Europe Polyurethane Dispersions Market – An Overview

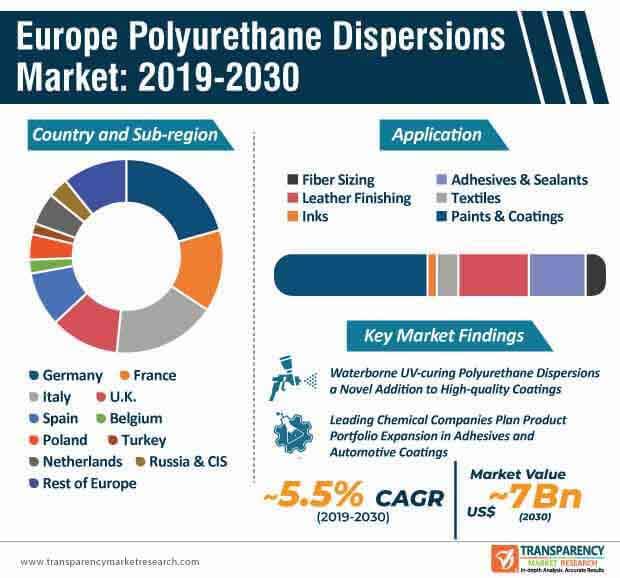

Demand for polyurethane dispersions is growing and as per Transparency Market Research the growth curve in the Europe region will be sturdy. It is significant to note here that in the Europe Polyurethane dispersions market, numerous factors will support this growth such as production of modern cars and growing demand for adhesives and sealants. This will therefore create a number of growth opportunities for companies operating in the market.

Some of the notable developments in the Europe Polyurethane Dispersions Market are mentioned below. These are creating the future of the market in a major way. A glimpse into trends and drivers is also provided below so a better understanding of market dynamics is grasped.

Manufacturers Bolster Credibility by Introducing Environment-friendly Water-based Systems

Rapid production of modern cars has created a demand for a mixture of materials. Apart from steel and aluminum, carmakers are harnessing the advantages of plastic materials. Likewise, leading chemical companies in the Europe polyurethane dispersions market are keen on expanding their portfolio in adhesives and automotive coatings to generate revenue streams. For instance, leading German chemical company BASF SE — announced to invest in the capacity expansion of water-based polyurethane dispersions (PUDs) at its production facility in Castellbisbal, Spain.

Companies in the Europe polyurethane dispersions market are tapping opportunities in automotive and industrial coatings. This is evident since paint & coating application segment is projected for exponential growth and the Europe polyurethane dispersions market is expected to reach a value of ~US$ 7 Bn by the end of 2030. Manufacturers in the market for polyurethane dispersions in Europe are aiming to increase their production capacities to strengthen their supply chains of high-quality polyurethane dispersions. They are increasing their focus in adhesives and coatings to support the preference from solvent-based coating systems to more environmental-friendly water-based systems.

Waterborne Polyurethane Coatings Acquire Prominence in Wood Flooring Applications

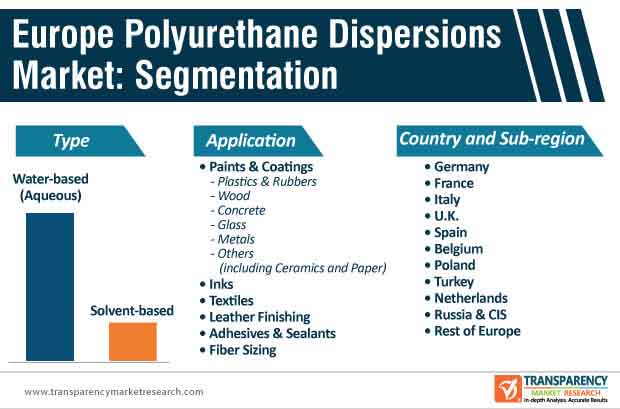

The demand for wood flooring coatings is estimated to progress at a steady rate. Likewise, one-component (1K) solventborne and two-component (2K) waterborne (WB) polyurethane (PUR) coatings are gaining prominence in residential and commercial sectors. The ever-growing construction sector is another key driver that is contributing toward the growth of the Europe polyurethane dispersions market. As such, water-based systems are being pervasively used in new unfinished wood floor installations as well as for the restoration of existing wood floors in construction. This is evident since water-based type segment is anticipated for exponential growth in the market for polyurethane dispersions in Europe.

