The pursuit of consumer satisfaction has been driving the scramble of numerous industries towards innovation, which has also taken the packaging industry by storm. As the industry operates amid stringent environmental regulations, consistent research and development activities are introducing competent materials to foster innovation in the space.

With the penetration of poly-vents, blips on the radar of the packaging industry – fluid leakage, misaligned pallets, ruined labels, and deformation of containers – are diminishing on account of the increasing quality gradient of these membranes. The trend of 'custom manufacturing' further offers a leeway to manufacturers to widen the application scope of electronic poly-vents for the development of cabinet housings, power supplies, and memory storage. However, the emergence of PTFE poly-vents added a new dimension to the wide plane of existing applications, owing to the flexibility, robustness, and non-resilience that polymer has to offer.

Polytetrafluoroethylene (PTFE) has come a long way since the time of its evolution in 1958, owing to its enormous potential of application in numerous end-use industries. As the quest for efficient coating continues for ensuring protection against harsh substances, PTFE poly-vents have been gaining traction in the chemical industry. Besides the chemical industry, the effective application of PTFE poly-vents as a lubricant in the automotive industry has been surging to bridge the demand-supply gap.

With the future being reliant on green technology, lithium-ion battery packs developed using PTFE poly-vents are poised to find extensive application in the automotive and transportation industries. However, the volatile prices of PTFE have been acting as a bottleneck to its adoption, which offers leeway to expanded Polytetrafluoroethylene (ePTFE) to make headways towards the manufacturing of poly-vents to up the quality notch with its improved features and durability.

Sensing the immense potential of ePTFE poly-vents and endeavors of manufacturers towards optimizing its competency and looking beyond the existing scope of applications, Transparency Market Research (TMR), in its recent study, measures the leap made by ePTFE market, with focus on poly-vents, during the forecast period of 2019-2027, which will serve as an instrument to further intensify the manufacturing of poly-vents and draw growth tangents.

According to the study, sales of ~ 27 thousand tons worth of ePTFE were recorded in 2018, which corresponded to a value of ~ US$ 360 million, owing to its key value proposition of being lightweight as compared to its traditional equivalents, PTFE. In recent times, as manufacturers step up their innovation competencies, improvement in fabric texture has led to the development of high quality athletic gear. Ease of manufacturing via injection molding of fine-powdered PTFE will further balance the demand-supply scale.

Increasing intelligence regarding the far-reaching characteristics of ePTFE poly-vents has been intensifying their scope of application in numerous industries. ePTFE offers high tolerance to liquid penetration, high heat resistance, and excellent chemical inertia (pH value ranging from 0 to 14), which has been surging its demand in the chemical and cleaners industry for the development of innovative sealing solutions. Following the high adoption trend, chemical and cleaner industries are likely to account for a majority of the demand for ePTFE. However, given the stringency of environmental laws encircling the automotive industry for the development of batteries, the adoption of ePTFE poly-vents will grow at an exponential rate in the landscape.

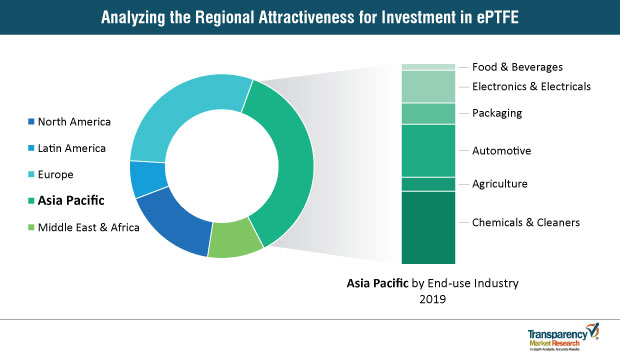

The automotive industry accounts for ~ 26% of the total ePTFE market share, on account of the industry’s quest for high mechanical strength, low friction, sealing at high rotational speeds, superior resistance to lubricants and fuels, and temperature resistance to 500°F. Such excellent characteristics of ePTFE aid in increasing the overall efficiency of an automotive, by detecting premature failures and offering high tolerances. Since Asia Pacific remains a lucrative region for the growth of the automotive industry, it will, in turn, be a key region for investment in the ePTFE market during the course of the forecast period.

Manufacturers of ePTFE have been striving to gauge the lucrativeness of regions, in order to set up and unfold numerous growth opportunities. In addition, they also emphasize on exchanging technological competencies to leverage a two-way benefit and create financial synergies. Asia Pacific and the Middle East and Africa remain profitable markets for manufacturers seeking productive partnerships, with regions such as India, China, and GCC exhibiting a huge potential for high returns on investments.

