Analysts’ Viewpoint on Market Scenario

Surge in office remodeling activities is expected to drive the global ergonomic chair market during the forecast period. Companies regularly refurbish workspaces in commercial spaces to include cutting-edge design elements such as ergonomic and multifunctional seating systems. A few brands in the market are manufacturing hybrid and autonomous ergo chairs, which can be used for office as well as gaming purposes.

Leading ergonomic chair brands are investing in advanced technologies to develop innovative products. Key players are likely to be involved in mergers and acquisitions in order to stay ahead of the competitive curve. Several governments and SMEs are also focusing on developing commercial infrastructure and manufacturing units. This is anticipated to drive the global ergonomic chair demand.

Ergonomic chairs are computer chairs or desk chairs with special features. These chairs are designed to support the natural posture of the body while working. Ergonomic office chairs are used in corporate and other commercial environments, especially where people sit for long periods of time. They provide height adjustability features and lumbar support.

Ergonomic chair reduces abnormal strain on the body while working. Manufacturers are focusing on developing innovative products with advanced features, including adjustable seats, armrests, padded seat, and padded back, to help reduce back pain.

Demand for ergonomic office chair is increasing across the globe, owing to the rise in awareness about the multiple health benefits of the chair in reducing back pain and increasing the productivity of employees. These chairs are widely adopted in corporate work environments to help improve the well-being of employees.

Corporate organizations are investing significantly in improving their interior spaces to offer employees a productive and comfortable work environment. Many office furniture manufacturers and designers offer comfortable chairs to minimize stress. This has led to the global ergonomic chair market expansion.

Increase in development of commercial offices is anticipated to augment the demand for ergonomic chairs in the next few years. Smart and multi-functionality furniture is required in various commercial spaces to increase the productivity of users.

Ergonomic chairs are gaining traction in commercial buildings due to their cost effectiveness. These chairs offer comfort and convenience while working, and can be adjusted as per the requirement of the user.

Based on design, the global market has been segmented into kneeling ergonomic chair, saddle ergonomic chair, exercise ball ergonomic chair, and recliner chair. The recliner chair segment is expected to hold major share of the global market during the forecast period, owing to the relaxing and comfortable design features of these chairs.

Increase in demand for recliner chairs due to the rise in remote working culture is also boosting the segment. Recliner chairs provide balanced sitting support. Rise in concerns about employee safety and health is driving the demand for recliner chairs.

Demand for ergonomic chairs is rising in commercial office premises across the globe. Increase in internal development and remodeling activities in commercial buildings and offices is positively affecting the global ergonomic chair market share.

Strong and durable office furniture is gaining popularity in various organizations across the globe. People are looking for more open and collaborative workspaces. These factors are contributing to the rise in ergonomic chair demand in commercial spaces.

According to the global ergonomic chair market forecast report, North America is expected to dominate the global market during the forecast period. Rise in population and increase in standard of living of the people are augmenting growth prospects of the construction industry in the region. This, in turn, is driving the demand for ergonomic chairs in North America.

People in the region are spending significantly on advanced products that help improve their health. This is positively impacting the ergonomic chair market share of North America.

A few large-scale players control majority of the share in the consolidated global business. Several companies are investing significantly in R&D activities to expand their product portfolio. Rise in investment in R&D activities is likely to open up new opportunities for market expansion. Ongoing strategic partnerships and mergers and acquisitions among players are projected to drive the future market value of the ergonomic chair industry.

Keekea, Steelcase Inc., ONLEAD Group, Herman Miller, Inc., Haworth Inc., HNI Corporation, Ergonomic Chair, UE Furniture Co., Ltd., PSI Seating Ltd, and Elite Office Furniture (UK) Ltd. are some of the key players operating in the global market.

Key players have been profiled in the ergonomic chair market research report based on parameters such as financial overview, business strategies, product portfolio, company overview, business segments, and recent developments.

|

Attribute |

Detail |

|

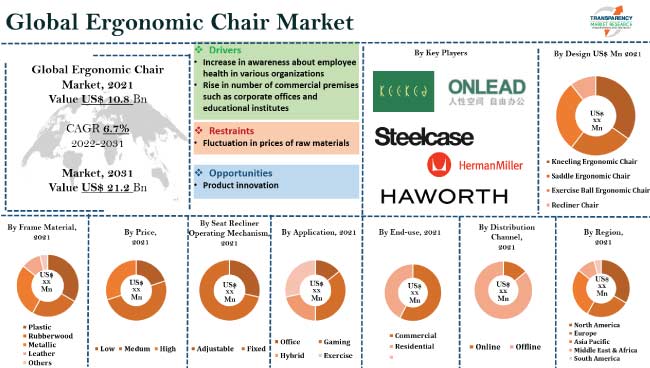

Market Value in 2021 |

US$ 10.8 Bn |

|

Market Forecast Value in 2031 |

US$ 21.2 Bn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 10.8 Bn in 2021

The CAGR is estimated to be 6.7% from 2022 to 2031

Increase in awareness about employee health in various organizations and rise in number of commercial premises such as corporate offices, educational institutes, government offices, and gaming zones

