Type

8.1.2. Y-o-Y Growth Projections, By Material Type

8.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Type

8.2.1. Corrugated

8.2.2. Boxboard/Cartonboard

8.2.3. Molded Pulp

8.2.4. Kraft Paper

8.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Type

8.3.1. Corrugated

8.3.2. Boxboard/Cartonboard

8.3.3. Molded Pulp

8.3.4. Kraft Paper

8.4. Market Attractiveness Analysis, By Material Type

9. Global Fiber Based Packaging Market Analysis and Forecast, By Material Source

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By Material Source

9.1.2. Y-o-Y Growth Projections, By Material Source

9.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Source

9.2.1. Virgin Fiber

9.2.2. Recycled Fiber

9.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Source

9.3.1. Virgin Fiber

9.3.2. Recycled Fiber

9.4. Market Attractiveness Analysis, By Material Source

10. Global Fiber Based Packaging Market Analysis and Forecast, By End User Base

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By End User Base

10.1.2. Y-o-Y Growth Projections, By End User Base

10.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By End User Base

10.2.1. Food

10.2.2. Beverages

10.2.3. Tobacco

10.2.4. Healthcare

10.2.5. Personal Care & Cosmetics

10.2.6. Homecare & Toiletries

10.2.7. Electrical & Electronics

10.2.8. Industrial

10.2.9. E-Commerce

10.2.10. Chemical & Fertilizers

10.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By End User Base

10.3.1. Food

10.3.2. Beverages

10.3.3. Tobacco

10.3.4. Healthcare

10.3.5. Personal Care & Cosmetics

10.3.6. Homecare & Toiletries

10.3.7. Electrical & Electronics

10.3.8. Industrial

10.3.9. E-Commerce

10.3.10. Chemical & Fertilizers

10.4. Market Attractiveness Analysis, By End User Base

10.5. Prominent Trends

11. Global Fiber Based Packaging Market Analysis and Forecast, By Level of Packaging

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Level of Packaging

11.1.2. Y-o-Y Growth Projections, By Level of Packaging

11.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Level of Packaging

11.2.1. Primary Packaging

11.2.2. Secondary Packaging

11.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Level of Packaging

11.3.1. Primary Packaging

11.3.2. Secondary Packaging

11.4. Market Attractiveness Analysis, By Level of Packaging

12. Global Fiber Based Packaging Market Analysis and Forecast, By Region

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis By Region

12.1.2. Y-o-Y Growth Projections By Region

12.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Region

12.2.1. North America

12.2.2. Latin America

12.2.3. Europe

12.2.4. Asia Pacific

12.2.5. Middle East & Africa (MEA)

12.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025 By Region

12.3.1. North America

12.3.2. Latin America

12.3.3. Europe

12.3.4. Asia Pacific

12.3.5. Middle East & Africa (MEA)

12.4. Market Attractiveness Analysis By Region

13. North America Fiber Based Packaging Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Country

13.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Country

13.3.1. U.S.

13.3.2. Canada

13.4. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, Packaging Type

13.5. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Packaging Type

13.5.1. Corrugated Boxes

13.5.2. Cartons

13.5.2.1. Folding Cartons

13.5.2.2. Liquid Cartons

13.5.2.3. Hinge Lid Cartons

13.5.3. Partitions & Inserts

13.5.4. Bottles & Cup Carriers

13.5.5. Trays

13.5.6. Plates

13.5.7. Clamshells

13.5.8. Display Packaging

13.5.9. Bags & Sacks

13.5.10. Others

13.6. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Type

13.7. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Type

13.7.1. Corrugated

13.7.2. Boxboard/Cartonboard

13.7.3. Molded Pulp

13.7.4. Kraft Paper

13.8. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Source

13.9. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Source

13.9.1. Virgin Fiber

13.9.2. Recycled Fiber

13.10. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By End User Base

13.11. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By End User Base

13.11.1. Food

13.11.2. Beverages

13.11.3. Tobacco

13.11.4. Healthcare

13.11.5. Personal Care & Cosmetics

13.11.6. Homecare & Toiletries

13.11.7. Electrical & Electronics

13.11.8. Industrial

13.11.9. E-Commerce

13.11.10. Chemical & Fertilizers

13.1. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Level of Packaging

13.2. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, , By Level of Packaging

