Analysts’ Viewpoint on Energy Measurement IC Market Scenario

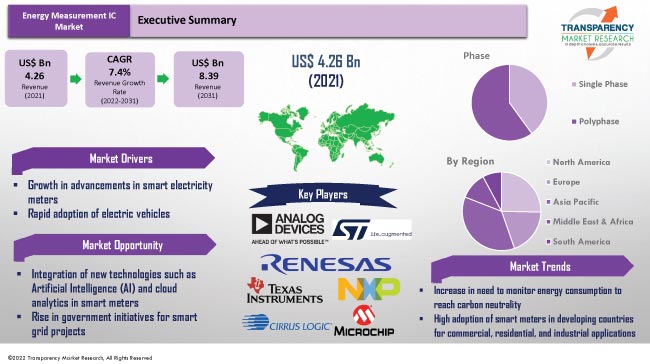

The global energy measurement IC market is growing due to the increase in usage of polyphase meters, industrial instruments, and power meter ICs; and the need for monitoring energy consumption in order to reach carbon neutrality. Rapid usage of smart meters is also fueling the global market. Modern energy measuring ICs offer utility companies real-time data and actionable insights on meter accuracy over time, meter malfunction, and improved tamper detection, owing to emergence of new technologies such as cloud analytics. Key players are collaborating with top utilities and meter manufacturing businesses to build next-generation electricity meters and integrate cloud analytics services to control meter health. This is encouraging energy measurement IC manufacturers to introduce innovative products such as self-calibrating energy metering ICs.

Energy measuring IC is used for high-accuracy electrical energy measurement in single, dual, and three phase power line systems. It can calculate active, reactive, and apparent energy as well as instantaneous RMS voltage and current, and measure line voltage and current. Energy measurement ICs help address difficulties of next-generation smart meter systems. Future market demand for energy measurement ICs is expected to be high owing to the increase in technological advancements in electric metering, substation automation, and emerging applications such as solar/wind generation and energy storage.

The energy sector has evolved technologically by incorporating renewable energy sources such as wind and solar. Bidirectional flow of energy, intermittent generation from renewable sources, unequal distribution of electrical power, and noise emission on power lines are among the new challenges for the energy sector. These challenges can affect the stability of the network. Therefore, energy distribution firms are implementing smart meters to enable real-time network diagnostics and fast fault identification in order to guarantee uninterrupted and quality service to end customers. This is fueling the global smart meter and smart plug market.

Smart electricity meter is an essential part of the energy distribution network. It can monitor electricity consumption and gather information on the quality of the power being supplied. For instance, it can measure reactive energy, total harmonic distortion, harmonic content, voltage transients and surges, and frequency variations. Smart meters can monitor meter health, eliminate the necessity for interventions in cases of actual failure, and prevent fraud. Energy metering ICs are suitable for measuring active energy (kWh), apparent energy (kVA), reactive energy (kVAR), RMS, and power quality in single phase and polyphase revenue meters with the highest accuracy. Thus, rise in usage of smart meters is propelling the revenue of energy measurement IC manufacturers.

The shift toward electric mobility is an effective way to reduce carbon emissions in the transportation industry. Reliable and accessible network of EV charging infrastructure is necessary for the quick adoption of electrical vehicles. Governments of various countries have enacted policies to encourage the growth of the charging infrastructure network. Consequently, demand for electric vehicles is rising across the globe. EV charging stations are now available at public places, private households, and even at business and residential structures such as offices and condos.

Energy measurement IC is exclusively deployed in EV charger wall boxes. Its modular design provides a range of connectivity options, from Wi-Fi and LTE to PLC, with the potential to add more interfaces owing to its support for MODBUS and Ethernet and Bluetooth Low Energy (LE). Furthermore, these ICs are used in swappable battery charging systems.

Several developing economies are promoting the adoption of electric vehicles. According to the Bureau of Energy Efficiency (BEE), the number of electric vehicles in India stood at 10,76,420 as of March 2022. The number of Public Charging Stations (PCS) were around 1,742 during the period. Thus, rise in adoption of EV vehicles and charging stations is augmenting the power monitoring market.

In terms of phase, the global energy measurement IC market has been classified into single phase and polyphase. The polyphase segment held significant share of the global market in 2021. It is the fastest growing market for energy measurement IC. Polyphase system is made up of two or more voltages that are offset from one another by an equal electrical angle, but have the same amplitude and frequency. Polyphase electricity meters are widely used in commercial and industrial applications.

