Analysts’ Viewpoint on Market Scenario

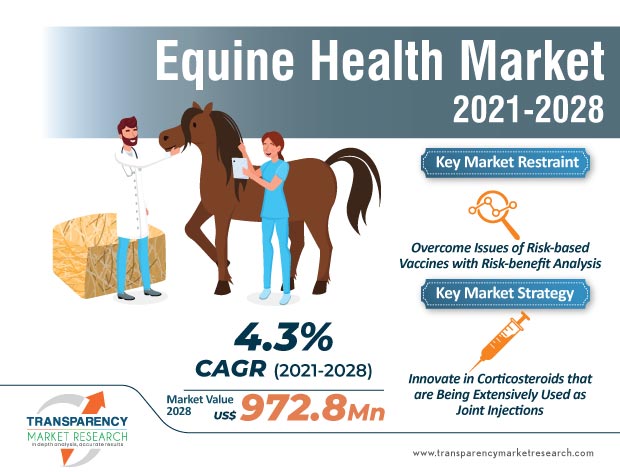

Equine practitioners are practicing strict biosecurity at all farms, performance venues, racetracks, and the likes during the ongoing COVID-19 pandemic. It has been found that issues of recurring common horse healthcare problems are affecting market growth. Hence, stakeholders in the global market for equine healthcare should increase awareness about regular de-worming schedules and professional veterinary advice to reduce the incidence of recurring common horse healthcare problems. Therapeutics such as corticosteroids are being extensively used as joint injections. Bisphosphonates such as tiludronate disodium (Tildren) and clondronate (Osphos) are labelled for controlling clinical signs associated with navicular syndrome. There is a need for research surrounding bisphosphonate use in horses under the age of four.

Equine practitioners are performing a risk-benefit analysis to determine if a horse should receive a particular risk-based vaccine. This is necessary since extra vaccinations can be costly and can cause unnecessary stress to the horse. Manufacturers in the equine healthcare market are increasing the production of vaccines to improve clinical numbers. With the help of risk-benefit analysis, veterinarians are educating horse owners about different types of risk-based vaccines such as equine influenza and strangle vaccines for horses active at events.

Manufacturers in the equine healthcare industry are developing the anthrax vaccine for horses that live in an area where spores are known to thrive in the soil. On the other hand, pregnant mares during specific months of pregnancy are advised to receive certain risk-based vaccines. Companies are developing a diverse portfolio of vaccines such as the equine herpesvirus, botulism, and rotaviral diarrhea.

Apart from ensuring healthcare services for horses, the COVID-19 pandemic has drawn attention to the well-being of equine veterinarians. Stakeholders in the equine healthcare market are taking cues from the AVMA (American Veterinary Medical Association) such as following the hierarchy of controls to reduce the spread of novel infection among equine practitioners.

While PPE (personal protective equipment) serves an important protective function, the optimal way to prevent disease transmission is to use a combination of interventions from across the hierarchy of controls. Participants in the equine healthcare business are rescheduling non-urgent veterinary procedures. They are considering telemedicine as an alternative to in-person visits.

Common horse healthcare problems such as laminitis or thrush can leave a horse more likely to contract it again. Hence, participants in the market are educating horse owners to seek professional veterinary advice and veterinary intervention to improve clinical outcomes.

The high prevalence of allergies, colic, and mud fever, among other common horse healthcare problems, is triggering the demand for healthcare services. Such findings are contributing to the growth of the equine healthcare market. Problems of worms, sweet itch, and back problems are translating into revenue opportunities for market stakeholders.

Apart from drugs, vaccines, and supplemental feed additives, market stakeholders are boosting R&D in equestrian sports technology such as wearables for horses. As such, there is a need for validated approaches to consistently and regularly track healthcare parameters such as temperature, heart rate, and respiratory rates. Thus, wearable devices hold the promising potential to offer these statistics.

The data gathered by wearable devices have the ability to give an earlier indication of issues, which may require veterinary investigation. Such innovations are translating into incremental opportunities for med-tech companies in the equine healthcare market.

