Analysts’ Viewpoint

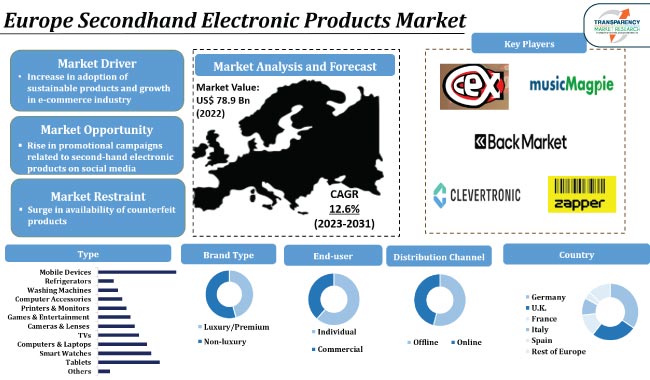

Increase in adoption of sustainable products and growth in the e-commerce sector are key factors driving the Europe secondhand electronic products market. Rise in aging population in countries in Europe is also expected to fuel market dynamics of secondhand electronic products in the region in the next few years.

Surge in promotional campaigns on social media is creating lucrative value-grab secondhand electronic products market opportunities for industry players in Europe. Increase in awareness about the negative impact of e-waste among consumers is also driving the sale of secondhand electronic products in the region.

Secondhand electronic products are gaining popularity in Europe. These products primarily include laptops, gaming consoles, smartphones, camera & lenses, and various other items. Secondhand electronic products may also include musical instruments such as musical keyboards, electric guitar processors, and electric drum kits. Consumers in Europe are increasingly looking for reliable sources to sell used electronic products.

Increase in innovation and new product launches in the electronics sector are fueling the Europe secondhand electronic products market value. Rise in number of tech-enthusiast consumers who frequently change their electronic devices is also boosting the market dynamics.

Europe secondhand electronic products market revenue is anticipated to rise in the near future due to the increase in adoption of environmentally-friendly products in the region. Large numbers of consumers are becoming conscious about the negative impact of their products on the environment. Hence, demand for secondhand electronic products is rising in Europe. Governmental organizations and educational institutions in the region are also increasingly prioritizing the usage of eco-friendly products.

Growth in the e-commerce sector is a significant factor augmenting market statistics in Europe. Companies operating in the market are using e-commerce portals to reach out to a wide range of consumers.

Refurbished phones are gaining popularity among consumers in Europe. This can be ascribed to the rise in number of market players offering excellent after-sale services such as repair and replacement of products.

As per the statistical information released by the Euroconsumers in 2021, 60.0% of respondents in a survey mentioned that they felt confident in purchasing refurbished smartphones.

Based on type, the market in Europe has been segmented into mobile devices, tablets, smart watches, computers & laptops, TVs, cameras & lenses, games & entertainment, printers & monitors, computer accessories, washing machines, refrigerators, and others (hard disks, kitchen appliances, etc.).

According to the latest Europe secondhand electronic products market forecast, the mobile devices type segment is projected to account for significant share during the forecast period. Launch of innovative electronic mobile gadgets enables companies to meet the rising demand for modern devices among tech-enthusiast consumers. This, in turn, is boosting the demand for secondhand mobile devices such as wearable devices, e-readers, portable gaming devices, and portable navigation devices in Europe.

The number of people immigrating from one place to another is rising in Europe. This is fueling the demand for secondhand mobile devices, as these are available at a lower cost than new devices.

As per the Europe secondhand electronic products market analysis, Germany is estimated to account for the major share of the regional landscape during the forecast period.

Increase in population and rise in awareness about sustainable products are key factors fueling market development in Germany. Surge in availability of secondhand electronic products and growth in the e-commerce sector are also contributing to market progress in the country.

As per the Europe secondhand electronic products market research analysis, companies are adopting strategies such as R&D investments, product expansions, and mergers & acquisitions to gain incremental opportunities.

CEX, Back Market, Music Magpie, Cash Converters, Clevertronic, Mobile Up, Rebuydeal, Zapper, Swappa, and Buy Green are prominent players operating in the market. These companies are following the latest secondhand electronic products industry trends in Europe to strengthen their market position.

