Analysts’ Viewpoint

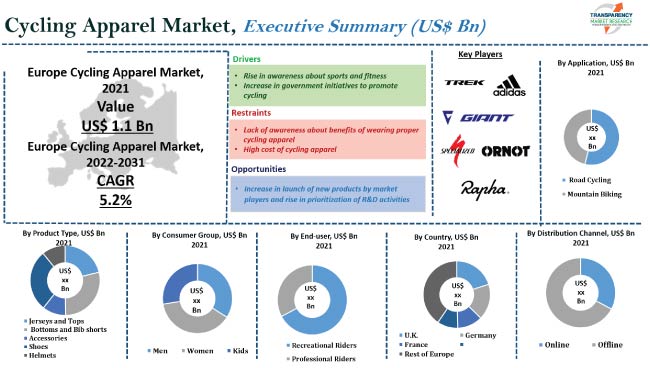

Growth in popularity of cycling as a recreational and sports activity is driving the Europe cycling apparel market. People of all age groups are becoming more inclined toward adopting cycling as a hobby owing to the rise in awareness about the health benefits of the sport. They are looking for apparel made of organic materials to avoid allergies or skin concerns.

Cycling apparel manufacturers are continuously investing in R&D activities to accelerate the roll out of cycling apparel and accessories with new designs and materials to boost their market share. Customization in cycling apparel products is a Europe cycling apparel market trend. Cycling apparel suppliers in the region are focusing on providing advanced products with the highest quality standards to strengthen their market position.

Cycling apparel are clothes worn by a cyclist, generally a professional cyclist. They are worn so that the cyclist stays comfortable while riding. Cycling apparel such as cycling jerseys help keep the cyclist’s body comfortable. They also protect the cyclist from adverse weather conditions while riding.

Cycling apparel are available in different styles and for different age groups. Rise in health concerns among various age groups and increase in population of working women are driving the demand for cycling apparel.

Diabetes and obesity are primarily caused by physical inactivity. Rise in cases of diabetes and obesity is encouraging youth to take up cycling as an activity, thus driving the usage of cycling apparel products. Furthermore, increase in focus of the youth population in Europe on enhancing their physical stature and fitness, owing to the growth in importance of leading an active lifestyle, is motivating them to indulge in several physical activities. This is also leading to an increase in demand for cycling products.

According to the European Cyclists’ Federation, cycling prevents 18,110 premature deaths per year in the European Union (EU). Cycling also contributes to healthier living by preventing a large number of severe and chronic diseases.

Surge in number of mountain biking and touring/expeditions in Europe, where cyclists enjoy the sport as a hobby and often go on one-day, multi-day, or even multi-week tours, has also positively impacted cycling apparel industry statistics in the region.

Governments of countries in Europe are continuously working toward promoting cycling as a sports activity as well as a mobility solution. This is expected to drive cycling apparel market development in the next few years. For instance, a 51,500 km long cycling route, which crosses several countries and joins together several national as well as regional cycle routes, was recently launched in Europe.

According to the European Cycling Federation, countries in the region have adopted the Vienna Declaration on clean, safe, and healthy transport and the first-ever Pan-European Master Plan for Cycling Promotion. The key objective of the master plan was “to significantly increase cycling in every country to contribute to the overall target of doubling cycling in the region as a whole.” This is also expected to lead to cycling apparel market progress in the region.

Increase in number of women participating in cycling as an activity is further augmenting the market. According to the European Cyclists’ Federation, more than 1,000 people participated in the launch of ‘Women in Cycling’ in February 2021, which aims to increase visibility, role, and impact of women in the cycling market development.

In terms of product type, the Europe cycling apparel market has been segmented into jerseys and tops, bottoms and bib shorts, accessories, shoes, and helmets. The jerseys and tops segment is expected to hold the largest share during the forecast period.

Sweating is one of the key concerns of cyclists while riding. Jerseys and tops are usually made of specific materials, which help lock moisture and are breathable and comfortable. Moreover, jerseys and tops absorb sweat faster and dry quickly. These factors are expected to boost the demand for jerseys and tops during the forecast period.

