Analysts’ Viewpoint on Market Scenario

Demand for EV chargers is anticipated to significantly increase during the forecast period, as more people switch to autonomous and electric vehicles. This is fueling the EV chargers market development. The automobile industry is currently witnessing significant investment in R&D activities to develop durable and cost-effective EV solutions. These solutions are estimated to create a sustainable ecosystem for the development of inexpensive infrastructure for emerging and underdeveloped countries.

ABB, Alfen N.V., Allego B.V., Baccus Global LLC, Bosch Automotive Service Solutions, and Clore Automotive LLC, are some of the leading market players. They are focused on the development of innovative products, such as off-board and on-board chargers, to grab significant business opportunities. Increase in government support to adopt electric vehicles in order to reduce carbon emissions is projected to fuel the demand for suitable charging infrastructure in developing countries.

Electric cars, communal EVs, and plug-in hybrids can all be recharged using an EV charger, which is a piece of equipment that connects an electric vehicle to an electric source. Commercial businesses or public utilities provide charging stations, also known as electric vehicle supply equipment (EVSE), in parking lots or retail shopping centers. These stations provide unique connectors that meet the various specifications for electric charging connectors. Additionally, charging for these vehicles can be done at many levels, including level 1, level 2, and level 3.

Electric automobiles are more cost-effective and fuel-efficient than traditional gasoline and diesel vehicles. EVs lessen the hazardous gas-containing carbon footprints that are emitted into the atmosphere. Rise in number of vehicles on road is primarily due to the rapid urbanization in several countries across the globe. Consequently, increase in traffic jams is driving the demand for better road infrastructure, which in turn is anticipated to drive the market for EV chargers during the forecast period.

The introduction and use of electric vehicles have raised the need for charging infrastructure. Leading EV markets such as China, the U.S., and Germany are investing heavily in the infrastructure needed for EV charging as well as in R&D of EV chargers. Automobile manufacturers are expected to invest significantly in the manufacture of EVs during the forecast period in order to cater to the rising demand from consumers. Tesla, Volkswagen, Ford, Nissan, BMW, and General Motors are some of the leading manufacturers of EVs worldwide.

3 million EVs were sold globally in 2020, despite COVID-19's effects on the market, a 41% increase; however, the global auto market shrank by 6%. This suggests that the market for EV charging stations is likely to get grow owing to the increase in demand for electric vehicles in the next few years. Demand for public charging stations is rising consistently across the globe, even if the majority of EV owners install Level 1 or Level 2 EV charging devices in their homes or apartment complex.

OEMs provide a wide range of electric vehicles, from stylish sedans, such as the Tesla Model 3 to small hatchbacks such as the Leaf. As per the EV chargers industry forecast report, the market for electric vehicles has expanded as a result of the high number of customers attracted by the wide range of product alternatives.

Traditional gas-powered automobiles use internal combustion engines to generate power. In a perfect world, the fuel would be entirely burned by the combustion system, leaving just carbon dioxide and water as waste. In reality, however, the combustion system generates a number of greenhouse gases, which pollute the environment.

A steady flow of electricity powers the electric motor in an electric car, which is emission-free. Governments of the United States, Germany, France, and China have formulated stringent legislation and regulations governing automobile emissions in order to combat high vehicle emission levels. A program launched by the California Air Resources Board (CARB) also involves mandates for manufacturers to build and provide zero-emission vehicles. This has considerably increased the adoption of electric vehicles and, consequently, contributed to the increase in electric vehicle chargers market size.

