Food retail and eCommerce have witnessed a sudden demand for food products during the COVID-19 pandemic, which is anticipated to boost the need for recyclable flexible packaging solutions. Companies in the Europe barrier coated flexible paper packaging market have been working at breakneck speeds to meet consumer demands during the pandemic. They are tapping into future growth opportunities with the help of the barrier Nano-coating technology in flexible packaging, which has drastically reduced the thickness of plastic, contributing toward reduced plastic use.

The COVID-19 crisis has raised concerns about food security, and has brought manufacturers in the Europe barrier coated flexible paper packaging market under scrutiny of healthcare and F&B (Food & Beverage) organizations. Manufacturers are increasing the availability for solutions that offer optimum barrier for oxygen and moisture to maintain the characteristics of products.

There is an increased hype for sustainable and recyclable materials in the Europe barrier coated flexible paper packaging market. However, such solutions need to undergo rigorous tests and approvals from regulatory authorities. Hence, manufacturers should increase their investments in R&D activities to innovate in sustainable and recyclable materials. For instance, Henkel is found in many talks for its hot- and cold-sealable coatings for paper that are certified for paper recycling.

Companies in the Europe barrier coated flexible paper packaging market are focusing on developing adhesives and coatings that help to improve the recyclability of paper packaging solutions whilst replacing plastic packaging.

The enhancing sustainability in packaging materials has become a key focus point for stakeholders in the Europe barrier coated flexible paper packaging market. The ever-evolving consumer packaging industry is witnessing growing consciousness for sustainable solutions and is facing regulatory pressures. Hence, manufacturers are offering its product portfolio in eco-friendly, compostable, and recyclable heat seal barrier coatings that are compatible with stand-up pouch paper packaging.

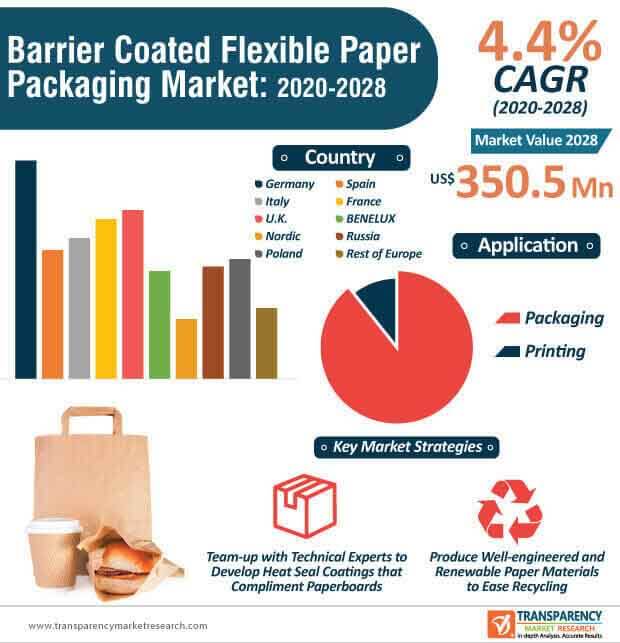

The Europe barrier coated flexible paper packaging market is predicted to expand at a modest CAGR of 4.4% during the assessment period. Manufacturers are establishing stable revenue streams in automated form-fill seal and stand-up pouch paper packaging. Eco-friendly heat seal products are a direct response to consumer demand and government regulations for earth-friendly, compostable, and recyclable products.

For package materials that are composed of paper, assuring that the package is resistant to moisture, oil, and grease can be potentially challenging. Companies in the Europe barrier coated flexible paper packaging market are seen to take a step further in water-based coatings for paper-based packaging to minimize the use of conventional coextruded or laminated polymeric films such as polyethylene.

Compared to an extruded polyolefin heat seal layer, a heat sealable coating made from water-based dispersions are enabling thinner coatings, less capital investment, and reduced material usage. Companies in the Europe barrier coated flexible paper packaging market have fixed their goal to minimize the use of extruded or laminated films and replace them with bio-based materials in paper and boardstock solutions.

Manufacturers are boosting their output capacities in flexible packaging designed for recycling. Huhtamäki Oyj - a global food packaging specialist, headquartered in Espoo, Finland, is gaining recognition for its new blueloop™ paper solutions that are made from renewable raw materials and compounded with recycling capabilities. In order to gain a competitive edge in the Europe barrier coated flexible paper packaging market, companies are collaborating with sustainability experts and technical advisors to enable packaging designs for recycling.

