Analysts’ Viewpoint on Market Scenario

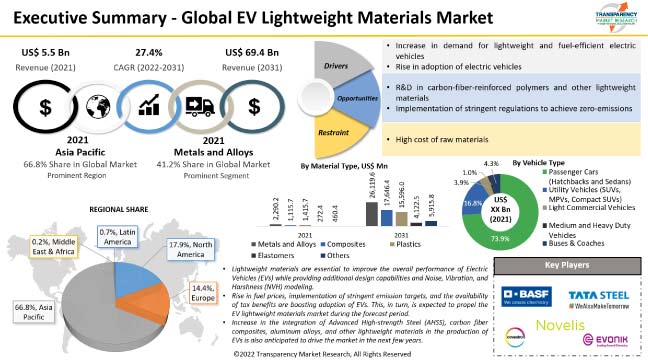

Rise in adoption of electric vehicles (EVs) is driving the EV lightweight materials market size. Depleting fossil fuels and surge in government focus on achieving zero-emission targets have boosted the demand for EVs. Lightweight materials help reduce vehicle weight and improve fuel economy. Thus, increase in demand for lightweight and power-efficient EVs is expected to augment market expansion during the forecast period.

EV manufacturers are investing in the research and replacement of conventional materials with lighter alternatives that have the potential to significantly reduce the overall weight of the vehicle. Vendors in the industry are developing novel lightweight materials to expand their market revenue.

Lightweighting refers to the development of lighter EVs to improve their handling and range. Various lightweight materials, such as carbon fiber, polycarbonate, and aluminum, are used to lighten the weight of EVs. Vehicle manufacturers widely employ glass and carbon fiber-reinforced polymers to develop lightweight parts.

Modern cars rely on lightweight electric car battery materials to increase their power efficiency while preserving performance and safety. A 10% decrease in vehicle weight can lead to a 6% to 8% increase in power efficiency. Raw materials used to manufacture EV batteries include aluminum, carbon, cobalt, copper, and graphite.

Lightweight materials reduce the overall weight of EVs, enabling them to travel farther on the same battery size. Governments across the globe are focused on reducing their carbon footprints. This has led to various subsidies in order to boost adoption of EVs.

Use of lightweight materials such as aluminum, carbon-fiber composites, and high-strength steel allows next-generation sedans, sports cars, pickup trucks, and SUVs to achieve high range and load capacity. Utilization of lightweight materials aids to balance the weight of heavier power components such as batteries and electric motors.

Rise in the emission of Greenhouse Gases (GHG) and growth in air pollution have prompted several governments around the world to implement stringent emission norms and regulations. These norms are aimed at addressing CO2 emission levels and subsequently restricting pollution levels. Thus, governments are encouraging automakers to adopt affordable lightweight materials and sustainable production processes while preserving the safety and performance of vehicles. This, in turn, is anticipated to fuel market development in the next few years.

According to the latest EV lightweight materials market trends, the metals and alloys material type segment held 41.2% share of the industry in 2021. Metals and alloys offer various benefits such as low density, high strength-to-weight ratio, and improved corrosion resistance. These advantages make metals and alloys ideal for forming, machining, and welding applications in the automobile sector.

The composites segment is anticipated to grow at a significant rate during the forecast period. Carbon-fiber-reinforced polymers are widely employed to manufacture various EV components. Use of such materials makes EVs substantially lighter, which improves their performance, range, and lifespan.

The body-in-white application segment dominated the EV lightweight materials market, in terms of revenue, and held 16.3% share in 2021. The segment is estimated to maintain its dominance and advance at a CAGR of more than 29.4% during the forecast period. Rise in the production of passenger cars, light commercial vehicles, and medium and heavy commercial vehicles is driving the segment in the global EV lightweight materials industry.

Lightweighting of body-in-white structures helps achieve the required mileage without compromising the structural integrity and safety of the vehicle. They reduce the vehicle curb weight of a fully electric passenger car to around 160 kilos. However, this increases the cost of manufacturing BIW components, thereby surging the demand for lightweight materials for body-in-white components.

Regional EV lightweight materials market forecast has been based on production trends, political reforms, regulation changes, and demand. Asia Pacific is expected to dominate the industry during the forecast period. Increase in adoption of EVs in countries such as Japan, China, India, South Korea, and Singapore is augmenting the market progress in the region.

China and India are major producers of automobiles. Rise in the production of electric passenger and commercial cars and the implementation of stringent pollution regulations are also fueling the market statistics in Asia Pacific.

The industry is consolidated, with a large number of manufacturers controlling the market share. Major vendors are focused on the development and launch of new products to expand their EV lightweight materials market share. They are also adopting collaboration, partnership, and M&A strategies to broaden their regional presence.

