Analysts’ Viewpoint on Farm Tractor Market Scenario

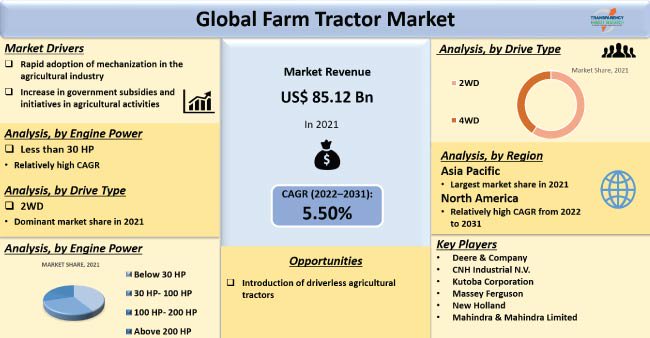

Rapid rise in adoption of mechanization in the agriculture industry, increase in number of medium-scale farmers, and proactive government initiatives are key factors that are likely to propel the global farm tractor market during the forecast period. Surge in demand for compact tractors in small farms and technological advancements, such as integrating telematics with agricultural tractors, are also driving the global market. Increased need for operational efficiency and profitability and rise in labor costs in developing countries such as the U.S., fuel the growth prospects for farm tractor market. Growing urbanization has increased the shortage of skilled laborers for agricultural activities. This shortage is expected to create opportunities for the global farm tractor market. Rise in adoption of driverless agricultural tractors for improving productivity in farming activities is the emerging trend of the farm tractor market.

A tractor is an industrial vehicle; usually with one or two small wheels in front, and two large wheels at the back to carry out agricultural and other functions. It is used to move the attached implement that plows the field or performs other activities. Farm tractors are primarily utilized in the farm for a wide range of farming operations including tilling, ploughing, and planting fields. Farm tractors are also utilized to spread fertilizers, clear bushes, etc. Major companies are manufacturing tractors for specific customer requirements, therefore a wide range of modern farm tractors or tractor farm equipment are available in the market. Modern electric farm tractors are suitable for various farming operational requirements. Utilization of tractors in farming improves productivity with minimum resources. Tractors are also used for industrial and construction purposes. Increase in farm cash receipt, i.e. profit and revenue generated from farming, boosts the affordability of tractors, which is estimated to fuel the agriculture tractor market in the next few years. For instance, the Government of India as well as state governments initiated several schemes that assist to diminish the plight of farmers.

Governments in developing economies provide generous subsidies for the purchase of farm tractors to encourage modernized farming. Additionally, governments of various countries have promoted the adoption of machinery for agricultural activities. This has resulted in an increase in preference for mechanized processes over traditional agriculture practices. Thus, in turn, is likely to propel the demand for farm tractors in the future. India has a lower level of mechanization as compared to other developing countries such as China, U.S., and Brazil; however, mechanization is definitely growing at a rapid pace in the country. For instance, the Government of India is encouraging ‘Balanced Farm Mechanization’ to raise the mechanization level, by providing subsidies on agricultural tractors, which is expected to boost the agricultural tractor market during the forecast period. The goal of the government is to promote the growth of the farming sector through its Rashtriya Krishi Vikasa Yojana (RKVY). The scheme is being implemented throughout India with 100% central assistance to increase the level of farm mechanization in India in the farming sector. Likewise, the Government of Canada has implemented the ‘Canadian Agricultural Loans Act’ (CALA) program that provides farmers with a loan of up to US$ 500,000 to purchase land or farm machinery. All these factors are expected to improve the scope for farm tractor market during the forecast period.

Precision farming and increase in adoption of farm technology to boost production are driving the demand for tractors. Increase in number of farm training programs promoting the use of agricultural machinery on a wide scale is also driving the tractor industry. Tractors with an engine volume of not more than 1,500 CC occupy less space and can be used with greater flexibility. Ease of customization makes them more amenable to experimentation, and consequentially, manufacturers are willing to try new components and technologies in this segment before moving on to high-powered ones. Low-horsepower tractors work well in soft soil conditions, such as river basins. The lesser than 40 HP tractors are primarily used for horticulture.