Polyurethane-coated floors are being highly publicized, owing to their excellent durability and desirable aesthetic looks. Due to strict environmental regulations, manufacturers in the market for polyurethane dispersions in Europe are increasing their production capacities to develop low-VOC (Volatile Organic Compound) and low-odor coatings. Hence, manufacturers in the Europe polyurethane dispersions market are increasing the availability of high-performance waterborne polyurethane coatings.

Companies Spark Interest in Traditional Bio-based Binders for Novel Adhesive Technologies

The demand for bio-based materials is surging due to increased awareness about environmental footprint in the market for polyurethane dispersions in Europe. This is also true in the field of adhesives, as manufacturers are increasing their efficacy to source renewable materials. As such, adhesives & sealants application segment is expected to witness considerable growth in terms of revenue in the Europe polyurethane dispersions market. However, sustainability is one of the main concerns in the field of bio-based materials, since it is challenging to incorporate new materials as drop-in replacements in existing technologies. This the modest growth of the Europe polyurethane dispersions market, which is anticipated to progress at a rate of 5.5% during the forecast period. Hence, manufacturers are focusing on new molecular architectures to overcome the limitations associated with bio-based resources.

Companies in the market for polyurethane dispersions in Europe are innovating in novel adhesive technologies by sparking interest in traditional bio-based binders such as starch and renewable rubber to comply with strict regulatory norms.

Uncompromised Performance Forms Key Success Factor for Development of PUDs

Solvent-free waterborne PUDs are growing popular as low/no VOC solutions for novel coatings and adhesives. Companies are aiming to bolster their credibility in the Europe polyurethane dispersions market by increasing the availability of coatings and adhesives that offer stable and precise performance properties that align with specific cost requirements of end users. For instance, Perstorp-a Swedish company dealing in specialty chemicals, has a rich portfolio in PUDs such as Oxymer™, Ymer™ and Bis-MPA™ plus renewable polyalcohols that offer the required flexibility to resin producers.

Uncompromised performance and enhanced sustainability are becoming the key focus points for companies in the Europe polyurethane dispersions market. Due to tighter environmental and health legislations, water-based dispersions are being highly preferred in the market for polyurethane dispersions in Europe. With the availability of innovative PUDs, manufacturers can create extremely versatile and high performance coating systems.

Analysts’ Viewpoint

The Europe polyurethane dispersions market is continuously growing due to high presence of fragmented players, accounting for ~58% of the market stake. Hence, manufacturers are competing to increase the availability of PUDs with customizable properties and that offer the required flexibility and durability to end users in demanding applications.

Bio-based materials are increasingly replacing petroleum-based resources for the development of adhesives. However, in the current scenario, large-scale commercialization of bio-based adhesives has led to additional costs associated with the implementation of materials in existing technologies. Hence, companies should increase their focus in plant-based materials to induce properties that favor densely cross-linked networks and adhesion to a variety of substrates.

Europe Polyurethane Dispersions Market: Overview

Europe Polyurethane Dispersions Market: Key Drivers and Restraints

Europe Polyurethane Dispersions Market: Key Type Segment

Europe Polyurethane Dispersions Market: Prominent Application Segment

Europe Polyurethane Dispersions Market: Major Business Strategies

Europe Polyurethane Dispersions Market: Competition Landscape

1. Executive Summary

1.1. Europe Polyurethane Dispersions Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments/Product Timeline

2.3. Key Market Indicators/Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Europe Polyurethane Dispersions Market Analysis and Forecast, 2018