In the racing industry, medication use has changed drastically over the years, as manufacturers develop new drugs whilst scientists hone techniques they use to analyze and identify therapeutic medications. healthcare companies are focusing on maintaining a level playing field, protecting the safety of the horse, and protecting the betting public. As such, companies are boosting the production of corticosteroids, NSAIDs, and bisphosphonates, among other drugs.

Racing regulators have historically permitted NSAID use within 24-hrs of race time. However, in recent times, there have been recommendations to increase the timeframe to no earlier than 48-hrs.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 698.7 Mn |

|

Market Forecast Value in 2028 |

US$ 972.8 Mn |

|

Growth Rate (CAGR) |

4.3% |

|

Forecast Period |

2021–2028 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross-segment analysis at the regional level. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, pricing analysis, and parent industry overview. |

|

Format |

Electronic (PDF) |

|

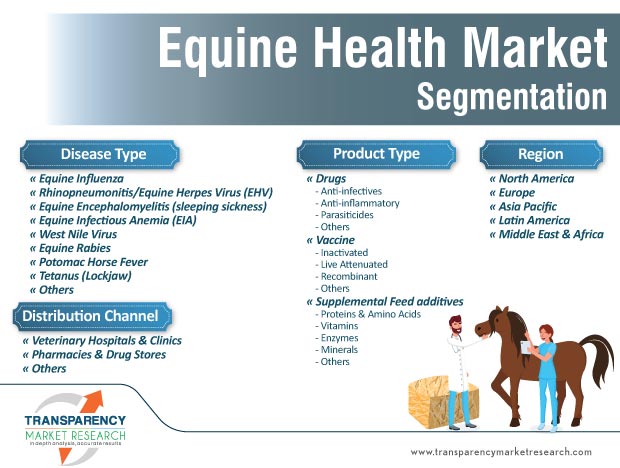

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market for equine healthcare was worth US$ 698.7 Mn and is projected to reach a value of US$ 972.8 Mn by the end of 2028

The equine healthcare market is anticipated to grow at a CAGR of 4.3% during the forecast period

North America accounted for a major share of the global market for equine healthcare.

The key factors driving equine healthcare market expansion include increased trend of horseracing and noteworthy growth in spending toward activities pertaining to equine care across the major parts of the globe

Key players in the global equine healthcare industry include Sanofi (Merial), Zoetis, Vetoquinol S.A., Purina Animal Nutrition LLC., and Bayer AG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Equine Healthcare Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Equine Healthcare Market Analysis and Forecast, 2017–2028

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Coagulation Disorders & Coagulation Pathways: Overview

5.2. Epidemiology: Coagulation Disorders

5.3. Regulatory Framework

5.4. Reimbursement Scenario

5.5. Equine Healthcare Market: Pricing Analysis

5.6. Equine Healthcare Market: Value Chain Analysis

5.7. Equine Healthcare Market: Porter’s Five Forces Analysis

6. Global Equine Healthcare Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.1.1. Key Findings / Developments

6.2. Global Equine Healthcare Market Value Forecast, by Product Type, 2017–2028

6.2.1. Drugs

6.2.1.1. Anti-infectives

6.2.1.2. Anti-inflammatory

6.2.1.3. Parasiticides

6.2.1.4. Others

6.2.2. Vaccines

6.2.2.1. Inactivated

6.2.2.2. Live Attenuated

6.2.2.3. Recombinant

6.2.2.4. Others

6.2.3. Medical Supplemental Feed

6.2.3.1. Minerals

6.2.3.2. Vitamins

6.2.3.3. Protein

6.2.3.4. Enzyme

6.2.3.5. Others

6.3. Global Equine Healthcare Market Attractiveness Analysis, by Product Type

7. Global Equine Healthcare Market Analysis and Forecast, by Disease Type

7.1. Introduction & Definition

7.1.1. Key Findings / Developments

7.2. Global Equine Healthcare Market Value Forecast, by Disease Type, 2017–2028

7.2.1. West Nile Virus

7.2.2. Equine Rabies

7.2.3. Potomac Horse Fever

7.2.4. Tetanus

7.2.5. Equine Influenza

7.2.6. Equine Herpes Virus

7.2.7. Equine Encephalomyelitis

7.2.8. Others (equine infectious anemia)

7.3. Global Equine Healthcare Market Attractiveness Analysis, by Disease Type

8. Global Equine Healthcare Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.1.1. Key Findings / Developments

8.2. Global Equine Healthcare Market Value Forecast, by Distribution Channel, 2017–2028

8.2.1. Veterinary Hospitals & Clinics

8.2.2. Retail Pharmacies & Drug Stores

8.2.3. Others

9. Global Equine Healthcare Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Equine Healthcare Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. North America Equine Healthcare Market Attractiveness Analysis, by Region

