Analysts’ Viewpoint on Market Scenario

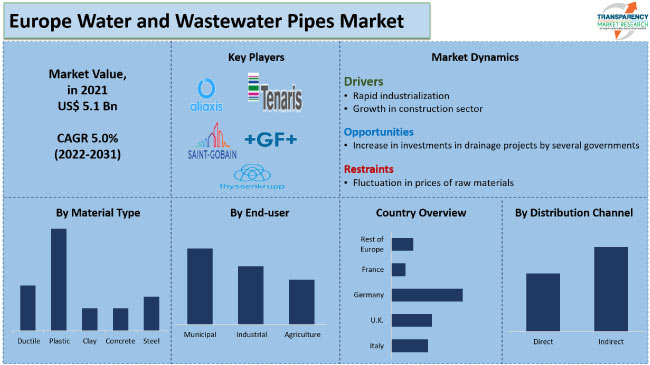

The market for water and wastewater pipes in Europe is expected to be driven by significant growth in the construction sector. Additionally, rapid industrialization and improvement in wastewater management systems are expected to fuel market expansion in the next few years. Rise in adoption of sensor technology in water and wastewater pipes is further augmenting market progress in the region.

Demand for ductile iron pipes is increasing as a result of expansion of smart city construction projects in Europe. This is also likely to have a positive impact on market development. Manufacturers are increasingly focusing on the development of efficient products for their customers by following the latest water and wastewater pipes market trends in Europe.

Modern water and wastewater treatment systems, such as desalination units, water pumping units, and cooling water systems, rely heavily on piping. Piping is employed to transport different types of liquids such as water, wastewater, chemicals, and combinations from one place to another. In the market, various types of water and wastewater pipes are widely available. Surge in end-user demand for flexible pipes and increased renovation and repair of conventional piping systems in industries are estimated to increase the water and wastewater pipes market size in Europe in the near future.

Rapid urbanization, industrialization, and rise in investment by governments in the development of water infrastructure are some of the major factors accelerating market growth. Moreover, the Europe water and wastewater pipes market is anticipated to increase during the forecast period, owing to growth in the construction sector along with rise in water consumption in the region. Surge in demand for residential homes and infrastructure facilities in urban areas supports the expansion of the construction and agricultural industries. Furthermore, rise in investments in both residential and commercial construction is driving the demand for water and wastewater pipes, which is expected to aid in the water and wastewater pipes market expansion in the next few years.

The need for HVAC systems is increasing due to extreme weather conditions in countries across Europe. Increase in renovation and repair of outdated plumbing systems is also contributing to the market demand for efficient water pipes. Demand for real-time devices, including pressure measurement meters and pumps is increasing in Europe. This is expected to offer potential business opportunities for manufacturers operating in the market.

Government bodies in Europe are working toward the improvement of drainage and sanitation in residential, commercial, and industrial units, which is likely to increase the demand for wastewater drain pipes in the next few years. Several regional administrations have given their approval to large-scale initiatives that are aimed at creating a dense system of underground water supply pipes. The “improvement of the water communal infrastructure – Rijeka Agglomeration” project is the major investment in utility infrastructure in the Republic of Croatia. This project is aimed at developing water supply systems and improving wastewater management. According to the Europe water and wastewater pipes market research report, rise in number of drainage projects in the region is likely to fuel market progress in the near future.

Based on material type, the Europe water and wastewater pipes business has been segmented into concrete, plastic, clay, ductile, and steel. Analysis of the Europe water and wastewater market forecast reveals that the demand for plastic piping materials, particularly high-density polyethylene (HDPE) and polyvinyl chloride (PVC) is rising among the utilities. Widespread usage of plastic water and wastewater pipes is due to advancements in materials as well as the benefits associated with their easy installation and portability. HDPE pipes are suitable for a wide range of applications, including sewage and industrial effluent disposal, portable water supply and distribution, electrical installation, drip irrigation, flood irrigation, and drainage pipes. Therefore, demand for plastic wastewater pipes is expected to remain high during the forecast period.

In terms of end-user, market segmentation comprises municipal, industrial, and agriculture. The municipal sector is projected to be the dominant end-user of the water and wastewater pipes industry in Europe during the forecast period. Increase in residential construction is likely to boost the demand for an effective water management system, which in turn is estimated to boost the demand for water and wastewater pipes in the next few years. This is anticipated to positively affect the Europe water and wastewater pipes market dynamics in the near future.

Expansion of the construction sector in Europe is driving the demand for PVC wastewater pipes in the region. The use of sustainable techniques and materials in the plumbing industry in the last few years has also received significant attention in several countries across Europe.