BASF SE, Covestro AG, Toray Industries, Inc., ArcelorMittal, SABIC, thyssenKrupp AG, Solvay, SGL Carbon SE, Celanese Corporation, Novelis Inc., LyondellBasell Industries Holdings B.V., Constellium, Teijin Limited, Evonik Industries AG, LANXESS Deutschland GmbH, Alcoa Corporation, Owens Corning, Stratasys Ltd., Tata Steel, US Magnesium LLC, and WHB Brasil are key entities operating in the industry. These players have been profiled in the EV lightweight materials market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 5.5 Bn |

|

Market Forecast Value in 2031 |

US$ 69.4 Bn |

|

Growth Rate (CAGR) |

27.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

Volume (Kilo Tons) & US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 5.5 Bn in 2021

It is expected to advance at a CAGR of 27.4% by 2031

It is anticipated to reach US$ 69.4 Bn in 2031

Increase in demand for lightweight and fuel-efficient electric vehicles and rise in adoption of electric vehicles

The metals and alloys segment accounted for 41.2% share in 2021

Asia Pacific is a highly lucrative region for vendors

BASF SE, Covestro AG, Toray Industries, Inc., ArcelorMittal, SABIC, thyssenKrupp AG, Solvay, SGL Carbon SE, Celanese Corporation, Novelis Inc., LyondellBasell Industries Holdings B.V., Constellium, Teijin Limited, Evonik Industries AG, LANXESS Deutschland GmbH, Alcoa Corporation, Owens Corning, Stratasys Ltd., Tata Steel, US Magnesium LLC, and WHB Brasil

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Kilo Tons, Value US$ Mn, 2017-2031

1.2. Competitive Dashboards Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage/Taxonomy

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.4.3. PESTEL Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