Market understanding and experience are playing a key role in innovations in recyclable and renewable barrier coated flexible paper packaging solutions. Companies are producing well-engineered paper-based flexible packaging that reduces reliance on materials based on fossil fuels.

Analysts’ Viewpoint

As the coronavirus pandemic continues to rage in certain regions, increased awareness about the significance of packaged products are translating into business opportunities for companies in the Europe barrier coated flexible paper packaging market. Kemira’s FennoGuard GO is being highly publicized as an innovative barrier solution that supports the development of fully repulpable and recyclable paper & board packaging. However, controlling the moisture vapor transmission rate and achieving grease resistance can be potentially challenging for manufacturers. Hence, companies should team up with technical experts and sustainability advisors to develop well-engineered heat seal coatings that adhere to paper & paperboard, whilst achieving a circular economy.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Market Background

3.1. Europe Packaging Industry Outlook

3.2. Europe Food & Foodservice Market Overview

3.3. Europe Pharmaceutical Market Overview

3.4. Macro-Economic Factors and Co-relation Analysis

3.5. Value Chain Analysis

3.5.1. Exhaustive List of Active Participants

3.5.1.1. Raw Material Suppliers

3.5.1.2. Manufacturers

3.5.1.3. End Users

3.5.2. Profitability Margins

3.6. Market Dynamics

3.6.1. Drivers

3.6.2. Restraints

3.6.3. Opportunities

3.6.4. Trends

4. Barrier Coated Flexible Paper Packaging Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Coating Type

4.2. Market Value (US$ Mn) and Volume (Tons) Analysis & Forecast

4.3. Y-o-Y Growth Projections

4.4. Absolute $ Opportunity Analysis

5. Impact of Covid-19

6. Europe Barrier Coated Flexible Paper Packaging Analysis and Forecast, By Coating Type

6.1. Section Summary

6.2. Introduction

6.2.1. Market share and Basis Points (BPS) Analysis By Coating Type

6.2.2. Y-o-Y Growth Projections By Coating Type

6.3. Historical Market Size (US$ Mn) and Volume (Tons) Analysis 2015-2019 By Coating Type

6.3.1. Water-based Coating (Dispersion)

6.3.2. Solvent-based Coating

6.3.3. Wax Coating

6.3.4. Extrusion Coating

6.4. Market Size (US$ Mn) and Volume (Tons) Forecast 2020-2028, By Coating Type

6.4.1. Water-based Coating (Dispersion)

6.4.2. Solvent-based Coating

6.4.3. Wax Coating

6.4.4. Extrusion Coating

6.5. Market Attractiveness Analysis By Coating Type

7. Europe Barrier Coated Flexible Paper Packaging Analysis and Forecast, By Application

7.1. Section Summary

7.2. Introduction

7.2.1. Market share and Basis Points (BPS) Analysis By Application

7.2.2. Y-o-Y Growth Projections By Application

7.3. Historical Market Size (US$ Mn) and Volume (Tons) Analysis 2015-2019 By Application

7.3.1. Packaging

7.3.1.1. Cups & Lids

7.3.1.2. Trays

7.3.1.3. Boxes

7.3.1.4. Bags & Pouches

7.3.1.5. Labels

7.3.1.6. Blisters

7.3.1.7. Wraps

7.3.1.8. Tapes

7.3.2. Printing

7.4. Market Size (US$ Mn) and Volume (Tons) Forecast 2020-2028, By Application

7.4.1. Packaging

7.4.1.1. Cups & Lids

7.4.1.2. Trays

7.4.1.3. Boxes

7.4.1.4. Bags & Pouches

7.4.1.5. Labels

7.4.1.6. Blisters

7.4.1.7. Wraps

7.4.1.8. Tapes