The recliner chair segment accounted for the largest share in 2021

North America is a more attractive region for vendors

Keekea, Steelcase Inc., ONLEAD Group, Herman Miller, Inc., Haworth Inc., HNI Corporation, Ergonomic Chair, UE Furniture Co., Ltd., PSI Seating Ltd, and Elite Office Furniture (UK) Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Interior Furniture Market Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Global Ergonomic Chair Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projections (US$ Bn)

5.8.2. Market Volume Projections (Million Units)

6. Global Ergonomic Chair Market Analysis and Forecast, By Design

6.1. Global Ergonomic Chair Market Size (US$ Bn and Million Units), By Design, 2017 - 2031

6.1.1. Kneeling Ergonomic Chair

6.1.2. Saddle Ergonomic Chair

6.1.3. Exercise Ball Ergonomic Chair

6.1.4. Recliner Chair

6.2. Incremental Opportunity, By Design

7. Global Ergonomic Chair Market Analysis and Forecast, By Frame Material

7.1. Global Ergonomic Chair Market Size (US$ Bn and Million Units), By Frame Material, 2017 - 2031

7.1.1. Plastic

7.1.2. Rubberwood

7.1.3. Metallic

7.1.4. Leather

7.1.5. Others

7.2. Incremental Opportunity, By Frame Material

8. Global Ergonomic Chair Market Analysis and Forecast, By Price

8.1. Global Ergonomic Chair Market Size (US$ Bn and Million Units), By Price, 2017 - 2031

8.1.1. Low (Below US$ 50)

8.1.2. Medium (US$ 50 - US$ 200)

8.1.3. High (Above US$ 200)

8.2. Incremental Opportunity, By Price

9. Global Ergonomic Chair Market Analysis and Forecast, By Seat Recliner Operating Mechanism

9.1. Global Ergonomic Chair Market Size (US$ Bn and Million Units), By Seat Recliner Operating Mechanism, 2017 - 2031

9.1.1. Adjustable

9.1.1.1. Up to 25 Inches

9.1.1.2. 26 to 50 Inches

9.1.1.3. Above 50 Inches

9.1.2. Fixed

9.2. Incremental Opportunity, By Seat Recliner Operating Mechanism

10. Global Ergonomic Chair Market Analysis and Forecast, By Application

10.1. Global Ergonomic Chair Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

10.1.1. Office

10.1.2. Gaming

10.1.3. Hybrid

10.1.4. Exercise

10.2. Incremental Opportunity, By Application

11. Global Ergonomic Chair Market Analysis and Forecast, By End-use

11.1. Global Ergonomic Chair Market Size (US$ Bn and Million Units), By End-use, 2017 - 2031

11.1.1. Commercial

11.1.2. Residential

11.2. Incremental Opportunity, By End-use

12. Global Ergonomic Chair Market Analysis and Forecast, By Distribution Channel

12.1. Global Ergonomic Chair Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

12.1.1. Online

12.1.1.1. E-commerce Websites

12.1.1.2. Company-owned Websites

12.1.2. Offline

12.1.2.1. Supermarkets/Hypermarkets

12.1.2.2. Speciality Stores

12.1.2.3. Other Retail Stores

12.2. Incremental Opportunity, By Distribution Channel

13. Global Ergonomic Chair Market Analysis and Forecast, Region

13.1. Global Ergonomic Chair Market Size (US$ Bn and Million Units), By Region, 2017 - 2031

13.1.1. North America

13.1.2. Europe

13.1.3. Asia Pacific

13.1.4. Middle East & Africa

13.1.5. South America

13.2. Incremental Opportunity, By Region

14. North America Ergonomic Chair Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Consumer Buying Behavior Analysis

14.3.1. Preferred Brand Design

14.3.2. Target Audience

14.3.3. Preferred Mode of Buying (Online/Offline)

14.3.4. Spending Capacity

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Key Trends Analysis

14.5.1. Demand Side Analysis

14.5.2. Supply Side Analysis

14.6. Ergonomic Chair Market Size (US$ Bn and Million Units), By Design, 2017 - 2031

14.6.1. Kneeling Ergonomic Chair

14.6.2. Saddle Ergonomic Chair

14.6.3. Exercise Ball Ergonomic Chair

14.6.4. Recliner Chair

14.7. Ergonomic Chair Market Size (US$ Bn and Million Units), By Frame Material, 2017 - 2031

14.7.1. Plastic

14.7.2. Rubberwood

14.7.3. Metallic

14.7.4. Leather

14.7.5. Others

14.8. Ergonomic Chair Market Size (US$ Bn and Million Units), By Price, 2017 - 2031

14.8.1. Low (Below US$ 50)

14.8.2. Medium (US$ 50 - US$ 200)

14.8.3. High (Above US$ 200)

14.9. Ergonomic Chair Market Size (US$ Bn and Million Units), By Seat Recliner Operating Mechanism, 2017 - 2031

14.9.1. Adjustable

14.9.1.1. Up to 25 Inches

