Analysts’ Viewpoint on Equine Supplement Products Market Scenario

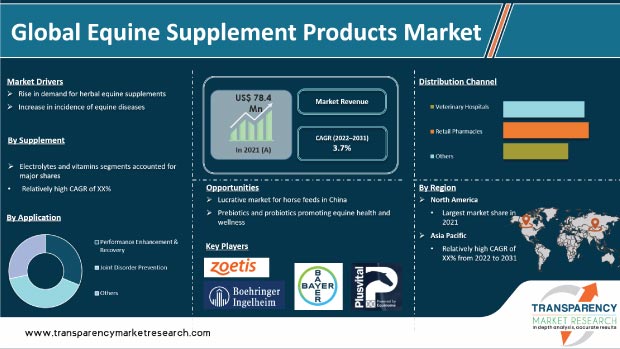

The global equine supplement products market is expected to grow at a moderate pace during the forecast period, led by the launch of new products. For instance, in July 2020, Buckeye Nutrition launched Ultimate Recovery, an extruded recovery supplement for performance horses. In 2019, Linkreservations, Inc. launched Cannabidiol (CBD) product for horses under the LinkResPet brand. Leading equine supplement companies are engaging in merger and acquisition activities to increase their presence in the market. Rise in government initiatives for equine health and growth in economic impact of the equine health industry are propelling the global equine supplement products market.

Equines are remarkable athletes and regularly require assistance for their high-performance regimen in the form of dietary horse supplements and additives. All horses, whether used for breeding, dressage, racing, or showing, need a balanced diet to improve their health. Performance horses have higher dietary needs than conventional horses due to the demands imposed on their bodies. A balanced diet, which sets priority on providing horses the nutrients they need for energy, is the secret to keep them strong and active. High-performance horses constantly burn their stored energy; hence, they need higher-than-average protein intake to maintain optimum health. In the U.S., the National Equine Health Plan was developed by the American Equine Council, the American Association of Equine Practitioners (AAEP), and the United States Department of Agriculture (USDA). Additionally, the National Animal Health Surveillance System (NAHMS), the Non-Regulatory Veterinary Services (VS) division of the USDA Animal and Plant Health Inspection Service, was developed to meet the national animal health information needs.

Incidence of equine diseases has increased globally over the last few years. Joint infections, microorganism infections, and higher metabolism infections are the common infections among horses. Horses in North America develop equine infectious anemia, salmonellosis, clostridial enteritis, and alternative diseases. In Europe, equine inflammation viral infection and animal disease are the key equine diseases reported in horses. According to the U.S. Department of Agriculture, cephalitis (EEE), Japanese Equine Infectious Anemia (EIA), equine viral arteritis (EVA), and West Nile River Virus (WNV) are the usually reported equine diseases in the country.

Various equine supplements, such as vitamins, minerals, and protein/amino acid supplements, are commercially available in the market. Veterinary supplements, especially herbal supplements, are increasingly being used as part of health and wellness programs for horses. Rise in availability of digestive products and food & energy supplements for equine animals; growth in studies on the effect of herbal supplements on horse health; and increase in preference for herbal products among owners are driving the demand for equine supplements, thus augmenting the equine supplement products market size.

In terms of supplement, the global equine supplement products market has been classified into protein/amino acid, vitamins, enzymes & electrolytes, and others. The electrolytes & vitamins segment accounted for major share of the global market in 2021. Horses need vitamins for growth, tissue maintenance, bodily functions, and peak sports performance. Several diets, especially those in coastal areas, contain low levels of copper and zinc. Hence, nutritional deficiency in horses is common. A growing horse requires at least 400 mg of zinc and 120 mg of copper per day. This increases the need for mineral supplements such as magnesium for horses.

Based on application, the global equine supplement products market has been segregated into performance enhancement/recovery, joint disorder prevention, and others. The joint disorder prevention segment dominated the global market in 2021. Young horses' orthopedic injuries not only have a significant financial impact on the horse business, but can be detrimental to the horse owner. Hence, the horse industry focuses on managing joint health by providing the right joint supplements for horses.

In terms of distribution channel, the global equine supplement products market has been divided into retail pharmacies, veterinary hospitals, and others. The others segment accounted for major share of the global equine supplement products market in 2021. Distribution channels such as online pharmacies save time, offer good discounts, and provide home delivery of equine supplement products.

North America dominated the global equine supplement products market in 2021. This can be ascribed to the increase in equine population, rise in awareness about various infectious as well as chronic diseases in horses, high per capita equine care expenditure, and launch of healthy supplements for equine by leading players in in the U.S.

