Analysts’ Viewpoint on Market Scenario

Development of high-efficiency engines, which comprise multiple, small, lightweight, and high-efficiency components, is a key factor driving the engine components market growth. In the modern age, the automotive industry is a major contributor to any country's economy. The share of the automotive industrial spare parts industry in the GDP structure of any country has been increasing for the last few years, and the growth dynamics are anticipated to generate more jobs and enhance the average wage of that country.

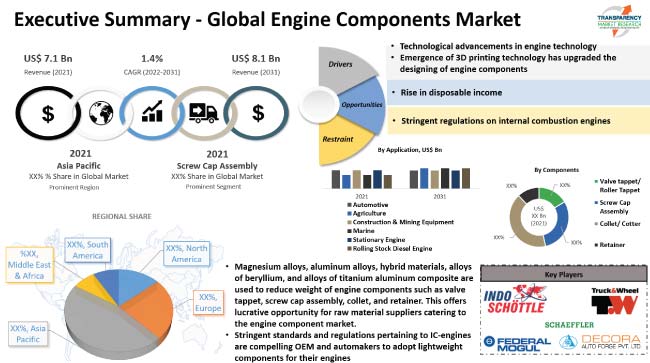

Rise in per capita income of the population coupled with increase urbanization and surge in demand for consumer products as well as the transportation of the population is boosting the demand for vehicles. The automotive industry has witnessed a surge in demand for both passenger vehicles and commercial vehicles in the last decade. Advanced materials such as magnesium alloys, aluminum alloys, hybrid materials, alloys of beryllium, and alloys of titanium aluminum composite are being used to achieve weight reduction of engine components, which include valve tappet, screw cap assembly, collet, and retainer. This, in turn, offers lucrative opportunity for raw material suppliers catering to the engine components industry.

The automotive industry contributes to the development of the taxable base and revenues of the budget of a country. It influences scientific and technical progress, develops auxiliary industries, testifies to the level of solvent demand, and the standard of living of the population of that country. Therefore, the effective functioning and development of the automotive industry is important not only for economic reasons, but also social significance for any country.

Rising industrialization and globalization are also boosting the demand for engine components. Moreover, longer lifespan and reliability of the engine components are fueling market demand for engine components.

The engine components market forecast is highly promising due to increase in number of applications of engine components in several industries such as automotive, marine, and agriculture. Furthermore, rise in R&D activities is anticipated to offer significant market opportunities to engine component manufacturers in the near future.

Enforcement of stringent vehicle standards and government regulations concerning diesel engine powered vehicles along with rise in preference toward electric vehicles is likely to restraint market progress.

Increase and expansion of trade agreements among nations is also anticipated to offer new business opportunities for key engine component manufacturers in the near future. Additionally, increase in concerns among environmentalists and government authorities on the reduction of emissions from vehicles to comply with international standards and norms is positively aiding engine components market development.

Stringent regulations pertaining vehicles emissions mandated by the regulatory authorities worldwide are compelling players engaged in the development and manufacturing of engines to invest toward improving performance of engine components and engine systems.

For instance, the players engaged in value chain of the engine components are adopting lightweight materials to manufacture camshafts, valve-train components including valve tappets, collets among others. The reduced weight of engine decreases the power requirements for vehicle operation, thereby saving fuel. Furthermore, emergence of 3D printing technology has improved the designing of engine components, which in turn is estimated to propel market expansion during the forecast period.

High volume of international trade has been witnessed among countries such as China, the U.S., the European Union, Japan, South Korea, India, Saudi Arabia, ASEAN countries, and GCC countries, thereby transforming and boosting the global economy completely. It has also been observed that around 25% of the total global production is exported. Considering the factors mentioned above, the demand for engine components is anticipated to rise in the near future, which in turn is estimated to boost the engine components market outlook during the forecast period.

Developing economies across the globe are greatly dependent on agriculture, and with an increase in population, the necessity for high farm yield is dire. International organizations and government associations have been formulating schemes to promote automation in the agriculture sector in order to meet this challenge.

Rise in mechanization in the agriculture sector is expected to propel the demand for agricultural tractors, harvesters, and cultivators among other mechanical farming equipment. Furthermore, rise in mining activities across the globe is boosting the need for off highway vehicles or mining machinery. These machines or equipment are powered by either gasoline or diesel engines. Therefore, increase in demand for off-highway engines is driving the global engine components market.

