Analysts’ Viewpoint on Europe Biomethane Market Scenario

Biomethane is a well-known source of clean energy, and is witnessing an increase in demand worldwide, especially in European countries, as it is one of the most cost-effective and eco-friendly replacements for natural gas and diesel. Access to gas grids for biogas suppliers is one of the key reasons for the rapid growth of the Europe biomethane market. Companies in the Europe biomethane market are looking for alternative sources of energy to minimize greenhouse gas emissions due to the global campaign to address climate change. Industries are aiming to reduce negative impacts and are moving toward a green economy model. Sustainable mobility is quickly growing as a strategic target.

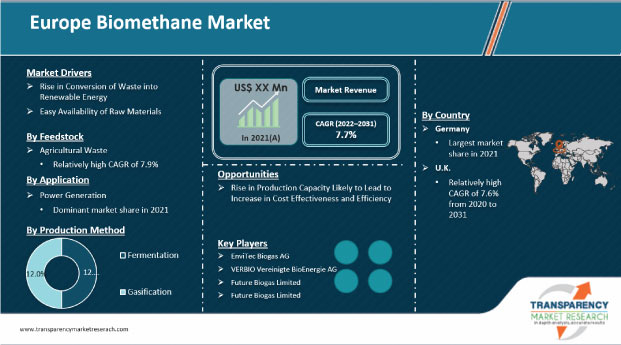

Biomethane is a sustainable fuel that is produced by the biogas upgrade technology (process of separation of methane from CO2 and other gases from biogas). Biomethane is produced from biogas that is derived from organic matter such as sewage waste, food waste, and agriculture materials. It is a renewable fuel that can be used to balance intermittent renewable electricity in order to provide a fully renewable power supply and transportation fuel. The Europe biomethane market is projected to grow, due to low cost and easy availability of raw materials. The revenue of Europe biomethane market is expected to surpass US$ 4.8 Bn by the end of the forecast period.

Biomethane is the upgraded form of biogas that is produced from anaerobic digestion of biodegradable wastes such as food waste and crop residues. Majority of biomethane in the European Union is produced from crops. Around 72% of the biomethane is produced by farm-based plants and industrial organic waste digesters. Germany, Austria, and Denmark produce a key share of biomethane from energy crops, agricultural by-products, and animal manure, while France, the U.K., Spain, and Italy are more dependent on landfill gas as a source of biomethane. Sewage sludge is also popular for the production of biomethane; 9% of biomethane is produced by sewage sludge waste. Biomethane produced by landfill waste stands at about 18% of the total production. Large numbers of biogas plants are located in agricultural areas.

Biomethane is an important tool in reducing the economic gap between urban and rural areas, and supporting sustainable, long-term rural development. More than 30% of greenhouse gas emission in Europe can be ascribed to transportation, which is almost entirely dependent on oil. Prices of natural gas have surged in Europe, as countries exit COVID-19 lockdown. This is fueling a crisis that is impacting consumer bills. The demand for biomethane is expected to continue to rise across Europe during the forecast period. Europe is focusing on renewable energy to meet the high demand for electricity and fuel. The availability of large quantity of raw materials is projected to boost the market in the region during the forecast period.

Environmental restrictions are becoming increasingly stringent around the world. This has prompted the power generation industry to use cleaner, more environment-friendly energy sources. Key global economies are focusing on improving renewable energy generation to reduce their dependence on fossil-fuel based electricity generation and transportation. The European Union targets renewable energy to account for at least 32% of total energy consumption by 2030, with renewable fuels constituting 14% of all transportation fuels. Renewable energies accounted for prominent share of about 40.8% of the primary energy production in the EU in 2020.

In terms of feedstock, the Europe biomethane market has been classified into organic household waste, animal manure, energy crops, agricultural waste, sewage sludge, industrial food processing waste, and others. The agricultural waste segment accounted for major share of 32.6% of the Europe market in 2021. The segment is estimated to expand at a significant growth rate of 7.79% during the forecast period. Biomethane feedstock includes agricultural waste such as corn stalks, straws, sugarcane leavings, bagasse, nutshell, and manure from cattle. Agricultural waste, generated in vast quantities in Europe, is a prospective feedstock for biogas production. It is being used as biomethane source to produce energy in small- and medium-scale industries. Additionally, several industries use biomethane as fuel for their manufacturing and production processes.

Based on application, the power generation segment dominated the Europe biomethane market with 43.9% share in 2021. Furthermore, the segment is expected to grow at a notable CAGR of 7.4% during the forecast period. Power generation is anticipated to be an attractive segment of the market during the forecast period. Biomethane fuel is used in combustion engines, which convert it into mechanical energy, thus powering an electric generator to produce electricity.

