Analysts’ Viewpoint on Market Scenario

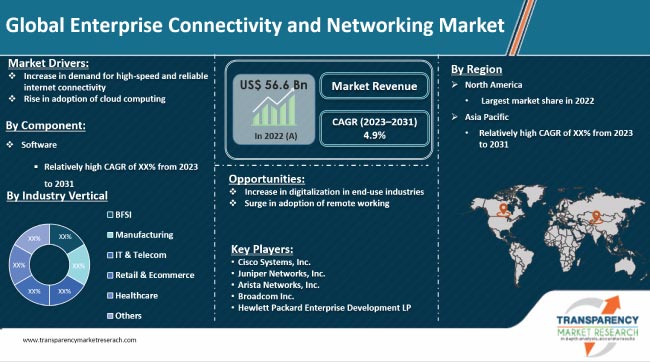

Increase in demand for high-speed and reliable internet connectivity is a key factor driving the enterprise connectivity and networking market size. Growth of cloud computing, big data, and Internet of Things (IoT) has encouraged businesses to transfer large amounts of data, connect remote workers, and support mission-critical applications. This has led to a rise in demand for enterprise networking solutions that can provide fast, secure, and reliable connectivity.

The COVID-19 pandemic has accelerated the trend of remote working and has led to an increase in need for fast and reliable internet connectivity. Therefore, the enterprise connectivity and networking industry is expected to grow at a steady pace, as businesses look to upgrade their networks to meet the demands of the digital age.

Enterprise connectivity and networking refers to technology infrastructure that connects and supports communication within an organization. This includes both wired and wireless networks as well as hardware and software components that make up these networks.

Multiple local computing devices are connected through routers, switches, and Ethernet or WIFI connections to share applications and data. Virtual Private Network (VPN) software is used to encrypt user data when connecting to servers outside of a LAN. Additionally, firewall software is deployed to inspect and control network traffic.

Demand for high-speed and reliable internet connectivity is increasing, as businesses are relying significantly on the internet for day-to-day operations. Adoption of the internet in organizations facilitates cloud computing, remote work, online collaboration, and data-intensive applications.

Businesses need networks that can support these applications and services effectively, with minimal downtime and disruptions. This has led to a growth in demand for high-speed broadband, fiber optics, and other advanced connectivity solutions. These solutions ensure that employees, customers, and partners can access information and resources wherever and whenever required. Thus, surge in demand for reliable internet connectivity is expected to spur enterprise connectivity and networking market growth in the near future.

Cloud computing enables organizations to store, process, and access data and applications over the internet, rather than on in-house servers. This results in greater scalability, flexibility, and cost-effectiveness.

Major businesses across the globe are shifting their operations and applications to the cloud. This requires reliable and secure connectivity solutions, including robust internet connection, firewalls, switches, and routers. These solutions ensure the security and performance of cloud-based systems. Thus, increase in adoption of the cloud is anticipated to augment enterprise connectivity and networking market development in the next few years.

Businesses are also relying on IoT for various operations. They are able to collect and analyze vast amounts of data from various sources by incorporating IoT devices into their operations. This offers improved efficiency, better decision-making, and reduced costs. For instance, IoT can be used in the manufacturing sector to track and monitor the performance of machinery. It can also be deployed in the transportation sector to monitor the location and condition of vehicles. Furthermore, IoT can help track patient data and monitor their vital signs in the healthcare sector.

IoT devices generate large amount of data that needs to be transmitted and processed to optimize performance. This requires robust and scalable networking solutions to support the flow of data between devices and cloud-based systems.

IoT devices also need to be securely connected to ensure the privacy and protection of sensitive information. These requirements are projected to boost the adoption of enterprise-grade networking and connectivity solutions, such as Wi-Fi networks, Ethernet switches, and cellular connectivity solutions. This, in turn, is estimated to fuel enterprise connectivity and networking market progress in the near future.

North America is anticipated to account for the largest market share during the forecast period. The region dominated the global landscape in 2022. Presence of major vendors and rise in adoption of cloud computing and remote work are driving the enterprise connectivity and networking market statistics in the region.

The market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. Increase in digitalization in end-use industries and surge in investment in smart city projects are boosting market dynamics of the region.

Middle East & Africa and South America are likely to witness moderate growth in demand for enterprise connectivity and networking solutions in the near future.