13.2.1. Primary Packaging

13.2.2. Secondary Packaging

13.3. Market Attractiveness Analysis

13.3.1. By Country

13.3.2. By Packaging Type

13.3.3. By Material Type

13.3.4. By Material Source

13.3.5. By End User Base

13.3.6. By Level of Packaging

13.4. Prominent Trends

13.5. Drivers and Restraints: Impact Analysis

14. Latin America Fiber Based Packaging Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Country

14.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025 By Country

14.3.1. Brazil

14.3.2. Mexico

14.3.3. Argentina

14.3.4. Rest of Latin America

14.4. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, Packaging Type

14.5. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Packaging Type

14.5.1. Corrugated Boxes

14.5.2. Cartons

14.5.2.1. Folding Cartons

14.5.2.2. Liquid Cartons

14.5.2.3. Hinge Lid Cartons

14.5.3. Partitions & Inserts

14.5.4. Bottles & Cup Carriers

14.5.5. Trays

14.5.6. Plates

14.5.7. Clamshells

14.5.8. Display Packaging

14.5.9. Bags & Sacks

14.5.10. Others

14.6. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Type

14.7. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Type

14.7.1. Corrugated

14.7.2. Boxboard/Cartonboard

14.7.3. Molded Pulp

14.7.4. Kraft Paper

14.8. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Source

14.9. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Source

14.9.1. Virgin Fiber

14.9.2. Recycled Fiber

14.10. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By End User Base

14.11. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By End User Base

14.11.1. Food

14.11.2. Beverages

14.11.3. Tobacco

14.11.4. Healthcare

14.11.5. Personal Care & Cosmetics

14.11.6. Homecare & Toiletries

14.11.7. Electrical & Electronics

14.11.8. Industrial

14.11.9. E-Commerce

14.11.10. Chemical & Fertilizers

14.12. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Level of Packaging

14.13. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, , By Level of Packaging

14.13.1. Primary Packaging

14.13.2. Secondary Packaging

14.14. Market Attractiveness Analysis

14.14.1. By Country

14.14.2. By Packaging Type

14.14.3. By Material Type

14.14.4. By Material Source

14.14.5. By End User Base

14.14.6. By Level of Packaging

14.15. Prominent Trends

14.16. Drivers and Restraints: Impact Analysis

15. Europe Fiber Based Packaging Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis, By Country

15.1.2. Y-o-Y Growth Projections, By Country

15.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Country

15.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025 By Country

15.3.1. Germany

15.3.2. Spain

15.3.3. Italy

15.3.4. France

15.3.5. U.K.

15.3.6. BENELUX

15.3.7. Nordic

15.3.8. Russia

15.3.9. Poland

15.3.10. Rest of Europe

15.4. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, Packaging Type

15.5. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Packaging Type

15.5.1. Corrugated Boxes

15.5.2. Cartons

15.5.2.1. Folding Cartons

15.5.2.2. Liquid Cartons

15.5.2.3. Hinge Lid Cartons

15.5.3. Partitions & Inserts

15.5.4. Bottles & Cup Carriers

15.5.5. Trays

15.5.6. Plates

15.5.7. Clamshells

15.5.8. Display Packaging

15.5.9. Bags & Sacks

15.5.10. Others

15.6. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Type

15.7. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Type

15.7.1. Corrugated

15.7.2. Boxboard/Cartonboard

15.7.3. Molded Pulp

15.7.4. Kraft Paper

15.8. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Source

15.9. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Source

15.9.1. Virgin Fiber

15.9.2. Recycled Fiber

15.10. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By End User Base

15.11. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By End User Base

15.11.1. Food

15.11.2. Beverages

15.11.3. Tobacco

15.11.4. Healthcare

15.11.5. Personal Care & Cosmetics

15.11.6. Homecare & Toiletries

15.11.7. Electrical & Electronics

15.11.8. Industrial

15.11.9. E-Commerce

15.11.10. Chemical & Fertilizers

15.12. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Level of Packaging

15.13. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, , By Level of Packaging