The market in Germany is growing rapidly due to the rise in demand for ductile iron pipes. Growth of the market in Germany is attributed to the rise in smart city construction projects in the country. Furthermore, growth in infrastructure development activities such as sanitation, and water & power supply is also contributing to market development in the country.

The U.K., Norway, and France are some of the lucrative markets for water and wastewater pipes in Europe, owing to the rise in demand for wastewater disposal systems in residential areas in these countries.

The water and wastewater pipes business in Europe is highly consolidated, a few large-scale players are controlling a significant share. Companies operating in water and wastewater pipes market are focusing on strategic expansions through mergers, acquisitions, collaborations, partnerships, and product innovations. Several market players are implementing recycling techniques to reduce carbon footprint and improve the environmental safety of water and wastewater pipes. Key players operating in the Europe water and wastewater pipes industry are Aliaxis, Tenaris, Vallourec, Georg Fischer, ThyssenKrupp, and Pipelife International GmbH.

The Europe water and wastewater pipes market report profiles these leading players based on parameters such as company overview, financial overview, recent developments, business strategies, product portfolio, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 5.1 Bn |

|

Market Forecast Value in 2031 |

US$ 8.3 Bn |

|

Growth Rate (CAGR) |

5% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

It includes a cross-segment analysis of Europe as well as country levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Countries Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It stood at US$ 5.1 Bn in 2021

The business is estimated to grow at a CAGR of 5.0% during 2022-2031

Rapid industrialization and growth in construction sector

The plastic segment accounted for highest share in 2021

Germany was the most lucrative country in 2021

Aliaxis, Saint-Gobain Group, Tenaris, Vallourec, Georg Fischer, ThyssenKrupp, Pipelife International GmbH., CEMEX S.A.B. de C.V., AWS Schäfer Technologie GmbH, and Tyman Plc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Technology Overview

5.9. Europe Electrically Powered Street Sweeper Market Analysis and Forecast, 2022- 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. Europe Water and Wastewater Pipes Market Analysis and Forecast, by Material Type

6.1. Europe Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By Material Type, 2022- 2031

6.1.1. Concrete

6.1.2. Plastic

6.1.3. Clay

6.1.4. Ductile

6.1.5. Steel

6.2. Incremental Opportunity, By Material Type

7. Europe Water and Wastewater Pipes Market Analysis and Forecast, by End-user

7.1. Europe Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By End-user, 2022 - 2031

7.1.1. Municipal

7.1.2. Industrial

7.1.3. Agriculture

7.2. Incremental Opportunity, By End-user

8. Europe Water and Wastewater Pipes Market Analysis and Forecast, by Distribution Channel

8.1. Europe Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2022 - 2031

8.1.1. Direct

8.1.2. Indirect

8.2. Incremental Opportunity, By Distribution Channel

9. Europe Water and Wastewater Pipes Market Analysis and Forecast, by Country

9.1. Europe Water and Wastewater Pipes Market Size (US$ Mn) (Thousand Units), by Region, 2022- 2031

9.1.1. U.K.

9.1.2. Germany

9.1.3. France

9.1.4. Italy

9.1.5. Rest of Europe

9.2. Incremental Opportunity, by Country

10. U.K. Water and Wastewater Pipes Market Analysis and Forecast

10.1. Country Snapshot

10.2. Key Trends Analysis

10.3. Key Supplier Analysis

10.4. Price Trend Analysis

10.5. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By Material, 2022 - 2031

10.5.1. Concrete

10.5.2. Plastic

10.5.3. Clay

10.5.4. Ductile

10.5.5. Steel

10.6. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By End-Use, 2022 - 2031

10.6.1. Municipal

10.6.2. Industrial

10.6.3. Agriculture

10.7. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2022 - 2031

10.7.1. Direct

10.7.2. Indirect

10.8. Incremental Opportunity Analysis

11. Germany Water and Wastewater Pipes Market Analysis and Forecast

11.1. Country Snapshot

11.2. Key Trends Analysis

11.3. Key Supplier Analysis

11.4. Price Trend Analysis

11.5. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By Material, 2022- 2031

11.5.1. Concrete

11.5.2. Plastic

11.5.3. Clay

11.5.4. Ductile

11.5.5. Steel

11.6. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By End-user, 2022- 2031

11.6.1. Municipal

11.6.2. Industrial

11.6.3. Agriculture

11.7. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2022 - 2031

11.7.1. Direct

11.7.2. Indirect

11.8. Incremental Opportunity Analysis

12. France Water and Wastewater Pipes Market Analysis and Forecast

12.1. Country Snapshot

12.2. Key Trends Analysis

12.3. Key Supplier Analysis

12.4. Price Trend Analysis

12.5. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By Material, 2022 - 2031

