The onset of the coronavirus pandemic has led to an increase in the consumption of single use plastics. Although these plastics are found to be the most sanitary choice in diverse applications, increasing volume of plastic waste is creating environmental, recycling, and disposal challenges. Companies in the ethylene bis stearamide market have been capitalizing on the demand for single use plastics in groceries and food service applications. However, manufacturers need to address the growing plastic waste to reduce environmental, recycling, and disposing burden during the ongoing COVID-19 pandemic.

Individuals are becoming aware that organizations is the U.S. are deliberately pushing their plastic agenda. Plastic manufacturers are scrambling to make a comeback by building fear in the minds of individuals and promoting the benefits of single use plastics. However, plastic manufacturers in the global ethylene bis stearamide market and other industries need to take cue from organizations such as the India Environment Ministry’s guidelines about Extended Producer’s Responsibility (EPR). Plastic manufacturers need to be accountable for environmentally sound management of plastic products until the end of its life.

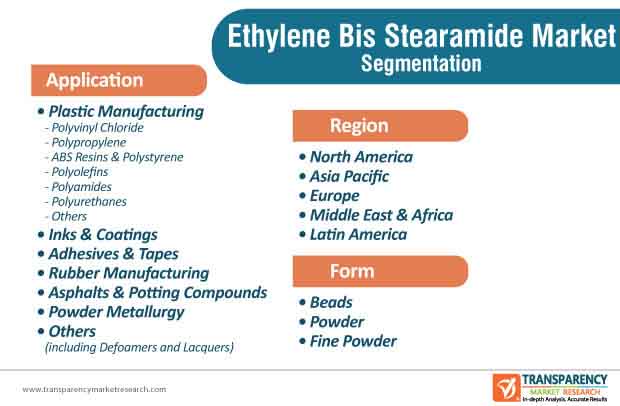

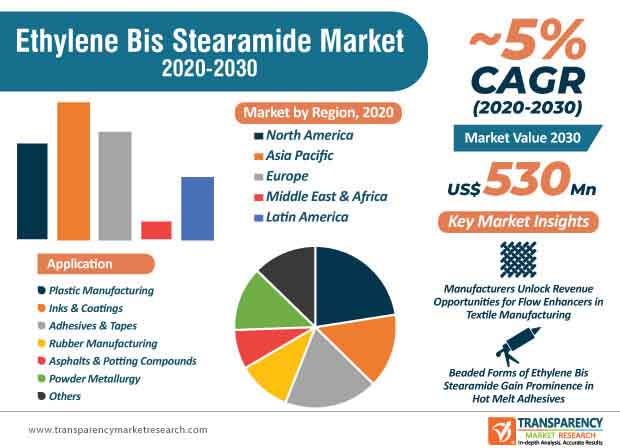

The ethylene bis stearamide market is predicted to reach the value of ~US$ 530 Mn by the end of 2030. Rubber, one of the key applications of ethylene bis stearamide, is virtually found in almost all end markets. However, selecting the right performance additives for rubber compounding can be potentially challenging for manufacturers. The demanding applications of rubber have stressed on the importance of rigorous R&D in order to gain a competitive edge over other market players.

Companies in the ethylene bis stearamide market are adopting cost efficient methods to produce powders and additives that translate into low cost rubber compounds.

Apart from plastic and rubber manufacturing, companies in the ethylene bis stearamide market are unlocking growth opportunities in ink, paint, and textile applications. 18C by Acme-Hardesty— the U.S.-based distributor of oleochemicals, is expanding its product portfolio of dispersing agents and flow enhancers such as ethylene bis stearamide that play a key role in textile, paint manufacturing, and ink applications.

Metalworking and construction are proving to be stable revenue streams for companies in the ethylene bis stearamide market. Ethylene bis stearamide plays an important role as a lubricant that reduces friction in wire drawing applications. In painting and printing, ethylene bis stearamide is being extensively used as a leveling and anti-sticking agent.

The eCommerce sector is emerging as a key platform in boosting the uptake of ethylene bis stearamide materials. Manufacturers are investing in online stores to boost product uptake. Companies in the ethylene bis stearamide market are increasing the availability of non-toxic ethylene bis stearamide, which is soluble in chlorinated and aromatic solvents. High temperature lubrication and surface smoothing properties of ethylene bis stearamide are being highly publicized in the ethylene bis stearamide market.