Utility companies can benefit from unmatched digital accuracy and reliability as well as a customizable platform, owing to energy measurement ICs for polyphase meters. Thus, utilities find it easier to supply their extensive automated meter reading (AMR) systems to their low- and mid-tier commercial and industrial customers.

In terms of application, the global energy measurement IC market has been classified into smart plugs, energy meters, solar inverters, Smart Power Distribution Units (PDU), street lighting, EV charger wall boxes, and others. The solar inverters segment dominated the global market in 2021. It is projected to grow at the fastest CAGR throughout the forecast period.

Significant increase in energy consumption is adversely affecting the environment and energy security. Thus, demand for renewable sources of energy, such as solar, has been rising across the globe. Smart energy meters play a key role in solar energy networks. Smart energy meters can communicate with utilities and end-users to share detailed information about how energy is utilized and the status of the energy network. They can also measure the energy flow. Energy management ICs used in smart meters are suitable for applications such as power monitoring of grid-connected cabinets for distributed photovoltaic power cabinets and energy demand management. These ICs measure single-phase or three-phase current, voltage, active power, reactive power, and apparent power in solar inverters.

Asia Pacific held the largest share of approximately 38.6% of the global energy measurement IC market in 2021 owing to the presence of key market players and technological advancements in the region. China, India, and Japan present lucrative opportunities for manufacturers of energy measurement ICs. China dominates the market in Asia Pacific owing to its highest smart meter installation in terms of volume. The country is investing significantly in the power grid sector. It plans to invest around US$ 896 Bn in power grids and related industries from 2021 to 2025. Thus, rise in investment in smart grids and smart city projects, and increase in data centers and IT hubs are augmenting the energy measurement IC market in Asia Pacific.

The market in Europe and North America is also growing significantly due to the rapid increase in installation of smart meters in these regions. Around 75% of U.S. households have adopted smart meters, while 42% of meters in the U.K. are now smart or advanced meters. Thus, growth in electricity meters (smart meters) market is fueling the energy measurement IC market in these regions.

The global energy measurement IC market is consolidated, with a number of large-scale vendors controlling majority of the share. Most of the firms are investing significantly in comprehensive research and development activities, including new product development. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by the key players. Analog Devices, Inc., Arch Meter Corporation, Cirrus Logic, Inc., Microchip Technology Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, Shanghai Belling Corp., Ltd., Shenzhen Heliwei Technology Co., Ltd., STMicroelectronics N.V., and Texas Instruments Incorporated are the prominent players operating in the global energy measurement IC market.

Each of these players has been profiled in the market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments in the energy measurement IC market.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 4.26 Bn |

|

Market Forecast Value in 2031 |

US$ 8.39 Bn |

|

Growth Rate (CAGR) |

7.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global energy measurement IC market stood at US$ 4.26 Bn in 2021

The global energy measurement IC market is expected to grow at a CAGR of 7.4% by 2031

The energy measurement IC market is projected to reach US$ 8.39 Bn by 2031

Analog Devices, Inc., Arch Meter Corporation, Cirrus Logic, Inc., Microchip Technology Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, Shanghai Belling Corp., Ltd., STMicroelectronics N.V., and Texas Instruments Incorporated

China accounted for approximately 15.8% share of the global energy measurement IC market in 2021

The polyphase segment held 37.4% share of the energy measurement IC market in 2021

Growth in government initiatives for digitalization of smart grid, increase in need to monitor energy consumption to reach carbon neutrality, and high adoption of smart meters in developing and developed countries for commercial, residential, and industrial applications

Asia Pacific is a more lucrative region of the global energy measurement IC market

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Energy Measurement IC Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macroeconomic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Power Management IC Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Energy Measurement IC Market Analysis, by Phase