7.4.2. Printing

7.5. Market Attractiveness Analysis By Application

8. Europe Barrier Coated Flexible Paper Packaging Analysis and Forecast, By End Use

8.1. Section Summary

8.2. Introduction

8.2.1. Market share and Basis Points (BPS) Analysis By End Use

8.2.2. Y-o-Y Growth Projections By End Use

8.3. Historical Market Size (US$ Mn) and Volume (Tons) Analysis 2015-2019 By End Use

8.3.1. Food

8.3.1.1. Bakery

8.3.1.2. Confectionery

8.3.1.3. Snacks

8.3.1.4. Dairy

8.3.1.5. Spices

8.3.1.6. Sauces

8.3.2. Beverages

8.3.3. Cosmetics

8.3.4. Pharmaceuticals

8.3.5. Building & Construction

8.3.6. Electrical & Electronics

8.3.7. Others (Publications, Automotive, etc.)

8.4. Market Size (US$ Mn) and Volume (Tons) Forecast 2020-2028, By End Use

8.4.1. Food

8.4.1.1. Bakery

8.4.1.2. Confectionery

8.4.1.3. Snacks

8.4.1.4. Dairy

8.4.1.5. Spices

8.4.1.6. Sauces

8.4.2. Beverages

8.4.3. Cosmetics

8.4.4. Pharmaceuticals

8.4.5. Building & Construction

8.4.6. Electrical & Electronics

8.4.7. Others (Publications, Automotive, etc.)

8.5. Market Attractiveness Analysis By End Use

9. Europe Barrier Coated Flexible Paper Packaging Market Analysis and Forecast, By Region

9.1. Section Summary

9.2. Introduction

9.2.1. Market share and Basis Points (BPS) Analysis By Region

9.2.2. Y-o-Y Growth Projections By Region

9.3. Historical Market Size (US$ Mn) and Volume (Tons) Analysis 2015-2019 By Region

9.3.1. North America

9.3.2. Latin America

9.3.3. Europe

9.3.4. Asia Pacific

9.3.5. Middle East and Africa (MEA)

9.4. Market Size (US$ Mn) and Volume (Tons) Forecast 2020-2028 By Region

9.4.1. North America

9.4.2. Latin America

9.4.3. Europe

9.4.4. Asia Pacific

9.4.5. Middle East and Africa (MEA)

9.5. Market Attractiveness Analysis By Region

10. Market Structure Analysis

10.1. Market Analysis, by Tier of Companies

10.2. Market Presence Analysis

10.2.1. By Regional footprint of Players

10.2.2. Channel footprint by Players

11. Competitive Landscape

11.1. Competition Dashboard

11.2. Company Market Share Analysis

11.3. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

11.4. Competition Deep Dive

11.4.1. Barrier Coated Flexible Paper Packaging Manufacturers

11.4.1.1. BASF SE

11.4.1.1.1. Overview

11.4.1.1.2. Product Portfolio

11.4.1.1.3. Profitability

11.4.1.1.4. Sales Footprint

11.4.1.1.5. Competition Benchmarking

11.4.1.1.6. Strategy

11.4.1.1.6.1. Marketing Strategy

11.4.1.1.6.2. Product Strategy

11.4.1.1.6.3. Channel Strategy

11.4.1.2. Dow Chemical Company

11.4.1.2.1. Overview

11.4.1.2.2. Product Portfolio

11.4.1.2.3. Profitability

11.4.1.2.4. Sales Footprint

11.4.1.2.5. Competition Benchmarking

11.4.1.2.6. Strategy

11.4.1.2.6.1. Marketing Strategy

11.4.1.2.6.2. Product Strategy

11.4.1.2.6.3. Channel Strategy

11.4.1.3. UPM-Kymmene Oyj

11.4.1.3.1. Overview

11.4.1.3.2. Product Portfolio

11.4.1.3.3. Profitability

11.4.1.3.4. Sales Footprint

11.4.1.3.5. Competition Benchmarking

11.4.1.3.6. Strategy

11.4.1.3.6.1. Marketing Strategy

11.4.1.3.6.2. Product Strategy

11.4.1.3.6.3. Channel Strategy

11.4.1.4. Sappi Ltd

11.4.1.4.1. Overview

11.4.1.4.2. Product Portfolio

11.4.1.4.3. Profitability

11.4.1.4.4. Sales Footprint

11.4.1.4.5. Competition Benchmarking

11.4.1.4.6. Strategy

11.4.1.4.6.1. Marketing Strategy

11.4.1.4.6.2. Product Strategy