2.10. COVID-19 Impact Analysis – EV Lightweight Materials Market

3. Global EV Lightweight Materials Market, by Material Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Material Type

3.2.1. Metals and Alloys

3.2.1.1. High-strength Steel (HSS)

3.2.1.2. Aluminum

3.2.1.3. Magnesium

3.2.1.4. Titanium

3.2.1.5. Beryllium

3.2.1.6. Others

3.2.2. Composites

3.2.2.1. Carbon-fiber-reinforced Polymers (CFRPs)

3.2.2.2. Glass-fiber-reinforced Polymers (CFRPs)

3.2.2.3. Natural Fiber-reinforced Polymers (NFRPs)

3.2.2.4. Other Composites

3.2.3. Plastics

3.2.3.1. Polycarbonate (PC)

3.2.3.2. Polyamide (PA)

3.2.3.3. Polymethyl Methacrylate (PMMA)

3.2.3.4. Polyacetal/Polyoxymethylene (POM)

3.2.3.5. PET

3.2.3.6. Others

3.2.4. Elastomers

3.2.5. Others

4. Global EV Lightweight Materials Market, by Application

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Application

4.2.1. Battery Packs

4.2.2. Electric Traction Motors

4.2.3. Electronic Components

4.2.4. Power Electronic Controllers

4.2.5. Body-in-White

4.2.6. Chassis and Suspension

4.2.7. Powertrains/Transmissions

4.2.8. Closures

4.2.9. Interiors

4.2.10. DC/DC Converters

4.2.11. Thermal Systems

4.2.12. On-board Charger

4.2.13. Tires and Wheels

4.2.14. Bumpers and Fenders

4.2.15. Lighting

4.2.16. Dashboards

4.2.17. Seat Systems

4.2.18. Steering Systems

4.2.19. Fuel Tanks

4.2.20. Doors

4.2.21. Others

5. Global EV Lightweight Materials Market, by Vehicle Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

5.2.1. Passenger Cars (Hatchbacks and Sedans)

5.2.1.1. Battery Electric Vehicles (BEVs)

5.2.1.2. Hybrid Electric Vehicles (HEVs)

5.2.2. Utility Vehicles (SUVs, MPVs, Compact SUVs)

5.2.2.1. Battery Electric Vehicles (BEVs)

5.2.2.2. Hybrid Electric Vehicles (HEVs)

5.2.3. Light Commercial Vehicles

5.2.3.1. Battery Electric Vehicles (BEVs)

5.2.3.2. Hybrid Electric Vehicles (HEVs)

5.2.4. Medium and Heavy-duty Vehicles

5.2.4.1. Battery Electric Vehicles (BEVs)

5.2.4.2. Hybrid Electric Vehicles (HEVs)

5.2.5. Buses & Coaches

5.2.5.1. Battery Electric Vehicles (BEVs)

5.2.5.2. Hybrid Electric Vehicles (HEVs)

6. Global EV Lightweight Materials Market, by Region

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East & Africa

6.2.5. Latin America

7. North America EV Lightweight Materials Market

7.1. Market Snapshot

7.2. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Material Type

7.2.1. Metals and Alloys

7.2.1.1. High-strength Steel (HSS)

7.2.1.2. Aluminum

7.2.1.3. Magnesium

7.2.1.4. Titanium

7.2.1.5. Beryllium

7.2.1.6. Others

7.2.2. Composites

7.2.2.1. Carbon-fiber-reinforced Polymers (CFRPs)

7.2.2.2. Glass-fiber-reinforced Polymers (CFRPs)

7.2.2.3. Natural Fiber-reinforced Polymers (NFRPs)

7.2.2.4. Other Composites

7.2.3. Plastics

7.2.3.1. Polycarbonate (PC)

7.2.3.2. Polyamide (PA)

7.2.3.3. Polymethyl Methacrylate (PMMA)

7.2.3.4. Polyacetal/Polyoxymethylene (POM)

7.2.3.5. PET

7.2.3.6. Others

7.2.4. Elastomers

7.2.5. Others

7.3. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Application

7.3.1. Battery Packs

7.3.2. Electric Traction Motors

7.3.3. Electronic Components

7.3.4. Power Electronic Controllers

7.3.5. Body-in-White

7.3.6. Chassis and Suspension

7.3.7. Powertrains/Transmissions

7.3.8. Closures

7.3.9. Interiors

7.3.10. DC/DC Converters

7.3.11. Thermal Systems

7.3.12. On-board Charger

7.3.13. Tires and Wheels

7.3.14. Bumpers and Fenders

7.3.15. Lighting

7.3.16. Dashboards

7.3.17. Seat Systems

7.3.18. Steering Systems

7.3.19. Fuel Tanks

7.3.20. Doors

7.3.21. Others

7.4. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

7.4.1. Passenger Cars (Hatchbacks and Sedans)

7.4.1.1. Battery Electric Vehicles (BEVs)

7.4.1.2. Hybrid Electric Vehicles (HEVs)

7.4.2. Utility Vehicles (SUVs, MPVs, Compact SUVs)

7.4.2.1. Battery Electric Vehicles (BEVs)

7.4.2.2. Hybrid Electric Vehicles (HEVs)

7.4.3. Light Commercial Vehicles

7.4.3.1. Battery Electric Vehicles (BEVs)

7.4.3.2. Hybrid Electric Vehicles (HEVs)

7.4.4. Medium and Heavy-duty Vehicles

7.4.4.1. Battery Electric Vehicles (BEVs)

7.4.4.2. Hybrid Electric Vehicles (HEVs)

7.4.5. Buses & Coaches

7.4.5.1. Battery Electric Vehicles (BEVs)

7.4.5.2. Hybrid Electric Vehicles (HEVs)