Cycling apparel manufacturers are also investing significantly in research and development activities to launch cycling jerseys with more stretchable and breathable clothing. This is also projected to augment the Europe cycling apparel market revenue.

In terms of end-user, the market has been divided into recreational riders and professional riders. Demand for cycling apparel is expected to be high among professional cyclers for several national and international cycling sporting events.

The number of professional cyclists has increased with the rise in number of cycling races and events such as We Ride Flanders, Paris-Roubaix Challenge, and Mallorca 312. This is projected to positively contribute to cycling apparel market growth.

Demand for cycling apparel is also likely to increase among recreational riders, as the trend of cycling as a recreational activity has been on the rise among all age groups.

In terms of country, the Europe bicycle clothing market has been segmented into the U.K., Germany, France, and Rest of Europe. Demand for cycling apparel is anticipated to be high in the U.K. during the forecast period, primarily due to the presence of large number of professional as well recreational riders and growth in awareness about the health benefits of cycling as a recreational activity. Demand for several cycling accessories is likely to be high among the health conscious population of the U.K.

Germany and France are also anticipated to witness steady market expansion during the forecast period due to the growth in popularity of cycling in these countries.

According to the cycling apparel market current scenario, expansion of product portfolio and geographical presence, and mergers & acquisitions are the key strategies adopted by prominent players and manufacturers.

Adidas Group, Black Sheep Cycling, Giant Bicycles, Trek Bicycle Corporation, Ornot, Specialized Bicycle Components, ASSOS of Switzerland GmbH, Rapha Racing Limited, Nike, Inc., and Campagnolo S.r.l are the players that account for significant share of the cycling apparel market in Europe.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 1.1 Bn |

|

Market Forecast Value in 2031 |

US$ 1.8 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, cycling apparel market insights and Europe cycling apparel market analysis. |

|

Competition Landscape |

|

|

Countries Covered |

|

|

Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 1.1 Bn in 2021

The CAGR is estimated to be 5.2% during 2022 to 2031

Rise in awareness about sports and fitness and increase in government initiatives to promote cycling

The jerseys and tops segment accounted for the largest share in 2021

The U.K. is likely to be the most lucrative country for vendors during the forecast period

Adidas Group, Black Sheep Cycling, Giant Bicycles, Trek Bicycle Corporation, Ornot, Specialized Bicycle Components, ASSOS of Switzerland GmbH, Rapha Racing Limited, Nike, Inc., and Campagnolo S.r.l.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overview of Cycles Market