5.1. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Phase, 2017–2031

5.1.1. Single Phase

5.1.2. Polyphase

5.2. Market Attractiveness Analysis, by Phase

6. Global Energy Measurement IC Market Analysis, by Package Type

6.1. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

6.1.1. QFN (Quad Flatpack No Lead)

6.1.2. TSSOP (Thin Shrink Small Outline Package)

6.1.3. SOIC (Surface Mount Integrated Circuit Package)

6.1.4. QFP (Quad Flat Package)

6.1.5. Others

6.2. Market Attractiveness Analysis, by Package Type

7. Global Energy Measurement IC Market Analysis, by Application

7.1. Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

7.1.1. Smart Plugs

7.1.2. Energy Meters

7.1.3. Solar Inverters

7.1.4. Smart Power Distribution Units (PDU)

7.1.5. Street Lighting

7.1.6. EV Charger Wall Boxes

7.1.7. Others

7.2. Market Attractiveness Analysis, by Application

8. Global Energy Measurement IC Market Analysis, by End-use Industry

8.1. Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

8.1.1. Energy & Utility

8.1.2. Automotive

8.1.3. Industrial

8.1.4. Consumer Electronics

8.1.5. IT & Telecommunication

8.1.6. Others

8.2. Market Attractiveness Analysis, by End-use Industry

9. Global Energy Measurement IC Market Analysis and Forecast, by Region

9.1. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Energy Measurement IC Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Phase, 2017–2031

10.3.1. Single Phase

10.3.2. Polyphase

10.4. Electronic Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

10.4.1. QFN (Quad Flatpack No Lead)

10.4.2. TSSOP (Thin Shrink Small Outline Package)

10.4.3. SOIC (Surface Mount Integrated Circuit Package)

10.4.4. QFP (Quad Flat Package)

10.4.5. Others

10.5. Others Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

10.5.1. Smart Plugs

10.5.2. Energy Meters

10.5.3. Solar Inverters

10.5.4. Smart Power Distribution Units (PDU)

10.5.5. Street Lighting

10.5.6. EV Charger Wall Boxes

10.5.7. Others

10.6. Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

10.6.1. Energy & Utility

10.6.2. Automotive

10.6.3. Industrial

10.6.4. Consumer Electronics

10.6.5. IT & Telecommunication

10.6.6. Others

10.7. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.7.1. The U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Phase

10.8.2. By Package Type

10.8.3. By Application

10.8.4. By End-use Industry

10.8.5. By Country/Sub-region

11. Europe Energy Measurement IC Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Phase, 2017–2031

11.3.1. Single Phase

11.3.2. Polyphase

11.4. Electronic Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

11.4.1. QFN (Quad Flatpack No Lead)

11.4.2. TSSOP (Thin Shrink Small Outline Package)

11.4.3. SOIC (Surface Mount Integrated Circuit Package)

11.4.4. QFP (Quad Flat Package)

11.4.5. Others

11.5. Others Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

11.5.1. Smart Plugs

11.5.2. Energy Meters

11.5.3. Solar Inverters

11.5.4. Smart Power Distribution Units (PDU)

11.5.5. Street Lighting

11.5.6. EV Charger Wall Boxes

11.5.7. Others

11.6. Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

11.6.1. Energy & Utility

11.6.2. Automotive

11.6.3. Industrial

11.6.4. Consumer Electronics

11.6.5. IT & Telecommunication

11.6.6. Others

11.7. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.7.1. The U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Phase

