Analysts’ Viewpoint on Envelope Paper Market Scenario

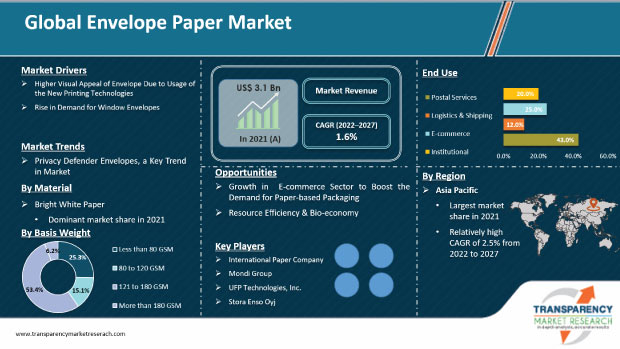

Growth of the global envelope paper market is driven by the rise in demand from various end-user industries, consumer preference for sustainable packaging, innovations by manufacturers, and favorable government policies. Introduction of attractive and traceable envelopes is also a prominent factor augmenting the envelope paper market. Benefits of envelopes such as lightweight packaging, secure packaging solution for small items, and transparency are expected to drive the market in the next few years. Furthermore, adoption of paper packaging, including paper envelopes & mailers, by brand owners supplements the sales of envelope paper. Leading players in the envelope paper market should focus on maintaining the quality of their products. They should manufacture envelope paper in various sizes along with printability features to increase their market share.

The envelope paper market is expected to grow during the forecast period owing to the increase in usage of paper envelopes in the e-commerce industry. Furthermore, growth in parcel delivery services, which offer shipping of envelopes at no cost to customers, is driving the envelope paper market aspects during the forecast period. In recent times, advancement in technologies has brought about major changes and trends in the market. Availability of printing on envelopes has increased the demand for printed envelopes. New printing technologies allow businesses to add more colors, images, and graphics to envelopes. Envelopes can be made more attractive using different colors and graphics. The usage of flexographic printing has increased in the market, as it is inexpensive. High-quality pictures and enhanced graphical printing have made envelopes more attractive. Thus, higher visual appeal of envelopes due to new printing technologies has boosted the market growth of envelope paper.

Most of the sectors in the world have experienced unfavorable effects due to the COVID-19 pandemic. Many industries had to witness supply chain disruption due to lockdowns and other restrictions that were imposed by governments. The global envelope paper market also had to face a downfall owing to the imposition of restrictions and limitations. Demand for envelope paper decreased, as consumers were focusing on essential goods. However, the e-commerce sector remained operational during the pandemic. Online sales through e-commerce sites increased significantly. This had a slightly positive impact on the envelope paper market. Overall, the envelope paper market has had a moderate negative impact on revenue during the COVID-19 pandemic. Nevertheless, applications of envelope paper in postal service, logistics, and e-commerce industries are likely to rise across the globe in the near future, thus driving the market.

Envelope paper is primarily used to send letters, cards, or documents through postal mail services. Different types of envelope paper are available in the market. The usage of the paper depends on applications such as business, postal, and institutional. Envelope paper is chosen from kraft paper, white paper, bright paper, or specialty paper. Various applications require a window envelope, which provides easy access to the information provided. Window envelopes are generally made with unique shapes. Different shapes and sizes of windows can be chosen according to the requirement. These envelopes provide customers a preview of the contents. Multiple windows can also be provided. Features of window envelopes include well-designed display, extra appeal, and increased visibility. Rise in demand for window envelopes is expected to augment the sales of envelope paper.

Digitization has increased the threat of data getting stolen or sensitive information being leaked. Newly developed privacy defender envelopes are certified by the FIPS (Federal Information Processing Standards). Privacy defender envelopes are designed for third-party mailers and financial institutions. Furthermore, privacy defender envelopes are used by government and health care agencies to safeguard data. Thus, the newly developed privacy defender envelope is driving the envelope paper market.

Postal services and e-commerce sectors are expected to remain the largest users of envelope papers. Envelopes are used for sending letters, documents, and small items through postal services and e-commerce. Moreover, envelopes are used for greeting cards and invitations. They are transported through postal services. Postal services and e-commerce end use segments are collectively estimated to create a growth opportunity of US$ 219.4 Mn during the forecast period and hold around 68% of the market share in terms of value by the end of next 2027.

Manufacturers in the envelope paper market are focusing on using renewable and recyclable paper to reduce the harmful effects on the environment. Customers are opting for sustainable packaging solutions. Rise in demand for envelope paper can be ascribed to innovations in design, appearance, and safety considerations. For instance, the European Federation of Envelope Manufacturers organized an exhibition to introduce innovations in paper products. Such efforts have increased the usage of paper products in packaging, thus boosting the envelope paper market.

