Analyst Viewpoint

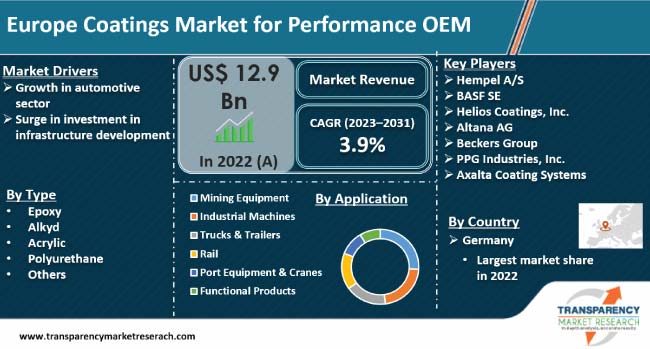

Growth in automotive sector and surge in investment in infrastructure development are expected to propel the market size during the forecast period. Antibacterial and high-performance protective coatings are gaining traction in the healthcare sector due to growth in cases of viral and bacterial infections. Demand for bio-based coatings is growing in the automotive sector with rise in emphasis on sustainability and circular economy.

Vendors in the sector are investing heavily in the R&D of bio-based coatings to cater to environmentally conscious customers and adhere to stringent regulations. They are also developing graphene-based and specialty coatings for the automotive industry.

Coatings are used to cover any surface or object against various environmental elements such as corrosion, wear and tear, heat, rain, and Ultraviolet (UV) radiation. Some coatings are also employed to limit cross-contamination, especially in the healthcare sector. Epoxy, alkyd, acrylic, and polyurethane are various types of coatings available in the market.

Epoxy coatings are known for their durable and protective characteristics. These coatings are widely utilized to protect metals, composites, and electronics & electrical components. Alkyd, a polyester resin, is water-resistant, environmentally friendly, and less toxic. It is modified by the addition of fatty acids and other components. Acrylic coatings are water-soluble and are mainly used in the construction sector. They are applied to various materials, including wood, fabric, paper mache, and leather.

Coatings are employed in the automotive sector to improve the rolling resistance of tires. They can also reduce the weight of vehicles. Rise in demand for fuel-efficient vehicles is expected to propel the Europe coatings market for performance OEM. According to the European Automobile Producers Association (ACEA), in 2022, Europe recorded the production of 10.9 million passenger cars, registering a 8.3% growth compared to that in 2021.

The construction sector heavily relies on various types of paints & coatings for the decoration and protection of buildings, appliances, and equipment. There are various types of architectural coatings such as organic and inorganic coatings. Some coatings are a mix of organic and inorganic composites.

Surge in investment in infrastructure development is boosting demand for architectural coatings, thereby driving the market revenue. In June 2023, The European Union (EU) announced plans to invest €6.2 Bn in sustainable, safe, and efficient transport infrastructure. Moreover, architectural coatings are gaining traction in several European countries. According to The Observatory of Economic Complexity (OEC), in 2022, paints, varnishes, printing inks, mastics, and similar coatings were France's 65th most traded product, with a total trade of €2.16 Bn.

Implementation of stringent environmental regulations in various end-used industries is boosting demand for eco-friendly paints and coatings in Europe. The EU demands that all polymers and coatings must be biodegradable. At least 90% of the materials present in polymers and coatings have to be broken down to CO2 by biological action within six months. Manufacturers in the Europe coatings industry for performance OEM are investing significantly in the R&D of bio-based coatings to adhere to such regulations and to cater to environmentally conscious customers. In November 2023, AkzoNobel provided KIA Motors with its newly developed bio-based paint for the interiors of KIA Motors’ EV9 electric SUV. Hence, development of bio-based coatings is augmenting the market expansion.

Antibacterial coatings are widely utilized in the healthcare sector to mitigate implant-associated infection. The emergence of the COVID-19 pandemic has led to rise in adoption of innovative methods and technologies to suppress the spread of bacteria and viruses. IN May 2023, a study from the University of Illinois Urbana-Champaign reported the development of smart antimicrobial coatings for surgical orthopedic implants. These coatings can detect strain on the devices to provide early warning of implant failures while destroying infection-causing bacteria. Hence, increase in adoption of antibacterial coatings in the healthcare sector is fueling the market development.

According to the latest Europe coatings market for Performance OEM forecast, Germany is expected to hold largest share from 2023 to 2031. Growth in automotive sector is fueling the market dynamics of the country. The automotive sector in Germany recorded a total revenue volume of €410.9 Bn in 2021, recording a 8% increase on 2020 revenue.