11.8.2. By Package Type

11.8.3. By Application

11.8.4. By End-use Industry

11.8.5. By Country/Sub-region

12. Asia Pacific Energy Measurement IC Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Phase, 2017–2031

12.3.1. Single Phase

12.3.2. Polyphase

12.4. Electronic Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

12.4.1. QFN (Quad Flatpack No Lead)

12.4.2. TSSOP (Thin Shrink Small Outline Package)

12.4.3. SOIC (Surface Mount Integrated Circuit Package)

12.4.4. QFP (Quad Flat Package)

12.4.5. Others

12.5. Others Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

12.5.1. Smart Plugs

12.5.2. Energy Meters

12.5.3. Solar Inverters

12.5.4. Smart Power Distribution Units (PDU)

12.5.5. Street Lighting

12.5.6. EV Charger Wall Boxes

12.5.7. Others

12.6. Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

12.6.1. Energy & Utility

12.6.2. Automotive

12.6.3. Industrial

12.6.4. Consumer Electronics

12.6.5. IT & Telecommunication

12.6.6. Others

12.7. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Phase

12.8.2. By Package Type

12.8.3. By Application

12.8.4. By End-use Industry

12.8.5. By Country/Sub-region

13. Middle East & Africa Energy Measurement IC Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Phase, 2017–2031

13.3.1. Single Phase

13.3.2. Polyphase

13.4. Electronic Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

13.4.1. QFN (Quad Flatpack No Lead)

13.4.2. TSSOP (Thin Shrink Small Outline Package)

13.4.3. SOIC (Surface Mount Integrated Circuit Package)

13.4.4. QFP (Quad Flat Package)

13.4.5. Others

13.5. Others Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

13.5.1. Smart Plugs

13.5.2. Energy Meters

13.5.3. Solar Inverters

13.5.4. Smart Power Distribution Units (PDU)

13.5.5. Street Lighting

13.5.6. EV Charger Wall Boxes

13.5.7. Others

13.6. Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

13.6.1. Energy & Utility

13.6.2. Automotive

13.6.3. Industrial

13.6.4. Consumer Electronics

13.6.5. IT & Telecommunication

13.6.6. Others

13.7. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Phase

13.8.2. By Package Type

13.8.3. By Application

13.8.4. By End-use Industry

13.8.5. By Country/Sub-region

14. South America Energy Measurement IC Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Phase, 2017–2031

14.3.1. Single Phase

14.3.2. Polyphase

14.4. Electronic Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Package Type, 2017–2031

14.4.1. QFN (Quad Flatpack No Lead)

14.4.2. TSSOP (Thin Shrink Small Outline Package)

14.4.3. SOIC (Surface Mount Integrated Circuit Package)

14.4.4. QFP (Quad Flat Package)

14.4.5. Others

14.5. Others Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

14.5.1. Smart Plugs

14.5.2. Energy Meters

14.5.3. Solar Inverters

14.5.4. Smart Power Distribution Units (PDU)

14.5.5. Street Lighting

14.5.6. EV Charger Wall Boxes

14.5.7. Others

14.6. Energy Measurement IC Market Size (US$ Bn) Analysis & Forecast, by End-use Industry, 2017–2031

14.6.1. Energy & Utility

14.6.2. Automotive

14.6.3. Industrial

14.6.4. Consumer Electronics

14.6.5. IT & Telecommunication

14.6.6. Others

14.7. Energy Measurement IC Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Phase

14.8.2. By Package Type

14.8.3. By Application

14.8.4. By End-use Industry

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Energy Measurement IC Market Competition Matrix - a Dashboard View

15.1.1. Global Energy Measurement IC Market Company Share Analysis, by Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Analog Devices, Inc.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Arch Meter Corporation

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Cirrus Logic, Inc

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Microchip Technology Inc.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. NXP Semiconductors N.V.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Renesas Electronics Corporation

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Shanghai Belling Corp., Ltd.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Shenzhen Heliwei Technology Co., Ltd.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. STMicroelectronics N.V.

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Texas Instruments Incorporated

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Phase

17.1.2. By Package Type

17.1.3. By Application

17.1.4. By End-use Industry

17.1.5. By Region

List of Tables

Table 1: Global Energy Measurement IC Market Size & Forecast, by Phase, Value (US$ Bn), 2017-2031

Table 2: Global Energy Measurement IC Market Size & Forecast, by Phase, Volume (Million Units), 2017-2031

Table 3: Global Energy Measurement IC Market Size & Forecast, by Package Type, Value (US$ Bn), 2017-2031

Table 4: Global Energy Measurement IC Market Size & Forecast, by Package Type, Volume (Million Units), 2017-2031

Table 5: Global Energy Measurement IC Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 6: Global Energy Measurement IC Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 7: Global Energy Measurement IC Market Size & Forecast, by Region, Value (US$ Bn), 2017-2031

Table 8: Global Energy Measurement IC Market Size & Forecast, by Region, Volume (Million Units), 2017-2031

Table 9: North America Energy Measurement IC Market Size & Forecast, by Phase, Value (US$ Bn), 2017-2031

Table 10: North America Energy Measurement IC Market Size & Forecast, by Phase, Volume (Million Units), 2017-2031

Table 11: North America Energy Measurement IC Market Size & Forecast, by Package Type, Value (US$ Bn), 2017-2031

Table 12: North America Energy Measurement IC Market Size & Forecast, by Package Type, Volume (Million Units), 2017-2031

Table 13: North America Energy Measurement IC Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 14: North America Energy Measurement IC Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 15: North America Energy Measurement IC Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 16: North America Energy Measurement IC Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 17: Europe Energy Measurement IC Market Size & Forecast, by Phase, Value (US$ Bn), 2017-2031