Based on component, the screw cap assembly holds a major share in the market and is expected to continue its dominance over the forecasted timeframe. This is primarily attributed to the extensive use in demanding applications such as in severe dynamic stresses and pressure condition. Presence of large number of industries and increasing volume production of automobiles has boosted the high demand for the screw cap assembly across the globe.

Enactment of stringent emission norms across the regions is prompting vehicle manufacturers to integrate advanced and energy efficient engines to enhance the efficiency of the vehicle engine. Demand for automobiles coupled with the expansion of automotive sector is also a key factor boosting the engine components market.

According to global engine components market analysis, Asia Pacific is expected to dominate the global engine components industry, as the region leads in terms of vehicle production and has highest consumption of vehicles as compared to that of other regions across the globe. Moreover, China and India produce a large number of engine components to export to the Middle East and Europe, which drives the manufacturing sector in Asia Pacific.

North America was a highly attractive market for engine components. This can be attributed to a highly developed market for engine parts engineering and manufacturing, services, and modification. Moreover, presence of key component manufacturers and automakers contribute to the high market share held by the region.

The global engine components business is controlled by established and new joint venture companies. Key companies hold the potential to drive global business, by adopting newer technologies and employing lightweight materials. However, key players are consolidating their position by pursuing partnerships, mergers, acquisitions, and focusing on expansion of product portfolios. Some of the key manufacturers identified in the global engine components industry include AcDelco, AmTech International, ASPPICE ENGINEERING, BLE products, Burgess-Norton Mfg. Co. Inc., Decora Auto Forge Pvt. Ltd., DNJ Engine Components, DREWCO Corporation, Eaton, EFC International, Federal-Mogul, GT Technologies, Hangzhou Heng Ji Trading Co., Ltd., Indo Schottle Pvt. Ltd., TW Automotive, Kent Automotive, LISI Automotive, LuK GmbH & Co. KG, MISUMI Group Inc., Nanjing Superior Machine & Parts Co., Nittan Valve Co., Ltd., PIOLAX, Inc., Pratt Burnerd America, Rane Group, Schaeffler Technologies AG & Co., Smit Auto Industries, SSV Technocrates and Young shin Automotive.

Key players in the engine components market report have been profiled in terms of financial overview, business strategies, company overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 7.1 Bn |

|

Market Forecast Value in 2031 |

US$ 8.1 Bn |

|

Growth Rate (CAGR) |

1.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market is valued at US$ 7.1 Bn in 2021

It is expected to expand at a CAGR of 1.40% by 2031

It is estimated to reach a value of US$ 8.1 Bn in 2031

Increase importance on the energy-efficient engines, rising demand for lightweight vehicles, growing concerns of government bodies to reduce the emissions from vehicles is augmenting the growth of market.

Based on components, the screw cap assembly segment accounted for majority share in 2021

Europe and Asia Pacific are anticipated to be the highly lucrative regions of the global market

AcDelco, AmTech International, ASPPICE ENGINEERING, BLE products, Burgess-Norton Mfg. Co. Inc., Decora Auto Forge Pvt. Ltd., DNJ Engine Components, DREWCO Corporation, Eaton, EFC International, Federal-Mogul, GT Technologies, Hangzhou Heng Ji Trading Co., Ltd., Indo Schottle Pvt. Ltd., TW Automotive, Kent Automotive, LISI Automotive, LuK GmbH & Co. KG, MISUMI Group Inc., Nanjing Superior Machine & Parts Co., Nittan Valve Co., Ltd., PIOLAX, Inc., Pratt Burnerd America, Rane Group, Schaeffler Tech

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Engine Components Market

4. Global Engine Components Market, by Components

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Engine Components Market Size & Forecast, 2017-2031, by Components

4.2.1. Valve tappet/ Roller Tappet

4.2.2. Screw Cap Assembly

4.2.3. Collet/ Cotter

4.2.4. Retainer

5. Global Engine Components Market, by Application

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Engine Components Market Size & Forecast, 2017-2031, by Application