10. North America Equine Healthcare Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. North America Equine Healthcare Market Value (US$ Bn) Forecast, by Product Type, 2017–2028

10.2.1. Drugs

10.2.1.1. Anti-infectives

10.2.1.2. Anti-infectives

10.2.1.3. Anti-inflammatory

10.2.1.4. Parasiticides

10.2.1.5. Others

10.2.1.6. Transfer Lifts

10.2.1.7. Door Openers

10.2.1.8. Others

10.2.2. Vaccines

10.2.2.1. Inactivated

10.2.2.2. Live Attenuated

10.2.2.3. Recombinant

10.2.2.4. Others

10.2.2.5. Others

10.2.3. Medical Supplemental Feed

10.2.3.1. Minerals

10.2.3.2. Vitamins

10.2.3.3. Protein

10.2.3.4. Enzyme

10.2.3.5. Others

10.3. North America Equine Healthcare Market Value (US$ Mn) Forecast, by Disease Type, 2017–2027

10.3.1. West Nile Virus

10.3.2. Equine Rabies

10.3.3. Potomac Horse Fever

10.3.4. Tetanus

10.3.5. Equine Influenza

10.3.6. Equine Herpes Virus

10.3.7. Equine Encephalomyelitis

10.3.8. Others (equine infectious anemia)

10.4. North America Equine Healthcare Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

10.4.1. Veterinary Hospitals & Clinics

10.4.2. Retail Pharmacies & Drug Stores

10.4.3. Others

10.5. North America Equine Healthcare Market Value (US$ Mn) Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. North America Equine Healthcare Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Disease Type

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Equine Healthcare Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Europe Equine Healthcare Market Value (US$ Bn) Forecast, by Product Type, 2017–2028

11.2.1. Drugs

11.2.1.1. Anti-infectives

11.2.1.2. Anti-infectives

11.2.1.3. Anti-inflammatory

11.2.1.4. Parasiticides

11.2.1.5. Others

11.2.1.6. Transfer Lifts

11.2.1.7. Door Openers

11.2.1.8. Others

11.2.2. Vaccines

11.2.2.1. Inactivated

11.2.2.2. Live Attenuated

11.2.2.3. Recombinant

11.2.2.4. Others

11.2.2.5. Others

11.2.3. Medical Supplemental Feed

11.2.3.1. Minerals

11.2.3.2. Vitamins

11.2.3.3. Protein

11.2.3.4. Enzyme

11.2.3.5. Others

11.3. Europe Equine Healthcare Market Value (US$ Mn) Forecast, by Disease Type, 2017–2027

11.3.1. West Nile Virus

11.3.2. Equine Rabies

11.3.3. Potomac Horse Fever

11.3.4. Tetanus

11.3.5. Equine Influenza

11.3.6. Equine Herpes Virus

11.3.7. Equine Encephalomyelitis

11.3.8. Others (Equine Infectious Anemia)

11.4. Europe Equine Healthcare Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

11.4.1. Veterinary Hospitals & Clinics

11.4.2. Retail Pharmacies & Drug Stores

11.4.3. Others

11.5. Europe Equine Healthcare Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe Equine Healthcare Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Disease Type

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Equine Healthcare Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Asia Pacific Equine Healthcare Market Value (US$ Bn) Forecast, by Product Type, 2017–2028

