Analysts’ Viewpoint on Epilepsy Monitoring Devices Market Scenario

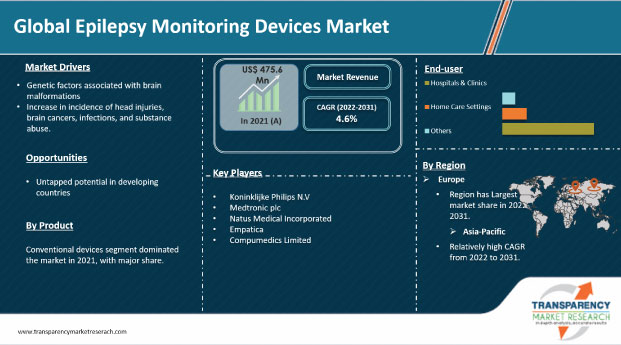

Advancements in technology; rise in product approvals; and increase in head injuries, brain cancer, and brain infections are expected to drive the global epilepsy monitoring devices market during the forecast period. For instance, the U.S. Food & Drug Administration approved the XCOPRI (cenobamate tablets) to treat partial onset seizures in adults. Existing companies and new entrants are launching new epilepsy monitor devices for children. NeuroPace launched the next-generation RNS system, which is the world’s only brain-computer interface for the treatment of refractory epilepsy. Moreover, genetic factors associated with brain malformations, improvement in health care infrastructure, and increase in investments in healthcare are augmenting the global market.

Epilepsy is a disorder of the central nervous system, in which the brain activity becomes abnormal, leading to seizures or periods of unusual behavior, sensations, and loss of awareness. Various conditions such as convulsions and epileptic seizures, including atonic seizures, myoclonic seizures, and tonic-clonic seizures, cause epilepsy. Rise in awareness about panic attack treatment in people is driving the market demand for epilepsy devices. According to the WHO, epilepsy accounts for a considerable proportion of the world’s disease burden; globally, more than 50 million people are affected by this disease. The projected proportion of the general population suffering from active epilepsy at a given time is between 4 and 10 per 1,000 people. Market players in the global epilepsy monitoring devices market are focusing on manufacturing innovative pediatric medical devices to create lucrative growth opportunities.

According to the NCBI, brain tumors are the second most common cause of epilepsy in the older population, behind cerebrovascular illness, and account for between 10% and 30% of all cases of geriatric epilepsy. Patients with brain tumors frequently have epilepsy as one of their symptoms. In 20% to 40% of brain tumor patients, seizures are the first symptom they experience; in 20% to 40% of patients, epileptic seizures are likely to occur at some point over the course of the disease.

According to the International League Against Epilepsy (ILAE), epilepsy and acute symptomatic seizures (which are strongly tied to the date of the initial infection) can both be brought on by diseases in the central nervous system such as meningitis, encephalitis, and neurocysticercosis. Furthermore, according to the American Association of Neurological Surgeons, alcohol or drug misuse and failure to take prescribed anticonvulsant medicine are the primary factors likely to increase the risk of seizures in persons who are prone to them. These factors are expected to drive the global demand for epilepsy monitoring devices during the forecast period.

Malformations of cortical development (MCD) is a significant contributor to developmental impairments, severe epilepsy, and reproductive disadvantage. Genes linked to MCD are mostly involved in neural migration, cell proliferation & specification, and late cortical architecture. These deformities have been linked to abnormalities in the LIS1, DCX, ARX, RELN, VLDLR, ACTB, ACTG1, TUBG1, KIF5C, KIF2A, and CDK5 genes. The International League Against Epilepsy (ILAE) Commission for Classification of Epilepsy, in accordance with the etiologies of epilepsy, classified epilepsies into three categories: genetic, structural/metabolic, and unknown origin. Epilepsy in younger people frequently has a hereditary basis. About 30% of the causes of epilepsy in people are due to genetic factors. Genetic factors can contribute to the ensuing epileptogenesis in ischemic stroke patients.