12.5.1. Concrete

12.5.2. Plastic

12.5.3. Clay

12.5.4. Ductile

12.5.5. Steel

12.6. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By End-user, 2022 - 2031

12.6.1. Municipal

12.6.2. Industrial

12.6.3. Agriculture

12.7. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2022 - 2031

12.7.1. Direct

12.7.2. Indirect

12.8. Incremental Opportunity Analysis

13. Italy Water and Wastewater Pipes Market Analysis and Forecast

13.1. Country Snapshot

13.2. Key Trends Analysis

13.3. Key Supplier Analysis

13.4. Price Trend Analysis

13.5. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By Material, 2022 - 2031

13.5.1. Concrete

13.5.2. Plastic

13.5.3. Clay

13.5.4. Ductile

13.5.5. Steel

13.6. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By End-user, 2022 - 2031

13.6.1. Municipal

13.6.2. Industrial

13.6.3. Agriculture

13.7. Water and Wastewater Pipes Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2022 - 2031

13.7.1. Direct

13.7.2. Indirect

13.8. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Competition Dashboard

14.2. Market Share Analysis (%), 2021

14.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

14.3.1. Aliaxis

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. Financial Information, (Subject to Data Availability)

14.3.1.4. Business Strategies / Recent Developments

14.3.2. Saint-Gobain Group

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. Financial Information, (Subject to Data Availability)

14.3.2.4. Business Strategies / Recent Developments

14.3.3. Tenaris

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. Financial Information, (Subject to Data Availability)

14.3.3.4. Business Strategies / Recent Developments

14.3.4. Vallourec

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. Financial Information, (Subject to Data Availability)

14.3.4.4. Business Strategies / Recent Developments

14.3.5. Georg Fischer

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. Financial Information, (Subject to Data Availability)

14.3.5.4. Business Strategies / Recent Developments

14.3.6. ThyssenKrupp

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. Financial Information, (Subject to Data Availability)

14.3.6.4. Business Strategies / Recent Developments

14.3.7. Pipelife International GmbH

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. Financial Information, (Subject to Data Availability)

14.3.7.4. Business Strategies / Recent Developments

14.3.8. CEMEX S.A.B. de C.V.

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. Financial Information, (Subject to Data Availability)

14.3.8.4. Business Strategies / Recent Developments

14.3.9. AWS Schäfer Technologie GmbH

14.3.9.1. Company Overview

14.3.9.2. Product Portfolio

14.3.9.3. Financial Information, (Subject to Data Availability)

14.3.9.4. Business Strategies / Recent Developments

14.3.10. Tyman Plc.

14.3.10.1. Company Overview

14.3.10.2. Product Portfolio

14.3.10.3. Financial Information, (Subject to Data Availability)

14.3.10.4. Business Strategies / Recent Developments

15. Key Takeaways

15.1. Identification of Potential Market Spaces

15.1.1. Material Type

15.1.2. End-user

15.1.3. Distribution Channel

15.1.4. Geography

15.1.4.1. The U.K.

15.1.4.2. France

15.1.4.3. Germany

15.1.4.4. Italy

15.1.4.5. Rest of Europe

15.2. Understanding the Procurement Process of the End-users

15.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Europe Water and Wastewater Pipes Market, by Material Type, Thousand Units, 2022-2031

Table 2: Europe Water and Wastewater Pipes Market, by Material Type, US$ Mn, 2022-2031

Table 3: Europe Water and Wastewater Pipes Market, by End-user, Thousand Units, 2022-2031

Table 4: Europe Water and Wastewater Pipes Market, by End-user, US$ Mn, 2022-2031

Table 5: Europe Water and Wastewater Pipes Market, by Distribution Channel, Thousand Units, 2022-2031

Table 6: Europe Water and Wastewater Pipes Market, by Distribution Channel, US$ Mn, 2022-2031

Table 7: U.K. Water and Wastewater Pipes Market, by Material Type, Thousand Units, 2022-2031

Table 8: U.K. Water and Wastewater Pipes Market, by Material Type, US$ Mn, 2022-2031

Table 9: U.K. Water and Wastewater Pipes Market, by End-user, Thousand Units, 2022-2031

Table 10: U.K. Water and Wastewater Pipes Market, by End-user, US$ Mn, 2022-2031

Table 11: U.K. Water and Wastewater Pipes Market, by Distribution Channel, Thousand Units, 2022-2031

Table 12: U.K. Water and Wastewater Pipes Market, by Distribution Channel, US$ Mn, 2022-2031