Demand for lower HP tractors is high in developing countries due to the low disposable income of farmers and high labor costs. Farmers prefer small and customized tractors for agricultural purposes due to small farmland sizes. Moreover, lesser fuel consumption by small tractors helps empower small and marginal farmers. Like India, governments in developing countries promote farm mechanization by subsidizing equipment purchases and supporting bulk buying through front-end agencies. Major players in the market are innovating new products due to increase in demand from developing countries. These factors are likely to boost the sales forecast for farm tractor market during the forecast period.

Based on engine power, the global farm tractor market has been classified into below 30 HP, 30 HP – 100 HP, 100 HP – 200 HP, and above 200 HP. The below 30 HP segment held major share of 39.10% of the global market in 2021. The segment is anticipated to maintain its share in the market and expand at a CAGR of more than 6.10% during the forecast period. The high growth is attributed to the low-cost, compact, and convenient tractors having engine power of less than 30 HP. This tractor agriculture equipment is adopted primarily in Asia Pacific, where approximately 80% of farmlands are below 10 hectares and are preferred by most farmers in the region for performing all the basic farming operations.

Compact tractors, commonly known as compact utility tractors, are manufactured for small farms. Compact tractors have a power lift for implements. Furthermore, these tractors are designed to be attached to a wide range of implements, including small farm implements, front-end loaders, and small backhoes. These tractors are often budget-friendly. If strength, reliability, and durability are the features to be considered, compact tractors are the best choice in a specified price range. All these factors are likely to boost the farm tractor market across the globe.

In terms of drive type, the global farm tractor market has been bifurcated into 2WD and 4WD. The 2WD segment held major share of 59.10% of the global farm tractor market in 2021. The segment is estimated to maintain its position in the market and expand at a CAGR of more than 4.56% during the forecast period. Low upfront cost and better maneuverability are major factors that are expected to drive the demand for 2 wheel-drive tractors, notably in Asia Pacific. 2WD tractors are preferred by middle-income farmers in India. However, a hike in diesel prices has already increased the operation cost for farmers, which is expected to hamper the 2WD segment growth during the forecast period. Followed by 2WD, the 4WD segment is expected to register significant growth during the forecast period, owing to rise in demand for high-power agricultural tractors to perform various agricultural activities efficiently. For instance, powerful agricultural tasks such as tilling and sowing can be easily performed with 4WD tractors.

Asia Pacific dominated the global farm tractor market in 2021. It is expected to hold more than 37.05% share of the global farm tractor market during the forecast period. This is due to the strong presence of the agricultural sector in emerging countries of Asia Pacific, including China and India. Initiatives by governments of several countries in Asia to encourage the adoption of modern farming techniques are anticipated to drive the market in the region during the forecast period. Rise in export of various agricultural products is anticipated to fuel the farming sector. This is expected to further surge in demand for farm tractors across the region.

Europe holds a significant share of the global farm tractor market, followed by North America. Shortage of skilled laborers in Europe and North America is expected to drive the demand for farm tractors in these regions. Technological advancement in these regions is also projected to fuel the demand for automated farming tractors in the next few years.

The global farm tractor market is consolidated, with a few tractor manufacturers controlling majority of the share. Prominent companies in the market possess the potential to increase the pace of growth by adopting newer technologies. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Some of the key players operating in the global farm tractor market are Deere & Company, Mahindra Group, Kubota Corporation, Yanmar, Massey Ferguson, Farmtac, Dongfeng, Kioti Tractor, New Holland, SDF Group, Valtra Tractor, Argo Tractors S.p.A., CNH Industrial N.V., CLAAS Agricultural Machinery Private Limited, Eicher Motors Limited, Escorts Limited, Force Motors Limited, Mahindra & Mahindra Limited, International Tractors Limited (Sonalika) and TAFE Limited.

Each of these players has been profiled in the farm tractor market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 85.12 Bn |

|

Market Forecast Value in 2031 |

US$ 145.40 Bn |

|

Growth Rate (CAGR) |

5.50% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global farm tractor market was valued at US$ 85.12 Bn in 2021.

The global farm tractor market is expected to grow at a CAGR of 5.50% by 2031.

The global farm tractor market would be worth US$ 145.40 Bn in 2031.