5.2.1. Automotive

5.2.1.1. Passenger Vehicle

5.2.1.2. Light Duty Vehicle

5.2.1.3. Medium & Heavy Duty Trucks

5.2.1.4. Buses & Coaches

5.2.1.5. Two-wheelers

5.2.2. Agriculture

5.2.2.1. Tractors

5.2.2.2. Agriculture Equipment

5.2.3. Construction & Mining Equipment

5.2.3.1. Excavators

5.2.3.2. Loaders

5.2.3.3. Dumpers

5.2.3.4. Bulldozers

5.2.3.5. Motor graders

5.2.3.6. Road rollers

5.2.3.7. Mixer trucks

5.2.3.8. Dump Trucks

5.2.3.9. Crushers

5.2.3.10. Underground mining equipment

5.2.3.11. Others Concrete Equipment

5.2.4. Marine

5.2.4.1. Commercial Vessel

5.2.4.2. Offshore Support Vessel

5.2.5. Stationary Engines

5.2.5.1. Utilities/ Power Suppliers

5.2.5.2. Healthcare

5.2.5.3. Commercial

5.2.5.4. Oil & Gas

5.2.5.5. Manufacturing

5.2.5.6. Telecommunications and Data Centers

5.2.6. Rolling Stock Diesel Engine

6. Global Engine Components Market, by Region

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Engine Components Market Size & Forecast, 2017-2031, by Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East & Africa

