Analysts’ Viewpoint

Rise in standard of living of the people is a key factor driving the demand for curtain and window blinds. Increase in awareness about eco-friendly window blinds, such as recycled blinds, is expected to positively impact the Europe window blinds business growth during the forecast period. Customers in the region prefer materials such as engineered wood, as they are made from recycled materials. Cellular blinds or honeycomb blinds are also energy-efficient products.

Innovation and technological developments in the industry are creating new market growth opportunities. Key players are introducing Bluetooth technology, which makes it easy to control the blinds from anywhere with a remote or smartphone, to increase their market share.

Window blind is a covering designed to protect a window from dust and regulate the amount of light entering a room. Window blinds are long vertical or horizontal curtains/slats made of a variety of rigid materials such as plastic, wood, and metal. They are held together by ropes threaded through the blind leaves.

When the shutter is lowered, the blades or slats drop, or can be pulled to the side of the window to be stacked lengthwise. The slats or shutters are joined together individually to form a complete shutter. Window blinds are designed to stay tightly closed for light control and privacy. They can be tilted or adjusted at different angles to limit the entry of light into the room.

Growth in population of middle-class homeowners and increase in spending on home products are likely to drive market progress. Strong demand for eco-friendly blinds made of wood, bamboo, reed, grass, or jute is also propelling the Europe window blinds market share. In 2020, Blinds.com, owned by The Home Depot, announced the launch of its SimplyEco Cellular Shade collection. These products are manufactured from recycled plastic water bottles.

Rapid urbanization and changes in standard of living are the key factors augmenting the demand for window blinds worldwide. Blinds are available in several types, materials, and colors. They are selected as per the esthetics of interior premises. Designing compact houses with smaller footprints and modest spaces is a Europe window blinds industry trend.

Customers are increasingly opting for window shades and blinds as effective options for updating home and wall designs. These products are used to control the inside temperature, light, and ventilation during hot and cold conditions. Homes and businesses are also sensitive to privacy and security.

Increase in need for security in residential and commercial establishments is driving the sale of blinds and blackout curtains. Growth in popularity of customized and stylish blinds and curtains is likely to boost the market.

Blinds are safe and attractive. They help improve the ambiance of interior premises. They also protect the home from dust, excess sun exposure, dirt, and cold weather. Besides this, continuous product development and innovation are driving the demand for window blinds.

Manufacturers are focusing on improving product durability to protect customers from extreme weather conditions such as extreme heat, cold, and hailstorms. Surge in construction activities in residential and non-residential sectors is a key Europe window blinds market driver. Additionally, large numbers of people have been renovating their homes and making lifestyle changes since the last few years. This is also driving the Europe window blinds market share.

In terms of operation, demand for automatic or motor-operated blinds has been increasing due to significant technological advancements. People in Europe prefer automated blinds in commercial and residential spaces. Automated blinds are ideal for commercial spaces such as accommodation centers and healthcare centers.

Growth in popularity of smart homes and commercial buildings is also propelling the segment. Innovations in interior designs of residential buildings are also boosting the Europe window blinds market development.

Retail stores were closed during the peak of the COVID-19 pandemic, owing to strict lockdowns enforced across the globe. This led to a shift in customers from offline platforms to online shopping. People prefer to buy window blinds on online platforms. Several customers are continuing to make online purchases, even after the peak of the COVID-19 pandemic.

A single online platform provides advantages over conventional retailing shopping and is likely to gain popularity among customers due to the easily availability of several brands. It provides the facility to compare different products on the basis of material, designs, color, and size. This is boosting the online distribution segment.

The U.K. is expected to dominate the market in Europe owing to the increase in demand for eco-friendly window coverings in the country. Window blinds can be made by recycling plastic.

Germany also accounts for key share of the market, led by the progress in R&D activities related to the quality and design of interior blinds in the country. The market in France follows that in Germany, due to the rise in awareness about the need for protection from harmful UV rays in residential and commercial spaces in the country.

Several companies operating in the blind & shade manufacturing industry in Europe are focusing on strengthening their distribution channels and expanding their presence in newer geographies. They are executing different window blinds marketing strategies, such as advertising, to increase their market share.

Advanced Window Blinds Ltd, Alulux GmbH, Aspect Blinds and Shutters, Dormakaba Group, Griesser AG, Hillarys, Hunter Douglas NV, Nantmor Blinds Ltd, Stevens Ltd, and TOSO Company, Limited are the prominent players in the market.