7.5. Key Country Analysis – North America EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031

7.5.1. U.S.

7.5.2. Canada

8. Europe EV Lightweight Materials Market

8.1. Market Snapshot

8.2. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Material Type

8.2.1. Metals and Alloys

8.2.1.1. High-strength Steel (HSS)

8.2.1.2. Aluminum

8.2.1.3. Magnesium

8.2.1.4. Titanium

8.2.1.5. Beryllium

8.2.1.6. Others

8.2.2. Composites

8.2.2.1. Carbon-fiber-reinforced Polymers (CFRPs)

8.2.2.2. Glass-fiber-reinforced Polymers (CFRPs)

8.2.2.3. Natural Fiber-reinforced Polymers (NFRPs)

8.2.2.4. Other Composites

8.2.3. Plastics

8.2.3.1. Polycarbonate (PC)

8.2.3.2. Polyamide (PA)

8.2.3.3. Polymethyl Methacrylate (PMMA)

8.2.3.4. Polyacetal/Polyoxymethylene (POM)

8.2.3.5. PET

8.2.3.6. Others

8.2.4. Elastomers

8.2.5. Others

8.3. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Application

8.3.1. Battery Packs

8.3.2. Electric Traction Motors

8.3.3. Electronic Components

8.3.4. Power Electronic Controllers

8.3.5. Body-in-White

8.3.6. Chassis and Suspension

8.3.7. Powertrains/Transmissions

8.3.8. Closures

8.3.9. Interiors

8.3.10. DC/DC Converters

8.3.11. Thermal Systems

8.3.12. On-board Charger

8.3.13. Tires and Wheels

8.3.14. Bumpers and Fenders

8.3.15. Lighting

8.3.16. Dashboards

8.3.17. Seat Systems

8.3.18. Steering Systems

8.3.19. Fuel Tanks

8.3.20. Doors

8.3.21. Others

8.4. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

8.4.1. Passenger Cars (Hatchbacks and Sedans)

8.4.1.1. Battery Electric Vehicles (BEVs)

8.4.1.2. Hybrid Electric Vehicles (HEVs)

8.4.2. Utility Vehicles (SUVs, MPVs, Compact SUVs)

8.4.2.1. Battery Electric Vehicles (BEVs)

8.4.2.2. Hybrid Electric Vehicles (HEVs)

8.4.3. Light Commercial Vehicles

8.4.3.1. Battery Electric Vehicles (BEVs)

8.4.3.2. Hybrid Electric Vehicles (HEVs)

8.4.4. Medium and Heavy-duty Vehicles

8.4.4.1. Battery Electric Vehicles (BEVs)

8.4.4.2. Hybrid Electric Vehicles (HEVs)

8.4.5. Buses & Coaches

8.4.5.1. Battery Electric Vehicles (BEVs)

8.4.5.2. Hybrid Electric Vehicles (HEVs)

8.5. Key Country Analysis – Europe EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031

8.5.1. Germany

8.5.2. U.K.

8.5.3. France

8.5.4. Italy

8.5.5. Spain

8.5.6. Nordic Countries

8.5.7. Russia & CIS

8.5.8. Rest of Europe

9. Asia Pacific EV Lightweight Materials Market

9.1. Market Snapshot

9.2. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Material Type

9.2.1. Metals and Alloys

9.2.1.1. High-strength Steel (HSS)

9.2.1.2. Aluminum

9.2.1.3. Magnesium

9.2.1.4. Titanium

9.2.1.5. Beryllium

9.2.1.6. Others

9.2.2. Composites

9.2.2.1. Carbon-fiber-reinforced Polymers (CFRPs)

9.2.2.2. Glass-fiber-reinforced Polymers (CFRPs)

9.2.2.3. Natural Fiber-reinforced Polymers (NFRPs)

9.2.2.4. Other Composites

9.2.3. Plastics

9.2.3.1. Polycarbonate (PC)

9.2.3.2. Polyamide (PA)

9.2.3.3. Polymethyl Methacrylate (PMMA)

9.2.3.4. Polyacetal/Polyoxymethylene (POM)

9.2.3.5. PET

9.2.3.6. Others

9.2.4. Elastomers

9.2.5. Others

9.3. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Application

9.3.1. Battery Packs

9.3.2. Electric Traction Motors

9.3.3. Electronic Components

9.3.4. Power Electronic Controllers

9.3.5. Body-in-White

9.3.6. Chassis and Suspension

9.3.7. Powertrains/Transmissions

9.3.8. Closures

9.3.9. Interiors

9.3.10. DC/DC Converters

9.3.11. Thermal Systems

9.3.12. On-board Charger

9.3.13. Tires and Wheels

9.3.14. Bumpers and Fenders

9.3.15. Lighting

9.3.16. Dashboards

9.3.17. Seat Systems

9.3.18. Steering Systems

9.3.19. Fuel Tanks

9.3.20. Doors

9.3.21. Others

9.4. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

9.4.1. Passenger Cars (Hatchbacks and Sedans)

9.4.1.1. Battery Electric Vehicles (BEVs)

9.4.1.2. Hybrid Electric Vehicles (HEVs)

9.4.2. Utility Vehicles (SUVs, MPVs, Compact SUVs)

9.4.2.1. Battery Electric Vehicles (BEVs)

9.4.2.2. Hybrid Electric Vehicles (HEVs)

9.4.3. Light Commercial Vehicles

9.4.3.1. Battery Electric Vehicles (BEVs)

9.4.3.2. Hybrid Electric Vehicles (HEVs)

9.4.4. Medium and Heavy-duty Vehicles

9.4.4.1. Battery Electric Vehicles (BEVs)

9.4.4.2. Hybrid Electric Vehicles (HEVs)

9.4.5. Buses & Coaches

