Analysts’ Viewpoint

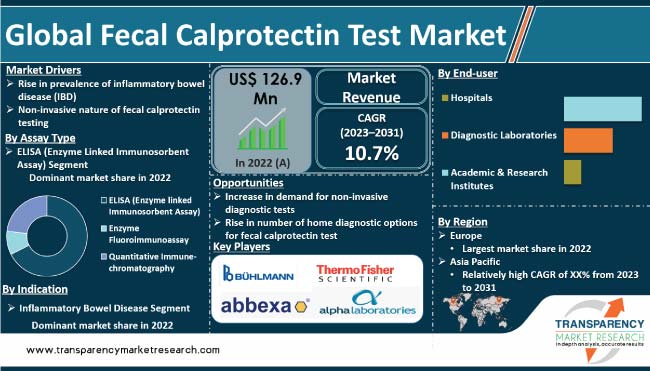

The global fecal calprotectin test market is expected to witness significant growth in the next few years due to rise in prevalence of inflammatory bowel disease (IBD) and gastrointestinal disorders. Fecal calprotectin test is most commonly used in adult patients due to high incidence rate of inflammatory bowel disease (IBD) and colorectal cancer among these patients. Increase in awareness among patients and healthcare professionals about the benefits of early diagnosis and treatment is expected to drive global fecal calprotectin test market growth.

Development of more accurate and low cost fecal calprotectin tests offers lucrative opportunities to market players. Companies are focusing on developing cost-efficient and more precise tests in order to increase market share and revenue. However, high cost of tests and lack of reimbursement policies in some regions are likely to hamper market growth.

The stool calprotectin test is a diagnostic tool used to measure the level of calprotectin in the stool. Calprotectin is a protein released by white blood cells in the intestines during inflammation, making it a useful marker for various gastrointestinal disorders, particularly inflammatory bowel disease (IBD) such as Crohn's disease and ulcerative colitis.

The stool calprotectin test is non-invasive and provides valuable information to healthcare professionals in assessing the severity of intestinal inflammation, monitoring disease activity, and determining treatment strategies. It is often used in combination with other clinical evaluations and imaging techniques to aid in the diagnosis and management of gastrointestinal conditions.

The two types of fecal calprotectin test available in the market are quantitative and qualitative. The quantitative test measures the exact amount of calprotectin in the stool, while the qualitative test provides a positive or negative result based on a predetermined threshold.

The quantitative test is more accurate and provides a more precise measurement of calprotectin levels, but it is also more expensive. The qualitative test is less expensive and provides a quick and easy result, but it is less accurate and may lead to false positives or false negatives.

Fecal calprotectin normal range is 10 to 50 or 60 μg/mg. The treatment for high calprotectin levels includes anti-inflammatory medicine, which helps to reduce inflammation in diseases such as IBD, colorectal cancer, and others.

Inflammatory bowel disease (IBD) is a chronic inflammatory disorder of the gastrointestinal tract that includes Crohn's disease and ulcerative colitis. Prevalence of IBD is increasing globally, particularly in developed countries.

According to the Centers for Disease Control and Prevention (CDC), around 3 million adults in the U.S. have been diagnosed with IBD. In Europe, the prevalence of IBD is estimated to be 0.3% to 0.5% of the total population.

Several factors contribute to the increasing prevalence of IBD, including:

Rise in prevalence of IBD is driving demand for accurate and reliable diagnostic tools such as fecal calprotectin testing. Early detection and treatment of IBD can help improve patient outcomes and reduce the risk of complications. Hence, demand for non-invasive diagnostic tests such as fecal calprotectin testing is high.

Non-invasiveness of fecal calprotectin testing is a major driver of the global fecal calprotectin test market. Fecal calprotectin testing is a non-invasive diagnostic tool used to evaluate gastrointestinal inflammation and is increasingly being used in the diagnosis and management of inflammatory bowel disease (IBD) and other gastrointestinal disorders.

Unlike other diagnostic tests, such as colonoscopy or biopsy, fecal calprotectin testing does not require insertion of any devices or instruments into the body. Instead, patients provide a stool sample, which is analyzed in a laboratory to measure the level of calprotectin in the stool. This non-invasive nature of fecal calprotectin testing can be particularly appealing to patients who could be hesitant to undergo more invasive diagnostic procedures.