2.5.1. Europe Polyurethane Dispersions Market Volume (Tons)

2.5.2. Europe Polyurethane Dispersions Market Value (US$ Mn)

2.6. Porters Five Forces Analysis

2.7. Regulatory Landscape

2.8. Value Chain Analysis

2.8.1. List of Key Manufacturers

2.8.2. List of Potential Customers

3. Europe Production Output Analysis, 2018–2027

3.1. By Region

4. Import-Export Analysis

4.1. Import Statistics for HS Code: 390950

5. Polyurethane Dispersions Price Trend Analysis, 2018–2027

5.1. Price Comparison Analysis, by Country

6. Europe Market Outlook

6.1. Europe – Key Findings

6.2. Europe Polyurethane Dispersions Market Regional Outlook

7. Europe Polyurethane Dispersions Market Analysis and Forecast, by Type

7.1. Europe Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

7.1.1. Water-based (Aqueous)

7.1.2. Solvent-based

7.2. Europe Polyurethane Dispersions Market Attractiveness Analysis, by Type

8. Europe Polyurethane Dispersions Market Analysis and Forecast, by Application

8.1. Europe Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

8.1.1. Paints & Coatings

8.1.1.1. Wood

8.1.1.2. Concrete

8.1.1.3. Glass

8.1.1.4. Metals

8.1.1.5. Others (including Ceramics and Paper)

8.1.2. Inks

8.1.3. Textiles

8.1.4. Leather Finishing

8.1.5. Adhesives and Sealants

8.1.6. Fiber Sizing

8.2. Europe Polyurethane Dispersions Market Attractiveness Analysis, by Application

9. Europe Polyurethane Dispersions Market Analysis and Forecast, by Country and Sub-region

9.1. Europe Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn), by Country and Sub-region, 2018–2027

9.1.1. Germany

9.1.2. France

9.1.3. U.K.

9.1.4. Italy

9.1.5. Spain

9.1.6. Belgium

9.1.7. Poland

9.1.8. Turkey

9.1.9. Netherland

9.1.10. Russia & CIS

9.1.11. Rest of Europe

9.2. Europe Polyurethane Dispersions Market Attractiveness Analysis, by Country and Sub-region

9.3. Germany Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

9.3.1. Water-based (Aqueous)

9.3.2. Solvent-based

9.4. Germany Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.4.1. Paints & Coatings

9.4.1.1. Wood

9.4.1.2. Concrete

9.4.1.3. Glass

9.4.1.4. Metals

9.4.1.5. Others (including Ceramics and Paper)

9.4.2. Inks

9.4.3. Textiles

9.4.4. Leather Finishing

9.4.5. Adhesives and Sealants

9.4.6. Fiber Sizing

9.5. U.K. Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

9.5.1. Water-based (Aqueous)

9.5.2. Solvent-based

9.6. U.K. Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.6.1. Paints & Coatings

9.6.1.1. Wood

9.6.1.2. Concrete

9.6.1.3. Glass

9.6.1.4. Metals

9.6.1.5. Others (including Ceramics and Paper)

9.6.2. Inks

9.6.3. Textiles

9.6.4. Leather Finishing

9.6.5. Adhesives and Sealants

9.6.6. Fiber Sizing

9.7. France Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

9.7.1. Water-based (Aqueous)

9.7.2. Solvent-based

9.8. France Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.8.1. Paints & Coatings

9.8.1.1. Wood

9.8.1.2. Concrete

9.8.1.3. Glass

9.8.1.4. Metals

9.8.1.5. Others (including Ceramics and Paper)

9.8.2. Inks

9.8.3. Textiles

9.8.4. Leather Finishing

9.8.5. Adhesives and Sealants

9.8.6. Fiber Sizing

9.9. Italy Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

9.9.1. Water-based (Aqueous)

9.9.2. Solvent-based

9.10. Italy Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.10.1. Paints & Coatings

9.10.1.1. Wood

9.10.1.2. Concrete

9.10.1.3. Glass

9.10.1.4. Metals

9.10.1.5. Others (including Ceramics and Paper)

9.10.2. Inks

9.10.3. Textiles

9.10.4. Leather Finishing

9.10.5. Adhesives and Sealants

9.10.6. Fiber Sizing

9.11. Belgium Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

9.11.1. Water-based (Aqueous)

9.11.2. Solvent-based

9.12. Belgium Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.12.1. Paints & Coatings

9.12.1.1. Wood

9.12.1.2. Concrete

9.12.1.3. Glass

