The virus stability characteristics and modes of transmission via fomites and air droplets make gastrointestinal (GI) endoscopy a high-risk procedure for COVID-19 transmission. This has led to the postponement and cancellation of medical procedures, which has ultimately slowed down revenue generation in the endoscopic camera systems market. Nevertheless, telehealth services and increasing number of mobile apps are helping medical practitioners and patients to prioritize important endoscopic procedures. Such findings are anticipated to revive market growth.

Companies in the endoscopic camera systems market are taking data-driven decisions before investing in new technologies and regions. They are maintaining stable supply of medical devices in order to improve medical outcomes during the pandemic. Mass vaccination programs and relaxations in lockdown restrictions are encouraging patients to seek professional medical assistance in endoscopic procedures. Stakeholders are establishing seamless communication with partners and robust after-sales services with clients and customers to ensure steady revenue flow.

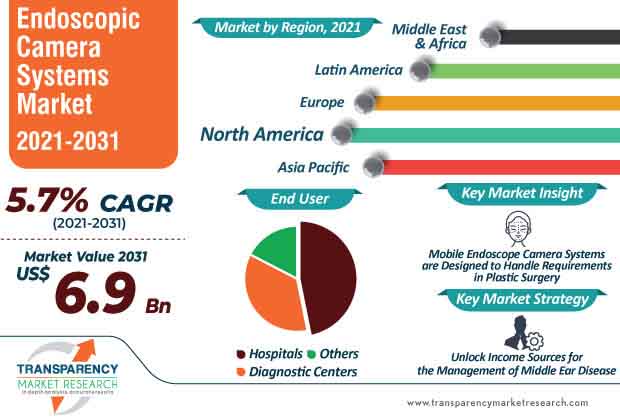

Endoscopic ear surgery (EES) is starting to gain popularity with the release of high-definition camera systems with image quality, which is a thousand times more detailed than a standard camera. With respect to the microscopic size of middle ear structures and the presence of important neurovascular structures in a small space, the use of low-definition systems could negatively affect the performance and outcomes of EES. Thus, companies in the endoscopic camera systems market are capitalizing on this opportunity to unlock income sources for the management of middle ear disease.

Despite technical improvements, the lack of depth perception provided by the two-dimensional (2D) vision and the need to operate with only one hand are some of the most cited limitations in EES. Hence, companies should increase their research in 4-mm high-definition 3D endoscopes that hold promising potentials in overcoming the cited limitations in EES.

The global endoscopic camera systems market is projected to reach US$ 6.9 Bn by 2031. Companies are working with researchers to innovate in low-cost wireless endoscope cameras. The technology currently used for surgical endoscopy is developed and manufactured in high-income economies. Thus, high cost of this equipment makes technology transfer to resource constrained environments difficult. This has led to the popularity of low-cost wireless endoscope cameras in resource-constrained economies.

Novel wireless endoscope cameras are grabbing the attention of companies in the endoscopic camera systems market and making minimally invasive surgery possible in resource-constrained environments.

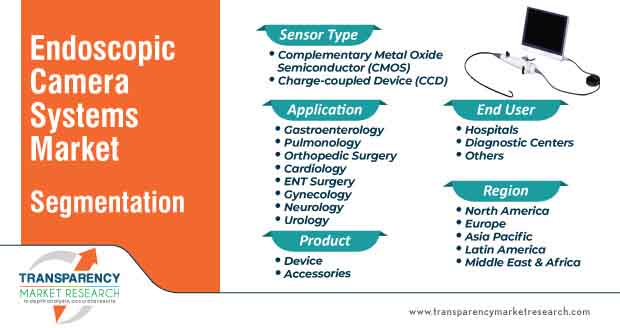

The endoscopic camera systems market is expected to expand at a CAGR of 5.7% during the forecast period. Demanding applications in the otolaryngology (ENT), gynecology, and urology sectors are creating revenue opportunities for med-tech companies. Firefly Global - a provider of wireless portable digital magnifying cameras, is marketing its Redfin R3800 Full HD Mobile Endoscope Camera System, which has powerful 1080p high definition video endoscopy system designed to handle the requirements in plastic surgery, ENT, and gynecology applications.

