Energy-efficient Warehouse Lighting Market: Snapshot

The global market for energy-efficient warehouse lighting is projected to gain significant traction in the coming years with warehouse owners constantly in search of solutions that can reduce energy consumption and provide significant savings to energy bills. The increasing introduction and implementation of energy-saving policies by governments across the globe is likely to give the energy-efficient warehouse lighting market a considerable boost in the coming years.

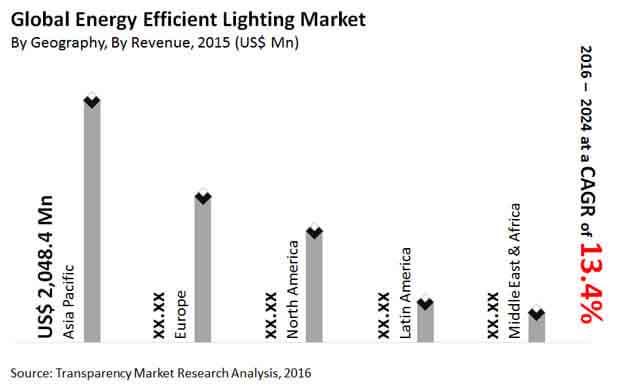

The development of smart lighting technologies that can maximize efficiency and provide increased safety and comfort is a key opportunity for players in the energy-efficient warehouse lighting market. Fueled by these favorable industry settings, the global market is poised to expand at a strong CAGR of 13.4% from 2016 to 2024, with the value rising from US$4.2 bn in 2015 to over US$15 bn by the end of the forecast period.

Shifting Focus from Developed to Developing Regions Benefits APAC and LATAM Markets

Geographically, the global energy-efficient warehouse lighting market has been segmented into five regions: North America, Asia Pacific, Europe, the Middle East and Africa, and Latin America. In the recent past, lighting companies have shifted their focus from the developed markets of North America and Europe to emerging markets such as India, China, South Africa, Argentina, and Brazil. On account of rapid economic growth, favorable government policies and mega urban projects, these countries present new opportunities for players in the energy-efficient warehouse lighting market.

Regionally, Asia Pacific emerged as the leading segment of the global energy-efficient warehouse lighting market in 2014, with a share of 42.3% in terms of revenue. Japan, China, and South Korea are prominent contributors to the growth of this regional market owing to major investments in the latest lighting technologies. Rapid industrial growth has also stimulated the demand for energy-efficient warehouse lighting. The rising demand for green technologies is likely to be instrumental in boosting the energy-efficient warehouse lighting market in APAC in the coming years.

Europe and North America are highly developed markets with continued steady growth throughout the forecast period. Latin America is fast emerging as an export destination owing to a rapid improvement in trade policies, which has resulted in infrastructure development on a promising scale. This is likely to have a positive impact on the Latin America energy-efficient warehouse lighting market in the years to come.

LED to be Game-changer in Energy-efficient Warehouse Lighting Market

The global energy-efficient warehouse lighting market has been segmented on the basis of source of lighting into linear fluorescent lamps (LFL), high-intensity discharge lamps (HID), light emitting diodes (LED), and others. Owing to the low cost of LFLs, this segment led the energy-efficient warehouse lighting market with a share of 40.0% in 2015. This was followed by the HID and LED segments. Although HID and LED lighting held a significant share in the energy-efficient warehouse lighting market in 2014, their combined share is predicted to decline by 2024 with LED emerging as the key contributor by light source.

The key players in the global energy efficient warehouse lighting market include Dialight, OSRAM GmbH, General Electric Company, Bajaj Electricals Ltd., Toshiba Lighting & Technology Corporation, Digital Lumens, Inc., LIGMAN Lighting Co., Ltd., Eaton, Cree, Inc., Zumtobel Group AG, and Philips Lighting Holding B.V.

1. Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Research Scope

1.4. Research Methodology

2. Executive Summary

2.1. Snapshot

2.2. Overview

3. Industry Analysis

3.1. Introduction

3.2. Overview

3.3. Value Chain Analysis – Snapshot

3.4. Value Chain Analysis – Overview

3.5. Market Dynamics – Overview

3.5.1. Driver 1 - Efforts to reduce energy consumption in warehouses driving the demand for energy efficient warehouse lighting

3.5.2. Driver 2 - Favorable government regulation supported by growth in warehouse and storage industry

3.5.3. Restraint 1 - High initial investments along with undefined technology issues discouraging the adoption

3.5.4. Opportunity 1 - Growing popularity of performance contracting model to provide huge opportunity

3.6. Porter’s Five Forces Analysis – Overview

3.6.1. Porter’s Five Forces Analysis – Bargaining Power of Suppliers

3.6.2. Porter’s Five Forces Analysis – Bargaining Power Of Buyers

3.6.3. Porter’s Five Forces Analysis – Threat Of Substitutes

3.6.4. Porter’s Five Forces Analysis – Threat Of New Entrants

3.6.5. Porter’s Five Forces Analysis – Degree Of Competition

3.7. Company Market Share- Energy Efficient Warehouse Lighting Systems Market (2015)

3.8. Market Attractiveness Analysis

4. Global Energy Efficient Lighting Market – Lighting Source Segment, by Revenue, 2014 – 2024 (US$ Mn)

4.1. Introduction

4.2. Overview

4.3. High-intensity Discharge Lamps (HID)

4.4. Linear Fluorescent Lamps (LFL)

4.5. Light Emitting Diodes (LED)

4.6. Other Lighting Sources

5. Global Energy Efficient Lighting Market – Regional Analysis by Revenue, 2014 – 2024 (US$ Mn)

5.1. Regional Overview

5.2. Energy Efficient Lighting Market - North America

5.3. North America - Overview

5.3.1. U.S. Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.3.1.1. Lighting Source Segment

5.3.1.1.1. High-intensity Discharge Lamps (HID)

5.3.1.1.2. Linear Fluorescent Lamps (LFL)

5.3.1.1.3. Light Emitting Diodes (LED)

5.3.1.1.4. Other Lighting Sources

5.3.2. Canada Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.3.2.1. Lighting Source Segment

5.3.2.1.1. High-intensity Discharge Lamps (HID)

5.3.2.1.2. Linear Fluorescent Lamps (LFL)

5.3.2.1.3. Light Emitting Diodes (LED)

5.3.2.1.4. Other Lighting Sources

5.3.3. Mexico Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.3.3.1. Lighting Source Segment

5.3.3.1.1. High-intensity Discharge Lamps (HID)

5.3.3.1.2. Linear Fluorescent Lamps (LFL)

5.3.3.1.3. Light Emitting Diodes (LED)

5.3.3.1.4. Other Lighting Sources

5.4. Energy Efficient Lighting Market - Europe

5.5. Europe - Overview

5.5.1. UK Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.5.1.1. Lighting Source Segment

5.5.1.1.1. High-intensity Discharge Lamps (HID)

5.5.1.1.2. Linear Fluorescent Lamps (LFL)

5.5.1.1.3. Light Emitting Diodes (LED)

5.5.1.1.4. Other Lighting Sources

5.5.2. France Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.5.2.1. Lighting Source Segment

5.5.2.1.1. High-intensity Discharge Lamps (HID)

5.5.2.1.2. Linear Fluorescent Lamps (LFL)

5.5.2.1.3. Light Emitting Diodes (LED)

5.5.2.1.4. Other Lighting Sources

5.5.3. Germany Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.5.3.1. Lighting Source Segment

5.5.3.1.1. High-intensity Discharge Lamps (HID)

5.5.3.1.2. Linear Fluorescent Lamps (LFL)

5.5.3.1.3. Light Emitting Diodes (LED)

5.5.3.1.4. Other Lighting Sources

5.5.4. Rest of Europe Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.5.4.1. Lighting Source Segment

5.5.4.1.1. High-intensity Discharge Lamps (HID)

5.5.4.1.2. Linear Fluorescent Lamps (LFL)

5.5.4.1.3. Light Emitting Diodes (LED)

5.5.4.1.4. Other Lighting Sources

5.6. Energy Efficient Lighting Market - Asia Pacific

5.7. Asia Pacific - Overview

5.7.1. China Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.7.1.1. Lighting Source Segment

5.7.1.1.1. High-intensity Discharge Lamps (HID)

5.7.1.1.2. Linear Fluorescent Lamps (LFL)

5.7.1.1.3. Light Emitting Diodes (LED)

5.7.1.1.4. Other Lighting Sources

5.7.2. India Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.7.2.1. Lighting Source Segment

5.7.2.1.1. High-intensity Discharge Lamps (HID)

5.7.2.1.2. Linear Fluorescent Lamps (LFL)

5.7.2.1.3. Light Emitting Diodes (LED)

5.7.2.1.4. Other Lighting Sources

5.7.3. Australia Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.7.3.1. Lighting Source Segment

5.7.3.1.1. High-intensity Discharge Lamps (HID)

5.7.3.1.2. Linear Fluorescent Lamps (LFL)

5.7.3.1.3. Light Emitting Diodes (LED)

5.7.3.1.4. Other Lighting Sources

5.7.4. Rest of Asia Pacific Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.7.4.1. Lighting Source Segment

5.7.4.1.1. High-intensity Discharge Lamps (HID)

5.7.4.1.2. Linear Fluorescent Lamps (LFL)

5.7.4.1.3. Light Emitting Diodes (LED)

5.7.4.1.4. Other Lighting Sources

5.8. Energy Efficient Lighting Market - Middle East and Africa

5.9. Middle East and Africa – Overview

5.9.1. South Africa Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.9.1.1. Lighting Source Segment

5.9.1.1.1. High-intensity Discharge Lamps (HID)

5.9.1.1.2. Linear Fluorescent Lamps (LFL)

5.9.1.1.3. Light Emitting Diodes (LED)

5.9.1.1.4. Other Lighting Sources

5.9.2. Saudi Arabia Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.9.2.1. Lighting Source Segment

5.9.2.1.1. High-intensity Discharge Lamps (HID)

5.9.2.1.2. Linear Fluorescent Lamps (LFL)

5.9.2.1.3. Light Emitting Diodes (LED)

5.9.2.1.4. Other Lighting Sources

5.9.3. UAE Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.9.3.1. Lighting Source Segment

5.9.3.1.1. High-intensity Discharge Lamps (HID)

5.9.3.1.2. Linear Fluorescent Lamps (LFL)

5.9.3.1.3. Light Emitting Diodes (LED)

5.9.3.1.4. Other Lighting Sources

5.9.4. Rest of Middle East and Africa Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.9.4.1. Lighting Source Segment