6.2.5. South America

7. North America Engine Components Market

7.1. Market Snapshot

7.2. North America Engine Components Market Size & Forecast, 2017-2031, by Components

7.2.1. Valve tappet/ Roller Tappet

7.2.2. Screw Cap Assembly

7.2.3. Collet/ Cotter

7.2.4. Retainer

7.3. North America Engine Components Market Size & Forecast, 2017-2031, by Application

7.3.1. Automotive

7.3.1.1. Passenger Vehicle

7.3.1.2. Light Duty Vehicle

7.3.1.3. Medium & Heavy Duty Trucks

7.3.1.4. Buses & Coaches

7.3.1.5. Two-wheelers

7.3.2. Agriculture

7.3.2.1. Tractors

7.3.2.2. Agriculture Equipment

7.3.3. Construction & Mining Equipment

7.3.3.1. Excavators

7.3.3.2. Loaders

7.3.3.3. Dumpers

7.3.3.4. Bulldozers

7.3.3.5. Motor graders

7.3.3.6. Road rollers

7.3.3.7. Mixer trucks

7.3.3.8. Dump Trucks

7.3.3.9. Crushers

7.3.3.10. Underground mining equipment

7.3.3.11. Others Concrete Equipment

7.3.4. Marine

7.3.4.1. Commercial Vessel

7.3.4.2. Offshore Support Vessel

7.3.5. Stationary Engines

7.3.5.1. Utilities/ Power Suppliers

7.3.5.2. Healthcare

7.3.5.3. Commercial

7.3.5.4. Oil & Gas

7.3.5.5. Manufacturing

7.3.5.6. Telecommunications and Data Centers

7.3.6. Rolling Stock Diesel Engine

7.4. North America Engine Components Market Size & Forecast, 2017-2031, by Country

7.4.1. The U. S.

7.4.2. Canada

7.4.3. Mexico

8. Europe Engine Components Market

8.1. Market Snapshot

8.2. Europe Engine Components Market Size & Forecast, 2017-2031, by Components

8.2.1. Valve tappet/ Roller Tappet

8.2.2. Screw Cap Assembly

8.2.3. Collet/ Cotter

8.2.4. Retainer

8.3. Europe Engine Components Market Size & Forecast, 2017-2031, by Application

8.3.1. Automotive

8.3.1.1. Passenger Vehicle

8.3.1.2. Light Duty Vehicle

8.3.1.3. Medium & Heavy Duty Trucks

8.3.1.4. Buses & Coaches

8.3.1.5. Two-wheelers

8.3.2. Agriculture

8.3.2.1. Tractors

8.3.2.2. Agriculture Equipment

8.3.3. Construction & Mining Equipment

8.3.3.1. Excavators

8.3.3.2. Loaders

8.3.3.3. Dumpers

8.3.3.4. Bulldozers

8.3.3.5. Motor graders

8.3.3.6. Road rollers

8.3.3.7. Mixer trucks

8.3.3.8. Dump Trucks

8.3.3.9. Crushers

8.3.3.10. Underground mining equipment

8.3.3.11. Others Concrete Equipment

8.3.4. Marine

8.3.4.1. Commercial Vessel

8.3.4.2. Offshore Support Vessel

8.3.5. Stationary Engines

8.3.5.1. Utilities/ Power Suppliers

8.3.5.2. Healthcare

8.3.5.3. Commercial

8.3.5.4. Oil & Gas

8.3.5.5. Manufacturing

8.3.5.6. Telecommunications and Data Centers

8.3.6. Rolling Stock Diesel Engine

8.4. Europe Engine Components Market Size & Forecast, 2017-2031, by Country

8.4.1. Germany

8.4.2. U. K.

8.4.3. France

8.4.4. Italy

8.4.5. Spain

8.4.6. Nordic Countries

8.4.7. Russia & CIS

8.4.8. Rest of Europe

9. Asia Pacific Engine Components Market

9.1. Market Snapshot

9.2. Asia Pacific Engine Components Market Size & Forecast, 2017-2031, by Components

9.2.1. Valve tappet/ Roller Tappet

9.2.2. Screw Cap Assembly

9.2.3. Collet/ Cotter

9.2.4. Retainer

9.3. Asia Pacific Engine Components Market Size & Forecast, 2017-2031, by Application

9.3.1. Automotive

9.3.1.1. Passenger Vehicle

9.3.1.2. Light Duty Vehicle

9.3.1.3. Medium & Heavy Duty Trucks

9.3.1.4. Buses & Coaches

9.3.1.5. Two-wheelers

9.3.2. Agriculture

9.3.2.1. Tractors

9.3.2.2. Agriculture Equipment

9.3.3. Construction & Mining Equipment

9.3.3.1. Excavators

9.3.3.2. Loaders

9.3.3.3. Dumpers

9.3.3.4. Bulldozers

9.3.3.5. Motor graders

9.3.3.6. Road rollers

9.3.3.7. Mixer trucks

9.3.3.8. Dump Trucks

9.3.3.9. Crushers

9.3.3.10. Underground mining equipment

9.3.3.11. Others Concrete Equipment

9.3.4. Marine

9.3.4.1. Commercial Vessel

9.3.4.2. Offshore Support Vessel

9.3.5. Stationary Engines

9.3.5.1. Utilities/ Power Suppliers

9.3.5.2. Healthcare

9.3.5.3. Commercial

9.3.5.4. Oil & Gas

9.3.5.5. Manufacturing

9.3.5.6. Telecommunications and Data Centers

9.3.6. Rolling Stock Diesel Engine

9.4. Asia Pacific Engine Components Market Size & Forecast, 2017-2031, by Country

9.4.1. China

9.4.2. India

9.4.3. Japan

9.4.4. ASEAN Countries

9.4.5. South Korea

9.4.6. ANZ

9.4.7. Rest of Asia Pacific

10. Middle East & Africa Engine Components Market

10.1. Market Snapshot

