Epichlorohydrin is a colorless, clear liquid with garlic like sweet, pungent odor that is mostly utilized in the making of epoxy resins. It also finds use in the procedures of surfactants, synthetic rubbers, paper chemicals, and water treatment.

Rising consumption of epoxy resins is likely to drive the global epichlorohydrin (ECH) market over the period of projection. The increased demand for epoxy resins is expected to be observed in the paints and coatings industry. However, various legislative bodies are likely to exhibit concern over the adverse impacts of epichlorohydrin on the environment and health. This factor is expected to pose challenge for the development of the global epichlorohydrin (ECH) market. However, epichlorohydrin-based glycerin is estimated to offer promising opportunities for the epichlorohydrin (ECH) market in the forthcoming years.

The global epichlorohydrin (ECH) market is likely to register a growth rate of 3.6% CAGR over the years of assessment.

Some of the well-entrenched players in the global epichlorohydrin (ECH) market are Jiangsu Yangnong Chemical Group Co., Samsung Fine Chemicals Co. Ltd, Shandong Haili Chemical Industry Co. Ltd, Aditya Birla Chemicals Ltd, and Sumitomo Chemical Co., Ltd.

Wide Scope of Application to Foster Growth of the Market in Near Future

The major areas of application for epichlorohydrin comprise synthetic glycerin, water treatment chemicals, pharmaceuticals, and epoxy resins. The resins that are produced from epichlorohydrin find use across several industries comprising plastics, adhesives, and coatings. Epoxy resins also find use in the making of dyes and inks, which are used across various industry verticals. In addition, synthetic glycerin is extensively utilized in the paper industry, cosmetic industry, textiles, solvents, commercial insecticides, pharmaceuticals, and surfactants.

In the construction industry, epoxy resins are utilized in the manufacturing of floorings in high traffic areas like hospitals, industrial buildings, and shopping malls, thanks to their anti-slip properties. They are also utilized in the binding of concrete to steel or to itself for the purpose of restoration of monuments. This factor is likely to work in favor of the expansion of the global epichlorohydrin (ECH) market in near future.

Epichlorohydrin comes with scores of applications across diverse end-use sectors. Its use across industries comprises epichlorohydrin-based rubber, paper, inks and dyes, ion-exchange resins, textiles, and agricultural products. These agricultural products comprise bactericides, insecticides, and fungicides. The existing trend in epichlorohydrin production has typically shifted bio-based feedstock from its manufacturing mechanism.

The agricultural residues are widely utilized in the preparation of anion exchangers after they are made to react with dimethylamine and epichlorohydrin. This holds substantial importance as agricultural residues anion exchangers are capable of doing away with NO3, thereby increasing agricultural yield at a much lower cost. This factor is estimated to support growth of the global epichlorohydrin (ECH) market.

North America to Lead the Market due to High Demand from End Users

In the global epichlorohydrin (ECH) market, North America is likely to come up as one of the leading regions in the market, both in terms of volume and value. A rise in the optimism toward industrial growth together with high demand for chemical substances is likely to foster growth of the global epichlorohydrin (ECH) market in the years to come. The market in the region is likely to driven by the US, which is a major consumer of the product. However, Canada is expected to register sluggish growth rate due to stringent laws against epichlorohydrin.

Asia Pacific is expected to emerge as one of the highly promising zone in the global epichlorohydrin (ECH) market. The regional dominance of the Asia Pacific is bolstered by the rapidly rising demand for the product from various end use industries such as electronic manufacturing industry, construction industry. Such a trend is expected to continue in the years to come.