Non-invasiveness of fecal calprotectin testing also makes it a convenient diagnostic tool for healthcare providers. Fecal calprotectin testing can be performed quickly and easily in a clinical setting, and the results are typically available within a few days. This convenience and ease of use could help to encourage more widespread adoption of fecal calprotectin testing, which is likely to drive the fecal calprotectin test market size.

In terms of patient type, the adults segment is anticipated to account for the largest global fecal calprotectin test market share during the forecast period. This can be ascribed to increase in demand for fecal calprotectin testing among adult patients. According to the National Health Service, people of any age can get IBD, but it is usually diagnosed in patients aged between 15 and 40.

Increase in number of adults suffering from gastrointestinal disorders is likely to drive the segment during the forecast period. According to a survey conducted by the Sahlgrenska Academy at the University of Gothenburg in 2020, nearly 40% of adults were suffering from a functional gastrointestinal disorder.

Functional gastrointestinal disorders represent a series of chronic disorders in the gastrointestinal tract that often include severe symptoms, including heartburn, acid reflux, and dyspepsia in the upper gastrointestinal tract and chronic constipation, abdominal distention or bloating, and irritable bowel syndrome in the lower gastrointestinal tract.

Based on assay type, the enzyme linked immunosorbent assay (ELISA) segment dominated the global fecal calprotectin test market in 2022. The ELISA test for fecal calprotectin is highly accurate and can detect levels as low as 15-20 μg/g of stool. It is a non-invasive diagnostic tool that is less costly and less time-consuming than more invasive diagnostic procedures such as endoscopy or colonoscopy.

The ELISA test for fecal calprotectin is particularly useful for the diagnosis and monitoring of inflammatory bowel disease (IBD) and can also be used to distinguish between IBD and non-IBD conditions with similar symptoms, such as irritable bowel syndrome (IBS).

In terms of indication, the inflammatory bowel disease segment accounted for leading share of the global market in 2022. Fecal calprotectin test is major inflammatory bowel disease test used for diseases diagnosis.

Fecal calprotectin test is primarily used in the diagnosis and monitoring of inflammatory bowel disease (IBD), which typically affects adults. IBD, including Crohn's disease and ulcerative colitis, is a chronic condition that causes inflammation in the gut, leading to symptoms such as abdominal pain, diarrhea, and rectal bleeding. Fecal calprotectin test is also referred as GI inflammation test.

Fecal calprotectin test helps to distinguish between IBD and IBS. Increase in number of patients suffering from inflammatory bowel disease is likely to drive the segment. According to the European Federation of Crohn's & Ulcerative Colitis Associations (EFCCA), there are 10 million people globally living with IBD. However, the number could be higher, if the same prevalence of 1% or more that is true in the U.K. and the U.S. applies to most other western countries.

Based on end-user, the hospitals segment dominated the global fecal calprotectin test market in 2022. Hospitals are one of the primary end-users of fecal calprotectin tests, which are used for the diagnosis and monitoring of patients with inflammatory bowel diseases (IBD), such as Crohn's disease and ulcerative colitis.

Presence of large, specialized hospitals equipped with advanced health care infrastructure and specialist professionals for consulting boosts patient preference for hospitals. Availability of a wide range of services in hospital settings is likely to propel the segment during the forecast period.

Europe is a major market for fecal calprotectin tests. This can be ascribed to high prevalence of IBDs, such as Crohn's and ulcerative colitis; availability of advanced healthcare infrastructure & facilities; and presence of several key market players.

Germany dominated the market in Europe in 2022 owing to factors such as large number of IBD patients, high adoption of new technologically advanced products, significant health care expenditure, early availability of advanced technologies, and increase in research activities across the country.

Asia Pacific is anticipated to be the fastest growing region for fecal calprotectin test during the forecast period. The market in the region is anticipated to expand at a high CAGR from 2022 to 2031 due to large patient base in countries such as India and China and rise in awareness about IBD and colorectal cancer.

The global fecal calprotectin test market is fragmented, with the presence of large number of leading players. Manufactures in calprotectin test are investing significantly in research & development, primarily to develop innovative fecal calprotectin test. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the key players in the market.

