During the coronavirus pandemic process, individuals have comprehended the value of food and food production. This is benefitting companies in the Europe wheat starch market, as wheat production is anticipated to increase despite the ongoing COVID-19 pandemic. However, trade challenges including the ones experienced in Moscow are surfacing where the Government imposed taxes on exports of many agricultural products to fight against inflation and involved taxes on wheat with a further export limitation.

Wheat being one of the most essential food grains is anticipated to keep economies running in the Europe wheat starch market. The International Grains Council is expecting a surge in wheat production during 2021 - 2022. France and the U.K. are emerging as key wheat producing countries that are anticipated to create future growth opportunities for producers.

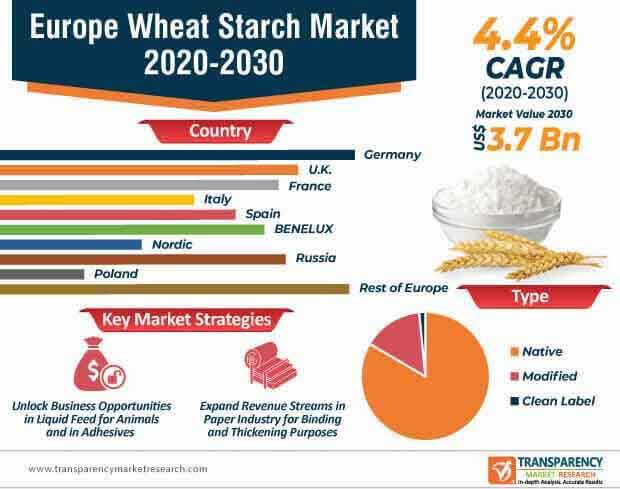

The Europe wheat starch market is projected to cross US$ 3.7 Bn by 2030. However, manufacturers are facing similar conveying and handling problems for wheat starch, which share similarities with refined corn starch. Hence, manufacturers are improving their production capabilities by taking measures such as not exceeding the cooker temperature after a certain degree to establish revenue streams in breweries.

Since modified wheat starch is gaining popularity in bakery products, manufacturers are capitalizing on this opportunity. They are gaining a strong research base in enzymatic, physical, and chemical processes to develop modified wheat starch.

Apart from bakery products and food additives, companies in the Europe wheat starch market are unlocking business opportunities in a variety of pharmaceutical and nutraceutical dosages involving hard capsules, pellet premix, swallowable tablets, and granules, among others.

Moreover, Starch Europe that represents the European Starch Industry is gaining recognition for offering high-quality plant-based ingredients that are being used in the dynamic food & beverage (F&B) processing industries. Companies in the Europe wheat starch market are achieving sustainability goals by valorizing entire wheat crops that serve food, feed, and industrial customers. Since native starch is predicted to dominate the highest revenue share among all wheat starch types, it is evident that manufacturers are increasing their production for the same to expand revenue streams in food and paper industries, primarily for binding and thickening purposes.

Wheat starch is gaining popularity as a binding agent, texture provider, and flavor carrier in food and animal feed applications. Crespel & Deiters - a food manufacturer based in Germany is boosting its output capacity for wheat starch, which is being used in baked goods, liquid feed for animals, and in adhesives for corrugated board. Paper and technical applications are also generating incremental opportunities for manufacturers in the Europe wheat starch market.

In order to bolster their credibility credentials, manufacturers in the Europe wheat starch market are adopting efficient and sustainable production practices to advance in non-food and animal feed industries.

Scientists from the University of São Paulo and the Atlantic National College of Veterinary Medicine, Food Science and Engineering are collaborating to discover a dry heating treatment that converts wheat starch to hydrogel form. Companies in the Europe wheat starch market are taking cues from such discoveries to innovate in additive manufacturing for food products. When wheat starch is transformed into the hydrogel form, it can be used to improve the printed wheat product’s ability to retain shape, which holds great importance in large scale additive food production.

Companies in the Europe wheat starch market are gaining awareness that printing food products is a growing segment in the additive manufacturing space.