9.12.1.4. Metals

9.12.1.5. Others (including Ceramics and Paper)

9.12.2. Inks

9.12.3. Textiles

9.12.4. Leather Finishing

9.12.5. Adhesives and Sealants

9.12.6. Fiber Sizing

9.13. Poland Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

9.13.1. Water-based (Aqueous)

9.13.2. Solvent-based

9.14. Poland Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.14.1. Paints & Coatings

9.14.1.1. Wood

9.14.1.2. Concrete

9.14.1.3. Glass

9.14.1.4. Metals

9.14.1.5. Others (including Ceramics and Paper)

9.14.2. Inks

9.14.3. Textiles

9.14.4. Leather Finishing

9.14.5. Adhesives and Sealants

9.14.6. Fiber Sizing

9.15. Turkey Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

9.15.1. Water-based (Aqueous)

9.15.2. Solvent-based

9.16. Turkey Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.16.1. Paints & Coatings

9.16.1.1. Wood

9.16.1.2. Concrete

9.16.1.3. Glass

9.16.1.4. Metals

9.16.1.5. Others (including Ceramics and Paper)

9.16.2. Inks

9.16.3. Textiles

9.16.4. Leather Finishing

9.16.5. Adhesives and Sealants

9.16.6. Fiber Sizing

9.17. Spain Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

9.17.1. Water-based (Aqueous)

9.17.2. Solvent-based

9.18. Spain Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.18.1. Paints & Coatings

9.18.1.1. Wood

9.18.1.2. Concrete

9.18.1.3. Glass

9.18.1.4. Metals

9.18.1.5. Others (including Ceramics and Paper)

9.18.2. Inks

9.18.3. Textiles

9.18.4. Leather Finishing

9.18.5. Adhesives and Sealants

9.18.6. Fiber Sizing

9.19. Netherlands Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

9.19.1. Water-based (Aqueous)

9.19.2. Solvent-based

9.20. Netherlands Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.20.1. Paints & Coatings

9.20.1.1. Wood

9.20.1.2. Concrete

9.20.1.3. Glass

9.20.1.4. Metals

9.20.1.5. Others (including Ceramics and Paper)

9.20.2. Inks

9.20.3. Textiles

9.20.4. Leather Finishing

9.20.5. Adhesives and Sealants

9.20.6. Fiber Sizing

9.21. Russia & CIS Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

9.21.1. Water-based (Aqueous)

9.21.2. Solvent-based

9.22. Russia & CIS Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.22.1. Paints & Coatings

9.22.1.1. Wood

9.22.1.2. Concrete

9.22.1.3. Glass

9.22.1.4. Metals

9.22.1.5. Others (including Ceramics and Paper)

9.22.2. Inks

9.22.3. Textiles

9.22.4. Leather Finishing

9.22.5. Adhesives and Sealants

9.22.6. Fiber Sizing

9.23. Rest of Europe Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

9.23.1. Water-based (Aqueous)

9.23.2. Solvent-based

9.24. Rest of Europe Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

9.24.1. Paints & Coatings

9.24.1.1. Wood

9.24.1.2. Concrete

9.24.1.3. Glass

9.24.1.4. Metals

9.24.1.5. Others (including Ceramics and Paper)

9.24.2. Inks

9.24.3. Textiles

9.24.4. Leather Finishing

9.24.5. Adhesives and Sealants

9.24.6. Fiber Sizing

10. Competition Landscape

10.1. Competition Matrix, by Key Players

10.2. Europe Polyurethane Dispersions Market Share Analysis, by Company (2018)

10.3. Market Footprint Analysis

10.3.1. By Type

10.4. Competitive Business Strategies

10.5. Competitive Benchmarking

10.5.1. By Strategy

10.5.2. By Brands

10.6. Company Profiles

10.6.1. BASF SE

10.6.1.1. Company Description

10.6.1.2. Business Overview

10.6.1.3. Product Portfolio

10.6.1.4. Financial Overview

10.6.1.5. Strategic Overview

10.6.2. LANXESS

10.6.2.1. Company Description

10.6.2.2. Business Overview

10.6.2.3. Product Portfolio

10.6.2.4. Financial Overview

10.6.2.5. Strategic Overview

10.6.3. Perstorp

10.6.3.1. Company Description

10.6.3.2. Business Overview

10.6.3.3. Product Portfolio

10.6.3.4. Financial Overview

10.6.3.5. Strategic Overview

10.6.4. Evonik Industries AG

10.6.4.1. Company Description

10.6.4.2. Business Overview

10.6.4.3. Product Portfolio

10.6.4.4. Financial Overview