Cisco Systems, Inc. Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Juniper Networks, Inc., ZTE Corporation, Nokia Corporation, Arista Networks, Inc., Broadcom Inc., Dell, Inc., NetScout Systems, Inc., Extreme Networks, and AT&T Inc. are key entities operating in this sector. Detailed profiles of these vendors have been provided in the market report to evaluate their financials, key product offerings, recent developments, and strategies.

Manufacturers are entering into partnerships and alliances with other companies to expand their reach and increase their enterprise connectivity and networking market share. They are also striving acquire other companies to gain access to new technologies and expertise as well as expand their product portfolio and customer base.

In July 2022, Juniper Networks partnered with Carahsoft Technology Corp, an IT solutions company, to provide its AI-powered networking solutions, AI-powered enterprise networking platform, and intent-based networking software through Carahsoft’s reseller partner network, NASA Solutions for Enterprise-Wide Procurement (SEWP) V, National Cooperative Purchasing Alliance (NCPA), and OMNIA Partners contracts

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 56.6 Bn |

|

Market Forecast Value in 2031 |

US$ 86.8 Bn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 56.6 Bn in 2022.

It is anticipated to grow at a CAGR of 4.9% from 2023 to 2031.

It is estimated to reach US$ 86.8 Bn by 2031.

Increase in demand for high-speed and reliable internet connectivity and rise in adoption of cloud computing.

Surge in adoption of Software-defined Networking (SDN) and increase in deployment of cloud computing solutions in SMEs.

North America was the leading regional segment in 2022.

Cisco Systems, Inc. Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Juniper Networks, Inc., ZTE Corporation, Nokia Corporation, Arista Networks, Inc., Broadcom Inc., Dell, Inc., NetScout Systems, Inc., Extreme Networks, and AT&T Inc.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global Enterprise Connectivity and Networking Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Enterprise Connectivity and Networking Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East and Africa/ South America)

4.5.1. By Component

4.5.2. By Enterprise Size

4.5.3. By Industry Vertical

5. Global Enterprise Connectivity and Networking Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2017-2031

5.1.1. Historic Growth Trends, 2017-2022

5.1.2. Forecast Trends, 2023-2031

5.2. Pricing Model Analysis/ Price Trend Analysis

6. Global Enterprise Connectivity and Networking Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Enterprise Connectivity and Networking Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.3.1. Hardware

6.3.2. Software

6.3.3. Services

7. Global Enterprise Connectivity and Networking Market Analysis, by Enterprise Size

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Enterprise Connectivity and Networking Market Size (US$ Bn) Forecast, by Enterprise Size, 2018 - 2031

7.3.1. SMEs

7.3.2. Large Enterprises

8. Global Enterprise Connectivity and Networking Market Analysis, by Industry Vertical

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Enterprise Connectivity and Networking Market Size (US$ Bn) Forecast, by Industry Vertical, 2018 - 2031

8.3.1. BFSI

8.3.2. Manufacturing

8.3.3. IT & Telecom

8.3.4. Retail & Ecommerce

8.3.5. Healthcare

8.3.6. Others

9. Global Enterprise Connectivity and Networking Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Size (US$ Bn) Forecast by Region, 2018-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Enterprise Connectivity and Networking Market Analysis and Forecast

10.1. Regional Outlook

10.2. Enterprise Connectivity and Networking Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

10.2.1. By Component

10.2.2. By Enterprise Size

10.2.3. By Industry Vertical

10.3. Enterprise Connectivity and Networking Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Enterprise Connectivity and Networking Market Analysis and Forecast

11.1. Regional Outlook

11.2. Enterprise Connectivity and Networking Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

11.2.1. By Component

11.2.2. By Enterprise Size

11.2.3. By Industry Vertical

11.3. Enterprise Connectivity and Networking Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific Enterprise Connectivity and Networking Market Analysis and Forecast

12.1. Regional Outlook

12.2. Enterprise Connectivity and Networking Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By Enterprise Size

12.2.3. By Industry Vertical

12.3. Enterprise Connectivity and Networking Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa Enterprise Connectivity and Networking Market Analysis and Forecast

13.1. Regional Outlook

13.2. Enterprise Connectivity and Networking Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By Enterprise Size

13.2.3. By Industry Vertical

13.3. Enterprise Connectivity and Networking Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America Enterprise Connectivity and Networking Market Analysis and Forecast

14.1. Regional Outlook

14.2. Enterprise Connectivity and Networking Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

14.2.1. By Component

14.2.2. By Enterprise Size

14.2.3. By Industry Vertical

14.3. Enterprise Connectivity and Networking Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2022)

15.3. Competitive Scenario

15.3.1. List of Emerging, Prominent and Leading Players

15.3.2. Major Mergers & Acquisitions, Expansions, Partnerships, Contracts, Deals, etc.

16. Company Profiles

16.1. Cisco Systems, Inc.

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.2. Hewlett Packard Enterprise Development LP

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.3. Huawei Technologies Co., Ltd.

