Analysts’ Viewpoint on Epilepsy Therapeutics Market Scenario

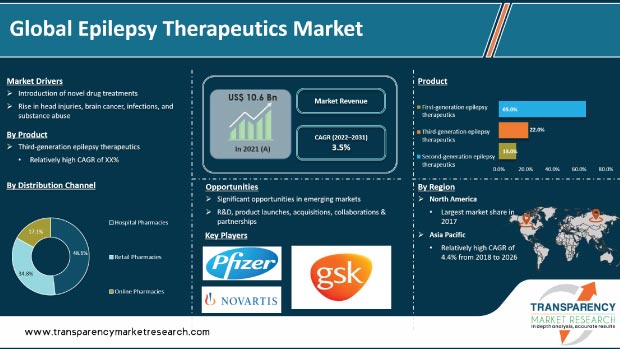

Rise in number of accidents and brain injuries; and high prevalence of post-traumatic epilepsy (PTE) and post-traumatic seizure (PTS) in patients with brain injuries are driving the epilepsy treatment market. Increase in funding by governments to improve and develop effective drugs and treatments for seizures; and rise in research and development activities to provide advanced healthcare facilities are also augmenting the epilepsy treatment market. Furthermore, growth in awareness about training programs for physicians and patients is fueling the epilepsy treatment market. Epilepsy biotech companies are entering into collaborations with market participants to provide better treatment lines. Development of new drugs and treatment options is likely to create lucrative opportunities for players operating in the epilepsy therapeutics market in the near future.

Epilepsy is a chronic neurological disorder that can cause unfounded and ongoing seizures. A person suffering from this disease may experience seizures with no explanation. These seizures can be caused by a previous brain injury or any traumatic event; however, the exact cause is still unknown. This condition is most common in adults and children, though the elderly population is also susceptible to it. Almost every patient with multiple seizures begins treatment with epilepsy medications or therapeutics. These medications prevent seizures by decreasing the brain cells' proclivity to direct disorganized and excessive electrical impulses. Most of the people with epilepsy can control their seizures with medication, or in some cases, surgery. Some people need treatment for the rest of their lives to control their seizures, but for others, the seizures eventually go away. Some children with epilepsy may outgrow it. Rise in public awareness about the treatment of neurological disorders combined with high adoption of antiepileptic drugs (AEDs) is expected to drive the epilepsy market size. Decrease in stigma associated with epilepsy is expected to drive the demand for appropriate treatment and care.

According to World Health Organization statistics for 2022, approximately 50 million people worldwide have epilepsy, making it one of the most common neurological diseases worldwide. Epilepsy is estimated to affect 49 people out of every 100,000 in high-income countries each year. This figure can reach 139 per 100 000 in low- and middle-income countries. However, up to 70% of people can live seizure-free lives if epilepsy is properly diagnosed and treated.

According to a ResearchGate study, anti-epileptic drugs (AEDs) are regarded as the most important types of drug treatment for epilepsy patients. Discovery of these drugs has nearly doubled since the 1980s. If a single AED does not control the occurrence of seizures, a combination of AEDs, known as polytherapy, is usually recommended. According to NCBI, an important trend in current anti-epileptic drug development focuses on approaches containing new pharmacology that can target therapies for specific subpopulations with drug-resistant epilepsy. According to the Journal of Drug Delivery and Therapeutics, new anti-epileptic drugs have been developed with fewer side effects and greater efficacy than those currently available.

According to the FDA, Epidiolex (cannabidiol) [CBD] oral solution was approved in June 2018 for the treatment of seizures associated with two rare and severe forms of epilepsy – Lennox-Gastaut syndrome and Dravet syndrome – in patients two years of age and older. This is the first FDA-approved drug that contains a purified marijuana-derived drug substance. It is also the first FDA approval of a drug for the treatment of Dravet syndrome patients. Three randomized, double-blind, placebo-controlled clinical trials involving 516 patients with either Lennox-Gastaut syndrome or Dravet syndrome were conducted to assess the efficacy of Epidiolex. When used in conjunction with other medications, Epidiolex was shown to be more effective than placebo in reducing the frequency of seizures. Such novel drugs have fewer side effects, greater specificity, and higher efficacy.