10.6.5. Covestro AG

10.6.5.1. Company Description

10.6.5.2. Business Overview

10.6.5.3. Product Portfolio

10.6.5.4. Financial Overview

10.6.5.5. Strategic Overview

10.6.6. Chase Corp

10.6.6.1. Company Description

10.6.6.2. Business Overview

10.6.6.3. Product Portfolio

10.6.6.4. Financial Overview

10.6.6.5. Strategic Overview

10.6.7. Mitsui Chemicals, Inc.

10.6.7.1. Company Description

10.6.7.2. Business Overview

10.6.7.3. Product Portfolio

10.6.7.4. Financial Overview

10.6.8. Wanhua Chemical Group Co., Ltd.

10.6.8.1. Company Description

10.6.8.2. Business Overview

10.6.8.3. Product Portfolio

10.6.8.4. Financial Overview

10.6.8.5. Strategic Overview

10.6.9. Alberdingk Boley

10.6.9.1. Company Description

10.6.9.2. Business Overview

10.6.9.3. Product Portfolio

10.6.9.4. Strategic Overview

10.6.10. C. L. Hauthaway & Sons Corp.

10.6.10.1. Company Description

10.6.10.2. Business Overview

10.6.10.3. Product Portfolio

10.6.10.4. Strategic Overview

10.6.11. Coim Group

10.6.11.1. Company Description

10.6.11.2. Business Overview

10.6.11.3. Product Portfolio

10.6.12. Lamberti S.p.A.

10.6.12.1. Company Description

10.6.12.2. Business Overview

10.6.12.3. Product Portfolio

10.6.12.4. Strategic Overview

10.6.13. Sun Chemical

10.6.13.1. Company Description

10.6.13.2. Business Overview

10.6.13.3. Product Portfolio

10.6.13.4. Financial Overview

10.6.13.5. Strategic Overview

10.6.14. The Lubrizol Corporation

10.6.14.1. Company Description

10.6.14.2. Business Overview

10.6.14.3. Product Portfolio

10.6.14.4. Financial Overview

10.6.14.5. Strategic Overview

11. Key Primary Insights

List of Tables

Table 1 Europe Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 2 Europe Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 3 Europe Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 4 Germany Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 5 Germany Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 6 U.K. Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 7 U.K. Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 8 France Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 9 France Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 10 Italy Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 11 Italy Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 12 Belgium Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 13 Belgium Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 14 Poland Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 15 Poland Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 16 Turkey Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 17 Turkey Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 18 Spain Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 19 Spain Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 20 Netherlands Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 21 Netherlands Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 22 Russia & CIS Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 23 Russia & CIS Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 24 Rest of Europe Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2018–2027

Table 25 Rest of Europe Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 1 Europe Polyurethane Dispersions Market Share Analysis, by Type

Figure 2 Europe Polyurethane Dispersions Market Attractiveness Analysis, by Type

Figure 3 Europe Polyurethane Dispersions Market Volume (Tons) and Value (US$ Mn), 2018–2027

Figure 4 Europe Polyurethane Dispersions Market Share Analysis, by Application

Figure 5 Europe Polyurethane Dispersions Market Attractiveness Analysis, by Application

Figure 6 Europe Polyurethane Dispersions Market Share Analysis, by Country and Sub-region

Figure 7 Europe Polyurethane Dispersions Market Attractiveness Analysis, by Country and Sub-region