Analysts’ Viewpoint

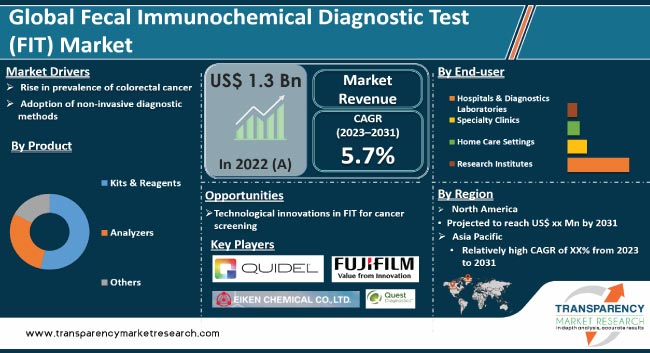

Rise in prevalence of colorectal cancer (CRC) across the globe and increase in demand for non-invasive diagnostic methods are driving the global fecal immunochemical diagnostic test (FIT) market. FIT is considered a highly accurate and convenient method for CRC screening, and its ease of use and patient acceptance have made it a preferred screening method in several countries.

Increase in demand for FIT testing in the next few years is likely to accelerate market development. Furthermore, governments and organizations are promoting CRC screening programs, which is expected to propel the fecal immunochemical diagnostic test (FIT) industry growth.

Development of more sensitive, higher specificity, and low cost fecal immunochemical diagnostic tests offers lucrative opportunities to market players. Companies are focusing on development of technologically advanced fecal immunochemical tests in order to increase market share.

Fecal immunochemical test (FIT) is a non-invasive diagnostic test used to detect the presence of blood in stool. The test, also known as fecal hemoglobin test, is used as a screening tool for colorectal cancer, as well as other gastrointestinal disorders such as inflammatory bowel disease (IBD) and diverticulitis.

FIT works by detecting the presence of hemoglobin, a protein found in red blood cells, in a stool sample. The test is easy to perform and can be done at home by collecting a small sample of stool and sending it to a laboratory for analysis.

Unlike the traditional fecal occult blood test (FOBT), FIT is more sensitive and specific in detecting blood in the stool. This is because the test only detects human hemoglobin, while FOBT can detect both human and non-human sources of blood, leading to more false positives.

FITs are widely used diagnostic tools to detect pre-cancerous lesions or early-stage colorectal cancer by detecting blood in stool samples. Advancements in FITs have focused on improving their sensitivity and specificity, as well as making them more user-friendly for patients.

One such advancement is the development of next-generation FIT tests, which use advanced algorithms and machine learning to improve the accuracy of the test. Newer FITs have been developed with improved sensitivity; these are better able to detect small amounts of blood in stool samples.

This could lead to early detection of colorectal cancer and better patient outcomes. Some FITs now use digital technology to analyze stool samples, which can improve accuracy and reduce the need for human interpretation.

Another major innovation in the FIT market is the development of point-of-care (POC) FIT tests, which can be performed in a doctor's office or even at home, without the need for a laboratory. POC FIT tests are cost-effective and convenient, making them an attractive option for patients and healthcare providers.

Development of liquid biopsy tests, which detect circulating tumor cells (CTCs) and cell-free DNA (cfDNA) in blood, could be a useful tool for the early detection of colorectal cancer. Liquid biopsy tests are non-invasive and can be used to monitor cancer progression and treatment response.

Colorectal cancer is a significant health concern across the world. Prevalence of the cancer has been steadily increasing due to several factors, including aging population, sedentary lifestyles, and unhealthy diets.

Early detection and screening of this disease are crucial for successful treatment and improved patient outcomes. FIT, which is non-invasive, simple to perform, and highly accurate test, is one of the most effective and convenient screening methods for colorectal cancer.

Compared to other screening methods, FITs offer several advantages, such as non-invasive, easy to perform at home, requirement of small stool sample, and high sensitivity & specificity, for detecting early-stage tumors when they are most treatable. Hence, rise in demand for FIT testing of cancer is driving the market.

According to the International Agency for Research on Cancer (IARC), incidence of colorectal cancer is expected to increase globally by 56% between 2020 and 2040, resulting in over 3 million new cases annually.