15.13.1. Primary Packaging

15.13.2. Secondary Packaging

15.14. Market Attractiveness Analysis

15.14.1. By Country

15.14.2. By Packaging Type

15.14.3. By Material Type

15.14.4. By Material Source

15.14.5. By End User Base

15.14.6. By Level of Packaging

15.15. Prominent Trends

15.16. Drivers and Restraints: Impact Analysis

16. Asia Pacific Fiber Based Packaging Market Analysis and Forecast

16.1. Introduction

16.1.1. Market share and Basis Points (BPS) Analysis, By Country

16.1.2. Y-o-Y Growth Projections, By Country

16.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Country

16.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025 By Country

16.3.1. China

16.3.2. India

16.3.3. Japan

16.3.4. ASEAN

16.3.5. Australia and New Zealand

16.3.6. Rest of APAC

16.4. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, Packaging Type

16.5. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Packaging Type

16.5.1. Corrugated Boxes

16.5.2. Cartons

16.5.2.1. Folding Cartons

16.5.2.2. Liquid Cartons

16.5.2.3. Hinge Lid Cartons

16.5.3. Partitions & Inserts

16.5.4. Bottles & Cup Carriers

16.5.5. Trays

16.5.6. Plates

16.5.7. Clamshells

16.5.8. Display Packaging

16.5.9. Bags & Sacks

16.5.10. Others

16.6. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Type

16.7. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Type

16.7.1. Corrugated

16.7.2. Boxboard/Cartonboard

16.7.3. Molded Pulp

16.7.4. Kraft Paper

16.8. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Source

16.9. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Source

16.9.1. Virgin Fiber

16.9.2. Recycled Fiber

16.10. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By End User Base

16.11. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By End User Base

16.11.1. Food

16.11.2. Beverages

16.11.3. Tobacco

16.11.4. Healthcare

16.11.5. Personal Care & Cosmetics

16.11.6. Homecare & Toiletries

16.11.7. Electrical & Electronics

16.11.8. Industrial

16.11.9. E-Commerce

16.11.10. Chemical & Fertilizers

16.12. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Level of Packaging

16.13. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, , By Level of Packaging

16.13.1. Primary Packaging

16.13.2. Secondary Packaging

16.14. Market Attractiveness Analysis

16.14.1. By Country

16.14.2. By Packaging Type

16.14.3. By Material Type

16.14.4. By Material Source

16.14.5. By End User Base

16.14.6. By Level of Packaging

16.15. Prominent Trends

16.16. Drivers and Restraints: Impact Analysis

17. Middle East and Africa Fiber Based Packaging Market Analysis and Forecast

17.1. Introduction

17.1.1. Market share and Basis Points (BPS) Analysis, By Country

17.1.2. Y-o-Y Growth Projections, By Country

17.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Country

17.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Country

17.3.1. North Africa

17.3.2. GCC countries

17.3.3. South Africa

17.3.4. Turkey

17.3.5. Rest of MEA

17.4. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, Packaging Type

17.5. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Packaging Type

17.5.1. Corrugated Boxes

17.5.2. Cartons

17.5.2.1. Folding Cartons

17.5.2.2. Liquid Cartons

17.5.2.3. Hinge Lid Cartons

17.5.3. Partitions & Inserts

17.5.4. Bottles & Cup Carriers

17.5.5. Trays

17.5.6. Plates

17.5.7. Clamshells

17.5.8. Display Packaging

17.5.9. Bags & Sacks

17.5.10. Others

17.6. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Type

17.7. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Type

17.7.1. Corrugated

17.7.2. Boxboard/Cartonboard

17.7.3. Molded Pulp

17.7.4. Kraft Paper

17.8. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Material Source

17.9. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By Material Source

17.9.1. Virgin Fiber

17.9.2. Recycled Fiber

17.10. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By End User Base

17.11. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, By End User Base

17.11.1. Food

17.11.2. Beverages

17.11.3. Tobacco

17.11.4. Healthcare

17.11.5. Personal Care & Cosmetics

17.11.6. Homecare & Toiletries

17.11.7. Electrical & Electronics

17.11.8. Industrial

17.11.9. E-Commerce

17.11.10. Chemical & Fertilizers

17.11.11.

17.12. Historical Market Value(US$ Mn) and Volume (Mn Units), 2016-2020, By Level of Packaging

17.13. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2021-2025, , By Level of Packaging

17.13.1. Primary Packaging

17.13.2. Secondary Packaging

17.14. Market Attractiveness Analysis

17.14.1. By Country

17.14.2. By Packaging Type

17.14.3. By Material Type

17.14.4. By Material Source

17.14.5. By End User Base

17.14.6. By Level of Packaging

17.15. Prominent Trends

17.16. Drivers and Restraints: Impact Analysis

18. Competitive Landscape

18.1. Market Structure

18.2. Competition Dashboard

18.3. Company Market Share Analysis

18.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

18.5. Competition Deep Dive

(Global Players)