According to the NCBI, brain tumors are the second most common cause of epilepsy in the geriatric population, accounting for 10% to 30% of all causes of geriatric epilepsy. Epilepsy is a common symptom in patients with brain tumors. Seizures are the onset symptom in 20% to 40% of brain tumor patients; about 20% to 45% of patients are likely to have epileptic seizures during the course of the disease. According to the International League Against Epilepsy (ILAE), infections in the central nervous system, such as meningitis, encephalitis, and neurocysticercosis, can result in both acute symptomatic seizures (which occur in a time frame related to the initial infection) and epilepsy. Alcohol or drug abuse as well as failure to take prescribed anticonvulsant medication are key factors that are likely to increase the risk of seizures in people who are predisposed to seizures, according to the American Association of Neurological Surgeons.

Extensive R&D activities form the foundation of new and advanced epilepsy therapeutics, improving their effectiveness, efficacy, and pharmacokinetics vis-à-vis currently available products in the market. Companies developing epilepsy therapeutics are focusing on creating antiepileptic drugs with improved tolerability, efficacy, and fewer side effects.

Several market participants develop novel products, obtain government approvals, launch new products, collaborate and form partnerships, engage in acquisitions and mergers, and create profit-making opportunities to strengthen their position in the epilepsy therapeutics market. Brivasure, a reasonably priced anti-epileptic medication for treating epilepsy in India, was introduced in March 2021 by Mumbai-based Alkem Laboratories. An entire line of Brivaracetam, an anti-epilepsy medicine, would be made available in India at a reasonable price, according to plans revealed by Sun Pharmaceutical Industries in February 2021. In 2019, Teva Pharmaceutical Industries Ltd. announced the U.S. launch of a generic version of Sabril (Vigabatrin). It was the first generic version of Sabril (vigabatrin) tablets to enter the market in the U.S. Furthermore, continuous innovations and developments in the field of epilepsy therapeutics industry are driving the market. For instance, art therapy for epilepsy, which allows people to explore their emotions and feelings through the process of creating, painting, or drawing, is gaining prominence across the globe.

In terms of product, the global epilepsy therapeutics market has been classified into first generation epilepsy therapeutics, second generation epilepsy therapeutics, and third generation epilepsy therapeutics. The second generation epilepsy therapeutics segment is expected to dominate the global market during the forecast period. Second generation epilepsy therapeutics offer several benefits such as decreased drug-drug interactions, fewer life-threatening adverse events, and less negative impact on cognitive functions. According to the American Academy of Neurology, second generation AEDs have lower risk of teratogenesis and a more favorable side-effect profile as compared to that of first generation epilepsy therapeutics.

Based on route of administration, the global epilepsy therapeutics market has been segregated into oral, intravenous, intramuscular, and others. The oral segment held prominent share of the global market in 2021. Oral administration is the most convenient, safest, and simplest mode of drug administration. It is convenient for prolonged and repeated usage. It can be self-administered and is pain-free. However, the intravenous segment is projected to grow at the fastest CAGR during the forecast period. Major technological innovations in the medical sector and emergence of effective analgesic drugs are expected to augment the segment.

In terms of distribution channel, the global epilepsy therapeutics market has been divided into hospital pharmacies, retail pharmacies, and online pharmacies. The online pharmacies segment is expected to grow at a rapid pace during the forecast period. Online pharmacies (e-pharmacies) sell drugs to customers via mail or shipping services. The pandemic-induced shutdowns and lockdowns have led to an increase in online drug purchases. Businesses and customers are increasingly preferring contactless delivery. This trend is expected to continue even after the pandemic. However, the hospital pharmacies segment is projected to account for the largest share of the global epilepsy therapeutics market during the forecast period.