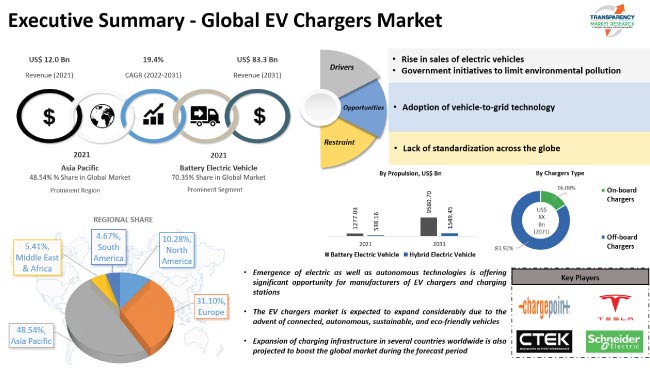

Based on propulsion, the global market segmentation comprises battery electric vehicle, and hybrid electric vehicle. According to the EV chargers market report, the battery electric vehicle segment held 70.3% share of the global market in 2021, owing to growing environmental consciousness among consumers and the advantages offered by BEVs.

The average driving range of BEVs has also been rising over time. The typical range of BEVs increased from 243 km in 2017 to roughly 350 km in 2021. The U.S. Government has established a net-zero greenhouse gas emission goal for 2050, aligned with substantial implications, and implemented stringent rules of CO2 emission limitations for vehicles powered by IC engines. Additionally, favorable government efforts, subsidies, and tax rebate programs are fueling electric vehicle charger market growth.

Analysis of the EV chargers market forecast reveals that the off-board chargers segment accounted for 83.9% market share in 2021. The segment is estimated to maintain its position in the market and expand at a CAGR of more than 19.6% during the forecast period. Off-board battery chargers are less restricted in terms of size and weight, and they maintain redundancy in power electronic converters, adding flexibility to the system.

On the other hand, the on-board charger needs to be fitted in the vehicle and charge at a sluggish pace, which means it takes a disproportionately long time to charge. The size of on-board chargers for BEVs/PHEVs is small due to the availability of limited space in the vehicle. One of the key benefits of using an on-board charger is that charging is possible wherever there is an electrical outlet. Consequently, the demand for on-board chargers is expected to rise in the near future.

Asia Pacific is anticipated to lead the global EV chargers market during the forecast period. The growth can be ascribed to the expansion of automotive sector in the region, increase in disposable income, and rise in living standards of consumers, notably in countries such as China and India. Rise in popularity and adoption of electric vehicles in Asia Pacific is augmenting the electric vehicle charger market statistics in the region.

The market for EV chargers is expanding as a result of the rapid increase in adoption of EVs for public transportation in densely populated nations such as China and India. Governments of these nations intend to increase the number of charging stations to encourage the use of electric vehicles. Rise in government initiatives to reduce carbon emission is also likely to propel the EV chargers market share held by Asia Pacific.

The global EV chargers market is consolidated with a large number of manufacturers controlling significant market share. Manufacturers are adopting advanced technologies to gain more revenues. Leading players are expanding their product portfolio through acquisitions & partnerships. These are the key growth strategies for EV chargers manufacturers operating in the industry.

Some of the leading players in EV chargers market across the globe are ABB, Alfen N.V., Allego B.V., Clore Automotive LLC, CTEK Holding AB, Efacec, Enervalis, EVBox, IES Synergy, Juuce Limited., Meta Systems S.P.A, OVO Energy Ltd, Schneider Electric, Schumacher Electric Corporation, Tesla Inc., and Wallbox Chargers, S.L.

Key players have been profiled in the global EV chargers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 12.0 Bn |

|

Market Forecast Value in 2031 |

US$ 83.3 Bn |

|

Growth Rate (CAGR) |

19.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It is valued at US$ 12.0 Bn in 2021

It is expected to advance at a CAGR of 19.4% by 2031

It is likely to reach US$ 83.3 Bn in 2031

Rise in sale of electric vehicles and increase in government initiatives to limit environmental pollution

The battery electric vehicle is expected to account for the largest share during the forecast period

Asia Pacific is a highly lucrative region for vendors

ABB, Alfen N.V., Allego B.V., Clore Automotive LLC, CTEK Holding AB, Efacec, Enervalis, EVBox, IES Synergy, Juuce Limited., Meta Systems S.P.A, OVO Energy Ltd, Schneider Electric, Schumacher Electric Corporation, Tesla Inc., and Wallbox Chargers, S.L.