14.9.1.2. 26 to 50 Inches

14.9.1.3. Above 50 Inches

14.9.2. Fixed

14.10. Ergonomic Chair Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

14.10.1. Office

14.10.2. Gaming

14.10.3. Hybrid

14.10.4. Exercise

14.11. Ergonomic Chair Market Size (US$ Bn and Million Units), By End-use, 2017 - 2031

14.11.1. Commercial

14.11.2. Residential

14.12. Ergonomic Chair Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

14.12.1. Online

14.12.1.1. E-commerce Websites

14.12.1.2. Company-owned Websites

14.12.2. Offline

14.12.2.1. Supermarkets/Hypermarkets

14.12.2.2. Speciality Stores

14.12.2.3. Other Retail Stores

14.13. Ergonomic Chair Market Size (US$ Bn and Million Units), By Country, 2017 - 2031

14.13.1. The U.S.

14.13.2. Canada

14.13.3. Rest of North America

14.14. Incremental Opportunity Analysis

15. Europe Ergonomic Chair Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. Consumer Buying Behavior Analysis

15.3.1. Preferred Brand Design

15.3.2. Target Audience

15.3.3. Preferred Mode of Buying (Online/Offline)

15.3.4. Spending Capacity

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Key Trends Analysis

15.5.1. Demand Side Analysis

15.5.2. Supply Side Analysis

15.6. Ergonomic Chair Market Size (US$ Bn and Million Units), By Design, 2017 - 2031

15.6.1. Kneeling Ergonomic Chair

15.6.2. Saddle Ergonomic Chair

15.6.3. Exercise Ball Ergonomic Chair

15.6.4. Recliner Chair

15.7. Ergonomic Chair Market Size (US$ Bn and Million Units), By Frame Material, 2017 - 2031

15.7.1. Plastic

15.7.2. Rubberwood

15.7.3. Metallic

15.7.4. Leather

15.7.5. Others

15.8. Ergonomic Chair Market Size (US$ Bn and Million Units), By Price, 2017 - 2031

15.8.1. Low (Below US$ 50)

15.8.2. Medium (US$ 50 - US$ 200)

15.8.3. High (Above US$ 200)

15.9. Ergonomic Chair Market Size (US$ Bn and Million Units), By Seat Recliner Operating Mechanism, 2017 - 2031

15.9.1. Adjustable

15.9.1.1. Up to 25 Inches

15.9.1.2. 26 to 50 Inches

15.9.1.3. Above 50 Inches

15.9.2. Fixed

15.10. Ergonomic Chair Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

15.10.1. Office

15.10.2. Gaming

15.10.3. Hybrid

15.10.4. Exercise

15.11. Ergonomic Chair Market Size (US$ Bn and Million Units), By End-use, 2017 - 2031

15.11.1. Commercial

15.11.2. Residential

15.12. Ergonomic Chair Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

15.12.1. Online

15.12.1.1. E-commerce Websites

15.12.1.2. Company-owned Websites

15.12.2. Offline

15.12.2.1. Supermarkets/Hypermarkets

15.12.2.2. Speciality Stores

15.12.2.3. Other Retail Stores

15.13. Ergonomic Chair Market Size (US$ Bn and Million Units), By Country, 2017 - 2031

15.13.1. The U.K.

15.13.2. Germany

15.13.3. France

15.13.4. Rest of Europe

15.14. Incremental Opportunity Analysis

16. Asia Pacific Ergonomic Chair Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Brand Analysis

16.3. Consumer Buying Behavior Analysis

16.3.1. Preferred Brand Design

16.3.2. Target Audience

16.3.3. Preferred Mode of Buying (Online/Offline)

16.3.4. Spending Capacity

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Key Trends Analysis

16.5.1. Demand Side Analysis

16.5.2. Supply Side Analysis

16.6. Ergonomic Chair Market Size (US$ Bn and Million Units), By Design, 2017 - 2031

16.6.1. Kneeling Ergonomic Chair

16.6.2. Saddle Ergonomic Chair

16.6.3. Exercise Ball Ergonomic Chair

16.6.4. Recliner Chair

16.7. Ergonomic Chair Market Size (US$ Bn and Million Units), By Frame Material, 2017 - 2031

16.7.1. Plastic

16.7.2. Rubberwood

16.7.3. Metallic

16.7.4. Leather

16.7.5. Others

16.8. Ergonomic Chair Market Size (US$ Bn and Million Units), By Price, 2017 - 2031

16.8.1. Low (Below US$ 50)

16.8.2. Medium (US$ 50 - US$ 200)

16.8.3. High (Above US$ 200)

16.9. Ergonomic Chair Market Size (US$ Bn and Million Units), By Seat Recliner Operating Mechanism, 2017 - 2031

16.9.1. Adjustable

16.9.1.1. Up to 25 Inches

16.9.1.2. 26 to 50 Inches

16.9.1.3. Above 50 Inches

16.9.2. Fixed

16.10. Ergonomic Chair Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

16.10.1. Office

16.10.2. Gaming

16.10.3. Hybrid

16.10.4. Exercise

16.11. Ergonomic Chair Market Size (US$ Bn and Million Units), By End-use, 2017 - 2031

16.11.1. Commercial