5.4.2. Overview of Recreational Sports Industry

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. COVID-19 Impact Analysis

5.9. Raw Material Analysis

5.10. Europe Cycling Apparel Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Thousand Units)

6. Europe Cycling Apparel Market Analysis and Forecast, By Product Type

6.1. Europe Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

6.1.1. Jerseys and Tops

6.1.1.1. T-Shirts

6.1.1.2. Jerseys

6.1.1.3. Jackets

6.1.1.3.1. Rainproof shells

6.1.1.3.2. Softshell jackets

6.1.1.3.3. Waterproof jackets

6.1.1.4. Base Layers

6.1.1.5. Triathlon Suit

6.1.1.6. Others (Safety Vest, etc.)

6.1.2. Bottoms and Bib shorts

6.1.2.1. Bib Shorts

6.1.2.2. Tights

6.1.2.3. Pants

6.1.2.4. Others (Over trousers, etc.)

6.1.3. Accessories

6.1.3.1. Eyewear

6.1.3.2. Gloves

6.1.3.3. Socks

6.1.3.4. Caps & Buffs

6.1.3.5. Antipollution Masks

6.1.3.6. Arm and Leg Warmers

6.1.3.7. Others (Headbands, etc.)

6.1.4. Helmets

6.1.5. Shoes

6.2. Incremental Opportunity, By Product

7. Europe Cycling Apparel Market Analysis and Forecast, By Consumer Group

7.1. Europe Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Consumer Group, 2017 - 2031

7.1.1. Women

7.1.2. Men

7.1.3. Kids

7.2. Incremental Opportunity, By Consumer Group

8. Europe Cycling Apparel Market Analysis and Forecast, By End-user

8.1. Europe Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By End-user, 2017 - 2031

8.1.1. Recreational Riders

8.1.2. Professional Riders

8.2. Incremental Opportunity, By End-user

9. Europe Cycling Apparel Market Analysis and Forecast, By Application

9.1. Europe Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

9.1.1. Road Cycling

9.1.2. Mountain Biking

9.2. Incremental Opportunity, By Application

10. Europe Cycling Apparel Market Analysis and Forecast, By Distribution Channel

10.1. Europe Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

10.1.1. Online

10.1.1.1. E-Commerce Websites

10.1.1.2. Company-owned Websites

10.1.2. Offline

10.1.2.1. Specialty Stores

10.1.2.2. Departmental Stores

10.1.2.3. Others (Independent Retailers, etc.)

10.2. Incremental Opportunity, By Distribution Channel

11. Europe Cycling Apparel Market Analysis and Forecast, By Country

11.1. Europe Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Country, 2017 - 2031

11.1.1. U.K

11.1.2. Germany

11.1.3. France

11.1.4. Rest of Europe

11.2. Incremental Opportunity, By Country

12. U.K Cycling Apparel Market Analysis and Forecast

12.1. Country Snapshot

12.2. Demographic Overview

12.3. Brand Analysis

12.4. Consumer Buying Behavior Analysis

12.4.1. Spending Capacity

12.4.2. Preferred Product Type

12.4.3. Preferred Mode of Buying

12.5. Price Trend Analysis

12.5.1. Weighted Average Price

12.6. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

12.6.1. Jerseys and Tops

12.6.1.1. T-Shirts

12.6.1.2. Jerseys

12.6.1.3. Jackets

12.6.1.3.1. Rainproof shells

12.6.1.3.2. Softshell jackets

12.6.1.3.3. Waterproof jackets

12.6.1.4. Base Layers

12.6.1.5. Triathlon Suit

12.6.1.6. Others (Safety Vest, etc.)

12.6.2. Bottoms and Bib shorts

12.6.2.1. Bib Shorts

12.6.2.2. Tights

12.6.2.3. Pants

12.6.2.4. Others (Over trousers, etc.)

12.6.3. Accessories

12.6.3.1. Eyewear

12.6.3.2. Gloves

12.6.3.3. Socks

12.6.3.4. Caps & Buffs

12.6.3.5. Antipollution Masks

12.6.3.6. Arm and Leg Warmers

12.6.3.7. Others (Headbands, etc.)

12.6.4. Helmets

12.6.5. Shoes

12.7. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Consumer Group, 2017 - 2031

12.7.1. Women

12.7.2. Men

12.7.3. Kids

12.8. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By End-user, 2017 - 2031

12.8.1. Recreational Riders

12.8.2. Professional Riders

12.9. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

12.9.1. Road Cycling

12.9.2. Mountain Biking

12.10. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.10.1. Online

12.10.1.1. E-Commerce Websites

12.10.1.2. Company-owned Websites

12.10.2. Offline

12.10.2.1. Specialty Stores

12.10.2.2. Departmental Stores

12.10.2.3. Others (Independent Retailers, etc.)

13. Germany Cycling Apparel Market Analysis and Forecast

13.1. Country Snapshot

13.2. Demographic Overview

13.3. Brand Analysis

13.4. Consumer Buying Behavior Analysis

13.4.1. Spending Capacity

13.4.2. Preferred Product Type

13.4.3. Preferred Mode of Buying

13.5. Price Trend Analysis

13.5.1. Weighted Average Price

13.6. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

13.6.1. Jerseys and Tops

13.6.1.1. T-Shirts

13.6.1.2. Jerseys

13.6.1.3. Jackets

13.6.1.3.1. Rainproof shells

13.6.1.3.2. Softshell jackets

13.6.1.3.3. Waterproof jackets

13.6.1.4. Base Layers

13.6.1.5. Triathlon Suit

13.6.1.6. Others (Safety Vest, etc.)

13.6.2. Bottoms and Bib shorts

13.6.2.1. Bib Shorts

13.6.2.2. Tights

13.6.2.3. Pants

13.6.2.4. Others (Over trousers, etc.)

13.6.3. Accessories

13.6.3.1. Eyewear

13.6.3.2. Gloves

13.6.3.3. Socks

13.6.3.4. Caps & Buffs

13.6.3.5. Antipollution Masks

13.6.3.6. Arm and Leg Warmers

13.6.3.7. Others (Headbands, etc.)

13.6.4. Helmets

13.6.5. Shoes

13.7. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Consumer Group, 2017 - 2031

