Analyst Viewpoint

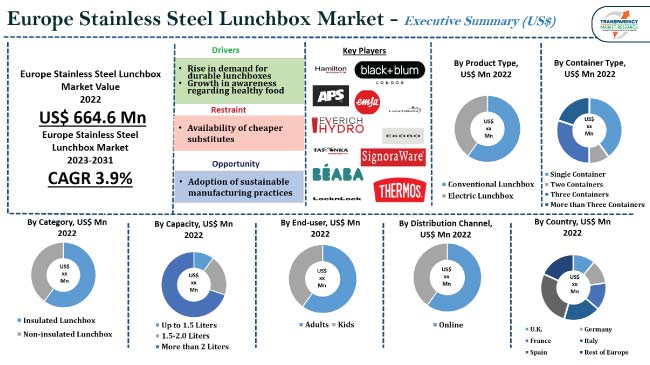

Rise in demand for durable lunchboxes and growth in awareness regarding healthy food are fueling the Europe stainless steel lunchbox market value. Growth in number of adults concerned about their health and wellness is fueling the demand for homemade food, thereby boosting the adoption of stainless steel lunchboxes.

Surge in working population is likely to offer lucrative Europe stainless steel lunchbox market opportunities to vendors. Advantages associated with stainless steel lunchbox materials, such as the odor-free nature, durability, and functionality, are augmenting the usage of stainless steel lunchboxes among the working class. Vendors are focusing on advancements in terms of design and features to broaden their customer base.

Stainless steel, often referred to as inox, is an iron alloy that is resistant to corrosion and rust. To get the appropriate features, it may also contain other elements, such as carbon, in addition to the minimum 10.5% chromium and nickel element. Customers frequently choose stainless steel lunchboxes as they provide several benefits including durability and safety. These lunchboxes help keep food fresh for several hours.

Using lunchboxes made of stainless steel saves waste and encourages sustainability as stainless steel is a recyclable material. There are many varieties of stainless steel bento lunchboxes available in the market with leak-proof silicone lids and adjustable internal dividers. Most stainless steel lunchbox manufacturers in Europe are providing various types of products to cater to a large group of customers. These lunchboxes are available in single and multiple containers. Multiple containers help keep various food items separate without worrying about them mixing or spilling.

Key advantages of stainless steel lunch containers include durability as they are remarkably strong and long-lasting. These lunch containers do not break easily or deteriorate over time as they can tolerate normal wear and tear. Stainless steel does not react with acidic or alkaline foods, which aids in maintaining the flavor and food quality. This means that a large range of dishes and cuisines can be stored in stainless steel lunchboxes. Low-cost plastic lunchboxes are an alternative to stainless steel lunchboxes, which is likely to limit the Europe stainless steel lunchbox market progress.

There is a growing awareness of health and well-being in numerous areas of modern society. Increasing number of individuals are realizing the need to uphold a healthy lifestyle. Consumer's daily decisions indicate this increased understanding of health consciousness, with an emphasis on nurturing the body, mind, and soul through healthy lifestyle choices.

Surge in health consciousness among consumers is boosting the demand for homely cooked food, which, in turn, is expected to spur the Europe stainless steel lunchbox market growth in the near future. Metal lunchboxes are a perfect choice for storing food items owing to their several benefits. Educational institutes worldwide encourage students to bring homemade foods.

The preference for nutritious and fresh homemade food is growing among working professionals. The high number of working professionals in Europe is fueling the demand for homemade food. The employed population in the European Union (EU) was over 198 million in 2021. The minimum is 269,600 for Malta, while the maximum is over 41 million people for Germany. Thus, high number of working professionals is fueling the Europe stainless steel lunchbox market size.

According to the latest Europe stainless steel lunchbox market trends, the conventional lunchbox product type segment held the largest share in 2022. Since conventional lunchboxes have been around for decades, consumers are more habituated to them and comfortable using them. These lunchboxes are preferred to electric lunchboxes for their simplicity.