The number of deaths due to the disease is also anticipated to rise by 69%, with approximately 1.6 million fatalities worldwide by 2040. This surge in cases is expected to be particularly pronounced in countries with a high Human Development Index.

Non-invasive diagnostic methods have become increasingly popular in the past few years due to their convenience and patient acceptance. FIT has emerged as a preferred screening method for colorectal cancer (CRC) due to its high accuracy, low cost, and ease of use.

FIT testing eliminates the need for invasive procedures such as colonoscopy, which can be uncomfortable and costly for patients. Unlike colonoscopy, FIT does not require any preparation or sedation, and the test can be performed at home using a stool sample.

FIT detects the presence of blood in the stool, which can be an indicator of CRC. If the test results are positive, further diagnostic tests such as colonoscopy may be recommended to confirm the diagnosis and determine the extent of the disease. However, if FIT results are negative, the patient could be considered low risk for CRC and can avoid undergoing an invasive procedure such as colonoscopy.

Colonoscopy is considered the gold standard for CRC screening; however, it can be uncomfortable and invasive, and patients may experience discomfort or complications. In contrast, FIT is a non-invasive and low-risk option for CRC screening, and its ease of use and patient acceptance have made it a preferred screening method in many countries.

In terms of product type, the kits & reagents segment dominated global fecal immunochemical diagnostic test (fit) market demand in 2022. Kits and reagents play a crucial role in FIT, as they help ensure the accuracy and reliability of test results.

The kits contain all the necessary components for collecting, handling, and analyzing fecal samples, including buffer solutions, reagents, and test strips. These simplify the testing process and reduce the likelihood of errors, making them a popular choice for healthcare professionals.

Kits and reagents are also cost-effective, which makes them attractive to both healthcare providers and patients. These are available in various formats and sizes, making them suitable for different types of FIT tests, from single-patient tests to large-scale screening programs.

Based on end-user, the hospitals & diagnostic laboratories segment accounted for the largest global fecal immunochemical diagnostic test (FIT) market share in 2022. People prefer hospitals for treatment than diagnostic & imaging centers.

Hospitals are the primary healthcare institutions that are equipped with the necessary resources and infrastructure required to facilitate endoscopy procedures. These resources include advanced medical devices, skilled medical personnel, and modern diagnostic and imaging equipment, all of which are essential for the successful implementation of FIT test.

As per fecal immunochemical diagnostic test (fit) market trends, North America accounted for major share of the global market in 2021. The market in the region is likely to expand at a high CAGR from 2022 to 2031.

According to the American Cancer Society, colorectal cancer is the third-most commonly diagnosed cancer and the second-leading cause of cancer-related deaths in both men and women in the U.S. This has fueled demand for early and accurate detection of colorectal cancer through non-invasive screening tests such as FIT.

The U.S. dominated the market in North America in 2022. This is ascribed to presence of strong research & development ecosystem in the country, with several companies investing significantly in the development of new and innovative diagnostic technologies.

Asia Pacific is the fastest growing region of the global fecal immunochemical diagnostic test (FIT) market. The market in the region is likely to grow at a rapid pace from 2022 to 2031.

According to the World Health Organization (WHO), incidence of colorectal cancer (CRC) in Asia Pacific is expected to rise by over 40% by 2030. This has led to increase in demand for fecal immunochemical tests, which are effective in detecting early stages of CRC and other gastrointestinal diseases. Moreover, Asia Pacific has a large population base, which has contributed to expansion of the fecal immunochemical diagnostics test market.

The global market is consolidated, with the presence of small number of large companies. Majority of the companies are making significant investment in research & development, primarily to develop more efficient products. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the key players.

Leading players in the global fecal immunochemical diagnostic test (FIT) market are Quest Diagnostics Incorporated, Sentinel CH. SpA, FUJIFILM Corporation, Quidel Corporation, Danaher (Beckman Coulter, Inc.), Eiken Chemical Co., Ltd., Freenome Holdings, Inc., Immunostics, Inc., BTNX, Inc., and Biohit Oyj.