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Thousand Units, US$ Bn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Macro-Economic Factors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Key Trend Analysis

4. Regulatory Scenario

4.1. National/ Country Legislation

4.2. Norms and Subsidies by Government for electric vehicles

5. Supply Chain Analysis

5.1. Key EV Charger Suppliers, by Country

5.1.1. Key Decision Maker for each key player for each of the component

5.1.1.1. By Charger Type

5.1.1.2. By Connector Type

5.2. Electric Vehicle Players, by Country (Top 10 EV players for each vehicle type and each country mentioned)

5.3. Supply Chain Constraints

6. EV Chargers - Actual packaging needs & spend (corrugated and other materials), by Country

7. EV Chargers - Packaging manufacturers active in this area (offering packaging for this segment)

7.1. Specific packaging solution offering

8. Global EV Chargers Market, by Chargers Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Chargers Type

8.2.1. On-board Chargers

8.2.2. Off-board Chargers

9. Global EV Chargers Market, by Application

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

9.2.1. Private

9.2.2. Public

10. Global EV Chargers Market, by Propulsion

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

10.2.1. Battery Electric Vehicle

10.2.2. Hybrid Electric Vehicle

11. Global EV Chargers Market, by Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America EV Chargers Market

12.1. Market Snapshot

12.2. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Chargers Type

12.2.1. On-board Chargers

12.2.2. Off-board Chargers

12.3. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

12.3.1. Private

12.3.2. Public

12.4. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

12.4.1. Battery Electric Vehicle

12.4.2. Hybrid Electric Vehicle

12.5. Key Country Analysis – North America EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031

12.5.1. The U. S.

12.5.2. Canada

12.5.3. Mexico

13. Europe EV Chargers Market

13.1. Market Snapshot

13.2. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Chargers Type

13.2.1. On-board Chargers

13.2.2. Off-board Chargers

13.3. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

13.3.1. Private

13.3.2. Public

13.4. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

13.4.1. Battery Electric Vehicle

13.4.2. Hybrid Electric Vehicle

13.5. Key Country Analysis – Europe EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031

13.5.1. Germany

13.5.2. U. K.

13.5.3. France

13.5.4. Italy

13.5.5. Spain

13.5.6. Hungary

13.5.7. Poland

13.5.8. Rest of Europe

14. Asia Pacific EV Chargers Market

14.1. Market Snapshot

14.2. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Chargers Type

14.2.1. On-board Chargers

14.2.2. Off-board Chargers

14.3. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

14.3.1. Private

14.3.2. Public

14.4. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

14.4.1. Battery Electric Vehicle

14.4.2. Hybrid Electric Vehicle

14.5. Key Country Analysis – Asia Pacific EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031

14.5.1. China

14.5.2. India

14.5.3. ASEAN Countries

14.5.4. Rest of Asia Pacific

15. Middle East & Africa EV Chargers Market

15.1. Market Snapshot

15.2. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Chargers Type

15.2.1. On-board Chargers

15.2.2. Off-board Chargers

15.3. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

15.3.1. Private

15.3.2. Public

15.4. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

15.4.1. Battery Electric Vehicle

15.4.2. Hybrid Electric Vehicle