Table 13: Germany Water and Wastewater Pipes Market, by Material Type, Thousand Units, 2022-2031

Table 14: Germany Water and Wastewater Pipes Market, by Material Type, US$ Mn, 2022-2031

Table 15: Germany Water and Wastewater Pipes Market, by End-user, Thousand Units, 2022-2031

Table 16: Germany Water and Wastewater Pipes Market, by End-user, US$ Mn, 2022-2031

Table 17: Germany Water and Wastewater Pipes Market, by Distribution Channel, Thousand Units, 2022-2031

Table 18: Germany Water and Wastewater Pipes Market, by Distribution Channel, US$ Mn, 2022-2031

Table 19: France Water and Wastewater Pipes Market, by Material Type, Thousand Units, 2022-2031

Table 20: France Water and Wastewater Pipes Market, by Material Type, US$ Mn, 2022-2031

Table 21: France Water and Wastewater Pipes Market, by End-user, Thousand Units, 2022-2031

Table 22: France Water and Wastewater Pipes Market, by End-user, US$ Mn, 2022-2031

Table 23: France Water and Wastewater Pipes Market, by Distribution Channel, Thousand Units, 2022-2031

Table 24: France Water and Wastewater Pipes Market, by Distribution Channel, US$ Mn, 2022-2031

Table 25: Italy Water and Wastewater Pipes Market, by Material Type, Thousand Units, 2022-2031

Table 26: Italy Water and Wastewater Pipes Market, by Material Type, US$ Mn, 2022-2031

Table 27: Italy Water and Wastewater Pipes Market, by End-user, Thousand Units, 2022-2031

Table 28: Italy Water and Wastewater Pipes Market, by End-user, US$ Mn, 2022-2031

Table 29: Italy Water and Wastewater Pipes Market, by Distribution Channel, Thousand Units, 2022-2031

Table 30: Italy Water and Wastewater Pipes Market, by Distribution Channel, US$ Mn, 2022-2031

Table 31: Rest of Europe Water and Wastewater Pipes Market, by Material Type, Thousand Units, 2022-2031

Table 32: Rest of Europe Water and Wastewater Pipes Market, by Material Type, US$ Mn, 2022-2031

Table 33: Rest of Europe Water and Wastewater Pipes Market, by End-user, Thousand Units, 2022-2031

Table 34: Rest of Europe Water and Wastewater Pipes Market, by End-user, US$ Mn, 2022-2031

Table 35: Rest of Europe Water and Wastewater Pipes Market, by Distribution Channel, Thousand Units, 2022-2031

Table 36: Rest of Europe Water and Wastewater Pipes Market, by Distribution Channel, US$ Mn, 2022-2031

List of Figures

Figure 1: Europe Water and Wastewater Pipes Market, By Material Type, Thousand Units, 2022-2031

Figure 2: Europe Water and Wastewater Pipes Market, By Material Type, US$ Mn, 2022-2031

Figure 3: Europe Water and Wastewater Pipes Market Incremental Opportunity, By Material Type, US$ Mn, 2022-2031

Figure 4: Europe Water and Wastewater Pipes Market, By End-user, Thousand Units, 2022-2031

Figure 5: Europe Water and Wastewater Pipes Market, By End-user, US$ Mn, 2022-2031

Figure 6: Europe Water and Wastewater Pipes Market Incremental Opportunity, By End-user, US$ Mn, 2022-2031

Figure 7: Europe Water and Wastewater Pipes Market, By Distribution Channel, Thousand Units, 2022-2031

Figure 8: Europe Water and Wastewater Pipes Market, By Distribution Channel, US$ Mn, 2022-2031

Figure 9: Europe Water and Wastewater Pipes Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2022-2031

Figure 10: Europe Water and Wastewater Pipes Market, By Country, Thousand Units, 2022-2031

Figure 11: Europe Water and Wastewater Pipes Market, By Country, US$ Mn, 2022-2031

Figure 12: Europe Water and Wastewater Pipes Market Incremental Opportunity, By Country, US$ Mn, 2022-2031

Figure 13: U.K. Water and Wastewater Pipes Market, By Material Type, Thousand Units, 2022-2031

Figure 14: U.K. Water and Wastewater Pipes Market, By Material Type, US$ Mn, 2022-2031

Figure 15: U.K. Water and Wastewater Pipes Market Incremental Opportunity, By Material Type, US$ Mn, 2022-2031

Figure 16: U.K. Water and Wastewater Pipes Market, By End-user, Thousand Units, 2022-2031