18.5.1. International Paper Company

18.5.1.1. Overview

18.5.1.2. Financials

18.5.1.3. Strategy

18.5.1.4. Recent Developments

18.5.1.5. SWOT Analysis

18.5.2. DS Smith Plc

18.5.2.1. Overview

18.5.2.2. Financials

18.5.2.3. Strategy

18.5.2.4. Recent Developments

18.5.2.5. SWOT Analysis

18.5.3. Huhtamaki Oyj

18.5.3.1. Overview

18.5.3.2. Financials

18.5.3.3. Strategy

18.5.3.4. Recent Developments

18.5.3.5. SWOT Analysis

18.5.4. Smurfit Kappa Group PLC

18.5.4.1. Overview

18.5.4.2. Financials

18.5.4.3. Strategy

18.5.4.4. Recent Developments

18.5.4.5. SWOT Analysis

18.5.5. Sonoco Products Company

18.5.5.1. Overview

18.5.5.2. Financials

18.5.5.3. Strategy

18.5.5.4. Recent Developments

18.5.5.5. SWOT Analysis

18.5.6. WestRock Company

18.5.6.1. Overview

18.5.6.2. Financials

18.5.6.3. Strategy

18.5.6.4. Recent Developments

18.5.6.5. SWOT Analysis

18.5.7. Georgia-Pacific LLC

18.5.7.1. Overview

18.5.7.2. Financials

18.5.7.3. Strategy

18.5.7.4. Recent Developments

18.5.7.5. SWOT Analysis

18.5.8. Pratt Industries Inc

18.5.8.1. Overview

18.5.8.2. Financials

18.5.8.3. Strategy

18.5.8.4. Recent Developments

18.5.8.5. SWOT Analysis

18.5.9. Reynolds Group Holdings Ltd

18.5.9.1. Overview

18.5.9.2. Financials

18.5.9.3. Strategy

18.5.9.4. Recent Developments

18.5.9.5. SWOT Analysis

18.5.10. U.S. Corrugated, Inc.

18.5.10.1. Overview

18.5.10.2. Financials

18.5.10.3. Strategy

18.5.10.4. Recent Developments

18.5.10.5. SWOT Analysis

18.5.11. UFP Technologies, Inc

18.5.11.1. Overview

18.5.11.2. Financials

18.5.11.3. Strategy

18.5.11.4. Recent Developments

18.5.11.5. SWOT Analysis

18.5.12. ESCO Technologies Inc

18.5.12.1. Overview

18.5.12.2. Financials

18.5.12.3. Strategy

18.5.12.4. Recent Developments

18.5.12.5. SWOT Analysis

18.5.13. Brodrene Hartmann A/S

18.5.13.1. Overview

18.5.13.2. Financials

18.5.13.3. Strategy

18.5.13.4. Recent Developments

18.5.13.5. SWOT Analysis

18.5.14. KapStone Paper and Packaging

18.5.14.1. Overview

18.5.14.2. Financials

18.5.14.3. Strategy

18.5.14.4. Recent Developments

18.5.14.5. SWOT Analysis

18.5.15. Mayr-Melnhof Karton AG

18.5.15.1. Overview

18.5.15.2. Financials

18.5.15.3. Strategy

18.5.15.4. Recent Developments

18.5.15.5. SWOT Analysis

18.5.16. Rengo Co., Ltd.

18.5.16.1. Overview

18.5.16.2. Financials

18.5.16.3. Strategy

18.5.16.4. Recent Developments

18.5.16.5. SWOT Analysis

18.5.17. Mondi Group

18.5.17.1. Overview

18.5.17.2. Financials

18.5.17.3. Strategy

18.5.17.4. Recent Developments

18.5.17.5. SWOT Analysis

18.5.18. Stora Enso

18.5.18.1. Overview

18.5.18.2. Financials

18.5.18.3. Strategy

18.5.18.4. Recent Developments

18.5.18.5. SWOT Analysis

18.5.19. AR Packaging Group AB

18.5.19.1. Overview

18.5.19.2. Financials

18.5.19.3. Strategy

18.5.19.4. Recent Developments

18.5.19.5. SWOT Analysis

18.5.20. BillerudKorsnas AB

18.5.20.1. Overview

18.5.20.2. Financials

18.5.20.3. Strategy

18.5.20.4. Recent Developments

18.5.20.5. SWOT Analysis

*The list of companies is indicative in nature and is subject to change during the course of research

19. Assumptions and Acronyms Used

20. Research Methodology

List of Tables

Table 01: Global Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by Packaging Type

Table 02: Global Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by Material Type

Table 03: Global Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by Material Source

Table 04: Global Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by Levels of Packaging

Table 05: Global Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by End User Base

Table 06: Global Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by Region

Table 07: North America Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by Country

Table 08: North America Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by Packaging Type

Table 09: North America Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by Material Type

Table 10: North America Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by Material Source

Table 11: North America Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by Material Source

Table 12: North America Fiber-based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016–2025, by End User Base

Table 13: Latin America Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Country

Table 14: Latin America Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Packaging type

Table 15: Latin America Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Type

Table 16: Latin America Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Source

Table 17: Latin America Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Source

Table 18: Latin America Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By End User Base

Table 19: Europe Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Country

Table 20: Europe Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Packaging type

Table 21: Europe Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Type

Table 22: Europe Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Source

Table 23: Europe Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Source

Table 24: Europe Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By End User Base

Table 25: APAC Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Country

Table 26: APAC Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Packaging type

Table 27: APAC Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Type

Table 28: APAC Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Source

Table 29: APAC Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Source

Table 30: APAC Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By End User Base

Table 31: MEA Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Country

Table 32: MEA Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Packaging type

Table 33: MEA Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Type

Table 34: MEA Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Source

Table 35: MEA Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By Material Source

Table 36: MEA Fiber Based Packaging Market Value (US$ Mn) and Volume (Mn Units) 2016-2025, By End User Base

List of Figures

Figure 01: Global Fiber-based Packaging Market Value Share and BPS Analysis, by Packaging Type, 2017 & 2025