Key players have been profiled in the Europe secondhand electronic products market report based on parameters such as financial overview, business segments, product portfolio, latest developments, business strategies, and company overview.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 78.9 Bn |

|

Market Forecast Value in 2031 |

US$ 225.5 Bn |

|

Growth Rate (CAGR) |

12.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. Furthermore, at the country level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 78.9 Bn in 2022

The CAGR is estimated to be 12.6% during 2023 to 2031

Rise in inclination toward sustainable products and growth in the e-commerce sector

The mobile devices type segment accounted for major share in 2022

Demand for secondhand electronic products is anticipated to be high in Germany in the near future

CEX, Back Market, Music Magpie, Cash Converters, Clevertronic, Mobile Up, Rebuydeal, Zapper, Swappa, and Buy Green

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Europe Secondhand Electronic Products Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projection (US$ Mn)

5.8.2. Market Volume Projection (Thousand Units)

6. Europe Secondhand Electronic Products Market Analysis and Forecast, By Type

6.1. Europe Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

6.1.1. Mobile Devices

6.1.2. Tablets

6.1.3. Smart Watches

6.1.4. Computers & Laptops

6.1.5. TVs

6.1.6. Cameras & Lenses

6.1.7. Games & Entertainment

6.1.8. Printers & Monitors

6.1.9. Computer Accessories

6.1.10. Washing Machines

6.1.11. Refrigerators

6.1.12. Others

6.2. Incremental Opportunity, By Type

7. Europe Secondhand Electronic Products Market Analysis and Forecast, By Brand Type

7.1. Europe Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Brand Type, 2017 - 2031

7.1.1. Luxury/Premium

7.1.2. Non-luxury

7.2. Incremental Opportunity, By Brand Type

8. Europe Secondhand Electronic Products Market Analysis and Forecast, By End-user

8.1. Europe Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

8.1.1. Individual

8.1.2. Commercial

8.2. Incremental Opportunity, By End Use

9. Europe Secondhand Electronic Products Market Analysis and Forecast, By Distribution Channel

9.1. Europe Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

9.1.1. Online

9.1.2. Offline

9.2. Incremental Opportunity, By Distribution Channel

10. Europe Secondhand Electronic Products Market Analysis and Forecast, Region

10.1. Europe Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Country, 2017 - 2031

10.1.1. Germany

10.1.2. U.K.

10.1.3. France

10.1.4. Italy

10.1.5. Spain

10.1.6. Rest of Europe

10.2. Incremental Opportunity, By Country

11. Germany Secondhand Electronic Products Market Analysis and Forecast

11.1. Country Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Brand Analysis

11.4. Consumer Buying Behavior Analysis

11.4.1. Brand Awareness

11.4.2. Average Spend

11.4.3. Purchasing Factors

11.5. Key Trends Analysis

11.5.1. Demand Side Analysis

11.5.2. Supply Side Analysis

11.6. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

11.6.1. Mobile Devices

11.6.2. Tablets

11.6.3. Smart Watches

11.6.4. Computers & Laptops

11.6.5. TVs

11.6.6. Cameras & Lenses

11.6.7. Games & Entertainment

11.6.8. Printers & Monitors

11.6.9. Computer Accessories

11.6.10. Washing Machines

11.6.11. Refrigerators

11.6.12. Others

11.7. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Brand Type, 2017 - 2031

11.7.1. Luxury/Premium

11.7.2. Non-luxury

11.8. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

11.8.1. Individual

11.8.2. Commercial

11.9. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

11.9.1. Online

11.9.2. Offline

12. U.K. Secondhand Electronic Products Market Analysis and Forecast

12.1. Country Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Brand Analysis

12.4. Consumer Buying Behavior Analysis

12.4.1. Brand Awareness

12.4.2. Average Spend

12.4.3. Purchasing Factors

12.5. Key Trends Analysis

12.5.1. Demand Side Analysis

12.5.2. Supply Side Analysis

12.6. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

12.6.1. Mobile Devices

12.6.2. Tablets

12.6.3. Smart Watches

12.6.4. Computers & Laptops

12.6.5. TVs

12.6.6. Cameras & Lenses

12.6.7. Games & Entertainment

12.6.8. Printers & Monitors

12.6.9. Computer Accessories

12.6.10. Washing Machines

12.6.11. Refrigerators

12.6.12. Others

12.7. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Brand Type, 2017 - 2031

12.7.1. Luxury/Premium

12.7.2. Non-luxury

12.8. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

12.8.1. Individual

12.8.2. Commercial

12.9. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

12.9.1. Online

12.9.2. Offline

13. France Secondhand Electronic Products Market Analysis and Forecast

13.1. Country Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Brand Analysis

13.4. Consumer Buying Behavior Analysis

13.4.1. Brand Awareness

13.4.2. Average Spend

13.4.3. Purchasing Factors

13.5. Key Trends Analysis

13.5.1. Demand Side Analysis

13.5.2. Supply Side Analysis

13.6. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

13.6.1. Mobile Devices

13.6.2. Tablets

13.6.3. Smart Watches

13.6.4. Computers & Laptops

13.6.5. TVs

13.6.6. Cameras & Lenses

13.6.7. Games & Entertainment

13.6.8. Printers & Monitors

13.6.9. Computer Accessories

13.6.10. Washing Machines

13.6.11. Refrigerators

13.6.12. Others

13.7. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Brand Type, 2017 - 2031