Europe held the second largest share of the global market in 2021. The market in the region is expected to be driven by the increase in number of horse riders and rise in spending on horse care in countries such as the U.K.

Asia Pacific is anticipated to be the fastest growing market for equine supplement products during the forecast period. The equine supplement products market outlook appears promising in the region owing to the increase in number of horse clubs, rise in interest in horse racing among the youth, high demand for horse feed supplements, and distribution agreements for business expansion. Furthermore, growth in number of equine shows is expected to propel the demand for equine health products in Asia Pacific.

The global equine supplement products market is consolidated, with the presence of a small number of large-scale players. Most of the firms are investing significantly in comprehensive research and development activities, primarily to introduce environmentally-friendly products in the market. Expansion of product portfolio and mergers & acquisitions are the major strategies adopted by the key players. Leading players in the global equine supplement products market are Zoetis, Boehringer Ingelheim International GmbH, Bayer AG, Equine Products UK LTD, Purina Animal Nutrition LLC., Vetoquinol S.A., Kentucky Equine Research, Plusvital Limited, Lallemand, Inc., and Virbac.

Each of these players has been profiled in the equine supplement products market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 78.4 Mn |

|

Market Forecast Value in 2031 |

US$ 111 Mn |

|

Growth Rate (CAGR) |

3.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global equine supplement products market was valued at US$ 78.4 Mn in 2021

The global equine supplement products market is projected to reach US$ 111 Mn by 2031

The global equine supplement products market is anticipated to grow at a CAGR 3.7% from 2022 to 2031

Rise in demand for herbal equine supplements, increase in incidence of equine diseases, and growth in government initiatives toward equine health

North America is expected to account for major share of the global equine supplement products market during the forecast period

Zoetis, Boehringer Ingelheim International GmbH, Bayer AG, Equine Products UK LTD, Purina Animal Nutrition LLC., Vetoquinol S.A., Kentucky Equine Research, Plusvital Limited, Lallemand, Inc., and Virbac

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Equine Supplement Products Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Equine Supplement Products Market Analysis and Forecast, 2017-2031

4.5. Porter’s Five Force Analysis

5. Market Outlook

5.1. New Product Launch

5.2. Key Mergers & Acquisitions

5.3. Equine Population Overview, by Region

5.4. Regulatory Scenario, by Region/globally

6. Global Equine Supplement Products Market Analysis and Forecast, by Supplement

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Supplement, 2017-2031

6.3.1. Proteins/Amino Acids

6.3.2. Vitamins

6.3.3. Enzymes

6.3.4. Electrolytes & Minerals

6.3.5. Others

6.4. Market Attractiveness Analysis, by Supplement

7. Global Equine Supplement Products Market Analysis and Forecasts, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017-2031

7.3.1. Performance Enhancement/Recovery

7.3.2. Joint Disorder Prevention

7.3.3. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Equine Supplement Products Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017-2031

8.3.1. Veterinary Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Others

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Equine Supplement Products Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Equine Supplement Products Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Supplement, 2017-2031

10.2.1. Proteins/Amino Acids

10.2.2. Vitamins

10.2.3. Enzymes

10.2.4. Electrolytes & Minerals

10.2.5. Others

10.3. Market Value Forecast, by Application, 2017-2031

10.3.1. Performance Enhancement/Recovery

10.3.2. Joint Disorder Prevention

10.3.3. Others

10.4. Market Value Forecast, by Distribution Channel, 2017-2031

10.4.1. Veterinary Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Supplement

10.6.2. By Application

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Equine Supplement Products Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Supplement, 2017-2031

11.2.1. Proteins/Amino Acids

11.2.2. Vitamins

11.2.3. Enzymes

11.2.4. Electrolytes & Minerals

11.2.5. Others

11.3. Market Value Forecast, by Application, 2017-2031

11.3.1. Performance Enhancement/Recovery

11.3.2. Joint Disorder Prevention

11.3.3. Others

11.4. Market Value Forecast, by Distribution Channel, 2017-2031

11.4.1. Veterinary Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Supplement

11.6.2. By Application

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Equine Supplement Products Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Supplement, 2017-2031

12.2.1. Proteins/Amino Acids

12.2.2. Vitamins

12.2.3. Enzymes

12.2.4. Electrolytes & Minerals

12.2.5. Others

12.3. Market Value Forecast, by Application, 2017-2031

12.3.1. Performance Enhancement/Recovery

12.3.2. Joint Disorder Prevention

12.3.3. Others

12.4. Market Value Forecast, by Distribution Channel, 2017-2031

12.4.1. Veterinary Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Supplement

12.6.2. By Application

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Equine Supplement Products Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Supplement, 2017-2031