Conventional lunchboxes feature a straightforward layout with food sections, which facilitates users in packing and arranging their meals. These lunchboxes are more practical and accessible for consumers in places with restricted access to electricity or during blackouts. Moreover, the minimal parts of conventional lunchboxes and no requirement for electricity, make these lunchboxes typically less expensive than electric ones. The demand for electric lunchboxes in Europe stainless steel lunchbox market landscape is expected to grow significantly in the near future.

According to the latest Europe stainless steel lunchbox market analysis, Germany held the largest market share in 2022. Surge in number of cardiovascular and other diseases has turned consumers in the Europe stainless steel lunchbox industry into eating homemade foods as frequent dining out increases the risk for heart disease. In Germany, cardiovascular diseases account for around 40% of all deaths, making them the country's leading cause of fatalities. Every year, over 37,000 heart bypasses are conducted in Germany, which is more than double the number of any of the other EU member states. Thus, the high number of cardiovascular diseases has forced people to eat healthy and stay fit. Additionally, the region's growing disposable income is giving customers more spending power, which is fueling the Europe market dynamics.

The Europe stainless steel lunchbox market report analysis has been done to evaluate financials, recent developments, and strategies of key players. Most vendors are investing in the R&D of new products to expand their product portfolio.

Assheuer + Pott GmbH & Co. KG, ASVEL CO., LTD., Beaba, Black + Blum Ltd., Blockhütte GmbH, ECO Brotbox GmbH, ECOLunchbox, EKOBO SAS, EMSA GmbH, Everich Commerce Group Limited, Hamilton Housewares Pvt. Ltd., LocknLock Co., LunchBots, PlanetBox, Sattvii, Signoraware, SKI Plastoware Private Limited, Tatonka GmbH, Thermos L.L.C., and Zojirushi Corporation are major companies in Europe stainless steel lunchbox market.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 (Base Year) | US$ 664.6 Mn |

| Market Forecast Value in 2031 | US$ 935.8 Mn |

| Growth Rate (CAGR) | 3.9% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Mn for Value and Thousand Units for Volume |

| Market Analysis | Country-wise qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 664.6 Mn in 2022

It is projected to reach US$ 935.8 Mn by the end of 2031

Rise in demand for durable lunchboxes and growth in awareness regarding healthy food

The conventional lunchbox segment held the highest share in 2022

Germany accounted for 34.5% share in 2022

Assheuer + Pott GmbH & Co. KG, ASVEL CO., LTD., Beaba, Black + Blum Ltd., Blockhütte GmbH, ECO Brotbox GmbH, ECOLunchbox, EKOBO SAS, EMSA GmbH, Everich Commerce Group Limited, Hamilton Housewares Pvt. Ltd., LocknLock Co., LunchBots, PlanetBox, Sattvii, Signoraware, SKI Plastoware Private Limited, Tatonka GmbH, Thermos L.L.C., and Zojirushi Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Value Chain Analysis