16.11.2. Residential

16.12. Ergonomic Chair Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

16.12.1. Online

16.12.1.1. E-commerce Websites

16.12.1.2. Company-owned Websites

16.12.2. Offline

16.12.2.1. Supermarkets/Hypermarkets

16.12.2.2. Speciality Stores

16.12.2.3. Other Retail Stores

16.13. Ergonomic Chair Market Size (US$ Bn and Million Units), By Country, 2017 - 2031

16.13.1. China

16.13.2. India

16.13.3. Japan

16.13.4. Rest of Asia Pacific

16.14. Incremental Opportunity Analysis

17. Middle East & Africa Ergonomic Chair Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Brand Analysis

17.3. Consumer Buying Behavior Analysis

17.3.1. Preferred Brand Design

17.3.2. Target Audience

17.3.3. Preferred Mode of Buying (Online/Offline)

17.3.4. Spending Capacity

17.4. Price Trend Analysis

17.4.1. Weighted Average Selling Price (US$)

17.5. Key Trends Analysis

17.5.1. Demand Side Analysis

17.5.2. Supply Side Analysis

17.6. Ergonomic Chair Market Size (US$ Bn and Million Units), By Design, 2017 - 2031

17.6.1. Kneeling Ergonomic Chair

17.6.2. Saddle Ergonomic Chair

17.6.3. Exercise Ball Ergonomic Chair

17.6.4. Recliner Chair

17.7. Ergonomic Chair Market Size (US$ Bn and Million Units), By Frame Material, 2017 - 2031

17.7.1. Plastic

17.7.2. Rubberwood

17.7.3. Metallic

17.7.4. Leather

17.7.5. Others

17.8. Ergonomic Chair Market Size (US$ Bn and Million Units), By Price, 2017 - 2031

17.8.1. Low (Below US$ 50)

17.8.2. Medium (US$ 50 - US$ 200)

17.8.3. High (Above US$ 200)

17.9. Ergonomic Chair Market Size (US$ Bn and Million Units), By Seat Recliner Operating Mechanism, 2017 - 2031

17.9.1. Adjustable

17.9.1.1. Up to 25 Inches

17.9.1.2. 26 to 50 Inches

17.9.1.3. Above 50 Inches

17.9.2. Fixed

17.10. Ergonomic Chair Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

17.10.1. Office

17.10.2. Gaming

17.10.3. Hybrid

17.10.4. Exercise

17.11. Ergonomic Chair Market Size (US$ Bn and Million Units), By End-use, 2017 - 2031

17.11.1. Commercial

17.11.2. Residential

17.12. Ergonomic Chair Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

17.12.1. Online

17.12.1.1. E-commerce Websites

17.12.1.2. Company-owned Websites

17.12.2. Offline

17.12.2.1. Supermarkets/Hypermarkets

17.12.2.2. Speciality Stores

17.12.2.3. Other Retail Stores

17.13. Ergonomic Chair Market Size (US$ Bn and Million Units), By Country, 2017 - 2031

17.13.1. GCC

17.13.2. South Africa

17.13.3. Rest of Middle East & Africa

17.14. Incremental Opportunity Analysis

18. South America Ergonomic Chair Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Brand Analysis

18.3. Consumer Buying Behavior Analysis

18.3.1. Preferred Brand Design

18.3.2. Target Audience

18.3.3. Preferred Mode of Buying (Online/Offline)

18.3.4. Spending Capacity

18.4. Price Trend Analysis

18.4.1. Weighted Average Selling Price (US$)

18.5. Key Trends Analysis

18.5.1. Demand Side Analysis

18.5.2. Supply Side Analysis

18.6. Ergonomic Chair Market Size (US$ Bn and Million Units), By Design, 2017 - 2031

18.6.1. Kneeling Ergonomic Chair

18.6.2. Saddle Ergonomic Chair

18.6.3. Exercise Ball Ergonomic Chair

18.6.4. Recliner Chair

18.7. Ergonomic Chair Market Size (US$ Bn and Million Units), By Frame Material, 2017 - 2031

18.7.1. Plastic

18.7.2. Rubberwood

18.7.3. Metallic

18.7.4. Leather

18.7.5. Others

18.8. Ergonomic Chair Market Size (US$ Bn and Million Units), By Price, 2017 - 2031

18.8.1. Low (Below US$ 50)

18.8.2. Medium (US$ 50 - US$ 200)

18.8.3. High (Above US$ 200)

18.9. Ergonomic Chair Market Size (US$ Bn and Million Units), By Seat Recliner Operating Mechanism, 2017 - 2031

18.9.1. Adjustable

18.9.1.1. Up to 25 Inches

18.9.1.2. 26 to 50 Inches

18.9.1.3. Above 50 Inches

18.9.2. Fixed

18.10. Ergonomic Chair Market Size (US$ Bn and Million Units), By Application, 2017 - 2031

18.10.1. Office

18.10.2. Gaming

18.10.3. Hybrid

18.10.4. Exercise

18.11. Ergonomic Chair Market Size (US$ Bn and Million Units), By End-use, 2017 - 2031

18.11.1. Commercial

18.11.2. Residential

18.12. Ergonomic Chair Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

18.12.1. Online

18.12.1.1. E-commerce Websites

18.12.1.2. Company-owned Websites

18.12.2. Offline

18.12.2.1. Supermarkets/Hypermarkets