High quality optics and multiple console output options in next-gen mobile endoscope camera systems are generating income sources for manufacturers in the endoscopic camera systems market. These devices are increasing the possibility of full HD image to any commercial or medical grade monitor. Manufacturers are offering video consoles that are compatible with any standard video recorder.

Companies in the endoscopic camera systems market are anticipated to diversify their offerings in endoscopic video camera systems. Certified refurbished endoscopic camera systems are growing popular and suit the needs of budget-constrained healthcare facilities. The improved image quality is eliminating issues of eye fatigue, which can result from working with a monitor.

The Storz IMAGE1 HD Camera Head is being publicized for its high definition, three-CCD (charge-coupled device) chip in the camera head that captures images in 16:9 format. These cameras are coupled with robust monitors, which help to run a clear picture at a maximum resolution of 1920 x 1080 pixels. Manufacturers in the endoscopic camera systems market are boosting their production capabilities in these camera heads. High definition progressive scan systems help to deliver extremely stable images.

Med-tech companies in the endoscopic camera systems market are increasing the production of devices that enable radical adjustments to the image generation systems. Scholly Fiber Optic GmbH - a medical technology manufacturer in Denzlingen, Germany, is gaining recognition for offering its FlexiVision camera platform that provides the basis for premium quality images.

Manufacturers in the endoscopic camera systems market are increasing the availability of camera systems based on state-of –the-art technologies and that can be modified with individual settings. 4K ultra HD (UHD) resolution is being preferred in camera systems that deploy 3840x2160 pixels image size, which is currently one of the highest standard for imaging. This makes it possible to work comfortably with large monitors. Such 4K camera heads offer high quality optical zoom in order to achieve the highest image quality in both circular and full-image endoscopy images.

Suppliers in the endoscopic camera systems market are increasing the availability of new and pre-owned world class surgical HD camera systems that are being used for endoscopy, arthroscopy, laparoscopy, veterinary purposes, and the likes. Improved clarity, focus, and sharpness make endoscopic camera systems ideal for gastroenterology, pulmonology, and cardiology applications. Manufacturers are developing camera systems with wireless transmission capabilities when used with wireless monitors.

Manufacturers are designing camera systems with fully programmable camera head buttons and touchscreen LCD interface. They are tapping incremental opportunities with full HD camera control units (CCU) that are being used for single-use endoscopy. Companies are providing both rigid and flexible full HD CCU platforms. The improved menu navigation is growing prominent in full HD CCU platforms, owing to the developments in the navigation interface.

Analysts’ Viewpoint

Stakeholders in the endoscopic camera systems market are implementing comprehensive vendor reviews and making sure they have alternatives for sourcing medical raw materials amid the ongoing COVID-19 outbreak. Although HD camera systems have made technological improvements, the lack of depth of perception provided by the 2D vision and the need to operate with only one hand are some of the limitations associated with the endoscopic ear surgery. Hence, companies should increase R&D in 4-mm HD 3D endoscopes to overcome limitations in the endoscopic ear surgery. Superb image quality and innovative compact form factors are being considered before launching endoscopic camera systems.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 3.7 Bn |

|

Market Forecast Value in 2031 |

US$ 6.9 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Done Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value & ‘000 Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends etc. |

|

Competition Landscape |

Company profiles section includes overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, key financials, competition matrix (by tier and size of companies), etc. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Endoscopic camera systems market is projected to reach US$ 6.9 Bn by 2031

Endoscopic camera systems market is expected to expand at a CAGR of 5.7% during 2021-2031

Endoscopic camera systems market is driven by innovative technologies and government initiatives to improve awareness about advanced technologies.

North America is expected to account for a significant share of the global endoscopic camera systems market during the forecast period.