5.5. Industry SWOT Analysis

5.6. Porter’s Five Forces Analysis

5.7. Raw End-User Analysis

5.8. Europe Stainless Steel Lunchbox Market Analysis and Forecast, 2017–2031

5.8.1. Market Revenue Projections (US$ Mn)

5.8.2. Market Revenue Projections (Thousand Units)

6. Europe Stainless Steel Lunchbox Market, By Product Type

6.1. Europe Stainless Steel Lunchbox Market (US$ Mn) & (Thousand Units) Forecast, By Product Type, 2017–2031

6.1.1. Conventional Lunchbox

6.1.2. Electric Lunchbox

6.1.2.1. Smart Electric Lunchbox

6.1.2.2. Standard Electric Lunchbox

6.2. Incremental Opportunity, By Product Type

7. Europe Stainless Steel Lunchbox Market, By Container Type

7.1. Europe Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Container Type, 2017–2031

7.1.1. Single Container

7.1.2. Two Containers

7.1.3. Three Containers

7.1.4. More than Three Containers

7.2. Incremental Opportunity, By Container Type

8. Europe Stainless Steel Lunchbox Market, By Category

8.1. Europe Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Category, 2017–2031

8.1.1. Insulated Lunchbox

8.1.2. Non-insulated Lunchbox

8.2. Incremental Opportunity, By Category

9. Europe Stainless Steel Lunchbox Market, By Capacity

9.1. Europe Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Capacity, 2017–2031

9.1.1. Up to 1.5 Liters

9.1.2. 1.5-2.0 Liters

9.1.3. More than 2 Liters

9.2. Incremental Opportunity, By Capacity

10. Europe Stainless Steel Lunchbox Market, By End-user

10.1. Europe Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By End-user, 2017–2031

10.1.1. Adults

10.1.2. Kids

10.2. Incremental Opportunity, By End-user

11. Europe Stainless Steel Lunchbox Market, By Distribution Channel

11.1. Europe Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Distribution Channel, 2017–2031

11.1.1. Online

11.1.1.1. E-commerce Websites

11.1.1.2. Company-owned Websites

11.1.2. Offline

11.1.2.1. Hypermarkets and Supermarkets

11.1.2.2. Specialty Stores

11.1.2.3. Other Retail-based Stores

11.2. Incremental Opportunity, By Distribution Channel

12. Europe Stainless Steel Lunchbox Market, By Country

12.1. Europe Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Country, 2017–2031

12.1.1. U.K.

12.1.2. Germany

12.1.3. France

12.1.4. Italy

12.1.5. Spain

12.1.6. Rest of Europe

12.2. Incremental Opportunity, By Country

13. U.K. Stainless Steel Lunchbox Market Analysis and Forecast

13.1. Country Snapshot

13.2. Demographic Overview

13.3. Key Trend Analysis

13.3.1. Demand Side

13.3.2. Supply Side

13.4. Pricing Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Market Share Analysis (%)

13.6. Consumer Buying Behavior Analysis

13.7. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Product Type, 2017–2031

13.7.1. Conventional Lunchbox

13.7.2. Electric Lunchbox

13.7.2.1. Smart Electric Lunchbox

13.7.2.2. Standard Electric Lunchbox

13.8. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Container Type, 2017–2031

13.8.1. Single Container

13.8.2. Two Containers

13.8.3. Three Containers

13.8.4. More than Three Containers

13.9. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Category, 2017–2031

13.9.1. Insulated Lunchbox

13.9.2. Non-insulated Lunchbox

13.10. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Capacity, 2017–2031

13.10.1. Up to 1.5 Liters

13.10.2. 1.5-2.0 Liters

13.10.3. More than 2 Liters

13.11. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By End-user, 2017–2031

13.11.1. Adults

13.11.2. Kids

13.12. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Distribution Channel, 2017–2031

13.12.1. Online

13.12.1.1. E-commerce Websites

13.12.1.2. Company-owned Websites

13.12.2. Offline

13.12.2.1. Hypermarkets and Supermarkets

13.12.2.2. Specialty Stores

13.12.2.3. Other Retail-based Stores

13.13. Incremental Opportunity Analysis

14. Germany Stainless Steel Lunchbox Market Analysis and Forecast

14.1. Country Snapshot

14.2. Demographic Overview

14.3. Key Trend Analysis

14.3.1. Demand Side

14.3.2. Supply Side

14.4. Pricing Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Market Share Analysis (%)

14.6. Consumer Buying Behavior Analysis

14.7. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Product Type, 2017–2031

14.7.1. Conventional Lunchbox

14.7.2. Electric Lunchbox

14.7.2.1. Smart Electric Lunchbox

14.7.2.2. Standard Electric Lunchbox

14.8. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Container Type, 2017–2031

14.8.1. Single Container

14.8.2. Two Containers

14.8.3. Three Containers

14.8.4. More than Three Containers

14.9. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Category, 2017–2031

14.9.1. Insulated Lunchbox

14.9.2. Non-insulated Lunchbox

14.10. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Capacity, 2017–2031

14.10.1. Up to 1.5 Liters

14.10.2. 1.5-2.0 Liters

14.10.3. More than 2 Liters

14.11. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By End-user, 2017–2031