Abbexa, ALPCO, Alpha Laboratories, Biomerica, BÜHLMANN Laboratories AG, DRG INSTRUMENTS GMBH, EagleBio, Epitope Diagnostics, Inc., OPERON, S.A., R-Biopharm AG, Svar Life Science, Thermo Fisher Scientific, Inc., Werfen, SENTINEL CH. SpA, Diazyme Laboratories, Inc., and DiAgam are the key players operating in the global market.

The fecal calprotectin test industry research report profiles key players based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size Value in 2022 |

US$ 126.9 Mn |

|

Forecast (Value) in 2031 |

More than US$ 355.8 Mn |

|

Growth Rate (CAGR) |

10.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 126.9 Mn in 2022

It is projected to reach more than US$ 355.8 Mn by 2031

The industry is anticipated to expand at a CAGR of 10.7% from 2023 to 2031

Rise in prevalence of inflammatory bowel disease (IBD) and non-invasive nature of fecal calprotectin testing are driving the market

Europe is projected to account for major market share during the forecast period

Abbexa, ALPCO, Alpha Laboratories, Biomerica, BÜHLMANN Laboratories AG, DRG Instruments GmbH, EagleBio, Epitope Diagnostics, Inc., OPERON, S.A., R-Biopharm AG, Svar Life Science, Thermo Fisher Scientific, Inc., Werfen, SENTINEL CH. SpA, Diazyme Laboratories Inc., and DiAgam are the prominent players in the market

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Fecal Calprotectin Test Market

4. Market Overview

4.1. Introduction

4.1.1. Patient Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Fecal Calprotectin Test Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancement

5.2. Diseases Epidemiology

5.3. Regulatory Scenario

5.4. Pricing Analysis

5.5. COVID-19 Impact Analysis

6. Global Fecal Calprotectin Test Market Analysis and Forecast, by Patient Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Patient Type, 2017-2031

6.3.1. Adult

6.3.2. Pediatric

6.4. Market Attractiveness Analysis, by Patient Type

7. Global Fecal Calprotectin Test Market Analysis and Forecast, by Assay Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Assay Type, 2017-2031

7.3.1. ELISA (Enzyme linked Immunosorbent Assay)

7.3.2. Enzyme Fluoroimmunoassay

7.3.3. Quantitative Immune-chromatography

7.4. Market Attractiveness Analysis, by Assay Type

8. Global Fecal Calprotectin Test Market Analysis and Forecast, by Indication

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Indication, 2017-2031

8.3.1. Inflammatory Bowel Disease

8.3.2. Colorectal Cancer

8.3.3. Celiac Disease

8.4. Market Attractiveness Analysis, by Indication

9. Global Fecal Calprotectin Test Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. Hospitals

9.3.2. Diagnostic Laboratories

9.3.3. Academic & Research Institutes

9.4. Market Attractiveness Analysis, by End-user

10. Global Fecal Calprotectin Test Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Fecal Calprotectin Test Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Patient Type, 2017-2031

11.2.1. Adult

11.2.2. Pediatric

11.3. Market Value Forecast, by Assay Type, 2017-2031

11.3.1. ELISA (Enzyme linked Immunosorbent Assay)

11.3.2. Enzyme Fluoroimmunoassay

11.3.3. Quantitative Immune-chromatography

11.4. Market Value Forecast, by Indication, 2017-2031

11.4.1. Inflammatory Bowel Disease

11.4.2. Colorectal Cancer

11.4.3. Celiac Disease

11.5. Market Value Forecast, by End-user, 2017-2031

11.5.1. Hospitals

11.5.2. Diagnostic Laboratories

11.5.3. Academic & Research Institutes

11.6. Market Value Forecast, by Country, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Patient Type

11.7.2. By Assay Type

11.7.3. By Indication

11.7.4. By End-user

11.7.5. By Country

12. Europe Fecal Calprotectin Test Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Patient Type, 2017-2031

12.2.1. Adult

12.2.2. Pediatric

12.3. Market Value Forecast, by Assay Type, 2017-2031

12.3.1. ELISA (Enzyme linked Immunosorbent Assay)

12.3.2. Enzyme Fluoroimmunoassay

12.3.3. Quantitative Immune-chromatography

12.4. Market Value Forecast, by Indication, 2017-2031

12.4.1. Inflammatory Bowel Disease

12.4.2. Colorectal Cancer

12.4.3. Celiac Disease

12.5. Market Value Forecast, by End-user, 2017-2031

12.5.1. Hospitals

12.5.2. Diagnostic Laboratories

12.5.3. Academic & Research Institutes

12.6. Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Patient Type

12.7.2. By Assay Type

12.7.3. By Indication

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Fecal Calprotectin Test Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Patient Type, 2017-2031