18.12.2.2. Speciality Stores

18.12.2.3. Other Retail Stores

18.13. Ergonomic Chair Market Size (US$ Bn and Million Units), By Country, 2017 - 2031

18.13.1. Brazil

18.13.2. Rest of South America

18.14. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Market Player – Competition Dashboard

19.2. Market Share Analysis (%), 2021

19.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

19.3.1. Keekea

19.3.1.1. Company Overview

19.3.1.2. Sales Area/Geographical Presence

19.3.1.3. Financial/Revenue

19.3.1.4. Strategy & Business Overview

19.3.1.5. Sales Channel Analysis

19.3.1.6. Size Portfolio

19.3.2. Steelcase Inc.

19.3.2.1. Company Overview

19.3.2.2. Sales Area/Geographical Presence

19.3.2.3. Financial/Revenue

19.3.2.4. Strategy & Business Overview

19.3.2.5. Sales Channel Analysis

19.3.2.6. Size Portfolio

19.3.3. ONLEAD Group

19.3.3.1. Company Overview

19.3.3.2. Sales Area/Geographical Presence

19.3.3.3. Financial/Revenue

19.3.3.4. Strategy & Business Overview

19.3.3.5. Sales Channel Analysis

19.3.3.6. Size Portfolio

19.3.4. Herman Miller, Inc.

19.3.4.1. Company Overview

19.3.4.2. Sales Area/Geographical Presence

19.3.4.3. Financial/Revenue

19.3.4.4. Strategy & Business Overview

19.3.4.5. Sales Channel Analysis

19.3.4.6. Size Portfolio

19.3.5. Haworth Inc.

19.3.5.1. Company Overview

19.3.5.2. Sales Area/Geographical Presence

19.3.5.3. Financial/Revenue

19.3.5.4. Strategy & Business Overview

19.3.5.5. Sales Channel Analysis

19.3.5.6. Size Portfolio

19.3.6. HNI Corporation

19.3.6.1. Company Overview

19.3.6.2. Sales Area/Geographical Presence

19.3.6.3. Financial/Revenue

19.3.6.4. Strategy & Business Overview

19.3.6.5. Sales Channel Analysis

19.3.6.6. Size Portfolio

19.3.7. Ergonomic Chair

19.3.7.1. Company Overview

19.3.7.2. Sales Area/Geographical Presence

19.3.7.3. Financial/Revenue

19.3.7.4. Strategy & Business Overview

19.3.7.5. Sales Channel Analysis

19.3.7.6. Size Portfolio

19.3.8. UE Furniture Co., Ltd.

19.3.8.1. Company Overview

19.3.8.2. Sales Area/Geographical Presence

19.3.8.3. Financial/Revenue

19.3.8.4. Strategy & Business Overview

19.3.8.5. Sales Channel Analysis

19.3.8.6. Size Portfolio

19.3.9. PSI Seating Ltd

19.3.9.1. Company Overview

19.3.9.2. Sales Area/Geographical Presence

19.3.9.3. Financial/Revenue

19.3.9.4. Strategy & Business Overview

19.3.9.5. Sales Channel Analysis

19.3.9.6. Size Portfolio

19.3.10. Elite Office Furniture (UK) Ltd.

19.3.10.1. Company Overview

19.3.10.2. Sales Area/Geographical Presence

19.3.10.3. Financial/Revenue

19.3.10.4. Strategy & Business Overview

19.3.10.5. Sales Channel Analysis

19.3.10.6. Size Portfolio

20. Key Takeaway

20.1. Identification of Potential Market Spaces

20.1.1. Design

20.1.2. Frame Material

20.1.3. Price

20.1.4. Seat Recliner Operating Mechanism

20.1.5. Application

20.1.6. End-use

20.1.7. Distribution Channel

20.1.8. Geography

20.2. Understanding the Buying Process of the Customers

20.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Ergonomic Chair Market, By Design, Million Units, 2017-2031

Table 2: Global Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Table 3: Global Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Table 4: Global Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Table 5: Global Ergonomic Chair Market, By Price, Million Units, 2017-2031

Table 6: Global Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Table 7: Global Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Table 8: Global Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Table 9: Global Ergonomic Chair Market, By Application, Million Units, 2017-2031

Table 10: Global Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Table 11: Global Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Table 12: Global Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Table 13: Global Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Table 14: Global Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Table 15: Global Ergonomic Chair Market, By Region, Million Units, 2017-2031

Table 16: Global Ergonomic Chair Market, By Region, US$ Bn, 2017-2031

Table 17: North America Ergonomic Chair Market, By Design, Million Units, 2017-2031