14.11.1. Adults

14.11.2. Kids

14.12. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Distribution Channel, 2017–2031

14.12.1. Online

14.12.1.1. E-commerce Websites

14.12.1.2. Company-owned Websites

14.12.2. Offline

14.12.2.1. Hypermarkets and Supermarkets

14.12.2.2. Specialty Stores

14.12.2.3. Other Retail-based Stores

14.13. Incremental Opportunity Analysis

15. France Stainless Steel Lunchbox Market Analysis and Forecast

15.1. Country Snapshot

15.2. Demographic Overview

15.3. Key Trend Analysis

15.3.1. Demand Side

15.3.2. Supply Side

15.4. Pricing Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Market Share Analysis (%)

15.6. Consumer Buying Behavior Analysis

15.7. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Product Type, 2017–2031

15.7.1. Conventional Lunchbox

15.7.2. Electric Lunchbox

15.7.2.1. Smart Electric Lunchbox

15.7.2.2. Standard Electric Lunchbox

15.8. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Container Type, 2017–2031

15.8.1. Single Container

15.8.2. Two Containers

15.8.3. Three Containers

15.8.4. More than Three Containers

15.9. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Category, 2017–2031

15.9.1. Insulated Lunchbox

15.9.2. Non-insulated Lunchbox

15.10. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Capacity, 2017–2031

15.10.1. Up to 1.5 Liters

15.10.2. 1.5-2.0 Liters

15.10.3. More than 2 Liters

15.11. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By End-user, 2017–2031

15.11.1. Adults

15.11.2. Kids

15.12. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Distribution Channel, 2017–2031

15.12.1. Online

15.12.1.1. E-commerce Websites

15.12.1.2. Company-owned Websites

15.12.2. Offline

15.12.2.1. Hypermarkets and Supermarkets

15.12.2.2. Specialty Stores

15.12.2.3. Other Retail-based Stores

15.13. Incremental Opportunity Analysis

16. Italy Stainless Steel Lunchbox Market Analysis and Forecast

16.1. Country Snapshot

16.2. Demographic Overview

16.3. Key Trend Analysis

16.3.1. Demand Side

16.3.2. Supply Side

16.4. Pricing Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Market Share Analysis (%)

16.6. Consumer Buying Behavior Analysis

16.7. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Product Type, 2017–2031

16.7.1. Conventional Lunchbox

16.7.2. Electric Lunchbox

16.7.2.1. Smart Electric Lunchbox

16.7.2.2. Standard Electric Lunchbox

16.8. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Container Type, 2017–2031

16.8.1. Single Container

16.8.2. Two Containers

16.8.3. Three Containers

16.8.4. More than Three Containers

16.9. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Category, 2017–2031

16.9.1. Insulated Lunchbox

16.9.2. Non-insulated Lunchbox

16.10. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Capacity, 2017–2031

16.10.1. Up to 1.5 Liters

16.10.2. 1.5-2.0 Liters

16.10.3. More than 2 Liters

16.11. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By End-user, 2017–2031

16.11.1. Adults

16.11.2. Kids

16.12. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Distribution Channel, 2017–2031

16.12.1. Online

16.12.1.1. E-commerce Websites

16.12.1.2. Company-owned Websites

16.12.2. Offline

16.12.2.1. Hypermarkets and Supermarkets

16.12.2.2. Specialty Stores

16.12.2.3. Other Retail-based Stores

16.13. Incremental Opportunity Analysis

17. Spain Stainless Steel Lunchbox Market Analysis and Forecast

17.1. Country Snapshot

17.2. Demographic Overview

17.3. Key Trend Analysis

17.3.1. Demand Side

17.3.2. Supply Side

17.4. Pricing Analysis

17.4.1. Weighted Average Selling Price (US$)

17.5. Market Share Analysis (%)

17.6. Consumer Buying Behavior Analysis

17.7. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Product Type, 2017–2031