Ethylene bis stearamide is gaining prominence as a powder coating additive and pigment stabilizer. Paper manufacturing has triggered the demand for anti-foaming and anti-static agents. As such, plastic manufacturing is estimated to hold the highest share in terms of revenue among all applications in the market of ethylene bis stearamide. This is evident since there is a steady surge in the demand for internal and external lubricants and dispersants for plastic manufacturing.

The ever-evolving building and construction sector is creating business opportunities for manufacturers in the ethylene bis stearamide market. Sainuo—a lubrication & dispersion system product supplier in China is increasing its product portfolio in ethylene bis stearamide and polyethylene wax to help end users accelerate production of hot melt adhesives. Manufacturers in the ethylene bis stearamide market are increasing the availability of products that are tailored and optimized as per specific and unique client requirements. Companies in China are establishing robust supply chains with end users in Korea, the U.S., Russia, Germany, and Turkey, among others.

Beaded forms of ethylene bis stearamide are gaining prominence in hot melt adhesives. Manufacturers are increasing awareness about the compatibility of ethylene bis stearamide with other products to boost product uptake. Access to reliable information and technical solutions is helping build credibility of suppliers and manufacturers.

Companies in the ethylene bis stearamide market are boosting their output capacities in natural and synthetic amide waxes. TER Nordic— a chemical wholesaler in Odense, Denmark, is offering amide waxes in powder, micro powder, and granule forms. It has been found that amide waxes are in high demand for manufacturing lubricants meant for developing inks and coatings. As such, manufacturers are tapping into incremental opportunities in powder metallurgy, cosmetics, and packaging applications.

In order to boost credibility credentials, manufacturers are establishing long-term partnerships to ensure the quality in products. They are setting their collaboration wheels in motion to forge new partnerships to maximize profitability. Ethylene bis stearamide is being used to improve the main effects of wet spray. This has led to the popularity of ethylene bis stearamide as a dispersant in pigment masterbatch production.

Moreover, to produce rubber and elastomers, manufacturers in the ethylene bis stearamide market are boosting their output capacities to develop anti-adhesive agents, release agents, and dispersants. Ethylene bis stearamide helps to increase the melt index of the resin, resulting in enhancement of the fluidity of materials. On the other hand, ethylene bis stearamide is being highly publicized as a stabilizer and slip agent in PVC rigid film calendering.

Analysts’ Viewpoint

The increasing consumption of single use plastics has led to the formation of mandates for waste collection systems involving local authorities during the COVID-19 pandemic. The ethylene bis stearamide market is projected to clock a modest CAGR of ~5% throughout the assessment period, as manufacturers are facing difficulty in adhering to stringent regulations and making selection of right additives for producing rubber compounds. In order to tide over these issues, manufacturers should adopt cost efficient methods of manufacturing high performance additives involving ethylene bis stearamide to excel in rubber production. They should work closely with plant chemists and operators to clearly define performance improvements in additives. Thus, to comply with regulations, manufacturers are educating clients about disposal, packaging, and shelf life of ethylene bis stearamide.

Ethylene Bis Stearamide Market: Overview

Rise in Plastic Production across Globe: Key Driver of Ethylene Bis Stearamide Market

Ethylene Bis Stearamide Market: Competition Landscape

Ethylene Bis Stearamide Market Key Developments

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

3. Market Dynamics

3.1. Drivers and Restraints Snapshot Analysis

3.1.1. Drivers

3.1.2. Restraints

3.1.3. Opportunities

3.2. Porter’s Five Forces Analysis

3.2.1. Threat of Substitutes

3.2.2. Bargaining Power of Buyers

3.2.3. Bargaining Power of Suppliers

3.2.4. Threat of New Entrants

3.2.5. Degree of Competition

3.3. Regulatory Scenario

3.4. Value Chain Analysis

4. COVID-19 Impact Analysis

5. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Analysis, by Form

5.1. Key Findings and Introduction

5.2. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

5.2.1. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Beads, 2019–2030

5.2.1.1. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Powder, 2019–2030

5.2.1.2. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Fine Powder, 2019–2030

5.3. Global Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

6. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Analysis, by Application

6.1. Key Findings and Introduction

6.2. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

6.2.1. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, Plastic Manufacturing , 2019–2030

6.2.2. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Inks & Coatings, 2019–2030

6.2.3. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Adhesives & Tapes, 2019–2030

6.2.4. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Rubber Manufacturing, 2019–2030

6.2.5. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Asphalts and Potting compounds, 2019–2030