Rapid adoption of mechanization in the agriculture industry, proactive government initiatives, and increase in number of medium-scale farmers are expected to drive the global farm tractor market during the forecast period.

The below 30 HP segment held 39.10% share of the global farm tractor market in 2021.

Asia Pacific is a highly lucrative region of the global farm tractor market.

Deere & Company, Mahindra Group, Kubota Corporation, Yanmar, Massey Ferguson, Farmtac, Dongfeng, Kioti Tractor, New Holland, SDF Group, Valtra Tractor, Argo Tractors S.p.A., CNH Industrial N.V., CLAAS Agricultural Machinery Private Limited., Eicher Motors Limited., Escorts Limited., Force Motors Limited, Mahindra & Mahindra Limited., International Tractors Limited (Sonalika), and TAFE Limited.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

3. Industry Ecosystem Analysis

3.1. Value Chain Analysis

3.2. Vendor Matrix

3.3. Gross Margin Analysis

4. Pricing Analysis

4.1. Cost Structure Analysis

4.2. Profit Margin Analysis

5. COVID-19 Impact Analysis – Farm Tractor Market

6. Global Farm Tractor Market, by Engine Power

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Engine Power

6.2.1. Below 30 HP

6.2.2. 30 HP - 100 HP

6.2.3. 100 HP - 200 HP

6.2.4. Above 200 HP

7. Global Farm Tractor Market, by Propulsion

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Propulsion

7.2.1. Internal Combustion Engine

7.2.1.1. Gasoline

7.2.1.2. Diesel

7.2.2. Electric

7.2.3. Others

8. Global Farm Tractor Market, by Drive Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Drive Type

8.2.1. 2WD

8.2.2. 4WD

9. Global Farm Tractor Market, by Level of Autonomy

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Level of Autonomy

9.2.1. Manual Tractors

9.2.2. Autonomous & Semi-Autonomous Tractors

10. Global Farm Tractor Market, by Application

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Application

10.2.1. Harvesting

10.2.2. Seed Sowing

10.2.3. Spraying

10.2.4. Others

11. Global Farm Tractor Market, by Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Farm Tractor Market

12.1. Market Snapshot

12.2. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Engine Power

12.2.1. Below 30 HP

12.2.2. 30 HP - 100 HP

12.2.3. 100 HP - 200 HP

12.2.4. Above 200 HP

12.3. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Propulsion

12.3.1. Internal Combustion Engine

12.3.1.1. Gasoline

12.3.1.2. Diesel

12.3.2. Electric

12.3.3. Others

12.4. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Drive Type

12.4.1. 2WD

12.4.2. 4WD

12.5. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Level of Autonomy

12.5.1. Manual Tractors

12.5.2. Autonomous & Semi-Autonomous Tractors

12.6. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Application

12.6.1. Harvesting

12.6.2. Seed Sowing

12.6.3. Spraying

12.6.4. Others

12.7. Key Country Analysis – North America Farm Tractor Market Size Analysis & Forecast, 2017-2031

12.7.1. U.S.

12.7.2. Canada

12.7.3. Mexico

13. Europe Farm Tractor Market

13.1. Market Snapshot

13.2. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Engine Power

13.2.1. Below 30 HP

13.2.2. 30 HP - 100 HP

13.2.3. 100 HP - 200 HP

13.2.4. Above 200 HP

13.3. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Propulsion

13.3.1. Internal Combustion Engine

13.3.1.1. Gasoline

13.3.1.2. Diesel

13.3.2. Electric

13.3.3. Others

13.4. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Drive Type

13.4.1. 2WD

13.4.2. 4WD

13.5. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Level of Autonomy

13.5.1. Manual Tractors

13.5.2. Autonomous & Semi-Autonomous Tractors

13.6. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Application

13.6.1. Harvesting

13.6.2. Seed Sowing

13.6.3. Spraying

13.6.4. Others

13.7. Key Country Analysis – Europe Farm Tractor Market Size Analysis & Forecast, 2017-2031

13.7.1. Germany

13.7.2. U. K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Nordic Countries

13.7.7. Russia & CIS

13.7.8. Rest of Europe

14. Asia Pacific Farm Tractor Market

14.1. Market Snapshot

14.2. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Engine Power

14.2.1. Below 30 HP

14.2.2. 30 HP - 100 HP

14.2.3. 100 HP - 200 HP

14.2.4. Above 200 HP

14.3. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Propulsion

14.3.1. Internal Combustion Engine

14.3.1.1. Gasoline

14.3.1.2. Diesel

14.3.2. Electric

14.3.3. Others

14.4. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Drive Type

14.4.1. 2WD

14.4.2. 4WD

14.5. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Level of Autonomy

14.5.1. Manual Tractors

14.5.2. Autonomous & Semi-Autonomous Tractors