17.7.1. Conventional Lunchbox

17.7.2. Electric Lunchbox

17.7.2.1. Smart Electric Lunchbox

17.7.2.2. Standard Electric Lunchbox

17.8. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Container Type, 2017–2031

17.8.1. Single Container

17.8.2. Two Containers

17.8.3. Three Containers

17.8.4. More than Three Containers

17.9. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Category, 2017–2031

17.9.1. Insulated Lunchbox

17.9.2. Non-insulated Lunchbox

17.10. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Capacity, 2017–2031

17.10.1. Up to 1.5 Liters

17.10.2. 1.5-2.0 Liters

17.10.3. More than 2 Liters

17.11. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By End-user, 2017–2031

17.11.1. Adults

17.11.2. Kids

17.12. Stainless Steel Lunchbox Market Size (US$ Mn) & (Thousand Units) Forecast, By Distribution Channel, 2017–2031

17.12.1. Online

17.12.1.1. E-commerce Websites

17.12.1.2. Company-owned Websites

17.12.2. Offline

17.12.2.1. Hypermarkets and Supermarkets

17.12.2.2. Specialty Stores

17.12.2.3. Other Retail-based Stores

17.13. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player–Competition Dashboard

18.2. Market Share Analysis (%), 2022

18.3. Company Profiles (Details–Company Overview, Sales End-User Product Type/Geographical Presence, Revenue, Strategy & Business Overview)