13.7.1. Women

13.7.2. Men

13.7.3. Kids

13.8. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By End-user, 2017 - 2031

13.8.1. Recreational Riders

13.8.2. Professional Riders

13.9. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

13.9.1. Road Cycling

13.9.2. Mountain Biking

13.10. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.10.1. Online

13.10.1.1. E-Commerce Websites

13.10.1.2. Company-Owned Websites

13.10.2. Offline

13.10.2.1. Specialty Stores

13.10.2.2. Departmental Stores

13.10.2.3. Others (Independent Retailers, etc.)

14. France Cycling Apparel Market Analysis and Forecast

14.1. Country Snapshot

14.2. Demographic Overview

14.3. Brand Analysis

14.4. Consumer Buying Behavior Analysis

14.4.1. Spending Capacity

14.4.2. Preferred Product Type

14.4.3. Preferred Mode of Buying

14.5. Price Trend Analysis

14.5.1. Weighted Average Price

14.6. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

14.6.1. Jerseys and Tops

14.6.1.1. T-Shirts

14.6.1.2. Jerseys

14.6.1.3. Jackets

14.6.1.3.1. Rainproof shells

14.6.1.3.2. Softshell jackets

14.6.1.3.3. Waterproof jackets

14.6.1.4. Base Layers

14.6.1.5. Triathlon Suit

14.6.1.6. Others (Safety Vest, etc.)

14.6.2. Bottoms and Bib shorts

14.6.2.1. Bib Shorts

14.6.2.2. Tights

14.6.2.3. Pants

14.6.2.4. Others (Over trousers, etc.)

14.6.3. Accessories

14.6.3.1. Eyewear

14.6.3.2. Gloves

14.6.3.3. Socks

14.6.3.4. Caps & Buffs

14.6.3.5. Antipollution Masks

14.6.3.6. Arm and Leg Warmers

14.6.3.7. Others (Headbands, etc.)

14.6.4. Helmets

14.6.5. Shoes

14.7. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Consumer Group, 2017 - 2031

14.7.1. Women

14.7.2. Men

14.7.3. Kids

14.8. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By End-user, 2017 - 2031

14.8.1. Recreational Riders

14.8.2. Professional Riders

14.9. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 - 2031

14.9.1. Road Cycling

14.9.2. Mountain Biking

14.10. Cycling Apparel Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.10.1. Online

14.10.1.1. E-commerce Websites

14.10.1.2. Company-Owned Websites

14.10.2. Offline

14.10.2.1. Specialty Stores

14.10.2.2. Departmental Stores

14.10.2.3. Others (Independent Retailers, etc.)

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share Analysis (%)

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Product Portfolio)

