Analysts’ Viewpoint

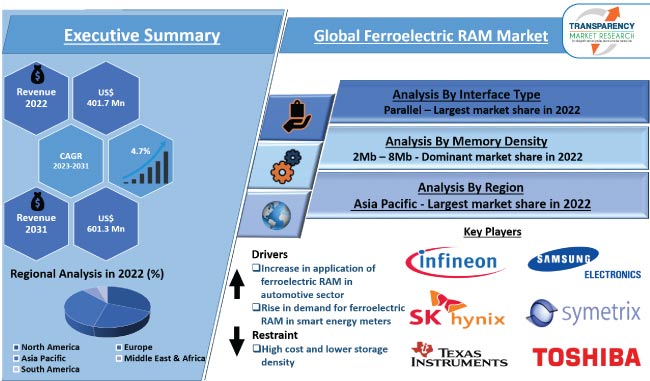

Increase in application of ferroelectric RAM (FRAM) in the automotive sector is a major factor fueling market expansion. Moreover, rise in demand for FRAM in smart energy meters is driving the ferroelectric RAM market dynamics. Ferroelectric RAM is used in a wide range of applications in various end-use industries including consumer electronics, healthcare, and automotive.

FRAM is being chosen over NAND Flash, SRAM, and EEPROM, in an increasing number of applications, as leading manufacturers are focusing on the improvement in their design to enhance performance and lifespan. Demand for non-volatile FRAM is increasing due to its high read/write speed, excellent radiation capability, and low power consumption. Market participants are focusing on various growth strategies, such as collaborations with key players, product launches, and developing a worldwide distribution network to increase their market share.

Ferroelectric RAM is a stand-alone non-volatile memory that instantly captures and preserves crucial data when power is interrupted. Ferroelectric non-volatile memory is best suited for mission-critical data-logging applications such as high-performance programmable logic controllers (PLCs) and life-enhancing patient monitoring systems.

Lead Zirconate Titanate (PZT) is the commonly used ferroelectric material. Applications of ferroelectric RAM are rising in medical devices as well as in industrial microcontrollers. Ferroelectric RAM is a type of non-volatile random-access memory that performs similar to flash memory.

The need for fast, reliable, low-power, high-performance NVM is becoming increasingly important for a variety of applications. In mission-critical areas such as automotive ADAS applications, data loss can have a significant impact on safety mechanisms. Therefore, several automotive designers are using FRAM in their advanced driver assistance systems to ensure reliable and safe operation.

Increase in use of ferroelectric RAM in automotive ADAS systems is contributing to the market dynamics. Highway Loss Data Institute estimated that the deployment of two ADAS systems would be present in half or more registered vehicles by 2026. FRAMs can be used for non-volatile data logging in most automotive subsystems such as power trains, smart airbags, stability control, dashboard instrumentation, engine controls, battery management, and infotainment applications.

Non-volatile memory (NVM) plays an important role in every embedded system design, but many designs have increasingly stringent requirements in terms of data write and access speed, power, and data retention. Manufacturers can easily store important data for years without sacrificing power requirements or performance by using ferroelectric RAM.

The latest generation of non-volatile ferroelectric RAM help improve the performance of existing memories, such as electrically erasable programmable read-only memory (EEPROM) and battery-backed static random access memory (BB-SRAM).

Mostly all conventional electricity meters use serial EEPROM as ideal non-volatile memory due to its low power consumption, low cost, and standard packaging options. EEPROM in the advanced metering infrastructure (AMI) limits the meter performance, owing to its limited endurance cycles and read/write speed. Consequently, alternative non-volatile memory solutions, such as ferroelectric RAM (FRAM), are being used.

Smart energy meters record electrical performance parameters, such as power consumption, active power, voltage, and load conditions at regular intervals. They are gaining popularity in households. Ferroelectric RAM plays an important role in storing critical data and electrical energy. Therefore, demand for ferroelectric RAM in smart energy meters is rising significantly across the globe.

