Analyst Viewpoint

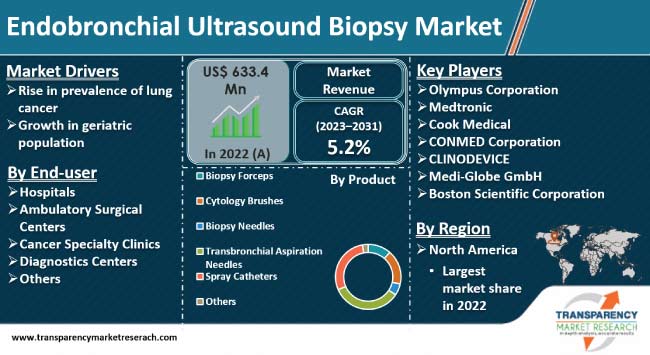

Rise in prevalence of lung cancer and growth in geriatric population are propelling the endobronchial ultrasound biopsy market size. A large patient pool with various chronic disorders relies on endobronchial ultrasound guided biopsy as it is minimally invasive. Endobronchial ultrasound is gaining traction in the treatment of tuberculosis and chronic pulmonary obstructive disorder.

Vendors in the global endobronchial ultrasound biopsy industry are launching products that conveniently integrate with EBUS procedures and are compatible with both traditional TBNA (cTBNA) and EBUS-enabled TBNA diagnostic methods. They are also offering advanced endobronchial ultrasound bronchoscopes for the minimally invasive diagnosis of lung cancer.

Endobronchial Ultrasound (EBUS) is used to sample (biopsy) and examine the anatomy around the tracheobronchial tree. Endobronchial ultrasound and endobronchial ultrasound-guided transbronchial needle aspiration (EBUS TBNA) are widely employed to evaluate pulmonary nodules, diagnose lung infections, and determine the stages of lung cancer. Transbronchial Needle Aspiration, Transesophageal Endoscopic Ultrasound-Guided Fine-Needle Aspiration (EUS-FNA), Radial Probe EBUS (RP-EBUS), and virtual bronchoscopic navigation are various types of endobronchial ultrasound biopsy.

EBUS and EBUS TBNA effectively evaluate pulmonary nodules and diagnose lung infections and stages of lung cancer. Endobronchial ultrasound biopsy is also employed to identify other diseases such as tuberculosis and chronic pulmonary obstructive disorder, which can affect the lungs and other respiratory organs. EBUS biopsy procedures have gained acceptance in the rapidly growing fields of gastroenterology and pulmonology. Biopsy samples can be studied to diagnose lung cancer and other diseases.

Lung cancer is the most common cause of cancer death across the world. According to The American Cancer Society's estimates for lung cancer for 2023, the U.S. reported about 238,340 new cases of lung cancer (117,550 in men and 120,790 in women) and about 127,070 deaths from the disease (67,160 in men and 59,910 in women).

Surge in preference for minimally invasive diagnosis procedures is driving the endobronchial ultrasound biopsy value. Several invasive and non-invasive techniques are used for the diagnosis and staging of lung cancer. The clinical staging of lung cancer plays a major role in identifying treatment options and disease prognosis. Transbronchial needle aspiration guided by endobronchial ultrasound is effective in detecting lung cancer. It helps reduce the time required to decide on treatment options.

The incidence of lung cancer and other chronic diseases increases with age. According to Cancer Research UK, less than 0.5% of lung cancer-related deaths occur at an age younger than 40 years and the highest incidence rates are in older people. Hence, surge in elderly population is augmenting the endobronchial ultrasound biopsy market expansion. Several studies have reported that EBUS-TBNA is a safe and effective technique in patients aged 65 years and over. It allows sufficient tissue for molecular testing. Thus, EBUS-TBNA is suitable as an integrated management program for elderly patients.