14.6. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Application

14.6.1. Harvesting

14.6.2. Seed Sowing

14.6.3. Spraying

14.6.4. Others

14.7. Key Country Analysis – Asia Pacific Farm Tractor Market Size Analysis & Forecast, 2017-2031

14.7.1. China

14.7.2. India

14.7.3. Japan

14.7.4. ASEAN Countries

14.7.5. South Korea

14.7.6. ANZ

14.7.7. Rest of Asia Pacific

15. Middle East & Africa Farm Tractor Market

15.1. Market Snapshot

15.2. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Engine Power

15.2.1. Below 30 HP

15.2.2. 30 HP - 100 HP

15.2.3. 100 HP - 200 HP

15.2.4. Above 200 HP

15.3. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Propulsion

15.3.1. Internal Combustion Engine

15.3.1.1. Gasoline

15.3.1.2. Diesel

15.3.2. Electric

15.3.3. Others

15.4. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Drive Type

15.4.1. 2WD

15.4.2. 4WD

15.5. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Level of Autonomy

15.5.1. Manual Tractors

15.5.2. Autonomous & Semi-Autonomous Tractors

15.6. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Application

15.6.1. Harvesting

15.6.2. Seed Sowing

15.6.3. Spraying

15.6.4. Others

15.7. Key Country Analysis – Middle East & Africa Farm Tractor Market Size Analysis & Forecast, 2017-2031

15.7.1. GCC

15.7.2. South Africa

15.7.3. Turkey

15.7.4. Rest of Middle East & Africa

16. South America Farm Tractor Market

16.1. Market Snapshot

16.2. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Engine Power

16.2.1. Below 30 HP

16.2.2. 30 HP - 100 HP

16.2.3. 100 HP - 200 HP

16.2.4. Above 200 HP

16.3. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Propulsion

16.3.1. Internal Combustion Engine

16.3.1.1. Gasoline

16.3.1.2. Diesel

16.3.2. Electric

16.3.3. Others

16.4. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Drive Type

16.4.1. 2WD

16.4.2. 4WD

16.5. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Level of Autonomy

16.5.1. Manual Tractors

16.5.2. Autonomous & Semi-Autonomous Tractors

16.6. Farm Tractor Market Size Analysis & Forecast, 2017-2031, by Application

16.6.1. Harvesting

16.6.2. Seed Sowing

16.6.3. Spraying

16.6.4. Others

16.7. Key Country Analysis – South America Farm Tractor Market Size Analysis & Forecast, 2017-2031

16.7.1. Brazil

16.7.2. Argentina

16.7.3. Rest of South America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Share Analysis, 2021

17.2. Pricing comparison among key players

17.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

18. Company Profile/ Key Players

18.1. Deere & Company

18.1.1. Company Overview

18.1.2. Company Footprints

18.1.3. Production Locations

18.1.4. Product Portfolio

18.1.5. Competitors & Customers

18.1.6. Subsidiaries & Parent Organization

18.1.7. Recent Developments

18.1.8. Financial Analysis

18.1.9. Profitability

18.1.10. Revenue Share

18.2. Mahindra Group

18.2.1. Company Overview

18.2.2. Company Footprints

18.2.3. Production Locations

18.2.4. Product Portfolio

18.2.5. Competitors & Customers

18.2.6. Subsidiaries & Parent Organization

18.2.7. Recent Developments

18.2.8. Financial Analysis

18.2.9. Profitability

18.2.10. Revenue Share

18.3. Kubota Corporation

18.3.1. Company Overview

18.3.2. Company Footprints

18.3.3. Production Locations

18.3.4. Product Portfolio

18.3.5. Competitors & Customers

18.3.6. Subsidiaries & Parent Organization

18.3.7. Recent Developments

18.3.8. Financial Analysis

18.3.9. Profitability

18.3.10. Revenue Share

18.4. Yanmar

18.4.1. Company Overview

18.4.2. Company Footprints

18.4.3. Production Locations

18.4.4. Product Portfolio

18.4.5. Competitors & Customers

18.4.6. Subsidiaries & Parent Organization

18.4.7. Recent Developments

18.4.8. Financial Analysis

18.4.9. Profitability

18.4.10. Revenue Share

18.5. Massey Ferguson

18.5.1. Company Overview

18.5.2. Company Footprints

18.5.3. Production Locations

18.5.4. Product Portfolio

18.5.5. Competitors & Customers

18.5.6. Subsidiaries & Parent Organization

18.5.7. Recent Developments

18.5.8. Financial Analysis

18.5.9. Profitability

18.5.10. Revenue Share

18.6. Farmtac

18.6.1. Company Overview

18.6.2. Company Footprints

18.6.3. Production Locations

18.6.4. Product Portfolio

18.6.5. Competitors & Customers

18.6.6. Subsidiaries & Parent Organization

18.6.7. Recent Developments

18.6.8. Financial Analysis

18.6.9. Profitability

18.6.10. Revenue Share

18.7. Dongfeng

18.7.1. Company Overview

18.7.2. Company Footprints

18.7.3. Production Locations

18.7.4. Product Portfolio

18.7.5. Competitors & Customers

18.7.6. Subsidiaries & Parent Organization

18.7.7. Recent Developments

18.7.8. Financial Analysis

18.7.9. Profitability

18.7.10. Revenue Share