Each of these players has been profiled in the fecal immunochemical diagnostic test (fit) market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|---|---|

|

Size in 2022 |

US$ 1.3 Bn |

|

Forecast (Value) in 2031 |

US$ 2.1 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 1.3 Bn in 2022

It is projected to reach more than US$ 2.1 Bn by 2031

The global industry is anticipated to expand at a CAGR of 5.7% from 2023 to 2031.

Rise in prevalence of colorectal cancer, adoption of non-invasive diagnostic methods, and increase in awareness about early cancer detection are propelling the global market.

North America is expected to account for the largest share of the global market during the forecast period.

Quest Diagnostics Incorporated, Sentinel CH. SpA, FUJIFILM Corporation, Quidel Corporation, Danaher (Beckman Coulter, Inc.), Eiken Chemical Co., Ltd, Freenome Holdings, Inc., Immunostics, Inc., BTNX, Inc., and Biohit Oyj are the prominent players in the global market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Fecal Immunochemical Diagnostic Test (FIT) Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Fecal Immunochemical Diagnostic Test (FIT) Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Disease Prevalence & Incidence Rate globally with key countries

5.2. Regulatory Scenario

5.3. Pricing Analysis

5.4. COVID-19 Pandemic Impact on Industry

6. Global Fecal Immunochemical Diagnostic Test (FIT) Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017-2031

6.3.1. Kits & Reagents

6.3.2. Analyzers

6.3.3. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Fecal Immunochemical Diagnostic Test (FIT) Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017-2031

7.3.1. Hospitals & Diagnostic Laboratories

7.3.2. Specialty Clinics

7.3.3. Home Care Settings

7.3.4. Research Institutes

7.4. Market Attractiveness Analysis, by End-user

8. Global Fecal Immunochemical Diagnostic Test (FIT) Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Fecal Immunochemical Diagnostic Test (FIT) Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product Type, 2017-2031

9.2.1. Kits & Reagents

9.2.2. Analyzers

9.2.3. Others

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. Hospitals & Diagnostic Laboratories

9.3.2. Specialty Clinics

9.3.3. Home Care Settings

9.3.4. Research Institutes

9.4. Market Value Forecast, by Country, 2017-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Fecal Immunochemical Diagnostic Test (FIT) Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017-2031

10.2.1. Kits & Reagents

10.2.2. Analyzers

10.2.3. Others

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Hospitals & Diagnostic Laboratories

10.3.2. Specialty Clinics

10.3.3. Home Care Settings

10.3.4. Research Institutes

10.4. Market Value Forecast, by Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Fecal Immunochemical Diagnostic Test (FIT) Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017-2031

11.2.1. Kits & Reagents

11.2.2. Analyzers

11.2.3. Others

11.3. Market Value Forecast, by End-user, 2017-2031

11.3.1. Hospitals & Diagnostic Laboratories

11.3.2. Specialty Clinics

11.3.3. Home Care Settings

11.3.4. Research Institutes

11.4. Market Value Forecast, by Country/Sub-region, 2017-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Fecal Immunochemical Diagnostic Test (FIT) Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017-2031

12.2.1. Kits & Reagents

12.2.2. Analyzers

12.2.3. Others

12.3. Market Value Forecast, by End-user, 2017-2031

12.3.1. Hospitals & Diagnostic Laboratories

12.3.2. Specialty Clinics

12.3.3. Home Care Settings

12.3.4. Research Institutes

12.4. Market Value Forecast, by Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Fecal Immunochemical Diagnostic Test (FIT) Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017-2031