North America accounted for major share of around 50.0% of the global epilepsy therapeutics market in 2021. The U.S. is the largest epilepsy drug market in the region, led by the improved healthcare infrastructure and rise in epilepsy cases in the country. According to the Centers for Disease Control and Prevention, approximately 470,000 children and 3 million adults in the U.S. had active epilepsy in 2020. The number of Americans suffering from epilepsy is higher than those suffering from multiple sclerosis, Parkinson's disease, and cerebral palsy combined. As a result, the future for epilepsy treatment options is high in the region. Furthermore, various organizations in the U.S. are raising awareness about epilepsy. For instance, Epilepsy Awareness Day or Purple Day is observed annually on March 26 to increase public understanding of the brain disorder and eliminate the fear and stigma associated with it. Thus, the market for epilepsy therapeutics is expected to grow rapidly in the near future. Development of products with high efficacy, better outcomes, and fewer side effects is also likely to accelerate market growth in North America.

The market in Asia Pacific is expected to grow at a significant pace during the forecast period. This can be ascribed to the ever-increasing geriatric population base, government initiatives to improve the healthcare industry, increased activities related to research and development, and rise in prevalence of epilepsy in the region.

The global epilepsy therapeutics market is consolidated, with the presence of small number of leading players. Most of the companies are investing significantly in research & development activities, primarily to introduce advanced epilepsy therapeutics products. Key players are entering into strategic alliances to increase their revenue and market share. Furthermore, diversification of product portfolios and mergers & acquisitions are the prominent strategies adopted by the leading players.

Pfizer, Inc., UCB S.A., Bausch Health Companies Inc., Novartis AG, GlaxoSmithKline plc., Teva Pharmaceutical Industries Ltd., Sunovion Pharmaceuticals Inc., Eisai Co., Upsher-Smith Laboratories, LLC., and Amneal Pharmaceuticals LLC. are the key players operating in the global epilepsy therapeutics market.

Each of these players has been profiled in the epilepsy therapeutics market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 10.6 Bn |

|

Market Forecast Value in 2031 |

More than US$ 14.9 Bn |

|

Growth Rate (CAGR) |

3.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global epilepsy therapeutics market was valued at US$ 10.6 Bn in 2021.

The global epilepsy therapeutics market is projected to reach more than US$ 14.9 Bn by 2031.

The global epilepsy therapeutics market is anticipated to grow at a CAGR of 3.5% from 2022 to 2031.

Introduction of promising drugs, rise in number of accidents and brain injuries; and high prevalence of post-traumatic epilepsy (PTE) and post-traumatic seizure (PTS).

The first generation epilepsy therapeutics segment held over 61% share of the global epilepsy therapeutics market in 2021.

Pfizer, Inc., UCB S.A., Bausch Health Companies Inc., Novartis AG, GlaxoSmithKline plc., Teva Pharmaceutical Industries Ltd., Sunovion Pharmaceuticals Inc., Eisai Co., Upsher-Smith Laboratories, LLC., and Amneal Pharmaceuticals LLC.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Epilepsy Therapeutics Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Epilepsy Therapeutics Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Pipeline

5.2. Epidemiology of Epilepsy

5.3. Key Industry Events

6. Global Epilepsy Therapeutics Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. First Generation Epilepsy Therapeutics

6.3.2. Second Generation Epilepsy Therapeutics

6.3.3. Third Generation Epilepsy Therapeutics

6.4. Market Attractiveness, by Product

7. Global Epilepsy Therapeutics Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Distribution Channel, 2017–2031

7.3.1. Hospital Pharmacies

7.3.2. Retail Pharmacies

7.3.3. Online Pharmacies

7.4. Market Attractiveness, by Distribution Channel

8. Global Epilepsy Therapeutics Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Epilepsy Therapeutics Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017–2031