Rise in incidence of respiratory diseases and increase in demand for less invasive procedures are projected to spur the endobronchial ultrasound biopsy market growth in the near future. Less invasive operations are gaining traction due to the benefits such as faster healing, a smaller incision, and less discomfort. Minimally invasive surgeries offer greater accuracy than traditional surgical procedures.

Endobronchial ultrasound is a minimally invasive technique utilized to collect tissue samples for biopsy. It does not cause much discomfort to the patients and in most cases, does not require surgery. The selection of bronchoscopes depends on the application and the condition of the organ. However, high cost of medical equipment and absence of reimbursement regulations in some developing countries are limiting the endobronchial ultrasound biopsy market progress.

According to the latest endobronchial ultrasound biopsy market trends, the transbronchial aspirational needles product segment held largest share in 2022. Transbronchial aspirational needles offer excellent puncture performance. These needles are designed for all tracheal and bronchial regions and ensure minimal channel damage. Needle aspiration is fairly quick and often does not require anesthesia.

According to the latest endobronchial ultrasound biopsy market analysis, the cancer diagnosis application segment accounted for major share in 2022. EBUS plays a major role in the minimally invasive staging of non–small cell lung cancer. Surge in prevalence of non–small cell lung cancer is driving the segment. According to the American Cancer Society, about 10% to 15% of all lung cancers are small cell lung cancer, and about 80% to 85% are non–small cell lung cancer.

According to the latest endobronchial ultrasound biopsy market research, North America held largest share in 2022. Increase in incidences of lung cancer and chronic respiratory diseases is fueling the market dynamics in the region.

The industry in Asia Pacific is projected to grow at a steady pace during the forecast period. Increase in healthcare expenditure and low product manufacturing costs in China and India are driving the endobronchial ultrasound biopsy market statistics in the region.

Most players are investing in the R&D of new products to expand their product portfolio and increase their endobronchial ultrasound biopsy market share. Olympus Corporation, Medtronic, Cook Medical, CONMED Corporation, CLINODEVICE, Medi-Globe GmbH, and Boston Scientific Corporation are major companies in the endobronchial ultrasound biopsy business.

These companies have been profiled in the endobronchial ultrasound biopsy market report based on various parameters such as company overview, business strategies, product portfolio, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 633.4 Mn |

| Market Forecast Value in 2031 | US$ 992.0 Mn |

| Growth Rate (CAGR) | 5.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Prominent Players – Competition Dashboard and Revenue Share Analysis, 2022 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 633.4 Mn in 2022

It is projected to grow at a CAGR of 5.2% from 2023 to 2031

Rise in prevalence of lung cancer and growth in geriatric population

The transbronchial aspiration needles segment held the largest share in 2022

North America dominated the global landscape in 2022

Olympus Corporation, Medtronic, Cook Medical, CONMED Corporation, CLINODEVICE, Medi-Globe GmbH, and Boston Scientific Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Endobronchial Ultrasound Biopsy Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Endobronchial Ultrasound Biopsy Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Endobronchial Ultrasound Biopsy Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Biopsy Forceps

6.3.2. Cytology Brushes

6.3.3. Biopsy Needles

6.3.4. Transbronchial Aspiration Needles

6.3.5. Spray Catheters

6.3.6. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Endobronchial Ultrasound Biopsy Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Cancer Diagnosis

7.3.2. Infection Diagnosis

7.3.3. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Endobronchial Ultrasound Biopsy Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Cancer Specialty Clinics

8.3.4. Diagnostics Centers

8.3.5. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Endobronchial Ultrasound Biopsy Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Endobronchial Ultrasound Biopsy Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Product, 2017–2031