1. Preface

1.1. Report Description

1.2. Research Scope

1.3. Assumptions

1.4. Market Segmentation

1.5. Research Methodology

2. Executive Summary

2.1. Global Epichlorohydrin Market, 2014-2023, (Kilo Tons) (US$ Mn)

2.2. Epichlorohydrin: Market Snapshot

3. Epichlorohydrin Market – Industry Analysis

3.1. Introduction

3.2. Value Chain Analysis

3.3. Market Drivers

3.3.1. Substantial Increase in the Demand of Epoxy Resins for Various End-user Industries Anticipated to Drive the Epichlorohydrin Market

3.3.2. High Demand of Synthetic Glycerin Due to Increasing Applications Projected to Drive the Epichlorohydrin Market

3.4. Restraints

3.4.1. Concern of Regulatory Bodies Regarding Harmful Effects of Epichlorohydrin on Health and Environment Likely to Hinder the Epichlorohydrin Market Growth

3.5. Opportunity

3.6. 3.5.1 Increase in the Production of Bio-based Epichlorohydrin Expected to Act as Opportunity for Epichlorohydrin Market

3.7. Porter’s Five Forces Analysis

3.7.1. Bargaining Power of Suppliers

3.7.2. Bargaining Power of Buyers

3.7.3. Threat of New Entrants

3.7.4. Threat of Substitutes

3.7.5. Degree of Competition

3.8. Global Epichlorohydrin Market Attractiveness, by End-user

3.9. Global Epichlorohydrin Market Attractiveness, by Country

3.10. Company Market Share, 2014

4. Raw Material and Price Trend Analysis

4.1. Epichlorohydrin Manufacturing Process

4.2. Raw Material Analysis

4.3. Global Average Propylene Price Trend, 2014-2023 (US$/Kg)

4.4. Global Average Epichlorohydrin Price Trend, 2014-2023 (US$/Kg)

5. Global Epichlorohydrin Market – Raw Material Analysis

5.1. Global Epichlorohydrin Market: Raw Material Overview

5.2. Global Epichlorohydrin Market by Propylene, 2014-2023 (Kilo Tons) (US$ Mn)

5.3. Global Epichlorohydrin Market by Glycerin, 2014-2023 (Kilo Tons) (US$ Mn)

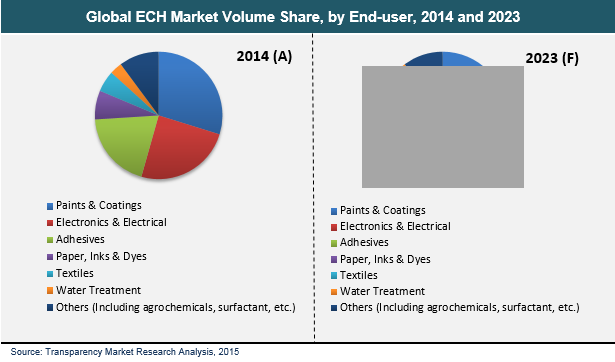

6. Global Epichlorohydrin Market – End-user Analysis

6.1. Global Epichlorohydrin Market: End-user Overview

6.2. Global Epichlorohydrin Market for Paints & Coatings, 2014-2023 (Kilo Tons) (US$ Mn)

6.3. Global Epichlorohydrin Market for Electronics & Electrical, 2014-2023 (Kilo Tons) (US$ Mn)

6.4. Global Epichlorohydrin Market for Adhesives, 2014-2023 (Kilo Tons) (US$ Mn)

6.5. Global Epichlorohydrin Market for Paper, Inks & Dyes, 2014-2023 (Kilo Tons) (US$ Mn)

6.6. Global Epichlorohydrin Market for Textiles, 2014-2023 (Kilo Tons) (US$ Mn)

6.7. Global Epichlorohydrin Market for Water Treatment, 2014-2023 (Kilo Tons) (US$ Mn)

6.8. Global Epichlorohydrin Market for Others, 2014-2023 (Kilo Tons) (US$ Mn)

7. Global Epichlorohydrin Market - Regional Analysis

7.1. Global Epichlorohydrin Market: Regional Overview

7.2. North America Epichlorohydrin Market, 2014 and 2023

7.2.1. North America Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.2.2. North America Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.2.3. North America Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.2.4. North America Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.2.5. U.S. Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.2.6. U.S. Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.2.7. U.S. Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.2.8. U.S. Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.2.9. Rest of North America Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.2.10. Rest of North America Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.2.11. Rest of North America Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.2.12. Rest of North America Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.3. Europe Epichlorohydrin Market, 2014 and 2023