Each of these players has been profiled in the Europe window blinds market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

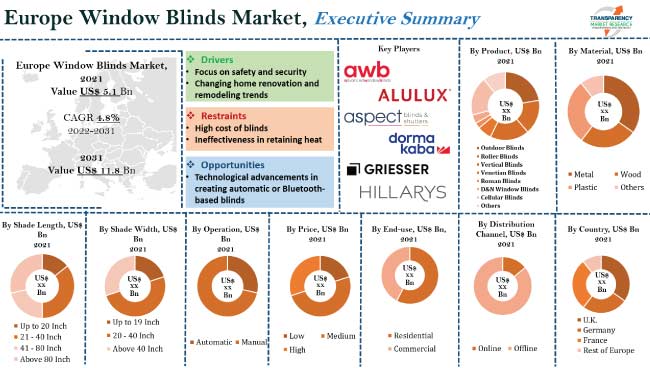

Size in 2021 |

US$ 5.1 Bn |

|

Europe Window Blinds Market Forecast Value in 2031 |

US$ 11.8 Bn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the Europe level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Europe Window Blinds Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 5.1 Bn in 2021

The CAGR is estimated to be 4.8% during 2022 to 2031

Focus on safety and security and changing home renovation and remodeling trends

The automatic segment accounted for the maximum share in 2021

The U.K. is likely to be one of the lucrative markets for vendors during the forecast period

Advanced Window Blinds Ltd, Alulux GmbH, Aspect Blinds and Shutters, Dormakaba Group, Griesser AG, Hillarys, Hunter Douglas NV, Nantmor Blinds Ltd, Stevens Ltd, and TOSO Company, Limited

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Global Window Blinds Market Overview

5.3.2. Overall Construction Market Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Raw Material Analysis

5.9. Technology Overview

5.10. Europe Window Blinds Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Europe Window Blinds Market Analysis and Forecast, By Product