Growth of the e-commerce sector is a major factor driving the market for envelop paper. Envelopes are the best suitable packaging option for goods dispatched in the letterbox. Moreover, small gifts/items, tickets, etc. are sent packed in envelopes. Manufacturers are increasingly providing envelopes, which are sustainable and ensure safe delivery. This has helped millions of small sellers in the e-commerce industry to gain revenue opportunities. Envelop papers are light in weight, innovative, attractive, and easily trackable. These envelopes have achieved traction in the e-commerce industry.

Bright white paper is the most preferred material for envelope paper among manufacturers. Demand for bright white paper envelope is increasing consistently across the globe. Smooth appearance of bright white paper is likely to create growth opportunities for envelope paper manufacturers during the forecast period. Bright white paper is also cost-efficient and commonly used for direct mail.

Asia Pacific is expected to remain the dominant region of the global market during the forecast period. The market in the region is estimated to grow at a rapid pace during the forecast period. Developing countries such as China and India are likely to constitute around 57% share of the envelope paper market in Asia Pacific by the end of 2022. This growth can be ascribed to the rise in domestic production and demand for paper in the envelope market, as small-scale industries cannot afford imported paper from other regions. Easy availability of paper in Asia Pacific attracts majority of envelope paper manufacturers. This augments the sale of envelope paper in the region. Growth of e-commerce is driving the demand for envelope paper in Asia Pacific. Moreover, government initiatives and expanding base of professionals are expected to augment the demand for envelope paper during the forecast period.

North America and Europe are expected to witness moderate growth in the envelope paper market. According to the United States Postal Service (USPS), around 425.3 million mail pieces are processed and delivered each day by the postal service in the country. This indicates the growth opportunity for the envelope paper market in North America.

The global envelope paper market is fragmented, with the presence of large numbers of manufacturers that control majority of the share. Mergers and acquisitions and development in product portfolios are prominent strategies adopted by key players. The global envelope paper market assessment report includes various sections such as envelope paper market outlook, envelope paper market drivers, envelope paper market restraints, envelope paper market challenges, envelope paper market pricing analysis, envelope paper market sales analysis, and envelope paper market opportunities analysis. It also focuses on envelope paper market competition analysis, envelope paper market recent developments, and envelope paper market demand analysis. The envelope paper market report concludes with the company profiles section, which includes key information about major players in the global envelope paper market. Mondi Group, International Paper Company, UPM Technologies, Inc., Stora Enso Oyj, Domtar Corporation, Neenah, Inc., Lintec Corporation, and JK Paper are the prominent companies operating in the market. Other leading players in the market include Moorim Paper Co. Ltd., Mohawk Paper Company, Koehler Paper, Packman Packaging Private Limited., TOMPLA, Kuvert Polska Group, and Mayer-Kuvert-network GmbH.

Each of these players has been profiled in global envelope paper market report based on parameters such as company overview, financial overview, business strategies, application portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 3.1 Bn |

|

Market Forecast Value in 2027 |

US$ 3.5 Bn |

|

Growth Rate (CAGR) |

1.6% from Year-to-Year |

|

Forecast Period |

2022–2027 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global envelope paper market was valued at US$ 3.1 Bn in 2021

By the end of 2027, the global envelope paper market is projected to reach US$ 3.5 Bn

During 2022-2027, the global envelope paper market is anticipated to grow at a CAGR of 1.6%

Increase in demand for window envelopes and rise in adoption of new printing technologies are projected to drive the demand for envelope paper

The market in Asia Pacific is projected to grow at a CAGR of 2.5% during the forecast period

Based on material, the bright white paper segment is estimated to remain the lucrative segment of the global envelope market

During 2022-2027, the postal services segment is projected to create the highest incremental opportunity of US$ 133.1 Mn in the global envelope market

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Envelope Paper Market Overview

3.1. Introduction

3.2. Global Envelope Paper Market Overview

3.3. Envelope Paper Market (US$ Bn) and Forecast

3.4. Value Chain Analysis

3.4.1. Exhaustive List of Active Participants

3.4.1.1. Raw Material Suppliers

3.4.1.2. Envelope Paper Manufacturers

3.4.1.3. End Users

3.4.2. Profitability Margins

3.5. Macro-economic Factors – Correlation Analysis

3.6. Forecast Factors – Relevance & Impact

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Impact of COVID-19 on Target Market

5. Envelope Paper Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections, By Region

5.2. Market Size (US$ Bn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. Envelope Paper Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

