Petroleum dyes are increasingly being used as a fuel marker due to which, the demand for petroleum dyes of different colors and concentration is on the rise. In addition, petroleum dyes are also used to segregate fuel on the basis of taxes applicable to each fuel type. Within the petroleum dyes market in Europe, a host of analytical techniques have emerged in the European Union wherein multiple blends of markers and dyes are used. In recent times, participants operating in the current petroleum dyes market in Europe and Asia Pacific are exploring the potential of different analytical techniques, including spectrophotometric, electrochemical, HPLC, and chromatography, among others.

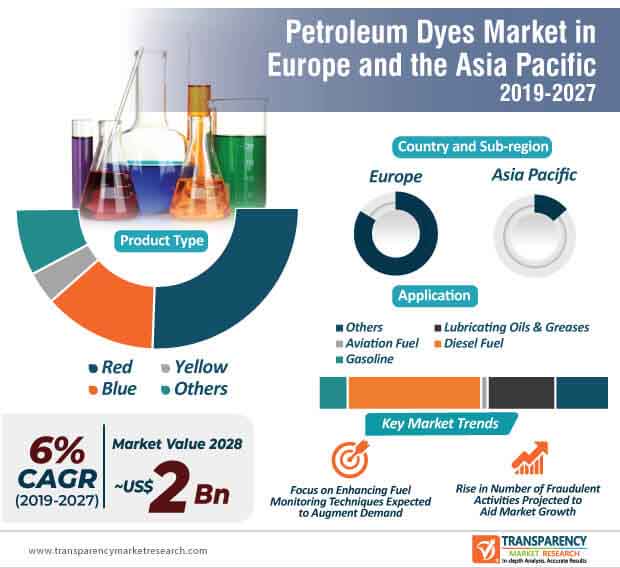

Within Europe and Asia Pacific, the number of fuel fraud cases have witnessed a considerable surge wherein dilution of expensive and high-taxed fuels are replaced with low-taxed substitutes. As these types of frauds continue to burden the governments across Europe and Asia Pacific, the demand for petroleum dyes is expected to witness consistent growth during the forecast period. The demand for petroleum dyes in off-road fuel is also projected to boost the growth of the petroleum dyes market in Europe and Asia Pacific in the coming years. Regulatory guidelines and evolving regulations will continue to influence the growth trajectory of the market – a trend that is set to continue during the forecast period. At the back of these factors, the petroleum dyes market in Europe and Asia Pacific is expected to reach of ~US$ 218 Mn by the end of 2027.

In recent times, the emphasis on improving the quality of automotive fuels, including ethanol, biofuel, biodiesel, and gasoline coupled with efforts to combat adulteration has triggered the demand for petroleum dyes in Europe and Asia Pacific. Companies operating in the current petroleum dyes market in Europe and Asia Pacific are expected to focus on improving monitoring quality and adulteration detection techniques. The growing prevalence of the illegal practice of fuel adulteration has also played a major role in increasing environmental contamination due to high emission rates. Fuel adulteration inflicts a huge amount of loss for governments due to lost tax revenues, which, in turn, dents the growth of the economy of these nations. Petroleum dyes are increasingly being used to prevent fraudulent activities across nations in the European Union and Asia Pacific.

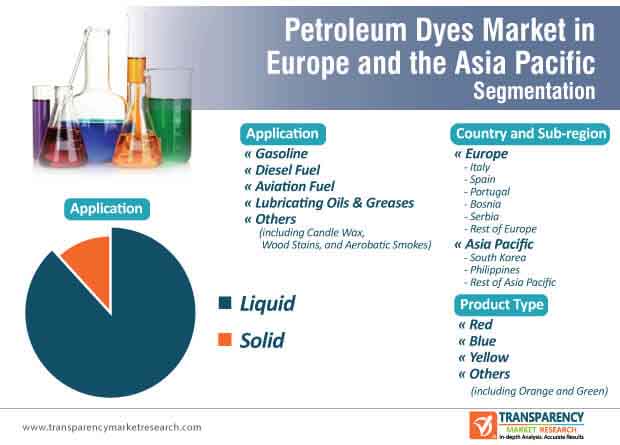

An array of petroleum products are being colored using petroleum dyes for efficient identification and improving the aesthetics of different fuel types, including diesel, kerosene, and lubrication oil. Several companies in the petroleum dyes market in Europe and Asia Pacific are increasingly using petroleum dyes to differentiate their products from the products manufactured by other players in the market to gain an edge. Test kits that are deployed to determine the quality and identify different fuels are also increasingly using petroleum dyes– a factor that is expected to boost the market growth in the coming years. Several nations in the Asia Pacific region, including China and India are opening their doors for foreign investments in the petroleum refining sector. Foreign investments are on the rise in China that are largely focusing on upstream petrochemical production.