Table 18: Europe Energy Measurement IC Market Size & Forecast, by Phase, Volume (Million Units), 2017-2031

Table 19: Europe Energy Measurement IC Market Size & Forecast, by Package Type, Value (US$ Bn), 2017-2031

Table 20: Europe Energy Measurement IC Market Size & Forecast, by Package Type, Volume (Million Units), 2017-2031

Table 21: Europe Energy Measurement IC Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 22: Europe Energy Measurement IC Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 23: Europe Energy Measurement IC Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 24: Europe Energy Measurement IC Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 25: Asia Pacific Energy Measurement IC Market Size & Forecast, by Phase, Value (US$ Bn), 2017-2031

Table 26: Asia Pacific Energy Measurement IC Market Size & Forecast, by Phase, Volume (Million Units), 2017-2031

Table 27: Asia Pacific Energy Measurement IC Market Size & Forecast, by Package Type, Value (US$ Bn), 2017-2031

Table 28: Asia Pacific Energy Measurement IC Market Size & Forecast, by Package Type, Volume (Million Units), 2017-2031

Table 29: Asia Pacific Energy Measurement IC Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 30: Asia Pacific Energy Measurement IC Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 31: Asia Pacific Energy Measurement IC Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 32: Asia Pacific Energy Measurement IC Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 33: Middle East & Africa Energy Measurement IC Market Size & Forecast, by Phase, Value (US$ Bn), 2017-2031

Table 34: Middle East & Africa Energy Measurement IC Market Size & Forecast, by Phase, Volume (Million Units), 2017-2031

Table 35: Middle East & Africa Energy Measurement IC Market Size & Forecast, by Package Type, Value (US$ Bn), 2017-2031

Table 36: Middle East & Africa Energy Measurement IC Market Size & Forecast, by Package Type, Volume (Million Units), 2017-2031

Table 37: Middle East & Africa Energy Measurement IC Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 38: Middle East & Africa Energy Measurement IC Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 39: Middle East & Africa (MEA) Energy Measurement IC Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 40: Middle East & Africa (MEA) Energy Measurement IC Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 41: South America Energy Measurement IC Market Size & Forecast, by Phase, Value (US$ Bn), 2017-2031

Table 42: South America Energy Measurement IC Market Size & Forecast, by Phase, Volume (Million Units), 2017-2031

Table 43: South America Energy Measurement IC Market Size & Forecast, by Package Type, Value (US$ Bn), 2017-2031

Table 44: South America Energy Measurement IC Market Size & Forecast, by Package Type, Volume (Million Units), 2017-2031

Table 45: South America Energy Measurement IC Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 46: South America Energy Measurement IC Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 47: South America Energy Measurement IC Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 48: South America Energy Measurement IC Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

List of Figures

Figure 1: Global Energy Measurement IC Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 2: Global Energy Measurement IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 3: Global Energy Measurement IC Market, Y-o-Y, 2017-2031

Figure 4: Global Energy Measurement IC Price Trend, 2017-2031

Figure 5: Global Energy Measurement IC Market Size & Forecast, by Phase, Revenue (US$ Bn), 2017-2031

Figure 6: Global Energy Measurement IC Market Attractiveness, by Phase, Value (US$ Bn), 2022–2031

Figure 7: Global Energy Measurement IC Market Share Analysis, by Phase, 2022 and 2031

Figure 8: Global Energy Measurement IC Market Size & Forecast, by Package Type, Revenue (US$ Bn), 2017-2031

Figure 9: Global Energy Measurement IC Market Attractiveness, by Package Type, Value (US$ Bn), 2022–2031

Figure 10: Global Energy Measurement IC Market Share Analysis, by Package Type, 2022 and 2031

Figure 11: Global Energy Measurement IC Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 12: Global Energy Measurement IC Market Attractiveness, by Application, Value (US$ Bn), 2022–2031

Figure 13: Global Energy Measurement IC Market Share Analysis, by Application, 2022 and 2031

Figure 14: Global Energy Measurement IC Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 15: Global Energy Measurement IC Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022–2031

Figure 16: Global Energy Measurement IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 17: Global Energy Measurement IC Market Size & Forecast, by Region, Revenue (US$ Bn), 2017-2031

Figure 18: Global Energy Measurement IC Market Attractiveness, by Region, Value (US$ Bn), 2022–2031