7. Global Envelope Paper Market Analysis and Forecast, By Material

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Material

7.1.2. Y-o-Y Growth Projections, By Material

7.2. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Material

7.2.1. Bright White Paper

7.2.2. Kraft Paper

7.2.3. Colored Paper

7.2.4. Specialty Paper

7.3. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027, By Material

7.3.1. Bright White Paper

7.3.2. Kraft Paper

7.3.3. Colored Paper

7.3.4. Specialty Paper

7.4. Market Attractiveness Analysis, By Material

8. Global Envelope Paper Market Analysis and Forecast, By Basis Weight

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Basis Weight

8.1.2. Y-o-Y Growth Projections, By Basis Weight

8.2. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Basis Weight

8.2.1. Less than 80 GSM

8.2.2. 80 to 120 GSM

8.2.3. 121 to 180 GSM

8.2.4. More than 180 GSM

8.3. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027, By Basis Weight

8.3.1. Less than 80 GSM

8.3.2. 80 to 120 GSM

8.3.3. 121 to 180 GSM

8.3.4. More than 180 GSM

8.4. Market Attractiveness Analysis, By Basis Weight

9. Global Envelope Paper Market Analysis and Forecast, By End Use

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By End Use

9.1.2. Y-o-Y Growth Projections, By End Use

9.2. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By End Use

9.2.1. Postal Services

9.2.2. Logistics & Shipping

9.2.3. E-commerce

9.2.4. Institutional

9.3. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027, By End Use

9.3.1. Postal Services

9.3.2. Logistics & Shipping

9.3.3. E-commerce

9.3.4. Institutional

9.4. Market Attractiveness Analysis, By End Use

9.5. Prominent Trends

10. Global Envelope Paper Market Analysis and Forecast, By Region

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By Region

10.1.2. Y-o-Y Growth Projections, By Region

10.2. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Region

10.2.1. North America

10.2.2. Latin America

10.2.3. Europe

10.2.4. Asia Pacific

10.2.5. Middle East and Africa

10.3. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 By Region

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific

10.3.5. Middle East and Africa

10.4. Market Attractiveness Analysis, By Region

11. North America Envelope Paper Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Country

11.3. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027, By Country

11.3.1. U.S.

11.3.2. Canada

11.4. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Material

11.5. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 Analysis 2022-2027, By Material

11.5.1. Bright White Paper

11.5.2. Kraft Paper

11.5.3. Colored Paper

11.5.4. Specialty Paper

11.6. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Basis Weight

11.7. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 Analysis 2022-2027, By Basis Weight

11.7.1. Less than 80 GSM

11.7.2. 80 to 120 GSM

11.7.3. 121 to 180 GSM

11.7.4. More than 180 GSM

11.8. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By End Use

11.9. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027, By End Use

11.9.1. Postal Services

11.9.2. Logistics & Shipping

11.9.3. E-commerce

11.9.4. Institutional

11.10. Market Attractiveness Analysis

11.10.1. By Country

11.10.2. By Material

11.10.3. By Basis Weight

11.10.4. By End Use

12. Latin America Envelope Paper Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Country

12.3. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 By Country

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Argentina

12.3.4. Rest of Latin America

12.4. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Material

12.5. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 Analysis 2022-2027, By Material

12.5.1. Bright White Paper

12.5.2. Kraft Paper

12.5.3. Colored Paper

12.5.4. Specialty Paper

12.6. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Basis Weight

12.7. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 Analysis 2022-2027, By Basis Weight

12.7.1. Less than 80 GSM

12.7.2. 80 to 120 GSM

12.7.3. 121 to 180 GSM

12.7.4. More than 180 GSM

12.8. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By End Use

12.9. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027, By End Use

12.9.1. Postal Services

12.9.2. Logistics & Shipping

12.9.3. E-commerce

12.9.4. Institutional

12.10. Market Attractiveness Analysis

12.10.1. By Country

12.10.2. By Material

12.10.3. By Basis Weight

12.10.4. By End Use

13. Europe Envelope Paper Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Country

13.3. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 By Country

13.3.1. Germany

13.3.2. Italy

13.3.3. Spain

13.3.4. Russia

13.3.5. U.K.

13.3.6. France

13.3.7. Benelux

13.3.8. Rest of Europe

13.4. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Material

13.5. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 Analysis 2022-2027, By Material

13.5.1. Bright White Paper

13.5.2. Kraft Paper

13.5.3. Colored Paper

13.5.4. Specialty Paper

13.6. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Basis Weight

13.7. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 Analysis 2022-2027, By Basis Weight

13.7.1. Less than 80 GSM

13.7.2. 80 to 120 GSM

13.7.3. 121 to 180 GSM

13.7.4. More than 180 GSM

13.8. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By End Use

13.9. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027, By End Use

13.9.1. Postal Services

13.9.2. Logistics & Shipping

13.9.3. E-commerce

13.9.4. Institutional

13.10. Market Attractiveness Analysis

13.10.1. By Country

13.10.2. By Material

13.10.3. By Basis Weight

13.10.4. By End Use

14. Asia Pacific Envelope Paper Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Country

14.3. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 By Country

14.3.1. China

14.3.2. India

14.3.3. ASEAN

14.3.4. Australia & New Zealand

14.3.5. Japan

14.3.6. Rest of Asia Pacific

14.4. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Material

14.5. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 Analysis 2022-2027, By Material