15.5. Key Country Analysis – Middle East & Africa EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031

15.5.1. GCC

15.5.2. South Africa

15.5.3. Turkey

15.5.4. Rest of Middle East & Africa

16. South America EV Chargers Market

16.1. Market Snapshot

16.2. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Chargers Type

16.2.1. On-board Chargers

16.2.2. Off-board Chargers

16.3. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

16.3.1. Private

16.3.2. Public

16.4. EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Propulsion

16.4.1. Battery Electric Vehicle

16.4.2. Hybrid Electric Vehicle

16.5. Key Country Analysis – South America EV Chargers Market Value (US$ Bn) Analysis & Forecast, 2017-2031

16.5.1. Brazil

16.5.2. Argentina

16.5.3. Rest of South America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Share Analysis, 2021

17.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

17.3. Company Profile, by EV Chargers

**Companies covering more than 75% market share for EV Chargers would be covered in the research report

17.4. Tentative List of EV Charger Manufacturers/ Suppliers

17.4.1. ABB

17.4.1.1. Company Overview

17.4.1.2. Company Footprints

17.4.1.3. Production Locations

17.4.1.4. Product Portfolio

17.4.1.5. Competitors & Customers

17.4.1.6. Subsidiaries & Parent Organization

17.4.1.7. Recent Developments

17.4.1.8. Financial Analysis

17.4.1.9. Profitability

17.4.1.10. Revenue Share

17.4.1.11. Executive Bios

17.4.2. Alfen N.V.

17.4.2.1. Company Overview

17.4.2.2. Company Footprints

17.4.2.3. Production Locations

17.4.2.4. Product Portfolio

17.4.2.5. Competitors & Customers

17.4.2.6. Subsidiaries & Parent Organization

17.4.2.7. Recent Developments

17.4.2.8. Financial Analysis

17.4.2.9. Profitability

17.4.2.10. Revenue Share

17.4.2.11. Executive Bios

17.4.3. Allego B.V.

17.4.3.1. Company Overview

17.4.3.2. Company Footprints

17.4.3.3. Production Locations

17.4.3.4. Product Portfolio

17.4.3.5. Competitors & Customers

17.4.3.6. Subsidiaries & Parent Organization

17.4.3.7. Recent Developments

17.4.3.8. Financial Analysis

17.4.3.9. Profitability

17.4.3.10. Revenue Share

17.4.3.11. Executive Bios

17.4.4. Baccus Global LLC

17.4.4.1. Company Overview

17.4.4.2. Company Footprints

17.4.4.3. Production Locations

17.4.4.4. Product Portfolio

17.4.4.5. Competitors & Customers

17.4.4.6. Subsidiaries & Parent Organization

17.4.4.7. Recent Developments

17.4.4.8. Financial Analysis

17.4.4.9. Profitability

17.4.4.10. Revenue Share

17.4.4.11. Executive Bios

17.4.5. Bosch Automotive Service Solutions

17.4.5.1. Company Overview

17.4.5.2. Company Footprints

17.4.5.3. Production Locations

17.4.5.4. Product Portfolio

17.4.5.5. Competitors & Customers

17.4.5.6. Subsidiaries & Parent Organization

17.4.5.7. Recent Developments

17.4.5.8. Financial Analysis

17.4.5.9. Profitability

17.4.5.10. Revenue Share

17.4.5.11. Executive Bios

17.4.6. Clore Automotive LLC

17.4.6.1. Company Overview

17.4.6.2. Company Footprints

17.4.6.3. Production Locations

17.4.6.4. Product Portfolio

17.4.6.5. Competitors & Customers

17.4.6.6. Subsidiaries & Parent Organization

17.4.6.7. Recent Developments

17.4.6.8. Financial Analysis

17.4.6.9. Profitability

17.4.6.10. Revenue Share

17.4.6.11. Executive Bios

17.4.7. CTEK Holding AB

17.4.7.1. Company Overview

17.4.7.2. Company Footprints

17.4.7.3. Production Locations

17.4.7.4. Product Portfolio

17.4.7.5. Competitors & Customers

17.4.7.6. Subsidiaries & Parent Organization

17.4.7.7. Recent Developments

17.4.7.8. Financial Analysis

17.4.7.9. Profitability

17.4.7.10. Revenue Share

17.4.7.11. Executive Bios

17.4.8. Current Ways Inc.

17.4.8.1. Company Overview

17.4.8.2. Company Footprints