15.3.1. Adidas group

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Financial/Revenue

15.3.1.4. Strategy & Business Overview

15.3.1.5. Sales Channel Analysis

15.3.1.6. Product Portfolio

15.3.2. Black Sheep Cycling

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Financial/Revenue

15.3.2.4. Strategy & Business Overview

15.3.2.5. Sales Channel Analysis

15.3.2.6. Product Portfolio

15.3.3. Giant Bicycles

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Financial/Revenue

15.3.3.4. Strategy & Business Overview

15.3.3.5. Sales Channel Analysis

15.3.3.6. Product Portfolio

15.3.4. Trek Bicycle Corporation

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Financial/Revenue

15.3.4.4. Strategy & Business Overview

15.3.4.5. Sales Channel Analysis

15.3.4.6. Product Portfolio

15.3.5. Ornot

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Financial/Revenue

15.3.5.4. Strategy & Business Overview

15.3.5.5. Sales Channel Analysis

15.3.5.6. Product Portfolio

15.3.6. Specialized Bicycle Components

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Financial/Revenue

15.3.6.4. Strategy & Business Overview

15.3.6.5. Sales Channel Analysis

15.3.6.6. Product Portfolio

15.3.7. ASSOS of Switzerland GmbH

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Financial/Revenue

15.3.7.4. Strategy & Business Overview

15.3.7.5. Sales Channel Analysis

15.3.7.6. Product Portfolio

15.3.8. Rapha Racing Limited

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Financial/Revenue

15.3.8.4. Strategy & Business Overview

15.3.8.5. Sales Channel Analysis

15.3.8.6. Product Portfolio

15.3.9. Nike, Inc.

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Financial/Revenue

15.3.9.4. Strategy & Business Overview

15.3.9.5. Sales Channel Analysis

15.3.9.6. Product Portfolio

15.3.10. Campagnolo S.r.l.

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Financial/Revenue

15.3.10.4. Strategy & Business Overview

15.3.10.5. Sales Channel Analysis

15.3.10.6. Product Portfolio

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. Product

16.1.2. Consumer Group

16.1.3. End-user

16.1.4. Application

16.1.5. Distribution Channel

16.1.6. Country

16.2. Preferred Sales & Marketing Strategy

List of Tables

Tables 1: Europe Cycling Apparel Market Volume (Thousand Units) Share, by Product, 2017-2031

Tables 2: Europe Cycling Apparel Market Value (US$ Mn) Share, by Product, 2017-2031

Tables 3: Europe Cycling Apparel Market Volume (Thousand Units) Share, by Consumer Group, 2017-2031

Tables 4: Europe Cycling Apparel Market Value(US$ Mn) Share, by Consumer Group, 2017-2031

Tables 5: Europe Cycling Apparel Market Volume(Thousand Units) Share, by End-user, 2017-2031

Tables 6: Europe Cycling Apparel Market Value(US$ Mn) Share, by End-user, 2017-2031

Tables 7: Europe Cycling Apparel Market Volume(Thousand Units) Share, by Application, 2017-2031

Tables 8: Europe Cycling Apparel Market Value(US$ Mn) Share, by Application, 2017-2031

Tables 9: Europe Cycling Apparel Market Volume(Thousand Units) Share, by Distribution Channel, 2017-2031

Tables 10: Europe Cycling Apparel Market Value(US$ Mn) Share, by Distribution Channel, 2017-2031

Tables 11: Europe Cycling Apparel Market Volume(Thousand Units) Share, by Country, 2017-2031

Tables 12: Europe Cycling Apparel Market Value(US$ Mn) Share, by Country, 2017-2031

Tables 13: U.K Cycling Apparel Market Volume(Thousand Units) Share, by Product, 2017-2031

Tables 14: U.K Cycling Apparel Market Value(US$ Mn) Share, by Product, 2017-2031

Tables 15: U.K Cycling Apparel Market Volume(Thousand Units) Share, by Consumer Group, 2017-2031

Tables 16: U.K Cycling Apparel Market Value(US$ Mn) Share, by Consumer Group, 2017-2031

Tables 17: U.K Cycling Apparel Market Volume(Thousand Units) Share, by End-user, 2017-2031

Tables 18: U.K Cycling Apparel Market Value(US$ Mn) Share, by End-user, 2017-2031

Tables 19: U.K Cycling Apparel Market Volume(Thousand Units) Share, by Application, 2017-2031

Tables 20: U.K Cycling Apparel Market Value(US$ Mn) Share, by Application, 2017-2031

Tables 21: U.K Cycling Apparel Market Volume(Thousand Units) Share, by Distribution Channel, 2017-2031

Tables 22: U.K Cycling Apparel Market Value(US$ Mn) Share, by Distribution Channel, 2017-2031

Tables 23: Germany Cycling Apparel Market Volume(Thousand Units) Share, by Product, 2017-2031

Tables 24: Germany Cycling Apparel Market Value(US$ Mn) Share, by Product, 2017-2031

Tables 25: Germany Cycling Apparel Market Volume(Thousand Units) Share, by Consumer Group, 2017-2031

Tables 26: Germany Cycling Apparel Market Value(US$ Mn) Share, by Consumer Group, 2017-2031

Tables 27: Germany Cycling Apparel Market Volume(Thousand Units) Share, by End-user, 2017-2031

Tables 28: Germany Cycling Apparel Market Value(US$ Mn) Share, by End-user, 2017-2031