13.2.1. Proteins/Amino Acids

13.2.2. Vitamins

13.2.3. Enzymes

13.2.4. Electrolytes & Minerals

13.2.5. Others

13.3. Market Value Forecast, by Application, 2017-2031

13.3.1. Performance Enhancement/Recovery

13.3.2. Joint Disorder Prevention

13.3.3. Others

13.4. Market Value Forecast, by Distribution Channel, 2017-2031

13.4.1. Veterinary Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Supplement

13.6.2. By Application

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Equine Supplement Products Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Supplement, 2017-2031

14.2.1. Proteins/Amino Acids

14.2.2. Vitamins

14.2.3. Enzymes

14.2.4. Electrolytes & Minerals

14.2.5. Others

14.3. Market Value Forecast, by Application, 2017-2031

14.3.1. Performance Enhancement/Recovery

14.3.2. Joint Disorder Prevention

14.3.3. Others

14.4. Market Value Forecast, by Distribution Channel, 2017-2031

14.4.1. Veterinary Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Supplement

14.6.2. By Application

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2018

15.3. Company Profiles

15.3.1. Zoetis

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Boehringer Ingelheim International GmbH

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Bayer AG

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Equine Products UK LTD

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Purina Animal Nutrition LLC.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Vetoquinol S.A.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Kentucky Equine Research

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Plusvital Limited

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Lallemand Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Virbac

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

List of Tables

Table 01: Global Equine Supplement Products Market Size (US$ Mn) Forecast, by Supplement, 2017-2031

Table 02: Global Equine Supplement Products Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 03: Global Equine Supplement Products Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 04: Global Equine Supplement Products Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Equine Supplement Products Market Value (US$ Mn) Forecast, by Supplement, 2017-2031

Table 06: North America Equine Supplement Products Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 07: North America Equine Supplement Products Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 08: North America Equine Supplement Products Market Size (US$ Mn) Forecast, by Country, 2017-2031

Table 09: Europe Equine Supplement Products Market Value (US$ Mn) Forecast, by Supplement, 2017-2031

Table 10: Europe Equine Supplement Products Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 11: Europe Equine Supplement Products Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 12: Europe Equine Supplement Products Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 13: Asia Pacific Equine Supplement Products Market Value (US$ Mn) Forecast, by Supplement, 2017-2031

Table 14: Asia Pacific Equine Supplement Products Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 15: Asia Pacific Equine Supplement Products Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 16: Asia Pacific Equine Supplement Products Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Latin America Equine Supplement Products Market Value (US$ Mn) Forecast, by Supplement, 2017-2031

Table 18: Latin America Equine Supplement Products Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 19: Latin America Equine Supplement Products Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 20: Latin America Equine Supplement Products Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 21: Middle East & Africa Equine Supplement Products Market Value (US$ Mn) Forecast, by Supplement, 2017-2031

Table 22: Middle East & Africa Equine Supplement Products Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 23: Middle East & Africa Equine Supplement Products Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 24: Middle East & Africa Equine Supplement Products Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 02: Global Equine Supplement Products Market Value Share, by Supplement, 2018

Figure 03: Global Equine Supplement Products Market Value Share, by Application, 2018

Figure 04: Global Equine Supplement Products Market Value Share, by Distribution Channel, 2018

Figure 05: Global Equine Supplement Products Market Value Share, by Region, 2018

Figure 06: Global Equine Supplement Products Market Value Share Analysis, by Supplement, 2021 and 2031

Figure 07: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Protein/Amino Acid, 2017-2031

Figure 08: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Vitamins, 2017-2031

Figure 09: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Enzymes, 2017-2031

Figure 10: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Electrolytes & Minerals, 2017-2031

Figure 11: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017-2031

Figure 12: Global Equine Supplement Products Market Attractiveness Analysis, by Supplement, 2022-2031

Figure 13: Global Equine Supplement Products Market Value Share Analysis, by Application, 2021 and 2031

Figure 14: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Performance Enhancement& Recovery, 2017-2031

Figure 15: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Joint Disorder Prevention, 2017-2031

Figure 16: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017-2031

Figure 17: Global Equine Supplement Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 18: Global Equine Supplement Products Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 19: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Veterinary Hospital Pharmacies, 2017-2031

Figure 20: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Retail Pharmacies, 2017-2031

Figure 21: Global Equine Supplement Products Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017-2031

Figure 22: Global Equine Supplement Products Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 23: Global Equine Supplement Products Market Value Share (%), by Region, 2021 and 2031

Figure 24: Global Equine Supplement Products Market Attractiveness Analysis, by Region, 2022-2031