Analysts’ Viewpoint

The petroleum dyes market in Europe and Asia Pacific is expected to grow at a moderate CAGR of ~3% during the forecast period. The market growth can be largely attributed to a host of factors, including soaring demand from petroleum companies, increase in fraudulent activities, and economic burden on government bodies in these regions. Companies operating in the petroleum dyes market in Europe and Asia Pacific landscape should focus on fulfilling the demand for petroleum dyes from different fuel companies.

Petroleum Dyes Market in Europe and Asia Pacific: Overview

Petroleum Dyes Market in Europe and Asia Pacific: Key Drivers and Restraints

Petroleum Dyes Market in Europe and Asia Pacific: Key Products

Petroleum Dyes Market in Europe and Asia Pacific: Key Applications

Europe to be Highly Lucrative Region

Petroleum Dyes Market in Europe and Asia Pacific: Competition Landscape

1. Executive Summary

1.1. Europe and Asia Pacific Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Outlook

2.5. Porters Five Forces Analysis

2.6. Regulatory Landscape

2.7. Value Chain Analysis

2.7.1. List of Petroleum Dyes Manufacturers

2.7.2. List of Potential Customers

2.8. Fuel Marker Analysis (Qualitative Analysis)

2.8.1. List of Key Manufacturers/Suppliers

2.8.2. Technological Overview

2.8.3. Application of Fuel Marker in Anti-Smuggling, Adulteration, and Supply Chain Management

3. Production Output Analysis, by Region, 2018

3.1. Europe

3.2. Asia Pacific

4. Petroleum Dyes Price Trend Analysis, 2018–2027

4.1. By Form

4.2. By Region

5. Europe and Asia Pacific Petroleum Dyes Market Analysis and Forecast, by Form

5.1. Key Findings, by Form

5.2. Europe and Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product, 2018–2027

5.2.1. Liquid

5.2.2. Solid

5.3. Europe and Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Form

6. Europe and Asia Pacific Petroleum Dyes Market Analysis and Forecast, by Product Type

6.1. Key Findings, by Product Type

6.2. Europe and Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

6.2.1. Red

6.2.2. Blue

6.2.3. Yellow

6.2.4. Others

6.3. Europe and Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Product Type

7. Europe and Asia Pacific Petroleum Dyes Market Analysis and Forecast, by Application

7.1. Key Findings, by Application

7.2. Europe and Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

7.2.1. Gasoline

7.2.2. Diesel Fuel

7.2.3. Aviation Fuel

7.2.4. Lubricating Oils & Greases

7.2.5. Others

7.3. Europe and Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Application

8. Europe and Asia Pacific Petroleum Dyes Market Analysis and Forecast, by Region

8.1. Europe and Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand), by Region, 2018–2027

8.1.1. Europe

8.1.2. Asia Pacific

8.2. Europe and Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Region

9. Europe Petroleum Dyes Market Analysis and Forecast, by Form

9.1. Key Findings, by Form

9.2. Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product, 2018–2027

9.2.1. Liquid

9.2.2. Solid

9.3. Europe Petroleum Dyes Market Attractiveness Analysis, by Form

10. Europe Petroleum Dyes Market Analysis and Forecast, by Product Type

10.1. Key Findings, by Product Type

10.2. Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

10.2.1. Red

10.2.2. Blue

10.2.3. Yellow

10.2.4. Others

10.3. Europe Petroleum Dyes Market Attractiveness Analysis, by Product Type

11. Europe Petroleum Dyes Market Analysis and Forecast, by Application

11.1. Key Findings, by Application

11.2. Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

11.2.1. Gasoline

11.2.2. Diesel Fuel

11.2.3. Aviation Fuel

11.2.4. Lubricating oils & greases

11.2.5. Others

11.3. Europe Petroleum Dyes Market Attractiveness Analysis, by Application

12. Europe Petroleum Dyes Market Analysis and Forecast, by Country and Sub-region

12.1. Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand), by Country and Sub-region, 2018–2027