14.5.1. Bright White Paper

14.5.2. Kraft Paper

14.5.3. Colored Paper

14.5.4. Specialty Paper

14.6. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Basis Weight

14.7. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 Analysis 2022-2027, By Basis Weight

14.7.1. Less than 80 GSM

14.7.2. 80 to 120 GSM

14.7.3. 121 to 180 GSM

14.7.4. More than 180 GSM

14.8. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By End Use

14.9. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027, By End Use

14.9.1. Postal Services

14.9.2. Logistics & Shipping

14.9.3. E-commerce

14.9.4. Institutional

14.10. Market Attractiveness Analysis

14.10.1. By Country

14.10.2. By Material

14.10.3. By Basis Weight

14.10.4. By End Use

15. Middle East and Africa Envelope Paper Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis, By Country

15.1.2. Y-o-Y Growth Projections, By Country

15.2. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Country

15.3. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027, By Country

15.3.1. Northern Africa

15.3.2. GCC countries

15.3.3. South Africa

15.3.4. Rest of MEA

15.4. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Material

15.5. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 Analysis 2022-2027, By Material

15.5.1. Bright White Paper

15.5.2. Kraft Paper

15.5.3. Colored Paper

15.5.4. Specialty Paper

15.6. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By Basis Weight

15.7. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027 Analysis 2022-2027, By Basis Weight