10.2. Middle East & Africa Engine Components Market Size & Forecast, 2017-2031, by Components

10.2.1. Valve tappet/ Roller Tappet

10.2.2. Screw Cap Assembly

10.2.3. Collet/ Cotter

10.2.4. Retainer

10.3. Middle East & Africa Engine Components Market Size & Forecast, 2017-2031, by Application

10.3.1. Automotive

10.3.1.1. Passenger Vehicle

10.3.1.2. Light Duty Vehicle

10.3.1.3. Medium & Heavy Duty Trucks

10.3.1.4. Buses & Coaches

10.3.1.5. Two-wheelers

10.3.2. Agriculture

10.3.2.1. Tractors

10.3.2.2. Agriculture Equipment

10.3.3. Construction & Mining Equipment

10.3.3.1. Excavators

10.3.3.2. Loaders

10.3.3.3. Dumpers

10.3.3.4. Bulldozers

10.3.3.5. Motor graders

10.3.3.6. Road rollers

10.3.3.7. Mixer trucks

10.3.3.8. Dump Trucks

10.3.3.9. Crushers

10.3.3.10. Underground mining equipment

10.3.3.11. Others Concrete Equipment

10.3.4. Marine

10.3.4.1. Commercial Vessel

10.3.4.2. Offshore Support Vessel

10.3.5. Stationary Engines

10.3.5.1. Utilities/ Power Suppliers

10.3.5.2. Healthcare

10.3.5.3. Commercial

10.3.5.4. Oil & Gas

10.3.5.5. Manufacturing

10.3.5.6. Telecommunications and Data Centers

10.3.6. Rolling Stock Diesel Engine

10.4. Middle East & Africa Engine Components Market Size & Forecast, 2017-2031, by Country

10.4.1. GCC

10.4.2. South Africa

10.4.3. Turkey

10.4.4. Rest of Middle East & Africa

11. South America Engine Components Market

11.1. Market Snapshot

11.2. South America Engine Components Market Size & Forecast, 2017-2031, by Components

11.2.1. Valve tappet/ Roller Tappet

11.2.2. Screw Cap Assembly

11.2.3. Collet/ Cotter

11.2.4. Retainer

11.3. South America Engine Components Market Size & Forecast, 2017-2031, by Application

11.3.1. Automotive

11.3.1.1. Passenger Vehicle

11.3.1.2. Light Duty Vehicle

11.3.1.3. Medium & Heavy Duty Trucks

11.3.1.4. Buses & Coaches

11.3.1.5. Two-wheelers

11.3.2. Agriculture

11.3.2.1. Tractors

11.3.2.2. Agriculture Equipment

11.3.3. Construction & Mining Equipment

11.3.3.1. Excavators

11.3.3.2. Loaders

11.3.3.3. Dumpers

11.3.3.4. Bulldozers

11.3.3.5. Motor graders

11.3.3.6. Road rollers

11.3.3.7. Mixer trucks

11.3.3.8. Dump Trucks

11.3.3.9. Crushers

11.3.3.10. Underground mining equipment

11.3.3.11. Others Concrete Equipment

11.3.4. Marine

11.3.4.1. Commercial Vessel

11.3.4.2. Offshore Support Vessel

11.3.5. Stationary Engines

11.3.5.1. Utilities/ Power Suppliers

11.3.5.2. Healthcare

11.3.5.3. Commercial

11.3.5.4. Oil & Gas

11.3.5.5. Manufacturing

11.3.5.6. Telecommunications and Data Centers

11.3.6. Rolling Stock Diesel Engine

11.4. South America Engine Components Market Size & Forecast, 2017-2031, by Country

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Competitive Landscape

12.1. Company Share Analysis/ Brand Share Analysis, 2021

12.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

13. Company Profile/ Key Players

13.1. AcDelco

13.1.1. Company Overview

13.1.2. Company Footprints

13.1.3. Production Locations

13.1.4. Product Portfolio

13.1.5. Competitors & Customers

13.1.6. Subsidiaries & Parent Organization

13.1.7. Recent Developments

13.1.8. Financial Analysis

13.1.9. Profitability

13.1.10. Revenue Share

13.2. AmTech International

13.2.1. Company Overview

13.2.2. Company Footprints

13.2.3. Production Locations

13.2.4. Product Portfolio

13.2.5. Competitors & Customers

13.2.6. Subsidiaries & Parent Organization

13.2.7. Recent Developments

13.2.8. Financial Analysis

13.2.9. Profitability

13.2.10. Revenue Share

13.3. ASPPICE ENGINEERING

13.3.1. Company Overview

13.3.2. Company Footprints

13.3.3. Production Locations

13.3.4. Product Portfolio

13.3.5. Competitors & Customers

13.3.6. Subsidiaries & Parent Organization

13.3.7. Recent Developments

13.3.8. Financial Analysis

13.3.9. Profitability

13.3.10. Revenue Share

13.4. BLE products

13.4.1. Company Overview

13.4.2. Company Footprints

13.4.3. Production Locations

13.4.4. Product Portfolio

13.4.5. Competitors & Customers

13.4.6. Subsidiaries & Parent Organization

13.4.7. Recent Developments

13.4.8. Financial Analysis

13.4.9. Profitability

13.4.10. Revenue Share

13.5. Burgess-Norton Mfg. Co. Inc.

13.5.1. Company Overview

13.5.2. Company Footprints