As ePTFE offers superior benefits as compared to PTFE, manufacturers leverage the prowess of technology to broaden their portfolios and safeguard their bottom lines. With an unbalanced demand-supply ratio from numerous industries, manufacturers can target specific demand and foster innovation. They can resort to research and development activities in their existing manufacturing facilities to enhance the performance of ePTFE, and further boost its adoption in numerous end-use applications.

The ePTFE market operates under a high degree of fragmentation. W.L. Gore & Associates enjoys a fair share of exposure at the top tier of the ePTFE market.

Expansion through acquisitions has been the key strategy of this player; however, it also resorts to research and development activities to broaden its product portfolio by fostering innovation in the landscape. The company has over 2,000 patents around the world in numerous fields, which include electronics, medical devices, and polymer processing. The company has its presence in over 25 countries, with manufacturing hubs in countries such as Japan, China, the U.K., and the U.S.

This group of players expend their endeavors in collaboration and partnership activities to gain reciprocal benefits. For example, in February 2017, CLARCON Industrial Air, which operates as a subsidiary of CLARCON Inc., became a part of the giant Parker Hannifin Corporation Filtration Group.

All-in-all, market players strive to cater to numerous industries such as aerospace, automotive, pharmaceuticals, and textiles to multiply the sales of their products.

Analysts’ Inference of the ePTFE Market

Authors of the report opine that, the ePTFE market will grow steadily over the course of the forecast period, as technological advancements surface in the landscape, which boosts the adoption of ePTFE in numerous end-use industries. Chemical and cleaner industries are likely to remain key revenue-generating end-user industries, owing to the extensive application of ePTFE in coating to prevent the effects of harsh substances. However, growth in automotive production is likely to bode lucrative business opportunities for ePTFE manufacturers.

Market players should bring developing countries of Asia Pacific and the Middle East and Africa in their radar, in order to consolidate their market position. However, manufacturers will need to adhere to extensive environmental, safety, and health regulations while setting up their production facilities.

Some of the key players in the global ePTFE market that are included in the report are

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Market Background

3.1. Strategies Adopted by Key Players

3.2. PESTLE Analysis for Top 5 Countries

3.3. Poly-vents Market Overview

3.3.1. Poly-Vents Market Scenario

3.3.1.1. Share of PTFE in Global Poly-Vents Market

3.3.1.2. Share of ePTFE in the Global PTFE Poly-Vents Market

3.3.1.3. Adoption Rate of Poly-Vents by End Users

3.3.2. End User Preference Analysis for Poly-Vents

3.3.3. Technological Development Analysis for Poly-Vents

3.3.4. Market Dynamics for Poly-Vents Market

3.3.5. Competition Analysis for Poly-Vents Market

3.3.6. List of End Users for Poly-Vents Market

3.4. Value Chain Analysis

3.4.1. Key Participants

3.4.1.1. Raw Material Suppliers

3.4.1.2. ePTFE Poly-Vents Manufacturers

3.4.1.3. End Use Industry

3.4.2. Profitability Margin

3.5. Market Dynamics

3.5.1. Drivers

3.5.1.1. Supply Side

3.5.1.2. Demand Side

3.5.2. Restraints

3.5.3. Opportunities

3.5.4. Trends

4. Global ePTFE Market Analysis

4.1. Market Value (US$ Mn) and Volume (Tonnes) Analysis & Forecast

4.2. Y-o-Y Growth Projections

4.3. Absolute $ Opportunity Analysis

5. Global ePTFE Market Analysis By End Use

5.1. Section Summary

5.2. Introduction

5.2.1. Market Value Share Analysis By End Use

5.2.2. Y-o-Y Growth Analysis By End Use

5.3. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By End Use

5.3.1. Chemicals & Cleaners

5.3.1.1. Industrial

5.3.1.2. Household

5.3.2. Agriculture

5.3.3. Automotive

5.3.3.1. Batteries

5.3.3.2. Electric motors

5.3.3.3. Headlamps

5.3.3.4. ABS Brakes

5.3.4. Packaging

5.3.5. Electronics & Electricals

5.3.6. Food & Beverages

Market Attractiveness Analysis By End Use

6. Global ePTFE Market Analysis By Region

6.1. Section Summary

6.2. Introduction

6.2.1. Market Value Share Analysis, By Region

6.2.2. Y-o-Y Growth Analysis, By Region

6.3. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027, By Region

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific (APAC)