Tables 29: Germany Cycling Apparel Market Volume(Thousand Units) Share, by Application, 2017-2031

Tables 30: Germany Cycling Apparel Market Value(US$ Mn) Share, by Application, 2017-2031

Tables 31: Germany Cycling Apparel Market Volume(Thousand Units) Share, by Distribution Channel, 2017-2031

Tables 32: Germany Cycling Apparel Market Value(US$ Mn) Share, by Distribution Channel, 2017-2031

Tables 33: France Cycling Apparel Market Volume(Thousand Units) Share, by Product, 2017-2031

Tables 34: France Cycling Apparel Market Value(US$ Mn) Share, by Product, 2017-2031

Tables 35: France Cycling Apparel Market Volume(Thousand Units) Share, by Consumer Group, 2017-2031

Tables 36: France Cycling Apparel Market Value(US$ Mn) Share, by Consumer Group, 2017-2031

Tables 37: France Cycling Apparel Market Volume(Thousand Units) Share, by End-user, 2017-2031

Tables 38: France Cycling Apparel Market Value(US$ Mn) Share, by End-user, 2017-2031

Tables 39: France Cycling Apparel Market Volume(Thousand Units) Share, by Application, 2017-2031

Tables 40: France Cycling Apparel Market Value(US$ Mn) Share, by Application, 2017-2031

Tables 41: France Cycling Apparel Market Volume(Thousand Units) Share, by Distribution Channel, 2017-2031

Tables 42: France Cycling Apparel Market Value(US$ Mn) Share, by Distribution Channel, 2017-2031

List of Figures

Figures 1: Europe Cycling Apparel Market Volume (Thousand Units) Share, by Product, 2017-2031

Figures 2: Europe Cycling Apparel Market Value (US$ Mn) Share, by Product, 2017-2031

Figures 3: Europe Cycling Apparel Market Incremental Opportunity (US$ Mn), by Product, 2017-2031

Figures 4: Europe Cycling Apparel Market Volume (Thousand Units) Share, by End-user, 2017-2031

Figures 5: Europe Cycling Apparel Market Value (US$ Mn) Share, by End-user, 2017-2031

Figures 6: Europe Cycling Apparel Market Incremental Opportunity (US$ Mn), by End-user, 2017-2031

Figures 7: Europe Cycling Apparel Market Volume (Thousand Units) Share, by Consumer Group, 2017-2031

Figures 8: Europe Cycling Apparel Market Value (US$ Mn) Share, by Consumer Group, 2017-2031

Figures 9: Europe Cycling Apparel Market Incremental Opportunity (US$ Mn), by Consumer Group, 2017-2031

Figures 10: Europe Cycling Apparel Market Volume(Thousand Units) Share, by Application, 2017-2031

Figures 11: Europe Cycling Apparel Market Value(US$ Mn) Share, by Application, 2017-2031

Figures 12: Europe Cycling Apparel Market Incremental Opportunity (US$ Mn), by Application, 2017-2031

Figures 13: Europe Cycling Apparel Market Volume(Thousand Units) Share, by Distribution Channel, 2017-2031

Figures 14: Europe Cycling Apparel Market Value(US$ Mn) Share, by Distribution Channel, 2017-2031

Figures 15: Europe Cycling Apparel Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2017-2031

Figures 16: Europe Cycling Apparel Market Volume(Thousand Units) Share, by Country, 2017-2031

Figures 17: Europe Cycling Apparel Market Value (US$ Mn) Share, by Country, 2017-2031

Figures 18: Europe Cycling Apparel Market Incremental Opportunity (US$ Mn), by Country, 2017-2031

Figures 19: U.K Cycling Apparel Market Volume(Thousand Units) Share, by Product, 2017-2031

Figures 20: U.K Cycling Apparel Market Value (US$ Mn) Share, by Product, 2017-2031

Figures 21: U.K Cycling Apparel Market Incremental Opportunity (US$ Mn), by Product, 2017-2031

Figures 22: U.K Cycling Apparel Market Volume(Thousand Units) Share, by End-user, 2017-2031

Figures 23: U.K Cycling Apparel Market Value(US$ Mn) Share, by End-user, 2017-2031