6.1. Europe Window Blinds Market Size (US$ Bn and Thousand Units), By Product, 2017 - 2031

6.1.1. Outdoor Blinds

6.1.1.1. Free Hanging

6.1.1.2. Channel

6.1.2. Roller Blinds

6.1.2.1. Screen Roller

6.1.2.2. Light Filter

6.1.2.3. Blackout

6.1.3. Vertical Blinds

6.1.4. Venetian Blinds

6.1.5. Roman Blinds

6.1.6. D&N Window Blinds

6.1.7. Cellular Blinds

6.1.8. Others

6.2. Incremental Opportunity, By Product

7. Europe Window Blinds Market Analysis and Forecast, By Material

7.1. Europe Window Blinds Market Size (US$ Bn and Thousand Units), By Material, 2017 - 2031

7.1.1. Metal

7.1.2. Wood

7.1.3. Plastic

7.1.4. Others

7.2. Incremental Opportunity, By Material

8. Europe Window Blinds Market Analysis and Forecast, By Shade Length

8.1. Europe Window Blinds Market Size (US$ Bn and Thousand Units), By Shade Length, 2017 - 2031

8.1.1. Up to 20 Inch

8.1.2. 21 - 40 Inch

8.1.3. 41 - 80 Inch

8.1.4. Above 80 Inch

8.2. Incremental Opportunity, By Shade Length

9. Europe Window Blinds Market Analysis and Forecast, By Shade Width

9.1. Europe Window Blinds Market Size (US$ Bn and Thousand Units), By Shade Width, 2017 - 2031

9.1.1. Up to 19 Inch

9.1.2. 20 - 40 Inch

9.1.3. Above 40 Inch

9.2. Incremental Opportunity, By Shade Width

10. Europe Window Blinds Market Analysis and Forecast, By Operation

10.1. Europe Window Blinds Market Size (US$ Bn and Thousand Units), By Operation, 2017 - 2031

10.1.1. Automatic

10.1.2. Manual

10.2. Incremental Opportunity, By Operation

11. Europe Window Blinds Market Analysis and Forecast, By Price

11.1. Europe Window Blinds Market Size (US$ Bn and Thousand Units), By Price, 2017 - 2031

11.1.1. Low

11.1.2. Medium

11.1.3. High

11.2. Incremental Opportunity, By Price

12. Europe Window Blinds Market Analysis and Forecast, By End-use

12.1. Europe Window Blinds Market Size (US$ Bn and Thousand Units), By End-use, 2017 - 2031

12.1.1. Residential

12.1.2. Commercial

12.1.2.1. Showroom and Office

12.1.2.2. Shopping Mall

12.1.2.3. Spa and Salon

12.1.2.4. Hospital and Nursing Home

12.1.2.5. Others

12.2. Incremental Opportunity, By End-use

13. Europe Window Blinds Market Analysis and Forecast, By Distribution Channel

13.1. Europe Window Blinds Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

13.1.1. Online

13.1.1.1. E-commerce

13.1.1.2. Company-owned Websites

13.1.2. Offline

13.1.2.1. Supermarket/Hypermarket

13.1.2.2. Specialty Stores

13.1.2.3. Other Retail Stores

13.2. Incremental Opportunity, By Distribution Channel

14. Europe Window Blinds Market Analysis and Forecast, Country & Sub-region

14.1. Europe Window Blinds Market Size (US$ Bn and Thousand Units), By Country & Sub-region, 2017 - 2031

14.1.1. U.K.

14.1.2. Germany

14.1.3. France

14.1.4. Rest of Europe

14.2. Incremental Opportunity, By Country

15. U.K. Window Blinds Market Analysis and Forecast

15.1. Country Snapshot

15.2. Brand Analysis

15.3. Consumer Buying Behavior Analysis

15.3.1. Preferred Brand Type

15.3.2. Target Audience

15.3.3. Preferred Mode of Buying (Online/Offline)

15.3.4. Spending Capacity

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Key Trends Analysis

15.5.1. Demand Side Analysis

15.5.2. Supply Side Analysis

15.6. Window Blinds Market Size (US$ Bn and Thousand Units), By Product, 2017 - 2031

15.6.1. Outdoor Blinds

15.6.1.1. Free Hanging

15.6.1.2. Channel

15.6.2. Roller Blinds

15.6.2.1. Screen Roller

15.6.2.2. Light Filter

15.6.2.3. Blackout

15.6.3. Vertical Blinds

15.6.4. Venetian Blinds

15.6.5. Roman Blinds

15.6.6. D&N Window Blinds

15.6.7. Cellular Blinds

15.6.8. Others

15.7. Window Blinds Market Size (US$ Bn and Thousand Units), By Material, 2017 - 2031

15.7.1. Metal

15.7.2. Wood

15.7.3. Plastic

15.7.4. Others

15.8. Window Blinds Market Size (US$ Bn and Thousand Units), By Shade Length, 2017 - 2031

15.8.1. Up to 20 Inch

15.8.2. 21 - 40 Inch

15.8.3. 41 - 80 Inch

15.8.4. Above 80 Inch

15.9. Window Blinds Market Size (US$ Bn and Thousand Units), By Shade Width, 2017 - 2031

15.9.1. Up to 19 Inch

15.9.2. 20 - 40 Inch

15.9.3. Above 40 Inch

15.10. Window Blinds Market Size (US$ Bn and Thousand Units), By Operation, 2017 - 2031

15.10.1. Automatic

15.10.2. Manual

15.11. Window Blinds Market Size (US$ Bn and Thousand Units), By Price, 2017 - 2031

15.11.1. Low

15.11.2. Medium

15.11.3. High

15.12. Window Blinds Market Size (US$ Bn and Thousand Units), By End-use, 2017 - 2031

15.12.1. Residential

15.12.2. Commercial

15.12.2.1. Showroom and Office

15.12.2.2. Shopping Mall

15.12.2.3. Spa and Salon

15.12.2.4. Hospital and Nursing Home

15.12.2.5. Others