In terms of interface type, the global market segmentation comprises serial and parallel. The parallel interface type segment accounted for 55.3% share in 2022. It is likely to dominate the global market during the forecast period. A parallel interface has the ability to operate multiple bits at a time and its transmission speed is also high. The parallel interface can move 8 bits of data simultaneously.

In terms of memory density, the global market has been classified into up to 16Kb, 32Kb - 128Kb, 256Kb - 1Mb, 2Mb - 8Mb, and Above 8Mb. As per the latest ferroelectric RAM market research analysis, the 2Mb - 8Mb memory density segment held 28.2% of the global ferroelectric RAM market share in 2022. This segment is likely to maintain its leading position in the next few years.

2Mb - 8Mb memory density is ideal for wearable devices, IoT sensors, portable medical devices, and several industrial and automotive applications. Therefore, demand for ferroelectric RAM with 2Mb - 8Mb memory density is increasing.

According to the ferroelectric RAM market analysis, Asia Pacific is projected to dominate the global market during the forecast period. Rise in demand for FRAM in automotive and consumer electronics industries is expected to fuel ferroelectric RAM market growth in the region during the forecast period. Additionally, growth in manufacturing industry in the region is also augmenting market statistics.

The ferroelectric RAM market size in North America is projected to increase in the near future due to the presence of several leading players in the region.

The global FRAM business is highly consolidated, with the presence of a few major organizations that control majority of the ferroelectric RAM market share. According to the latest ferroelectric RAM market forecast, many companies are implementing innovative strategies to increase their global presence. Some of the strategies include mergers & acquisitions and expansion of product portfolios.

Cypress Semiconductor Corporation, Fujitsu Limited (Furukawa Group), SK Hynix Inc, Infineon Technologies AG, LAPIS Semiconductor Co., Ltd. (Rohm Semiconductor), Ramtron International, Samsung Electronics Co., Ltd, Symetrix Corporation, Texas Instruments Incorporated, and Toshiba Corporation are the key entities operating in the global market. These players are engaged in following the latest ferroelectric RAM market trends to gain revenue opportunities.

Key players have been profiled in the ferroelectric RAM market report based on parameters such as business segments, financial overview, product portfolio, latest developments, business strategies, and company overview.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 401.7 Mn |

|

Market Forecast Value in 2031 |

US$ 601.3 Mn |

|

Growth Rate (CAGR) |

4.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 401.7 Mn in 2022

It is expected to grow at a CAGR of 4.7% from 2023 to 2031

Increase in usage of ferroelectric RAM in automotive sector and rise in demand for ferroelectric RAM in smart energy meters

The parallel interface type segment accounted for major share in 2022

The 2Mb – 8Mb memory density segment accounted for major share in 2022

Asia Pacific is projected to be most attractive in the near future

Cypress Semiconductor Corporation, Fujitsu Limited (Furukawa Group), Infineon Technologies AG, LAPIS Semiconductor Co., Ltd. (Rohm Semiconductor), Ramtron International, Samsung Electronics Co., Ltd, SK Hynix Inc., Symetrix Corporation, Texas Instruments Incorporated, and Toshiba Corporation

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Ferroelectric RAM Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Semiconductor Memory Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Ferroelectric RAM Market Analysis, by Interface Type

5.1. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface Type, 2017-2031

5.1.1. Serial

5.1.2. Parallel

5.2. Market Attractiveness Analysis, by Interface Type

6. Global Ferroelectric RAM Market Analysis, by Memory Density

6.1. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Memory Density, 2017-2031

