Analysts’ Viewpoint on Market Overview

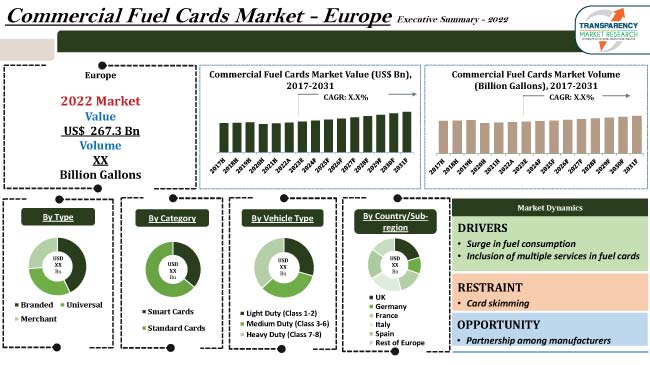

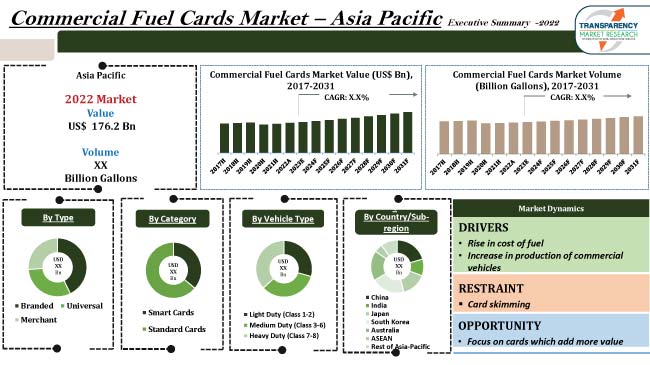

Rapid increase in number of commercial vehicles, and growth in demand for non-cash payment options is boosting the Europe and Asia Pacific commercial fuel cards market size. Surge in cost of fuel is anticipated to draw more commercial vehicle owners toward the use of fuel cards.

The global landscape is highly competitive, with the presence of various global and regional players. Key players are offering digital fuel card solutions for businesses, corporate fuel purchasing cards, and money-saving fuel cards, which come with the assurance of discounts and help in real-time fuel monitoring and tracking. Players in the market are striving to improve the card scheme options and collaborating with different companies for the introduction of fuel cards specifically targeted to meet the requirements of specific businesses.

Commercial fuel cards or commercial fleet fuel cards are payment options for businesses, enabling drivers to purchase fuel for the vehicles they use for business purposes. These cards are an ideal way of managing fuel expenses. Payment for various types of fuel purchases- diesel and gasoline (petrol) - can be made using these cards. One of the key elements driving the Europe and Asia Pacific commercial fuel cards market share is the growth in demand for fuel such as diesel and the focus on cost savings.

Branded, universal, and merchant are the different types of commercial fleet cards available.

Europe and Asia Pacific have a significant number of fleets on the road, including buses, and trucks. Demand for efficient fleet management solutions such as fuel cards has increased with the rise in number of fleets, in order to streamline operations and control expenses.

Several fuel cards have a spending cap on them, so drivers can control fuel spending and budget accordingly each month. Total number of new commercial vehicle sales in 2022 for Europe stood at 2,384,341 and for Asia Pacific it was 6,748,742. With the surge in number of new commercial vehicles year on year in Europe and Asia Pacific, customers are seeking affordable commercial fuel payment options. This is creating huge demand for fuel management cards and is expected to augment the Europe and Asia Pacific commercial fuel cards industry.

The Europe and Asia Pacific commercial fuel cards market segmentation in terms of vehicle type includes light duty, medium duty, and heavy duty. The heavy duty vehicle segment is projected to dominate the market during the forecast period.

Fuel card service providers have started to embed the telematics interface and robust reporting facilities (derived from telematics data and enhanced data capture) as standard product offerings to improve fleet management efficiency for heavy duty vehicles. Technology enhancements are thus expected to further accelerate the Europe and Asia Pacific commercial fuel cards market development.