15.13. Window Blinds Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

15.13.1. Online

15.13.1.1. E-commerce

15.13.1.2. Company-owned Websites

15.13.2. Offline

15.13.2.1. Supermarket/Hypermarket

15.13.2.2. Specialty Stores

15.13.2.3. Other Retail Stores

15.14. Incremental Opportunity Analysis

16. Germany Window Blinds Market Analysis and Forecast

16.1. Country Snapshot

16.2. Brand Analysis

16.3. Consumer Buying Behavior Analysis

16.3.1. Preferred Brand Type

16.3.2. Target Audience

16.3.3. Preferred Mode of Buying (Online/Offline)

16.3.4. Spending Capacity

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Key Trends Analysis

16.5.1. Demand Side Analysis

16.5.2. Supply Side Analysis

16.6. Window Blinds Market Size (US$ Bn and Thousand Units), By Product, 2017 - 2031

16.6.1. Outdoor Blinds

16.6.1.1. Free Hanging

16.6.1.2. Channel

16.6.2. Roller Blinds

16.6.2.1. Screen Roller

16.6.2.2. Light Filter

16.6.2.3. Blackout

16.6.3. Vertical Blinds

16.6.4. Venetian Blinds

16.6.5. Roman Blinds

16.6.6. D&N Window Blinds

16.6.7. Cellular Blinds

16.6.8. Others

16.7. Window Blinds Market Size (US$ Bn and Thousand Units), By Material, 2017 - 2031

16.7.1. Metal

16.7.2. Wood

16.7.3. Plastic

16.7.4. Others

16.8. Window Blinds Market Size (US$ Bn and Thousand Units), By Shade Length, 2017 - 2031

16.8.1. Up to 20 Inch

16.8.2. 21 - 40 Inch

16.8.3. 41 - 80 Inch

16.8.4. Above 80 Inch

16.9. Window Blinds Market Size (US$ Bn and Thousand Units), By Shade Width, 2017 - 2031

16.9.1. Up to 19 Inch

16.9.2. 20 - 40 Inch

16.9.3. Above 40 Inch

16.10. Window Blinds Market Size (US$ Bn and Thousand Units), By Operation, 2017 - 2031

16.10.1. Automatic

16.10.2. Manual

16.11. Window Blinds Market Size (US$ Bn and Thousand Units), By Price, 2017 - 2031

16.11.1. Low

16.11.2. Medium

16.11.3. High

16.12. Window Blinds Market Size (US$ Bn and Thousand Units), By End-use, 2017 - 2031

16.12.1. Residential

16.12.2. Commercial

16.12.2.1. Showroom and Office

16.12.2.2. Shopping Mall

16.12.2.3. Spa and Salon

16.12.2.4. Hospital and Nursing Home

16.12.2.5. Others

16.13. Window Blinds Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

16.13.1. Online

16.13.1.1. E-commerce

16.13.1.2. Company-owned Websites

16.13.2. Offline

16.13.2.1. Supermarket/Hypermarket

16.13.2.2. Specialty Stores

16.13.2.3. Other Retail Stores

16.14. Incremental Opportunity Analysis

17. France Window Blinds Market Analysis and Forecast

17.1. Country Snapshot

17.2. Brand Analysis

17.3. Consumer Buying Behavior Analysis

17.3.1. Preferred Brand Type

17.3.2. Target Audience

17.3.3. Preferred Mode of Buying (Online/Offline)

17.3.4. Spending Capacity

17.4. Price Trend Analysis

17.4.1. Weighted Average Selling Price (US$)

17.5. Key Trends Analysis

17.5.1. Demand Side Analysis

17.5.2. Supply Side Analysis

17.6. Window Blinds Market Size (US$ Bn and Thousand Units), By Product, 2017 - 2031

17.6.1. Outdoor Blinds

17.6.1.1. Free Hanging

17.6.1.2. Channel

17.6.2. Roller Blinds

17.6.2.1. Screen Roller

17.6.2.2. Light Filter

17.6.2.3. Blackout

17.6.3. Vertical Blinds

17.6.4. Venetian Blinds

17.6.5. Roman Blinds

17.6.6. D&N Window Blinds

17.6.7. Cellular Blinds

17.6.8. Others

17.7. Window Blinds Market Size (US$ Bn and Thousand Units), By Material, 2017 - 2031

17.7.1. Metal

17.7.2. Wood

17.7.3. Plastic

17.7.4. Others

17.8. Window Blinds Market Size (US$ Bn and Thousand Units), By Shade Length, 2017 - 2031

17.8.1. Up to 20 Inch

17.8.2. 21 - 40 Inch

17.8.3. 41 - 80 Inch

17.8.4. Above 80 Inch

17.9. Window Blinds Market Size (US$ Bn and Thousand Units), By Shade Width, 2017 - 2031

17.9.1. Up to 19 Inch

17.9.2. 20 - 40 Inch

17.9.3. Above 40 Inch

17.10. Window Blinds Market Size (US$ Bn and Thousand Units), By Operation, 2017 - 2031

17.10.1. Automatic

17.10.2. Manual

17.11. Window Blinds Market Size (US$ Bn and Thousand Units), By Price, 2017 - 2031

17.11.1. Low

17.11.2. Medium

17.11.3. High

17.12. Window Blinds Market Size (US$ Bn and Thousand Units), By End-use, 2017 - 2031

17.12.1. Residential

17.12.2. Commercial

17.12.2.1. Showroom and Office

17.12.2.2. Shopping Mall

17.12.2.3. Spa and Salon

17.12.2.4. Hospital and Nursing Home

17.12.2.5. Others

17.13. Window Blinds Market Size (US$ Bn and Thousand Units), By Distribution Channel, 2017 - 2031

17.13.1. Online

17.13.1.1. E-commerce

17.13.1.2. Company-owned Websites

17.13.2. Offline

17.13.2.1. Supermarket/Hypermarket

17.13.2.2. Specialty Stores

17.13.2.3. Other Retail Stores

17.14. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player – Competition Dashboard