Figure 02: Global Fiber-based Packaging Market Attractiveness Analysis, by Packaging Type, 2017 & 2025

Figure 03: Global Fiber-based Packaging Market Y-o-Y Growth, by Packaging Type 2017 & 2025

Figure 04: Global Fiber-based Packaging Market Absolute $ Opportunity, by Corrugated Boxes Segment, 2017–2025

Figure 05: Global Fiber-based Packaging Market Absolute $ Opportunity, by Cartons Segment, 2017–2025

Figure 06: Global Fiber-based Packaging Market Value (US$ Mn) Forecast, by Cartons Sub-segment, 2016–2025

Figure 07: Global Fiber-based Packaging Market Volume (Mn Units) Forecast, by Cartons Sub-segment, 2016–2025

Figure 08: Global Fiber-based Packaging Market Absolute $ Opportunity, by Partitions and Inserts Segment, 2017–2025

Figure 09: Global Fiber-based Packaging Market Absolute $ Opportunity, by Bottle and Cup Carriers Segment, 2017–2025

Figure 10: Global Fiber-based Packaging Market Absolute $ Opportunity, by Trays Segment, 2017–2025

Figure 11: Global Fiber-based Packaging Market Absolute $ Opportunity, by Plates Segment, 2017–2025

Figure 12: Global Fiber-based Packaging Market Absolute $ Opportunity, by Clamshells Segment, 2017–2025

Figure 13: Global Fiber-based Packaging Market Absolute $ Opportunity, by Display Packaging Segment, 2017–2025

Figure 14: Global Fiber-based Packaging Market Absolute $ Opportunity, by Bags and Sacks Segment, 2017–2025

Figure 15: Global Fiber-based Packaging Market Absolute $ Opportunity, by Other Packaging Segment, 2017–2025

Figure 16: Global Fiber-based Packaging Market Value Share and BPS Analysis, by Material Type, 2017 & 2025

Figure 17: Global Fiber-based Packaging Market Attractiveness Analysis, by Material Type, (2017)

Figure 18: Global Fiber-based Packaging Market Y-o-Y Growth, by Material Type 2017 & 2025

Figure 19: Global Fiber-based Packaging Market Absolute $ Opportunity, by Corrugated Material Segment, 2017–2025

Figure 20: Global Fiber-based Packaging Market Absolute $ Opportunity, by Boxboard / Cartonboard Segment, 2017–2025

Figure 21: Global Fiber-based Packaging Market Absolute $ Opportunity, by Molded Pulp Material Segment, 2017–2025

Figure 22: Global Fiber-based Packaging Market Absolute $ Opportunity, by Kraft Paper Segment, 2017–2025

Figure 23: Global Fiber-based Packaging Market Value Share and BPS Analysis, by Material Source, 2017 & 2025

Figure 24: Global Fiber-based Packaging Market Attractiveness Analysis, by Material Source, (2017)

Figure 25: Global Fiber-based Packaging Market Y-o-Y Growth, by Material Source, 2017 & 2025

Figure 26: Global Fiber-based Packaging Market Absolute $ Opportunity, by Virgin Fiber Segment, 2017–2025

Figure 27: Global Fiber-based Packaging Market Absolute $ Opportunity, by Recycled Fiber Segment, 2017–2025

Figure 28: Global Fiber-based Packaging Market Value Share and BPS Analysis, by Levels of Packaging, 2017 & 2025

Figure 29: Global Fiber-based Packaging Market Attractiveness Analysis, by Levels of Packaging, (2017)

Figure 30: Global Fiber-based Packaging Market Y-o-Y growth, by Levels of Packaging, 2017 & 2025

Figure 31: Global Fiber-based Packaging Market Absolute $ Opportunity, by Primary Packaging Segment, 2017–2025

Figure 32: Global Fiber-based Packaging Market Absolute $ Opportunity, by Secondary Packaging Segment, 2017–2025

Figure 33: Global Fiber-based Packaging Market Value Share and BPS Analysis, by End User Base, 2017 & 2025

Figure 34: Global Fiber-based Packaging Market Attractiveness Analysis, by End User Base, (2017)

Figure 35: Global Fiber-based Packaging Market Y-o-Y Growth, by End User Base, 2017 & 2025

Figure 36: Global Fiber-based Packaging Market Absolute $ Opportunity, by Food Packaging Segment, 2017–2025

Figure 37: Global Fiber-based Packaging Market Absolute $ Opportunity, by Beverages Packaging Segment, 2017–2025

Figure 38: Global Fiber-based Packaging Market Absolute $ Opportunity, by Tobacco Packaging Segment, 2017–2025

Figure 39: Global Fiber-based Packaging Market Absolute $ Opportunity, by Healthcare Packaging Segment, 2017–2025