Figure 19: Global Energy Measurement IC Market Share Analysis, by Region, 2022 and 2031

Figure 20: North America Energy Measurement IC Market Size & Forecast, Value (US$ Bn ), 2017-2031

Figure 21: North America Energy Measurement IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 22: North America Energy Measurement IC Market, Value (US$ Bn), 2017-2031

Figure 23: North America Energy Measurement IC Market Size & Forecast, by Phase, Revenue (US$ Bn), 2017-2031

Figure 24: North America Energy Measurement IC Market Attractiveness, by Phase, Value (US$ Bn), 2022–2031

Figure 25: North America Energy Measurement IC Market Share Analysis, by Phase, 2022 and 2031

Figure 26: North America Energy Measurement IC Market Size & Forecast, by Package Type, Revenue (US$ Bn), 2017-2031

Figure 27: North America Energy Measurement IC Market Attractiveness, by Package Type, Value (US$ Bn), 2022–2031

Figure 28: North America Energy Measurement IC Market Share Analysis, by Package Type, 2022 and 2031

Figure 29: North America Energy Measurement IC Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 30: North America Energy Measurement IC Market Attractiveness, by Application, Value (US$ Bn), 2022–2031

Figure 31: North America Energy Measurement IC Market Share Analysis, by Application, 2022 and 2031

Figure 32: North America Energy Measurement IC Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 33: North America Energy Measurement IC Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022–2031

Figure 34: North America Energy Measurement IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 35: North America Energy Measurement IC Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 36: North America Energy Measurement IC Market Attractiveness, by Country, Value (US$ Bn), 2022–2031

Figure 37: North America Energy Measurement IC Market Share Analysis, by Country, 2022 and 2031

Figure 38: Europe Energy Measurement IC Market Size & Forecast, Value (US$ Bn ), 2017-2031

Figure 39: Europe Energy Measurement IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 40: Europe Energy Measurement IC Market, Y-o-Y, 2017-2031

Figure 41: Europe Energy Measurement IC Market Size & Forecast, by Phase, Revenue (US$ Bn), 2017-2031

Figure 42: Europe Energy Measurement IC Market Attractiveness, by Phase, Value (US$ Bn), 2022–2031

Figure 43: Europe Energy Measurement IC Market Share Analysis, by Phase, 2022 and 2031

Figure 44: Europe Energy Measurement IC Market Size & Forecast, by Package Type, Revenue (US$ Bn), 2017-2031

Figure 45: Europe Energy Measurement IC Market Attractiveness, by Package Type, Value (US$ Bn), 2022–2031

Figure 46: Europe Energy Measurement IC Market Share Analysis, by Package Type, 2022 and 2031

Figure 47: Europe Energy Measurement IC Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 48: Europe Energy Measurement IC Market Attractiveness, by Application, Value (US$ Bn), 2022–2031

Figure 49: Europe Energy Measurement IC Market Share Analysis, by Application, 2022 and 2031

Figure 50: Europe Energy Measurement IC Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 51: Europe Energy Measurement IC Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022–2031

Figure 52: Europe Energy Measurement IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 53: Europe Energy Measurement IC Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 54: Europe Energy Measurement IC Market Attractiveness, by Country, Value (US$ Bn), 2022–2031

Figure 55: Europe Energy Measurement IC Market Share Analysis, by Country, 2022 and 2031

Figure 56: Asia Pacific Energy Measurement IC Market Size & Forecast, Value (US$ Bn ), 2017-2031

Figure 57: Asia Pacific Energy Measurement IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 58: Asia Pacific Energy Measurement IC Market, Y-o-Y, 2017-2031

Figure 59: Asia Pacific Energy Measurement IC Market Size & Forecast, by Phase, Revenue (US$ Bn), 2017-2031

Figure 60: Asia Pacific Energy Measurement IC Market Attractiveness, by Phase, Value (US$ Bn), 2022–2031

Figure 61: Asia Pacific Energy Measurement IC Market Share Analysis, by Phase, 2022 and 2031

Figure 62: Asia Pacific Energy Measurement IC Market Size & Forecast, by Package Type, Revenue (US$ Bn), 2017-2031

Figure 63: Asia Pacific Energy Measurement IC Market Attractiveness, by Package Type, Value (US$ Bn), 2022–2031

Figure 64: Asia Pacific Energy Measurement IC Market Share Analysis, by Package Type, 2022 and 2031