18.8. Kioti Tractor

18.8.1. Company Overview

18.8.2. Company Footprints

18.8.3. Production Locations

18.8.4. Product Portfolio

18.8.5. Competitors & Customers

18.8.6. Subsidiaries & Parent Organization

18.8.7. Recent Developments

18.8.8. Financial Analysis

18.8.9. Profitability

18.8.10. Revenue Share

18.9. New Holland

18.9.1. Company Overview

18.9.2. Company Footprints

18.9.3. Production Locations

18.9.4. Product Portfolio

18.9.5. Competitors & Customers

18.9.6. Subsidiaries & Parent Organization

18.9.7. Recent Developments

18.9.8. Financial Analysis

18.9.9. Profitability

18.9.10. Revenue Share

18.10. SDF Group

18.10.1. Company Overview

18.10.2. Company Footprints

18.10.3. Production Locations

18.10.4. Product Portfolio

18.10.5. Competitors & Customers

18.10.6. Subsidiaries & Parent Organization

18.10.7. Recent Developments

18.10.8. Financial Analysis

18.10.9. Profitability

18.10.10. Revenue Share

18.11. Valtra Tractor

18.11.1. Company Overview

18.11.2. Company Footprints

18.11.3. Production Locations

18.11.4. Product Portfolio

18.11.5. Competitors & Customers

18.11.6. Subsidiaries & Parent Organization

18.11.7. Recent Developments

18.11.8. Financial Analysis

18.11.9. Profitability

18.11.10. Revenue Share

18.12. Argo Tractors S.p.A.

18.12.1. Company Overview

18.12.2. Company Footprints

18.12.3. Production Locations

18.12.4. Product Portfolio

18.12.5. Competitors & Customers

18.12.6. Subsidiaries & Parent Organization

18.12.7. Recent Developments

18.12.8. Financial Analysis

18.12.9. Profitability

18.12.10. Revenue Share

18.13. CNH Industrial N.V.

18.13.1. Company Overview

18.13.2. Company Footprints

18.13.3. Production Locations

18.13.4. Product Portfolio

18.13.5. Competitors & Customers

18.13.6. Subsidiaries & Parent Organization

18.13.7. Recent Developments

18.13.8. Financial Analysis

18.13.9. Profitability

18.13.10. Revenue Share

18.14. CLAAS Agricultural Machinery Private Limited.

18.14.1. Company Overview

18.14.2. Company Footprints

18.14.3. Production Locations

18.14.4. Product Portfolio

18.14.5. Competitors & Customers

18.14.6. Subsidiaries & Parent Organization

18.14.7. Recent Developments

18.14.8. Financial Analysis

18.14.9. Profitability

18.14.10. Revenue Share

18.15. Either Motors Limited.

18.15.1. Company Overview

18.15.2. Company Footprints

18.15.3. Production Locations

18.15.4. Product Portfolio

18.15.5. Competitors & Customers

18.15.6. Subsidiaries & Parent Organization

18.15.7. Recent Developments

18.15.8. Financial Analysis

18.15.9. Profitability

18.15.10. Revenue Share

18.16. Escorts Limited.

18.16.1. Company Overview

18.16.2. Company Footprints

18.16.3. Production Locations

18.16.4. Product Portfolio

18.16.5. Competitors & Customers

18.16.6. Subsidiaries & Parent Organization

18.16.7. Recent Developments

18.16.8. Financial Analysis

18.16.9. Profitability

18.16.10. Revenue Share

18.17. Force Motors Limited

18.17.1. Company Overview

18.17.2. Company Footprints

18.17.3. Production Locations

18.17.4. Product Portfolio

18.17.5. Competitors & Customers

18.17.6. Subsidiaries & Parent Organization

18.17.7. Recent Developments

18.17.8. Financial Analysis

18.17.9. Profitability

18.17.10. Revenue Share

18.18. Mahindra & Mahindra Limited.

18.18.1. Company Overview

18.18.2. Company Footprints

18.18.3. Production Locations

18.18.4. Product Portfolio

18.18.5. Competitors & Customers

18.18.6. Subsidiaries & Parent Organization

18.18.7. Recent Developments

18.18.8. Financial Analysis

18.18.9. Profitability

18.18.10. Revenue Share

18.19. International Tractors Limited. (Sonalika)

18.19.1. Company Overview

18.19.2. Company Footprints

18.19.3. Production Locations

18.19.4. Product Portfolio

18.19.5. Competitors & Customers

18.19.6. Subsidiaries & Parent Organization

18.19.7. Recent Developments

18.19.8. Financial Analysis

18.19.9. Profitability

18.19.10. Revenue Share

18.20. TAFE Limited.

18.20.1. Company Overview

18.20.2. Company Footprints

18.20.3. Production Locations

18.20.4. Product Portfolio

18.20.5. Competitors & Customers

18.20.6. Subsidiaries & Parent Organization

18.20.7. Recent Developments

18.20.8. Financial Analysis

18.20.9. Profitability

18.20.10. Revenue Share

18.21. Other Key Players

18..21.1. Company Overview

18.21.2. Company Footprints

18.21.3. Production Locations

18.21.4. Product Portfolio

18.21.5. Competitors & Customers

18.21.6. Subsidiaries & Parent Organization

18.21.7. Recent Developments

18.21.8. Financial Analysis

18.21.9. Profitability

18.21.10. Revenue Share

List of Tables

Table 1: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Table 2: Global Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017‒2031