9.2.1. First Generation Epilepsy Therapeutics

9.2.2. Second Generation Epilepsy Therapeutics

9.2.3. Third Generation Epilepsy Therapeutics

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Epilepsy Therapeutics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. First Generation Epilepsy Therapeutics

10.2.2. Second Generation Epilepsy Therapeutics

10.2.3. Third Generation Epilepsy Therapeutics

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By Distribution Channel

10.5.3. By Country/Sub-region

11. Asia Pacific Epilepsy Therapeutics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. First Generation Epilepsy Therapeutics

11.2.2. Second Generation Epilepsy Therapeutics

11.2.3. Third Generation Epilepsy Therapeutics

11.3. Market Value Forecast, by Distribution Channel, 2017–2031

11.3.1. Hospital Pharmacies

11.3.2. Retail Pharmacies

11.3.3. Online Pharmacies

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By Distribution Channel

11.5.3. By Country/Sub-region

12. Latin America Epilepsy Therapeutics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. First Generation Epilepsy Therapeutics

12.2.2. Second Generation Epilepsy Therapeutics

12.2.3. Third Generation Epilepsy Therapeutics

12.3. Market Value Forecast, by Distribution Channel, 2017–2031

12.3.1. Hospital Pharmacies

12.3.2. Retail Pharmacies

12.3.3. Online Pharmacies

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By Distribution Channel

12.5.3. By Country/Sub-region

13. Middle East & Africa Epilepsy Therapeutics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. First Generation Epilepsy Therapeutics

13.2.2. Second Generation Epilepsy Therapeutics

13.2.3. Third Generation Epilepsy Therapeutics

13.3. Market Value Forecast, by Distribution Channel, 2017–2031

13.3.1. Hospital Pharmacies

13.3.2. Retail Pharmacies

13.3.3. Online Pharmacies

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Israel

13.4.4. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By Distribution Channel

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2018)

14.3. Company Profiles

14.3.1. Pfizer, Inc.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Company Financials

14.3.1.3. Growth Strategies

14.3.1.4. SWOT Analysis

14.3.2. UCB S.A.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Company Financials

14.3.2.3. Growth Strategies

14.3.2.4. SWOT Analysis

14.3.3. Bausch Health Companies Inc.

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Company Financials

14.3.3.3. Growth Strategies

14.3.3.4. SWOT Analysis

14.3.4. Novartis AG

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Company Financials

14.3.4.3. Growth Strategies

14.3.4.4. SWOT Analysis

14.3.5. GlaxoSmithKline plc.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Company Financials

14.3.5.3. Growth Strategies

14.3.5.4. SWOT Analysis

14.3.6. Teva Pharmaceutical Industries Ltd.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Company Financials

14.3.6.3. Growth Strategies

14.3.6.4. SWOT Analysis

14.3.7. Sunovion Pharmaceuticals Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Company Financials

14.3.7.3. Growth Strategies

14.3.7.4. SWOT Analysis

14.3.8. Eisai Co., Ltd.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Company Financials

14.3.8.3. Growth Strategies

14.3.8.4. SWOT Analysis

14.3.9. Upsher-Smith Laboratories, LLC.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Company Financials

14.3.9.3. Growth Strategies

14.3.9.4. SWOT Analysis

14.3.10. Amneal Pharmaceuticals LLC.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Company Financials

14.3.10.3. Growth Strategies

14.3.10.4. SWOT Analysis

List of Tables

Table 01: Global Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 03: Global Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 06: North America Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 07: Europe Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Europe Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 09: Europe Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 10: Asia Pacific Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 12: Asia Pacific Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Latin America Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Latin America Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 16: Middle East & Africa Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Middle East & Africa Epilepsy Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Epilepsy Therapeutics Market Size (US$ Mn) and Distribution, by Region, 2021 and 2031

Figure 02: Global Epilepsy Therapeutics Market Size (US$ Mn) and Distribution, by Segment, 2021 and 2031