5.9.4.1.1. High-intensity Discharge Lamps (HID)

5.9.4.1.2. Linear Fluorescent Lamps (LFL)

5.9.4.1.3. Light Emitting Diodes (LED)

5.9.4.1.4. Other Lighting Sources

5.10. Energy Efficient Lighting Market - Latin America

5.11. Latin America – Overview

5.11.1. Brazil Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.11.1.1. Lighting Source Segment

5.11.1.1.1. High-intensity Discharge Lamps (HID)

5.11.1.1.2. Linear Fluorescent Lamps (LFL)

5.11.1.1.3. Light Emitting Diodes (LED)

5.11.1.1.4. Other Lighting Sources

5.11.2. Argentina Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.11.2.1. Lighting Source Segment

5.11.2.1.1. High-intensity Discharge Lamps (HID)

5.11.2.1.2. Linear Fluorescent Lamps (LFL)

5.11.2.1.3. Light Emitting Diodes (LED)

5.11.2.1.4. Other Lighting Sources

5.11.3. Rest of Latin America Energy Efficient Lighting Market, by Revenue (US$ Mn), 2014–2024

5.11.3.1. Lighting Source Segment

5.11.3.1.1. High-intensity Discharge Lamps (HID)

5.11.3.1.2. Linear Fluorescent Lamps (LFL)

5.11.3.1.3. Light Emitting Diodes (LED)

5.11.3.1.4. Other Lighting Sources

6. Company Profiles

6.1. Dialight

6.1.1. Company Overview

6.1.2. Financial Overview

6.1.3. Business Strategy

6.1.4. Recent Developments

6.2. LIGMAN Lighting Co., Ltd.

6.2.1. Company Overview

6.2.2. Financial Overview

6.2.3. Business Strategy

6.2.4. Recent Developments

6.3. Philips Lighting Holding B.V.

6.3.1. Company Overview

6.3.2. Financial Overview

6.3.3. Business Strategy

6.3.4. Recent Developments

6.4. Digital Lumens, Inc.

6.4.1. Company Overview

6.4.2. Financial Overview

6.4.3. Business Strategy

6.4.4. Recent Developments

6.5. OSRAM GmbH

6.5.1. Company Overview

6.5.2. Financial Overview

6.5.3. Business Strategy

6.5.4. Recent Developments

6.6. Cree, Inc.

6.6.1. Company Overview

6.6.2. Financial Overview

6.6.3. Business Strategy

6.6.4. Recent Developments

6.7. Eaton

6.7.1. Company Overview

6.7.2. Financial Overview

6.7.3. Business Strategy

6.7.4. Recent Developments

6.8. General Electric Company

6.8.1. Company Overview

6.8.2. Financial Overview

6.8.3. Business Strategy

6.8.4. Recent Developments

6.9. Toshiba Lighting & Technology Corporation

6.9.1. Company Overview

6.9.2. Financial Overview

6.9.3. Business Strategy

6.9.4. Recent Developments

6.10. Zumtobel Group AG

6.10.1. Company Overview

6.10.2. Financial Overview

6.10.3. Business Strategy

6.10.4. Recent Developments

6.11. Bajaj Electricals Ltd.

6.11.1. Company Overview

6.11.2. Financial Overview

6.11.3. Business Strategy

6.11.4. Recent Developments

List of Tables

Table 1 Energy efficient lighting Market: Snapshot

Table 2 Energy Efficient Lighting against Traditional Technology

Table 3 North America Energy efficient lighting Market, US$ Mn

Table 4 Europe Energy efficient lighting Market, US$ Mn

Table 5 Asia Pacific Energy efficient lighting Market, US$ Mn

Table 6 Latin America Energy efficient lighting Market, US$ Mn

Table 7 Middle East and Africa Energy efficient lighting Market, US$ Mn

List of Figures

Figure 1 Global Energy efficient lighting Market Segmentation

Figure 2 Global Energy efficient lighting Market, Estimates and Forecast, by Revenue, 2014–2024 (US$ Mn)

Figure 3 Global Energy efficient lighting Market, Geographical Revenue Share in 2015 (%)

Figure 4 Warehouse electricity usage and cost saving

Figure 5 Company Market Share, Energy efficient lighting Market (%) (2015)

Figure 6 Market Attractiveness Analysis of Energy efficient lighting Market, 2015

Figure 7 Global Energy efficient lighting Market Share, by Region, 2014 and 2024

Figure 8 US Energy efficient lighting Market Share, 2014

Figure 9 US Energy efficient lighting Market Share, 2024

Figure 10 US Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 11 US Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 12 US Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 13 US Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 14 Canada Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 15 Canada Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 16 Canada Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 17 Canada Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 18 Mexico Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 19 Mexico Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 20 Mexico Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 21 Mexico Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 21 Europe Energy efficient lighting Market Share, 2014

Figure 22 Europe Energy efficient lighting Market Share, 2024