Key players operating in the global endoscopic camera systems market include Olympus, Stryker, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., SCHÖLLY FIBEROPTIC GMBH, Gimmi GmbH

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Endoscopic Camera Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Endoscopic Camera Systems Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

5.2. Key Industry Events (Mergers, Acquisitions, Partnerships, etc.)

5.3. Product Comparison

6. Global Endoscopic Camera Systems Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.1.1. Key Findings / Developments

6.2. Global Endoscopic Camera Systems Market Value & Volume Forecast, by Product, 2017–2031

6.2.1. Device

6.2.2. Accessories

6.3. Global Endoscopic Camera Systems Market Attractiveness, by Product

7. Global Endoscopic Camera Systems Market Analysis and Forecast, by Sensor Type

7.1. Introduction & Definition

7.1.1. Key Findings / Developments

7.2. Global Endoscopic Camera Systems Market Value Forecast, by Sensor Type, 2017–2031

7.2.1. Complementary Metal Oxide Semiconductor (CMOS)

7.2.2. Charge-coupled device (CCD)

7.3. Global Endoscopic Camera Systems Market Attractiveness, by Sensor Type

8. Global Endoscopic Camera Systems Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.1.1. Key Findings / Developments

8.2. Global Endoscopic Camera Systems Market Value Forecast, by Application, 2017–2031

8.2.1. Gastroenterology

8.2.2. Pulmonology

8.2.3. Orthopedic Surgery

8.2.4. Cardiology

8.2.5. ENT Surgery

8.2.6. Gynecology

8.2.7. Neurology

8.2.8. Urology

8.3. Global Endoscopic Camera Systems Market Attractiveness, by Application

9. Global Endoscopic Camera Systems Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.1.1. Key Findings / Developments

9.2. Global Endoscopic Camera Systems Market Value Forecast, by End-user, 2017–2031

9.2.1. Hospitals

9.2.2. Diagnostic Centres

9.2.3. Others

9.3. Global Endoscopic Camera Systems Market Attractiveness, by End-user

10. Global Endoscopic Camera Systems Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Global Endoscopic Camera Systems Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Global Endoscopic Camera Systems Market Attractiveness, by Country/Region

11. North America Endoscopic Camera Systems Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. North America Endoscopic Camera Systems Market Value & Volume Forecast, by Product, 2017–2031

11.2.1. Device

11.2.2. Accessories

11.3. North America Endoscopic Camera Systems Market Value Forecast, by Sensor Type, 2017–2031

11.3.1. Complementary Metal Oxide Semiconductor (CMOS)

11.3.2. Charge-coupled device (CCD)

11.4. North America Endoscopic Camera Systems Market Value Forecast, by Application, 2017–2031

11.4.1. Gastroenterology

11.4.2. Pulmonology

11.4.3. Orthopedic Surgery

11.4.4. Cardiology

11.4.5. ENT Surgery

11.4.6. Gynecology

11.4.7. Neurology

11.4.8. Urology

11.5. North America Endoscopic Camera Systems Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospitals

11.5.2. Diagnostic Centres

11.5.3. Others

11.6. North America Endoscopic Camera Systems Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. North America Endoscopic Camera Systems Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Sensor Type

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Endoscopic Camera Systems Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Europe Endoscopic Camera Systems Market Value & Volume Forecast, by Product, 2017–2031

12.2.1. Device

12.2.2. Accessories

12.3. Europe Endoscopic Camera Systems Market Value Forecast, by Sensor Type, 2017–2031

12.3.1. Complementary Metal Oxide Semiconductor (CMOS)

12.3.2. Charge-coupled device (CCD)

12.4. Europe Endoscopic Camera Systems Market Value Forecast, by Application, 2017–2031

12.4.1. Gastroenterology

12.4.2. Pulmonology

12.4.3. Orthopedic Surgery

12.4.4. Cardiology

12.4.5. ENT Surgery

12.4.6. Gynecology

12.4.7. Neurology

12.4.8. Urology

12.5. Europe Endoscopic Camera Systems Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospitals

12.5.2. Diagnostic Centres

12.5.3. Others

12.6. Europe Endoscopic Camera Systems Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Europe Endoscopic Camera Systems Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Sensor Type