Figure 40: Global Fiber-based Packaging Market Absolute $ Opportunity, by Personal Care and Cosmetics Packaging Segment, 2017–2025

Figure 41: Global Fiber-based Packaging Market Absolute $ Opportunity, by Homecare and Toiletries Packaging Segment, 2017–2025

Figure 42: Global Fiber-based Packaging Market Absolute $ Opportunity, by Electrical and Electronics Packaging Segment, 2017–2025

Figure 43: Global Fiber-based Packaging Market Absolute $ Opportunity, by Industrial Packaging Segment, 2017–2025

Figure 44: Global Fiber-based Packaging Market Absolute $ Opportunity, by E-commerce Packaging Segment, 2017–2025

Figure 45: Global Fiber-based Packaging Market Absolute $ Opportunity, by Chemical and Fertilizers Packaging Segment, 2017–2025

Figure 46: Global Fiber-based Packaging Market Value Share and BPS Analysis, by Region, 2017 & 2025

Figure 47: Global Fiber-based Packaging Market Attractiveness Analysis, by Region, (2017)

Figure 48: Global Fiber-based Packaging Market Y-o-Y Growth, by Region, 2017–2025

Figure 49: North America Fiber-based Packaging Market Value (US$ Mn), and Volume (Mn Units) analysis, 2016–2025

Figure 50: North America Fiber-based Packaging Market Absolute $ Opportunity, 2017–2025

Figure 51: North America Fiber-based Packaging Market Value Share and BPS Analysis, by Country 2017 & 2025

Figure 52: North America Fiber-based Packaging Market Attractiveness Analysis, by Country (2017)

Figure 53: North America Fiber-based Packaging Market Y-o-Y Growth, by Country 2017 & 2025

Figure 54: North America Fiber-based Packaging Market BPS Analysis (2017 & 2025), by Packaging type

Figure 55: North America Fiber-based Packaging Market Attractiveness Analysis (2017), by Packaging Type

Figure besides represent the North America fiber-based packaging market BPS and market attractiveness analysis, by packaging type

Figure 56: North America Fiber-based Packaging Market Value (US$ Mn) Forecast, by Packaging Type, 2016–2025

Figure 57: North America Fiber-based Packaging Market Volume (Mn Units) Forecast, by Packaging Type, 2016–2025

Figure 58: North America Fiber-based Packaging Market BPS Analysis (2017 & 2025), by Material Type

Figure 59: North America Fiber-based Packaging Market Attractiveness Analysis (2017), by Material Type

Figure besides represent the North America fiber-based packaging market BPS and market attractiveness analysis, by material type

Figure 60: North America Fiber-based Packaging Market Value (US$ Mn) Forecast, by Material Type, 2016–2025

Figure 61: North America Fiber-based Packaging Market Volume (Mn Units) Forecast, by Material Type, 2016–2025

Figure 62: North America Fiber-based Packaging Market BPS Analysis (2017 & 2025), by Material Source

Figure 63: North America Fiber-based Packaging Market Attractiveness Analysis (2017), by Material Source

Figure besides represent the North America fiber-based packaging market BPS and market attractiveness analysis, by material source

Figure 64: North America Fiber-based Packaging Market Value (US$ Mn) Forecast, by Material Source, 2016–2025

Figure 65: North America Fiber-based Packaging Market Volume (Mn Units) Forecast, by Material Source, 2016–2025

Figure 66: North America Fiber-based Packaging Market BPS Analysis (2017 & 2025), by Levels of Packaging

Figure 67: North America Fiber-based Packaging Market Attractiveness Analysis (2017), by Levels of Packaging

Figure besides represent the North America fiber-based packaging market BPS and market attractiveness analysis, by levels of packaging

Figure 68: North America Fiber-based Packaging Market Value (US$ Mn) Forecast, by Material Source, 2016–2025

Figure 69: North America Fiber-based Packaging Market Volume (Mn Units) Forecast, by Material Source, 2016–2025

Figure 70: North America Fiber-based Packaging Market BPS Analysis (2017 & 2025), by End user base

Figure 71: North America Fiber-based Packaging Market Attractiveness Analysis (2017), by End user base

Figure besides represent the North America fiber-based packaging market BPS and market attractiveness analysis, by end user base

Figure 72: North America Fiber-based Packaging Market Value (US$ Mn) Forecast, by End User Base, 2016–2025

Figure 73: North America Fiber-based Packaging Market Volume (Mn Units) Forecast, by End User Base, 2016–2025

Figure 74: Latin America Fiber Based Packaging Market Value (US$ Mn), and volume (Mn Units) analysis, 2016-2025

Figure 75: Latin America Fiber Based Packaging Market Absolute $ Opportunity, 2017-2025

Figure 76: Latin America Fiber Based Packaging Market Value Share and BPS Analysis, By Country 2017 & 2025