Figure 17: U.K. Water and Wastewater Pipes Market, By End-user, US$ Mn, 2022-2031

Figure 18: U.K. Water and Wastewater Pipes Market Incremental Opportunity, By End-user, US$ Mn, 2022-2031

Figure 19: U.K. Water and Wastewater Pipes Market, By Distribution Channel, Thousand Units, 2022-2031

Figure 20: U.K. Water and Wastewater Pipes Market, By Distribution Channel, US$ Mn, 2022-2031

Figure 21: U.K. Water and Wastewater Pipes Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2022-2031

Figure 22: Germany Water and Wastewater Pipes Market, By Material Type, Thousand Units, 2022-2031

Figure 23: Germany Water and Wastewater Pipes Market, By Material Type, US$ Mn, 2022-2031

Figure 24: Germany Water and Wastewater Pipes Market Incremental Opportunity, By Material Type, US$ Mn, 2022-2031

Figure 25: Germany Water and Wastewater Pipes Market, By End-user, Thousand Units, 2022-2031

Figure 26: Germany Water and Wastewater Pipes Market, By End-user, US$ Mn, 2022-2031

Figure 27: Germany Water and Wastewater Pipes Market Incremental Opportunity, By End-user, US$ Mn, 2022-2031

Figure 28: Germany Water and Wastewater Pipes Market, By Distribution Channel, Thousand Units, 2022-2031

Figure 29: Germany Water and Wastewater Pipes Market, By Distribution Channel, US$ Mn, 2022-2031

Figure 30: Germany Water and Wastewater Pipes Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2022-2031

Figure 31: France Water and Wastewater Pipes Market, By Material Type, Thousand Units, 2022-2031

Figure 32: France Water and Wastewater Pipes Market, By Material Type, US$ Mn, 2022-2031

Figure 33: France Water and Wastewater Pipes Market Incremental Opportunity, By Material Type, US$ Mn, 2022-2031

Figure 34: France Water and Wastewater Pipes Market, By End-user, Thousand Units, 2022-2031

Figure 35: France Water and Wastewater Pipes Market, By End-user, US$ Mn, 2022-2031

Figure 36: France Water and Wastewater Pipes Market Incremental Opportunity, By End-user, US$ Mn, 2022-2031

Figure 37: France Water and Wastewater Pipes Market, By Distribution Channel, Thousand Units, 2022-2031

Figure 38: France Water and Wastewater Pipes Market, By Distribution Channel, US$ Mn, 2022-2031

Figure 39: France Water and Wastewater Pipes Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2022-2031

Figure 40: Italy Water and Wastewater Pipes Market, By Material Type, Thousand Units, 2022-2031

Figure 41: Italy Water and Wastewater Pipes Market, By Material Type, US$ Mn, 2022-2031

Figure 42: Italy Water and Wastewater Pipes Market Incremental Opportunity, By Material Type, US$ Mn, 2022-2031

Figure 43: Italy Water and Wastewater Pipes Market, By End-user, Thousand Units, 2022-2031

Figure 44: Italy Water and Wastewater Pipes Market, By End-user, US$ Mn, 2022-2031

Figure 45: Italy Water and Wastewater Pipes Market Incremental Opportunity, By End-user, US$ Mn, 2022-2031

Figure 46: Italy Water and Wastewater Pipes Market, By Distribution Channel, Thousand Units, 2022-2031

Figure 47: Italy Water and Wastewater Pipes Market, By Distribution Channel, US$ Mn, 2022-2031

Figure 48: Italy Water and Wastewater Pipes Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2022-2031

Figure 49: Rest of Europe Water and Wastewater Pipes Market, By Material Type, Thousand Units, 2022-2031

Figure 50: Rest of Europe Water and Wastewater Pipes Market, By Material Type, US$ Mn, 2022-2031

Figure 51: Rest of Europe Water and Wastewater Pipes Market Incremental Opportunity, By Material Type, US$ Mn, 2022-2031

Figure 52: Rest of Europe Water and Wastewater Pipes Market, By End-user, Thousand Units, 2022-2031

Figure 53: Rest of Europe Water and Wastewater Pipes Market, By End-user, US$ Mn, 2022-2031

Figure 54: Rest of Europe Water and Wastewater Pipes Market Incremental Opportunity, By End-user, US$ Mn, 2022-2031

Figure 55: Rest of Europe Water and Wastewater Pipes Market, By Distribution Channel, Thousand Units, 2022-2031

Figure 56: Rest of Europe Water and Wastewater Pipes Market, By Distribution Channel, US$ Mn, 2022-2031

Figure 57: Rest of Europe Water and Wastewater Pipes Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2022-2031