18.2. Market Share Analysis (%), 2021

18.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

18.3.1. Advanced Window Blinds Ltd

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Financial/Revenue

18.3.1.4. Strategy & Business Overview

18.3.1.5. Sales Channel Analysis

18.3.1.6. Size Portfolio

18.3.2. Alulux GmbH

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Financial/Revenue

18.3.2.4. Strategy & Business Overview

18.3.2.5. Sales Channel Analysis

18.3.2.6. Size Portfolio

18.3.3. Aspect Blinds and Shutters

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Financial/Revenue

18.3.3.4. Strategy & Business Overview

18.3.3.5. Sales Channel Analysis

18.3.3.6. Size Portfolio

18.3.4. Dormakaba Group

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Financial/Revenue

18.3.4.4. Strategy & Business Overview

18.3.4.5. Sales Channel Analysis

18.3.4.6. Size Portfolio

18.3.5. Griesser AG

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Financial/Revenue

18.3.5.4. Strategy & Business Overview

18.3.5.5. Sales Channel Analysis

18.3.5.6. Size Portfolio

18.3.6. Hillarys

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Financial/Revenue

18.3.6.4. Strategy & Business Overview

18.3.6.5. Sales Channel Analysis

18.3.6.6. Size Portfolio

18.3.7. Hunter Douglas NV

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Financial/Revenue

18.3.7.4. Strategy & Business Overview

18.3.7.5. Sales Channel Analysis

18.3.7.6. Size Portfolio

18.3.8. Nantmor Blinds Ltd

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Financial/Revenue

18.3.8.4. Strategy & Business Overview

18.3.8.5. Sales Channel Analysis

18.3.8.6. Size Portfolio

18.3.9. Stevens Ltd

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Financial/Revenue

18.3.9.4. Strategy & Business Overview

18.3.9.5. Sales Channel Analysis

18.3.9.6. Size Portfolio

18.3.10. TOSO Company, Limited

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Financial/Revenue

18.3.10.4. Strategy & Business Overview

18.3.10.5. Sales Channel Analysis

18.3.10.6. Size Portfolio

19. Key Takeaways

19.1. Identification of Potential Market Spaces

19.1.1. Product

19.1.2. Material

19.1.3. Shade Length

19.1.4. Shade Width

19.1.5. Operation

19.1.6. Price

19.1.7. End-use

19.1.8. Distribution Channel

19.1.9. Country

19.2. Understanding the Buying Process of Customers

19.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Europe Window Blinds Market, By Product, Thousand Units, 2017-2031

Table 2: Europe Window Blinds Market, By Product, US$ Bn, 2017-2031

Table 3: Europe Window Blinds Market, By Material, Thousand Units, 2017-2031

Table 4: Europe Window Blinds Market, By Material, US$ Bn, 2017-2031

Table 5: Europe Window Blinds Market, By Shade Length, Thousand Units, 2017-2031

Table 6: Europe Window Blinds Market, By Shade Length, US$ Bn, 2017-2031

Table 7: Europe Window Blinds Market, By Shade Width, Thousand Units, 2017-2031

Table 8: Europe Window Blinds Market, By Shade Width, US$ Bn, 2017-2031

Table 9: Europe Window Blinds Market, By Operation, Thousand Units, 2017-2031

Table 10: Europe Window Blinds Market, By Operation, US$ Bn, 2017-2031

Table 11: Europe Window Blinds Market, By Price, Thousand Units, 2017-2031

Table 12: Europe Window Blinds Market, By Price, US$ Bn, 2017-2031

Table 13: Europe Window Blinds Market, By End-use, Thousand Units, 2017-2031

Table 14: Europe Window Blinds Market, By End-use, US$ Bn, 2017-2031

Table 15: Europe Window Blinds Market, By Distribution Channel, Thousand Units, 2017-2031

Table 16: Europe Window Blinds Market, By Distribution Channel, US$ Bn, 2017-2031