11.4.1.4.6.3. Channel Strategy

11.4.1.5. Stora Enso Oyj.

11.4.1.5.1. Overview

11.4.1.5.2. Product Portfolio

11.4.1.5.3. Profitability

11.4.1.5.4. Sales Footprint

11.4.1.5.5. Competition Benchmarking

11.4.1.5.6. Strategy

11.4.1.5.6.1. Marketing Strategy

11.4.1.5.6.2. Product Strategy

11.4.1.5.6.3. Channel Strategy

11.4.1.6. Mondi Plc.

11.4.1.6.1. Overview

11.4.1.6.2. Product Portfolio

11.4.1.6.3. Profitability

11.4.1.6.4. Sales Footprint

11.4.1.6.5. Competition Benchmarking

11.4.1.6.6. Strategy

11.4.1.6.6.1. Marketing Strategy

11.4.1.6.6.2. Product Strategy

11.4.1.6.6.3. Channel Strategy

11.4.1.7. Nippon Paper Industries Co., Ltd

11.4.1.7.1. Overview

11.4.1.7.2. Product Portfolio

11.4.1.7.3. Profitability

11.4.1.7.4. Sales Footprint

11.4.1.7.5. Competition Benchmarking

11.4.1.7.6. Strategy

11.4.1.7.6.1. Marketing Strategy

11.4.1.7.6.2. Product Strategy

11.4.1.7.6.3. Channel Strategy

11.4.1.8. Ahlstrom-Munksjö Oyj

11.4.1.8.1. Overview

11.4.1.8.2. Product Portfolio

11.4.1.8.3. Profitability

11.4.1.8.4. Sales Footprint

11.4.1.8.5. Competition Benchmarking

11.4.1.8.6. Strategy

11.4.1.8.6.1. Marketing Strategy

11.4.1.8.6.2. Product Strategy

11.4.1.8.6.3. Channel Strategy

11.4.1.9. Mitsubishi Paper Mills Limited

11.4.1.9.1. Overview

11.4.1.9.2. Product Portfolio

11.4.1.9.3. Profitability

11.4.1.9.4. Sales Footprint

11.4.1.9.5. Competition Benchmarking

11.4.1.9.6. Strategy

11.4.1.9.6.1. Marketing Strategy

11.4.1.9.6.2. Product Strategy

11.4.1.9.6.3. Channel Strategy

11.4.1.10. WestRock Company

11.4.1.10.1. Overview

11.4.1.10.2. Product Portfolio

11.4.1.10.3. Profitability

11.4.1.10.4. Sales Footprint

11.4.1.10.5. Competition Benchmarking

11.4.1.10.6. Strategy

11.4.1.10.6.1. Marketing Strategy

11.4.1.10.6.2. Product Strategy

11.4.1.10.6.3. Channel Strategy

11.4.1.11. Billerudkorsnas AB

11.4.1.11.1. Overview

11.4.1.11.2. Product Portfolio

11.4.1.11.3. Profitability

11.4.1.11.4. Sales Footprint

11.4.1.11.5. Competition Benchmarking

11.4.1.11.6. Strategy

11.4.1.11.6.1. Marketing Strategy

11.4.1.11.6.2. Product Strategy

11.4.1.11.6.3. Channel Strategy

11.4.1.12. Solenis

11.4.1.12.1. Overview

11.4.1.12.2. Product Portfolio

11.4.1.12.3. Profitability

11.4.1.12.4. Sales Footprint

11.4.1.12.5. Competition Benchmarking

11.4.1.12.6. Strategy

11.4.1.12.6.1. Marketing Strategy

11.4.1.12.6.2. Product Strategy

11.4.1.12.6.3. Channel Strategy

11.4.1.13. International Paper Company

11.4.1.13.1. Overview

11.4.1.13.2. Product Portfolio

11.4.1.13.3. Profitability

11.4.1.13.4. Sales Footprint

11.4.1.13.5. Competition Benchmarking

11.4.1.13.6. Strategy

11.4.1.13.6.1. Marketing Strategy

11.4.1.13.6.2. Product Strategy

11.4.1.13.6.3. Channel Strategy

11.4.1.14. Graphic Packaging International

11.4.1.14.1. Overview

11.4.1.14.2. Product Portfolio

11.4.1.14.3. Profitability

11.4.1.14.4. Sales Footprint

11.4.1.14.5. Competition Benchmarking

11.4.1.14.6. Strategy

11.4.1.14.6.1. Marketing Strategy

11.4.1.14.6.2. Product Strategy

11.4.1.14.6.3. Channel Strategy

11.4.1.15. Gascogne Group

11.4.1.15.1. Overview

11.4.1.15.2. Product Portfolio

11.4.1.15.3. Profitability

11.4.1.15.4. Sales Footprint

11.4.1.15.5. Competition Benchmarking

11.4.1.15.6. Strategy

11.4.1.15.6.1. Marketing Strategy

11.4.1.15.6.2. Product Strategy