Analysts’ Viewpoint

Since conventional exhibitions, international travels, and trade delegations have become potentially impracticable during the coronavirus outbreak, companies have been swift to adopt digital marketing strategies to boost product uptake. The Europe wheat starch market is slated to register a modest CAGR of 4.4% during the assessment period. This is evident as refined wheat starch is losing its importance in most breweries, owing to its high price. Thus, manufacturers should increase awareness that wheat starch helps to achieve higher yields compared to refined cornstarch. Printing food products by converting wheat starch to hydrogel form are emerging as one of the new revenue generating sectors for manufacturers.

Europe Wheat Starch Market: Overview

Europe Wheat Starch: Market Frontrunners

Europe Wheat Starch Market: Dynamics

Rapid Growth of Food Additive Industry Benefiting Wheat Starch Market

Europe Wheat Starch Market: Strategies

Europe Wheat Starch Market: Key Players

In 2020, Europe Wheat Starch Market was valued at US$ 2.4 Bn

Europe Wheat Starch Market is expected to reach US$ 3.7 Bn by 2030

Europe Wheat Starch Market is estimated to rise at a CAGR of 4.4% during forecast period

Increasing demand for native and clean label wheat starch from the food & beverages industry is expected to drive the Europe Wheat Starch Market

Key players of Europe Wheat Starch Market are Archer Daniels Midland Company, Sacchetto S.p.A, Cargill Incorporated, AGRANA Beteiligungs AG, Crespel & Deiters GmbH & Co. KG, Royal Ingredients Group, Tereos Starch & Sweeteners, Roquette Frères S. A, Aminola B.V, Amylon, a.s, Sedamyl, viresol, Škrobárny Pelhřimov, Lantmännen Reppe and Solam GmbH