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.4. Juniper Networks, Inc.

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.5. ZTE Corporation

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.6. Nokia Corporation

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.7. Arista Networks, Inc.

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.8. Broadcom Inc.

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.9. Dell, Inc.

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.10. NetScout Systems, Inc.

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.11. Extreme Networks

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.12. AT&T Inc.

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

16.13. Others

16.13.1. Business Overview

16.13.2. Company Revenue

16.13.3. Product Portfolio

16.13.4. Geographic Footprint

16.13.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in Enterprise Connectivity and Networking Market

Table 2: North America Enterprise Connectivity and Networking Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 3: Europe Enterprise Connectivity and Networking Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 4: Asia Pacific Enterprise Connectivity and Networking Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 5: Middle East & Africa Enterprise Connectivity and Networking Market Revenue Analysis, by Country, 2023 and 2031 (US$ Bn)

Table 6: South America Enterprise Connectivity and Networking Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 11: Global Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 12: Global Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Industry Vertical, 2018 – 2031

Table 13: Global Enterprise Connectivity and Networking Market Volume (US$ Bn) Forecast, by Region, 2018 - 2031

Table 14: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 15: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 16: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Industry Vertical, 2018 – 2031

Table 17: North America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 18: U.S. Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Canada Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 20: Mexico Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 21: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 22: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 23: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Industry Vertical, 2018 – 2031

Table 24: Europe Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 25: Germany Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: U.K. Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: France Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: Italy Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: Spain Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 31: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 32: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Industry Vertical, 2018 – 2031

Table 33: Asia Pacific Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 34: China Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: India Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Japan Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 37: ASEAN Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 38: Middle East & Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 39: Middle East & Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 40: Middle East & Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Industry Vertical, 2018 – 2031

Table 41: Middle East & Africa Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 42: Saudi Arabia Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: United Arab Emirates Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: South Africa Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: South America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 46: South America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 47: South America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Industry Vertical, 2018 – 2031

Table 48: South America Enterprise Connectivity and Networking Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 49: Brazil Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 50: Argentina Enterprise Connectivity and Networking Market Revenue CAGR Breakdown (%), by Growth Term

Table 51: Mergers & Acquisitions, Partnerships (1/2)

Table 52: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global Enterprise Connectivity and Networking Market Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of Enterprise Connectivity and Networking Market

Figure 4: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Enterprise Connectivity and Networking Market Attractiveness Assessment, by Component

Figure 6: Global Enterprise Connectivity and Networking Market Attractiveness Assessment, by Enterprise Size

Figure 7: Global Enterprise Connectivity and Networking Market Attractiveness Assessment, by Industry Vertical

Figure 8: Global Enterprise Connectivity and Networking Market Attractiveness Assessment, by Region

Figure 9: Global Enterprise Connectivity and Networking Market Revenue (US$ Bn) Historic Trends, 2017 – 2023

Figure 10: Global Enterprise Connectivity and Networking Market Revenue Opportunity (US$ Bn) Historic Trends, 2017 – 2023

Figure 11: Global Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2023

Figure 12: Global Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2031

Figure 13: Global Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2023 – 2031

Figure 14: Global Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Software, 2023 – 2031

Figure 15: Global Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Services, 2023 – 2031

Figure 16: Global Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2023

Figure 17: Global Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2031

Figure 18: Global Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by SMEs, 2023 – 2031

Figure 19: Global Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2023 – 2031

Figure 20: Global Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2023

Figure 21: Global Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2031

Figure 22: Global Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Manufacturing, 2023 – 2031

Figure 23: Global Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2023 – 2031

Figure 24: Global Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2023 – 2031

Figure 25: Global Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2023 – 2031

Figure 26: Global Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 – 2031

Figure 27: Global Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Others, 2023 – 2031

Figure 28: Global Enterprise Connectivity and Networking Market Opportunity (US$ Bn), by Region

Figure 29: Global Enterprise Connectivity and Networking Market Opportunity Share (%), by Region, 2023–2031

Figure 30: Global Enterprise Connectivity and Networking Market Size (US$ Bn), by Region, 2023 & 2031

Figure 31: Global Enterprise Connectivity and Networking Market Value Share Analysis, by Region, 2023

Figure 32: Global Enterprise Connectivity and Networking Market Value Share Analysis, by Region, 2031