In terms of product, the global market has been bifurcated into conventional devices and wearable devices. The conventional devices segment dominated the global market in 2021. Increase in awareness initiatives about epilepsy monitoring to reduce cases of SUDEP (Sudden Death due to Epilepsy) is ascribed to the rise in demand for conventional devices.

The wearable devices segment is expected to grow at the fastest CAGR during the forecast period. Wearable epilepsy monitoring equipment such as Empatica’s Embrace not only provides 24-hour surveillance for epilepsy episodes in patients, but can also raise an alarm by sending a message or even making a call immediately to the caregiver in case of an emergency. This feature provides additional support for care providers, leading to an increase in demand for advanced wearables and seizure alert devices such as seizure alarms or seizure monitors.

Based on end-user, the global market has been divided into hospitals & clinics, home care settings, and others. The hospital & clinics segment accounted for major market share in 2021. The segment is anticipated to grow at a high CAGR from 2022 to 2031. Hospitals and clinics are the largest users of EEG monitoring and emergency medical services. The segment is anticipated to offer lucrative opportunities, especially in developing countries. Governments of various countries such as China and India are investing significantly in healthcare infrastructure. Moreover, growth in medical tourism and rise in demand for quality healthcare are likely to augment the hospital & clinics segment during the forecast period.

Europe dominated the global epilepsy monitoring device market in 2021. The market in Europe is expected to grow at a high CAGR from 2022 to 2031 due to the presence of a large geriatric population and increase in healthcare expenditure. According to Epilepsy Action, 600,000 people are living with epilepsy in the U.K., which is nearly equal to people living with autism and four times higher than those living with Parkinson's disease. Furthermore, a study by The Lancet Neurology in 2016 revealed that the prevalence of idiopathic epilepsy in Germany was 429,396.

North America is projected to be the second largest market for epilepsy monitoring tools during the forecast period. This can be ascribed to the high adoption of advanced treatment approaches and favorable reimbursement policies due to rise in patient population that is more susceptible to epilepsy. According to the U.S. Bureau of Labor Statistics, the average disposable income was US$ 3,258 per person per month in the U.S. in 2018, which is about a sixth higher than Canada's average. However, personal disposable income varies quite significantly across different states of the U.S.

Asia Pacific is expected to be the fastest growing region of the global epilepsy monitoring devices market during the forecast period. The market in the region is likely to grow at a high CAGR during the forecast period. Asia Pacific is experiencing increase in adoption of new technologies, rise in healthcare expenditure, and changing dynamics in the healthcare industry. Furthermore, increase in number of patients with epilepsy along with quality improvement in medical education is driving the demand for epilepsy monitoring devices in Asia Pacific.

The global epilepsy monitoring devices market is consolidated, with the presence of a small number of large-scale companies. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the key players. Koninklijke Philips N.V, Medtronic plc, Compumedics Limited, Natus Medical Incorporated, Empatica, Inc., PulseGuard International Ltd., and Masimo are the prominent companies operating in the market.

Each of these players has been profiled in the epilepsy monitoring devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 475.6 Mn |

|

Market Forecast Value in 2031 |

More than US$ 737 Mn |

|

Growth Rate (CAGR) |

4.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global epilepsy monitoring devices market was valued at US$ 475.6 Mn in 2021

The global epilepsy monitoring devices market is projected to reach more than US$ 737 Mn by 2031

The global epilepsy monitoring devices market grew at a CAGR of 3.8% from 2017 to 2021

The global epilepsy monitoring devices market is anticipated to grow at a CAGR of 4.6% from 2022 to 2031

Genetic factors associated with brain malformations and increase in incidence of head injuries, brain cancer, infections, and substance abuse

Europe is expected to account for the major share of the global epilepsy monitoring devices market during the forecast period

Koninklijke Philips N.V., Medtronic plc, Compumedics Limited, Natus Medical Incorporated, Empatica Inc., PulseGuard International Ltd, and Masimo