9.4.5.1. Battery Electric Vehicles (BEVs)

9.4.5.2. Hybrid Electric Vehicles (HEVs)

9.5. Key Country Analysis – Asia Pacific EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031

9.5.1. China

9.5.2. India

9.5.3. Japan

9.5.4. ASEAN Countries

9.5.5. South Korea

9.5.6. ANZ

9.5.7. Rest of Asia Pacific

10. Middle East & Africa EV Lightweight Materials Market

10.1. Market Snapshot

10.2. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Material Type

10.2.1. Metals and Alloys

10.2.1.1. High-strength Steel (HSS)

10.2.1.2. Aluminum

10.2.1.3. Magnesium

10.2.1.4. Titanium

10.2.1.5. Beryllium

10.2.1.6. Others

10.2.2. Composites

10.2.2.1. Carbon-fiber-reinforced Polymers (CFRPs)

10.2.2.2. Glass-fiber-reinforced Polymers (CFRPs)

10.2.2.3. Natural Fiber-reinforced Polymers (NFRPs)

10.2.2.4. Other Composites

10.2.3. Plastics

10.2.3.1. Polycarbonate (PC)

10.2.3.2. Polyamide (PA)

10.2.3.3. Polymethyl Methacrylate (PMMA)

10.2.3.4. Polyacetal/Polyoxymethylene (POM)

10.2.3.5. PET

10.2.3.6. Others

10.2.4. Elastomers

10.2.5. Others

10.3. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Application

10.3.1. Battery Packs

10.3.2. Electric Traction Motors

10.3.3. Electronic Components

10.3.4. Power Electronic Controllers

10.3.5. Body-in-White

10.3.6. Chassis and Suspension

10.3.7. Powertrains/Transmissions

10.3.8. Closures

10.3.9. Interiors

10.3.10. DC/DC Converters

10.3.11. Thermal Systems

10.3.12. On-board Charger

10.3.13. Tires and Wheels

10.3.14. Bumpers and Fenders

10.3.15. Lighting

10.3.16. Dashboards

10.3.17. Seat Systems

10.3.18. Steering Systems

10.3.19. Fuel Tanks

10.3.20. Doors

10.3.21. Others

10.4. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

10.4.1. Passenger Cars (Hatchbacks and Sedans)

10.4.1.1. Battery Electric Vehicles (BEVs)

10.4.1.2. Hybrid Electric Vehicles (HEVs)

10.4.2. Utility Vehicles (SUVs, MPVs, Compact SUVs)

10.4.2.1. Battery Electric Vehicles (BEVs)

10.4.2.2. Hybrid Electric Vehicles (HEVs)

10.4.3. Light Commercial Vehicles

10.4.3.1. Battery Electric Vehicles (BEVs)

10.4.3.2. Hybrid Electric Vehicles (HEVs)

10.4.4. Medium and Heavy-duty Vehicles

10.4.4.1. Battery Electric Vehicles (BEVs)

10.4.4.2. Hybrid Electric Vehicles (HEVs)

10.4.5. Buses & Coaches

10.4.5.1. Battery Electric Vehicles (BEVs)

10.4.5.2. Hybrid Electric Vehicles (HEVs)

10.5. Key Country Analysis – Middle East & Africa EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031

10.5.1. GCC

10.5.2. South Africa

10.5.3. Turkey

10.5.4. Rest of Middle East & Africa

11. Latin America EV Lightweight Materials Market

11.1. Market Snapshot

11.2. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Material Type

11.2.1. Metals and Alloys

11.2.1.1. High-strength Steel (HSS)

11.2.1.2. Aluminum

11.2.1.3. Magnesium

11.2.1.4. Titanium

11.2.1.5. Beryllium

11.2.1.6. Others

11.2.2. Composites

11.2.2.1. Carbon-fiber-reinforced Polymers (CFRPs)

11.2.2.2. Glass-fiber-reinforced Polymers (CFRPs)

11.2.2.3. Natural Fiber-reinforced Polymers (NFRPs)

11.2.2.4. Other Composites

11.2.3. Plastics

11.2.3.1. Polycarbonate (PC)

11.2.3.2. Polyamide (PA)

11.2.3.3. Polymethyl Methacrylate (PMMA)

11.2.3.4. Polyacetal/Polyoxymethylene (POM)

11.2.3.5. PET

11.2.3.6. Others

11.2.4. Elastomers

11.2.5. Others

11.3. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Application

11.3.1. Battery Packs

11.3.2. Electric Traction Motors

11.3.3. Electronic Components

11.3.4. Power Electronic Controllers

11.3.5. Body-in-White

11.3.6. Chassis and Suspension

11.3.7. Powertrains/Transmissions

11.3.8. Closures

11.3.9. Interiors

11.3.10. DC/DC Converters

11.3.11. Thermal Systems

11.3.12. On-board Charger

11.3.13. Tires and Wheels

11.3.14. Bumpers and Fenders

11.3.15. Lighting

11.3.16. Dashboards

11.3.17. Seat Systems

11.3.18. Steering Systems

11.3.19. Fuel Tanks

11.3.20. Doors

11.3.21. Others

11.4. EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

11.4.1. Passenger Cars (Hatchbacks and Sedans)

11.4.1.1. Battery Electric Vehicles (BEVs)

11.4.1.2. Hybrid Electric Vehicles (HEVs)

11.4.2. Utility Vehicles (SUVs, MPVs, Compact SUVs)

11.4.2.1. Battery Electric Vehicles (BEVs)

11.4.2.2. Hybrid Electric Vehicles (HEVs)