6.3.4. Latin America

6.3.5. Middle East & Africa (MEA)

6.4. Market Attractiveness Analysis, By Region

7. North America ePTFE Market Analysis

7.1. Introduction

7.2. Regional Pricing Analysis

7.3. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By Country,

7.3.1. U.S.

7.3.2. Canada

7.4. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By End Use

7.4.1. Chemicals & Cleaners

7.4.1.1. Industrial

7.4.1.2. Household

7.4.2. Agriculture

7.4.3. Automotive

7.4.3.1. Batteries

7.4.3.2. Electric motors

7.4.3.3. Headlamps

7.4.3.4. ABS Brakes

7.4.4. Packaging

7.4.5. Electronics & Electricals

7.4.6. Food & Beverages

7.5. Key Market Participants – Intensity Mapping

8. Latin America ePTFE Market Analysis

8.1. Introduction

8.2. Regional Pricing Analysis

8.3. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By Country,

8.3.1. Brazil

8.3.2. Mexico

8.3.3. Rest of Latin America

8.4. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By End Use

8.4.1. Chemicals & Cleaners

8.4.1.1. Industrial

8.4.1.2. Household

8.4.2. Agriculture

8.4.3. Automotive

8.4.3.1. Batteries

8.4.3.2. Electric motors

8.4.3.3. Headlamps

8.4.3.4. ABS Brakes

8.4.4. Packaging

8.4.5. Electronics & Electricals

8.4.6. Food & Beverages

8.5. Key Market Participants – Intensity Mapping

9. Europe ePTFE Market Analysis

9.1. Introduction

9.2. Regional Pricing Analysis

9.3. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By Country,

9.3.1. Germany

9.3.2. Italy

9.3.3. France

9.3.4. U.K.

9.3.5. Spain

9.3.6. Benelux

9.3.7. Nordic

9.3.8. Russia

9.3.9. Poland

9.3.10. Rest of Europe

9.4. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By End Use

9.4.1. Chemicals & Cleaners

9.4.1.1. Industrial

9.4.1.2. Household

9.4.2. Agriculture

9.4.3. Automotive

9.4.3.1. Batteries

9.4.3.2. Electric motors

9.4.3.3. Headlamps

9.4.3.4. ABS Brakes

9.4.4. Packaging

9.4.5. Electronics & Electricals

9.4.6. Food & Beverages

9.5. Key Market Participants – Intensity Mapping

10. APAC ePTFE Market Analysis

10.1. Introduction

10.2. Regional Pricing Analysis

10.3. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By Country,

10.3.1. China

10.3.2. India

10.3.3. ASEAN

10.3.4. Australia and New Zealand

10.3.5. Japan

10.3.6. Rest of APAC

10.4. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By End Use

10.4.1. Chemicals & Cleaners

10.4.1.1. Industrial

10.4.1.2. Household

10.4.2. Agriculture

10.4.3. Automotive

10.4.3.1. Batteries

10.4.3.2. Electric motors

10.4.3.3. Headlamps

10.4.3.4. ABS Brakes

10.4.4. Packaging

10.4.5. Electronics & Electricals

10.4.6. Food & Beverages

10.5. Key Market Participants – Intensity Mapping

11. MEA ePTFE Market Analysis

11.1. Introduction

11.2. Regional Pricing Analysis

11.3. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By Country,

11.3.1. GCC Countries

11.3.2. North Africa

11.3.3. South Africa

11.3.4. Turkey

11.3.5. Rest of MEA

11.4. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By End Use

11.4.1. Chemicals & Cleaners

11.4.1.1. Industrial

11.4.1.2. Household

11.4.2. Agriculture

11.4.3. Automotive

11.4.3.1. Batteries

11.4.3.2. Electric motors

11.4.3.3. Headlamps

11.4.3.4. ABS Brakes

11.4.4. Packaging

11.4.5. Electronics & Electricals

11.4.6. Food & Beverages

11.5. Key Market Participants – Intensity Mapping

12. India ePTFE Market Analysis

12.1. Introduction

12.2. Regional Pricing Analysis

12.3. Market Value (US$ Mn) and Volume (Tonnes) Historical Analysis 2014-2018 and Forecast 2019-2027 By End Use

12.3.1. Chemicals & Cleaners

12.3.1.1. Industrial

12.3.1.2. Household

12.3.2. Agriculture

12.3.3. Automotive

12.3.3.1. Batteries

12.3.3.2. Electric motors

12.3.3.3. Headlamps

12.3.3.4. ABS Brakes

12.3.4. Packaging

12.3.5. Electronics & Electricals

12.3.6. Food & Beverages

12.4. Key Market Participants – Intensity Mapping

13. Market Structure Analysis

13.1. Market Analysis by Tier of Companies

13.1.1. By Large, Medium and Small