6.2.6. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Powder Metallurgy, 2019–2030

6.2.7. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Others, 2019–2030

6.3. Global Ethylene Bis Stearamide Market Attractiveness Analysis, by Application

7. Global Ethylene Bis Stearamide Market Analysis, by Region

7.1. Key Findings

7.2. Global Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Global Ethylene Bis Stearamide Market Attractiveness Analysis, by Region

8. North America Ethylene Bis Stearamide Market Overview

8.1. Key Findings

8.2. North America Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

8.3. North America Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.4. North America Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Country

8.4.1. U.S. Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

8.4.2. U.S. Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.4.3. Canada Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

8.4.4. Canada Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.5. North America Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

8.6. North America Ethylene Bis Stearamide Market Attractiveness Analysis, by Application

8.7. North America Ethylene Bis Stearamide Market Attractiveness Analysis, by Country

9. Europe Ethylene Bis Stearamide Market Overview

9.1. Key Findings

9.2. Europe Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

9.3. Europe Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.4. Europe Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) and Forecast, by Country and Sub-region

9.4.1. Germany Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

9.4.2. Germany Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.4.3. U.K. Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

9.4.4. U.K. Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.4.5. France Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

9.4.6. France Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.4.7. Spain Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

9.4.8. Spain Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.4.9. Italy Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

9.4.10. Italy Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.4.11. Russia & CIS Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

9.4.12. Russia & CIS Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.4.13. Rest of Europe Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

9.4.14. Rest of Europe Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

9.5. Europe Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

9.6. Europe Ethylene Bis Stearamide Market Attractiveness Analysis, by Application

9.7. Europe Ethylene Bis Stearamide Market Attractiveness Analysis, by Country and Sub-region

10. Asia Pacific Ethylene Bis Stearamide Market Overview

10.1. Key Findings

10.2. Asia Pacific Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

10.3. Asia Pacific Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.4. Asia Pacific Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

10.4.1. China Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

10.4.2. China Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.4.3. India Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019-2030

10.4.4. India Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.4.5. Japan Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019-2030

10.4.6. Japan Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.4.7. ASEAN Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019-2030

10.4.8. ASEAN Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.4.9. Rest of Asia Pacific Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

10.4.10. Rest of Asia Pacific Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

10.5. Asia Pacific Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

10.6. Asia Pacific Ethylene Bis Stearamide Market Attractiveness Analysis, by Application

10.7. Asia Pacific Ethylene Bis Stearamide Market Attractiveness Analysis, by Country and Sub-region

11. Latin America Ethylene Bis Stearamide Market Overview

11.1. Key Findings

11.2. Latin America Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

11.3. Latin America Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

11.4. Latin America Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

11.4.1. Brazil Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

11.4.2. Brazil Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

11.4.3. Mexico Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

11.4.4. Mexico Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

11.4.5. Rest of Latin America Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

11.4.6. Rest of Latin America Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

11.5. Latin America Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

11.6. Latin America Ethylene Bis Stearamide Market Attractiveness Analysis, by Application

11.7. Latin America Ethylene Bis Stearamide Market Attractiveness Analysis, by Country and Sub-region

12. Middle East & Africa Ethylene Bis Stearamide Market Overview

12.1. Key Findings

12.2. Middle East & Africa Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

12.3. Middle East & Africa Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.4. Middle East & Africa Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

12.4.1. GCC Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

12.4.2. GCC Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.4.3. South Africa Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

12.4.4. South Africa Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.4.5. Rest of Middle East & Africa Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2019–2030

12.4.6. Rest of Middle East & Africa Ethylene Bis Stearamide Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2019–2030