15.7.1. Less than 80 GSM

15.7.2. 80 to 120 GSM

15.7.3. 121 to 180 GSM

15.7.4. More than 180 GSM

15.8. Historical Market Value (US$ Bn) and Volume (Mn ‘000 Tons), 2017-2021, By End Use

15.9. Market Size (US$ Bn) and Volume (Mn ‘000 Tons) Forecast Analysis 2022-2027, By End Use

15.9.1. Postal Services

15.9.2. Logistics & Shipping

15.9.3. E-commerce

15.9.4. Institutional

15.10. Market Attractiveness Analysis

15.10.1. By Country

15.10.2. By Material

15.10.3. By Basis Weight

15.10.4. By End Use

16. Country wise Envelope Paper Market Analysis, 2022-2027

16.1. U.S. Rigid Packaging Containers Market Analysis

16.1.1. By Material

16.1.2. By Basis Weight

16.1.3. By End Use

16.2. Canada Rigid Packaging Containers Market Analysis

16.2.1. By Material

16.2.2. By Basis Weight

16.2.3. By End Use

16.3. Brazil Rigid Packaging Containers Market Analysis

16.3.1. By Material

16.3.2. By Basis Weight

16.3.3. By End Use

16.4. Mexico Rigid Packaging Containers Market Analysis

16.4.1. By Material

16.4.2. By Basis Weight

16.4.3. By End Use

16.5. Germany Rigid Packaging Containers Market Analysis

16.5.1. By Material

16.5.2. By Basis Weight

16.5.3. By End Use

16.6. Spain Rigid Packaging Containers Market Analysis

16.6.1. By Material

16.6.2. By Basis Weight

16.6.3. By End Use

16.7. France Rigid Packaging Containers Market Analysis

16.7.1. By Material

16.7.2. By Basis Weight

16.7.3. By End Use

16.8. U.K. Rigid Packaging Containers Market Analysis

16.8.1. By Material

16.8.2. By Basis Weight

16.8.3. By End Use

16.9. Italy Rigid Packaging Containers Market Analysis

16.9.1. By Material

16.9.2. By Basis Weight

16.9.3. By End Use

16.10. Russia Rigid Packaging Containers Market Analysis

16.10.1. By Material

16.10.2. By Basis Weight

16.10.3. By End Use

16.11. China Rigid Packaging Containers Market Analysis

16.11.1. By Material

16.11.2. By Basis Weight

16.11.3. By End Use

16.12. India Rigid Packaging Containers Market Analysis

16.12.1. By Material

16.12.2. By Basis Weight

16.12.3. By End Use

16.13. Japan Rigid Packaging Containers Market Analysis

16.13.1. By Material

16.13.2. By Basis Weight

16.13.3. By End Use

16.14. GCC Countries Rigid Packaging Containers Market Analysis

16.14.1. By Material

16.14.2. By Basis Weight

16.14.3. By End Use

16.15. South Africa Rigid Packaging Containers Market Analysis

16.15.1. By Material

16.15.2. By Basis Weight

16.15.3. By End Use

17. Competitive Landscape

17.1. Market Structure

17.2. Competition Dashboard

17.3. Company Market Share Analysis

17.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

17.5. Competition Deep Dive

17.5.1. International Paper Company

17.5.1.1. Overview

17.5.1.2. Financials

17.5.1.3. Strategy

17.5.1.4. Recent Developments

17.5.1.5. SWOT Analysis

17.5.2. Mondi Group

17.5.2.1. Overview

17.5.2.2. Financials

17.5.2.3. Strategy

17.5.2.4. Recent Developments

17.5.2.5. SWOT Analysis

17.5.3. Domtar Corporation

17.5.3.1. Overview

17.5.3.2. Financials

17.5.3.3. Strategy

17.5.3.4. Recent Developments

17.5.3.5. SWOT Analysis

17.5.4. UPM Technologies, Inc.

17.5.4.1. Overview

17.5.4.2. Financials

17.5.4.3. Strategy

17.5.4.4. Recent Developments

17.5.4.5. SWOT Analysis

17.5.5. Stora Enso Oyj

17.5.5.1. Overview

17.5.5.2. Financials

17.5.5.3. Strategy

17.5.5.4. Recent Developments

17.5.5.5. SWOT Analysis

17.5.6. Neenah, Inc.

17.5.6.1. Overview

17.5.6.2. Financials

17.5.6.3. Strategy

17.5.6.4. Recent Developments

17.5.6.5. SWOT Analysis

17.5.7. Lintec Corporation

17.5.7.1. Overview

17.5.7.2. Financials

17.5.7.3. Strategy

17.5.7.4. Recent Developments

17.5.7.5. SWOT Analysis

17.5.8. JK Paper

17.5.8.1. Overview

17.5.8.2. Financials

17.5.8.3. Strategy

17.5.8.4. Recent Developments

17.5.8.5. SWOT Analysis

17.5.9. Moorim Paper Co. Ltd.

17.5.9.1. Overview

17.5.9.2. Financials

17.5.9.3. Strategy

17.5.9.4. Recent Developments

17.5.9.5. SWOT Analysis

17.5.10. Mohawk Paper Company

17.5.10.1. Overview

17.5.10.2. Financials

17.5.10.3. Strategy

17.5.10.4. Recent Developments

17.5.10.5. SWOT Analysis

17.5.11. Koehler Paper

17.5.11.1. Overview

17.5.11.2. Financials

17.5.11.3. Strategy

17.5.11.4. Recent Developments

17.5.11.5. SWOT Analysis

17.5.12. Packman Packaging Private Limited.

17.5.12.1. Overview

17.5.12.2. Financials

17.5.12.3. Strategy

17.5.12.4. Recent Developments

17.5.12.5. SWOT Analysis

17.5.13. Cosmo papers

17.5.13.1. Overview

17.5.13.2. Financials

17.5.13.3. Strategy

17.5.13.4. Recent Developments

17.5.13.5. SWOT Analysis

17.5.14. Sangal Papers Ltd.

17.5.14.1. Overview

17.5.14.2. Financials

17.5.14.3. Strategy

17.5.14.4. Recent Developments

17.5.14.5. SWOT Analysis

17.5.15. TOMPLA

17.5.15.1. Overview

17.5.15.2. Financials

17.5.15.3. Strategy

17.5.15.4. Recent Developments

17.5.15.5. SWOT Analysis

17.5.16. Kuvert Polska Group

17.5.16.1. Overview

17.5.16.2. Financials

17.5.16.3. Strategy

17.5.16.4. Recent Developments

17.5.16.5. SWOT Analysis

17.5.17. Mayer-Kuvert-network GmbH

17.5.17.1. Overview

17.5.17.2. Financials

17.5.17.3. Strategy

17.5.17.4. Recent Developments

17.5.17.5. SWOT Analysis

18. Assumptions and Acronyms Used

19. Research Methodology

List of Tables

Table 01: Global Envelope Paper Market Historic Value (US$ Bn), By Material 2017(H)-2021(A)

Table 02: Global Envelope Paper Market Forecast Value (US$ Bn), By Material 2022(E)-2027(F)

Table 03: Global Envelope Paper Market Historic Volume (‘000 Tons), By Material 2017(H)-2021(A)

Table 04: Global Envelope Paper Market Forecast Volume (‘000 Tons), By Material 2022(E)-2027(F)

Table 05: Global Envelope Paper Market Historic Value (US$ Bn), By Basis Weight 2017(H)-2021(A)

Table 06: Global Envelope Paper Market Forecast Value (US$ Bn), By Basis Weight 2022(E)-2027(F)

Table 07: Global Envelope Paper Market Historic Volume (‘000 Tons), By Basis Weight 2017(H)-2021(A)

Table 08: Global Envelope Paper Market Forecast Volume (‘000 Tons), By Basis Weight 2022(E)-2027(F)

Table 09: Global Envelope Paper Market Historic Value (US$ Bn), By End Use 2017(H)-2021(A)

Table 10: Global Envelope Paper Market Forecast Value (US$ Bn), By End Use 2022(E)-2027(F)

Table 11: Global Envelope Paper Market Historic Volume (‘000 Tons), By End Use 2017(H)-2021(A)

Table 12: Global Envelope Paper Market Forecast Volume (‘000 Tons), By End Use 2022(E)-2027(F)

Table 13: Global Envelope Paper Market Historic Value (US$ Bn), By Region 2017(H)-2021(A)