According to the latest Europe and Asia Pacific commercial fuel cards market forecast, China holds major share based on countries due to rise in adoption of fleet cards for various commercial vehicles. Growth in commercial vehicle sales and demand for less expensive payment methods are further boosting market statistics.

China, Japan, South Korea, and Australia in Asia Pacific; and Germany, U.K, and France in Europe are major contributors to Europe and Asia Pacific commercial fuel cards market growth

Detailed profiles of companies in the Europe and Asia Pacific market research report are provided to evaluate their financials, key product offerings, recent developments, and strategies. Most of the companies are spending significantly on comprehensive R&D activities, primarily to develop innovative fuel cards.

Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by companies. They follow the latest Europe and Asia Pacific commercial fuel cards market trends to expand their customer base.

FLEETCOR Technologies, Exxon Mobil Corporation, Shell, Puma Energy, WEX, Sinopec, BP Plc, Chevron Corporation, Indian Oil Corporation Ltd, and European Diesel Card Ltd. are some of the key entities profiled in the Europe and Asia Pacific commercial fuel cards market report.

Key players have been profiled in the Europe and Asia Pacific commercial fuel cards market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, and business segments

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 443.5 Bn |

|

Market Forecast Value in 2031 |

US$ 826.0 Bn |

|

Growth Rate (CAGR) |

6.4% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for value and Billion Gallons for volume |

|

Market Analysis |

Europe and Asia Pacific qualitative analysis includes drivers, restraints, key trends, opportunities, Porter’s Five Forces analysis, key market indicators, value chain analysis, SWOT analysis, etc. Furthermore, at the country level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 443.5 Bn in 2022

It is expected to reach US$ 826.0 Bn by 2031

The CAGR is expected to be 6.4% from 2023 to 2031

Increase in number of commercial vehicles and concerns regarding expenditure on fuel

Heavy duty vehicle type accounted for major share in 2022

China is more attractive in Asia Pacific and in Europe, France, and Germany are more attractive for vendors

Fleetcor Technologies, Exxon Mobil Corporation, Shell, Puma Energy, WEX, Sinopec, BP Plc, Chevron Corporation, Indian Oil Corporation Ltd, and European Diesel Card Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Value Chain Analysis