13.5.3. Production Locations

13.5.4. Product Portfolio

13.5.5. Competitors & Customers

13.5.6. Subsidiaries & Parent Organization

13.5.7. Recent Developments

13.5.8. Financial Analysis

13.5.9. Profitability

13.5.10. Revenue Share

13.6. Decora Auto Forge Pvt. Ltd.

13.6.1. Company Overview

13.6.2. Company Footprints

13.6.3. Production Locations

13.6.4. Product Portfolio

13.6.5. Competitors & Customers

13.6.6. Subsidiaries & Parent Organization

13.6.7. Recent Developments

13.6.8. Financial Analysis

13.6.9. Profitability

13.6.10. Revenue Share

13.7. DNJ Engine Components

13.7.1. Company Overview

13.7.2. Company Footprints

13.7.3. Production Locations

13.7.4. Product Portfolio

13.7.5. Competitors & Customers

13.7.6. Subsidiaries & Parent Organization

13.7.7. Recent Developments

13.7.8. Financial Analysis

13.7.9. Profitability

13.7.10. Revenue Share

13.8. DREWCO Corporation

13.8.1. Company Overview

13.8.2. Company Footprints

13.8.3. Production Locations

13.8.4. Product Portfolio

13.8.5. Competitors & Customers

13.8.6. Subsidiaries & Parent Organization

13.8.7. Recent Developments

13.8.8. Financial Analysis

13.8.9. Profitability

13.8.10. Revenue Share

13.9. Eaton

13.9.1. Company Overview

13.9.2. Company Footprints

13.9.3. Production Locations

13.9.4. Product Portfolio

13.9.5. Competitors & Customers

13.9.6. Subsidiaries & Parent Organization

13.9.7. Recent Developments

13.9.8. Financial Analysis

13.9.9. Profitability

13.9.10. Revenue Share

13.10. EFC International

13.10.1. Company Overview

13.10.2. Company Footprints

13.10.3. Production Locations

13.10.4. Product Portfolio

13.10.5. Competitors & Customers

13.10.6. Subsidiaries & Parent Organization

13.10.7. Recent Developments

13.10.8. Financial Analysis

13.10.9. Profitability

13.10.10. Revenue Share

13.11. Federal-Mogul

13.11.1. Company Overview

13.11.2. Company Footprints

13.11.3. Production Locations

13.11.4. Product Portfolio

13.11.5. Competitors & Customers

13.11.6. Subsidiaries & Parent Organization

13.11.7. Recent Developments

13.11.8. Financial Analysis

13.11.9. Profitability

13.11.10. Revenue Share

13.12. GT Technologies

13.12.1. Company Overview

13.12.2. Company Footprints

13.12.3. Production Locations

13.12.4. Product Portfolio

13.12.5. Competitors & Customers

13.12.6. Subsidiaries & Parent Organization

13.12.7. Recent Developments

13.12.8. Financial Analysis

13.12.9. Profitability

13.12.10. Revenue Share

13.13. Hangzhou Heng Ji Trading Co., Ltd.

13.13.1. Company Overview

13.13.2. Company Footprints

13.13.3. Production Locations

13.13.4. Product Portfolio

13.13.5. Competitors & Customers

13.13.6. Subsidiaries & Parent Organization

13.13.7. Recent Developments

13.13.8. Financial Analysis

13.13.9. Profitability

13.13.10. Revenue Share

13.14. Indo Schottle Pvt. Ltd.

13.14.1. Company Overview

13.14.2. Company Footprints

13.14.3. Production Locations

13.14.4. Product Portfolio

13.14.5. Competitors & Customers

13.14.6. Subsidiaries & Parent Organization

13.14.7. Recent Developments

13.14.8. Financial Analysis

13.14.9. Profitability

13.14.10. Revenue Share

13.15. ITW Automotive

13.15.1. Company Overview

13.15.2. Company Footprints

13.15.3. Production Locations

13.15.4. Product Portfolio

13.15.5. Competitors & Customers

13.15.6. Subsidiaries & Parent Organization

13.15.7. Recent Developments

13.15.8. Financial Analysis

13.15.9. Profitability

13.15.10. Revenue Share

13.16. Kent Automotive

13.16.1. Company Overview

13.16.2. Company Footprints

13.16.3. Production Locations

13.16.4. Product Portfolio

13.16.5. Competitors & Customers

13.16.6. Subsidiaries & Parent Organization

13.16.7. Recent Developments

13.16.8. Financial Analysis

13.16.9. Profitability

13.16.10. Revenue Share

13.17. LISI Automotive

13.17.1. Company Overview

13.17.2. Company Footprints

13.17.3. Production Locations

13.17.4. Product Portfolio

13.17.5. Competitors & Customers

13.17.6. Subsidiaries & Parent Organization

13.17.7. Recent Developments

13.17.8. Financial Analysis

13.17.9. Profitability

13.17.10. Revenue Share

13.18. LuK GmbH & Co. KG

13.18.1. Company Overview

13.18.2. Company Footprints

13.18.3. Production Locations