Table 14: Global Envelope Paper Market Forecast Value (US$ Bn), By Region 2022(E)-2027(F)

Table 15: Global Envelope Paper Market Historic Volume (‘000 Tons), By Region 2017(H)-2021(A)

Table 16: Global Envelope Paper Market Forecast Volume (‘000 Tons), By Region 2022(E)-2027(F)

Table 17: North America Envelope Paper Market Historic Value (US$ Bn), By Material 2017(H)-2021(A)

Table 18: North America Envelope Paper Market Forecast Value (US$ Bn), By Material 2022(E)-2027(F)

Table 19: North America Envelope Paper Market Historic Volume (‘000 Tons), By Material 2017(H)-2021(A)

Table 20: North America Envelope Paper Market Forecast Volume (‘000 Tons), By Material 2022(E)-2027(F)

Table 21: North America Envelope Paper Market Historic Value (US$ Bn), By Basis Weight 2017(H)-2021(A)

Table 22: North America Envelope Paper Market Forecast Value (US$ Bn), By Basis Weight 2022(E)-2027(F)

Table 23: North America Envelope Paper Market Historic Volume (‘000 Tons), By Basis Weight 2017(H)-2021(A)

Table 24: North America Envelope Paper Market Forecast Volume (‘000 Tons), By Basis Weight 2022(E)-2027(F)

Table 25: North America Envelope Paper Market Historic Value (US$ Bn), By End Use 2017(H)-2021(A)

Table 26: North America Envelope Paper Market Forecast Value (US$ Bn), By End Use 2022(E)-2027(F)

Table 27: North America Envelope Paper Market Historic Volume (‘000 Tons), By End Use 2017(H)-2021(A)

Table 28: North America Envelope Paper Market Forecast Volume (‘000 Tons), By End Use 2022(E)-2027(F)

Table 29: North America Envelope Paper Market Historic Value (US$ Bn), By Country 2017(H)-2021(A)

Table 30: North America Envelope Paper Market Forecast Value (US$ Bn), By Country 2022(E)-2027(F)

Table 31: North America Envelope Paper Market Historic Volume (‘000 Tons), By Country 2017(H)-2021(A)

Table 32: North America Envelope Paper Market Forecast Volume (‘000 Tons), By Country 2022(E)-2027(F)

Table 33: Latin America Envelope Paper Market Historic Value (US$ Bn), By Material 2017(H)-2021(A)

Table 34: Latin America Envelope Paper Market Forecast Value (US$ Bn), By Material 2022(E)-2027(F)

Table 35: Latin America Envelope Paper Market Historic Volume (‘000 Tons), By Material 2017(H)-2021(A)

Table 36: Latin America Envelope Paper Market Forecast Volume (‘000 Tons), By Material 2022(E)-2027(F)

Table 37: Latin America Envelope Paper Market Historic Value (US$ Bn), By Basis Weight 2017(H)-2021(A)

Table 38: Latin America Envelope Paper Market Forecast Value (US$ Bn), By Basis Weight 2022(E)-2027(F)

Table 39: Latin America Envelope Paper Market Historic Volume (‘000 Tons), By Basis Weight 2017(H)-2021(A)

Table 40: Latin America Envelope Paper Market Forecast Volume (‘000 Tons), By Basis Weight 2022(E)-2027(F)

Table 41: Latin America Envelope Paper Market Historic Value (US$ Bn), By End Use 2017(H)-2021(A)

Table 42: Latin America Envelope Paper Market Forecast Value (US$ Bn), By End Use 2022(E)-2027(F)

Table 43: Latin America Envelope Paper Market Historic Volume (‘000 Tons), By End Use 2017(H)-2021(A)

Table 44: Latin America Envelope Paper Market Forecast Volume (‘000 Tons), By End Use 2022(E)-2027(F)

Table 45: Latin America Envelope Paper Market Historic Value (US$ Bn), By Country 2017(H)-2021(A)

Table 46: Latin America Envelope Paper Market Forecast Value (US$ Bn), By Country 2022(E)-2027(F)

Table 47: Latin America Envelope Paper Market Historic Volume (‘000 Tons), By Country 2017(H)-2021(A)

Table 48: Latin America Envelope Paper Market Forecast Volume (‘000 Tons), By Country 2022(E)-2027(F)

Table 49: Europe Envelope Paper Market Historic Value (US$ Bn), By Material 2017(H)-2021(A)

Table 50: Europe Envelope Paper Market Forecast Value (US$ Bn), By Material 2022(E)-2027(F)

Table 51: Europe Envelope Paper Market Historic Volume (‘000 Tons), By Material 2017(H)-2021(A)

Table 52: Europe Envelope Paper Market Forecast Volume (‘000 Tons), By Material 2022(E)-2027(F)

Table 53: Europe Envelope Paper Market Historic Value (US$ Bn), By Basis Weight 2017(H)-2021(A)