1. Executive Summary

1.1. Europe Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Wheat Starch Market – Production Scenario

4.1. Technologies used in extraction of Wheat Starch

4.1.1. Traditional method for extraction of Starch

4.1.2. Alkaline Steeping Method for Starch Extraction

4.2. Wheat Starch Market- Exports to the World (HS Code : 11081100)

4.2.1. List of Key Exporters

4.2.2. Key Exporting Countries/Regions- Market Share Analysis (2019)

4.3. Wheat Starch Market- Imports to the World

4.3.1. List of Key Importers

4.3.2. Key importing Countries/Regions- Market Share Analysis (2019)

4.4. Wheat Market- Exports to the World

4.4.1. List of Key Exporters

4.4.2. Key Exporting Countries/Regions- Market Share Analysis (2019)

4.5. Wheat Market- Imports to the World

4.5.1. List of Key Importers

4.5.2. Key Importers Countries/Regions- Market Share Analysis (2019)

4.6. Wheat Starch Market by Functionality, (% of demand)

4.6.1. Thickening

4.6.2. Stabilizing

4.6.3. Binding

4.6.4. Emulsifying Agents

4.6.5. Texturizers

4.6.6. Viscosifier

4.6.7. Film Formers

5. Key Success Factors

5.1. Product Adoption / Usage Analysis

5.2. Product USPs / Features

6. Europe Wheat Starch Market Demand Analysis 2015–2019 and Forecast, 2020–2030

6.1. Historical Market Volume (Tons) Analysis, 2015–2019

6.2. Current and Future Market Volume (Tons) Projections, 2020–2030

7. Europe Wheat Starch Market - Pricing Analysis

7.1. Regional Pricing Analysis

7.2. Europe Average Pricing Analysis Benchmark

8. Europe Wheat Starch Market Demand Analysis 2015–2019 and Forecast, 2020–2030

8.1. Historical Market Value (US$ Mn) Analysis, 2015–2019

8.2. Current and Future Market Value (US$ Mn) Projections, 2020–2030

8.2.1. Y-o-Y Growth Trend Analysis

8.2.2. Absolute $ opportunity Analysis

9. Market Background

9.1. Macro-Economic Factors

9.1.1. Europe GDP Growth Outlook

9.1.2. Europe Industry Value Added

9.1.3. Europe Urbanization Growth Outlook

9.1.4. Europe Food Security Index Outlook

9.1.5. Europe Rank – Ease of Doing Business

9.1.6. Europe Rank – Trading Across Borders

9.2. Impact of COVID-19 on Food & Beverage Industry

9.2.1. Manufacturer/Processors

9.2.2. Supply Chain and Logistics

9.2.3. Wholesalers/Traders

9.2.4. Retailers

9.3. COVID-19 Risk Assessment/Impact

9.4. Europe Starch Market Outlook

9.5. Industry Value and Supply Chain Analysis

9.6. Key Certifications/Claims

9.7. Key Regulations

9.8. Market Dynamics

9.8.1. Drivers

9.8.2. Restraints

9.8.3. Opportunity Analysis

9.9. Forecast Factors - Relevance & Impact

10. Europe Wheat Starch Market Analysis 2015–2019 and Forecast 2020–2030, By Type

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Mn) and Volume Analysis By Type, 2015–2019

10.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Type, 2020–2030

10.3.1. Native Starch

10.3.2. Modified Starch

10.3.3. Clean Label

10.4. Market Attractiveness Analysis By Type

11. Europe Wheat Starch Market Analysis 2015–2019 and Forecast 2020–2030, By End-use

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Mn) and Volume Analysis By End-use, 2015–2019