13.18.4. Product Portfolio

13.18.5. Competitors & Customers

13.18.6. Subsidiaries & Parent Organization

13.18.7. Recent Developments

13.18.8. Financial Analysis

13.18.9. Profitability

13.18.10. Revenue Share

13.19. MISUMI Group Inc.

13.19.1. Company Overview

13.19.2. Company Footprints

13.19.3. Production Locations

13.19.4. Product Portfolio

13.19.5. Competitors & Customers

13.19.6. Subsidiaries & Parent Organization

13.19.7. Recent Developments

13.19.8. Financial Analysis

13.19.9. Profitability

13.19.10. Revenue Share

13.20. Nanjing Superior Machine & Parts Co.

13.20.1. Company Overview

13.20.2. Company Footprints

13.20.3. Production Locations

13.20.4. Product Portfolio

13.20.5. Competitors & Customers

13.20.6. Subsidiaries & Parent Organization

13.20.7. Recent Developments

13.20.8. Financial Analysis

13.20.9. Profitability

13.20.10. Revenue Share

13.21. Nittan Valve Co.,Ltd.

13.21.1. Company Overview

13.21.2. Company Footprints

13.21.3. Production Locations

13.21.4. Product Portfolio

13.21.5. Competitors & Customers

13.21.6. Subsidiaries & Parent Organization

13.21.7. Recent Developments

13.21.8. Financial Analysis

13.21.9. Profitability

13.21.10. Revenue Share

13.22. PIOLAX, Inc.

13.22.1. Company Overview

13.22.2. Company Footprints

13.22.3. Production Locations

13.22.4. Product Portfolio

13.22.5. Competitors & Customers

13.22.6. Subsidiaries & Parent Organization

13.22.7. Recent Developments

13.22.8. Financial Analysis

13.22.9. Profitability

13.22.10. Revenue Share

13.23. Pratt Burnerd America

13.23.1. Company Overview

13.23.2. Company Footprints

13.23.3. Production Locations

13.23.4. Product Portfolio

13.23.5. Competitors & Customers

13.23.6. Subsidiaries & Parent Organization

13.23.7. Recent Developments

13.23.8. Financial Analysis

13.23.9. Profitability

13.23.10. Revenue Share

13.24. Rane Group

13.24.1. Company Overview

13.24.2. Company Footprints

13.24.3. Production Locations

13.24.4. Product Portfolio

13.24.5. Competitors & Customers

13.24.6. Subsidiaries & Parent Organization

13.24.7. Recent Developments

13.24.8. Financial Analysis

13.24.9. Profitability

13.24.10. Revenue Share

13.25. Schaeffler Technologies AG & Co

13.25.1. Company Overview

13.25.2. Company Footprints

13.25.3. Production Locations

13.25.4. Product Portfolio

13.25.5. Competitors & Customers

13.25.6. Subsidiaries & Parent Organization

13.25.7. Recent Developments

13.25.8. Financial Analysis

13.25.9. Profitability

13.25.10. Revenue Share

13.26. Smit Auto Industries

13.26.1. Company Overview

13.26.2. Company Footprints

13.26.3. Production Locations

13.26.4. Product Portfolio

13.26.5. Competitors & Customers

13.26.6. Subsidiaries & Parent Organization

13.26.7. Recent Developments

13.26.8. Financial Analysis

13.26.9. Profitability

13.26.10. Revenue Share

13.27. SSV Technocrates

13.27.1. Company Overview

13.27.2. Company Footprints

13.27.3. Production Locations

13.27.4. Product Portfolio

13.27.5. Competitors & Customers

13.27.6. Subsidiaries & Parent Organization

13.27.7. Recent Developments

13.27.8. Financial Analysis

13.27.9. Profitability

13.27.10. Revenue Share

13.28. Young shin Automotive

13.28.1. Company Overview

13.28.2. Company Footprints

13.28.3. Production Locations

13.28.4. Product Portfolio

13.28.5. Competitors & Customers

13.28.6. Subsidiaries & Parent Organization

13.28.7. Recent Developments

13.28.8. Financial Analysis

13.28.9. Profitability

13.28.10. Revenue Share

13.29. Other Key Players

13.29.1. Company Overview

13.29.2. Company Footprints

13.29.3. Production Locations

13.29.4. Product Portfolio

13.29.5. Competitors & Customers

13.29.6. Subsidiaries & Parent Organization

13.29.7. Recent Developments

13.29.8. Financial Analysis

13.29.9. Profitability

13.29.10. Revenue Share

List of Tables

Table 1: Global Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Table 2: Global Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Table 3: Global Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Table 4: Global Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 5: Global Engine Components Market Volume (Units) Forecast, by Region, 2017-2031