Table 18: North America Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Table 19: North America Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Table 20: North America Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Table 21: North America Ergonomic Chair Market, By Price, Million Units, 2017-2031

Table 22: North America Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Table 23: North America Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Table 24: North America Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Table 25: North America Ergonomic Chair Market, By Application, Million Units, 2017-2031

Table 26: North America Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Table 27: North America Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Table 28: North America Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Table 29: North America Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Table 30: North America Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Table 31: North America Ergonomic Chair Market, By Country, Million Units, 2017-2031

Table 32: North America Ergonomic Chair Market, By Country, US$ Bn, 2017-2031

Table 33: Europe Ergonomic Chair Market, By Design, Million Units, 2017-2031

Table 34: Europe Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Table 35: Europe Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Table 36: Europe Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Table 37: Europe Ergonomic Chair Market, By Price, Million Units, 2017-2031

Table 38: Europe Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Table 39: Europe Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Table 40: Europe Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Table 41: Europe Ergonomic Chair Market, By Application, Million Units, 2017-2031

Table 42: Europe Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Table 43: Europe Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Table 44: Europe Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Table 45: Europe Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Table 46: Europe Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Table 47: Europe Ergonomic Chair Market, By Country, Million Units, 2017-2031

Table 48: Europe Ergonomic Chair Market, By Country, US$ Bn, 2017-2031

Table 49: Asia Pacific Ergonomic Chair Market, By Design, Million Units, 2017-2031

Table 50: Asia Pacific Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Table 51: Asia Pacific Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Table 52: Asia Pacific Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Table 53: Asia Pacific Ergonomic Chair Market, By Price, Million Units, 2017-2031

Table 54: Asia Pacific Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Table 55: Asia Pacific Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Table 56: Asia Pacific Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Table 57: Asia Pacific Ergonomic Chair Market, By Application, Million Units, 2017-2031

Table 58: Asia Pacific Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Table 59: Asia Pacific Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Table 60: Asia Pacific Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Table 61: Asia Pacific Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Table 62: Asia Pacific Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Table 63: Asia Pacific Ergonomic Chair Market, By Country, Million Units, 2017-2031

Table 64: Asia Pacific Ergonomic Chair Market, By Country, US$ Bn, 2017-2031

Table 65: Middle East & Africa Ergonomic Chair Market, By Design, Million Units, 2017-2031

Table 66: Middle East & Africa Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Table 67: Middle East & Africa Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Table 68: Middle East & Africa Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Table 69: Middle East & Africa Ergonomic Chair Market, By Price, Million Units, 2017-2031

Table 70: Middle East & Africa Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Table 71: Middle East & Africa Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Table 72: Middle East & Africa Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Table 73: Middle East & Africa Ergonomic Chair Market, By Application, Million Units, 2017-2031

Table 74: Middle East & Africa Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Table 75: Middle East & Africa Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Table 76: Middle East & Africa Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Table 77: Middle East & Africa Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Table 78: Middle East & Africa Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Table 79: Middle East & Africa Ergonomic Chair Market, By Country, Million Units, 2017-2031

Table 80: Middle East & Africa Ergonomic Chair Market, By Country, US$ Bn, 2017-2031

Table 81: South America Ergonomic Chair Market, By Design, Million Units, 2017-2031

Table 82: South America Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Table 83: South America Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Table 84: South America Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Table 85: South America Ergonomic Chair Market, By Price, Million Units, 2017-2031

Table 86: South America Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Table 87: South America Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Table 88: South America Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Table 89: South America Ergonomic Chair Market, By Application, Million Units, 2017-2031

Table 90: South America Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Table 91: South America Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Table 92: South America Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Table 93: South America Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Table 94: South America Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Table 95: South America Ergonomic Chair Market, By Country, Million Units, 2017-2031

Table 96: South America Ergonomic Chair Market, By Country, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Ergonomic Chair Market, By Design, Million Units, 2017-2031

Figure 2: Global Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Figure 3: Global Ergonomic Chair Market Incremental Opportunity, By Design, US$ Bn, 2022-2031

Figure 4: Global Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Figure 5: Global Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Figure 6: Global Ergonomic Chair Market Incremental Opportunity, By Frame Material, US$ Bn, 2022-2031

Figure 7: Global Ergonomic Chair Market, By Price, Million Units, 2017-2031

Figure 8: Global Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Figure 9: Global Ergonomic Chair Market Incremental Opportunity, By Price, US$ Bn, 2022-2031

Figure 10: Global Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Figure 11: Global Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Figure 12: Global Ergonomic Chair Market Incremental Opportunity, By Seat Recliner Operating Mechanism, US$ Bn, 2022-2031

Figure 13: Global Ergonomic Chair Market, By Application, Million Units, 2017-2031

Figure 14: Global Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Figure 15: Global Ergonomic Chair Market Incremental Opportunity, By Application, US$ Bn, 2022-2031

Figure 16: Global Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Figure 17: Global Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Figure 18: Global Ergonomic Chair Market Incremental Opportunity, By End-use, US$ Bn, 2022-2031

Figure 19: Global Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Figure 20: Global Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 21: Global Ergonomic Chair Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2022-2031