11.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By End-use, 2020–2030

11.3.1. Food Processing Industry

11.3.2. Textile & Paper

11.3.3. Cosmetics

11.3.4. Animal Feed

11.3.5. Others

11.4. Market Attractiveness Analysis By End-use

12. Europe Wheat Starch Market Analysis 2015–2019 and Forecast 2020–2030, by Country

12.1. Introduction

12.2. Historical Market Size (US$ Mn) and Volume Analysis By Country, 2015–2019

12.3. Current Market Size (US$ Mn) and Volume Analysis and Forecast By Country, 2020–2030

12.3.1. Germany

12.3.2. Italy

12.3.3. France

12.3.4. U.K.

12.3.5. Spain

12.3.6. BENELUX

12.3.7. Nordic

12.3.8. Russia

12.3.9. Poland

12.3.10. Rest of Europe

12.4. Market Attractiveness Analysis By Country

13. Market Structure Analysis

13.1. Market Analysis by Tier of Companies

13.2. Market Concentration

13.3. Market Presence Analysis

14. Competition Analysis

14.1. Competition Dashboard

14.2. Competition Deep Dive

14.2.1. Archer Daniels Midland Company

14.2.1.1. Overview

14.2.1.2. Product Portfolio

14.2.1.3. Sales Footprint

14.2.1.4. Key Developments

14.2.1.5. Strategy Overview

14.2.1.6. Financial Overview

14.2.2. Sacchetto S.p.A

14.2.2.1. Overview

14.2.2.2. Product Portfolio

14.2.2.3. Sales Footprint

14.2.2.4. Key Developments

14.2.2.5. Strategy Overview

14.2.2.6. Financial Overview

14.2.3. Cargill Incorporated

14.2.3.1. Overview

14.2.3.2. Product Portfolio

14.2.3.3. Sales Footprint

14.2.3.4. Key Developments

14.2.3.5. Strategy Overview

14.2.3.6. Financial Overview

14.2.4. AGRANA Beteiligungs AG

14.2.4.1. Overview

14.2.4.2. Product Portfolio

14.2.4.3. Sales Footprint

14.2.4.4. Key Developments

14.2.4.5. Strategy Overview

14.2.4.6. Financial Overview

14.2.5. Crespel & Deiters GmbH & Co. KG

14.2.5.1. Overview

14.2.5.2. Product Portfolio

14.2.5.3. Sales Footprint

14.2.5.4. Key Developments

14.2.5.5. Strategy Overview

14.2.5.6. Financial Overview

14.2.6. Royal Ingredients Group

14.2.6.1. Overview

14.2.6.2. Product Portfolio

14.2.6.3. Sales Footprint

14.2.6.4. Key Developments

14.2.6.5. Strategy Overview

14.2.6.6. Financial Overview

14.2.7. Tereos Starch & Sweeteners

14.2.7.1. Overview

14.2.7.2. Product Portfolio

14.2.7.3. Sales Footprint

14.2.7.4. Key Developments

14.2.7.5. Strategy Overview

14.2.7.6. Financial Overview

14.2.8. Roquette Frères S. A

14.2.8.1. Overview

14.2.8.2. Product Portfolio

14.2.8.3. Sales Footprint

14.2.8.4. Key Developments

14.2.8.5. Strategy Overview

14.2.8.6. Financial Overview

14.2.9. Aminola B.V.

14.2.9.1. Overview

14.2.9.2. Product Portfolio

14.2.9.3. Sales Footprint

14.2.9.4. Key Developments

14.2.9.5. Strategy Overview

14.2.9.6. Financial Overview

14.2.10. Amylon, a.s

14.2.10.1. Overview

14.2.10.2. Product Portfolio

14.2.10.3. Sales Footprint

14.2.10.4. Key Developments

14.2.10.5. Strategy Overview

14.2.10.6. Financial Overview

14.2.11. Sedamyl

14.2.11.1. Overview

14.2.11.2. Product Portfolio

14.2.11.3. Sales Footprint

14.2.11.4. Key Developments

14.2.11.5. Strategy Overview

14.2.11.6. Financial Overview

14.2.12. Viresol

14.2.12.1. Overview

14.2.12.2. Product Portfolio

14.2.12.3. Sales Footprint

14.2.12.4. Key Developments

14.2.12.5. Strategy Overview

14.2.12.6. Financial Overview

14.2.13. Škrobárny Pelhrimov, as

14.2.13.1. Overview

14.2.13.2. Product Portfolio

14.2.13.3. Sales Footprint

14.2.13.4. Key Developments

14.2.13.5. Strategy Overview

14.2.13.6. Financial Overview

14.2.14. Lantmännen Reppe

14.2.14.1. Overview

14.2.14.2. Product Portfolio

14.2.14.3. Sales Footprint

14.2.14.4. Key Developments

14.2.14.5. Strategy Overview

14.2.14.6. Financial Overview

14.2.15. Solam GmbH

14.2.15.1. Overview

14.2.15.2. Product Portfolio

14.2.15.3. Sales Footprint

14.2.15.4. Key Developments

14.2.15.5. Strategy Overview

14.2.15.6. Financial Overview

14.2.16. Others (on Additional request)

15. Assumptions and Acronyms Used

16. Research Methodology

List of Tables

Table 01: Europe Wheat Starch Market Value (US$ Mn) Analysis and Forecast by Type, 2015-2030

Table 02: Europe Wheat Starch Market Volume (Tons) Analysis and Forecast by Type, 2015-2030

Table 03: Europe Wheat Starch Market Value (US$ Mn) Analysis and Forecast By End-use, 2015-2030

Table 04: Europe Wheat Starch Market Volume (Tons) Analysis and Forecast By End-use, 2015-2030

Table 05: Europe Wheat Starch Market Value (US$ Mn) Analysis and Forecast by Country, 2015-2030

Table 06: Europe Wheat Starch Market Volume (Tons) Analysis and Forecast by Country, 2015-2030

List of Figures

Figure 01: Europe Wheat Starch Market Value (US$ Mn) Forecast, 2020–2030

Figure 02: Europe Wheat Starch Market Volume (Tons) Forecast, 2020–2030

Figure 03: Europe Wheat Starch Market Value Share Analysis by Type, 2020 E

Figure 04: Europe Wheat Starch Market Y-o-Y Growth Rate by Type, 2020-2030

Figure 05: Europe Wheat Starch Market Value (US$ Mn) Analysis & Forecast by Type, 2020–2030

Figure 06: Europe Wheat Starch Market Volume (Tons) Analysis & Forecast by Type, 2020–2030

Figure 07: Europe Wheat Starch Market Value Share Analysis By End-use, 2020 E

Figure 08: Europe Wheat Starch Market Y-o-Y Growth Rate By End-use, 2020-2030

Figure 09: Europe Wheat Starch Market Value (US$ Mn) Analysis & Forecast By End-use, 2020–2030