Figure 65: Asia Pacific Energy Measurement IC Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 66: Asia Pacific Energy Measurement IC Market Attractiveness, by Application, Value (US$ Bn), 2022–2031

Figure 67: Asia Pacific Energy Measurement IC Market Share Analysis, by Application, 2022 and 2031

Figure 68: Asia Pacific Energy Measurement IC Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 69: Asia Pacific Energy Measurement IC Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022–2031

Figure 70: Asia Pacific Energy Measurement IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 71: Asia Pacific Energy Measurement IC Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 72: Asia Pacific Energy Measurement IC Market Attractiveness, by Country, Value (US$ Bn), 2022–2031

Figure 73: Asia Pacific Energy Measurement IC Market Share Analysis, by Country, 2022 and 2031

Figure 74: Middle East & Africa Energy Measurement IC Market Size & Forecast, Value (US$ Bn ), 2017-2031

Figure 75: Middle East & Africa Energy Measurement IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 76: Middle East & Africa Energy Measurement IC Market, Y-o-Y, 2017-2031

Figure 77: Middle East & Africa Energy Measurement IC Market Size & Forecast, by Phase, Revenue (US$ Bn), 2017-2031

Figure 78: Middle East & Africa Energy Measurement IC Market Attractiveness, by Phase, Value (US$ Bn), 2022–2031

Figure 79: Middle East & Africa Energy Measurement IC Market Share Analysis, by Phase, 2022 and 2031

Figure 80: Middle East & Africa Energy Measurement IC Market Size & Forecast, by Package Type, Revenue (US$ Bn), 2017-2031

Figure 81: Middle East & Africa Energy Measurement IC Market Attractiveness, by Package Type, Value (US$ Bn), 2022–2031

Figure 82: Middle East & Africa Energy Measurement IC Market Share Analysis, by Package Type, 2022 and 2031

Figure 83: Middle East & Africa Energy Measurement IC Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 84: Middle East & Africa Energy Measurement IC Market Attractiveness, by Application, Value (US$ Bn), 2022–2031

Figure 85: Middle East & Africa Energy Measurement IC Market Share Analysis, by Application, 2022 and 2031

Figure 86: Middle East & Africa Energy Measurement IC Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 87: Middle East & Africa Energy Measurement IC Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022–2031

Figure 88: Middle East & Africa Energy Measurement IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 89: Middle East & Africa Energy Measurement IC Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 90: Middle East & Africa Energy Measurement IC Market Attractiveness, by Country, Value (US$ Bn), 2022–2031

Figure 91: Middle East & Africa Energy Measurement IC Market Share Analysis, by Country, 2022 and 2031

Figure 92: South America Energy Measurement IC Market Size & Forecast, Value (US$ Bn ), 2017-2031

Figure 93: South America Energy Measurement IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 94: South America Energy Measurement IC Market, Value (US$ Bn), 2017-2031

Figure 95: South America Energy Measurement IC Market Size & Forecast, by Phase, Revenue (US$ Bn), 2017-2031

Figure 96: South America Energy Measurement IC Market Attractiveness, by Phase, Value (US$ Bn), 2022–2031

Figure 97: South America Energy Measurement IC Market Share Analysis, by Phase, 2022 and 2031

Figure 98: South America Energy Measurement IC Market Size & Forecast, by Package Type, Revenue (US$ Bn), 2017-2031

Figure 99: South America Energy Measurement IC Market Attractiveness, by Package Type, Value (US$ Bn), 2022–2031

Figure 100: South America Energy Measurement IC Market Share Analysis, by Package Type, 2022 and 2031

Figure 101: South America Energy Measurement IC Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 102: South America Energy Measurement IC Market Attractiveness, by Application, Value (US$ Bn), 2022–2031

Figure 103: South America Energy Measurement IC Market Share Analysis, by Application, 2022 and 2031

Figure 104: South America Energy Measurement IC Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 105: South America Energy Measurement IC Market Attractiveness, by End-use Industry, Value (US$ Bn), 2022–2031

Figure 106: South America Energy Measurement IC Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 107: South America Energy Measurement IC Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 108: South America Energy Measurement IC Market Attractiveness, by Country, Value (US$ Bn), 2022–2031

Figure 109: South America Energy Measurement IC Market Share Analysis, by Country, 2022 and 2031