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Endoscopic Camera Systems Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Asia Pacific Endoscopic Camera Systems Market Value & Volume Forecast, by Product, 2017–2031

13.2.1. Device

13.2.2. Accessories

13.3. Asia Pacific Endoscopic Camera Systems Market Value Forecast, by Sensor Type, 2017–2031

13.3.1. Complementary Metal Oxide Semiconductor (CMOS)

13.3.2. Charge-coupled device (CCD)

13.4. Asia Pacific Endoscopic Camera Systems Market Value Forecast, by Application, 2017–2031

13.4.1. Gastroenterology

13.4.2. Pulmonology

13.4.3. Orthopedic Surgery

13.4.4. Cardiology

13.4.5. ENT Surgery

13.4.6. Gynecology

13.4.7. Neurology

13.4.8. Urology

13.5. Asia Pacific Endoscopic Camera Systems Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospitals

13.5.2. Diagnostic Centres

13.5.3. Others

13.6. Asia Pacific Endoscopic Camera Systems Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Asia Pacific Endoscopic Camera Systems Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Sensor Type

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Endoscopic Camera Systems Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Latin America Endoscopic Camera Systems Market Value & Volume Forecast, by Product, 2017–2031

14.2.1. Device

14.2.2. Accessories

14.3. Latin America Endoscopic Camera Systems Market Value Forecast, by Sensor Type, 2017–2031

14.3.1. Complementary Metal Oxide Semiconductor (CMOS)

14.3.2. Charge-coupled device (CCD)

14.4. Latin America Endoscopic Camera Systems Market Value Forecast, by Application, 2017–2031

14.4.1. Gastroenterology

14.4.2. Pulmonology

14.4.3. Orthopedic Surgery

14.4.4. Cardiology

14.4.5. ENT Surgery

14.4.6. Gynecology

14.4.7. Neurology

14.4.8. Urology

14.5. Latin America Endoscopic Camera Systems Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospitals

14.5.2. Diagnostic Centres

14.5.3. Others

14.6. Latin America Endoscopic Camera Systems Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Latin America Endoscopic Camera Systems Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Sensor Type

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Endoscopic Camera Systems Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Middle East & Africa Endoscopic Camera Systems Market Value & Volume Forecast, by Product, 2017–2031

15.2.1. Device

15.2.2. Accessories

15.3. Middle East & Africa Endoscopic Camera Systems Market Value Forecast, by Sensor Type, 2017–2031

15.3.1. Complementary Metal Oxide Semiconductor (CMOS)

15.3.2. Charge-coupled device (CCD)

15.4. Middle East & Africa Endoscopic Camera Systems Market Value Forecast, by Application, 2017–2031

15.4.1. Gastroenterology

15.4.2. Pulmonology

15.4.3. Orthopedic Surgery

15.4.4. Cardiology

15.4.5. ENT Surgery

15.4.6. Gynecology

15.4.7. Neurology

15.4.8. Urology

15.5. Middle East & Africa Endoscopic Camera Systems Market Value Forecast, by End-user, 2017–2031

15.5.1. Hospitals

15.5.2. Diagnostic Centres

15.5.3. Others

15.6. Middle East & Africa Endoscopic Camera Systems Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Middle East & Africa Endoscopic Camera Systems Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Sensor Type