Figure 77: Latin America Fiber Based Packaging Market Attractiveness analysis, By Country (2017)

Figure 78: Latin America Fiber Based Packaging Market Y-o-Y growth, By Country 2017 & 2025

Figure 79: Latin America Fiber Based Packaging Market BPS analysis (2017 & 2025), by Packaging type

Figure 80: Latin America Fiber Based Packaging Market attractiveness analysis (2017), by Packaging type

Figure 81: Latin America Fiber Based Packaging Market Value (US$ Mn) forecast, By Packaging Type, 2016 - 2025

Figure 82: Latin America Fiber Based Packaging Market Volume (Mn Units) forecast, By Packaging Type, 2016 - 2025

Figure 83: Latin America Fiber Based Packaging Market BPS analysis (2017 & 2025), By Material Type

Figure 84: Latin America Fiber Based Packaging Market attractiveness analysis (2017), By Material Type

Figure 85: Latin America Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Type, 2016 - 2025

Figure 86: Latin America Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Type, 2016 - 2025

Figure 87: Latin America Fiber Based Packaging Market BPS analysis (2017 & 2025), By Material Source

Figure 88: Latin America Fiber Based Packaging Market attractiveness analysis (2017), By Material Source

Figure 89: Latin America Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Source, 2016 - 2025

Figure 90: Latin America Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Source, 2016 - 2025

Figure 91: Latin America Fiber Based Packaging Market BPS analysis (2017 & 2025), By Levels of Packaging

Figure 92: Latin America Fiber Based Packaging Market attractiveness analysis (2017), By Levels of Packaging

Figure 93: Latin America Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Source, 2016 - 2025

Figure 94: Latin America Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Source, 2016 - 2025

Figure 95: Latin America Fiber Based Packaging Market BPS analysis (2017 & 2025), By End User Base

Figure 96: Latin America Fiber Based Packaging Market attractiveness analysis (2017), By End User Base

Figure 97: Latin America Fiber Based Packaging Market Value (US$ Mn) forecast, By End User Base, 2016 - 2025

Figure 98: Latin America Fiber Based Packaging Market Volume (Mn Units) forecast, By End User Base, 2016 - 2025

Figure 99: Europe Fiber Based Packaging Market Value (US$ Mn), and volume (Mn Units) analysis, 2016-2025

Figure 100: Europe Fiber Based Packaging Market Absolute $ Opportunity, 2017-2025

Figure 101: Europe Fiber Based Packaging Market Value Share and BPS Analysis, By Country 2017 & 2025

Figure 102: Europe Fiber Based Packaging Market Attractiveness analysis, By Country (2017)

Figure 103: Europe Fiber Based Packaging Market Y-o-Y growth, By Country 2017 & 2025

Figure 104: Europe Fiber Based Packaging Market BPS analysis (2017 & 2025), by Packaging type

Figure 105: Europe Fiber Based Packaging Market attractiveness analysis (2017), by Packaging type

Figure 106: Europe Fiber Based Packaging Market Value (US$ Mn) forecast, By Packaging Type, 2016 - 2025

Figure 107: Europe Fiber Based Packaging Market Volume (Mn Units) forecast, By Packaging Type, 2016 - 2025

Figure 108: Europe Fiber Based Packaging Market BPS analysis (2017 & 2025), By Material Type

Figure 109: Europe Fiber Based Packaging Market attractiveness analysis (2017), By Material Type

Figure 110: Europe Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Type, 2016 - 2025

Figure 111: Europe Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Type, 2016 - 2025

Figure 112: Europe Fiber Based Packaging Market BPS analysis (2017 & 2025), By Material Source

Figure 113: Europe Fiber Based Packaging Market attractiveness analysis (2017), By Material Source

Figure 114: Europe Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Source, 2016 - 2025

Figure 115: Europe Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Source, 2016 - 2025

Figure 116: Europe Fiber Based Packaging Market BPS analysis (2017 & 2025), By Levels of Packaging

Figure 117: Europe Fiber Based Packaging Market attractiveness analysis (2017), By Levels of Packaging

Figure 118: Europe Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Source, 2016 - 2025

Figure 119: Europe Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Source, 2016 - 2025

Figure 120: Europe Fiber Based Packaging Market BPS analysis (2017 & 2025), By End User Base

Figure 121: Europe Fiber Based Packaging Market attractiveness analysis (2017), By End User Base

Figure 122: Europe Fiber Based Packaging Market Value (US$ Mn) forecast, By End User Base, 2016 - 2025

Figure 123: Europe Fiber Based Packaging Market Volume (Mn Units) forecast, By End User Base, 2016 - 2025

Figure 124: APAC Fiber Based Packaging Market Value (US$ Mn), and volume (Mn Units) analysis, 2016-2025