Figures 24: U.K Cycling Apparel Market Incremental Opportunity (US$ Mn), by End-user, 2017-2031

Figures 25: U.K Cycling Apparel Market Volume(Thousand Units) Share, by Consumer Group, 2017-2031

Figures 26: U.K Cycling Apparel Market Value(US$ Mn) Share, by Consumer Group, 2017-2031

Figures 27: U.K Cycling Apparel Market Incremental Opportunity (US$ Mn), by Consumer Group, 2017-2031

Figures 28: U.K Cycling Apparel Market Volume(Thousand Units) Share, by Application, 2017-2031

Figures 29: U.K Cycling Apparel Market Value (US$ Mn) Share, by Application, 2017-2031

Figures 30: U.K Cycling Apparel Market Incremental Opportunity (US$ Mn), by Application, 2017-2031

Figures 31: U.K Cycling Apparel Market Volume(Thousand Units) Share, by Distribution Channel, 2017-2031

Figures 32: U.K Cycling Apparel Market Value(US$ Mn) Share, by Distribution Channel, 2017-2031

Figures 33: U.K Cycling Apparel Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2017-2031

Figures 34: Germany Cycling Apparel Market Volume(Thousand Units) Share, by Product, 2017-2031

Figures 35: Germany Cycling Apparel Market Value(US$ Mn) Share, by Product, 2017-2031

Figures 36: Germany Cycling Apparel Market Incremental Opportunity (US$ Mn), by Product, 2017-2031

Figures 37: Germany Cycling Apparel Market Volume (Thousand Units) Share, by End-user, 2017-2031

Figures 38: Germany Cycling Apparel Market Value (US$ Mn) Share, by End-user, 2017-2031

Figures 39: Germany Cycling Apparel Market Incremental Opportunity (US$ Mn), by End-user, 2017-2031

Figures 40: Germany Cycling Apparel Market Volume(Thousand Units) Share, by Consumer Group, 2017-2031

Figures 41: Germany Cycling Apparel Market Value(US$ Mn) Share, by Consumer Group, 2017-2031

Figures 42: Germany Cycling Apparel Market Incremental Opportunity (US$ Mn), by Consumer Group, 2017-2031

Figures 43: Germany Cycling Apparel Market Volume(Thousand Units) Share, by Application, 2017-2031

Figures 44: Germany Cycling Apparel Market Value(US$ Mn) Share, by Application, 2017-2031

Figures 45: Germany Cycling Apparel Market Incremental Opportunity (US$ Mn), by Application, 2017-2031

Figures 46: Germany Cycling Apparel Market Volume(Thousand Units) Share, by Distribution Channel, 2017-2031

Figures 47: Germany Cycling Apparel Market Value(US$ Mn) Share, by Distribution Channel, 2017-2031

Figures 48: Germany Cycling Apparel Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2017-2031

Figures 49: France Cycling Apparel Market Volume(Thousand Units) Share, by Product, 2017-2031

Figures 50: France Cycling Apparel Market Value(US$ Mn) Share, by Product, 2017-2031

Figures 51: France Cycling Apparel Market Incremental Opportunity (US$ Mn), by Product, 2017-2031

Figures 52: France Cycling Apparel Market Volume(Thousand Units) Share, by End-user, 2017-2031

Figures 53: France Cycling Apparel Market Value(US$ Mn) Share, by End-user, 2017-2031

Figures 54: France Cycling Apparel Market Incremental Opportunity (US$ Mn), by End-user, 2017-2031

Figures 55: France Cycling Apparel Market Volume(Thousand Units) Share, by Application, 2017-2031

Figures 56: France Cycling Apparel Market Value(US$ Mn) Share, by Application, 2017-2031

Figures 57: France Cycling Apparel Market Incremental Opportunity (US$ Mn), by Application, 2017-2031

Figures 58: France Cycling Apparel Market Volume(Thousand Units) Share, by Distribution Channel, 2017-2031

Figures 59: France Cycling Apparel Market Value(US$ Mn) Share, by Distribution Channel, 2017-2031

Figures 60: France Cycling Apparel Market Incremental Opportunity (US$ Mn), by Distribution Channel, 2017-2031