12.1.1. Italy

12.1.2. Spain

12.1.3. Portugal

12.1.4. Bosnia

12.1.5. Serbia

12.1.6. Rest of Europe

12.2. Europe Petroleum Dyes Market Attractiveness Analysis, by Country and Sub-region

12.3. Italy Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.3.1. Liquid

12.3.2. Solid

12.4. Italy Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.4.1. Red

12.4.2. Blue

12.4.3. Yellow

12.4.4. Others

12.5. Italy Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

12.5.1. Gasoline

12.5.2. Diesel Fuel

12.5.3. Aviation Fuel

12.5.4. Lubricating Oils & Greases

12.5.5. Others

12.6. Spain Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.6.1. Liquid

12.6.2. Solid

12.7. Spain Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.7.1. Red

12.7.2. Blue

12.7.3. Yellow

12.7.4. Others

12.8. Spain Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

12.8.1. Gasoline

12.8.2. Diesel Fuel

12.8.3. Aviation Fuel

12.8.4. Lubricating Oils & Greases

12.8.5. Others

12.9. Portugal Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.9.1. Liquid

12.9.2. Solid

12.10. Portugal Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.10.1. Red

12.10.2. Blue

12.10.3. Yellow

12.10.4. Others

12.11. Portugal Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

12.11.1. Gasoline

12.11.2. Diesel Fuel

12.11.3. Aviation Fuel

12.11.4. Lubricating Oils & Greases

12.11.5. Others

12.12. Bosnia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.12.1. Liquid

12.12.2. Solid

12.13. Bosnia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.13.1. Red

12.13.2. Blue

12.13.3. Yellow

12.13.4. Others

12.14. Bosnia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

12.14.1. Gasoline

12.14.2. Diesel Fuel

12.14.3. Aviation Fuel

12.14.4. Lubricating Oils & Greases

12.14.5. Others

12.15. Serbia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.15.1. Liquid

12.15.2. Solid

12.16. Serbia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.16.1. Red

12.16.2. Blue

12.16.3. Yellow

12.16.4. Others

12.17. Serbia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

12.17.1. Gasoline

12.17.2. Diesel Fuel

12.17.3. Aviation Fuel

12.17.4. Lubricating Oils & Greases

12.17.5. Others

12.18. Rest of Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.18.1. Liquid

12.18.2. Solid

12.19. Rest of Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.19.1. Red

12.19.2. Blue

12.19.3. Yellow

12.19.4. Others

12.20. Rest of Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

12.20.1. Gasoline

12.20.2. Diesel Fuel

12.20.3. Aviation Fuel

12.20.4. Lubricating Oils & Greases

12.20.5. Others

13. Asia Pacific Petroleum Dyes Market Analysis and Forecast, by Form

13.1. Key Findings, by Form

13.2. Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product, 2018–2027

13.2.1. Liquid

13.2.2. Solid

13.3. Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Form

14. Asia Pacific Petroleum Dyes Market Analysis and Forecast, by Product Type

14.1. Key Findings, by Product Type

14.2. Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

14.2.1. Red

14.2.2. Blue

14.2.3. Yellow

14.2.4. Others

14.3. Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Product Type

15. Asia Pacific Petroleum Dyes Market Analysis and Forecast, by Application

15.1. Key Findings, by Application

15.2. Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

15.2.1. Gasoline

15.2.2. Diesel Fuel

15.2.3. Aviation Fuel

15.2.4. Lubricating Oils & Greases

15.2.5. Others

15.3. Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Application

16. Asia Pacific Petroleum Dyes Market Analysis and Forecast, by Country and Sub-region

16.1. Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand), by Country and Sub-region, 2018–2027