Figure 23 UK Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 24 UK Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 25 UK Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 26 UK Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 14 France Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 27 France Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 28 France Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 29 France Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 30 Germany Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 31 Germany Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 32 Germany Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 33 Germany Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 34 Rest of Europe Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 35 Rest of Europe Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 36 Rest of Europe Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 37 Rest of Europe Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 38 Asia Pacific Energy efficient lighting Market Share, 2014

Figure 39 Asia Pacific Energy efficient lighting Market Share, 2024

Figure 40 China Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 41 China Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 42 China Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 43 China Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 44 India Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 45 India Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 46 India Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 47 India Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 48 Australia Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 49 Australia Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 50 Australia Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 51 Australia Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 52 Rest of Asia Pacific Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 53 Rest of Asia Pacific Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 54 Rest of Asia Pacific Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 55 Rest of Asia Pacific Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 56 Latin America Energy efficient lighting Market Share, 2014

Figure 57 Latin America Energy efficient lighting Market Share, 2024

Figure 10 Brazil Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 58 Brazil Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 59 Brazil Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 60 Brazil Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 61 Argentina Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 62 Argentina Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 63 Argentina Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 64 Argentina Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 65 Rest of Latin America Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 66 Rest of Latin America Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 67 Rest of Latin America Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 68 Rest of Latin America Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 69 Middle East and Africa Energy efficient lighting Market Share, 2014

Figure 70 Middle East and Africa Energy efficient lighting Market Share, 2024

Figure 71 Saudi Arabia Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 72 Saudi Arabia Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 73 Saudi Arabia Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 74 Saudi Arabia Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 75 UAE Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 76 UAE Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 77 UAE Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 78 UAE Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 79 South Africa Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 80 South Africa Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 81 South Africa Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 82 South Africa Energy efficient lighting Market - Market Overview - Others (US$ Mn)

Figure 79 Rest of Middle East & Africa Energy efficient lighting Market - Market Overview - HID (US$ Mn)

Figure 80 Rest of Middle East & Africa Energy efficient lighting Market - Market Overview - LFL (US$ Mn)

Figure 81 Rest of Middle East & Africa Energy efficient lighting Market - Market Overview - LED (US$ Mn)

Figure 82 Rest of Middle East & Africa Energy efficient lighting Market - Market Overview - Others (US$ Mn)