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Epilepsy Monitoring Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Epilepsy Monitoring Devices Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Product Details/ Providers/ Technological Advancements

5.2. Product Details & Pricing Analysis

5.3. Epidemiology of Epilepsy & Prevalence Data

5.4. Volume Data for epilepsy devices (2021)

5.5. Epilepsy Biomarkers

5.6. Epilepsy Monitoring Devices: Demand/Supply Scenario

6. Global Epilepsy Monitoring Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Conventional Devices

6.3.2. Wearable Devices

6.4. Market Attractiveness Analysis, by Product

7. Global Epilepsy Monitoring Devices Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals & Clinics

7.3.2. Home Care Settings

7.3.3. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Epilepsy Monitoring Devices Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia-Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region/Sub-region

9. North America Epilepsy Monitoring Devices Market Analysis and Forecast

9.1. Introduction

9.2. Market Value Forecast, by Product, 2017–2031

9.2.1. Conventional Devices

9.2.2. Wearable Devices

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals & Clinics

9.3.2. Home Care Settings

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Epilepsy Monitoring Devices Market Analysis and Forecast

10.1. Introduction

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Conventional Devices

10.2.2. Wearable Devices

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals & Clinics

10.3.2. Home Care Settings

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. France

10.4.3. U.K.

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia-Pacific Epilepsy Monitoring Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Conventional Devices

11.2.2. Wearable Devices

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals & Clinics

11.3.2. Home Care Settings

11.3.3. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. Japan

11.4.2. China

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Epilepsy Monitoring Devices Market Analysis and Forecast

12.1. Introduction

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Conventional Devices

12.2.2. Wearable Devices

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals & Clinics

12.3.2. Home Care Settings

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Epilepsy Monitoring Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast by Product, 2017–2031

13.2.1. Conventional Devices

13.2.2. Wearable Devices

13.3. Market Value Forecast by End-user, 2017–2031

13.3.1. Hospitals & Clinics

13.3.2. Home Care Settings

13.3.3. Others

13.4. Market Value Forecast by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. Israel

13.4.3. South Africa

13.4.4. Rest of MEA

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Top Players Operating in the Market

14.2. Market Share/Heat Map Analysis of Product, by Company, 2021

14.3. Competitive Business Strategies

14.4. Company Profiles

14.4.1. Koninklijke Philips N.V.

14.4.1.1. Company Overview

14.4.1.2. Financial Overview

14.4.1.3. Product Portfolio

14.4.1.4. Business Strategies

14.4.2. Medtronic plc

14.4.2.1 Company Overview

14.4.2.2. Financial Overview

14.4.2.3. Product Portfolio

14.4.2.4. Business Strategies

14.4.3. Compumedics Limited

14.4.3.1. Company Overview

14.4.3.2. Financial Overview

14.4.3.3. Product Portfolio

14.4.3.4. Business Strategies

14.4.4. Natus Medical Incorporated

14.4.4.1. Company Overview

14.4.4.2. Financial Overview

14.4.4.3. Product Portfolio

14.4.4.4. Business Strategies

14.4.5. Empatica, Inc.

14.4.5.1. Company Overview

14.4.5.2. Product Portfolio

14.4.5.3. Business Strategies

14.4.6. PulseGuard International Ltd.

14.4.6.1. Company Overview

14.4.6.2. Product Portfolio

14.4.6.3. Business Strategies

14.4.7. Masimo

14.4.7.1. Company Overview

14.4.7.2. Financial Overview

14.4.7.3. Product Portfolio

14.4.7.4. Business Strategies

List of Tables

Table 01: Product Details and Technology

Table 02: Wrist-worn sensors

Table 03: Bed monitors

Table 04: Bed Monitors & Video Monitor

Table 05: Epilepsy Prevalence Data

Table 06: Approximate Volume Data for Epilepsy Devices (2021)