16.1.1. South Korea

16.1.2. Philippines

16.1.3. Rest of Asia Pacific

16.2. Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Country and Sub-region

16.3. South Korea Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

16.3.1. Liquid

16.3.2. Solid

16.4. South Korea Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

16.4.1. Red

16.4.2. Blue

16.4.3. Yellow

16.4.4. Others

16.5. South Korea Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

16.5.1. Gasoline

16.5.2. Diesel Fuel

16.5.3. Aviation Fuel

16.5.4. Lubricating Oils & Greases

16.5.5. Others

16.6. Philippines Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

16.6.1. Liquid

16.6.2. Solid

16.7. Philippines Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

16.7.1. Red

16.7.2. Blue

16.7.3. Yellow

16.7.4. Others

16.8. Philippines Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

16.8.1. Gasoline

16.8.2. Diesel Fuel

16.8.3. Aviation Fuel

16.8.4. Lubricating Oils & Greases

16.8.5. Others

16.9. Rest of Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

16.9.1. Liquid

16.9.2. Solid

16.10. Rest of Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

16.10.1. Red

16.10.2. Blue

16.10.3. Yellow

16.10.4. Others

16.11. Rest of Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

16.11.1. Gasoline

16.11.2. Diesel Fuel

16.11.3. Aviation Fuel

16.11.4. Lubricating Oils & Greases

16.11.5. Others

17. Competition Landscape

17.1. Competition Matrix, by Key Players

17.2. Europe and Asia Pacific Petroleum Dyes Market Share Analysis, by Company (2018)

17.3. Market Footprint

17.3.1. By Form

17.3.2. By Product Type

17.4. Company Profiles

17.4.1. Innospec Inc.

17.4.1.1. Company Description

17.4.1.2. Business Overview

17.4.1.3. Product Portfolio

17.4.1.4. Financial Overview

17.4.2. The Dow Chemical Company

17.4.2.1. Company Description

17.4.2.2. Business Overview

17.4.2.3. Product Portfolio

17.4.2.4. Financial Overview

17.4.3. Retort Chemicals Private Limited

17.4.3.1. Company Description

17.4.3.2. Business Overview

17.4.3.3. Product Portfolio

17.4.4. Spectronics Corporation

17.4.4.1. Company Description

17.4.4.2. Business Overview

17.4.4.3. Product Portfolio

17.4.5. Anchor Color and Chemical

17.4.5.1. Company Description

17.4.5.2. Business Overview

17.4.5.3. Product Portfolio

17.4.6. AUM FARBEN-CHEM (INDIA) PVT. LTD.

17.4.6.1. Company Description

17.4.6.2. Business Overview

17.4.6.3. Product Portfolio

17.4.7. United Color Manufacturing, Inc.

17.4.7.1. Company Description

17.4.7.2. Business Overview

17.4.7.3. Product Portfolio

17.4.8. John Hogg Technical Solutions

17.4.8.1. Company Description

17.4.8.2. Business Overview

17.4.8.3. Product Portfolio

17.4.9. Dayglo Color Corporation

17.4.9.1. Company Description

17.4.9.2. Business Overview

17.4.9.3. Product Portfolio

17.4.10. Orient Chemical (Korea) Ltd.

17.4.10.1. Company Description

17.4.10.2. Business Overview

17.4.10.3. Product Portfolio

18. Key Primary Insights

List of Tables

Table 1 Europe and Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 2 Europe and Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 3 Europe and Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

Table 4 Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Country and Sub-region, 2018–2027

Table 5 Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 6 Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 7 Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

Table 8 Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Country and Sub-region, 2018–2027

Table 9 Italy Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 10 Italy Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 11 Italy Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

Table 12 Spain Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 13 Spain Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 14 Spain Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

Table 15 Portugal Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 16 Portugal Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 17 Portugal Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

Table 18 Bosnia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 19 Bosnia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 20 Bosnia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

Table 21 Serbia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 22 Serbia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 23 Serbia Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

Table 24 Rest of Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 25 Rest of Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 26 Rest of Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

Table 27 Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 28 Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 29 Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

Table 30 Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Country and Sub-region, 2018–2027

Table 31 South Korea Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 32 South Korea Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 33 South Korea Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

Table 34 Philippines Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 35 Philippines Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 36 Philippines Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

Table 37 Rest of Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 38 Rest of Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Product Type, 2018–2027

Table 39 Rest of Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand) Forecast, by Application, 2018–2027

List of Figures

Figure 1 Europe and Asia Pacific Petroleum Dyes Market Share Analysis, by Form

Figure 2 Europe and Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Form

Figure 3 Europe and Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand), 2018–2027

Figure 4 Europe and Asia Pacific Petroleum Dyes Market Share Analysis, by Product Type

Figure 5 Europe and Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Product Type

Figure 6 Europe and Asia Pacific Petroleum Dyes Market Share Analysis, by Application

Figure 7 Europe and Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Application

Figure 8 Europe and Asia Pacific Petroleum Dyes Market Share Analysis, by Country and Sub-region

Figure 9 Europe and Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Country and Sub-region

Figure 10 Europe Petroleum Dyes Market Share Analysis, by Form

Figure 11 Europe Petroleum Dyes Market Attractiveness Analysis, by Form

Figure 12 Europe Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand), 2018–2027

Figure 13 Europe Petroleum Dyes Market Share Analysis, by Product Type

Figure 14 Europe Petroleum Dyes Market Attractiveness Analysis, by Product Type

Figure 15 Europe Petroleum Dyes Market Share Analysis, by Application

Figure 16 Europe Petroleum Dyes Market Attractiveness Analysis, by Application

Figure 17 Europe Petroleum Dyes Market Share Analysis, by Country and Sub-region

Figure 18 Europe Petroleum Dyes Market Attractiveness Analysis, by Country and Sub-region

Figure 19 Asia Pacific Petroleum Dyes Market Share Analysis, by Form

Figure 20 Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Form

Figure 21 Asia Pacific Petroleum Dyes Market Volume (Kilograms) and Value (US$ Thousand), 2018–2027

Figure 22 Asia Pacific Petroleum Dyes Market Share Analysis, by Product Type

Figure 23 Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Product Type

Figure 24 Asia Pacific Petroleum Dyes Market Share Analysis, by Application

Figure 25 Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Application

Figure 26 Asia Pacific Petroleum Dyes Market Share Analysis, by Country and Sub-region

Figure 27 Asia Pacific Petroleum Dyes Market Attractiveness Analysis, by Country and Sub-region