Table 3: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 4: Global Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 5: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 6: Global Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017‒2031

Table 7: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Table 8: Global Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 9: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 10: Global Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 11: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 12: Global Farm Tractor Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 13: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Table 14: North America Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017‒2031

Table 15: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 16: North America Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 17: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 18: North America Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017‒2031

Table 19: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Table 20: North America Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 21: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 22: North America Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 23: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: North America Farm Tractor Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Table 26: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017‒2031

Table 27: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 28: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 29: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 30: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017‒2031

Table 31: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Table 32: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 33: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 34: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 35: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017-2031

Table 36: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017‒2031

Table 37: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Table 38: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017‒2031

Table 39: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 40: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 41: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 42: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017‒2031

Table 43: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Table 44: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 45: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 46: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 47: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017-2031

Table 48: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017‒2031

Table 49: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Table 50: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017‒2031

Table 51: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 52: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 53: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 54: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017‒2031

Table 55: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Table 56: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 57: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 58: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 59: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017-2031

Table 60: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017‒2031

Table 61: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Table 62: South America Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017‒2031

Table 63: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 64: South America Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 65: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Table 66: South America Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017‒2031

Table 67: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Table 68: South America Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017‒2031

Table 69: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 70: South America Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 71: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017-2031

Table 72: South America Farm Tractor Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 1: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Figure 2: Global Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017-2031