Figure 22: Global Ergonomic Chair Market, By Region, Million Units, 2017-2031

Figure 23: Global Ergonomic Chair Market, By Region, US$ Bn, 2017-2031

Figure 24: Global Ergonomic Chair Market Incremental Opportunity, By Region, US$ Bn, 2017-2031

Figure 25: North America Ergonomic Chair Market, By Design, Million Units, 2017-2031

Figure 26: North America Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Figure 27: North America Ergonomic Chair Market Incremental Opportunity, By Design, US$ Bn, 2022-2031

Figure 28: North America Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Figure 29: North America Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Figure 30: North America Ergonomic Chair Market Incremental Opportunity, By Frame Material, US$ Bn, 2022-2031

Figure 31: North America Ergonomic Chair Market, By Price, Million Units, 2017-2031

Figure 32: North America Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Figure 33: North America Ergonomic Chair Market Incremental Opportunity, By Price, US$ Bn, 2022-2031

Figure 34: North America Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Figure 35: North America Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Figure 36: North America Ergonomic Chair Market Incremental Opportunity, By Seat Recliner Operating Mechanism, US$ Bn, 2022-2031

Figure 37: North America Ergonomic Chair Market, By Application, Million Units, 2017-2031

Figure 38: North America Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Figure 39: North America Ergonomic Chair Market Incremental Opportunity, By Application, US$ Bn, 2022-2031

Figure 40: North America Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Figure 41: North America Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Figure 42: North America Ergonomic Chair Market Incremental Opportunity, By End-use, US$ Bn, 2022-2031

Figure 43: North America Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Figure 44: North America Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 45: North America Ergonomic Chair Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2022-2031

Figure 46: North America Ergonomic Chair Market, By Country, Million Units, 2017-2031

Figure 47: North America Ergonomic Chair Market, By Country, US$ Bn, 2017-2031

Figure 48: North America Ergonomic Chair Market Incremental Opportunity, By Country, US$ Bn, 2022-2031

Figure 49: Europe Ergonomic Chair Market, By Design, Million Units, 2017-2031

Figure 50: Europe Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Figure 51: Europe Ergonomic Chair Market Incremental Opportunity, By Design, US$ Bn, 2022-2031

Figure 52: Europe Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Figure 53: Europe Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Figure 54: Europe Ergonomic Chair Market Incremental Opportunity, By Frame Material, US$ Bn, 2022-2031

Figure 55: Europe Ergonomic Chair Market, By Price, Million Units, 2017-2031

Figure 56: Europe Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Figure 57: Europe Ergonomic Chair Market Incremental Opportunity, By Price, US$ Bn, 2022-2031

Figure 58: Europe Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Figure 59: Europe Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Figure 60: Europe Ergonomic Chair Market Incremental Opportunity, By Seat Recliner Operating Mechanism, US$ Bn, 2022-2031

Figure 61: Europe Ergonomic Chair Market, By Application, Million Units, 2017-2031

Figure 62: Europe Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Figure 63: Europe Ergonomic Chair Market Incremental Opportunity, By Application, US$ Bn, 2022-2031

Figure 64: Europe Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Figure 65: Europe Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Figure 66: Europe Ergonomic Chair Market Incremental Opportunity, By End-use, US$ Bn, 2022-2031

Figure 67: Europe Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Figure 68: Europe Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 69: Europe Ergonomic Chair Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2022-2031

Figure 70: Europe Ergonomic Chair Market, By Country, Million Units, 2017-2031

Figure 71: Europe Ergonomic Chair Market, By Country, US$ Bn, 2017-2031

Figure 72: Europe Ergonomic Chair Market Incremental Opportunity, By Country, US$ Bn, 2022-2031

Figure 73: Asia Pacific Ergonomic Chair Market, By Design, Million Units, 2017-2031

Figure 74: Asia Pacific Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Figure 75: Asia Pacific Ergonomic Chair Market Incremental Opportunity, By Design, US$ Bn, 2022-2031

Figure 76: Asia Pacific Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Figure 77: Asia Pacific Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Figure 78: Asia Pacific Ergonomic Chair Market Incremental Opportunity, By Frame Material, US$ Bn, 2022-2031

Figure 79: Asia Pacific Ergonomic Chair Market, By Price, Million Units, 2017-2031

Figure 80: Asia Pacific Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Figure 81: Asia Pacific Ergonomic Chair Market Incremental Opportunity, By Price, US$ Bn, 2022-2031

Figure 82: Asia Pacific Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Figure 83: Asia Pacific Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Figure 84: Asia Pacific Ergonomic Chair Market Incremental Opportunity, By Seat Recliner Operating Mechanism, US$ Bn, 2022-2031

Figure 85: Asia Pacific Ergonomic Chair Market, By Application, Million Units, 2017-2031

Figure 86: Asia Pacific Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Figure 87: Asia Pacific Ergonomic Chair Market Incremental Opportunity, By Application, US$ Bn, 2022-2031

Figure 88: Asia Pacific Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Figure 89: Asia Pacific Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Figure 90: Asia Pacific Ergonomic Chair Market Incremental Opportunity, By End-use, US$ Bn, 2022-2031