12.2.1. Drugs

12.2.1.1. Anti-infectives

12.2.1.2. Anti-infectives

12.2.1.3. Anti-inflammatory

12.2.1.4. Parasiticides

12.2.1.5. Others

12.2.1.6. Transfer Lifts

12.2.1.7. Door Openers

12.2.1.8. Others

12.2.2. Vaccines

12.2.2.1. Inactivated

12.2.2.2. Live Attenuated

12.2.2.3. Recombinant

12.2.2.4. Others

12.2.2.5. Others

12.2.3. Medical Supplemental Feed

12.2.3.1. Minerals

12.2.3.2. Vitamins

12.2.3.3. Protein

12.2.3.4. Enzyme

12.2.3.5. Others

12.3. Asia Pacific Equine Healthcare Market Value (US$ Mn) Forecast, by Disease Type, 2017–2027

12.3.1. West Nile Virus

12.3.2. Equine Rabies

12.3.3. Potomac Horse Fever

12.3.4. Tetanus

12.3.5. Equine Influenza

12.3.6. Equine Herpes Virus

12.3.7. Equine Encephalomyelitis

12.3.8. Others (equine infectious anemia)

12.4. Asia Pacific Equine Healthcare Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

12.4.1. Veterinary Hospitals & Clinics

12.4.2. Retail Pharmacies & Drug Stores

12.4.3. Others

12.5. Asia Pacific Equine Healthcare Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific Equine Healthcare Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Disease Type

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Equine Healthcare Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Latin America Equine Healthcare Market Value (US$ Bn) Forecast, by Product Type, 2017–2028

13.2.1. Drugs

13.2.1.1. Anti-infectives

13.2.1.2. Anti-infectives

13.2.1.3. Anti-inflammatory

13.2.1.4. Parasiticides

13.2.1.5. Others

13.2.1.6. Transfer Lifts

13.2.1.7. Door Openers

13.2.1.8. Others

13.2.2. Vaccines

13.2.2.1. Inactivated

13.2.2.2. Live Attenuated

13.2.2.3. Recombinant

13.2.2.4. Others

13.2.2.5. Others

13.2.3. Medical Supplemental Feed

13.2.3.1. Minerals

13.2.3.2. Vitamins

13.2.3.3. Protein

13.2.3.4. Enzyme

13.2.3.5. Others

13.3. Latin America Equine Healthcare Market Value (US$ Mn) Forecast, by Disease Type, 2017–2027

13.3.1. West Nile Virus

13.3.2. Equine Rabies

13.3.3. Potomac Horse Fever

13.3.4. Tetanus

13.3.5. Equine Influenza

13.3.6. Equine Herpes Virus

13.3.7. Equine Encephalomyelitis

13.3.8. Others (equine infectious anemia)

13.4. Latin America Equine Healthcare Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

13.4.1. Veterinary Hospitals & Clinics

13.4.2. Retail Pharmacies & Drug Stores

13.4.3. Others

13.5. Latin America Equine Healthcare Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America Latin America

13.6. Latin America Equine Healthcare Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Disease Type

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Equine Healthcare Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Middle East & Africa Equine Healthcare Market Value (US$ Bn) Forecast, by Product Type, 2017–2028

14.2.1. Drugs

14.2.1.1. Anti-infectives

14.2.1.2. Anti-infectives

14.2.1.3. Anti-inflammatory

14.2.1.4. Parasiticides

14.2.1.5. Others

14.2.1.6. Transfer Lifts

14.2.1.7. Door Openers

14.2.1.8. Others

14.2.2. Vaccines

14.2.2.1. Inactivated

14.2.2.2. Live Attenuated

14.2.2.3. Recombinant

14.2.2.4. Others

14.2.2.5. Others

14.2.3. Medical Supplemental Feed

14.2.3.1. Minerals

14.2.3.2. Vitamins

14.2.3.3. Protein

14.2.3.4. Enzyme

14.2.3.5. Others

14.3. Middle East & Africa Equine Healthcare Market Value (US$ Mn) Forecast, by Disease Type, 2017–2027

14.3.1. West Nile Virus

14.3.2. Equine Rabies

14.3.3. Potomac Horse Fever

14.3.4. Tetanus

14.3.5. Equine Influenza

14.3.6. Equine Herpes Virus

14.3.7. Equine Encephalomyelitis

14.3.8. Others (equine infectious anemia)

14.4. Middle East & Africa Equine Healthcare Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

14.4.1. Veterinary Hospitals & Clinics

14.4.2. Retail Pharmacies & Drug Stores

14.4.3. Others

14.5. Middle East & Africa Equine Healthcare Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa Equine Healthcare Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Disease Type