5.6. Covid-19 Impact Analysis

5.7. Standards and Regulations

5.8. Porter’s Five Forces Analysis

5.9. Industry SWOT Analysis

6. Asia Pacific Commercial Fuel Cards Market Analysis and Forecast

6.1. Regional Snapshot

6.2. Key Supplier Analysis

6.3. Key Trend Analysis

6.4. Price Trend Analysis

6.5. Commercial Fuel Cards Market Size (US$ Bn and Billion Gallons) Forecast, By Type, 2017 - 2031

6.5.1. Branded

6.5.2. Universal

6.5.3. Merchant

6.6. Commercial Fuel Cards Market Size (US$ Bn and Billion Gallons) Forecast, By Category, 2017 - 2031

6.6.1. Smart Cards

6.6.2. Standard Cards

6.7. Commercial Fuel Cards Market Size (US$ Bn and Billion Gallons) Forecast, By Vehicle Type, 2017 - 2031

6.7.1. Light Duty

6.7.2. Medium Duty

6.7.3. Heavy Duty

6.8. Commercial Fuel Cards Market Size (US$ Bn and Billion Gallons), by Country/Sub-region, 2017 - 2031

6.8.1. China

6.8.2. India

6.8.3. Japan

6.8.4. South Korea

6.8.5. Australia

6.8.6. ASEAN

6.8.7. Rest of Asia Pacific

6.9. Incremental Opportunity Analysis

7. Europe Commercial Fuel Cards Market Analysis and Forecast

7.1. Commercial Fuel Cards Market Size (US$ Bn and Billion Gallons) Forecast, By Type, 2017 - 2031

7.1.1. Branded

7.1.2. Universal

7.1.3. Merchant

7.2. Commercial Fuel Cards Market Size (US$ Bn and Billion Gallons) Forecast, By Category, 2017 - 2031

7.2.1. Smart Cards

7.2.2. Standard Cards

7.3. Commercial Fuel Cards Market Size (US$ Bn and Billion Gallons) Forecast, By Vehicle Type, 2017 - 2031

7.3.1. Light Duty

7.3.2. Medium Duty

7.3.3. Heavy Duty

7.4. Commercial Fuel Cards Market Size (US$ Bn and Billion Gallons) Forecast, By Country/Sub-region, 2017 - 2031

7.4.1. U.K

7.4.2. Germany

7.4.3. France

7.4.4. Italy

7.4.5. Spain

7.4.6. Rest of Europe

7.5. Incremental Opportunity Analysis

8. Competition Landscape

8.1. Market Player - Competition Dashboard

8.2. Market Share Analysis (%)-2022

8.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Manufacturing Location, Revenue, Strategy & Business Process Overview)

8.3.1. FLEETCOR Technologies

8.3.1.1. Company Overview

8.3.1.2. Sales Area/Geographical Presence

8.3.1.3. Manufacturing Location

8.3.1.4. Revenue

8.3.1.5. Strategy & Business Process Overview

8.3.2. Exxon Mobil Corporation

8.3.2.1. Company Overview

8.3.2.2. Sales Area/Geographical Presence

8.3.2.3. Manufacturing Location

8.3.2.4. Revenue

8.3.2.5. Strategy & Business Process Overview

8.3.3. Shell

8.3.3.1. Company Overview

8.3.3.2. Sales Area/Geographical Presence

8.3.3.3. Manufacturing Location

8.3.3.4. Revenue

8.3.3.5. Strategy & Business Process Overview

8.3.4. Puma Energy

8.3.4.1. Company Overview

8.3.4.2. Sales Area/Geographical Presence

8.3.4.3. Manufacturing Location

8.3.4.4. Revenue

8.3.4.5. Strategy & Business Process Overview

8.3.5. WEX

8.3.5.1. Company Overview

8.3.5.2. Sales Area/Geographical Presence

8.3.5.3. Manufacturing Location

8.3.5.4. Revenue

8.3.5.5. Strategy & Business Process Overview

8.3.6. Sinopec

8.3.6.1. Company Overview

8.3.6.2. Sales Area/Geographical Presence

8.3.6.3. Manufacturing Location

8.3.6.4. Revenue

8.3.6.5. Strategy & Business Process Overview

8.3.7. BP Plc

8.3.7.1. Company Overview

8.3.7.2. Sales Area/Geographical Presence

8.3.7.3. Manufacturing Location

8.3.7.4. Revenue

8.3.7.5. Strategy & Business Process Overview

8.3.8. Chevron Corporation

8.3.8.1. Company Overview

8.3.8.2. Sales Area/Geographical Presence

8.3.8.3. Manufacturing Location

8.3.8.4. Revenue

8.3.8.5. Strategy & Business Process Overview

8.3.9. Indian Oil Corporation Ltd

8.3.9.1. Company Overview

8.3.9.2. Sales Area/Geographical Presence

8.3.9.3. Manufacturing Location

8.3.9.4. Revenue

8.3.9.5. Strategy & Business Process Overview

8.3.10. European Diesel Card Ltd.

8.3.10.1. Company Overview

8.3.10.2. Sales Area/Geographical Presence

8.3.10.3. Manufacturing Location

8.3.10.4. Revenue

8.3.10.5. Strategy & Business Process Overview

8.3.11. Other Key Players

8.3.11.1. Company Overview

8.3.11.2. Sales Area/Geographical Presence

8.3.11.3. Manufacturing Location

8.3.11.4. Revenue

8.3.11.5. Strategy & Business Process Overview

9. Key Takeaways

9.1. Identification of Potential Market Spaces

9.1.1. By Type

9.1.2. By Category

9.1.3. By Vehicle Type

9.1.4. By Region

9.2. Understanding the Procurement Process of End-users

9.3. Prevailing Market Risks

List of Tables

Table 1: Asia Pacific Commercial Fuel Cards Market by Type, Thousand Units 2017-2031

Table 2: Asia Pacific Commercial Fuel Cards Market by Type, US$ Bn 2017-2031

Table 3: Asia Pacific Commercial Fuel Cards Market by Category, Thousand Units 2017-2031