Table 54: Europe Envelope Paper Market Forecast Value (US$ Bn), By Basis Weight 2022(E)-2027(F)

Table 55: Europe Envelope Paper Market Historic Volume (‘000 Tons), By Basis Weight 2017(H)-2021(A)

Table 56: Europe Envelope Paper Market Forecast Volume (‘000 Tons), By Basis Weight 2022(E)-2027(F)

Table 57: Europe Envelope Paper Market Historic Value (US$ Bn), By End Use 2017(H)-2021(A)

Table 58: Europe Envelope Paper Market Forecast Value (US$ Bn), By End Use 2022(E)-2027(F)

Table 59: Europe Envelope Paper Market Historic Volume (‘000 Tons), By End Use 2017(H)-2021(A)

Table 60: Europe Envelope Paper Market Forecast Volume (‘000 Tons), By End Use 2022(E)-2027(F)

Table 61: Europe Envelope Paper Market Historic Value (US$ Bn), By Country 2017(H)-2021(A)

Table 62: Europe Envelope Paper Market Forecast Value (US$ Bn), By Country 2022(E)-2027(F)

Table 63: Europe Envelope Paper Market Historic Volume (‘000 Tons), By Country 2017(H)-2021(A)

Table 64: Europe Envelope Paper Market Forecast Volume (‘000 Tons), By Country 2022(E)-2027(F)

Table 65: Asia Pacific Envelope Paper Market Historic Value (US$ Bn), By Material 2017(H)-2021(A)

Table 66: Asia Pacific Envelope Paper Market Forecast Value (US$ Bn), By Material 2022(E)-2027(F)

Table 67: Asia Pacific Envelope Paper Market Historic Volume (‘000 Tons), By Material 2017(H)-2021(A)

Table 68: Asia Pacific Envelope Paper Market Forecast Volume (‘000 Tons), By Material 2022(E)-2027(F)

Table 69: Asia Pacific Envelope Paper Market Historic Value (US$ Bn), By Basis Weight 2017(H)-2021(A)

Table 70: Asia Pacific Envelope Paper Market Forecast Value (US$ Bn), By Basis Weight 2022(E)-2027(F)

Table 71: Asia Pacific Envelope Paper Market Historic Volume (‘000 Tons), By Basis Weight 2017(H)-2021(A)

Table 72: Asia Pacific Envelope Paper Market Forecast Volume (‘000 Tons), By Basis Weight 2022(E)-2027(F)

Table 73: Asia Pacific Envelope Paper Market Historic Value (US$ Bn), By End Use 2017(H)-2021(A)

Table 74: Asia Pacific Envelope Paper Market Forecast Value (US$ Bn), By End Use 2022(E)-2027(F)

Table 75: Asia Pacific Envelope Paper Market Historic Volume (‘000 Tons), By End Use 2017(H)-2021(A)

Table 76: Asia Pacific Envelope Paper Market Forecast Volume (‘000 Tons), By End Use 2022(E)-2027(F)

Table 77: Asia Pacific Envelope Paper Market Historic Value (US$ Bn), By Country 2017(H)-2021(A)

Table 78: Asia Pacific Envelope Paper Market Forecast Value (US$ Bn), By Country 2022(E)-2027(F)

Table 79: Asia Pacific Envelope Paper Market Historic Volume (‘000 Tons), By Country 2017(H)-2021(A)

Table 80: Asia Pacific Envelope Paper Market Forecast Volume (‘000 Tons), By Country 2022(E)-2027(F)

Table 81: MEA Envelope Paper Market Historic Value (US$ Bn), By Material 2017(H)-2021(A)

Table 82: MEA Envelope Paper Market Forecast Value (US$ Bn), By Material 2022(E)-2027(F)

Table 83: MEA Envelope Paper Market Historic Volume (‘000 Tons), By Material 2017(H)-2021(A)

Table 84: MEA Envelope Paper Market Forecast Volume (‘000 Tons), By Material 2022(E)-2027(F)

Table 85: MEA Envelope Paper Market Historic Value (US$ Bn), By Basis Weight 2017(H)-2021(A)

Table 86: MEA Envelope Paper Market Forecast Value (US$ Bn), By Basis Weight 2022(E)-2027(F)

Table 87: MEA Envelope Paper Market Historic Volume (‘000 Tons), By Basis Weight 2017(H)-2021(A)

Table 88: MEA Envelope Paper Market Forecast Volume (‘000 Tons), By Basis Weight 2022(E)-2027(F)

Table 89: MEA Envelope Paper Market Historic Value (US$ Bn), By End Use 2017(H)-2021(A)

Table 90: MEA Envelope Paper Market Forecast Value (US$ Bn), By End Use 2022(E)-2027(F)

Table 91: MEA Envelope Paper Market Historic Volume (‘000 Tons), By End Use 2017(H)-2021(A)