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Company Profiles

16.2.1. Olympus

16.2.1.1. Company Description

16.2.1.2. Business Overview

16.2.1.3. Strategic Overview

16.2.1.4. SWOT Analysis

16.2.2. Stryker

16.2.2.1. Company Description

16.2.2.2. Business Overview

16.2.2.3. SWOT Analysis

16.2.3. Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

16.2.3.1. Company Description

16.2.3.2. Strategic Overview

16.2.3.3. SWOT Analysis

16.2.4. SCHÖLLY FIBEROPTIC GMBH

16.2.4.1. Company Description

16.2.4.2. Strategic Overview

16.2.4.3. SWOT Analysis

16.2.5. Gimmi GmbH

16.2.5.1. Company Description

16.2.5.2. SWOT Analysis

16.2.6. B. Braun Melsungen AG

16.2.6.1. Company Description

16.2.6.2. Business Overview

16.2.6.3. Strategic Overview

16.2.6.4. SWOT Analysis

16.2.7. KARL STORZ

16.2.7.1. Company Description

16.2.7.2. Strategic Overview

16.2.7.3. SWOT Analysis

16.2.8. Xuzhou AKX Electronic Science And Technology Co., Ltd.

16.2.8.1. Company Description

16.2.8.2. SWOT Analysis

16.2.9. MEDIT INC

16.2.9.1. Company Description

16.2.9.2. SWOT Analysis

16.2.10. Richard Wolf GmbH

16.2.10.1. Company Description

16.2.10.2. Strategic Overview

16.2.10.3. SWOT Analysis

List of Tables

Table 01: Global Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Endoscopic Camera Systems Market Volume (Units) Forecast, by Product, 2017–2031

Table 03: Global Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Sensor Type, 2017–2031

Table 04: Global Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 05: Global Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Country2017–2031

Table 08: North America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 09: North America Endoscopic Camera Systems Market Volume (Units) Forecast, by Product, 2017–2031

Table 10: North America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Sensor Type, 2017–2031

Table 11: North America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: North America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Europe Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Europe Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Europe Endoscopic Camera Systems Market Volume (Units) Forecast, by Product, 2017–2031

Table 16: Europe Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Sensor Type, 2017–2031

Table 17: Europe Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 18: Europe Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 19: Asia Pacific Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Asia Pacific Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 21: Asia Pacific Endoscopic Camera Systems Market Volume (Units) Forecast, by Product, 2017–2031

Table 22: Asia Pacific Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Sensor Type, 2017–2031

Table 23: Asia Pacific Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Asia Pacific Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: Latin America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 26: Latin America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 27: Latin America Endoscopic Camera Systems Market Volume (Units) Forecast, by Product, 2017–2031

Table 28: Latin America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Sensor Type, 2017–2031

Table 29: Latin America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 30: Latin America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 31: Middle East & Africa Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 32: Middle East & Africa Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 33: Middle East & Africa Endoscopic Camera Systems Market Volume (Units) Forecast, by Product, 2017–2031

Table 34: Middle East & Africa Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Sensor Type, 2017–2031

Table 35: Middle East & Africa Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 36: Middle East & Africa Endoscopic Camera Systems Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Endoscopic Camera Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Endoscopic Camera Systems Market Value Share, by Product, 2020

Figure 03: Global Endoscopic Camera Systems Market Value Share, by Application, 2020

Figure 04: Global Endoscopic Camera Systems Market Value Share, by End-user, 2020

Figure 05: Global Endoscopic Camera Systems Market Value Share, by Region, 2020

Figure 06: Global Endoscopic Camera Systems Market Value Share Analysis, by Product, 2020 and 2031

Figure 07: Global Endoscopic Camera Systems Market Attractiveness Analysis, by Product, 2021–2031

Figure 08: Global Endoscopic Camera Systems Market Value (US$ Mn), by Device, 2017–2031

Figure 09: Global Endoscopic Camera Systems Market Value (US$ Mn), by Accessories, 2017–2031

Figure 10: Global Endoscopic Camera Systems Market Value Share Analysis, by Sensor Type, 2020 and 2031

Figure 11: Global Endoscopic Camera Systems Market Attractiveness Analysis, by Sensor Type, 2021–2031

Figure 12: Global Endoscopic Camera Systems Market Value (US$ Mn), by Complementary Metal Oxide Semiconductor (CMOS), 2017–2031