Figure 3: Global Farm Tractor Market, Incremental Opportunity, by Engine Power, Value (US$ Bn), 2022-2031

Figure 4: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 5: Global Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 6: Global Farm Tractor Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 7: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 8: Global Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 9: Global Farm Tractor Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 10: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Figure 11: Global Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017-2031

Figure 12: Global Farm Tractor Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022-2031

Figure 13: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 14: Global Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 15: Global Farm Tractor Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 16: Global Farm Tractor Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 17: Global Farm Tractor Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Farm Tractor Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 19: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Figure 20: North America Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017-2031

Figure 21: North America Farm Tractor Market, Incremental Opportunity, by Engine Power, Value (US$ Bn), 2022-2031

Figure 22: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 23: North America Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 24: North America Farm Tractor Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 25: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 26: North America Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 27: North America Farm Tractor Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 28: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Figure 29: North America Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017-2031

Figure 30: North America Farm Tractor Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022-2031

Figure 31: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 32: North America Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 33: North America Farm Tractor Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 34: North America Farm Tractor Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: North America Farm Tractor Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Farm Tractor Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Figure 38: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017-2031

Figure 39: Europe Farm Tractor Market, Incremental Opportunity, by Engine Power, Value (US$ Bn), 2022-2031

Figure 40: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 41: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 42: Europe Farm Tractor Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 43: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 44: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 45: Europe Farm Tractor Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 46: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Figure 47: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017-2031

Figure 48: Europe Farm Tractor Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022-2031

Figure 49: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 50: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 51: Europe Farm Tractor Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 52: Europe Farm Tractor Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017-2031

Figure 53: Europe Farm Tractor Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

Figure 54: Europe Farm Tractor Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Figure 56: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017-2031

Figure 57: Asia Pacific Farm Tractor Market, Incremental Opportunity, by Engine Power, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 59: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 60: Asia Pacific Farm Tractor Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 61: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 62: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 63: Asia Pacific Farm Tractor Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 64: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Figure 65: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017-2031

Figure 66: Asia Pacific Farm Tractor Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022-2031

Figure 67: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 68: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 69: Asia Pacific Farm Tractor Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 70: Asia Pacific Farm Tractor Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017-2031

Figure 71: Asia Pacific Farm Tractor Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

Figure 72: Asia Pacific Farm Tractor Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Bn), 2022-2031

Figure 73: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Figure 74: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017-2031

Figure 75: Middle East & Africa Farm Tractor Market, Incremental Opportunity, by Engine Power, Value (US$ Bn), 2022-2031

Figure 76: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 77: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 78: Middle East & Africa Farm Tractor Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 79: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 80: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 81: Middle East & Africa Farm Tractor Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 82: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Figure 83: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017-2031

Figure 84: Middle East & Africa Farm Tractor Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022-2031

Figure 85: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 86: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 87: Middle East & Africa Farm Tractor Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 88: Middle East & Africa Farm Tractor Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017-2031

Figure 89: Middle East & Africa Farm Tractor Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

Figure 90: Middle East & Africa Farm Tractor Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Bn), 2022-2031

Figure 91: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Engine Power, 2017-2031

Figure 92: South America Farm Tractor Market Value (US$ Bn) Forecast, by Engine Power, 2017-2031

Figure 93: South America Farm Tractor Market, Incremental Opportunity, by Engine Power, Value (US$ Bn), 2022-2031

Figure 94: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 95: South America Farm Tractor Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 96: South America Farm Tractor Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 97: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Drive Type, 2017-2031

Figure 98: South America Farm Tractor Market Value (US$ Bn) Forecast, by Drive Type, 2017-2031

Figure 99: South America Farm Tractor Market, Incremental Opportunity, by Drive Type, Value (US$ Bn), 2022-2031

Figure 100: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2017-2031

Figure 101: South America Farm Tractor Market Value (US$ Bn) Forecast, by Level of Autonomy, 2017-2031

Figure 102: South America Farm Tractor Market, Incremental Opportunity, by Level of Autonomy, Value (US$ Bn), 2022-2031

Figure 103: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 104: South America Farm Tractor Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 105: South America Farm Tractor Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 106: South America Farm Tractor Market Volume (Thousand Units) Forecast, by Country and Sub-region, 2017-2031

Figure 107: South America Farm Tractor Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

Figure 108: South America Farm Tractor Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Bn), 2022-2031