Figure 03: Global Epilepsy Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 04: Global Epilepsy Therapeutics Market Value Share (%), by Product, 2018 and 2027

Figure 05: Global Epilepsy Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by First Generation Epilepsy Therapeutics, 2017–2031

Figure 06: Global Epilepsy Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Second Generation Epilepsy Therapeutics, 2017–2031

Figure 07: Global Epilepsy Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Third Generation Epilepsy Therapeutics, 2017–2031

Figure 08: Global Epilepsy Therapeutics Market Attractiveness Analysis, by Product, 2019–2027

Figure 09: Global Epilepsy Therapeutics Market Value Share, by Distribution Channel, 2018 and 2027

Figure 10: Global Epilepsy Therapeutics Market Attractiveness, by Distribution Channel, 2019–2027

Figure 11: Global Epilepsy Therapeutics Market Value (US$ Mn) and Y-o-Y Growth, by Hospital Pharmacies, 2017–2031

Figure 12: Global Epilepsy Therapeutics Market Value (US$ Mn) and Y-o-Y Growth, by Retail Pharmacies, 2017–2031

Figure 13: Global Epilepsy Therapeutics Market Value (US$ Mn) and Y-o-Y Growth, by Online Pharmacies, 2017–2031

Figure 14: Global Epilepsy Therapeutics Market Value Share, by Region, 2018 and 2027

Figure 15: Global Epilepsy Therapeutics Market Attractiveness, by Region, 2019–2027

Figure 16: North America Epilepsy Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 17: North America Epilepsy Therapeutics Market Value Share (%), by Country, 2018 and 2027

Figure 18: North America Epilepsy Therapeutics Market Attractiveness, by Country, 2019–2027

Figure 19: North America Epilepsy Therapeutics Market Value Share, by Product, 2018 and 2027

Figure 20: North America Epilepsy Therapeutics Market Attractiveness, by Product, 2019–2027

Figure 21: North America Epilepsy Therapeutics Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 22: North America Epilepsy Therapeutics Market Attractiveness, by Distribution Channel, 2019–2027

Figure 23: Europe Epilepsy Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 24: Europe Epilepsy Therapeutics Market Value Share (%), by Country / Sub-region, 2018 and 2027

Figure 25: Europe Epilepsy Therapeutics Market Attractiveness, by Country / Sub-region, 2019–2027

Figure 26: Europe Epilepsy Therapeutics Market Value Share, by Product, 2018 and 2027

Figure 27: Europe Epilepsy Therapeutics Market Attractiveness, by Product, 2019–2027

Figure 28: Europe Epilepsy Therapeutics Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 29: Europe Epilepsy Therapeutics Market Attractiveness, by Distribution Channel, 2019–2027

Figure 30: Asia Pacific Epilepsy Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 31: Asia Pacific Epilepsy Therapeutics Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 32: Asia Pacific Epilepsy Therapeutics Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 33: Asia Pacific Epilepsy Therapeutics Market Value Share, by Product, 2018 and 2027

Figure 34: Asia Pacific Epilepsy Therapeutics Market Attractiveness, by Product, 2019–2027

Figure 35: Asia Pacific Epilepsy Therapeutics Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 36: Asia Pacific Epilepsy Therapeutics Market Attractiveness, by Distribution Channel, 2019–2027

Figure 37: Latin America Epilepsy Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 38: Latin America Epilepsy Therapeutics Market Value Share (%), by Country / Sub-region, 2018 and 2027

Figure 39: Europe Epilepsy Therapeutics Market Attractiveness, by Country / Sub-region, 2019–2027

Figure 40: Latin America Epilepsy Therapeutics Market Value Share, by Product, 2018 and 2027

Figure 41: Latin America Epilepsy Therapeutics Market Attractiveness, by Product, 2019–2027

Figure 42: Latin America Epilepsy Therapeutics Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 43: Latin America Epilepsy Therapeutics Market Attractiveness, by Distribution Channel, 2019–2027