11.4.3. Light Commercial Vehicles

11.4.3.1. Battery Electric Vehicles (BEVs)

11.4.3.2. Hybrid Electric Vehicles (HEVs)

11.4.4. Medium and Heavy-duty Vehicles

11.4.4.1. Battery Electric Vehicles (BEVs)

11.4.4.2. Hybrid Electric Vehicles (HEVs)

11.4.5. Buses & Coaches

11.4.5.1. Battery Electric Vehicles (BEVs)

11.4.5.2. Hybrid Electric Vehicles (HEVs)

11.5. Key Country Analysis – Latin America EV Lightweight Materials Market Size Analysis & Forecast, 2017-2031

11.5.1. Brazil

11.5.2. Mexico

11.5.3. Argentina

11.5.4. Rest of Latin America

12. Competitive Landscape

12.1. Company Share Analysis/Brand Share Analysis, 2021

12.2. Pricing Comparison Among Key Players

12.3. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

12.4. Company Profile/Key Players

12.4.1. BASF SE

12.4.1.1. Company Overview

12.4.1.2. Company Footprints

12.4.1.3. Production Locations

12.4.1.4. Product Portfolio

12.4.1.5. Competitors & Customers

12.4.1.6. Subsidiaries & Parent Organization

12.4.1.7. Recent Developments

12.4.1.8. Financial Analysis

12.4.1.9. Profitability

12.4.1.10. Revenue Share

12.4.2. Covestro AG

12.4.2.1. Company Overview

12.4.2.2. Company Footprints

12.4.2.3. Production Locations

12.4.2.4. Product Portfolio

12.4.2.5. Competitors & Customers

12.4.2.6. Subsidiaries & Parent Organization

12.4.2.7. Recent Developments

12.4.2.8. Financial Analysis

12.4.2.9. Profitability

12.4.2.10. Revenue Share

12.4.3. Toray Industries, Inc.

12.4.3.1. Company Overview

12.4.3.2. Company Footprints

12.4.3.3. Production Locations

12.4.3.4. Product Portfolio

12.4.3.5. Competitors & Customers

12.4.3.6. Subsidiaries & Parent Organization

12.4.3.7. Recent Developments

12.4.3.8. Financial Analysis

12.4.3.9. Profitability

12.4.3.10. Revenue Share

12.4.4. ArcelorMittal

12.4.4.1. Company Overview

12.4.4.2. Company Footprints

12.4.4.3. Production Locations

12.4.4.4. Product Portfolio

12.4.4.5. Competitors & Customers

12.4.4.6. Subsidiaries & Parent Organization

12.4.4.7. Recent Developments

12.4.4.8. Financial Analysis

12.4.4.9. Profitability

12.4.4.10. Revenue Share

12.4.5. SABIC

12.4.5.1. Company Overview

12.4.5.2. Company Footprints

12.4.5.3. Production Locations

12.4.5.4. Product Portfolio

12.4.5.5. Competitors & Customers

12.4.5.6. Subsidiaries & Parent Organization

12.4.5.7. Recent Developments

12.4.5.8. Financial Analysis

12.4.5.9. Profitability

12.4.5.10. Revenue Share

12.4.6. thyssenkrupp AG

12.4.6.1. Company Overview

12.4.6.2. Company Footprints

12.4.6.3. Production Locations

12.4.6.4. Product Portfolio

12.4.6.5. Competitors & Customers

12.4.6.6. Subsidiaries & Parent Organization

12.4.6.7. Recent Developments

12.4.6.8. Financial Analysis

12.4.6.9. Profitability

12.4.6.10. Revenue Share

12.4.7. Solvay

12.4.7.1. Company Overview

12.4.7.2. Company Footprints

12.4.7.3. Production Locations

12.4.7.4. Product Portfolio

12.4.7.5. Competitors & Customers

12.4.7.6. Subsidiaries & Parent Organization

12.4.7.7. Recent Developments

12.4.7.8. Financial Analysis

12.4.7.9. Profitability

12.4.7.10. Revenue Share

12.4.8. SGL Carbon SE

12.4.8.1. Company Overview

12.4.8.2. Company Footprints

12.4.8.3. Production Locations

12.4.8.4. Product Portfolio

12.4.8.5. Competitors & Customers

12.4.8.6. Subsidiaries & Parent Organization

12.4.8.7. Recent Developments

12.4.8.8. Financial Analysis

12.4.8.9. Profitability

12.4.8.10. Revenue Share

12.4.9. Celanese Corporation

12.4.9.1. Company Overview

12.4.9.2. Company Footprints

12.4.9.3. Production Locations

12.4.9.4. Product Portfolio

12.4.9.5. Competitors & Customers

12.4.9.6. Subsidiaries & Parent Organization

12.4.9.7. Recent Developments

12.4.9.8. Financial Analysis

12.4.9.9. Profitability

12.4.9.10. Revenue Share

12.4.10. Novelis Inc.

12.4.10.1. Company Overview

12.4.10.2. Company Footprints

12.4.10.3. Production Locations

12.4.10.4. Product Portfolio

12.4.10.5. Competitors & Customers

12.4.10.6. Subsidiaries & Parent Organization

12.4.10.7. Recent Developments

12.4.10.8. Financial Analysis

12.4.10.9. Profitability

12.4.10.10. Revenue Share

12.4.11. LyondellBasell Industries Holdings B.V.

12.4.11.1. Company Overview

12.4.11.2. Company Footprints

