Analysts’ Viewpoint

Rapid growth in integration of camera-based systems into modern vehicles is a key factor driving the Europe automotive camera washers market. Demand for luxury vehicles and quick adoption of automotive technologies is further fueling the Europe automotive camera washer market share. Several advanced driver assistance system (ADAS) technologies depend on cameras. Any malfunction caused by the accumulation of mud, fog, or dirt can affect the operational effectiveness of vehicle camera sensing operations.

Government backed policies favoring the increase in need for safer and autonomous vehicles, rise in disposable income, and numerous financial options coupled with declining car loan interest rates in the emerging countries of Eastern Europe, are likely to offer lucrative growth opportunities in the near future for the Europe automotive camera washers industry.

An automotive camera washer is a system designed to clean cameras installed on vehicles, particularly those used for advanced driver assistance systems (ADAS) and other safety features. These cameras, often mounted on the exterior of the vehicle, can be obstructed by dirt, dust, mud, or other environmental elements, affecting their functionality. The automotive camera washer system typically includes a mechanism for spraying or washing the camera lens, ensuring optimal visibility and performance.

European markets, known for a high concentration of luxury and premium vehicle manufacturers, witness significant integration of advanced safety technologies. Automotive camera washers are commonly featured in these high-end vehicles.

Ongoing technological advancements in camera-based safety systems and washers are likely to bolster the Europe automotive camera washers market growth. A potential aftermarket for camera washer systems also exists, as vehicle owners may seek to retrofit or replace existing systems for improved performance.

European nations are increasingly prioritizing road safety initiatives to reduce accidents and fatalities. The effective functioning of camera-based advanced driver assistance systems (ADAS) is integral to these efforts, and camera washer systems play a crucial role in ensuring the efficiency of these safety features. Camera washer systems perform regular cleaning of the cameras, to ensure clear visibility for the driver both in the front and in the rear of the vehicle. This significantly contributes to ensuring the safety of the driver.

As Europe progresses toward semi-autonomous and autonomous vehicles, the significance of cameras and sensors becomes even more pivotal. These vehicles heavily rely on camera-based systems for navigation and decision-making while driving. The cleanliness of cameras is imperative for their secure operation.

MS Foster & Associates, Inc. has developed the CAMWASH vehicle camera washing system, designed for both commercial and passenger cars. Various types of sensors are now integrated into automobiles, showcasing advancements in in-vehicle electronics and sensor technologies aimed at enhancing safety. The growing emphasis on driver safety is expected to augment the Europe automotive camera washers market value.

The increase in demand for comfort and safety has led to the incorporation of numerous cameras in vehicles. Automakers are consistently innovating in the realm of autonomous driving, driven by the proliferation of cameras and sensors in both passenger and commercial vehicles. These camera systems primarily serve to assist drivers in tasks such as parking, navigation, and performance evaluation.

A significant number of safety systems rely on cameras for functionalities such as lane-keeping, pedestrian detection, and adaptive cruise control. The proper functioning of these systems is contingent on having clean and clear camera lenses. European regulations and consumer safety expectations are compelling automakers to integrate camera washer systems, ensuring that these crucial cameras remain unobstructed by dirt, debris, and other impediments. By maintaining the cleanliness of camera lenses, camera washer systems play a vital role in enhancing the efficiency of advanced driver assistance systems (ADAS), thereby reducing the likelihood of accidents and consequently emissions.

The 2019 Kia K900 was specifically designed to eliminate blind spots by incorporating 16 cameras and sensors. This innovation made blind areas visible on the digital dashboard, demonstrating the potential of increasing camera integration in modern vehicles, which is likely to offer lucrative opportunities for Europe automotive camera washers market expansion.

The Europe automotive camera washers market segmentation based on application includes LiDAR system, rear camera, and front camera.

The rear camera segment dominated the market due to the widespread integration of advanced driver assistance systems (ADAS) in vehicles. Rear cameras are a crucial component of ADAS, and their proper functioning is essential for safety features such as parking assistance and collision avoidance. Washing systems help maintain the clarity of rear camera lenses, ensuring optimal performance. Rear cameras contribute to improved visibility and safety while reversing, and the inclusion of washing systems addresses the need for clear camera lenses

The Europe automotive camera washers market analysis in terms of sales channel comprises OEM and aftermarket. The OEM category dominates the market in Europe. OEM camera washers are seamlessly integrated into the original design and manufacturing process of vehicles. They are tailor-made to fit specific vehicle models, ensuring a cohesive and integrated appearance. This ensures compatibility and reliability, as they are engineered to work seamlessly with other OEM components, including the camera systems and associated electronics. Vehicles equipped with OEM camera washers typically come with the manufacturer's warranty, providing consumers with a sense of assurance and protection against potential defects.