17.4.8.3. Production Locations

17.4.8.4. Product Portfolio

17.4.8.5. Competitors & Customers

17.4.8.6. Subsidiaries & Parent Organization

17.4.8.7. Recent Developments

17.4.8.8. Financial Analysis

17.4.8.9. Profitability

17.4.8.10. Revenue Share

17.4.8.11. Executive Bios

17.4.9. Delphi Automotive LLP

17.4.9.1. Company Overview

17.4.9.2. Company Footprints

17.4.9.3. Production Locations

17.4.9.4. Product Portfolio

17.4.9.5. Competitors & Customers

17.4.9.6. Subsidiaries & Parent Organization

17.4.9.7. Recent Developments

17.4.9.8. Financial Analysis

17.4.9.9. Profitability

17.4.9.10. Revenue Share

17.4.9.11. Executive Bios

17.4.10. Efacec

17.4.10.1. Company Overview

17.4.10.2. Company Footprints

17.4.10.3. Production Locations

17.4.10.4. Product Portfolio

17.4.10.5. Competitors & Customers

17.4.10.6. Subsidiaries & Parent Organization

17.4.10.7. Recent Developments

17.4.10.8. Financial Analysis

17.4.10.9. Profitability

17.4.10.10. Revenue Share

17.4.10.11. Executive Bios

17.4.11. Enervalis

17.4.11.1. Company Overview

17.4.11.2. Company Footprints

17.4.11.3. Production Locations

17.4.11.4. Product Portfolio

17.4.11.5. Competitors & Customers

17.4.11.6. Subsidiaries & Parent Organization

17.4.11.7. Recent Developments

17.4.11.8. Financial Analysis

17.4.11.9. Profitability

17.4.11.10. Revenue Share

17.4.11.11. Executive Bios

17.4.12. EVBox

17.4.12.1. Company Overview

17.4.12.2. Company Footprints

17.4.12.3. Production Locations

17.4.12.4. Product Portfolio

17.4.12.5. Competitors & Customers

17.4.12.6. Subsidiaries & Parent Organization

17.4.12.7. Recent Developments

17.4.12.8. Financial Analysis

17.4.12.9. Profitability

17.4.12.10. Revenue Share

17.4.12.11. Executive Bios

17.4.13. Ficosa International SA

17.4.13.1. Company Overview

17.4.13.2. Company Footprints

17.4.13.3. Production Locations

17.4.13.4. Product Portfolio

17.4.13.5. Competitors & Customers

17.4.13.6. Subsidiaries & Parent Organization

17.4.13.7. Recent Developments

17.4.13.8. Financial Analysis

17.4.13.9. Profitability

17.4.13.10. Revenue Share

17.4.13.11. Executive Bios

17.4.14. General Electric Company

17.4.14.1. Company Overview

17.4.14.2. Company Footprints

17.4.14.3. Production Locations

17.4.14.4. Product Portfolio

17.4.14.5. Competitors & Customers

17.4.14.6. Subsidiaries & Parent Organization

17.4.14.7. Recent Developments

17.4.14.8. Financial Analysis

17.4.14.9. Profitability

17.4.14.10. Revenue Share

17.4.14.11. Executive Bios

17.4.15. IES Synergy

17.4.15.1. Company Overview

17.4.15.2. Company Footprints

17.4.15.3. Production Locations

17.4.15.4. Product Portfolio

17.4.15.5. Competitors & Customers

17.4.15.6. Subsidiaries & Parent Organization

17.4.15.7. Recent Developments

17.4.15.8. Financial Analysis

17.4.15.9. Profitability

17.4.15.10. Revenue Share

17.4.15.11. Executive Bios

17.4.16. Juuce Limited.

17.4.16.1. Company Overview

17.4.16.2. Company Footprints

17.4.16.3. Production Locations

17.4.16.4. Product Portfolio

17.4.16.5. Competitors & Customers

17.4.16.6. Subsidiaries & Parent Organization

17.4.16.7. Recent Developments

17.4.16.8. Financial Analysis

17.4.16.9. Profitability

17.4.16.10. Revenue Share

17.4.16.11. Executive Bios

17.4.17. LG Electronics

17.4.17.1. Company Overview

17.4.17.2. Company Footprints

17.4.17.3. Production Locations

17.4.17.4. Product Portfolio

17.4.17.5. Competitors & Customers

17.4.17.6. Subsidiaries & Parent Organization

17.4.17.7. Recent Developments

17.4.17.8. Financial Analysis

17.4.17.9. Profitability

17.4.17.10. Revenue Share

17.4.17.11. Executive Bios

17.4.18. Meta Systems S.P.A

17.4.18.1. Company Overview