Figure 91: Asia Pacific Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Figure 92: Asia Pacific Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 93: Asia Pacific Ergonomic Chair Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2022-2031

Figure 94: Asia Pacific Ergonomic Chair Market, By Country, Million Units, 2017-2031

Figure 95: Asia Pacific Ergonomic Chair Market, By Country, US$ Bn, 2017-2031

Figure 96: Asia Pacific Ergonomic Chair Market Incremental Opportunity, By Country, US$ Bn, 2022-2031

Figure 97: Middle East & Africa Ergonomic Chair Market, By Design, Million Units, 2017-2031

Figure 98: Middle East & Africa Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Figure 99: Middle East & Africa Ergonomic Chair Market Incremental Opportunity, By Design, US$ Bn, 2022-2031

Figure 100: Middle East & Africa Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Figure 101: Middle East & Africa Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Figure 102: Middle East & Africa Ergonomic Chair Market Incremental Opportunity, By Frame Material, US$ Bn, 2022-2031

Figure 103: Middle East & Africa Ergonomic Chair Market, By Price, Million Units, 2017-2031

Figure 104: Middle East & Africa Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Figure 105: Middle East & Africa Ergonomic Chair Market Incremental Opportunity, By Price, US$ Bn, 2022-2031

Figure 106: Middle East & Africa Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Figure 107: Middle East & Africa Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Figure 108: Middle East & Africa Ergonomic Chair Market Incremental Opportunity, By Seat Recliner Operating Mechanism, US$ Bn, 2022-2031

Figure 109: Middle East & Africa Ergonomic Chair Market, By Application, Million Units, 2017-2031

Figure 110: Middle East & Africa Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Figure 111: Middle East & Africa Ergonomic Chair Market Incremental Opportunity, By Application, US$ Bn, 2022-2031

Figure 112: Middle East & Africa Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Figure 113: Middle East & Africa Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Figure 114: Middle East & Africa Ergonomic Chair Market Incremental Opportunity, By End-use, US$ Bn, 2022-2031

Figure 115: Middle East & Africa Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Figure 116: Middle East & Africa Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 117: Middle East & Africa Ergonomic Chair Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2022-2031

Figure 118: Middle East & Africa Ergonomic Chair Market, By Country, Million Units, 2017-2031

Figure 119: Middle East & Africa Ergonomic Chair Market, By Country, US$ Bn, 2017-2031

Figure 120: Middle East & Africa Ergonomic Chair Market Incremental Opportunity, By Country, US$ Bn, 2022-2031

Figure 121: South America Ergonomic Chair Market, By Design, Million Units, 2017-2031

Figure 122: South America Ergonomic Chair Market, By Design, US$ Bn, 2017-2031

Figure 123: South America Ergonomic Chair Market Incremental Opportunity, By Design, US$ Bn, 2022-2031

Figure 124: South America Ergonomic Chair Market, By Frame Material, Million Units, 2017-2031

Figure 125: South America Ergonomic Chair Market, By Frame Material, US$ Bn, 2017-2031

Figure 126: South America Ergonomic Chair Market Incremental Opportunity, By Frame Material, US$ Bn, 2022-2031

Figure 127: South America Ergonomic Chair Market, By Price, Million Units, 2017-2031

Figure 128: South America Ergonomic Chair Market, By Price, US$ Bn, 2017-2031

Figure 129: South America Ergonomic Chair Market Incremental Opportunity, By Price, US$ Bn, 2022-2031

Figure 130: South America Ergonomic Chair Market, By Seat Recliner Operating Mechanism, Million Units, 2017-2031

Figure 131: South America Ergonomic Chair Market, By Seat Recliner Operating Mechanism, US$ Bn, 2017-2031

Figure 132: South America Ergonomic Chair Market Incremental Opportunity, By Seat Recliner Operating Mechanism, US$ Bn, 2022-2031

Figure 133: South America Ergonomic Chair Market, By Application, Million Units, 2017-2031

Figure 134: South America Ergonomic Chair Market, By Application, US$ Bn, 2017-2031

Figure 135: South America Ergonomic Chair Market Incremental Opportunity, By Application, US$ Bn, 2022-2031

Figure 136: South America Ergonomic Chair Market, By End-use, Million Units, 2017-2031

Figure 137: South America Ergonomic Chair Market, By End-use, US$ Bn, 2017-2031

Figure 138: South America Ergonomic Chair Market Incremental Opportunity, By End-use, US$ Bn, 2022-2031

Figure 139: South America Ergonomic Chair Market, By Distribution Channel, Million Units, 2017-2031

Figure 140: South America Ergonomic Chair Market, By Distribution Channel, US$ Bn, 2017-2031

Figure 141: South America Ergonomic Chair Market Incremental Opportunity, By Distribution Channel, US$ Bn, 2022-2031

Figure 142: South America Ergonomic Chair Market, By Country, Million Units, 2017-2031

Figure 143: South America Ergonomic Chair Market, By Country, US$ Bn, 2017-2031

Figure 144: South America Ergonomic Chair Market Incremental Opportunity, By Country, US$ Bn, 2022-2031