Table 4: Asia Pacific Commercial Fuel Cards Market by Category, US$ Bn 2017-2031

Table 5: Asia Pacific Commercial Fuel Cards Market by Vehicle Type, Thousand Units 2017-2031

Table 6: Asia Pacific Commercial Fuel Cards Market by Vehicle Type, US$ Bn 2017-2031

Table7: Asia Pacific Commercial Fuel Cards Market by Country, Thousand Units 2017-2031

Table 8: Asia Pacific Commercial Fuel Cards Market by Country, US$ Bn 2017-2031

Table 9: Europe Commercial Fuel Cards Market by Type, Thousand Units 2017-2031

Table 10: Europe Commercial Fuel Cards Market by Type, US$ Bn 2017-2031

Table 11: Europe Commercial Fuel Cards Market by Category, Thousand Units 2017-2031

Table 12: Europe Commercial Fuel Card Market by Category, US$ Bn 2017-2031

Table 13: Europe Commercial Fuel Card Market by Vehicle Type, Thousand Units 2017-2031

Table 14: Europe Commercial Fuel Card Market by Vehicle Type, US$ Bn 2017-2031

Table 15: Europe Commercial Fuel Card Market by Country, Thousand Units 2017-2031

Table 16: Europe Commercial Fuel Card Market by Country, US$ Bn 2017-2031

List of Figures

Figure 1: Asia Pacific Commercial Fuel Cards Market Projections, by Type, Thousand Units 2017-2031

Figure 2: Asia Pacific Commercial Fuel Cards Market Projections, by Type, US$ Bn 2017-2031

Figure 3: Asia Pacific Commercial Fuel Cards Market, Incremental Opportunity, by Type, US$ Bn 2023-2031

Figure 4: Asia Pacific Commercial Fuel Cards Market Projections, by Category, Thousand Units 2017-2031

Figure 5: Asia Pacific Commercial Fuel Cards Market Projections, by Category, US$ Bn 2017-2031

Figure 6: Asia Pacific Commercial Fuel Cards Market, Incremental Opportunity, by Category, US$ Bn 2023-2031

Figure 7: Asia Pacific Commercial Fuel Cards Market Projections, by Vehicle Type, Thousand Units 2017-2031

Figure 8: Asia Pacific Commercial Fuel Cards Market Projections, by Vehicle Type, US$ Bn 2017-2031

Figure 9: Asia Pacific Commercial Fuel Cards Market Incremental, by Vehicle Type, US$ Bn 2023-2031

Figure 10: Asia Pacific Commercial Fuel Cards Market Projections, by Country, Thousand Units 2017-2031

Figure 11: Asia Pacific Commercial Fuel Cards Market Projections, by Country, US$ Bn 2017-2031

Figure 12: Asia Pacific Commercial Fuel Cards Market Incremental, by Country, US$ Bn 2023-2031

Figure 13: Europe Commercial Fuel Cards Market Projections, by Type, Thousand Units 2017-2031

Figure 14: Europe Commercial Fuel Cards Market Projections, by Type, US$ Bn 2017-2031

Figure 15: Europe Commercial Fuel Cards Market, Incremental Opportunity, by Type, US$ Bn 2023-2031

Figure 16: Europe Commercial Fuel Cards Market Projections, by Category, Thousand Units 2017-2031

Figure 17: Europe Commercial Fuel Cards Market Projections, by Category, US$ Bn 2017-2031

Figure 18: Europe Commercial Fuel Cards Market, Incremental Opportunity, by Category, US$ Bn 2023-2031

Figure 19: Europe Commercial Fuel Cards Market Projections, by Vehicle Type, Thousand Units 2017-2031

Figure 20: Europe Commercial Fuel Cards Market Projections, by Vehicle Type, US$ Bn 2017-2031

Figure 21: Europe Commercial Fuel Cards Market Projections, by Vehicle Type, US$ Bn 2023-2031

Figure 22 Europe Commercial Fuel Cards Market Projections, by Country, Thousand Units 2017-2031

Figure 23: Europe Commercial Fuel Cards Market Projections, by Country, US$ Bn 2017-2031

Figure 24: Europe Commercial Fuel Cards Market, Incremental Opportunity, by Country, US$ Bn 2023-2031