13.7.1. Luxury/Premium

13.7.2. Non-luxury

13.8. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

13.8.1. Individual

13.8.2. Commercial

13.9. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

13.9.1. Online

13.9.2. Offline

14. Italy Secondhand Electronic Products Market Analysis and Forecast

14.1. Country Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Brand Analysis

14.4. Consumer Buying Behavior Analysis

14.4.1. Brand Awareness

14.4.2. Average Spend

14.4.3. Purchasing Factors

14.5. Key Trends Analysis

14.5.1. Demand Side Analysis

14.5.2. Supply Side Analysis

14.6. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

14.6.1. Mobile Devices

14.6.2. Tablets

14.6.3. Smart Watches

14.6.4. Computers & Laptops

14.6.5. TVs

14.6.6. Cameras & Lenses

14.6.7. Games & Entertainment

14.6.8. Printers & Monitors

14.6.9. Computer Accessories

14.6.10. Washing Machines

14.6.11. Refrigerators

14.6.12. Others

14.7. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Brand Type, 2017 - 2031

14.7.1. Luxury/Premium

14.7.2. Non-luxury

14.8. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

14.8.1. Individual

14.8.2. Commercial

14.9. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

14.9.1. Online

14.9.2. Offline

15. Spain Secondhand Electronic Products Market Analysis and Forecast

15.1. Country Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Brand Analysis

15.4. Consumer Buying Behavior Analysis

15.4.1. Brand Awareness

15.4.2. Average Spend

15.4.3. Purchasing Factors

15.5. Key Trends Analysis

15.5.1. Demand Side Analysis

15.5.2. Supply Side Analysis

15.6. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

15.6.1. Mobile Devices

15.6.2. Tablets

15.6.3. Smart Watches

15.6.4. Computers & Laptops

15.6.5. TVs

15.6.6. Cameras & Lenses

15.6.7. Games & Entertainment

15.6.8. Printers & Monitors

15.6.9. Computer Accessories

15.6.10. Washing Machines

15.6.11. Refrigerators

15.6.12. Others

15.7. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Brand Type, 2017 - 2031

15.7.1. Luxury/Premium

15.7.2. Non-luxury

15.8. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By End-user, 2017 - 2031

15.8.1. Individual

15.8.2. Commercial

15.9. Secondhand Electronic Products Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

15.9.1. Online

15.9.2. Offline

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis (%), 2022

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

16.3.1. CEX

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Financial/Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Sales Channel Analysis

16.3.1.6. Size Portfolio

16.3.2. Back Market

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Financial/Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Sales Channel Analysis

16.3.2.6. Size Portfolio

16.3.3. Music Magpie

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Financial/Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Sales Channel Analysis

16.3.3.6. Size Portfolio

16.3.4. Cash Converters

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Financial/Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Sales Channel Analysis

16.3.4.6. Size Portfolio

16.3.5. Clevertronic

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Financial/Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Sales Channel Analysis

16.3.5.6. Size Portfolio

16.3.6. Mobile Up

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Financial/Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Sales Channel Analysis

16.3.6.6. Size Portfolio

16.3.7. Rebuydeal

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Financial/Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Sales Channel Analysis

16.3.7.6. Size Portfolio

16.3.8. Zapper

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Financial/Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Sales Channel Analysis

16.3.8.6. Size Portfolio

16.3.9. Swappa

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Financial/Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Sales Channel Analysis

16.3.9.6. Size Portfolio

16.3.10. Buy Green

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Financial/Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Sales Channel Analysis

16.3.10.6. Size Portfolio

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Understanding the Buying Process of the Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Europe Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Table 2: Europe Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Table 3: Europe Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Table 4: Europe Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Table 5: Europe Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Table 6: Europe Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Table 7: Europe Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Table 8: Europe Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

Table 9: Europe Secondhand Electronic Products Market, By Country, Thousand Units, 2017-2031

Table 10: Europe Secondhand Electronic Products Market, By Country, US$ Mn, 2017-2031

Table 11: Germany Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Table 12: Germany Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Table 13: Germany Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Table 14: Germany Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Table 15: Germany Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Table 16: Germany Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Table 17: Germany Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Table 18: Germany Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