17.4.18.2. Company Footprints

17.4.18.3. Production Locations

17.4.18.4. Product Portfolio

17.4.18.5. Competitors & Customers

17.4.18.6. Subsidiaries & Parent Organization

17.4.18.7. Recent Developments

17.4.18.8. Financial Analysis

17.4.18.9. Profitability

17.4.18.10. Revenue Share

17.4.18.11. Executive Bios

17.4.19. OVO Energy Ltd

17.4.19.1. Company Overview

17.4.19.2. Company Footprints

17.4.19.3. Production Locations

17.4.19.4. Product Portfolio

17.4.19.5. Competitors & Customers

17.4.19.6. Subsidiaries & Parent Organization

17.4.19.7. Recent Developments

17.4.19.8. Financial Analysis

17.4.19.9. Profitability

17.4.19.10. Revenue Share

17.4.19.11. Executive Bios

17.4.20. Schneider Electric

17.4.20.1. Company Overview

17.4.20.2. Company Footprints

17.4.20.3. Production Locations

17.4.20.4. Product Portfolio

17.4.20.5. Competitors & Customers

17.4.20.6. Subsidiaries & Parent Organization

17.4.20.7. Recent Developments

17.4.20.8. Financial Analysis

17.4.20.9. Profitability

17.4.20.10. Revenue Share

17.4.20.11. Executive Bios

17.4.21. Schumacher Electric Corporation

17.4.21.1. Company Overview

17.4.21.2. Company Footprints

17.4.21.3. Production Locations

17.4.21.4. Product Portfolio

17.4.21.5. Competitors & Customers

17.4.21.6. Subsidiaries & Parent Organization

17.4.21.7. Recent Developments

17.4.21.8. Financial Analysis

17.4.21.9. Profitability

17.4.21.10. Revenue Share

17.4.21.11. Executive Bios

17.4.22. Tesla Inc.

17.4.22.1. Company Overview

17.4.22.2. Company Footprints

17.4.22.3. Production Locations

17.4.22.4. Product Portfolio

17.4.22.5. Competitors & Customers

17.4.22.6. Subsidiaries & Parent Organization

17.4.22.7. Recent Developments

17.4.22.8. Financial Analysis

17.4.22.9. Profitability

17.4.22.10. Revenue Share

17.4.22.11. Executive Bios

17.4.23. Wallbox Chargers, S.L.

17.4.23.1. Company Overview

17.4.23.2. Company Footprints

17.4.23.3. Production Locations

17.4.23.4. Product Portfolio

17.4.23.5. Competitors & Customers

17.4.23.6. Subsidiaries & Parent Organization

17.4.23.7. Recent Developments

17.4.23.8. Financial Analysis

17.4.23.9. Profitability

17.4.23.10. Revenue Share

17.4.23.11. Executive Bios

17.4.24. Other Key Players

List of Tables

Table 1: Global EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 2: Global EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 3: Global EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Table 4: Global EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017‒2031

Table 5: Global EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 6: Global EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 7: Global EV Chargers Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 8: Global EV Chargers Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 9: North America EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 10: North America EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 11: North America EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Table 12: North America EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017‒2031

Table 13: North America EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 14: North America EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 15: North America EV Chargers Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 16: North America EV Chargers Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 17: Europe EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 18: Europe EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 19: Europe EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Table 20: Europe EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017‒2031