Figure 125: APAC Fiber Based Packaging Market Absolute $ Opportunity, 2017-2025

Figure 126: APAC Fiber Based Packaging Market Value Share and BPS Analysis, By Country 2017 & 2025

Figure 127: APAC Fiber Based Packaging Market Attractiveness analysis, By Country (2017)

Figure 128: APAC Fiber Based Packaging Market Y-o-Y growth, By Country 2017 & 2025

Figure 129: APAC Fiber Based Packaging Market BPS analysis (2017 & 2025), by Packaging type

Figure 130: APAC Fiber Based Packaging Market attractiveness analysis (2017), by Packaging type

Figure 131: APAC Fiber Based Packaging Market Value (US$ Mn) forecast, By Packaging Type, 2016 - 2025

Figure 132: APAC Fiber Based Packaging Market Volume (Mn Units) forecast, By Packaging Type, 2016 - 2025

Figure 133: APAC Fiber Based Packaging Market BPS analysis (2017 & 2025), By Material Type

Figure 134: APAC Fiber Based Packaging Market attractiveness analysis (2017), By Material Type

Figure 135: APAC Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Type, 2016 - 2025

Figure 136: APAC Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Type, 2016 - 2025

Figure 137: APAC Fiber Based Packaging Market BPS analysis (2017 & 2025), By Material Source

Figure 138: APAC Fiber Based Packaging Market attractiveness analysis (2017), By Material Source

Figure 139: APAC Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Source, 2016 - 2025

Figure 140: APAC Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Source, 2016 - 2025

Figure 141 : APAC Fiber Based Packaging Market BPS analysis (2017 & 2025), By Levels of Packaging

Figure 142: APAC Fiber Based Packaging Market attractiveness analysis (2017), By Levels of Packaging

Figure 143: APAC Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Source, 2016 - 2025

Figure 144: APAC Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Source, 2016 - 2025

Figure 145: APAC Fiber Based Packaging Market BPS analysis (2017 & 2025), By End User Base

Figure 146: APAC Fiber Based Packaging Market attractiveness analysis (2017), By End User Base

Figure 147: APAC Fiber Based Packaging Market Value (US$ Mn) forecast, By End User Base, 2016 - 2025

Figure 148: APAC Fiber Based Packaging Market Volume (Mn Units) forecast, By End User Base, 2016 - 2025

Figure 149: MEA Fiber Based Packaging Market Value (US$ Mn), and volume (Mn Units) analysis, 2016-2025

Figure 150: MEA Fiber Based Packaging Market Absolute $ Opportunity, 2017-2025

Figure 151: MEA Fiber Based Packaging Market Value Share and BPS Analysis, By Country 2017 & 2025

Figure 152: MEA Fiber Based Packaging Market Attractiveness analysis, By Country (2017)

Figure 153: MEA Fiber Based Packaging Market Y-o-Y growth, By Country 2017 & 2025

Figure 154: MEA Fiber Based Packaging Market BPS analysis (2017 & 2025), by Packaging type

Figure 155: MEA Fiber Based Packaging Market attractiveness analysis (2017), by Packaging type

Figure 156: MEA Fiber Based Packaging Market Value (US$ Mn) forecast, By Packaging Type, 2016 - 2025

Figure 157: MEA Fiber Based Packaging Market Volume (Mn Units) forecast, By Packaging Type, 2016 - 2025

Figure 158: MEA Fiber Based Packaging Market BPS analysis (2017 & 2025), By Material Type

Figure 159: MEA Fiber Based Packaging Market attractiveness analysis (2017), By Material Type

Figure 160: MEA Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Type, 2016 - 2025

Figure 161: MEA Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Type, 2016 - 2025

Figure 162: MEA Fiber Based Packaging Market BPS analysis (2017 & 2025), By Material Source

Figure 163: MEA Fiber Based Packaging Market attractiveness analysis (2017), By Material Source

Figure 164: MEA Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Source, 2016 - 2025

Figure 165: MEA Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Source, 2016 - 2025

Figure 166: MEA Fiber Based Packaging Market BPS analysis (2017 & 2025), By Levels of Packaging

Figure 167: MEA Fiber Based Packaging Market attractiveness analysis (2017), By Levels of Packaging

Figure 168: MEA Fiber Based Packaging Market Value (US$ Mn) forecast, By Material Source, 2016 - 2025

Figure 169: MEA Fiber Based Packaging Market Volume (Mn Units) forecast, By Material Source, 2016 - 2025

Figure 170: MEA Fiber Based Packaging Market BPS analysis (2017 & 2025), By End User Base

Figure 171: MEA Fiber Based Packaging Market attractiveness analysis (2017), By End User Base

Figure 172: MEA Fiber Based Packaging Market Value (US$ Mn) forecast, By End User Base, 2016 - 2025

Figure 173: MEA Fiber Based Packaging Market Volume (Mn Units) forecast, By End User Base, 2016 - 2025