6.1.1. Up to 16Kb

6.1.2. 32Kb - 128Kb

6.1.3. 256Kb - 1Mb

6.1.4. 2Mb - 8Mb

6.1.5. Above 8Mb

6.2. Market Attractiveness Analysis, by Memory Density

7. Global Ferroelectric RAM Market Analysis, by Package

7.1. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package, 2017-2031

7.1.1. BGA

7.1.2. QFN

7.1.3. SOIC

7.1.4. Others

7.2. Market Attractiveness Analysis, by Package

8. Global Ferroelectric RAM Market Analysis, by Application

8.1. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

8.1.1. Advanced Driver Assistance System (ADAS)

8.1.2. Battery Management System (BMS)

8.1.3. Wearable Device

8.1.4. Base Station Equipment

8.1.5. Customer Premise Equipment (CPE)

8.1.6. Robot

8.1.7. CT Scan

8.1.8. Smart Utility Meter

8.1.9. Others

8.2. Market Attractiveness Analysis, by Application

9. Global Ferroelectric RAM Market Analysis, by End-use Industry

9.1. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

9.1.1. Automotive

9.1.2. Consumer Electronics

9.1.3. Industrial

9.1.4. IT and Telecommunication

9.1.5. Energy and Utility

9.1.6. Healthcare

9.1.7. Others

9.2. Market Attractiveness Analysis, by End-use Industry

10. Global Ferroelectric RAM Market Analysis and Forecast, by Region

10.1. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017-2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, by Region

11. North America Ferroelectric RAM Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface Type, 2017-2031

11.3.1. Serial

11.3.2. Parallel

11.4. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Memory Density, 2017-2031

11.4.1. Up to 16Kb

11.4.2. 32Kb - 128Kb

11.4.3. 256Kb - 1Mb

11.4.4. 2Mb - 8Mb

11.4.5. Above 8Mb

11.5. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package, 2017-2031

11.5.1. BGA

11.5.2. QFN

11.5.3. SOIC

11.5.4. Others

11.6. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

11.6.1. Advanced Driver Assistance System (ADAS)

11.6.2. Battery Management System (BMS)

11.6.3. Wearable Device

11.6.4. Base Station Equipment

11.6.5. Customer Premise Equipment (CPE)

11.6.6. Robot

11.6.7. CT Scan

11.6.8. Smart Utility Meter

11.6.9. Others

11.7. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

11.7.1. Automotive

11.7.2. Consumer Electronics

11.7.3. Industrial

11.7.4. IT and Telecommunication

11.7.5. Energy and Utility

11.7.6. Healthcare

11.7.7. Others

11.8. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

11.8.1. U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Market Attractiveness Analysis

11.9.1. By Interface Type

11.9.2. By Memory Density

11.9.3. By Application

11.9.4. By End-use Industry

11.9.5. By Country/Sub-region

12. Europe Ferroelectric RAM Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface Type, 2017-2031

12.3.1. Serial

12.3.2. Parallel

12.4. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Memory Density, 2017-2031

12.4.1. Up to 16Kb

12.4.2. 32Kb - 128Kb

12.4.3. 256Kb - 1Mb

12.4.4. 2Mb - 8Mb

12.4.5. Above 8Mb

12.5. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package, 2017-2031

12.5.1. BGA

12.5.2. QFN

12.5.3. SOIC

12.5.4. Others

12.6. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

12.6.1. Advanced Driver Assistance System (ADAS)

12.6.2. Battery Management System (BMS)

12.6.3. Wearable Device

12.6.4. Base Station Equipment

12.6.5. Customer Premise Equipment (CPE)

12.6.6. Robot

12.6.7. CT Scan

12.6.8. Smart Utility Meter

12.6.9. Others

12.7. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

12.7.1. Automotive

12.7.2. Consumer Electronics

12.7.3. Industrial

12.7.4. IT and Telecommunication

12.7.5. Energy and Utility

12.7.6. Healthcare

12.7.7. Others

12.8. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

12.8.1. U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Market Attractiveness Analysis

12.9.1. By Interface Type

12.9.2. By Memory Density

12.9.3. By Application

12.9.4. By End-use Industry

12.9.5. By Country/Sub-region

13. Asia Pacific Ferroelectric RAM Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface Type, 2017-2031

13.3.1. Serial

13.3.2. Parallel

13.4. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Memory Density, 2017-2031