Table 6: Global Engine Components Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 7: North America Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Table 8: North America Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Table 9: North America Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Table 10: North America Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 11: North America Engine Components Market Volume (Units) Forecast, by Country, 2017-2031

Table 12: North America Engine Components Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 13: Europe Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Table 14: Europe Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Table 15: Europe Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Table 16: Europe Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 17: Europe Engine Components Market Volume (Units) Forecast, by Country, 2017-2031

Table 18: Europe Engine Components Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 19: Asia Pacific Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Table 20: Asia Pacific Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Table 21: Asia Pacific Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Table 22: Asia Pacific Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 23: Asia Pacific Engine Components Market Volume (Units) Forecast, by Country, 2017-2031

Table 24: Asia Pacific Engine Components Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Middle East & Africa Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Table 26: Middle East & Africa Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Table 27: Middle East & Africa Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Table 28: Middle East & Africa Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 29: Middle East & Africa Engine Components Market Volume (Units) Forecast, by Country, 2017-2031

Table 30: Middle East & Africa Engine Components Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 31: South America Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Table 32: South America Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Table 33: South America Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Table 34: South America Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 35: South America Engine Components Market Volume (Units) Forecast, by Country, 2017-2031

Table 36: South America Engine Components Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Figure 2: Global Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Figure 3: Global Engine Components Market, Incremental Opportunity, by Components, Value (US$ Mn), 2022-2031

Figure 4: Global Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Figure 5: Global Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 6: Global Engine Components Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 7: Global Engine Components Market Volume (Units) Forecast, by Region, 2017-2031

Figure 8: Global Engine Components Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 9: Global Engine Components Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022-2031

Figure 10: North America Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Figure 11: North America Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Figure 12: North America Engine Components Market, Incremental Opportunity, by Components, Value (US$ Mn), 2022-2031

Figure 13: North America Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Figure 14: North America Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 15: North America Engine Components Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 16: North America Engine Components Market Volume (Units) Forecast, by Country, 2017-2031

Figure 17: North America Engine Components Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 18: North America Engine Components Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 19: Europe Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Figure 20: Europe Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Figure 21: Europe Engine Components Market, Incremental Opportunity, by Components, Value (US$ Mn), 2022-2031

Figure 22: Europe Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Figure 23: Europe Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 24: Europe Engine Components Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 25: Europe Engine Components Market Volume (Units) Forecast, by Country, 2017-2031

Figure 26: Europe Engine Components Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 27: Europe Engine Components Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 28: Asia Pacific Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Figure 29: Asia Pacific Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Figure 30: Asia Pacific Engine Components Market, Incremental Opportunity, by Components, Value (US$ Mn), 2022-2031

Figure 31: Asia Pacific Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Figure 32: Asia Pacific Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 33: Asia Pacific Engine Components Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 34: Asia Pacific Engine Components Market Volume (Units) Forecast, by Country, 2017-2031

Figure 35: Asia Pacific Engine Components Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Asia Pacific Engine Components Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 37: Middle East & Africa Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Figure 38: Middle East & Africa Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Figure 39: Middle East & Africa Engine Components Market, Incremental Opportunity, by Components, Value (US$ Mn), 2022-2031

Figure 40: Middle East & Africa Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Figure 41: Middle East & Africa Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 42: Middle East & Africa Engine Components Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 43: Middle East & Africa Engine Components Market Volume (Units) Forecast, by Country, 2017-2031

Figure 44: Middle East & Africa Engine Components Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: Middle East & Africa Engine Components Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 46: South America Engine Components Market Volume (Units) Forecast, by Components, 2017-2031

Figure 47: South America Engine Components Market Value (US$ Bn) Forecast, by Components, 2017-2031

Figure 48: South America Engine Components Market, Incremental Opportunity, by Components, Value (US$ Mn), 2022-2031

Figure 49: South America Engine Components Market Volume (Units) Forecast, by Application, 2017-2031

Figure 50: South America Engine Components Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 51: South America Engine Components Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 52: South America Engine Components Market Volume (Units) Forecast, by Country, 2017-2031

Figure 53: South America Engine Components Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: South America Engine Components Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031