Figure 25: North America Equine Supplement Products Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 26: North America Equine Supplement Products Market Value Share Analysis, by Supplement, 2021 and 2031

Figure 27: North America Equine Supplement Products Market Attractiveness Analysis, by Supplement, 2022-2031

Figure 28: North America Equine Supplement Products Market Value Share Analysis, by Application, 2021 and 2031

Figure 29: North America Equine Supplement Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 30: North America Equine Supplement Products Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 31: North America Equine Supplement Products Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 32: North America Equine Supplement Products Market Value Share Analysis, by Country, 2021 and 2031

Figure 33: North America Equine Supplement Products Market Attractiveness Analysis, by Country, 2022-2031

Figure 34: Europe Equine Supplement Products Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 35: Europe Equine Supplement Products Market Value Share Analysis, by Supplement, 2021 and 2031

Figure 36: Europe Equine Supplement Products Market Attractiveness Analysis, by Supplement, 2022-2031

Figure 37: Europe Equine Supplement Products Market Value Share Analysis, by Application, 2021 and 2031

Figure 38: Europe Equine Supplement Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 39: Europe Equine Supplement Products Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 40: Europe Equine Supplement Products Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 41: Europe Equine Supplement Products Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 42: Europe Equine Supplement Products Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 43: Asia Pacific Equine Supplement Products Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 44: Asia Pacific Equine Supplement Products Market Value Share Analysis, by Supplement, 2021 and 2031

Figure 45: Asia Pacific Equine Supplement Products Market Attractiveness Analysis, by Supplement, 2022-2031

Figure 46: Asia Pacific Equine Supplement Products Market Value Share Analysis, by Application, 2021 and 2031

Figure 47: Asia Pacific Equine Supplement Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 48: Asia Pacific Equine Supplement Products Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 49: Asia Pacific Equine Supplement Products Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 50: Asia Pacific Equine Supplement Products Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 51: Asia Pacific Equine Supplement Products Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 52: Latin America Equine Supplement Products Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 53: Latin America Equine Supplement Products Market Value Share Analysis, by Supplement, 2021 and 2031

Figure 54: Latin America Equine Supplement Products Market Attractiveness Analysis, by Supplement, 2022-2031

Figure 55: Latin America Equine Supplement Products Market Value Share Analysis, by Application, 2021 and 2031

Figure 56: Latin America Equine Supplement Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 57: Latin America Equine Supplement Products Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 58: Latin America Equine Supplement Products Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 59: Latin America Equine Supplement Products Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 60: Latin America Equine Supplement Products Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 61: Middle East & Africa Equine Supplement Products Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 62: Middle East & Africa Equine Supplement Products Market Value Share Analysis, by Supplement, 2021 and 2031

Figure 63: Middle East & Africa Equine Supplement Products Market Attractiveness Analysis, by Supplement, 2022-2031

Figure 64: Middle East & Africa Equine Supplement Products Market Value Share Analysis, by Application, 2021 and 2031

Figure 65: Middle East & Africa Equine Supplement Products Market Attractiveness Analysis, by Application, 2022-2031

Figure 66: Middle East & Africa Equine Supplement Products Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 67: Middle East & Africa Equine Supplement Products Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 68: Middle East & Africa Equine Supplement Products Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 69: Middle East & Africa Equine Supplement Products Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 70: Boehringer Ingelheim International GmbH Animal Health Business Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 71: Boehringer Ingelheim International GmbH R&D expenditure (US$ Mn) and Y-o-Y Growth (%), 2018

Figure 72: Boehringer Ingelheim International GmbH Breakdown of Net Sales, by Product Segment, 2018

Figure 73: Boehringer Ingelheim International GmbH Breakdown of Net Sales, by Region, 2018

Figure 74: Bayer AG Animal Health Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 75: Bayer AG R&D Expenses and Marketing & Sales Expenses (US$ Mn), 2017–2018

Figure 76: Bayer AG Breakdown of Net Sales, by Business Segment, 2018

Figure 77: Bayer AG Breakdown of Animal Health Segment Net Sales, by Region, 2018

Figure 78: Zoetis Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 79: Zoetis R&D expenditure (US$ Mn) and Y-o-Y Growth (%), 2016-2018

Figure 80: Zoetis Breakdown of Net Sales, by Species, 2018

Figure 81: Zoetis Breakdown of Net Sales, by Business Segment, 2018

Figure 82: Vetoquinol S.A. Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2017

Figure 83: Vetoquinol S.A. Breakdown of Net Sales, by Region, 2017

Figure 84: Virbac Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 85: Virbac R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016-2018

Figure 86: Virbac Breakdown of Net Sales, by Business Segment, 2018

Figure 87: Virbac Breakdown of Net Sales, by Region, 2018