13.4.1. Up to 16Kb

13.4.2. 32Kb - 128Kb

13.4.3. 256Kb - 1Mb

13.4.4. 2Mb - 8Mb

13.4.5. Above 8Mb

13.5. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package, 2017-2031

13.5.1. BGA

13.5.2. QFN

13.5.3. SOIC

13.5.4. Others

13.6. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

13.6.1. Advanced Driver Assistance System (ADAS)

13.6.2. Battery Management System (BMS)

13.6.3. Wearable Device

13.6.4. Base Station Equipment

13.6.5. Customer Premise Equipment (CPE)

13.6.6. Robot

13.6.7. CT Scan

13.6.8. Smart Utility Meter

13.6.9. Others

13.7. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

13.7.1. Automotive

13.7.2. Consumer Electronics

13.7.3. Industrial

13.7.4. IT and Telecommunication

13.7.5. Energy and Utility

13.7.6. Healthcare

13.7.7. Others

13.8. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. South Korea

13.8.5. ASEAN

13.8.6. Rest of Asia Pacific

13.9. Market Attractiveness Analysis

13.9.1. By Interface Type

13.9.2. By Memory Density

13.9.3. By Application

13.9.4. By End-use Industry

13.9.5. By Country/Sub-region

14. Middle East & Africa Ferroelectric RAM Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface Type, 2017-2031

14.3.1. Serial

14.3.2. Parallel

14.4. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Memory Density, 2017-2031

14.4.1. Up to 16Kb

14.4.2. 32Kb - 128Kb

14.4.3. 256Kb - 1Mb

14.4.4. 2Mb - 8Mb

14.4.5. Above 8Mb

14.5. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package, 2017-2031

14.5.1. BGA

14.5.2. QFN

14.5.3. SOIC

14.5.4. Others

14.6. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

14.6.1. Advanced Driver Assistance System (ADAS)

14.6.2. Battery Management System (BMS)

14.6.3. Wearable Device

14.6.4. Base Station Equipment

14.6.5. Customer Premise Equipment (CPE)

14.6.6. Robot

14.6.7. CT Scan

14.6.8. Smart Utility Meter

14.6.9. Others

14.7. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

14.7.1. Automotive

14.7.2. Consumer Electronics

14.7.3. Industrial

14.7.4. IT and Telecommunication

14.7.5. Energy and Utility

14.7.6. Healthcare

14.7.7. Others

14.8. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. By Interface Type

14.9.2. By Memory Density

14.9.3. By Application

14.9.4. By End-use Industry

14.9.5. By Country/Sub-region

15. South America Ferroelectric RAM Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface Type, 2017-2031

15.3.1. Serial

15.3.2. Parallel

15.4. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Memory Density, 2017-2031

15.4.1. Up to 16Kb

15.4.2. 32Kb - 128Kb

15.4.3. 256Kb - 1Mb

15.4.4. 2Mb - 8Mb

15.4.5. Above 8Mb

15.5. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Package, 2017-2031

15.5.1. BGA

15.5.2. QFN

15.5.3. SOIC

15.5.4. Others

15.6. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by Application, 2017-2031

15.6.1. Advanced Driver Assistance System (ADAS)

15.6.2. Battery Management System (BMS)

15.6.3. Wearable Device

15.6.4. Base Station Equipment

15.6.5. Customer Premise Equipment (CPE)

15.6.6. Robot

15.6.7. CT Scan

15.6.8. Smart Utility Meter

15.6.9. Others

15.7. Ferroelectric RAM Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

15.7.1. Automotive

15.7.2. Consumer Electronics

15.7.3. Industrial

15.7.4. IT and Telecommunication

15.7.5. Energy and Utility

15.7.6. Healthcare

15.7.7. Others

15.8. Ferroelectric RAM Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Market Attractiveness Analysis

15.9.1. By Interface Type

15.9.2. By Memory Density

15.9.3. By Application

15.9.4. By End-use Industry

15.9.5. By Country/Sub-region

16. Competition Assessment

16.1. Global Ferroelectric RAM Market Competition Matrix - a Dashboard View

16.1.1. Global Ferroelectric RAM Market Company Share Analysis, by Value (2022)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. Cypress Semiconductor Corporation

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. Fujitsu Limited (Furukawa Group)

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Infineon Technologies AG

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. LAPIS Semiconductor Co., Ltd. (Rohm Semiconductor)

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. Ramtron International

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. Samsung Electronics Co., Ltd.