Table 19: U.K. Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Table 20: U.K. Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Table 21: U.K. Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Table 22: U.K. Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Table 23: U.K. Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Table 24: U.K. Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Table 25: U.K. Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Table 26: U.K. Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

Table 27: France Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Table 28: France Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Table 29: France Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Table 30: France Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Table 31: France Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Table 32: France Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Table 33: France Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Table 34: France Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

Table 35: Italy Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Table 36: Italy Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Table 37: Italy Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Table 38: Italy Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Table 39: Italy Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Table 40: Italy Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Table 41: Italy Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Table 42: Italy Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

Table 43: Spain Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Table 44: Spain Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Table 45: Spain Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Table 46: Spain Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Table 47: Spain Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Table 48: Spain Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Table 49: Spain Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Table 50: Spain Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

List of Figures

Figure 1: Europe Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Figure 2: Europe Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Figure 3: Europe Secondhand Electronic Products Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 4: Europe Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Figure 5: Europe Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Figure 6: Europe Secondhand Electronic Products Market Incremental Opportunity, By Brand Type, US$ Mn, 2017-2031

Figure 7: Europe Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Figure 8: Europe Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Figure 9: Europe Secondhand Electronic Products Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031

Figure 10: Europe Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 11: Europe Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 12: Europe Secondhand Electronic Products Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 13: Europe Secondhand Electronic Products Market, By Country, Thousand Units, 2017-2031

Figure 14: Europe Secondhand Electronic Products Market, By Country, US$ Mn, 2017-2031

Figure 15: Europe Secondhand Electronic Products Market Incremental Opportunity, By Country, US$ Mn, 2017-2031

Figure 16: Germany Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Figure 17: Germany Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Figure 18: Germany Secondhand Electronic Products Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 19: Germany Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Figure 20: Germany Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Figure 21: Germany Secondhand Electronic Products Market Incremental Opportunity, By Brand Type, US$ Mn, 2017-2031

Figure 22: Germany Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Figure 23: Germany Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Figure 24: Germany Secondhand Electronic Products Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031

Figure 25: Germany Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 26: Germany Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 27: Germany Secondhand Electronic Products Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 28: U.K. Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Figure 29: U.K. Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Figure 30: U.K. Secondhand Electronic Products Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 31: U.K. Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Figure 32: U.K. Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Figure 33: U.K. Secondhand Electronic Products Market Incremental Opportunity, By Brand Type, US$ Mn, 2017-2031

Figure 34: U.K. Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Figure 35: U.K. Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Figure 36: U.K. Secondhand Electronic Products Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031

Figure 37: U.K. Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 38: U.K. Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 39: U.K. Secondhand Electronic Products Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 40: France Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Figure 41: France Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Figure 42: France Secondhand Electronic Products Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 43: France Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Figure 44: France Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Figure 45: France Secondhand Electronic Products Market Incremental Opportunity, By Brand Type, US$ Mn, 2017-2031

Figure 46: France Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Figure 47: France Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Figure 48: France Secondhand Electronic Products Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031

Figure 49: France Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 50: France Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 51: France Secondhand Electronic Products Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 52: Italy Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Figure 53: Italy Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Figure 54: Italy Secondhand Electronic Products Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 55: Italy Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Figure 56: Italy Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Figure 57: Italy Secondhand Electronic Products Market Incremental Opportunity, By Brand Type, US$ Mn, 2017-2031

Figure 58: Italy Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Figure 59: Italy Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Figure 60: Italy Secondhand Electronic Products Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031

Figure 61: Italy Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 62: Italy Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 63: Italy Secondhand Electronic Products Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 64: Spain Secondhand Electronic Products Market, By Type, Thousand Units, 2017-2031

Figure 65: Spain Secondhand Electronic Products Market, By Type, US$ Mn, 2017-2031

Figure 66: Spain Secondhand Electronic Products Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 67: Spain Secondhand Electronic Products Market, By Brand Type, Thousand Units, 2017-2031

Figure 68: Spain Secondhand Electronic Products Market, By Brand Type, US$ Mn, 2017-2031

Figure 69: Spain Secondhand Electronic Products Market Incremental Opportunity, By Brand Type, US$ Mn, 2017-2031

Figure 70: Spain Secondhand Electronic Products Market, By End-user, Thousand Units, 2017-2031

Figure 71: Spain Secondhand Electronic Products Market, By End-user, US$ Mn, 2017-2031

Figure 72: Spain Secondhand Electronic Products Market Incremental Opportunity, By End-user, US$ Mn, 2017-2031

Figure 73: Spain Secondhand Electronic Products Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 74: Spain Secondhand Electronic Products Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 75: Spain Secondhand Electronic Products Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031