Figure 44: Middle East & Africa Epilepsy Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2031

Figure 45: Middle East & Africa Epilepsy Therapeutics Market Value Share (%), by Country/Sub-region, 2018 and 2027

Figure 46: Middle East & Africa Epilepsy Therapeutics Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 47: Middle East & Africa Epilepsy Therapeutics Market Value Share, by Product, 2018 and 2027

Figure 48: Middle East & Africa Epilepsy Therapeutics Market Attractiveness, by Product, 2019–2027

Figure 49: Middle East & Africa Epilepsy Therapeutics Market Value Share Analysis, by Distribution Channel, 2018 and 2027

Figure 50: Middle East & Africa Epilepsy Therapeutics Market Attractiveness, by Distribution Channel, 2019–2027

Figure 51: Pfizer, Inc. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 52: Pfizer, Inc. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 53: Pfizer, Inc. Breakdown of Net Sales, by Geography 2018

Figure 54: Pfizer, Inc. Breakdown of Net Sales, by Business Segments (%), 2018

Figure 55: Bausch Health Companies Inc. Breakdown of Net Sales (%), by Region, 2017

Figure 56: Bausch Health Companies Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2017

Figure 57: Bausch Health Companies Inc. Breakdown of Revenue (%), by Product Category, 2017

Figure 58: Bausch Health Companies Inc. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2017

Figure 59: UCB, Inc. Breakdown of Net Sales, by Region 2018

Figure 60: UCB, Inc. Breakdown of Net Sales, by Therapeutic Area 2018

Figure 61: UCB, Inc. Revenue (US$ Bn) and Y-o-Y Growth (%), 2013–2018

Figure 62: UCB, Inc. R&D Intensity and Sales & Marketing Intensity - Company Level, 2017–2018

Figure 63: Novartis AG Breakdown of Net Sales, by Region, 2018

Figure 64: Novartis AG Breakdown of Net Sales, by Business Segment, 2018

Figure 65: Novartis AG Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2018

Figure 66: Novartis AG R&D Intensity and Sales & Marketing Intensity - Company Level, 2017–2018

Figure 67: GlaxoSmithKline plc. Sales Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 68: GlaxoSmithKline plc. Breakdown of R&D Expenditure (US$ Bn), 2016-2018

Figure 69: GlaxoSmithKline plc. Breakdown of Net Sales, by Region, 2018

Figure 70: GlaxoSmithKline plc. Breakdown of Net Sales, by Business Segments, 2018

Figure 71: Teva Pharmaceutical Industries Ltd. Revenue (US$ Mn) & Y-o-Y Growth (%), 2015–2018

Figure 72: Teva Pharmaceutical Industries Ltd. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 73: Sumitomo Dainippon Pharma Co., Ltd Pharmaceuticals Segment Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2017

Figure 74: Sumitomo Dainippon Pharma Co., Ltd Breakdown of Net Sales (%), by Region, 2017

Figure 75: Sumitomo Dainippon Pharma Co., Ltd R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2015–2017

Figure 76: Sumitomo Dainippon Pharma Co., Ltd Breakdown of Net Sales (%), by Product Segment, 2017

Figure 77: Eisai Co., Ltd., Revenue (US$ Mn) ,2017–2018

Figure 78: Eisai Co., Ltd., R&D Expenses (US$ Mn), 2017–2018

Figure 79: Eisai Co., Ltd., Breakdown of Net Sales (%), by Region, 2018

Figure 80: Sawai Pharmaceutical, Co.,Ltd., Revenue (US$ Mn), 2017–2018

Figure 81: Sawai Pharmaceutical, Co.,Ltd., Ltd, R&D Expenses (US$ Mn), 2017–2018

Figure 82: Sawai Pharmaceutical, Co.,Ltd., Breakdown of Net Sales (%), by Region, 2018

Figure 83: Amneal Pharmaceuticals LLC., Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 84: Amneal Pharmaceuticals LLC., R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2018