13.2.1. Adult

13.2.2. Pediatric

13.3. Market Value Forecast, by Assay Type, 2017-2031

13.3.1. ELISA (Enzyme linked Immunosorbent Assay)

13.3.2. Enzyme Fluoroimmunoassay

13.3.3. Quantitative Immune-chromatography

13.4. Market Value Forecast, by Indication, 2017-2031

13.4.1. Inflammatory Bowel Disease

13.4.2. Colorectal Cancer

13.4.3. Celiac Disease

13.5. Market Value Forecast, by End-user, 2017-2031

13.5.1. Hospitals

13.5.2. Diagnostic Laboratories

13.5.3. Academic & Research Institutes

13.6. Market Value Forecast, by Country/Sub-region, 2017-2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Patient Type

13.7.2. By Assay Type

13.7.3. By Indication

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Fecal Calprotectin Test Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Patient Type, 2017-2031

14.2.1. Adult

14.2.2. Pediatric

14.3. Market Value Forecast, by Assay Type, 2017-2031

14.3.1. ELISA (Enzyme linked Immunosorbent Assay)

14.3.2. Enzyme Fluoroimmunoassay

14.3.3. Quantitative Immune-chromatography

14.4. Market Value Forecast, by Indication, 2017-2031

14.4.1. Inflammatory Bowel Disease

14.4.2. Colorectal Cancer

14.4.3. Celiac Disease

14.5. Market Value Forecast, by End-user, 2017-2031

14.5.1. Hospitals

14.5.2. Diagnostic Laboratories

14.5.3. Academic & Research Institutes

14.6. Market Value Forecast, by Country/Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Patient Type

14.7.2. By Assay Type

14.7.3. By Indication

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Fecal Calprotectin Test Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Patient Type, 2017-2031

15.2.1. Adult

15.2.2. Pediatric

15.3. Market Value Forecast, by Assay Type, 2017-2031

15.3.1. ELISA (Enzyme linked Immunosorbent Assay)

15.3.2. Enzyme Fluoroimmunoassay

15.3.3. Quantitative Immune-chromatography

15.4. Market Value Forecast, by Indication, 2017-2031

15.4.1. Inflammatory Bowel Disease

15.4.2. Colorectal Cancer

15.4.3. Celiac Disease

15.5. Market Value Forecast, by End-user, 2017-2031

15.5.1. Hospitals

15.5.2. Diagnostic Laboratories

15.5.3. Academic & Research Institutes

15.6. Market Value Forecast, by Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Patient Type

15.7.2. By Assay Type

15.7.3. By Indication

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competitive Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. Abbexa