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. SK Hynix Inc.

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. Symetrix Corporation

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. Texas Instruments Incorporated

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. Toshiba Corporation

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. Other Key Players

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

18. Go to Market Strategy

18.1. Identification of Potential Market Spaces

18.2. Understanding Buying Process of Customers

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Interface Type, 2017‒2031

Table 2: Global Ferroelectric RAM Market Volume (Million Units) & Forecast, by Interface Type, 2017‒2031

Table 3: Global Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Memory Density, 2017‒2031

Table 4: Global Ferroelectric RAM Market Volume (Million Units) & Forecast, by Memory Density, 2017‒2031

Table 5: Global Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Package, 2017‒2031

Table 6: Global Ferroelectric RAM Market Volume (Million Units) & Forecast, by Package, 2017‒2031

Table 7: Global Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 8: Global Ferroelectric RAM Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 9: Global Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 10: Global Ferroelectric RAM Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 11: North America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Interface Type, 2017‒2031

Table 12: North America Ferroelectric RAM Market Volume (Million Units) & Forecast, by Interface Type, 2017‒2031

Table 13: North America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Memory Density, 2017‒2031

Table 14: North America Ferroelectric RAM Market Volume (Million Units) & Forecast, by Memory Density, 2017‒2031

Table 15: North America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Package, 2017‒2031

Table 16: North America Ferroelectric RAM Market Volume (Million Units) & Forecast, by Package, 2017‒2031

Table 17: North America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 18: North America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 19: North America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 20: North America Ferroelectric RAM Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: Europe Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Interface Type, 2017‒2031

Table 22: Europe Ferroelectric RAM Market Volume (Million Units) & Forecast, by Interface Type, 2017‒2031

Table 23: Europe Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Memory Density, 2017‒2031

Table 24: Europe Ferroelectric RAM Market Volume (Million Units) & Forecast, by Memory Density, 2017‒2031

Table 25: Europe Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Package, 2017‒2031

Table 26: Europe Ferroelectric RAM Market Volume (Million Units) & Forecast, by Package, 2017‒2031

Table 27: Europe Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 28: Europe Ferroelectric RAM Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 29: Europe Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 30: Europe Ferroelectric RAM Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 31: Asia Pacific Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Interface Type, 2017‒2031

Table 32: Asia Pacific Ferroelectric RAM Market Volume (Million Units) & Forecast, by Interface Type, 2017‒2031

Table 33: Asia Pacific Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Memory Density, 2017‒2031

Table 34: Asia Pacific Ferroelectric RAM Market Volume (Million Units) & Forecast, by Memory Density, 2017‒2031

Table 35: Asia Pacific Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Package, 2017‒2031

Table 36: Asia Pacific Ferroelectric RAM Market Volume (Million Units) & Forecast, by Package, 2017‒2031

Table 37: Asia Pacific Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 38: Asia Pacific Ferroelectric RAM Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 39: Asia Pacific Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 40: Asia Pacific Ferroelectric RAM Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 41: Middle East & Africa Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Interface Type, 2017‒2031

Table 42: Middle East & Africa Ferroelectric RAM Market Volume (Million Units) & Forecast, by Interface Type, 2017‒2031

Table 43: Middle East & Africa Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Memory Density, 2017‒2031

Table 44: Middle East & Africa Ferroelectric RAM Market Volume (Million Units) & Forecast, by Memory Density, 2017‒2031