Germany, France, and the United Kingdom have a strong automotive industry and high consumer demand for advanced safety features. As per the latest Europe automotive camera washers market forecast, Germany, as a key player in the European automotive industry, exhibits a strong focus on advanced technologies and safety features and dominates the landscape. Germany is home to a sizable number of luxury automobile producers.

Sales of automobiles are increasing in Slovakia, Hungary, Austria, and the Czech Republic, which is driving the sub region's market for car camera cleaning systems. Continuous technological innovations and research contributes to the integration of advanced safety systems in the U.K., owing to high awareness of safety features among consumers as well as stringent regulations. This is likely to drive Europe automotive camera washers market progress.

France, with a strong automotive industry, is expected to witness significant integration of advanced safety technologies, including camera washers. For Italy and Spain, economic conditions may influence consumer purchasing power and the adoption of optional safety features. Italy's automotive culture and preferences for advanced features may drive the adoption of camera washers.

Nordic Countries (Sweden, Norway, Denmark, and Finland) are known to be early adopters of new technologies, which may contribute to the integration of camera washers in vehicles. The market diversity in the rest of Europe with varying consumer preferences and economic conditions and compliance with EU safety standards and regulations is projected to be a key factor influencing market statistics.

Major players in the Europe automotive camera washers market are investing significantly in R&D activities. They are collaborating strategically to accelerate product innovation and expand their business lines. Manufacturers continually innovate to enhance the effectiveness and efficiency of camera washer systems.

Continental AG, Denso Corporation, Ficosa Internacional SA, KAUTEX TEXTRON GMBH & CO. KG, MAGNA Electronics Inc., MS Foster & Associates, Inc., Panasonic Corp., Valeo S.A, ZF Friedrichshafen AG, Vitesco Technologies Group, and Mergon Group are the key entities in the Europe automotive camera washers market.

Each of these players has been profiled in the Europe automotive camera washers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

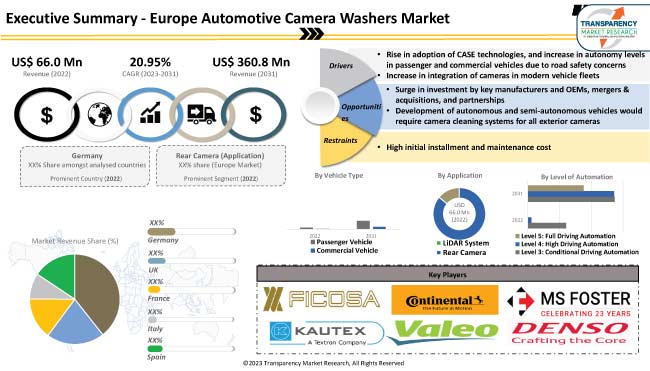

| Market Value in 2022 | US$ 66.0 Mn |

| Market Forecast Value in 2031 | US$ 360.8 Mn |

| Growth Rate (CAGR) | 20.95% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value and Thousand Units for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Region and Countries Covered |

|

| Companies Profile |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 66.0 Mn in 2022

The CAGR is projected to be 20.95% from 2023-2031

It is expected to reach US$ 360.8 Mn by the end of 2031

Rise in adoption of CASE technologies, and increase in autonomy levels in passenger and commercial vehicles due to rising road safety concerns

Based on application, the rear camera segment was dominant

Germany is anticipated to be a highly lucrative market

Continental AG, Denso Corporation, Ficosa Internacional SA, KAUTEX TEXTRON GMBH & CO. KG, MAGNA Electronics Inc., MS Foster & Associates, Inc., Panasonic Corp., Valeo S.A, ZF Friedrichshafen AG, Vitesco Technologies Group, and Mergon Group.

1. Executive Summary

1.1. Market Outlook

1.1.1. Market Value, US$ Mn, 2023-2031

1.2. Competitive Dashboard Analysis

1.3. TMR Analysis and Recommendation

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. SWOT Analysis

2.4. Regulatory Scenario

2.5. SWOT Analysis

2.6. Value Chain Analysis

2.7. Vendor Matrix

3. Europe Automotive Camera Washers Market, By Vehicle Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Europe Automotive Camera Washers Market Size Analysis & Forecast, 2023-2031, By Vehicle Type

3.2.1. Passenger Vehicle

3.2.1.1. Hatchback

3.2.1.2. Sedan

3.2.1.3. Utility Vehicles

3.2.2. Commercial Vehicle

4. Europe Automotive Camera Washers Market, By Application

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Europe Automotive Camera Washers Market Size Analysis & Forecast, 2023-2031, By Application