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share / Position Analysis, by Company, 2020

15.3. Competitive Business Strategies

15.4. Company Profiles

15.4.1. Bayer AG (Bayer Animal Healthcare)

15.4.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.1.2. Financial Analysis

15.4.1.3. Growth Strategies

15.4.1.4. SWOT Analysis

15.4.2. Boehringer Ingelheim

15.4.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.2.2. Financial Analysis

15.4.2.3. Growth Strategies

15.4.2.4. SWOT Analysis

15.4.3. Ceva Santé Animale

15.4.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.3.2. Financial Analysis

15.4.3.3. Growth Strategies

15.4.3.4. SWOT Analysis

15.4.4. Eli Lilly and Company (Elanco)

15.4.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.4.2. Financial Analysis

15.4.4.3. Growth Strategies

15.4.4.4. SWOT Analysis

15.4.5. Equine Products U.K. Ltd.

15.4.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.5.2. Financial Analysis

15.4.5.3. Growth Strategies

15.4.5.4. SWOT Analysis

15.4.6. Merck & Co. (Merck Animal Healthcare)

15.4.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.6.2. Financial Analysis

15.4.6.3. Growth Strategies

15.4.6.4. SWOT Analysis

15.4.7. Sanofi (Merial)

15.4.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.7.2. Financial Analysis

15.4.7.3. Growth Strategies

15.4.7.4. SWOT Analysis

15.4.8. Purina Animal Nutrition LLC

15.4.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.8.2. Financial Analysis

15.4.8.3. Growth Strategies

15.4.8.4. SWOT Analysis

15.4.9. Vetoquinol S.A.

15.4.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.9.2. Financial Analysis

15.4.9.3. Growth Strategies

15.4.9.4. SWOT Analysis

15.4.10. Zoetis

15.4.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.10.2. Financial Analysis

15.4.10.3. Growth Strategies

15.4.10.4. SWOT Analysis

List of Table

Table 01: Global Equine Healthcare Market Size (US$ Mn) Forecast, by Product, 2021–2028

Table 02: Global Equine Healthcare Market Size (US$ Mn) Forecast, by Disease Type, 2021–2028

Table 03: Global Equine Healthcare Market Size (US$ Mn) Forecast, by Distribution Channel, 2021–2028

Table 04: Global Equine Healthcare Market Size (US$ Mn) Forecast, by Region, 2021–2028

Table 05: North America Equine Healthcare Market Size (US$ Mn) Forecast, by Product, 2021–2028

Table 06: North America Equine Healthcare Market Size (US$ Mn) Forecast, by Disease Type, 2021–2028

Table 07: North America Equine Healthcare Market Size (US$ Mn) Forecast, by Distribution Channel, 2021–2028

Table 08: North America Equine Healthcare Market Size (US$ Mn) Forecast, by Country, 2021–2028

Table 09: Europe Equine Healthcare Market Size (US$ Mn) Forecast, by Product, 2021–2028

Table 10: Europe Equine Healthcare Market Size (US$ Mn) Forecast, by Disease Type, 2021–2028

Table 11: Europe Equine Healthcare Market Size (US$ Mn) Forecast, by Distribution Channel, 2021–2028

Table 12: Europe Equine Healthcare Market Size (US$ Mn) Forecast, by Country/Sub-region, 2021–2028

Table 13: Asia Pacific Equine Healthcare Market Size (US$ Mn) Forecast, by Product, 2021–2028

Table 14: Asia Pacific Equine Healthcare Market Size (US$ Mn) Forecast, by Disease Type, 2021–2028

Table 15: Asia Pacific Equine Healthcare Market Size (US$ Mn) Forecast, by Distribution Channel, 2021–2028

Table 16: Asia Pacific Equine Healthcare Market Size (US$ Mn) Forecast, by Country/Sub-region, 2021–2028