Several technologies are available to generate electricity from biomethane at the household level. In principle, the chemical energy of combustible gases is converted into mechanical energy in a controlled combustion system by a heat engine. This mechanical energy activates a generator to produce electrical power.

Gas turbines and combustion engines are the commonly used heat engines in biomethane energy conversion. Combustion engines can be either internal combustion engines or external combustion engines.

In terms of volume, Germany held 39.20% share of the Europe biomethane market in 2021. Rise in demand for biomethane in Germany can be ascribed to the growth of the power sector in the country. The U.K. and Sweden are also prominent users of biomethane, in terms of volume. These countries held 16.1% and 13.2% share, respectively, of the Europe biomethane market in 2021. The demand for biomethane in the U.K. is anticipated to increase in the near future, owing to the rise in transportation infrastructure and increase in deployment of vehicles using biomethane fuel as compressed natural gas CNG and liquefied natural gas (LNG).

The Europe biomethane market comprises several small- and large-scale manufacturers and suppliers who control majority of the share. Most of the firms are adopting new technologies and strategies with comprehensive research and development activities, primarily to develop and prioritize eco-friendly energy sources. Diversification of product portfolios and mergers & acquisitions are key strategies adopted by major players. EnviTech Biogas AG, PlanET Biogas Global GmbH, Gasrec Ltd., SGN, Future Biogas Limited, VERBIO, Gazasia Ltd., Schmack Carbotech Gmbh, ETW ENERGIETECHNIK Gmbh, ORBITAL, and J V Energen are the prominent entities operating in the market.

Each of these players has been profiled in the Europe biomethane market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.3 Bn |

|

Market Forecast Value in 2031 |

US$ 4.8 Bn |

|

Growth Rate (CAGR) |

7.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Cubic Meters for Volume |

|

Market Analysis |

It includes cross segment analysis at Europe as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood over US$ 2.3 Bn in 2021.

The market is expected to grow at a CAGR of 7.7% from 2022 to 2031.

Easy availability of raw materials and rise in conversion of waste into renewable energy.

Agricultural waste was the largest feedstock segment that held 32.6% share in 2021.

Germany was the most lucrative country of the Europe biomethane market in 2021.

EnviTech Biogas AG, PlanET Biogas Global GmbH, Gasrec Ltd., SGN, Future Biogas Limited, and VERBIO.

1. Executive Summary

1.1. Biomethane Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material Providers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/ Distributors

2.6.4. List of Potential Customers

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2021

5. Price Trend Analysis

6. Europe Biomethane Market Analysis and Forecast, by Feedstock, 2020–2031

6.1. Introduction and Definitions

6.2. Europe Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

6.2.1. Organic Household Waste

6.2.2. Animal Manure

6.2.3. Energy Crops

6.2.4. Agricultural Waste

6.2.5. Sewage Sludge

6.2.6. Industrial Food Processing Waste

6.2.7. Others

6.3. Europe Biomethane Market Attractiveness, by Feedstock

7. Europe Biomethane Market Analysis and Forecast, by Application, 2020–2031

7.1. Introduction and Definitions

7.2. Europe Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.2.1. Transport

7.2.2. Power Generation

7.2.3. Heat Generation

7.3. Europe Biomethane Market Attractiveness, by Application

8. Europe Biomethane Market Analysis and Forecast, by Production Methodology, 2020–2031

8.1. Introduction and Definitions

8.2. Europe Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

8.2.1.1. Fermentation

8.2.1.2. Gasification

8.3. Europe Biomethane Market Attractiveness, by Production Methodology

9. Europe Biomethane Market Analysis and Forecast, by Country, 2020–2031

9.1. Key Findings

9.2. Europe Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Country, 2020–2031

9.2.1. Germany

9.2.2. U.K.

9.2.3. France

9.2.4. Sweden

9.2.5. Italy

9.2.6. The Netherland

9.2.7. Rest of Europe

9.3. Europe Biomethane Market Attractiveness, by Country

10. Europe Biomethane Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Europe Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

10.3. Europe Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. Europe Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

10.5. Europe Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Country, 2022‒2031

10.5.1. Germany Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.2. Germany Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

10.5.3. France Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

10.5.4. France Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.5. France Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

10.5.6. Sweden Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

10.5.7. Sweden Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.8. Sweden Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

10.5.9. U.K. Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

10.5.10. U.K. Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.11. U.K. Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

10.5.12. Italy Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

10.5.13. Italy. Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.14. Italy Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

10.5.15. The Netherland Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

10.5.16. The Netherland Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.17. The Netherland Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

10.5.18. Rest of Europe Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

10.5.19. Rest of Europe Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.20. Rest of Europe Biomethane Market Volume (Thousand Cubic Meters) and Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