Figure 13: Global Endoscopic Camera Systems Market Value (US$ Mn), by Charge-coupled device (CCD), 2017–2031

Figure 14: Global Endoscopic Camera Systems Market Value Share Analysis, by Application, 2020 and 2031

Figure 15: Global Endoscopic Camera Systems Market Attractiveness Analysis, by Application, 2021–2031

Figure 16: Global Endoscopic Camera Systems Market Value (US$ Mn), by Gastroenterology, 2017–2031

Figure 17: Global Endoscopic Camera Systems Market Value (US$ Mn), by Pulmonology, 2017–2031

Figure 18: Global Endoscopic Camera Systems Market Value (US$ Mn), by Orthopedic Surgery, 2017–2031

Figure 19: Global Endoscopic Camera Systems Market Value (US$ Mn), by Cardiology, 2017–2031

Figure 20: Global Endoscopic Camera Systems Market Value (US$ Mn), by ENT Surgery, 2017–2031

Figure 21: Global Endoscopic Camera Systems Market Value (US$ Mn), by Gynecology, 2017–2031

Figure 22: Global Endoscopic Camera Systems Market Value (US$ Mn), by Neurology, 2017–2031

Figure 23: Global Endoscopic Camera Systems Market Value (US$ Mn), by Urology, 2017–2031

Figure 24: Global Endoscopic Camera Systems Market Value Share Analysis, by End-user, 2020 and 2031

Figure 25: Global Endoscopic Camera Systems Market Attractiveness Analysis, by Application, 2021–2031

Figure 26: Global Endoscopic Camera Systems Market Value (US$ Mn), by Hospitals, 2017–2031

Figure 27: Global Endoscopic Camera Systems Market Value (US$ Mn), by Diagnostic Centers, 2017–2031

Figure 28: Global Endoscopic Camera Systems Market Value (US$ Mn), by Others, 2017–2031

Figure 29: Global Endoscopic Camera Systems Market Value Share Analysis, by Region, 2020 and 2031

Figure 30: Global Endoscopic Camera Systems Market Attractiveness Analysis, by Region, 2021–2031

Figure 31: North America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: North America Endoscopic Camera Systems Market Value Share Analysis, by Country, 2020 and 2031

Figure 33: North America Endoscopic Camera Systems Market Attractiveness Analysis, by Country, 2021–2031

Figure 34: North America Endoscopic Camera Systems Market Value Share Analysis, by Product, 2020 and 2031

Figure 35: North America Endoscopic Camera Systems Market Attractiveness Analysis, by Product, 2021–2031

Figure 36: North America Endoscopic Camera Systems Market Value Share Analysis, by Sensor Type, 2020 and 2031

Figure 37: North America Endoscopic Camera Systems Market Attractiveness Analysis, by Sensor Type, 2021–2031

Figure 38: North America Endoscopic Camera Systems Market Value Share Analysis, by Application, 2020 and 2031

Figure 39: North America Endoscopic Camera Systems Market Attractiveness Analysis, by Application, 2021–2031

Figure 40: North America Endoscopic Camera Systems Market Value Share Analysis, by End-user, 2020 and 2031

Figure 41: North America Endoscopic Camera Systems Market Attractiveness Analysis, by End-user, 2021–2031

Figure 42: Europe Endoscopic Camera Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 43: Europe Endoscopic Camera Systems Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 44: Europe Endoscopic Camera Systems Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 45: Europe Endoscopic Camera Systems Market Value Share Analysis, by Product, 2020 and 2031

Figure 46: Europe Endoscopic Camera Systems Market Attractiveness Analysis, by Product, 2021–2031

Figure 47: Europe Endoscopic Camera Systems Market Value Share Analysis, by Sensor Type, 2020 and 2031

Figure 48: Europe Endoscopic Camera Systems Market Attractiveness Analysis, by Sensor Type, 2021–2031

Figure 49: Europe Endoscopic Camera Systems Market Value Share Analysis, by Application, 2020 and 2031