4.2.1. LiDAR System

4.2.2. Rear Camera

4.2.3. Front Camera

5. Europe Automotive Camera Washers Market, By Level of Automation

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Europe Automotive Camera Washers Market Size Analysis & Forecast, 2023-2031, By Level of Automation

5.2.1. Level 3: Conditional Driving Automation

5.2.2. Level 4: High Driving Automation

5.2.3. Level 5: Full Driving Automation

6. Europe Automotive Camera Washers Market, By Sales Channel

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Europe Automotive Camera Washers Market Size Analysis & Forecast, 2023-2031, By Sales Channel

6.2.1. OEM

6.2.2. Aftermarket

7. Europe Automotive Camera Washers Market, by Country

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Europe Automotive Camera Washers Market Size Analysis & Forecast, 2023-2031, By Country

7.2.1. Germany

7.2.2. U. K.

7.2.3. France

7.2.4. Italy

7.2.5. Spain

7.2.6. Nordic Countries

7.2.7. Russia & CIS

7.2.8. Rest of Europe

8. Competitive Landscape

8.1. Company Share Analysis / Brand Share Analysis, 2022

8.2. Pricing comparison among key players

8.3. Company Analysis for each player

8.4. Company Profile/ Key Players

8.4.1. Continental AG

8.4.1.1. Company Overview

8.4.1.2. Company Footprints

8.4.1.3. Production Locations

8.4.1.4. Product Portfolio

8.4.1.5. Competitors & Customers

8.4.1.6. Subsidiaries & Parent Organization

8.4.1.7. Recent Developments

8.4.1.8. Financial Analysis

8.4.1.9. Profitability

8.4.1.10. Revenue Share

8.4.2. Denso Corporation

8.4.2.1. Company Overview

8.4.2.2. Company Footprints

8.4.2.3. Production Locations

8.4.2.4. Product Portfolio

8.4.2.5. Competitors & Customers

8.4.2.6. Subsidiaries & Parent Organization

8.4.2.7. Recent Developments

8.4.2.8. Financial Analysis

8.4.2.9. Profitability

8.4.2.10. Revenue Share

8.4.3. Ficosa Internacional SA

8.4.3.1. Company Overview

8.4.3.2. Company Footprints

8.4.3.3. Production Locations

8.4.3.4. Product Portfolio

8.4.3.5. Competitors & Customers

8.4.3.6. Subsidiaries & Parent Organization

8.4.3.7. Recent Developments

8.4.3.8. Financial Analysis

8.4.3.9. Profitability

8.4.3.10. Revenue Share

8.4.4. KAUTEX TEXTRON GMBH & CO. KG

8.4.4.1. Company Overview

8.4.4.2. Company Footprints

8.4.4.3. Production Locations

8.4.4.4. Product Portfolio

8.4.4.5. Competitors & Customers

8.4.4.6. Subsidiaries & Parent Organization

8.4.4.7. Recent Developments

8.4.4.8. Financial Analysis

8.4.4.9. Profitability

8.4.4.10. Revenue Share

8.4.5. MAGNA ELECTRONICS INC.

8.4.5.1. Company Overview

8.4.5.2. Company Footprints

8.4.5.3. Production Locations

8.4.5.4. Product Portfolio

8.4.5.5. Competitors & Customers

8.4.5.6. Subsidiaries & Parent Organization

8.4.5.7. Recent Developments

8.4.5.8. Financial Analysis

8.4.5.9. Profitability

8.4.5.10. Revenue Share

8.4.6. MS FOSTER & ASSOCIATES, INC.

8.4.6.1. Company Overview

8.4.6.2. Company Footprints

8.4.6.3. Production Locations

8.4.6.4. Product Portfolio

8.4.6.5. Competitors & Customers

8.4.6.6. Subsidiaries & Parent Organization

8.4.6.7. Recent Developments

8.4.6.8. Financial Analysis

8.4.6.9. Profitability

8.4.6.10. Revenue Share

8.4.7. Panasonic Corp.

8.4.7.1. Company Overview

8.4.7.2. Company Footprints

8.4.7.3. Production Locations

8.4.7.4. Product Portfolio

8.4.7.5. Competitors & Customers

8.4.7.6. Subsidiaries & Parent Organization

8.4.7.7. Recent Developments

8.4.7.8. Financial Analysis

8.4.7.9. Profitability

8.4.7.10. Revenue Share

8.4.8. Valeo S.A

8.4.8.1. Company Overview

8.4.8.2. Company Footprints

8.4.8.3. Production Locations

8.4.8.4. Product Portfolio

8.4.8.5. Competitors & Customers

8.4.8.6. Subsidiaries & Parent Organization

8.4.8.7. Recent Developments

8.4.8.8. Financial Analysis

8.4.8.9. Profitability

8.4.8.10. Revenue Share

8.4.9. ZF Friedrichshafen AG

8.4.9.1. Company Overview

8.4.9.2. Company Footprints

8.4.9.3. Production Locations

8.4.9.4. Product Portfolio