10.5.21. Europe Biomethane Market Attractiveness Analysis

11. Competition Landscape

11.1. Europe Biomethane Company Market Share Analysis, 2021

11.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

11.2.1. EnviTec Biogas AG.

11.2.1.1. Company Description

11.2.1.2. Business Overview

11.2.1.3. Financial Overview

11.2.1.4. Strategic Overview

11.2.2. VERBIO Vereinigte BioEnergie AG

11.2.2.1. Company Description

11.2.2.2. Business Overview

11.2.2.3. Financial Overview

11.2.2.4. Strategic Overview

11.2.3. Future Biogas Limited

11.2.3.1. Company Description

11.2.3.2. Business Overview

11.2.3.3. Financial Overview

11.2.3.4. Strategic Overview

11.2.4. PlanET Biogas Global GmbH

11.2.4.1. Company Description

11.2.4.2. Business Overview

11.2.4.3. Financial Overview

11.2.4.4. Strategic Overview

11.2.5. CNG Services Ltd

11.2.5.1. Company Description

11.2.5.2. Business Overview

11.2.5.3. Financial Overview

11.2.5.4. Strategic Overview

11.2.6. Gazasia Ltd

11.2.6.1. Company Description

11.2.6.2. Business Overview

11.2.6.3. Financial Overview

11.2.6.4. Strategic Overview

11.2.7. LANDWARME GMBH

11.2.7.1. Company Description

11.2.7.2. Business Overview

11.2.7.3. Financial Overview

11.2.7.4. Strategic Overview

11.2.8. Qila Energy

11.2.8.1. Company Description

11.2.8.2. Business Overview

11.2.8.3. Financial Overview

11.2.8.4. Strategic Overview

11.2.9. Evergaz

11.2.9.1. Company Description

11.2.9.2. Business Overview

11.2.9.3. Financial Overview

11.2.9.4. Strategic Overview

11.2.10. WELTEC BIOPOWER GmbH

11.2.10.1. Company Description

11.2.10.2. Business Overview

11.2.10.3. Financial Overview

11.2.10.4. Strategic Overview

11.2.11. ETW ENERGIETECHNIK GMBH

11.2.11.1. Company Description

11.2.11.2. Business Overview

11.2.11.3. Financial Overview

11.2.11.4. Strategic Overview

12. Primary Research: Key Insights

13. Appendix

List of Tables

Table 1: Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2020–2031

Table 2: Europe Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 3: Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2020–2031

Table 4: Europe Biomethane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 5: Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2020–2031

Table 6: Europe Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

Table 7: Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Country, 2020–2031

Table 8: Europe Biomethane Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 9: Germany Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2020–2031

Table 10: Germany Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 11: Germany Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2020–2031

Table 12: Germany Biomethane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 13: Germany Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2020–2031

Table 14: Germany Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

Table 15: France Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2020–2031

Table 16: France Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 17: France Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2020–2031

Table 18: France Biomethane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 19: France Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2020–2031

Table 20: France Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

Table 21: Sweden Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2020–2031

Table 22: Sweden Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 23: Sweden Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2020–2031

Table 24: Sweden Biomethane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 25: Sweden Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2020–2031

Table 26: Sweden Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

Table 27: U.K. Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2020–2031

Table 28: U.K. Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 29: U.K. Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2020–2031

Table 30: U.K. Biomethane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: U.K. Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2020–2031

Table 32: U.K. Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

Table 33: Italy Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2020–2031

Table 34: Italy Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 35: Italy Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2020–2031

Table 36: Italy Biomethane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 37: Italy Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2020–2031

Table 38: Italy Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

Table 39: The Netherland Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2020–2031

Table 40: The Netherland Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 41: The Netherland Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2020–2031

Table 42: The Netherland Biomethane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: The Netherland Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2020–2031

Table 44: The Netherland Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

Table 45: Rest of Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2020–2031

Table 46: Rest of Europe Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 47: Rest of Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2020–2031

Table 48: Rest of Europe Biomethane Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 49: Rest of Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2020–2031

Table 50: Rest of Europe Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2020–2031

List of Figures

Figure 1: Europe Biomethane Market Volume Share Analysis, by Feedstock, 2021, 2025, and 2031

Figure 2: Europe Biomethane Market Attractiveness, by Feedstock

Figure 3: Europe Biomethane Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 4: Europe Biomethane Market Attractiveness, by Application

Figure 5: Europe Biomethane Market Volume Share Analysis, by Production Methodology, 2021, 2025, and 2031

Figure 6: Europe Biomethane Market Attractiveness, by Production Methodology

Figure 7: Europe Biomethane Market Volume Share Analysis, by Country, 2021, 2025, and 2031

Figure 8: Europe Biomethane Market Attractiveness, by Country