Figure 33: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), 2023 – 2031

Figure 34: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), 2023 – 2031

Figure 35: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), 2023 – 2031

Figure 36: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), 2023 – 2031

Figure 37: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), 2023 – 2031

Figure 38: North America Enterprise Connectivity and Networking Market Attractiveness Assessment, by Component

Figure 39: North America Enterprise Connectivity and Networking Market Attractiveness Assessment, by Enterprise Size

Figure 40: North America Enterprise Connectivity and Networking Market Attractiveness Assessment, by Industry Vertical

Figure 41: North America Enterprise Connectivity and Networking Market Attractiveness Assessment, by Region

Figure 42: North America Enterprise Connectivity and Networking Market Revenue (US$ Bn) Historic Trends, 2017 – 2023

Figure 43: North America Enterprise Connectivity and Networking Market Revenue Opportunity (US$ Bn) Historic Trends, 2017 – 2023

Figure 44: North America Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2023

Figure 45: North America Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2031

Figure 46: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2023 – 2031

Figure 47: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Software, 2023 – 2031

Figure 48: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Services, 2023 – 2031

Figure 49: North America Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2023

Figure 50: North America Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2031

Figure 51: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by SMEs, 2023 – 2031

Figure 52: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2023 – 2031

Figure 53: North America Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2023

Figure 54: North America Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2031

Figure 55: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Manufacturing, 2023 – 2031

Figure 56: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2023 – 2031

Figure 57: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2023 – 2031

Figure 58: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2023 – 2031

Figure 59: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 – 2031

Figure 60: North America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Others, 2023 – 2031

Figure 61: North America Enterprise Connectivity and Networking Market Value Share Analysis, by Country, 2023

Figure 62: North America Enterprise Connectivity and Networking Market Value Share Analysis, by Country, 2031

Figure 63: U.S. Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 64: Canada Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 65: Mexico Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 66: Europe Enterprise Connectivity and Networking Market Attractiveness Assessment, by Component

Figure 67: Europe Enterprise Connectivity and Networking Market Attractiveness Assessment, by Enterprise Size

Figure 68: Europe Enterprise Connectivity and Networking Market Attractiveness Assessment, by Industry Vertical

Figure 69: Europe Enterprise Connectivity and Networking Market Attractiveness Assessment, by Region

Figure 70: Europe Enterprise Connectivity and Networking Market Revenue (US$ Bn) Historic Trends, 2017 – 2023

Figure 71: Europe Enterprise Connectivity and Networking Market Revenue Opportunity (US$ Bn) Historic Trends, 2017 – 2023

Figure 72: Europe Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2023

Figure 73: Europe Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2031

Figure 74: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2023 – 2031

Figure 75: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Software, 2023 – 2031

Figure 76: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Services, 2023 – 2031

Figure 77: Europe Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2023

Figure 78: Europe Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2031

Figure 79: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by SMEs, 2023 – 2031

Figure 80: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2023 – 2031

Figure 81: Europe Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2023

Figure 82: Europe Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2031

Figure 83: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Manufacturing, 2023 – 2031

Figure 84: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2023 – 2031

Figure 85: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2023 – 2031

Figure 86: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2023 – 2031

Figure 87: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 – 2031

Figure 88: Europe Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Others, 2023 – 2031

Figure 89: Europe Enterprise Connectivity and Networking Market Value Share Analysis, by Country, 2023

Figure 90: Europe Enterprise Connectivity and Networking Market Value Share Analysis, by Country, 2031

Figure 91: Germany Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 92: U.K. Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 93: France Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 94: Italy Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 95: Spain Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 96: Asia Pacific Enterprise Connectivity and Networking Market Attractiveness Assessment, by Component

Figure 97: Asia Pacific Enterprise Connectivity and Networking Market Attractiveness Assessment, by Enterprise Size

Figure 98: Asia Pacific Enterprise Connectivity and Networking Market Attractiveness Assessment, by Industry Vertical

Figure 99: Asia Pacific Enterprise Connectivity and Networking Market Attractiveness Assessment, by Region

Figure 100: Asia Pacific Enterprise Connectivity and Networking Market Revenue (US$ Bn) Historic Trends, 2017 – 2023

Figure 101: Asia Pacific Enterprise Connectivity and Networking Market Revenue Opportunity (US$ Bn) Historic Trends, 2017 – 2023

Figure 102: Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2023

Figure 103: Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2031

Figure 104: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2023 – 2031

Figure 105: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Software, 2023 – 2031

Figure 106: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Services, 2023 – 2031