16.3.1.1. Company Overview

16.3.1.2. Drug Class Portfolio

16.3.1.3. SWOT Analysis

16.3.1.4. Financial Overview

16.3.1.5. Strategic Overview

16.3.2. ALPCO

16.3.2.1. Company Overview

16.3.2.2. Drug Class Portfolio

16.3.2.3. SWOT Analysis

16.3.2.4. Financial Overview

16.3.2.5. Strategic Overview

16.3.3. Alpha Laboratories

16.3.3.1. Company Overview

16.3.3.2. Drug Class Portfolio

16.3.3.3. SWOT Analysis

16.3.3.4. Financial Overview

16.3.3.5. Strategic Overview

16.3.4. Biomerica

16.3.4.1. Company Overview

16.3.4.2. Drug Class Portfolio

16.3.4.3. SWOT Analysis

16.3.4.4. Financial Overview

16.3.4.5. Strategic Overview

16.3.5. BÜHLMANN Laboratories AG

16.3.5.1. Company Overview

16.3.5.2. Drug Class Portfolio

16.3.5.3. SWOT Analysis

16.3.5.4. Financial Overview

16.3.5.5. Strategic Overview

16.3.6. DRG Instruments GmbH

16.3.6.1. Company Overview

16.3.6.2. Drug Class Portfolio

16.3.6.3. SWOT Analysis

16.3.6.4. Financial Overview

16.3.6.5. Strategic Overview

16.3.7. EagleBio

16.3.7.1. Company Overview

16.3.7.2. Drug Class Portfolio

16.3.7.3. SWOT Analysis

16.3.7.4. Financial Overview

16.3.7.5. Strategic Overview

16.3.8. Epitope Diagnostics, Inc.

16.3.8.1. Company Overview

16.3.8.2. Drug Class Portfolio

16.3.8.3. SWOT Analysis

16.3.8.4. Financial Overview

16.3.8.5. Strategic Overview

16.3.9. OPERON, S.A.

16.3.9.1. Company Overview

16.3.9.2. Drug Class Portfolio

16.3.9.3. SWOT Analysis

16.3.9.4. Financial Overview

16.3.9.5. Strategic Overview

16.3.10. R-Biopharm AG

16.3.10.1. Company Overview

16.3.10.2. Drug Class Portfolio

16.3.10.3. SWOT Analysis

16.3.10.4. Financial Overview

16.3.10.5. Strategic Overview

16.3.11. Svar Life Science

16.3.11.1. Company Overview

16.3.11.2. Drug Class Portfolio

16.3.11.3. SWOT Analysis

16.3.11.4. Financial Overview

16.3.11.5. Strategic Overview

16.3.12. Thermo Fisher Scientific, Inc.

16.3.12.1. Company Overview

16.3.12.2. Drug Class Portfolio

16.3.12.3. SWOT Analysis

16.3.12.4. Financial Overview

16.3.12.5. Strategic Overview

16.3.13. Werfen

16.3.13.1. Company Overview

16.3.13.2. Drug Class Portfolio

16.3.13.3. SWOT Analysis

16.3.13.4. Financial Overview

16.3.13.5. Strategic Overview

16.3.14. SENTINEL CH. SpA

16.3.14.1. Company Overview

16.3.14.2. Drug Class Portfolio

16.3.14.3. SWOT Analysis

16.3.14.4. Financial Overview

16.3.14.5. Strategic Overview

16.3.15. Diazyme Laboratories, Inc.

16.3.15.1. Company Overview

16.3.15.2. Drug Class Portfolio

16.3.15.3. SWOT Analysis

16.3.15.4. Financial Overview

16.3.15.5. Strategic Overview

16.3.16. DiAgam

16.3.16.1. Company Overview

16.3.16.2. Drug Class Portfolio

16.3.16.3. SWOT Analysis

16.3.16.4. Financial Overview

16.3.16.5. Strategic Overview

List of Tables

Table 01: Global Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Patient Type, 2017-2031

Table 02: Global Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Assay Type, 2017-2031

Table 03: Global Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 04: Global Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 05: Global Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 06: North America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 07: North America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Patient Type, 2017-2031

Table 08: North America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Assay Type, 2017-2031

Table 09: North America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 10: North America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 11: Europe Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 12: Europe Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Patient Type, 2017-2031

Table 13: Europe Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Assay Type, 2017-2031

Table 14: Europe Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 15: Europe Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 16: Asia Pacific Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Asia Pacific Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Patient Type, 2017-2031

Table 18: Asia Pacific Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Assay Type, 2017-2031

Table 19: Asia Pacific Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 20: Asia Pacific Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 21: Latin America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Patient Type, 2017-2031

Table 23: Latin America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Assay Type, 2017-2031

Table 24: Latin America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 25: Latin America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 26: Middle East & Africa Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 27: Middle East & Africa Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 28: Middle East & Africa Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Assay Type, 2017-2031

Table 29: Middle East & Africa Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 30: Middle East & Africa Fecal Calprotectin Test Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Fecal Calprotectin Test Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Fecal Calprotectin Test Market Value Share, by Patient Type, 2022

Figure 03: Global Fecal Calprotectin Test Market Value Share, by Assay Type, 2022

Figure 04: Global Fecal Calprotectin Test Market Value Share, by Indication, 2022

Figure 05: Global Fecal Calprotectin Test Market Value Share, by End-user, 2022

Figure 06: Global Fecal Calprotectin Test Market Value Share, by Region, 2022

Figure 07: Global Fecal Calprotectin Test Market Value Share Analysis, by Patient Type, 2022 and 2031