Table 45: Middle East & Africa Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Package, 2017‒2031

Table 46: Middle East & Africa Ferroelectric RAM Market Volume (Million Units) & Forecast, by Package, 2017‒2031

Table 47: Middle East & Africa Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 48: Middle East & Africa Ferroelectric RAM Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 49: Middle East & Africa Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 50: Middle East & Africa Ferroelectric RAM Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 51: South America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Interface Type, 2017‒2031

Table 52: South America Ferroelectric RAM Market Volume (Million Units) & Forecast, by Interface Type, 2017‒2031

Table 53: South America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Memory Density, 2017‒2031

Table 54: South America Ferroelectric RAM Market Volume (Million Units) & Forecast, by Memory Density, 2017‒2031

Table 55: South America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Package, 2017‒2031

Table 56: South America Ferroelectric RAM Market Volume (Million Units) & Forecast, by Package, 2017‒2031

Table 57: South America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 58: South America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 59: South America Ferroelectric RAM Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 60: South America Ferroelectric RAM Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Ferroelectric RAM

Figure 02: Porter Five Forces Analysis - Global Ferroelectric RAM

Figure 03: Technology Road Map - Global Ferroelectric RAM

Figure 04: Global Ferroelectric RAM Market, Value (US$ Mn), 2017-2031

Figure 05: Global Ferroelectric RAM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global Ferroelectric RAM Market Projections by Interface Type, Value (US$ Mn), 2017‒2031

Figure 07: Global Ferroelectric RAM Market, Incremental Opportunity, by Interface Type, 2023‒2031

Figure 08: Global Ferroelectric RAM Market Share Analysis, by Interface Type, 2023 and 2031

Figure 09: Global Ferroelectric RAM Market Projections by Memory Density, Value (US$ Mn), 2017‒2031

Figure 10: Global Ferroelectric RAM Market, Incremental Opportunity, by Memory Density, 2023‒2031

Figure 11: Global Ferroelectric RAM Market Share Analysis, by Memory Density, 2023 and 2031

Figure 12: Global Ferroelectric RAM Market Projections by Package, Value (US$ Mn), 2017‒2031

Figure 13: Global Ferroelectric RAM Market, Incremental Opportunity, by Package, 2023‒2031

Figure 14: Global Ferroelectric RAM Market Share Analysis, by Package, 2023 and 2031

Figure 15: Global Ferroelectric RAM Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 16: Global Ferroelectric RAM Market, Incremental Opportunity, by Application, 2023‒2031

Figure 17: Global Ferroelectric RAM Market Share Analysis, by Application, 2023 and 2031

Figure 18: Global Ferroelectric RAM Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 19: Global Ferroelectric RAM Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 20: Global Ferroelectric RAM Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 21: Global Ferroelectric RAM Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 22: Global Ferroelectric RAM Market, Incremental Opportunity, by Region, 2023‒2031

Figure 23: Global Ferroelectric RAM Market Share Analysis, by Region, 2023 and 2031

Figure 24: North America Ferroelectric RAM Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 25: North America Ferroelectric RAM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 26: North America Ferroelectric RAM Market Projections by Interface Type Value (US$ Mn), 2017‒2031

Figure 27: North America Ferroelectric RAM Market, Incremental Opportunity, by Interface Type, 2023‒2031

Figure 28: North America Ferroelectric RAM Market Share Analysis, by Interface Type, 2023 and 2031

Figure 29: North America Ferroelectric RAM Market Projections by Memory Density Value (US$ Mn), 2017‒2031

Figure 30: North America Ferroelectric RAM Market, Incremental Opportunity, by Memory Density, 2023‒2031

Figure 31: North America Ferroelectric RAM Market Share Analysis, by Memory Density, 2023 and 2031

Figure 32: North America Ferroelectric RAM Market Projections by Package (US$ Mn), 2017‒2031

Figure 33: North America Ferroelectric RAM Market, Incremental Opportunity, by Package, 2023‒2031