7.3.1. Europe Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.3.2. Europe Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.3.3. Europe Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.3.4. Europe Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.3.5. France Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.3.6. France Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.3.7. France Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.3.8. France Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.3.9. UK Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.3.10. UK Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.3.11. UK Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.3.12. UK Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.3.13. Spain Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.3.14. Spain Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.3.15. Spain Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.3.16. Spain Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.3.17. Germany Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.3.18. Germany Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.3.19. Germany Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.3.20. Germany Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.3.21. Italy Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.3.22. Italy Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.3.23. Italy Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.3.24. Italy Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.3.25. Rest of Europe Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.3.26. Rest of Europe Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.3.27. Rest of Europe Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.3.28. Rest of Europe Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.4. Asia Pacific (APAC) Epichlorohydrin Market, 2014 and 2023

7.4.1. Asia Pacific Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.4.2. Asia Pacific Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.4.3. Asia Pacific Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.4.4. Asia Pacific Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.4.5. China Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.4.6. China Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.4.7. China Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.4.8. China Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.4.9. Taiwan Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.4.10. Taiwan Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.4.11. Taiwan Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.4.12. Taiwan Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.4.13. South Korea Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.4.14. South Korea Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.4.15. South Korea Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.4.16. South Korea Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.4.17. Japan Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.4.18. Japan Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.4.19. Japan Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.4.20. Japan Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.4.21. ASEAN Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.4.22. ASEAN Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.4.23. ASEAN Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.4.24. ASEAN Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.4.25. Rest of APAC Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.4.26. Rest of APAC Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.4.27. Rest of APAC Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.4.28. Rest of APAC Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.5. Latin America (LA) Epichlorohydrin Market, 2014 and 2023

7.5.1. Latin America Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.5.2. Latin America Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.5.3. Latin America Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.5.4. Latin America Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.5.5. Brazil Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.5.6. Brazil Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.5.7. Brazil Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.5.8. Brazil Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.5.9. Rest of LA Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.5.10. Rest of LA Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.5.11. Rest of LA Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.5.12. Rest of LA Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.6. Middle East & Africa (MEA) Epichlorohydrin Market, 2014 and 2023

7.6.1. Middle East & Africa Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.6.2. Middle East & Africa Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.6.3. Middle East & Africa Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.6.4. Middle East & Africa Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.6.5. GCC Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.6.6. GCC Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.6.7. GCC Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.6.8. GCC Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.6.9. South Africa Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.6.10. South Africa Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.6.11. South Africa Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.6.12. South Africa Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

7.6.13. Rest of Middle East & Africa Epichlorohydrin Market Volume, by Raw Material, 2014-2023 (Kilo Tons)

7.6.14. Rest of Middle East & Africa Epichlorohydrin Market Revenue, by Raw Material, 2014-2023 (US$ Mn)

7.6.15. Rest of Middle East & Africa Epichlorohydrin Market Volume, by End-user, 2014-2023 (Kilo Tons)

7.6.16. Rest of Middle East & Africa Epichlorohydrin Market Revenue, by End-user, 2014-2023 (US$ Mn)

8. Company Profiles

8.1. Sumitomo Chemical Co., Ltd.

8.2. Solvay

8.3. Aditya Birla Chemicals (Thailand) Ltd.

8.4. Spolchemie A.S.

8.5. Osaka Soda Co., Ltd.

8.6. Shandong Haili Chemical Industry Co. Ltd (Haili)

8.7. Samsung Fine Chemicals Co. Ltd.

8.8. The Dow Chemical Company

8.9. Jiangsu Yangnong Chemical Group Co.

8.10. Hexion Inc.

8.11. Tensar International Corporation

9. Primary Research – Key Findings

10. List of Key Customers