Figure 08: Global Fecal Calprotectin Test Market (US$ Mn), by Adult, 2017-2031

Figure 09 Global Fecal Calprotectin Test Market (US$ Mn), by Pediatric, 2017-2031

Figure 10: Global Fecal Calprotectin Test Market Attractiveness Analysis, by Patient Type, 2023-2031

Figure 11: Global Fecal Calprotectin Test Market Value Share Analysis, by Assay Type, 2022 and 2031

Figure 12: Global Fecal Calprotectin Test Market (US$ Mn), by ELISA (Enzyme linked Immunosorbent Assay), 2017-2031

Figure 13 Global Fecal Calprotectin Test Market (US$ Mn), by Enzyme Fluoroimmunoassay, 2017-2031

Figure 14: Global Fecal Calprotectin Test Market (US$ Mn), by Quantitative Immune-chromatography, 2017-2031

Figure 15: Global Fecal Calprotectin Test Market Attractiveness Analysis, by Assay Type, 2023-2031

Figure 16: Global Fecal Calprotectin Test Market Value Share Analysis, by Indication, 2022 and 2031

Figure 17: Global Fecal Calprotectin Test Market (US$ Mn), by Inflammatory Bowel Disease, 2017-2031

Figure 18: Global Fecal Calprotectin Test Market (US$ Mn), by Colorectal Cancer, 2017-2031

Figure 19: Global Fecal Calprotectin Test Market (US$ Mn), by Celiac Disease, 2017-2031

Figure 20: Global Fecal Calprotectin Test Market Attractiveness Analysis, by Indication, 2023-2031

Figure 21: Global Fecal Calprotectin Test Market Value Share Analysis, by End-user, 2022 and 2031

Figure 22: Global Fecal Calprotectin Test Market (US$ Mn), by Hospitals, 2017-2031

Figure 23: Global Fecal Calprotectin Test Market (US$ Mn), by Diagnostic Laboratories, 2017-2031

Figure 24: Global Fecal Calprotectin Test Market (US$ Mn), by Academic & Research Institutes, 2017-2031

Figure 25: Global Fecal Calprotectin Test Market Attractiveness Analysis, by End-user, 2023-2031

Figure 26: Global Fecal Calprotectin Test Market Value Share Analysis, by Region, 2022 and 2031

Figure 27: Global Fecal Calprotectin Test Market Attractiveness Analysis, by Region, 2023-2031

Figure 28: North America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, 2017-2031

Figure 29: North America Fecal Calprotectin Test Market Value Share Analysis, by Country, 2022 and 2031

Figure 30: North America Fecal Calprotectin Test Market Attractiveness Analysis, by Country, 2023-2031

Figure 31: North America Fecal Calprotectin Test Market Value Share Analysis, by Patient Type, 2022 and 2031

Figure 32: North America Fecal Calprotectin Test Market Attractiveness Analysis, by Patient Type, 2023-2031

Figure 33: North America Fecal Calprotectin Test Market Value Share Analysis, by Assay Type, 2022 and 2031

Figure 34: North America Fecal Calprotectin Test Market Attractiveness Analysis, by Assay Type, 2023-2031

Figure 35: North America Fecal Calprotectin Test Market Value Share Analysis, by Indication, 2022 and 2031

Figure 36: North America Fecal Calprotectin Test Market Attractiveness Analysis, by Indication, 2023-2031

Figure 37: North America Fecal Calprotectin Test Market Value Share Analysis, by End-user, 2022 and 2031

Figure 38: North America Fecal Calprotectin Test Market Attractiveness Analysis, by End-user, 2023-2031

Figure 39: Europe Fecal Calprotectin Test Market Value (US$ Mn) Forecast, 2017-2031

Figure 40: Europe Fecal Calprotectin Test Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 41: Europe Fecal Calprotectin Test Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 42: Europe Fecal Calprotectin Test Market Value Share Analysis, by Patient Type, 2022 and 2031

Figure 43: Europe Fecal Calprotectin Test Market Attractiveness Analysis, by Patient Type, 2023-2031

Figure 44: Europe Fecal Calprotectin Test Market Value Share Analysis, by Assay Type, 2022 and 2031

Figure 45: Europe Fecal Calprotectin Test Market Attractiveness Analysis, by Assay Type, 2023-2031