12.4.11.3. Production Locations

12.4.11.4. Product Portfolio

12.4.11.5. Competitors & Customers

12.4.11.6. Subsidiaries & Parent Organization

12.4.11.7. Recent Developments

12.4.11.8. Financial Analysis

12.4.11.9. Profitability

12.4.11.10. Revenue Share

12.4.12. Constellium

12.4.12.1. Company Overview

12.4.12.2. Company Footprints

12.4.12.3. Production Locations

12.4.12.4. Product Portfolio

12.4.12.5. Competitors & Customers

12.4.12.6. Subsidiaries & Parent Organization

12.4.12.7. Recent Developments

12.4.12.8. Financial Analysis

12.4.12.9. Profitability

12.4.12.10. Revenue Share

12.4.13. Teijin Limited

12.4.13.1. Company Overview

12.4.13.2. Company Footprints

12.4.13.3. Production Locations

12.4.13.4. Product Portfolio

12.4.13.5. Competitors & Customers

12.4.13.6. Subsidiaries & Parent Organization

12.4.13.7. Recent Developments

12.4.13.8. Financial Analysis

12.4.13.9. Profitability

12.4.13.10. Revenue Share

12.4.14. Evonik Industries AG

12.4.14.1. Company Overview

12.4.14.2. Company Footprints

12.4.14.3. Production Locations

12.4.14.4. Product Portfolio

12.4.14.5. Competitors & Customers

12.4.14.6. Subsidiaries & Parent Organization

12.4.14.7. Recent Developments

12.4.14.8. Financial Analysis

12.4.14.9. Profitability

12.4.14.10. Revenue Share

12.4.15. LANXESS Deutschland GmbH

12.4.15.1. Company Overview

12.4.15.2. Company Footprints

12.4.15.3. Production Locations

12.4.15.4. Product Portfolio

12.4.15.5. Competitors & Customers

12.4.15.6. Subsidiaries & Parent Organization

12.4.15.7. Recent Developments

12.4.15.8. Financial Analysis

12.4.15.9. Profitability

12.4.15.10. Revenue Share

12.4.16. Alcoa Corporation

12.4.16.1. Company Overview

12.4.16.2. Company Footprints

12.4.16.3. Production Locations

12.4.16.4. Product Portfolio

12.4.16.5. Competitors & Customers

12.4.16.6. Subsidiaries & Parent Organization

12.4.16.7. Recent Developments

12.4.16.8. Financial Analysis

12.4.16.9. Profitability

12.4.16.10. Revenue Share

12.4.17. Owens Corning

12.4.17.1. Company Overview

12.4.17.2. Company Footprints

12.4.17.3. Production Locations

12.4.17.4. Product Portfolio

12.4.17.5. Competitors & Customers

12.4.17.6. Subsidiaries & Parent Organization

12.4.17.7. Recent Developments

12.4.17.8. Financial Analysis

12.4.17.9. Profitability

12.4.17.10. Revenue Share

12.4.18. Stratasys Ltd.

12.4.18.1. Company Overview

12.4.18.2. Company Footprints

12.4.18.3. Production Locations

12.4.18.4. Product Portfolio

12.4.18.5. Competitors & Customers

12.4.18.6. Subsidiaries & Parent Organization

12.4.18.7. Recent Developments

12.4.18.8. Financial Analysis

12.4.18.9. Profitability

12.4.18.10. Revenue Share

12.4.19. Tata Steel

12.4.19.1. Company Overview

12.4.19.2. Company Footprints

12.4.19.3. Production Locations

12.4.19.4. Product Portfolio

12.4.19.5. Competitors & Customers

12.4.19.6. Subsidiaries & Parent Organization

12.4.19.7. Recent Developments

12.4.19.8. Financial Analysis

12.4.19.9. Profitability

12.4.19.10. Revenue Share

12.4.20. US Magnesium LLC

12.4.20.1. Company Overview

12.4.20.2. Company Footprints

12.4.20.3. Production Locations

12.4.20.4. Product Portfolio

12.4.20.5. Competitors & Customers

12.4.20.6. Subsidiaries & Parent Organization

12.4.20.7. Recent Developments

12.4.20.8. Financial Analysis

12.4.20.9. Profitability

12.4.20.10. Revenue Share

12.4.21. WHB Brasil

12.4.21.1. Company Overview

12.4.21.2. Company Footprints

12.4.21.3. Production Locations

12.4.21.4. Product Portfolio

12.4.21.5. Competitors & Customers

12.4.21.6. Subsidiaries & Parent Organization

12.4.21.7. Recent Developments

12.4.21.8. Financial Analysis

12.4.21.9. Profitability

12.4.21.10. Revenue Share

List of Tables

Table 1: Global EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Table 2: Global EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 3: Global EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 4: Global EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 5: Global EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Table 6: Global EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 7: Global EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Region, 2017-2031