Table 17: Europe Window Blinds Market, By Country, Thousand Units, 2017-2031

Table 18: Europe Window Blinds Market, By Country, US$ Bn, 2017-2031

Table 19: U.K. Window Blinds Market, By Product, Thousand Units, 2017-2031

Table 20: U.K. Window Blinds Market, By Product, US$ Bn, 2017-2031

Table 21: U.K. Window Blinds Market, By Material, Thousand Units, 2017-2031

Table 22: U.K. Window Blinds Market, By Material, US$ Bn, 2017-2031

Table 23: U.K. Window Blinds Market, By Shade Length, Thousand Units, 2017-2031

Table 24: U.K. Window Blinds Market, By Shade Length, US$ Bn, 2017-2031

Table 25: U.K. Window Blinds Market, By Shade Width, Thousand Units, 2017-2031

Table 26: U.K. Window Blinds Market, By Shade Width, US$ Bn, 2017-2031

Table 27: U.K. Window Blinds Market, By Operation, Thousand Units, 2017-2031

Table 28: U.K. Window Blinds Market, By Operation, US$ Bn, 2017-2031

Table 29: U.K. Window Blinds Market, By Price, Thousand Units, 2017-2031

Table 30: U.K. Window Blinds Market, By Price, US$ Bn, 2017-2031

Table 31: U.K. Window Blinds Market, By End-use, Thousand Units, 2017-2031

Table 32: U.K. Window Blinds Market, By End-use, US$ Bn, 2017-2031

Table 33: U.K. Window Blinds Market, By Distribution Channel, Thousand Units, 2017-2031

Table 34: U.K. Window Blinds Market, By Distribution Channel, US$ Bn, 2017-2031

Table 35: Germany Window Blinds Market, By Product, Thousand Units, 2017-2031

Table 36: Germany Window Blinds Market, By Product, US$ Bn, 2017-2031

Table 37: Germany Window Blinds Market, By Material, Thousand Units, 2017-2031

Table 38: Germany Window Blinds Market, By Material, US$ Bn, 2017-2031

Table 39: Germany Window Blinds Market, By Shade Length, Thousand Units, 2017-2031

Table 40: Germany Window Blinds Market, By Shade Length, US$ Bn, 2017-2031

Table 41: Germany Window Blinds Market, By Shade Width, Thousand Units, 2017-2031

Table 42: Germany Window Blinds Market, By Shade Width, US$ Bn, 2017-2031

Table 43: Germany Window Blinds Market, By Operation, Thousand Units, 2017-2031

Table 44: Germany Window Blinds Market, By Operation, US$ Bn, 2017-2031

Table 45: Germany Window Blinds Market, By Price, Thousand Units, 2017-2031

Table 46: Germany Window Blinds Market, By Price, US$ Bn, 2017-2031

Table 47: Germany Window Blinds Market, By End-use, Thousand Units, 2017-2031

Table 48: Germany Window Blinds Market, By End-use, US$ Bn, 2017-2031

Table 49: Germany Window Blinds Market, By Distribution Channel, Thousand Units, 2017-2031

Table 50: Germany Window Blinds Market, By Distribution Channel, US$ Bn, 2017-2031

Table 51: France Window Blinds Market, By Product, Thousand Units, 2017-2031

Table 52: France Window Blinds Market, By Product, US$ Bn, 2017-2031

Table 53: France Window Blinds Market, By Material, Thousand Units, 2017-2031

Table 54: France Window Blinds Market, By Material, US$ Bn, 2017-2031

Table 55: France Window Blinds Market, By Shade Length, Thousand Units, 2017-2031

Table 56: France Window Blinds Market, By Shade Length, US$ Bn, 2017-2031

Table 57: France Window Blinds Market, By Shade Width, Thousand Units, 2017-2031

Table 58: France Window Blinds Market, By Shade Width, US$ Bn, 2017-2031

Table 59: France Window Blinds Market, By Operation, Thousand Units, 2017-2031

Table 60: France Window Blinds Market, By Operation, US$ Bn, 2017-2031

Table 61: France Window Blinds Market, By Price, Thousand Units, 2017-2031

Table 62: France Window Blinds Market, By Price, US$ Bn, 2017-2031

Table 63: France Window Blinds Market, By End-use, Thousand Units, 2017-2031

Table 64: France Window Blinds Market, By End-use, US$ Bn, 2017-2031

Table 65: France Window Blinds Market, By Distribution Channel, Thousand Units, 2017-2031

Table 66: France Window Blinds Market, By Distribution Channel, US$ Bn, 2017-2031

List of Figures

Figure 1: Europe Window Blinds Market, By Product, Thousand Units, 2017-2031

Figure 2: Europe Window Blinds Market, By Product, US$ Bn, 2017-2031

Figure 3: Europe Window Blinds Market Incremental Opportunity, By Product, US$ Bn, 2017-2031