18.3.1. Assheuer + Pott GmbH & Co. KG

18.3.1.1. Company Overview

18.3.1.2. Sales End-User Product Type

18.3.1.3. Geographical Presence

18.3.1.4. Revenue

18.3.1.5. Strategy & Business Overview

18.3.2. ASVEL CO., LTD.

18.3.2.1. Company Overview

18.3.2.2. Sales End-User Product Type

18.3.2.3. Geographical Presence

18.3.2.4. Revenue

18.3.2.5. Strategy & Business Overview

18.3.3. Beaba

18.3.3.1. Company Overview

18.3.3.2. Sales End-User Product Type

18.3.3.3. Geographical Presence

18.3.3.4. Revenue

18.3.3.5. Strategy & Business Overview

18.3.4. Black + Blum Ltd.

18.3.4.1. Company Overview

18.3.4.2. Sales End-User Product Type

18.3.4.3. Geographical Presence

18.3.4.4. Revenue

18.3.4.5. Strategy & Business Overview

18.3.5. Blockhütte GmbH

18.3.5.1. Company Overview

18.3.5.2. Sales End-User Product Type

18.3.5.3. Geographical Presence

18.3.5.4. Revenue

18.3.5.5. Strategy & Business Overview

18.3.6. ECO Brotbox GmbH

18.3.6.1. Company Overview

18.3.6.2. Sales End-User Product Type

18.3.6.3. Geographical Presence

18.3.6.4. Revenue

18.3.6.5. Strategy & Business Overview

18.3.7. ECOLunchbox

18.3.7.1. Company Overview

18.3.7.2. Sales End-User Product Type

18.3.7.3. Geographical Presence

18.3.7.4. Revenue

18.3.7.5. Strategy & Business Overview

18.3.8. EKOBO SAS

18.3.8.1. Company Overview

18.3.8.2. Sales End-User Product Type

18.3.8.3. Geographical Presence

18.3.8.4. Revenue

18.3.8.5. Strategy & Business Overview

18.3.9. EMSA GmbH

18.3.9.1. Company Overview

18.3.9.2. Sales End-User Product Type

18.3.9.3. Geographical Presence

18.3.9.4. Revenue

18.3.9.5. Strategy & Business Overview

18.3.10. Everich Commerce Group Limited

18.3.10.1. Company Overview

18.3.10.2. Sales End-User Product Type

18.3.10.3. Geographical Presence

18.3.10.4. Revenue

18.3.10.5. Strategy & Business Overview

18.3.11. Hamilton Housewares Pvt. Ltd.

18.3.11.1. Company Overview

18.3.11.2. Sales End-User Product Type

18.3.11.3. Geographical Presence

18.3.11.4. Revenue

18.3.11.5. Strategy & Business Overview

18.3.12. LocknLock Co.

18.3.12.1. Company Overview

18.3.12.2. Sales End-User Product Type

18.3.12.3. Geographical Presence

18.3.12.4. Revenue

18.3.12.5. Strategy & Business Overview

18.3.13. LunchBots

18.3.13.1. Company Overview

18.3.13.2. Sales End-User Product Type

18.3.13.3. Geographical Presence

18.3.13.4. Revenue

18.3.13.5. Strategy & Business Overview

18.3.14. PlanetBox

18.3.14.1. Company Overview

18.3.14.2. Sales End-User Product Type

18.3.14.3. Geographical Presence

18.3.14.4. Revenue

18.3.14.5. Strategy & Business Overview

18.3.15. Sattvii

18.3.15.1. Company Overview

18.3.15.2. Sales End-User Product Type

18.3.15.3. Geographical Presence

18.3.15.4. Revenue

18.3.15.5. Strategy & Business Overview

18.3.16. Signoraware

18.3.16.1. Company Overview

18.3.16.2. Sales End-User Product Type

18.3.16.3. Geographical Presence

18.3.16.4. Revenue

18.3.16.5. Strategy & Business Overview

18.3.17. SKI Plastoware Private Limited

18.3.17.1. Company Overview

18.3.17.2. Sales End-User Product Type

18.3.17.3. Geographical Presence

18.3.17.4. Revenue

18.3.17.5. Strategy & Business Overview

18.3.18. Tatonka GmbH

18.3.18.1. Company Overview

18.3.18.2. Sales End-User Product Type

18.3.18.3. Geographical Presence

18.3.18.4. Revenue

18.3.18.5. Strategy & Business Overview

18.3.19. Thermos L.L.C.

18.3.19.1. Company Overview

18.3.19.2. Sales End-User Product Type

18.3.19.3. Geographical Presence

18.3.19.4. Revenue

18.3.19.5. Strategy & Business Overview

18.3.20. Zojirushi Corporation

18.3.20.1. Company Overview

18.3.20.2. Sales End-User Product Type

18.3.20.3. Geographical Presence

18.3.20.4. Revenue

18.3.20.5. Strategy & Business Overview

18.3.21. Other Key Players

18.3.21.1. Company Overview

18.3.21.2. Sales End-User Product Type

18.3.21.3. Geographical Presence

18.3.21.4. Revenue

18.3.21.5. Strategy & Business Overview

19. Go To Market Strategy

19.1. Identification of Potential Market Spaces

19.2. Understanding Buying Process of Customers

19.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Europe Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Table 2: Europe Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Table 3: Europe Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Table 4: Europe Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Table 5: Europe Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Table 6: Europe Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Table 7: Europe Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Table 8: Europe Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Table 9: Europe Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Table 10: Europe Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Table 11: Europe Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 12: Europe Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Table 13: Europe Stainless Steel Lunchbox Market Value, By Country, US$ Mn, 2017-2031

Table 14: Europe Stainless Steel Lunchbox Market Volume, By Country, Thousand Units, 2017-2031

Table 15: U.K. Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Table 16: U.K. Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Table 17: U.K. Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Table 18: U.K. Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Table 19: U.K. Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Table 20: U.K. Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Table 21: U.K. Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Table 22: U.K. Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Table 23: U.K. Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Table 24: U.K. Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Table 25: U.K. Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 26: U.K. Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Table 27: Germany Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Table 28: Germany Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Table 29: Germany Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Table 30: Germany Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Table 31: Germany Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Table 32: Germany Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Table 33: Germany Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Table 34: Germany Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Table 35: Germany Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Table 36: Germany Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Table 37: Germany Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 38: Germany Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Table 39: France Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Table 40: France Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Table 41: France Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Table 42: France Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Table 43: France Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Table 44: France Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Table 45: France Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Table 46: France Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Table 47: France Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Table 48: France Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Table 49: France Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 50: France Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Table 51: Italy Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Table 52: Italy Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Table 53: Italy Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Table 54: Italy Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Table 55: Italy Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Table 56: Italy Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Table 57: Italy Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Table 58: Italy Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Table 59: Italy Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Table 60: Italy Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Table 61: Italy Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 62: Italy Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Table 63: Spain Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Table 64: Spain Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Table 65: Spain Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Table 66: Spain Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Table 67: Spain Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Table 68: Spain Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Table 69: Spain Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Table 70: Spain Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Table 71: Spain Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Table 72: Spain Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Table 73: Spain Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 74: Spain Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