The industry in France is anticipated to grow at a significant pace in the near future. Surge in export of paints & coatings is driving the market statistics in the country. As per the OEC, the exports of paints, varnishes, printing inks, and mastics, and similar coatings in France grew from €1.74 Bn in 2021 to €2.16 Bn in 2022.

Most companies are adopting M&A strategies to expand their market presence. They are also launching new products to increase their market share. Vendors are developing graphene-based coatings that offer scratch-resistant and protection against UV radiation.

Hempel A/S, BASF SE, Helios Coatings, Inc., Altana AG, Beckers Group, PPG Industries, Inc., Axalta Coating Systems, Jotun A/S, Yasar Holding A.S., ALLNEX Netherlands B.V., SilcoTek, Continental Coatings Inc., Sherwin-Williams Company, Akzo Nobel N.V., Nippon Paint Holdings Co., Ltd., and Kansai Paint Co., Ltd. are key players operating in this market.

Each of these companies has been profiled in the Europe coatings market for performance OEM report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 12.9 Bn |

| Market Forecast Value in 2031 | US$ 17.6 Bn |

| Growth Rate (CAGR) | 3.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value and Million Liters for Volume |

| Market Analysis | It includes segment analysis as well as country level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 12.9 Bn in 2022

It is anticipated to grow at a CAGR of 3.9% from 2023 to 2031

It is projected to reach US$ 17.6 Bn by the end of 2031

Growth in automotive sector and surge in investment in infrastructure development

Germany recorded the highest demand in 2022

Hempel A/S, BASF SE, Helios Coatings, Inc., Altana AG, Beckers Group, PPG Industries, Inc., Axalta Coating Systems, Jotun A/S, Yasar Holding A.S., ALLNEX Netherlands B.V., SilcoTek, Continental Coatings Inc., Sherwin-Williams Company, Akzo Nobel N.V., Nippon Paint Holdings Co., Ltd., and Kansai Paint Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Material Analysis

5.7. Industry SWOT Analysis

5.8. Europe Coatings Market for Performance OEM Analysis and Forecast, 2023 - 2031

5.8.1. Market Value Projection (US$ Bn)

5.8.2. Market Volume Projection (Million Liters)

6. Europe Coatings Market for Performance OEM Analysis and Forecast, by Type

6.1. Europe Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Type, 2023- 2031

6.1.1. Rental Epoxy

6.1.2. Alkyd

6.1.3. Acrylic

6.1.4. Polyurethane

6.1.5. Others

6.2. Incremental Opportunity, by Type

7. Europe Coatings Market for Performance OEM Analysis and Forecast, by Application

7.1. Europe Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Application, 2023- 2031

7.1.1. Mining Equipment

7.1.2. Industrial Machines

7.1.3. Trucks & Trailers

7.1.4. Rail

7.1.5. Port Equipment & Cranes

7.1.6. Functional Products

7.2. Incremental Opportunity, by Application

8. Europe Coatings Market for Performance OEM Analysis and Forecast, by Country

8.1. Europe Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Country, 2023- 2031

8.1.1. U.K.

8.1.2. Germany

8.1.3. France

8.1.4. Spain

8.1.5. Italy

8.2. Incremental Opportunity, by Country

9. U.K. Coatings Market for Performance OEM Analysis and Forecast

9.1. Country Snapshot

9.2. Key Brand Analysis

9.3. Consumer Buying Behavior Analysis

9.4. Key Trends Analysis

9.4.1. Supply Side

9.4.2. Demand Side

9.5. Price Trend Analysis

9.5.1. Weighted Average Selling Price (US$)

9.6. Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Type, 2023- 2031

9.6.1. Rental Epoxy

9.6.2. Alkyd

9.6.3. Acrylic

9.6.4. Polyurethane

9.6.5. Others

9.7. Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Application, 2023- 2031

9.7.1. Mining Equipment

9.7.2. Industrial Machines

9.7.3. Trucks & Trailers

9.7.4. Rail

9.7.5. Port Equipment & Cranes

9.7.6. Functional Products

9.8. Incremental Opportunity Analysis

10. Germany Coatings Market for Performance OEM Analysis and Forecast

10.1. Country Snapshot

10.2. Key Brand Analysis

10.3. Consumer Buying Behavior Analysis

10.4. Key Trends Analysis

10.4.1. Supply Side

10.4.2. Demand Side

10.5. Price Trend Analysis

10.5.1. Weighted Average Selling Price (US$)

10.6. Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Type, 2023- 2031

10.6.1. Rental Epoxy

10.6.2. Alkyd

10.6.3. Acrylic

10.6.4. Polyurethane

10.6.5. Others

10.7. Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Application, 2023- 2031