Figure 34: North America Ferroelectric RAM Market Share Analysis, by Package, 2023 and 2031

Figure 35: North America Ferroelectric RAM Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 36: North America Ferroelectric RAM Market, Incremental Opportunity, by Application, 2023‒2031

Figure 37: North America Ferroelectric RAM Market Share Analysis, by Application, 2023 and 2031

Figure 38: North America Ferroelectric RAM Market Projections by End-use Industry Value (US$ Mn), 2017‒2031

Figure 39: North America Ferroelectric RAM Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 40: North America Ferroelectric RAM Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 41: North America Ferroelectric RAM Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 42: North America Ferroelectric RAM Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 43: North America Ferroelectric RAM Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 44: Europe Ferroelectric RAM Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 45: Europe Ferroelectric RAM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 46: Europe Ferroelectric RAM Market Projections by Interface Type Value (US$ Mn), 2017‒2031

Figure 47: Europe Ferroelectric RAM Market, Incremental Opportunity, by Interface Type, 2023‒2031

Figure 48: Europe Ferroelectric RAM Market Share Analysis, by Interface Type, 2023 and 2031

Figure 49: Europe Ferroelectric RAM Market Projections by Memory Density, Value (US$ Mn), 2017‒2031

Figure 50: Europe Ferroelectric RAM Market, Incremental Opportunity, by Memory Density, 2023‒2031

Figure 51: Europe Ferroelectric RAM Market Share Analysis, by Memory Density, 2023 and 2031

Figure 52: Europe Ferroelectric RAM Market Projections by Package, Value (US$ Mn), 2017‒2031

Figure 53: Europe Ferroelectric RAM Market, Incremental Opportunity, by Package, 2023‒2031

Figure 54: Europe Ferroelectric RAM Market Share Analysis, by Package, 2023 and 2031

Figure 55: Europe Ferroelectric RAM Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 56: Europe Ferroelectric RAM Market, Incremental Opportunity, by Application, 2023‒2031

Figure 57: Europe Ferroelectric RAM Market Share Analysis, by Application, 2023 and 2031

Figure 58: Europe Ferroelectric RAM Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 59: Europe Ferroelectric RAM Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 60: Europe Ferroelectric RAM Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 61: Europe Ferroelectric RAM Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 62: Europe Ferroelectric RAM Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 63: Europe Ferroelectric RAM Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 64: Asia Pacific Ferroelectric RAM Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 65: Asia Pacific Ferroelectric RAM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 66: Asia Pacific Ferroelectric RAM Market Projections by Interface Type Value (US$ Mn), 2017‒2031

Figure 67: Asia Pacific Ferroelectric RAM Market, Incremental Opportunity, by Interface Type, 2023‒2031

Figure 68: Asia Pacific Ferroelectric RAM Market Share Analysis, by Interface Type, 2023 and 2031

Figure 69: Asia Pacific Ferroelectric RAM Market Projections by Memory Density Value (US$ Mn), 2017‒2031

Figure 70: Asia Pacific Ferroelectric RAM Market, Incremental Opportunity, by Memory Density, 2023‒2031

Figure 71: Asia Pacific Ferroelectric RAM Market Share Analysis, by Memory Density, 2023 and 2031

Figure 72: Asia Pacific Ferroelectric RAM Market Projections by Package, Value (US$ Mn), 2017‒2031

Figure 73: Asia Pacific Ferroelectric RAM Market, Incremental Opportunity, by Package, 2023‒2031

Figure 74: Asia Pacific Ferroelectric RAM Market Share Analysis, by Package, 2023 and 2031

Figure 75: Asia Pacific Ferroelectric RAM Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 76: Asia Pacific Ferroelectric RAM Market, Incremental Opportunity, by Application, 2023‒2031

Figure 77: Asia Pacific Ferroelectric RAM Market Share Analysis, by Application, 2023 and 2031