Figure 107: Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2023

Figure 108: Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2031

Figure 109: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by SMEs, 2023 – 2031

Figure 110: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2023 – 2031

Figure 111: Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2023

Figure 112: Asia Pacific Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2031

Figure 113: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), By Manufacturing, 2023 – 2031

Figure 114: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2023 – 2031

Figure 115: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2023 – 2031

Figure 116: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 – 2031

Figure 117: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2023 – 2031

Figure 118: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 – 2031

Figure 119: Asia Pacific Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Others, 2023 – 2031

Figure 120: Asia Pacific Enterprise Connectivity and Networking Market Revenue Opportunity Share, by Country

Figure 121: China Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 122: India Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 123: Japan Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 124: ASEAN Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 125: Middle East & Africa Enterprise Connectivity and Networking Market Attractiveness Assessment, by Component

Figure 126: Middle East & Africa Enterprise Connectivity and Networking Market Attractiveness Assessment, by Enterprise Size

Figure 127: Middle East & Africa Enterprise Connectivity and Networking Market Attractiveness Assessment, by Industry Vertical

Figure 128: Middle East & Africa Enterprise Connectivity and Networking Market Attractiveness Assessment, by Region

Figure 129: Middle East & Africa Enterprise Connectivity and Networking Market Revenue (US$ Bn) Historic Trends, 2017 – 2023

Figure 130: Middle East & Africa Enterprise Connectivity and Networking Market Revenue Opportunity (US$ Bn) Historic Trends, 2017 – 2023

Figure 131: Middle East & Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2023

Figure 132: Middle East & Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2031

Figure 133: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2023 – 2031

Figure 134: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Software, 2023 – 2031

Figure 135: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Services, 2023 – 2031

Figure 136: Middle East & Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2023

Figure 137: Middle East & Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2031

Figure 138: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by SMEs, 2023 – 2031

Figure 139: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2023 – 2031

Figure 140: Middle East & Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2023

Figure 141: Middle East & Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2031

Figure 142: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), By Manufacturing, 2023 – 2031

Figure 143: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2023 – 2031

Figure 144: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2023 – 2031

Figure 145: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2023 – 2031

Figure 146: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 – 2031

Figure 147: Middle East & Africa Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Others, 2023 – 2031

Figure 148: Middle East & Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Country, 2023

Figure 149: Middle East & Africa Enterprise Connectivity and Networking Market Value Share Analysis, by Country, 2031

Figure 150: Saudi Arabia Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 151: United Arab Emirates Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 152: South Africa Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 153: South America Enterprise Connectivity and Networking Market Attractiveness Assessment, by Component

Figure 154: South America Enterprise Connectivity and Networking Market Attractiveness Assessment, by Enterprise Size

Figure 155: South America Enterprise Connectivity and Networking Market Attractiveness Assessment, by Industry Vertical

Figure 156: South America Enterprise Connectivity and Networking Market Attractiveness Assessment, by Region

Figure 157: South America Enterprise Connectivity and Networking Market Revenue (US$ Bn) Historic Trends, 2017 – 2023

Figure 158: South America Enterprise Connectivity and Networking Market Revenue Opportunity (US$ Bn) Historic Trends, 2017 – 2023

Figure 159: South America Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2023

Figure 160: South America Enterprise Connectivity and Networking Market Value Share Analysis, by Component, 2031

Figure 161: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Hardware, 2023 – 2031

Figure 162: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Software, 2023 – 2031

Figure 163: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Services, 2023 – 2031

Figure 164: South America Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2023

Figure 165: South America Enterprise Connectivity and Networking Market Value Share Analysis, by Enterprise Size, 2031

Figure 166: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by SMEs, 2023 – 2031

Figure 167: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2023 – 2031

Figure 168: South America Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2023

Figure 169: South America Enterprise Connectivity and Networking Market Value Share Analysis, by Industry Vertical, 2031

Figure 170: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by BFSI, 2023 – 2031

Figure 171: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Manufacturing, 2023 – 2031

Figure 172: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2023 – 2031

Figure 173: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Retail & Ecommerce, 2023 – 2031

Figure 174: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 – 2031

Figure 175: South America Enterprise Connectivity and Networking Market Absolute Opportunity (US$ Bn), by Others, 2023 – 2031

Figure 176: South America Enterprise Connectivity and Networking Market Value Share Analysis, by Country, 2023

Figure 177: South America Enterprise Connectivity and Networking Market Value Share Analysis, by Country, 2031

Figure 178: Brazil Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031

Figure 179: Argentina Enterprise Connectivity and Networking Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 – 2031