12.5. Middle East & Africa Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

12.6. Middle East & Africa Ethylene Bis Stearamide Market Attractiveness Analysis, by Application

12.7. Middle East & Africa Ethylene Bis Stearamide Market Attractiveness Analysis, by Country and Sub-region

13. Competition Landscape

13.1. Competition Matrix

13.2. Global Ethylene Bis Stearamide Market Share Analysis, by Company (2019)

13.3. Market Footprint Analysis

13.4. Company Profiles

13.4.1. Croda International PlC.

13.4.1.1. Company Details

13.4.1.2. Company Description

13.4.1.3. Business Overview

13.4.1.4. Financial Details

13.4.2. BassTech International

13.4.2.1. Company Details

13.4.2.2. Company Description

13.4.2.3. Business Overview

13.4.2.4. Financial Details

13.4.2.5. Strategic Overview

13.4.3. DEUREX

13.4.3.1. Company Details

13.4.3.2. Company Description

13.4.3.3. Business Overview

13.4.4. Tarak Chemicals

13.4.4.1. Company Details

13.4.4.2. Company Description

13.4.4.3. Business Overview

13.4.5. GreenTech Plastics

13.4.5.1. Company Details

13.4.5.2. Company Description

13.4.5.3. Business Overview

13.4.6. Sinwon Chemical.

13.4.6.1. Company Details

13.4.6.2. Company Description

13.4.6.3. Business Overview

13.4.6.4. Financial Details

13.4.6.5. Strategic Overview

13.4.7. KLK OLEO

13.4.7.1. Company Details

13.4.7.2. Company Description

13.4.7.3. Business Overview

13.4.7.4. Financial Details

13.4.8. PMC Biogenix

13.4.8.1. Company Details

13.4.8.2. Company Description

13.4.8.3. Business Overview

13.4.8.4. Financial Details

13.4.9. Kao Chemicals

13.4.9.1. Company Details

13.4.9.2. Company Description

13.4.9.3. Business Overview

13.4.9.4. Financial Details

13.4.9.5. Strategic Overview

13.4.10. Guangzhou Cardlo Biochemical technology Co., Ltd.

13.4.10.1. Company Details

13.4.10.2. Company Description

13.4.10.3. Business Overview

13.4.10.4. Financial Details

13.4.11. Valtris

13.4.11.1. Company Details

13.4.11.2. Company Description

13.4.11.3. Business Overview

13.4.11.4. Financial Details

13.4.12. Shandong Chuangying

13.4.12.1. Company Details

13.4.12.2. Company Description

13.4.12.3. Business Overview

13.4.12.4. Financial Details

14. Primary Research – Key Insights

15. Appendix

15.1. Research Methodology and Assumptions

List of Tables

Table 01: Global Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 02: Global Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 03: Global Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 04: Global Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 05: Global Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Region, 2019–2030

Table 06: Global Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Region, 2019–2030

Table 07: North America Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Country, 2019–2030

Table 08: North America Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Country, 2019–2030

Table 09: North America Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 10: North America Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 11: North America Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 12: North America Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 13: U.S. Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 14: U.S. Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 15: U.S. Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 16: U.S. Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 17: Canada Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 18: Canada Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 19: Canada Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 20: Canada Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 21: Europe Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Country and Sub-region, 2019–2030

Table 22: Europe Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 23: Europe Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 24: Europe Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 25: Europe Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 26: Europe Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 27: Germany Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 28: Germany Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 29: Germany Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 30: Germany Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 31: France Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 32: France Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 33: France Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 34: France Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 35: U.K. Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 36: U.K. Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 37: U.K. Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 38: U.K. Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 39: Italy Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 40: Italy Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 41: Italy Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 42: Italy Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 43: Spain Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 44: Spain Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 45: Spain Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 46: Spain Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 47: Russia & CIS Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 48: Russia & CIS Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 49: Russia & CIS Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 50: Russia & CIS Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 51: Rest of Europe Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 52: Rest of Europe Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 53: Rest of Europe Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 54: Rest of Europe Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 55: Asia Pacific Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Country and Sub-region, 2019–2030

Table 56: Asia Pacific Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 57: Asia Pacific Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 58: Asia Pacific Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 59: Asia Pacific Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 60: Asia Pacific Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 61: China Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 62: China Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 63: China Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 64: China Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 65: India Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 66: India Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 67: India Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 68: India Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 69: Japan Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 70: Japan Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 71: Japan Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 72: Japan Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 73: ASEAN Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 74: ASEAN Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 75: ASEAN Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 76: ASEAN Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 77: Rest of Asia Pacific Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 78: Rest of Asia Pacific Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 79: Rest of Asia Pacific Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 80: Rest of Asia Pacific Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 81: Latin America Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Country and Sub-region, 2019–2030

Table 82: Latin America Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 83: Latin America Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 84: Latin America Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 85: Latin America Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 86: Latin America Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 87: Brazil Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 88: Brazil Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 89: Brazil Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 90: Brazil Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 91: Mexico Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 92: Mexico Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 93: Mexico Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 94: Mexico Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 95: Rest of Latin America Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 96: Rest of Latin America Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 97: Rest of Latin America Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 98: Rest of Latin America Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 99: Rest of Latin America Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Fuel, 2019–2030

Table 100: Rest of Latin America Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Fuel, 2019–2030

Table 101: Middle East & Africa Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Country and Sub-region, 2019–2030

Table 102: Middle East & Africa Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2030

Table 103: Middle East & Africa Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 104: Middle East & Africa Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 105: Middle East & Africa Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 106: Middle East & Africa Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 107: Middle East & Africa Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Fuel, 2019–2030