10.7.1. Mining Equipment

10.7.2. Industrial Machines

10.7.3. Trucks & Trailers

10.7.4. Rail

10.7.5. Port Equipment & Cranes

10.7.6. Functional Products

10.8. Incremental Opportunity Analysis

11. France Coatings Market for Performance OEM Analysis and Forecast

11.1. Country Snapshot

11.2. Key Brand Analysis

11.3. Consumer Buying Behavior Analysis

11.4. Key Trends Analysis

11.4.1. Supply Side

11.4.2. Demand Side

11.5. Price Trend Analysis

11.5.1. Weighted Average Selling Price (US$)

11.6. Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Type, 2023- 2031

11.6.1. Rental Epoxy

11.6.2. Alkyd

11.6.3. Acrylic

11.6.4. Polyurethane

11.6.5. Others

11.7. Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Application, 2023- 2031

11.7.1. Mining Equipment

11.7.2. Industrial Machines

11.7.3. Trucks & Trailers

11.7.4. Rail

11.7.5. Port Equipment & Cranes

11.7.6. Functional Products

11.8. Incremental Opportunity Analysis

12. Spain Coatings Market for Performance OEM Analysis and Forecast

12.1. Country Snapshot

12.2. Key Brand Analysis

12.3. Consumer Buying Behavior Analysis

12.4. Key Trends Analysis

12.4.1. Supply Side

12.4.2. Demand Side

12.5. Price Trend Analysis

12.5.1. Weighted Average Selling Price (US$)

12.6. Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Type, 2023- 2031

12.6.1. Rental Epoxy

12.6.2. Alkyd

12.6.3. Acrylic

12.6.4. Polyurethane

12.6.5. Others

12.7. Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Application, 2023- 2031

12.7.1. Mining Equipment

12.7.2. Industrial Machines

12.7.3. Trucks & Trailers

12.7.4. Rail

12.7.5. Port Equipment & Cranes

12.7.6. Functional Products

12.8. Incremental Opportunity Analysis

13. Italy Coatings Market for Performance OEM Analysis and Forecast

13.1. Country Snapshot

13.2. Key Brand Analysis

13.3. Consumer Buying Behavior Analysis

13.4. Key Trends Analysis

13.4.1. Supply Side

13.4.2. Demand Side

13.5. Price Trend Analysis

13.5.1. Weighted Average Selling Price (US$)

13.6. Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Type, 2023- 2031

13.6.1. Rental Epoxy

13.6.2. Alkyd

13.6.3. Acrylic

13.6.4. Polyurethane

13.6.5. Others

13.7. Coatings Market for Performance OEM Size (US$ Bn) (Million Liters), by Application, 2023- 2031

13.7.1. Mining Equipment

13.7.2. Industrial Machines

13.7.3. Trucks & Trailers

13.7.4. Rail

13.7.5. Port Equipment & Cranes

13.7.6. Functional Products

13.8. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Competition Dashboard

14.2. Market Share Analysis % (2022)

14.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

14.3.1. Hempel A/S

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. Financial Information

14.3.1.4. (Subject to Data Availability)

14.3.1.5. Business Strategies / Recent Developments

14.3.2. BASF SE

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. Financial Information

14.3.2.4. (Subject to Data Availability)

14.3.2.5. Business Strategies / Recent Developments

14.3.3. Helios Coatings, Inc.

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. Financial Information

14.3.3.4. (Subject to Data Availability)

14.3.3.5. Business Strategies / Recent Developments

14.3.4. Altana AG

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. Financial Information

14.3.4.4. (Subject to Data Availability)

14.3.4.5. Business Strategies / Recent Developments

14.3.5. Beckers Group

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. Financial Information

14.3.5.4. (Subject to Data Availability)

14.3.5.5. Business Strategies / Recent Developments

14.3.6. PPG Industries, Inc.

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. Financial Information

14.3.6.4. (Subject to Data Availability)

14.3.6.5. Business Strategies / Recent Developments

14.3.7. Axalta Coating Systems

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. Financial Information

14.3.7.4. (Subject to Data Availability)

14.3.7.5. Business Strategies / Recent Developments

14.3.8. Jotun A/S

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. Financial Information

14.3.8.4. (Subject to Data Availability)

14.3.8.5. Business Strategies / Recent Developments

14.3.9. Yasar Holding A.S.

14.3.9.1. Company Overview

14.3.9.2. Product Portfolio

14.3.9.3. Financial Information

14.3.9.4. (Subject to Data Availability)