Table 17: Latin America Equine Healthcare Market Size (US$ Mn) Forecast, by Product, 2021–2028

Table 18: Latin America Equine Healthcare Market Size (US$ Mn) Forecast, by Disease Type, 2021–2028

Table 19: Latin America Equine Healthcare Market Size (US$ Mn) Forecast, by Distribution Channel, 2021–2028

Table 20: Latin America Equine Healthcare Market Size (US$ Mn) Forecast, by Country/Sub-region, 2021–2028

Table 21: Middle East & Africa Equine Healthcare Market Size (US$ Mn) Forecast, by Product, 2021–2028

Table 22: Middle East & Africa Equine Healthcare Market Size (US$ Mn) Forecast, by Disease Type, 2021–2028

Table 23: Middle East & Africa Equine Healthcare Market Size (US$ Mn) Forecast, by Distribution Channel, 2021–2028

Table 24: Middle East & Africa Equine Healthcare Market Size (US$ Mn) Forecast, by Country/Sub-region, 2021–2028

List of Figure

Figure 01: Equine Healthcare Market Snapshot

Figure 02: Global Equine Healthcare Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2028

Figure 03: Market Value Share, by Product, 2020

Figure 04: Market Value Share, by Disease Type, 2020

Figure 05: Market Value Share, by Distribution Channel, 2020

Figure 06: Market Value Share, by Region, 2020

Figure 07: Global Equine Healthcare Market Value Share Analysis, by Product, 2020 and 2028

Figure 08: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Drugs, 2017–2028

Figure 09: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Vaccines, 2017–2028

Figure 10: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Medical Supplemental Feed, 2017–2028

Figure 11: Global Equine Healthcare Market Attractiveness Analysis, by Product, 2021–2028

Figure 12: Global Equine Healthcare Market Value Share Analysis, by Disease Type, 2020 and 2028

Figure 13: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by West Nile Virus, 2017–2028

Figure 14: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by EQUINE RABIES, 2017–2028

Figure 15: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Potomac Horse Fever, 2017–2028

Figure 16: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Tetanus, 2017–2028

Figure 17: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Equine Influenza, 2017–2028

Figure 18: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Equine Herpes Virus, 2017–2028

Figure 19: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Equine Encephalomyelitis, 2017–2028

Figure 20: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others (Equine Infectious Anemia), 2017–2028

Figure 21: Global Equine Healthcare Market Attractiveness Analysis, by Disease Type, 2021–2028

Figure 22: Global Equine Healthcare Market Value Share Analysis, by Distribution Channel, 2020 and 2028

Figure 23: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Veterinary Hospitals & Clinics, 2017–2028

Figure 24: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Retail Pharmacies & Drug Stores, 2017–2028

Figure 25: Global Equine Healthcare Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2028

Figure 26: Global Equine Healthcare Market Attractiveness Analysis, by Distribution Channel, 2021–2028

Figure 27: Global Equine Healthcare Market Value Share Analysis, by Region, 2020 and 2028

Figure 28: Global Equine Healthcare Market Attractiveness Analysis, by Region, 2021–2028

Figure 29: North America Equine Healthcare Market Size (US$ Mn) Forecast, 2021–2028

Figure 30: North America Equine Healthcare Market Attractiveness Analysis, by Country, 2021–2028

Figure 31: North America Equine Healthcare Market Value Share Analysis, by Product, 2020 and 2028

Figure 32: North America Equine Healthcare Market Value Share Analysis, by Disease Type, 2020 and 2028

Figure 33: North America Equine Healthcare Market Value Share Analysis, by Distribution Channel, 2020 and 2028

Figure 34: North America Equine Healthcare Market Value Share Analysis, by Country, 2020 and 2028

Figure 35: North America Equine Healthcare Market Attractiveness Analysis, by Product, 2021–2028

Figure 36: North America Equine Healthcare Market Attractiveness Analysis, by Disease Type, 2021–2028

Figure 37: North America Equine Healthcare Market Attractiveness Analysis, by Distribution Channel, 2021–2028