11.4.1.15.6.3. Channel Strategy

11.4.1.16. MetPro Group

11.4.1.16.1. Overview

11.4.1.16.2. Product Portfolio

11.4.1.16.3. Profitability

11.4.1.16.4. Sales Footprint

11.4.1.16.5. Competition Benchmarking

11.4.1.16.6. Strategy

11.4.1.16.6.1. Marketing Strategy

11.4.1.16.6.2. Product Strategy

11.4.1.16.6.3. Channel Strategy

11.4.1.17. PG Paper Company Ltd.

11.4.1.17.1. Overview

11.4.1.17.2. Product Portfolio

11.4.1.17.3. Profitability

11.4.1.17.4. Sales Footprint

11.4.1.17.5. Competition Benchmarking

11.4.1.17.6. Strategy

11.4.1.17.6.1. Marketing Strategy

11.4.1.17.6.2. Product Strategy

11.4.1.17.6.3. Channel Strategy

11.4.1.18. Feldmuehle GmbH

11.4.1.18.1. Overview

11.4.1.18.2. Product Portfolio

11.4.1.18.3. Profitability

11.4.1.18.4. Sales Footprint

11.4.1.18.5. Competition Benchmarking

11.4.1.18.6. Strategy

11.4.1.18.6.1. Marketing Strategy

11.4.1.18.6.2. Product Strategy

11.4.1.18.6.3. Channel Strategy

11.4.1.19. Nordic Paper AS

11.4.1.19.1. Overview

11.4.1.19.2. Product Portfolio

11.4.1.19.3. Profitability

11.4.1.19.4. Sales Footprint

11.4.1.19.5. Competition Benchmarking

11.4.1.19.6. Strategy

11.4.1.19.6.1. Marketing Strategy

11.4.1.19.6.2. Product Strategy

11.4.1.19.6.3. Channel Strategy

*The above list is indicative in nature and is subject to change during the course of research

12. Assumptions and Acronyms

13. Research Methodology

List of Tables

Table 01: Europe Barrier Coated Flexible Paper Packaging Market Value (US$Mn) Analysis, by Coating Type, 2015(H)-2028(F)

Table 02: Europe Barrier Coated Flexible Paper Packaging Market Volume (Tonnes) Analysis, by Coating Type, 2015(H)-2028(F)

Table 03: Europe Barrier Coated Flexible Paper Packaging Market Value (US$Mn ) Analysis, by Application, 2015(H)-2028(F)

Table 04: Europe Barrier Coated Flexible Paper Packaging Market Volume (Tonnes) Analysis, by Application, 2015(H)-2028(F)

Table 05: Europe Barrier Coated Flexible Paper Packaging Market Value (US$Mn ) Analysis, by End Use, 2015(H)-2028(F)

Table 06: Europe Barrier Coated Flexible Paper Packaging Market Volume (Tonnes) Analysis, by End Use, 2015(H)-2028(F)

Table 07: Europe Barrier Coated Flexible Paper Packaging Market Value (US$Mn) Analysis, by Country, 2015(H)-2028(F)

Table 08: Europe Barrier Coated Flexible Paper Packaging Market Volume (Tonnes) Analysis, by Country, 2015(H)-2028(F)

List of Figures

Figure 01: Europe Barrier Coated Flexible Paper Packaging Market Share Analysis, by Coating Type, 2020(E) & 2028(F)

Figure 02: Europe Barrier Coated Flexible Paper Packaging Market Attractiveness Analysis, by Coating Type, 2020(E)-2028(F)

Figure 03: Europe Barrier Coated Flexible Paper Packaging Market Share Analysis, by Application, 2020(E) & 2028(F)

Figure 04: Europe Barrier Coated Flexible Paper Packaging Market Attractiveness Analysis, by Application, 2020(E)-2028(F)

Figure 05: Europe Barrier Coated Flexible Paper Packaging Market Share Analysis, by End Use, 2020(E) & 2028(F)

Figure 06: Europe Barrier Coated Flexible Paper Packaging Market Attractiveness Analysis, by End Use, 2020(E)-2028(F)

Figure 07: Europe Barrier Coated Flexible Paper Packaging Market Share Analysis, by Country, 2020(E) & 2028(F)

Figure 08: Europe Barrier Coated Flexible Paper Packaging Market Attractiveness Analysis, by Country, 2020(E)-2028(F)