Figure 78: Asia Pacific Ferroelectric RAM Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 79: Asia Pacific Ferroelectric RAM Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 80: Asia Pacific Ferroelectric RAM Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 81: Asia Pacific Ferroelectric RAM Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 82: Asia Pacific Ferroelectric RAM Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 83: Asia Pacific Ferroelectric RAM Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 84: Middle East & Africa Ferroelectric RAM Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 85: Middle East & Africa Ferroelectric RAM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 86: Middle East & Africa Ferroelectric RAM Market Projections by Interface Type Value (US$ Mn), 2017‒2031

Figure 87: Middle East & Africa Ferroelectric RAM Market, Incremental Opportunity, by Interface Type, 2023‒2031

Figure 88: Middle East & Africa Ferroelectric RAM Market Share Analysis, by Interface Type, 2023 and 2031

Figure 89: Middle East & Africa Ferroelectric RAM Market Projections by Memory Density Value (US$ Mn), 2017‒2031

Figure 90: Middle East & Africa Ferroelectric RAM Market, Incremental Opportunity, by Memory Density, 2023‒2031

Figure 91: Middle East & Africa Ferroelectric RAM Market Share Analysis, by Memory Density, 2023 and 2031

Figure 92: Middle East & Africa Ferroelectric RAM Market Projections by Package, Value (US$ Mn), 2017‒2031

Figure 93: Middle East & Africa Ferroelectric RAM Market, Incremental Opportunity, by Package, 2023‒2031

Figure 94: Middle East & Africa Ferroelectric RAM Market Share Analysis, by Package, 2023 and 2031

Figure 95: Middle East & Africa Ferroelectric RAM Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 96: Middle East & Africa Ferroelectric RAM Market, Incremental Opportunity, by Application, 2023‒2031

Figure 97: Middle East & Africa Ferroelectric RAM Market Share Analysis, by Application, 2023 and 2031

Figure 98: Middle East & Africa Ferroelectric RAM Market Projections by End-use Industry Value (US$ Mn), 2017‒2031

Figure 99: Middle East & Africa Ferroelectric RAM Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 100: Middle East & Africa Ferroelectric RAM Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 101: Middle East & Africa Ferroelectric RAM Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 102: Middle East & Africa Ferroelectric RAM Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 103: Middle East & Africa Ferroelectric RAM Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 104: South America Ferroelectric RAM Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 105: South America Ferroelectric RAM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 106: South America Ferroelectric RAM Market Projections by Interface Type Value (US$ Mn), 2017‒2031

Figure 107: South America Ferroelectric RAM Market, Incremental Opportunity, by Interface Type, 2023‒2031

Figure 108: South America Ferroelectric RAM Market Share Analysis, by Interface Type, 2023 and 2031

Figure 109: South America Ferroelectric RAM Market Projections by Memory Density Value (US$ Mn), 2017‒2031

Figure 110: South America Ferroelectric RAM Market, Incremental Opportunity, by Memory Density, 2023‒2031

Figure 111: South America Ferroelectric RAM Market Share Analysis, by Memory Density, 2023 and 2031

Figure 112: South America Ferroelectric RAM Market Projections by Package, Value (US$ Mn), 2017‒2031

Figure 113: South America Ferroelectric RAM Market, Incremental Opportunity, by Package, 2023‒2031

Figure 114: South America Ferroelectric RAM Market Share Analysis, by Package, 2023 and 2031

Figure 115: South America Ferroelectric RAM Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 116: South America Ferroelectric RAM Market, Incremental Opportunity, by Application, 2023‒2031

Figure 117: South America Ferroelectric RAM Market Share Analysis, by Application, 2023 and 2031

Figure 118: South America Ferroelectric RAM Market Projections by End-use Industry Value (US$ Mn), 2017‒2031

Figure 119: South America Ferroelectric RAM Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 120: South America Ferroelectric RAM Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 121: South America Ferroelectric RAM Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 122: South America Ferroelectric RAM Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 123: South America Ferroelectric RAM Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 124: Global Ferroelectric RAM Market Competition

Figure 125: Global Ferroelectric RAM Market Company Share Analysis