List of Figures

Figure 1: Europe Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Figure 2: Europe Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Figure 3: Europe Stainless Steel Lunchbox Market Incremental Opportunity, By Product Type, 2023-2031

Figure 4: Europe Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Figure 5: Europe Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Figure 6: Europe Stainless Steel Lunchbox Market Incremental Opportunity, By Container Type, 2023-2031

Figure 7: Europe Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Figure 8: Europe Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Figure 9: Europe Stainless Steel Lunchbox Market Incremental Opportunity, By Category, 2023-2031

Figure 10: Europe Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Figure 11: Europe Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Figure 12: Europe Stainless Steel Lunchbox Market Incremental Opportunity, By Capacity, 2023-2031

Figure 13: Europe Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Figure 14: Europe Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Figure 15: Europe Stainless Steel Lunchbox Market Incremental Opportunity, By End-user, 2023-2031

Figure 16: Europe Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 17: Europe Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Figure 18: Europe Stainless Steel Lunchbox Market Incremental Opportunity, By Distribution Channel, 2023-2031

Figure 19: Europe Stainless Steel Lunchbox Market Value, By Country, US$ Mn, 2017-2031

Figure 20: Europe Stainless Steel Lunchbox Market Volume, By Country, Thousand Units, 2017-2031

Figure 21: Europe Stainless Steel Lunchbox Market Incremental Opportunity, By Country, 2023-2031

Figure 22: U.K. Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Figure 23: U.K. Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Figure 24: U.K. Stainless Steel Lunchbox Market Incremental Opportunity, By Product Type, 2023-2031

Figure 25: U.K. Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Figure 26: U.K. Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Figure 27: U.K. Stainless Steel Lunchbox Market Incremental Opportunity, By Container Type, 2023-2031

Figure 28: U.K. Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Figure 29: U.K. Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Figure 30: U.K. Stainless Steel Lunchbox Market Incremental Opportunity, By Category, 2023-2031

Figure 31: U.K. Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Figure 32: U.K. Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Figure 33: U.K. Stainless Steel Lunchbox Market Incremental Opportunity, By Capacity, 2023-2031

Figure 34: U.K. Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Figure 35: U.K. Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Figure 36: U.K. Stainless Steel Lunchbox Market Incremental Opportunity, By End-user, 2023-2031

Figure 37: U.K. Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 38: U.K. Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Figure 39: U.K. Stainless Steel Lunchbox Market Incremental Opportunity, By Distribution Channel, 2023-2031

Figure 40: Germany Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Figure 41: Germany Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Figure 42: Germany Stainless Steel Lunchbox Market Incremental Opportunity, By Product Type, 2023-2031

Figure 43: Germany Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Figure 44: Germany Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Figure 45: Germany Stainless Steel Lunchbox Market Incremental Opportunity, By Container Type, 2023-2031

Figure 46: Germany Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Figure 47: Germany Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Figure 48: Germany Stainless Steel Lunchbox Market Incremental Opportunity, By Category, 2023-2031

Figure 49: Germany Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Figure 50: Germany Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Figure 51: Germany Stainless Steel Lunchbox Market Incremental Opportunity, By Capacity, 2023-2031

Figure 52: Germany Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Figure 53: Germany Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Figure 54: Germany Stainless Steel Lunchbox Market Incremental Opportunity, By End-user, 2023-2031

Figure 55: Germany Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 56: Germany Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Figure 57: Germany Stainless Steel Lunchbox Market Incremental Opportunity, By Distribution Channel, 2023-2031