13.2. Market Concentration

13.2.1. By Top 5 and by Top 10

13.3. Market Share Analysis of Top 10 Players

13.3.1. The Americas Market Share Analysis, by Top Players

13.3.2. EMEA Market Share Analysis, by Top Players

13.3.3. Asia Pacific Market Share Analysis, by Top Players

13.4. Market Presence Analysis

13.4.1. By Regional Footprint of Players

13.4.2. Product Footprint by Players

13.4.3. Channel Foot Print by Players

14. Competition Analysis

14.1. Competition Dashboard

14.2. Profitability and Gross Margin Analysis By Competition

14.3. Competition Developments

14.4. Competition Deep Dive

14.4.1. W.L. Gore & Associates, Inc.

14.4.1.1. Overview

14.4.1.2. Product Portfolio

14.4.1.3. Profitability

14.4.1.4. Production Footprint

14.4.1.5. Sales Footprint

14.4.1.6. Channel Footprint

14.4.1.7. Competition Benchmarking

14.4.1.8. Strategy

14.4.1.8.1. Marketing Strategy

14.4.1.8.2. Product Strategy

14.4.1.8.3. Channel Strategy

14.4.2. Technology International

14.4.2.1. . Overview

14.4.2.2. Product Portfolio

14.4.2.3. Profitability

14.4.2.4. Production Footprint

14.4.2.5. Sales Footprint

14.4.2.6. Channel Footprint

14.4.2.7. Competition Benchmarking

14.4.2.8. Strategy

14.4.2.8.1. Marketing Strategy

14.4.2.8.2. Product Strategy

14.4.2.8.3. Channel Strategy

14.4.3. Interstate Specialty Products

14.4.3.1. Overview

14.4.3.2. Product Portfolio

14.4.3.3. Profitability

14.4.3.4. Production Footprint

14.4.3.5. Sales Footprint

14.4.3.6. .Channel Footprint

14.4.3.7. Competition Benchmarking

14.4.3.8. Strategy

14.4.3.8.1. Marketing Strategy

14.4.3.8.2. .Product Strategy

14.4.3.8.3. Channel Strategy

14.4.4. SABEU GmbH & Co. KG

14.4.4.1. Overview

14.4.4.2. Product Portfolio

14.4.4.3. Profitability

14.4.4.4. Production Footprint

14.4.4.5. Sales Footprint

14.4.4.6. Channel Footprint

14.4.4.7. Competition Benchmarking

14.4.4.8. Strategy

14.4.4.8.1. Marketing Strategy

14.4.4.8.2. Product Strategy

14.4.4.8.3. Channel Strategy

14.4.5. Saya Packaging

14.4.5.1. . Overview

14.4.5.2. Product Portfolio

14.4.5.3. Profitability

14.4.5.4. . Production Footprint

14.4.5.5. Sales Footprint

14.4.5.6. . Channel Footprint

14.4.5.7. Competition Benchmarking

14.4.5.8. Strategy

14.4.5.8.1. Marketing Strategy

14.4.5.8.2. Product Strategy

14.4.5.8.3. Channel Strategy

14.4.6. MOCAP LLC

14.4.6.1. Overview

14.4.6.2. Product Portfolio

14.4.6.3. Profitability

14.4.6.4. Production Footprint

14.4.6.5. Sales Footprint

14.4.6.6. Channel Footprint

14.4.6.7. Competition Benchmarking

14.4.6.8. Strategy

14.4.6.8.1. Marketing Strategy

14.4.6.8.2. Product Strategy

14.4.6.8.3. Channel Strategy

14.4.7. Sanghvi Techno Products

14.4.7.1. Overview

14.4.7.2. Product Portfolio

14.4.7.3. Profitability

14.4.7.4. Production Footprint

14.4.7.5. Sales Footprint

14.4.7.6. Channel Footprint

14.4.7.7. Competition Benchmarking

14.4.7.8. Strategy

14.4.7.8.1. Marketing Strategy

14.4.7.8.2. Product Strategy

14.4.7.8.3. Channel Strategy

14.4.8. CLARCOR Industrial Air.

14.4.8.1. Overview

14.4.8.2. Product Portfolio

14.4.8.3. Profitability

14.4.8.4. Production Footprint

14.4.8.5. Sales Footprint

14.4.8.6. Channel Footprint

14.4.8.7. Competition Benchmarking

14.4.8.8. Strategy

14.4.8.8.1. Marketing Strategy

14.4.8.8.2. Product Strategy

14.4.8.8.3. Channel Strategy

14.4.9. Milvent Technology Co., Ltd

14.4.9.1. Overview

14.4.9.2. Product Portfolio

14.4.9.3. Profitability

14.4.9.4. Production Footprint

14.4.9.5. . Sales Footprint

14.4.9.6. . Channel Footprint

14.4.9.7. Competition Benchmarking

14.4.9.8. . Strategy

14.4.9.8.1. Marketing Strategy

14.4.9.8.2. . Product Strategy

14.4.9.8.3. Channel Strategy

15. Assumptions and Acronyms Used

16. Research Methodology

List of Tables

Table 01: Global ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 02: Global ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 03: Global ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Region