Table 8: Global EV Lightweight Materials Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 9: North America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Table 10: North America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 11: North America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 12: North America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 13: North America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Table 14: North America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 15: North America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Country, 2017-2031

Table 16: North America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 17: Europe EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Table 18: Europe EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 19: Europe EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 20: Europe EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 21: Europe EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Table 22: Europe EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 23: Europe EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Country, 2017-2031

Table 24: Europe EV Lightweight Materials Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 25: Asia Pacific EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Table 26: Asia Pacific EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 27: Asia Pacific EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 28: Asia Pacific EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 29: Asia Pacific EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Table 30: Asia Pacific EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 31: Asia Pacific EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Country, 2017-2031

Table 32: Asia Pacific EV Lightweight Materials Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 33: Middle East & Africa EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Table 34: Middle East & Africa EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 35: Middle East & Africa EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 36: Middle East & Africa EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 37: Middle East & Africa EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Table 38: Middle East & Africa EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 39: Middle East & Africa EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Country, 2017-2031

Table 40: Middle East & Africa EV Lightweight Materials Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 41: Latin America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Table 42: Latin America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017‒2031

Table 43: Latin America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Table 44: Latin America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 45: Latin America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Table 46: Latin America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 47: Latin America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Country, 2017-2031

Table 48: Latin America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Figure 2: Global EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017-2031

Figure 3: Global EV Lightweight Materials Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022-2031

Figure 4: Global EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Figure 5: Global EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 6: Global EV Lightweight Materials Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 7: Global EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global EV Lightweight Materials Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 10: Global EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Region, 2017-2031

Figure 11: Global EV Lightweight Materials Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 12: Global EV Lightweight Materials Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022-2031

Figure 13: North America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Figure 14: North America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017-2031

Figure 15: North America EV Lightweight Materials Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022-2031

Figure 16: North America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Figure 17: North America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 18: North America EV Lightweight Materials Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 19: North America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Figure 20: North America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 21: North America EV Lightweight Materials Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 22: North America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Country, 2017-2031

Figure 23: North America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 24: North America EV Lightweight Materials Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 25: Europe EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Figure 26: Europe EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017-2031

Figure 27: Europe EV Lightweight Materials Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022-2031

Figure 28: Europe EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Figure 29: Europe EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 30: Europe EV Lightweight Materials Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 31: Europe EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Figure 32: Europe EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 33: Europe EV Lightweight Materials Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 34: Europe EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Country, 2017-2031

Figure 35: Europe EV Lightweight Materials Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 36: Europe EV Lightweight Materials Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 37: Asia Pacific EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Figure 38: Asia Pacific EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017-2031

Figure 39: Asia Pacific EV Lightweight Materials Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022-2031

Figure 40: Asia Pacific EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Figure 41: Asia Pacific EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 42: Asia Pacific EV Lightweight Materials Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 43: Asia Pacific EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Figure 44: Asia Pacific EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 45: Asia Pacific EV Lightweight Materials Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 46: Asia Pacific EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Country, 2017-2031

Figure 47: Asia Pacific EV Lightweight Materials Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific EV Lightweight Materials Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 49: Middle East & Africa EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Figure 50: Middle East & Africa EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017-2031

Figure 51: Middle East & Africa EV Lightweight Materials Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022-2031

Figure 52: Middle East & Africa EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Figure 53: Middle East & Africa EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 54: Middle East & Africa EV Lightweight Materials Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 55: Middle East & Africa EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Figure 56: Middle East & Africa EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 57: Middle East & Africa EV Lightweight Materials Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 58: Middle East & Africa EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Country, 2017-2031

Figure 59: Middle East & Africa EV Lightweight Materials Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa EV Lightweight Materials Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 61: Latin America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Material Type, 2017-2031

Figure 62: Latin America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Material Type, 2017-2031

Figure 63: Latin America EV Lightweight Materials Market, Incremental Opportunity, by Material Type, Value (US$ Mn), 2022-2031

Figure 64: Latin America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Application, 2017-2031

Figure 65: Latin America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 66: Latin America EV Lightweight Materials Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 67: Latin America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Vehicle Type, 2017-2031

Figure 68: Latin America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 69: Latin America EV Lightweight Materials Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022-2031

Figure 70: Latin America EV Lightweight Materials Market Volume (Kilo Tons) Forecast, by Country, 2017-2031

Figure 71: Latin America EV Lightweight Materials Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 72: Latin America EV Lightweight Materials Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031