Figure 46: Europe Fecal Calprotectin Test Market Value Share Analysis, by Indication, 2022 and 2031

Figure 47: Europe Fecal Calprotectin Test Market Attractiveness Analysis, by Indication, 2023-2031

Figure 48: Europe Fecal Calprotectin Test Market Value Share Analysis, by End-user, 2022 and 2031

Figure 49: Europe Fecal Calprotectin Test Market Attractiveness Analysis, by End-user, 2023-2031

Figure 50: Asia Pacific Fecal Calprotectin Test Market Value (US$ Mn) Forecast, 2017-2031

Figure 51: Asia Pacific Fecal Calprotectin Test Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 52: Asia Pacific Fecal Calprotectin Test Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 53: Asia Pacific Fecal Calprotectin Test Market Value Share Analysis, by Patient Type, 2022 and 2031

Figure 54: Asia Pacific Fecal Calprotectin Test Market Attractiveness Analysis, by Patient Type, 2023-2031

Figure 55: Asia Pacific Fecal Calprotectin Test Market Value Share Analysis, by Assay Type, 2022 and 2031

Figure 56: Asia Pacific Fecal Calprotectin Test Market Attractiveness Analysis, by Assay Type, 2023-2031

Figure 57: Asia Pacific Fecal Calprotectin Test Market Value Share Analysis, by Indication, 2022 and 2031

Figure 58: Asia Pacific Fecal Calprotectin Test Market Attractiveness Analysis, by Indication, 2023-2031

Figure 51: Asia Pacific Fecal Calprotectin Test Market Value Share Analysis, by End-user, 2022 and 2031

Figure 60: Asia Pacific Fecal Calprotectin Test Market Attractiveness Analysis, by End-user, 2023-2031

Figure 61: Latin America Fecal Calprotectin Test Market Value (US$ Mn) Forecast, 2017-2031

Figure 62: Latin America Fecal Calprotectin Test Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 63: Latin America Fecal Calprotectin Test Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 64: Latin America Fecal Calprotectin Test Market Value Share Analysis, by Patient Type, 2022 and 2031

Figure 65: Latin America Fecal Calprotectin Test Market Attractiveness Analysis, by Patient Type, 2023-2031

Figure 66: Latin America Fecal Calprotectin Test Market Value Share Analysis, by Assay Type, 2022 and 2031

Figure 67: Latin America Fecal Calprotectin Test Market Attractiveness Analysis, by Assay Type, 2023-2031

Figure 68: Latin America Fecal Calprotectin Test Market Value Share Analysis, by Indication, 2022 and 2031

Figure 69: Latin America Fecal Calprotectin Test Market Attractiveness Analysis, by Indication, 2023-2031

Figure 70: Latin America Fecal Calprotectin Test Market Value Share Analysis, by End-user, 2022 and 2031

Figure 71: Latin America Fecal Calprotectin Test Market Attractiveness Analysis, by End-user, 2023-2031

Figure 72: Middle East & Africa Fecal Calprotectin Test Market Value (US$ Mn) Forecast, 2017-2031

Figure 73: Middle East & Africa Fecal Calprotectin Test Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 74: Middle East & Africa Fecal Calprotectin Test Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 75: Middle East & Africa Fecal Calprotectin Test Market Value Share Analysis, by Patient Type, 2022 and 2031

Figure 76: Middle East & Africa Fecal Calprotectin Test Market Attractiveness Analysis, by Patient Type, 2023-2031

Figure 77: Middle East & Africa Fecal Calprotectin Test Market Value Share Analysis, by Assay Type, 2022 and 2031

Figure 78: Middle East & Africa Fecal Calprotectin Test Market Attractiveness Analysis, by Assay Type, 2023-2031

Figure 79: Middle East & Africa Fecal Calprotectin Test Market Value Share Analysis, by Indication, 2022 and 2031

Figure 80: Middle East & Africa Fecal Calprotectin Test Market Attractiveness Analysis, by Indication, 2023-2031

Figure 81: Middle East & Africa Fecal Calprotectin Test Market Value Share Analysis, by End-user, 2022 and 2031

Figure 82: Middle East & Africa Fecal Calprotectin Test Market Attractiveness Analysis, by End-user, 2023-2031

Figure 83: Global Fecal Calprotectin Test Market Share, by Company, 2022