Table 04: North America ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Country

Table 05: North America ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 06: North America ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 07: Latin America ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Country

Table 08: Latin America ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 09: Latin America ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 10: Europe ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Country

Table 11: Europe ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 12: Europe ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 13: APAC ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Country

Table 14: APAC ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 15: APAC ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 16: MEA ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by Country

Table 17: MEA ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 18: MEA ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 19: India ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

Table 20: India ePTFE Market Value (US$ Mn) & Volume (Tonnes) 2014-2027, by End Use Industry

List of Figures

Figure 01: Global ePTFE Market BPS Analysis, by End Use Industry, 2019(E) & 2027(F)

Figure 02: Global ePTFE Market Y-o-Y growth, by End Use Industry, 2019(E) – 2027(F)

Figure 03: Global ePTFE Market Attractiveness Index, by End Use Industry, 2019(E) – 2027(F)

Figure 04: Global ePTFE Market BPS Analysis, by Region, 2019(E) & 2027(F)

Figure 05: Global ePTFE Market Y-o-Y growth, by Region, 2019(E) – 2027(F)

Figure 06: Global ePTFE Market Attractiveness Index, by Region, 2019(E) – 2027(F)

Figure 07: North America ePTFE Market Value (US$ Mn) and Volume (Tonnes), 2018 (A) – 2027 (F)

Figure 08: North America ePTFE Market, Absolute $ Opportunity Analysis, 2018 (A) – 2027 (F)

Figure 09: North America ePTFE (Polytetrafluoroethylene) Poly-Vents Market Value Share, by End Use Industry, 2019 (E)

Figure 10: North America ePTFE (Polytetrafluoroethylene) Poly-Vents Market Value Share, by Country, 2019 (E)

Figure 11: Latin America ePTFE Market Value (US$ Mn) and Volume (Tonnes), 2018 (A) – 2027 (F)

Figure 12: Latin America ePTFE Market, Absolute $ Opportunity Analysis, 2018 (A) – 2027 (F)

Figure 13: Latin America ePTFE (Polytetrafluoroethylene) Poly-Vents Market Value Share, by End Use Industry, 2019 (E)

Figure 14: Latin America ePTFE (Polytetrafluoroethylene) Poly-Vents Market Value Share, by Country, 2019 (E)

Figure 15: Europe ePTFE Market Value (US$ Mn) and Volume (Tonnes), 2018 (A) – 2027 (F)

Figure 16: Europe ePTFE Market, Absolute $ Opportunity Analysis, 2018 (A) – 2027 (F)

Figure 17: Europe ePTFE (Polytetrafluoroethylene) Poly-Vents Market Value Share, by End Use Industry, 2019 (E)

Figure 18: Europe ePTFE (Polytetrafluoroethylene) Poly-Vents Market Value Share, by Country, 2019 (E)

Figure 19: APAC ePTFE Market Value (US$ Mn) and Volume (Tonnes), 2018 (A) – 2027 (F)

Figure 20: APAC ePTFE Market, Absolute $ Opportunity Analysis, 2018 (A) – 2027 (F)

Figure 21: APAC ePTFE (Polytetrafluoroethylene) Poly-Vents Market Value Share, by End Use Industry, 2019 (E)

Figure 22: APAC ePTFE (Polytetrafluoroethylene) Poly-Vents Market Value Share, by Country, 2019 (E)

Figure 23: MEA ePTFE Market Value (US$ Mn) and Volume (Tonnes), 2018 (A) – 2027 (F)

Figure 24: MEA ePTFE Market, Absolute $ Opportunity Analysis, 2018 (A) – 2027 (F)

Figure 25: MEA ePTFE (Polytetrafluoroethylene) Poly-Vents Market Value Share, by End Use Industry, 2019 (E)

Figure 26: MEA ePTFE (Polytetrafluoroethylene) Poly-Vents Market Value Share, by Country, 2019 (E)

Figure 27: India ePTFE Market Value (US$ Mn) and Volume (Tonnes), 2018 (A) – 2027 (F)

Figure 28: India ePTFE Market, Absolute $ Opportunity Analysis, 2018 (A) – 2027 (F)