Figure 38: Europe Equine Healthcare Market Size (US$ Mn) Forecast, 2021–2028

Figure 39: Europe Equine Healthcare Market Attractiveness Analysis, by Country/Sub-region, 2021–2028

Figure 40: Europe Equine Healthcare Market Value Share Analysis, by Product, 2020 and 2028

Figure 41: Europe Equine Healthcare Market Value Share Analysis, by Disease Type, 2020 and 2028

Figure 42: Europe Equine Healthcare Market Value Share Analysis, by Distribution Channel, 2020 and 2028

Figure 43: Europe Equine Healthcare Market Value Share Analysis, by Country/Sub-region, 2020 and 2028

Figure 44: Europe Equine Healthcare Market Attractiveness Analysis, by Product, 2021–2028

Figure 45: Europe Equine Healthcare Market Attractiveness Analysis, by Disease Type, 2021–2028

Figure 46: Europe Equine Healthcare Market Attractiveness Analysis, by Distribution Channel, 2021–2028

Figure 47: Asia Pacific Equine Healthcare Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017– 2028

Figure 48: Asia Pacific Equine Healthcare Market Attractiveness Analysis, by Country/Sub-region, 2021–2028

Figure 49: Asia Pacific Equine Healthcare Market Value Share Analysis, by Product, 2020 and 2028

Figure 50: Asia Pacific Equine Healthcare Market Value Share Analysis, by Disease Type, 2020 and 2028

Figure 51: Asia Pacific Equine Healthcare Market Value Share Analysis, by Distribution Channel, 2020 and 2028

Figure 52: Asia Pacific Equine Healthcare Market Value Share Analysis, by Country/Sub-region, 2020 and 2028

Figure 53: Asia Pacific Equine Healthcare Market Attractiveness Analysis, by Product, 2021–2028

Figure 54: Asia Pacific Equine Healthcare Market Attractiveness Analysis, by Disease Type, 2021–2028

Figure 55: Asia Pacific Equine Healthcare Market Attractiveness Analysis, by Distribution Channel, 2021–2028

Figure 56: Latin America Equine Healthcare Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2028

Figure 57: Latin America Equine Healthcare Market Attractiveness Analysis, by Country/Sub-region, 2021–2028

Figure 58: Latin America Equine Healthcare Market Value Share Analysis, by Product, 2020 and 2028

Figure 59: Latin America Equine Healthcare Market Value Share Analysis, by Disease Type, 2020 and 2028

Figure 60: Latin America Equine Healthcare Market Value Share Analysis, by Distribution Channel, 2020 and 2028

Figure 61: Latin America Equine Healthcare Market Value Share Analysis, by Country/Sub-region, 2020 and 2028

Figure 62: Latin America Equine Healthcare Market Attractiveness Analysis, by Product, 2021–2028

Figure 63: Latin America Equine Healthcare Market Attractiveness Analysis, by Disease Type, 2021–2028

Figure 64: Latin America Equine Healthcare Market Attractiveness Analysis, by Distribution Channel, 2021–2028

Figure 65: Middle East & Africa Equine Healthcare Market Size (US$ Mn) Forecast, 2017–2028

Figure 66: Middle East & Africa Equine Healthcare Market Attractiveness Analysis, by Country/Sub-region, 2021–2028

Figure 67: Middle East & Africa Equine Healthcare Market Value Share Analysis, by Product, 2020 and 2028

Figure 68: Middle East & Africa Equine Healthcare Market Value Share Analysis, by Disease Type, 2020 and 2028

Figure 69: Middle East & Africa Equine Healthcare Market Value Share Analysis, by Distribution Channel, 2020 and 2028

Figure 70: Middle East & Africa Equine Healthcare Market Value Share Analysis, by Country/Sub-region, 2020 and 2028

Figure 71: Middle East & Africa Equine Healthcare Market Attractiveness Analysis, by Product, 2021–2028

Figure 72: Middle East & Africa Equine Healthcare Market Attractiveness Analysis, by Disease Type, 2021–2028

Figure 73: Middle East & Africa Equine Healthcare Market Attractiveness Analysis, by Distribution Channel, 2021–2028

Figure 74: Global Equine Healthcare Market Share Analysis, by Company, 2020