Figure 4: Europe Window Blinds Market, By Material, Thousand Units, 2017-2031

Figure 5: Europe Window Blinds Market, By Material, US$ Bn, 2017-2031

Figure 6: Europe Window Blinds Market Incremental Opportunity, By Material, US$ Bn, 2017-2031

Figure 7: Europe Window Blinds Market, By Shade Length, Thousand Units, 2017-2031

Figure 8: Europe Window Blinds Market, By Shade Length, US$ Bn, 2017-2031

Figure 9: Europe Window Blinds Market Incremental Opportunity, By Shade Length, US$ Bn, 2017-2031

Figure 10: Europe Window Blinds Market, By Shade Width, Thousand Units, 2017-2031

Figure 11: Europe Window Blinds Market, By Shade Width, US$ Bn, 2017-2031

Figure 12: Europe Window Blinds Market Incremental Opportunity, By Shade Width, US$ Bn, 2017-2031

Figure 13: Europe Window Blinds Market, By Operation, Thousand Units, 2017-2031

Figure 14: Europe Window Blinds Market, By Operation, US$ Bn, 2017-2031

Figure 15: Europe Window Blinds Market Incremental Opportunity, By Operation, US$ Bn, 2017-2031

Figure 16: Europe Window Blinds Market, By Price, Thousand Units, 2017-2031

Figure 17: Europe Window Blinds Market, By Price, US$ Bn, 2017-2031

Figure 18: Europe Window Blinds Market Incremental Opportunity, By Price, US$ Bn, 2017-2031

Figure 19: Europe Window Blinds Market, By End-use, Thousand Units, 2017-2031

Figure 20: Europe Window Blinds Market, By End-use, US$ Bn, 2017-2031

Figure 21: Europe Window Blinds Market Incremental Opportunity, By End-use, US$ Bn, 2017-2031

Figure 22: Europe Window Blinds Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 23: Europe Window Blinds Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 24: Europe Window Blinds Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2017-2031

Figure 25: Europe Window Blinds Market, By Country, Thousand Units, 2017-2031

Figure 26: Europe Window Blinds Market, By Country, US$ Bn, 2017-2031

Figure 27: Europe Window Blinds Market Incremental Opportunity, By Country, US$ Bn, 2017-2031

Figure 28: U.K. Window Blinds Market, By Product, Thousand Units, 2017-2031

Figure 29: U.K. Window Blinds Market, By Product, US$ Bn, 2017-2031

Figure 30: U.K. Window Blinds Market Incremental Opportunity, By Product, US$ Bn, 2017-2031

Figure 31: U.K. Window Blinds Market, By Material, Thousand Units, 2017-2031

Figure 32: U.K. Window Blinds Market, By Material, US$ Bn, 2017-2031

Figure 33: U.K. Window Blinds Market Incremental Opportunity, By Material, US$ Bn, 2017-2031

Figure 34: U.K. Window Blinds Market, By Shade Length, Thousand Units, 2017-2031

Figure 35: U.K. Window Blinds Market, By Shade Length, US$ Bn, 2017-2031

Figure 36: U.K. Window Blinds Market Incremental Opportunity, By Shade Length, US$ Bn, 2017-2031

Figure 37: U.K. Window Blinds Market, By Shade Width, Thousand Units, 2017-2031

Figure 38: U.K. Window Blinds Market, By Shade Width, US$ Bn, 2017-2031

Figure 39: U.K. Window Blinds Market Incremental Opportunity, By Shade Width, US$ Bn, 2017-2031

Figure 40: U.K. Window Blinds Market, By Operation, Thousand Units, 2017-2031

Figure 41: U.K. Window Blinds Market, By Operation, US$ Bn, 2017-2031

Figure 42: U.K. Window Blinds Market Incremental Opportunity, By Operation, US$ Bn, 2017-2031

Figure 43: U.K. Window Blinds Market, By Price, Thousand Units, 2017-2031

Figure 44: U.K. Window Blinds Market, By Price, US$ Bn, 2017-2031

Figure 45: U.K. Window Blinds Market Incremental Opportunity, By Price, US$ Bn, 2017-2031

Figure 46: U.K. Window Blinds Market, By End-use, Thousand Units, 2017-2031

Figure 47: U.K. Window Blinds Market, By End-use, US$ Bn, 2017-2031

Figure 48: U.K. Window Blinds Market Incremental Opportunity, By End-use, US$ Bn, 2017-2031