Table 92: MEA Envelope Paper Market Forecast Volume (‘000 Tons), By End Use 2022(E)-2027(F)

Table 93: MEA Envelope Paper Market Historic Value (US$ Bn), By Country 2017(H)-2021(A)

Table 94: MEA Envelope Paper Market Forecast Value (US$ Bn), By Country 2022(E)-2027(F)

Table 95: MEA Envelope Paper Market Historic Volume (‘000 Tons), By Country 2017(H)-2021(A)

Table 96: MEA Envelope Paper Market Forecast Volume (‘000 Tons), By Country 2022(E)-2027(F)

List of Figures

Figure 01: Global Envelope Paper Market Share Analysis, By Material, 2022E & 2027F

Figure 02: Global Envelope Paper Market Attractiveness Analysis, By Material, 2022E-2027F

Figure 03: Global Envelope Paper Market Y-o-Y Analysis, By Material, 2019H-2027F

Figure 04: Global Envelope Paper Market Share Analysis, By Basis Weight, 2022E & 2027F

Figure 05: Global Envelope Paper Market Attractiveness Analysis, By Basis Weight, 2022E-2027F

Figure 06: Global Envelope Paper Market Y-o-Y Analysis, By Basis Weight, 2019H-2027F

Figure 07: Global Envelope Paper Market Share Analysis, By End Use, 2022E & 2027F

Figure 08: Global Envelope Paper Market Attractiveness Analysis, By End Use, 2022E-2027F

Figure 09: Global Envelope Paper Market Y-o-Y Analysis, By End Use, 2019H-2027F

Figure 10: Global Envelope Paper Market Share Analysis, By Region, 2022E & 2027F

Figure 11: Global Envelope Paper Market Attractiveness Analysis, By Region, 2022E-2027F

Figure 12: Global Envelope Paper Market Y-o-Y Analysis, By Region, 2019H-2027F

Figure 13: North America Envelope Paper Market Share Analysis, By Material, 2022E & 2027F

Figure 14: North America Envelope Paper Market Value Share Analysis, By Basis Weight 2022(E)

Figure 15: North America Envelope Paper Market Attractiveness Analysis, By End Use, 2021E-2031F

Figure 16: North America Envelope Paper Market Value Share Analysis, By Country 2022(E)

Figure 17: Latin America Envelope Paper Market Share Analysis, By Material, 2022E & 2027F

Figure 18: Latin America Envelope Paper Market Value Share Analysis, By Basis Weight 2022(E)

Figure 19: Latin America Envelope Paper Market Attractiveness Analysis, By End Use, 2021E-2031F

Figure 20: Latin America Envelope Paper Market Value Share Analysis, By Country 2022(E)

Figure 21: Europe Envelope Paper Market Share Analysis, By Material, 2022E & 2027F

Figure 22: Europe Envelope Paper Market Value Share Analysis, By Basis Weight 2022(E)

Figure 23: Europe Envelope Paper Market Attractiveness Analysis, By End Use, 2021E-2031F

Figure 24: Europe Envelope Paper Market Value Share Analysis, By Country 2022(E)

Figure 25: Asia Pacific Envelope Paper Market Share Analysis, By Material, 2022E & 2027F

Figure 26: Asia Pacific Envelope Paper Market Value Share Analysis, By Basis Weight 2022(E)

Figure 27: Asia Pacific Envelope Paper Market Attractiveness Analysis, By End Use, 2021E-2031F

Figure 28: Asia Pacific Envelope Paper Market Value Share Analysis, By Country 2022(E)

Figure 29: MEA Envelope Paper Market Share Analysis, By Material, 2022E & 2027F

Figure 30: MEA Envelope Paper Market Value Share Analysis, By Basis Weight 2022(E)

Figure 31: MEA Envelope Paper Market Attractiveness Analysis, By End Use, 2021E-2031F

Figure 32: MEA Envelope Paper Market Value Share Analysis, By Country 2022(E)

Figure 33: U.S. Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 34: U.S. Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 35: U.S. Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 36: Canada Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 37: Canada Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 38: Canada Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 39: Brazil Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 40: Brazil Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 41: Brazil Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 42: Mexico Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 43: Mexico Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 44: Mexico Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 45: Germany Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 46: Germany Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 47: Germany Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 48: Spain Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 49: Spain Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 50: Spain Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 51: France Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 52: France Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 53: France Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 54: U.K. Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 55: U.K. Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 56: U.K. Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 57: Italy Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 58: Italy Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 59: Italy Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 60: Russia Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 61: Russia Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 62: Russia Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 63: China Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 64: China Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 65: China Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 66: India Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 67: India Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 68: India Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 69: Japan Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 70: Japan Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 71: Japan Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 72: GCC Countries Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 73: GCC Countries Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 74: GCC Countries Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F

Figure 75: South Africa Envelope Paper Market Value Share Analysis, by Material, 2022E & 2027F

Figure 76: South Africa Envelope Paper Market Value Share Analysis, by Basis Weight, 2022E

Figure 77: South Africa Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2027F