Figure 58: France Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Figure 59: France Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Figure 60: France Stainless Steel Lunchbox Market Incremental Opportunity, By Product Type, 2023-2031

Figure 61: France Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Figure 62: France Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Figure 63: France Stainless Steel Lunchbox Market Incremental Opportunity, By Container Type, 2023-2031

Figure 64: France Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Figure 65: France Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Figure 66: France Stainless Steel Lunchbox Market Incremental Opportunity, By Category, 2023-2031

Figure 67: France Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Figure 68: France Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Figure 69: France Stainless Steel Lunchbox Market Incremental Opportunity, By Capacity, 2023-2031

Figure 70: France Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Figure 71: France Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Figure 72: France Stainless Steel Lunchbox Market Incremental Opportunity, By End-user, 2023-2031

Figure 73: France Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 74: France Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Figure 75: France Stainless Steel Lunchbox Market Incremental Opportunity, By Distribution Channel, 2023-2031

Figure 76: Italy Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Figure 77: Italy Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Figure 78: Italy Stainless Steel Lunchbox Market Incremental Opportunity, By Product Type, 2023-2031

Figure 79: Italy Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Figure 80: Italy Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Figure 81: Italy Stainless Steel Lunchbox Market Incremental Opportunity, By Container Type, 2023-2031

Figure 82: Italy Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Figure 83: Italy Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Figure 84: Italy Stainless Steel Lunchbox Market Incremental Opportunity, By Category, 2023-2031

Figure 85: Italy Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Figure 86: Italy Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Figure 87: Italy Stainless Steel Lunchbox Market Incremental Opportunity, By Capacity, 2023-2031

Figure 88: Italy Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Figure 89: Italy Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Figure 90: Italy Stainless Steel Lunchbox Market Incremental Opportunity, By End-user, 2023-2031

Figure 91: Italy Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 92: Italy Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Figure 93: Italy Stainless Steel Lunchbox Market Incremental Opportunity, By Distribution Channel, 2023-2031

Figure 94: Spain Stainless Steel Lunchbox Market Value, By Product Type, US$ Mn, 2017-2031

Figure 95: Spain Stainless Steel Lunchbox Market Volume, By Product Type, Thousand Units, 2017-2031

Figure 96: Spain Stainless Steel Lunchbox Market Incremental Opportunity, By Product Type, 2023-2031

Figure 97: Spain Stainless Steel Lunchbox Market Value, By Container Type, US$ Mn, 2017-2031

Figure 98: Spain Stainless Steel Lunchbox Market Volume, By Container Type, Thousand Units, 2017-2031

Figure 99: Spain Stainless Steel Lunchbox Market Incremental Opportunity, By Container Type, 2023-2031

Figure 100: Spain Stainless Steel Lunchbox Market Value, By Category, US$ Mn, 2017-2031

Figure 101: Spain Stainless Steel Lunchbox Market Volume, By Category, Thousand Units, 2017-2031

Figure 102: Spain Stainless Steel Lunchbox Market Incremental Opportunity, By Category, 2023-2031

Figure 103: Spain Stainless Steel Lunchbox Market Value, By Capacity, US$ Mn, 2017-2031

Figure 104: Spain Stainless Steel Lunchbox Market Volume, By Capacity, Thousand Units, 2017-2031

Figure 105: Spain Stainless Steel Lunchbox Market Incremental Opportunity, By Capacity, 2023-2031

Figure 106: Spain Stainless Steel Lunchbox Market Value, By End-user, US$ Mn, 2017-2031

Figure 107: Spain Stainless Steel Lunchbox Market Volume, By End-user, Thousand Units, 2017-2031

Figure 108: Spain Stainless Steel Lunchbox Market Incremental Opportunity, By End-user, 2023-2031

Figure 109: Spain Stainless Steel Lunchbox Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 110: Spain Stainless Steel Lunchbox Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Figure 111: Spain Stainless Steel Lunchbox Market Incremental Opportunity, By Distribution Channel, 2023-2031