14.3.9.5. Business Strategies / Recent Developments

14.3.10. ALLNEX Netherlands B.V.

14.3.10.1. Company Overview

14.3.10.2. Product Portfolio

14.3.10.3. Financial Information

14.3.10.4. (Subject to Data Availability)

14.3.10.5. Business Strategies / Recent Developments

14.3.11. SilcoTek

14.3.11.1. Company Overview

14.3.11.2. Product Portfolio

14.3.11.3. Financial Information

14.3.11.4. (Subject to Data Availability)

14.3.11.5. Business Strategies / Recent Developments

14.3.12. Continental Coatings Inc.

14.3.12.1. Company Overview

14.3.12.2. Product Portfolio

14.3.12.3. Financial Information

14.3.12.4. (Subject to Data Availability)

14.3.12.5. Business Strategies / Recent Developments

14.3.13. Sherwin-Williams Company

14.3.13.1. Company Overview

14.3.13.2. Product Portfolio

14.3.13.3. Financial Information

14.3.13.4. (Subject to Data Availability)

14.3.13.5. Business Strategies / Recent Developments

14.3.14. Akzo Nobel N.V.

14.3.14.1. Company Overview

14.3.14.2. Product Portfolio

14.3.14.3. Financial Information

14.3.14.4. (Subject to Data Availability)

14.3.14.5. Business Strategies / Recent Developments

14.3.15. Nippon Paint Holdings Co., Ltd.

14.3.15.1. Company Overview

14.3.15.2. Product Portfolio

14.3.15.3. Financial Information

14.3.15.4. (Subject to Data Availability)

14.3.15.5. Business Strategies / Recent Developments

14.3.16. Kansai Paint Co., Ltd.

14.3.16.1. Company Overview

14.3.16.2. Product Portfolio

14.3.16.3. Financial Information

14.3.16.4. (Subject to Data Availability)

14.3.16.5. Business Strategies / Recent Developments

15. Go to Market Strategy

15.1. Identification of Potential Market Spaces

15.2. Understanding Buying Process of Customers

15.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Europe Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Table 2: Europe Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Table 3: Europe Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Table 4: Europe Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

Table 5: Europe Coatings Market for Performance OEM Value (US$ Bn), by Country, 2023-2031

Table 6: Europe Coatings Market for Performance OEM Volume (Million Liters), by Country, 2023-2031

Table 7: U.K. Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Table 8: U.K. Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Table 9: U.K. Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Table 10: U.K. Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

Table 11: Germany Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Table 12: Germany Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Table 13: Germany Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Table 14: Germany Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

Table 15: France Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Table 16: France Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Table 17: France Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Table 18: France Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

Table 19: Spain Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Table 20: Spain Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Table 21: Spain Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Table 22: Spain Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

Table 23: Italy Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Table 24: Italy Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Table 25: Italy Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Table 26: Italy Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

List of Figures

Figure 1: Europe Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Figure 2: Europe Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Figure 3: Europe Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Type, 2023-2031

Figure 4: Europe Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Figure 5: Europe Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

Figure 6: Europe Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Application, 2023-2031

Figure 7: Europe Coatings Market for Performance OEM Value (US$ Bn), by Country, 2023-2031

Figure 8: Europe Coatings Market for Performance OEM Volume (Million Liters), by Country, 2023-2031

Figure 9: Europe Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Country, 2023-2031

Figure 10: U.K. Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Figure 11: U.K. Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Figure 12: U.K. Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Type, 2023-2031

Figure 13: U.K. Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Figure 14: U.K. Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

Figure 15: U.K. Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Application, 2023-2031

Figure 16: Germany Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Figure 17: Germany Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Figure 18: Germany Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Type, 2023-2031

Figure 19: Germany Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Figure 20: Germany Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

Figure 21: Germany Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Application, 2023-2031

Figure 22: France Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Figure 23: France Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Figure 24: France Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Type, 2023-2031

Figure 25: France Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Figure 26: France Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

Figure 27: France Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Application, 2023-2031

Figure 28: Spain Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Figure 29: Spain Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Figure 30: Spain Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Type, 2023-2031

Figure 31: Spain Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Figure 32: Spain Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

Figure 33: Spain Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Application, 2023-2031

Figure 34: Italy Coatings Market for Performance OEM Value (US$ Bn), by Type, 2023-2031

Figure 35: Italy Coatings Market for Performance OEM Volume (Million Liters), by Type, 2023-2031

Figure 36: Italy Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Type, 2023-2031

Figure 37: Italy Coatings Market for Performance OEM Value (US$ Bn), by Application, 2023-2031

Figure 38: Italy Coatings Market for Performance OEM Volume (Million Liters), by Application, 2023-2031

Figure 39: Italy Coatings Market for Performance OEM Incremental Opportunity (US$ Bn), by Application, 2023-2031