13.2.1. Kits & Reagents

13.2.2. Analyzers

13.2.3. Others

13.3. Market Value Forecast, by End-user, 2017-2031

13.3.1. Hospitals & Diagnostic Laboratories

13.3.2. Specialty Clinics

13.3.3. Home Care Settings

13.3.4. Research Institutes

13.4. Market Value Forecast, by Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2022

14.3. Company Profiles

14.3.1. Quest Diagnostics Incorporated

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Strategic Overview

14.3.2. Sentinel CH. SpA

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Strategic Overview

14.3.3. FUJIFILM Corporation

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Strategic Overview

14.3.4. Quidel Corporation

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Strategic Overview

14.3.5. Danaher (Beckman Coulter, Inc.)

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Strategic Overview

14.3.6. Eiken Chemical Co., Ltd.

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Strategic Overview

14.3.7. Freenome Holdings, Inc.

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Strategic Overview

14.3.8. Immunostics, Inc.

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Strategic Overview

14.3.9. BTNX, Inc.

14.3.9.1. Company Overview

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Strategic Overview

14.3.10. Biohit Oyj

14.3.10.1. Company Overview

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

14.3.10.4. Strategic Overview

List of Tables

Table 01: Global Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 02: Global Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 03: Global Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 04: North America Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 05: North America Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 06: North America Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 07: Europe Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 08: Europe Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 09: Europe Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 10: Asia Pacific Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 11: Asia Pacific Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 12: Asia Pacific Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Latin America Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Latin America Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 15: Latin America Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 16: Middle East and Africa Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Middle East and Africa Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by Product Type, 2017-2031

Table 18: Middle East and Africa Fecal Immunochemical Diagnostic Test (FIT) Market Size (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Fecal Immunochemical Diagnostic Test (FIT) Market Value Share, by Product Type, 2022

Figure 03: Global Fecal Immunochemical Diagnostic Test (FIT) Market Value Share, by End-user, 2022

Figure 04: Global Fecal Immunochemical Diagnostic Test (FIT) Market Value Share, by Region, 2022

Figure 05: Global Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 06: Global Fecal Immunochemical Diagnostic Test (FIT) Market Revenue (US$ Mn), by Kits & Reagents, 2017-2031

Figure 07: Global Fecal Immunochemical Diagnostic Test (FIT) Market Revenue (US$ Mn), by Analyzers, 2017-2031

Figure 08: Global Fecal Immunochemical Diagnostic Test (FIT) Market Revenue (US$ Mn), by Others, 2017-2031

Figure 09: Global Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 10: Global Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by End-user, 2022 and 2031

Figure 11: Global Fecal Immunochemical Diagnostic Test (FIT) Market Revenue (US$ Mn), by Hospitals & Diagnostic Laboratories, 2017-2031

Figure 12: Global Fecal Immunochemical Diagnostic Test (FIT) Market Revenue (US$ Mn), by Specialty Clinics, 2017-2031

Figure 13: Global Fecal Immunochemical Diagnostic Test (FIT) Market Revenue (US$ Mn), by Home Care Settings, 2017-2031

Figure 14: Global Fecal Immunochemical Diagnostic Test (FIT) Market Revenue (US$ Mn), by Research Institutes, 2017-2031

Figure 15: Global Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by End-user, 2023-2031

Figure 16: Global Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Region, 2023-2031

Figure 18: North America Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, 2017-2031

Figure 19: North America Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Country, 2022 and 2031

Figure 20: North America Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Country, 2023-2031

Figure 21: North America Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 22: North America Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 23: North America Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: North America Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by End-user, 2023-2031

Figure 25: Europe Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, 2017-2031

Figure 26: Europe Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 27: Europe Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 28: Europe Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 29: Europe Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 30: Europe Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by End-user, 2022 and 2031

Figure 31: Europe Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by End-user, 2023-2031

Figure 32: Asia Pacific Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, 2017-2031

Figure 33: Asia Pacific Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 34: Asia Pacific Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 35: Asia Pacific Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 36: Asia Pacific Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 37 Asia Pacific Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by End-user, 2022 and 2031

Figure 38: Asia Pacific Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by End-user, 2023-2031

Figure 39: Latin America Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, 2017-2031

Figure 40: Latin America Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 41: Latin America Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 42: Latin America Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 43: Latin America Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 44: Latin America Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by End-user, 2022 and 2031

Figure 45: Latin America Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by End-user, 2023-2031

Figure 46: Middle East and Africa Fecal Immunochemical Diagnostic Test (FIT) Market Value (US$ Mn) Forecast, 2017-2031

Figure 47: Middle East and Africa Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Middle East and Africa Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 49: Middle East and Africa Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 50: Middle East and Africa Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 51: Middle East and Africa Fecal Immunochemical Diagnostic Test (FIT) Market Value Share Analysis, by End-user, 2022 and 2031

Figure 52: Middle East and Africa Fecal Immunochemical Diagnostic Test (FIT) Market Attractiveness Analysis, by End-user, 2023-2031