Table 21: Europe EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 22: Europe EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 23: Europe EV Chargers Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: Europe EV Chargers Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Asia Pacific EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 26: Asia Pacific EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 27: Asia Pacific EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Table 28: Asia Pacific EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017‒2031

Table 29: Asia Pacific EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 30: Asia Pacific EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 31: Asia Pacific EV Chargers Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 32: Asia Pacific EV Chargers Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 33: Middle East & Africa EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 34: Middle East & Africa EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 35: Middle East & Africa EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Table 36: Middle East & Africa EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017‒2031

Table 37: Middle East & Africa EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 38: Middle East & Africa EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 39: Middle East & Africa EV Chargers Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Middle East & Africa EV Chargers Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: South America EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 42: South America EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 43: South America EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Table 44: South America EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017‒2031

Table 45: South America EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 46: South America EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 47: South America EV Chargers Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: South America EV Chargers Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 2: Global EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 3: Global EV Chargers Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 4: Global EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Figure 5: Global EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017-2031

Figure 6: Global EV Chargers Market, Incremental Opportunity, by Chargers Type, Value (US$ Bn), 2022-2031

Figure 7: Global EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 8: Global EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 9: Global EV Chargers Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 10: Global EV Chargers Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 11: Global EV Chargers Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global EV Chargers Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 13: North America EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 14: North America EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 15: North America EV Chargers Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 16: North America EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Figure 17: North America EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017-2031

Figure 18: North America EV Chargers Market, Incremental Opportunity, by Chargers Type, Value (US$ Bn), 2022-2031

Figure 19: North America EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 20: North America EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 21: North America EV Chargers Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 22: North America EV Chargers Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 23: North America EV Chargers Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America EV Chargers Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 25: Europe EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 26: Europe EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 27: Europe EV Chargers Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 28: Europe EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Figure 29: Europe EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017-2031

Figure 30: Europe EV Chargers Market, Incremental Opportunity, by Chargers Type, Value (US$ Bn), 2022-2031

Figure 31: Europe EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 32: Europe EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 33: Europe EV Chargers Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 34: Europe EV Chargers Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: Europe EV Chargers Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe EV Chargers Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Asia Pacific EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 38: Asia Pacific EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 39: Asia Pacific EV Chargers Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 40: Asia Pacific EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Figure 41: Asia Pacific EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017-2031

Figure 42: Asia Pacific EV Chargers Market, Incremental Opportunity, by Chargers Type, Value (US$ Bn), 2022-2031

Figure 43: Asia Pacific EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 44: Asia Pacific EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 45: Asia Pacific EV Chargers Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 46: Asia Pacific EV Chargers Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 47: Asia Pacific EV Chargers Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific EV Chargers Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 49: Middle East & Africa EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 50: Middle East & Africa EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 51: Middle East & Africa EV Chargers Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 52: Middle East & Africa EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Figure 53: Middle East & Africa EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017-2031

Figure 54: Middle East & Africa EV Chargers Market, Incremental Opportunity, by Chargers Type, Value (US$ Bn), 2022-2031

Figure 55: Middle East & Africa EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 56: Middle East & Africa EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 57: Middle East & Africa EV Chargers Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 58: Middle East & Africa EV Chargers Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Middle East & Africa EV Chargers Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa EV Chargers Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 61: South America EV Chargers Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 62: South America EV Chargers Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 63: South America EV Chargers Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2022-2031

Figure 64: South America EV Chargers Market Volume (Thousand Units) Forecast, by Chargers Type, 2017-2031

Figure 65: South America EV Chargers Market Value (US$ Bn) Forecast, by Chargers Type, 2017-2031

Figure 66: South America EV Chargers Market, Incremental Opportunity, by Chargers Type, Value (US$ Bn), 2022-2031

Figure 67: South America EV Chargers Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 68: South America EV Chargers Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 69: South America EV Chargers Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 70: South America EV Chargers Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: South America EV Chargers Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America EV Chargers Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031