Table 07: Epilepsy Biomarkers

Table 08: Global Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 09: Global Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 10: Global Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 11: North America Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 12: North America Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 13: North America Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 14: Europe Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 15: Europe Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 16: Europe Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Asia Pacific Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 18: Asia Pacific Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Asia Pacific Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Latin America Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Latin America Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 22: Latin America Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 23: MEA Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 24: MEA Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 25: MEA Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Market Value, by Product (US$ Mn), 2021

Figure 02: Global Epilepsy Monitoring Devices Market Snapshot

Figure 03: Global Epilepsy Monitoring Devices Market Share, by End-user, 2021

Figure 04: Global Epilepsy Monitoring Devices Market Share Analysis, by Region, 2021

Figure 05: Global Epilepsy Monitoring Devices Market Outlook, by Region

Figure 06: Global Epilepsy Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 07: Global Epilepsy Monitoring Devices Market Value Share, by Region, 2021

Figure 08: Global Epilepsy Monitoring Devices Market Value Share, by Product, 2021

Figure 09: Global Epilepsy Monitoring Devices Market Value Share, by End-user, 2021

Figure 10: Global Epilepsy Monitoring Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 11: Global Epilepsy Monitoring Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 12: Global Epilepsy Monitoring Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Conventional Devices, 2017–2031

Figure 13: Global Epilepsy Monitoring Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Wearable Devices, 2017–2031

Figure 14: Global Epilepsy Monitoring Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 15: Global Epilepsy Monitoring Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 16: Global Epilepsy Monitoring Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals & Clinics, 2017–2031

Figure 17: Global Epilepsy Monitoring Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Home Care Settings, 2017–2031

Figure 18: Global Epilepsy Monitoring Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2031

Figure 19: Global Epilepsy Monitoring Devices Market Value Share Analysis, by Region, 2021 and 2031

Figure 20: Global Epilepsy Monitoring Devices Market Attractiveness Analysis, by Region, 2022-2031

Figure 21: North America Epilepsy Monitoring Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 22: North America Epilepsy Monitoring Devices Market Value Share Analysis, by Country, 2021 and 2031

Figure 23: North America Epilepsy Monitoring Devices Market Attractiveness Analysis, by Country, 2022-2031

Figure 24: North America Epilepsy Monitoring Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 25: North America Epilepsy Monitoring Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 26: North America Epilepsy Monitoring Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 27: North America Epilepsy Monitoring Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 28: Europe Epilepsy Monitoring Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 29: Europe Epilepsy Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 30: Europe Epilepsy Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 31: Europe Epilepsy Monitoring Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 32: Europe Epilepsy Monitoring Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 33: Europe Epilepsy Monitoring Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 34: Europe Epilepsy Monitoring Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 35: Asia Pacific Epilepsy Monitoring Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2021 and 2031

Figure 36: Asia Pacific Epilepsy Monitoring Devices Market Value Share Analysis, by Country/Sub/region, 2021 and 2031

Figure 37: Asia Pacific Epilepsy Monitoring Devices Market Attractiveness Analysis, by Country, 2022-2031

Figure 38: Asia Pacific Epilepsy Monitoring Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 39: Asia Pacific Epilepsy Monitoring Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 40: Asia Pacific Epilepsy Monitoring Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 41: Asia Pacific Epilepsy Monitoring Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 42: Latin America Epilepsy Monitoring Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2021 and 2031

Figure 43: Latin America Epilepsy Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 44: Latin America Epilepsy Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 45: Latin America Epilepsy Monitoring Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 46: Latin America Epilepsy Monitoring Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 47: Latin America Epilepsy Monitoring Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 48: Latin America Epilepsy Monitoring Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 49: MEA Epilepsy Monitoring Devices Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 50: MEA Epilepsy Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 51: MEA Epilepsy Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 52: MEA Epilepsy Monitoring Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 53: MEA Epilepsy Monitoring Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 54: MEA Epilepsy Monitoring Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 55: MEA Epilepsy Monitoring Devices Market Attractiveness Analysis, by End-user, 2022-2031