Table 108: Middle East & Africa Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Fuel, 2019–2030

Table 109: GCC Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 110: GCC Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 111: GCC Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 112: GCC Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 113: South Africa Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 114: South Africa Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 115: South Africa Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 116: South Africa Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

Table 117: Rest of Middle East & Africa Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Form, 2019–2030

Table 118: Rest of Middle East & Africa Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Form, 2019–2030

Table 119: Rest of Middle East & Africa Ethylene Bis Stearamide Market Volume (Tons) Forecast, by Application, 2019–2030

Table 120: Rest of Middle East & Africa Ethylene Bis Stearamide Market Value (US$ Mn) Forecast, by Application, 2019–2030

List of Figures

Figure 01: Global Ethylene Bis Stearamide Market Share Analysis, by Form

Figure 02: Global Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

Figure 03: Global Ethylene Bis Stearamide Market Share Analysis, by Application

Figure 04: Global Ethylene Bis Stearamide Market Attractiveness Analysis, by Application

Figure 05: North America Ethylene Bis Stearamide Market Value Share Analysis, by Country, 2019, 2025, and 2030

Figure 06: North America Ethylene Bis Stearamide Market Value Share Analysis, by Country, 2019, 2025, and 2030

Figure 07: North America Ethylene Bis Stearamide Market Attractiveness Analysis, by Country

Figure 08: North America Ethylene Bis Stearamide Market Share Analysis, by Form

Figure 09: North America Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

Figure 10: North America Ethylene Bis Stearamide Market Share Analysis, by Application

Figure 11: North America Ethylene Bis Stearamide Market Attractiveness Analysis, by Application

Figure 12: Europe Ethylene Bis Stearamide Market Value (US$ Mn), 2019–2030

Figure 13: Europe Ethylene Bis Stearamide Market Value Share Analysis, by Country and Sub-region, 2019, 2025, and 2030

Figure 14: Europe Ethylene Bis Stearamide Market Attractiveness Analysis, by Country and Sub-region

Figure 15: Europe Ethylene Bis Stearamide Market Share Analysis, by Form

Figure 16: Europe Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

Figure 17: Europe Ethylene Bis Stearamide Market Share Analysis, by Application

Figure 18: Europe Ethylene Bis Stearamide Market Attractiveness Analysis, by Application

Figure 19: Asia Pacific Ethylene Bis Stearamide Market Value Share Analysis, by Country and Sub-region, 2019, 2025, and 2030

Figure 20: Asia Pacific Ethylene Bis Stearamide Market Attractiveness Analysis, by Country and Sub-region

Figure 21: Asia Pacific Ethylene Bis Stearamide Market Share Analysis, by Form

Figure 22: Asia Pacific Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

Figure 23: Asia Pacific Ethylene Bis Stearamide Market Share Analysis, by Application

Figure 24: Asia Pacific Ethylene Bis Stearamide Market Attractiveness Analysis, by Application

Figure 25: Latin America Ethylene Bis Stearamide Market Value (US$ Mn), 2019–2030

Figure 26: Latin America Ethylene Bis Stearamide Market Value Share Analysis, by Country and Sub-region, 2019, 2025, and 2030

Figure 27: Latin America Ethylene Bis Stearamide Market Attractiveness Analysis, by Country and Sub-region

Figure 28: Latin America Ethylene Bis Stearamide Market Share Analysis, by Form

Figure 29: Latin America Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

Figure 30: Latin America Ethylene Bis Stearamide Market Share Analysis, by Application

Figure 31: Latin America Ethylene Bis Stearamide Market Attractiveness Analysis, by Application

Figure 32: Middle East & Africa Ethylene Bis Stearamide Market Value (US$ Mn), 2019–2030

Figure 33: Middle East & Africa Ethylene Bis Stearamide Market Value Share Analysis, by Country and Sub-region, 2019, 2025, and 2030

Figure 34: Middle East & Africa Ethylene Bis Stearamide Market Attractiveness Analysis, by Country and Sub-region

Figure 35: Middle East & Africa Ethylene Bis Stearamide Market Share Analysis, by Form

Figure 36: Middle East & Africa Ethylene Bis Stearamide Market Attractiveness Analysis, by Form

Figure 37: Middle East & Africa Ethylene Bis Stearamide Market Share Analysis, by Application

Figure 38: Middle East & Africa Ethylene Bis Stearamide Market Attractiveness Analysis, by Application