Figure 50: Europe Endoscopic Camera Systems Market Attractiveness Analysis, by Application, 2021–2031

Figure 51: Europe Endoscopic Camera Systems Market Value Share Analysis, by End-user, 2020 and 2031

Figure 52: Europe Endoscopic Camera Systems Market Attractiveness Analysis, by End-user, 2021–2031

Figure 53: Asia Pacific Endoscopic Camera Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 54: Asia Pacific Endoscopic Camera Systems Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 55: Asia Pacific Endoscopic Camera Systems Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 56: Asia Pacific Endoscopic Camera Systems Market Value Share Analysis, by Product, 2020 and 2031

Figure 57: Asia Pacific Endoscopic Camera Systems Market Attractiveness Analysis, by Product, 2021–2031

Figure 58: Asia Pacific Endoscopic Camera Systems Market Value Share Analysis, by Sensor Type, 2020 and 2031

Figure 59: Asia Pacific Endoscopic Camera Systems Market Attractiveness Analysis, by Sensor Type, 2021–2031

Figure 60: Asia Pacific Endoscopic Camera Systems Market Value Share Analysis, by Application, 2020 and 2031

Figure 61: Asia Pacific Endoscopic Camera Systems Market Attractiveness Analysis, by Application, 2021–2031

Figure 62: Asia Pacific Endoscopic Camera Systems Market Value Share Analysis, by End-user, 2020 and 2031

Figure 63: Asia Pacific Endoscopic Camera Systems Market Attractiveness Analysis, by End-user, 2021–2031

Figure 64: Latin America Endoscopic Camera Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 65: Latin America Endoscopic Camera Systems Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 66: Latin America Endoscopic Camera Systems Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 67: Latin America Endoscopic Camera Systems Market Value Share Analysis, by Product, 2020 and 2031

Figure 68: Latin America Endoscopic Camera Systems Market Attractiveness Analysis, by Product, 2021–2031

Figure 69: Latin America Endoscopic Camera Systems Market Value Share Analysis, by Sensor Type, 2020 and 2031

Figure 70: Latin America Endoscopic Camera Systems Market Attractiveness Analysis, by Sensor Type, 2021–2031

Figure 71: Latin America Endoscopic Camera Systems Market Value Share Analysis, by Application, 2020 and 2031

Figure 72: Latin America Endoscopic Camera Systems Market Attractiveness Analysis, by Application, 2021–2031

Figure 73: Latin America Endoscopic Camera Systems Market Value Share Analysis, by End-user, 2020 and 2031

Figure 74: Latin America Endoscopic Camera Systems Market Attractiveness Analysis, by End-user, 2021–2031

Figure 75: Middle East & Africa Endoscopic Camera Systems Market Value (US$ Mn) Forecast, 2017–2031

Figure 76: Middle East & Africa Endoscopic Camera Systems Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 77: Middle East & Africa Endoscopic Camera Systems Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 78: Middle East & Africa Endoscopic Camera Systems Market Value Share Analysis, by Product, 2020 and 2031

Figure 79: Middle East & Africa Endoscopic Camera Systems Market Attractiveness Analysis, by Product, 2021–2031

Figure 80: Middle East & Africa Endoscopic Camera Systems Market Value Share Analysis, by Sensor Type, 2020 and 2031

Figure 81: Middle East & Africa Endoscopic Camera Systems Market Attractiveness Analysis, by Sensor Type, 2021–2031

Figure 82: Middle East & Africa Endoscopic Camera Systems Market Value Share Analysis, by Application, 2020 and 2031

Figure 83: Middle East & Africa Endoscopic Camera Systems Market Attractiveness Analysis, by Application, 2021–2031

Figure 84: Middle East & Africa Endoscopic Camera Systems Market Value Share Analysis, by End-user, 2020 and 2031

Figure 85: Middle East & Africa Endoscopic Camera Systems Market Attractiveness Analysis, by End-user, 2021–2031