8.4.9.5. Competitors & Customers

8.4.9.6. Subsidiaries & Parent Organization

8.4.9.7. Recent Developments

8.4.9.8. Financial Analysis

8.4.9.9. Profitability

8.4.9.10. Revenue Share

8.4.10. Vitesco Technologies Group

8.4.10.1. Company Overview

8.4.10.2. Company Footprints

8.4.10.3. Production Locations

8.4.10.4. Product Portfolio

8.4.10.5. Competitors & Customers

8.4.10.6. Subsidiaries & Parent Organization

8.4.10.7. Recent Developments

8.4.10.8. Financial Analysis

8.4.10.9. Profitability

8.4.10.10. Revenue Share

8.4.11. Mergon Group

8.4.11.1. Company Overview

8.4.11.2. Company Footprints

8.4.11.3. Production Locations

8.4.11.4. Product Portfolio

8.4.11.5. Competitors & Customers

8.4.11.6. Subsidiaries & Parent Organization

8.4.11.7. Recent Developments

8.4.11.8. Financial Analysis

8.4.11.9. Profitability

8.4.11.10. Revenue Share

8.4.12. Others

8.4.12.1. Company Overview

8.4.12.2. Company Footprints

8.4.12.3. Production Locations

8.4.12.4. Product Portfolio

8.4.12.5. Competitors & Customers

8.4.12.6. Subsidiaries & Parent Organization

8.4.12.7. Recent Developments

8.4.12.8. Financial Analysis

8.4.12.9. Profitability

8.4.12.10. Revenue Share

List of Tables

Table 01: Europe Automotive Camera Washers Market Volume (Thousand Units) Forecast, by Vehicle Type, 2023-2031

Table 02: Europe Automotive Camera Washers Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2023-2031

Table 03: Europe Automotive Camera Washers Market Volume (Thousand Units) Forecast, by Application, 2023-2031

Table 04: Europe Automotive Camera Washers Market Revenue (US$ Mn) Forecast, by Application, 2023-2031

Table 05: Europe Automotive Camera Washers Market Volume (Thousand Units) Forecast, by Level of Automation (Vehicle), 2023-2031

Table 06: Europe Automotive Camera Washers Market Revenue (US$ Mn) Forecast, by Level of Automation (Vehicle), 2023-2031

Table 07: Europe Automotive Camera Washers Market Volume (Thousand Units) Forecast, by Sales Channel, 2023-2031

Table 08: Europe Automotive Camera Washers Market Revenue (US$ Mn) Forecast, by Sales Channel, 2023-2031

Table 09: Europe Automotive Camera Washers Market Volume (Thousand Units) Forecast, by Country, 2023-2031

Table 10: Europe Automotive Camera Washers Market Revenue (US$ Mn) Forecast, by Country, 2023-2031

List of Figures

Figure 01: Europe Automotive Camera Washers Market Volume (Thousand Units) Forecast, by Vehicle Type, 2023-2031

Figure 02: Europe Automotive Camera Washers Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2023-2031

Figure 03: Europe Automotive Camera Washers Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 04: Europe Automotive Camera Washers Market Volume (Thousand Units) Forecast, by Application, 2023-2031

Figure 05: Europe Automotive Camera Washers Market Revenue (US$ Mn) Forecast, by Application, 2023-2031

Figure 06: Europe Automotive Camera Washers Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 07: Europe Automotive Camera Washers Market Volume (Thousand Units) Forecast, by Level of Automation (Vehicle), 2023-2031

Figure 08: Europe Automotive Camera Washers Market Revenue (US$ Mn) Forecast, by Level of Automation (Vehicle), 2023-2031

Figure 09: Europe Automotive Camera Washers Market, Incremental Opportunity, by Country, Level of Automation (Vehicle), 2023-2031

Figure 10: Europe Automotive Camera Washers Market Volume (Thousand Units) Forecast, by Sales Channel, 2023-2031

Figure 11: Europe Automotive Camera Washers Market Revenue (US$ Mn) Forecast, by Sales Channel, 2023-2031

Figure 12: Europe Automotive Camera Washers Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 13: Europe Automotive Camera Washers Market Volume (Thousand Units) Forecast, by Country, 2023-2031

Figure 14: Europe Automotive Camera Washers Market Revenue (US$ Mn) Forecast, by Country, 2023-2031

Figure 15: Europe Automotive Camera Washers Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031