Figure 49: U.K. Window Blinds Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 50: U.K. Window Blinds Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 51: U.K. Window Blinds Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2017-2031

Figure 52: Germany Window Blinds Market, By Product, Thousand Units, 2017-2031

Figure 53: Germany Window Blinds Market, By Product, US$ Bn, 2017-2031

Figure 54: Germany Window Blinds Market Incremental Opportunity, By Product, US$ Bn, 2017-2031

Figure 55: Germany Window Blinds Market, By Material, Thousand Units, 2017-2031

Figure 56: Germany Window Blinds Market, By Material, US$ Bn, 2017-2031

Figure 57: Germany Window Blinds Market Incremental Opportunity, By Material, US$ Bn, 2017-2031

Figure 58: Germany Window Blinds Market, By Shade Length, Thousand Units, 2017-2031

Figure 59: Germany Window Blinds Market, By Shade Length, US$ Bn, 2017-2031

Figure 60: Germany Window Blinds Market Incremental Opportunity, By Shade Length, US$ Bn, 2017-2031

Figure 61: Germany Window Blinds Market, By Shade Width, Thousand Units, 2017-2031

Figure 62: Germany Window Blinds Market, By Shade Width, US$ Bn, 2017-2031

Figure 63: Germany Window Blinds Market Incremental Opportunity, By Shade Width, US$ Bn, 2017-2031

Figure 64: Germany Window Blinds Market, By Operation, Thousand Units, 2017-2031

Figure 65: Germany Window Blinds Market, By Operation, US$ Bn, 2017-2031

Figure 66: Germany Window Blinds Market Incremental Opportunity, By Operation, US$ Bn, 2017-2031

Figure 67: Germany Window Blinds Market, By Price, Thousand Units, 2017-2031

Figure 68: Germany Window Blinds Market, By Price, US$ Bn, 2017-2031

Figure 69: Germany Window Blinds Market Incremental Opportunity, By Price, US$ Bn, 2017-2031

Figure 70: Germany Window Blinds Market, By End-use, Thousand Units, 2017-2031

Figure 71: Germany Window Blinds Market, By End-use, US$ Bn, 2017-2031

Figure 72: Germany Window Blinds Market Incremental Opportunity, By End-use, US$ Bn, 2017-2031

Figure 73: Germany Window Blinds Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 74: Germany Window Blinds Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 75: Germany Window Blinds Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2017-2031

Figure 76: France Window Blinds Market, By Product, Thousand Units, 2017-2031

Figure 77: France Window Blinds Market, By Product, US$ Bn, 2017-2031

Figure 78: France Window Blinds Market Incremental Opportunity, By Product, US$ Bn, 2017-2031

Figure 79: France Window Blinds Market, By Material, Thousand Units, 2017-2031

Figure 80: France Window Blinds Market, By Material, US$ Bn, 2017-2031

Figure 81: France Window Blinds Market Incremental Opportunity, By Material, US$ Bn, 2017-2031

Figure 82: France Window Blinds Market, By Shade Length, Thousand Units, 2017-2031

Figure 83: France Window Blinds Market, By Shade Length, US$ Bn, 2017-2031

Figure 84: France Window Blinds Market Incremental Opportunity, By Shade Length, US$ Bn, 2017-2031

Figure 85: France Window Blinds Market, By Shade Width, Thousand Units, 2017-2031

Figure 86: France Window Blinds Market, By Shade Width, US$ Bn, 2017-2031

Figure 87: France Window Blinds Market Incremental Opportunity, By Shade Width, US$ Bn, 2017-2031

Figure 88: France Window Blinds Market, By Operation, Thousand Units, 2017-2031

Figure 89: France Window Blinds Market, By Operation, US$ Bn, 2017-2031

Figure 90: France Window Blinds Market Incremental Opportunity, By Operation, US$ Bn, 2017-2031

Figure 91: France Window Blinds Market, By Price, Thousand Units, 2017-2031

Figure 92: France Window Blinds Market, By Price, US$ Bn, 2017-2031

Figure 93: France Window Blinds Market Incremental Opportunity, By Price, US$ Bn, 2017-2031

Figure 94: France Window Blinds Market, By End-use, Thousand Units, 2017-2031

Figure 95: France Window Blinds Market, By End-use, US$ Bn, 2017-2031

Figure 96: France Window Blinds Market Incremental Opportunity, By End-use, US$ Bn, 2017-2031

Figure 97: France Window Blinds Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 98: France Window Blinds Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 99: France Window Blinds Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2017-2031