10.3.1. Biopsy Forceps

10.3.2. Cytology Brushes

10.3.3. Biopsy Needles

10.3.4. Transbronchial Aspiration Needles

10.3.5. Spray Catheters

10.3.6. Others

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Cancer Diagnosis

10.4.2. Infection Diagnosis

10.4.3. Others

10.5. Market Value Forecast, by End-user, 2017–2031

10.5.1. Hospitals

10.5.2. Ambulatory Surgical Centers

10.5.3. Cancer Specialty Clinics

10.5.4. Diagnostics Centers

10.5.5. Others

10.6. Market Value Forecast, by Country, 2017–2031

10.6.1. U.S.

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Product

10.7.2. By Application

10.7.3. By End-user

10.7.4. By Country

11. Europe Endobronchial Ultrasound Biopsy Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Product, 2017–2031

11.3.1. Biopsy Forceps

11.3.2. Cytology Brushes

11.3.3. Biopsy Needles

11.3.4. Transbronchial Aspiration Needles

11.3.5. Spray Catheters

11.3.6. Others

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Cancer Diagnosis

11.4.2. Infection Diagnosis

11.4.3. Others

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospitals

11.5.2. Ambulatory Surgical Centers

11.5.3. Cancer Specialty Clinics

11.5.4. Diagnostics Centers

11.5.5. Others

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Application

11.7.3. By End-user

11.7.4. By Country/Sub-region

12. Asia Pacific Endobronchial Ultrasound Biopsy Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Product, 2017–2031

12.3.1. Biopsy Forceps

12.3.2. Cytology Brushes

12.3.3. Biopsy Needles

12.3.4. Transbronchial Aspiration Needles

12.3.5. Spray Catheters

12.3.6. Others

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Cancer Diagnosis

12.4.2. Infection Diagnosis

12.4.3. Others

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospitals

12.5.2. Ambulatory Surgical Centers

12.5.3. Cancer Specialty Clinics

12.5.4. Diagnostics Centers

12.5.5. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Application

12.7.3. By End-user

12.7.4. By Country/Sub-region

13. Latin America Endobronchial Ultrasound Biopsy Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Product, 2017–2031

13.3.1. Biopsy Forceps

13.3.2. Cytology Brushes

13.3.3. Biopsy Needles

13.3.4. Transbronchial Aspiration Needles

13.3.5. Spray Catheters

13.3.6. Others

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Cancer Diagnosis

13.4.2. Infection Diagnosis

13.4.3. Others

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospitals

13.5.2. Ambulatory Surgical Centers

13.5.3. Cancer Specialty Clinics

13.5.4. Diagnostics Centers

13.5.5. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Application

13.7.3. By End-user

13.7.4. By Country/Sub-region

14. Middle East & Africa Endobronchial Ultrasound Biopsy Market Analysis and Forecast

14.1. Introduction

14.2. Key Findings

14.3. Market Value Forecast, by Product, 2017–2031

14.3.1. Biopsy Forceps

14.3.2. Cytology Brushes

14.3.3. Biopsy Needles

14.3.4. Transbronchial Aspiration Needles

14.3.5. Spray Catheters

14.3.6. Others

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Cancer Diagnosis

14.4.2. Infection Diagnosis

14.4.3. Others

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospitals

14.5.2. Ambulatory Surgical Centers

14.5.3. Cancer Specialty Clinics

14.5.4. Diagnostics Centers

14.5.5. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Application

14.7.3. By End-user

14.7.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Olympus Corporation

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Medtronic

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Cook Medical

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. CONMED Corporation

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. CLINODEVICE

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Medi-Globe GmbH

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Boston Scientific Corporation

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

List of Tables

Table 01: Global Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 07: North America Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 11: Europe Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Asia Pacific Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Latin America Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Middle East & Africa Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Endobronchial Ultrasound Biopsy Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Endobronchial Ultrasound Biopsy Market Revenue (US$ Mn), by Product, 2022

Figure 03: Global Endobronchial Ultrasound Biopsy Market Value Share, by Product, 2022

Figure 04: Global Endobronchial Ultrasound Biopsy Market Revenue (US$ Mn), by Application, 2022

Figure 05: Global Endobronchial Ultrasound Biopsy Market Value Share, by Application, 2022

Figure 06: Global Endobronchial Ultrasound Biopsy Market Revenue (US$ Mn), by End-user, 2022

Figure 07: Global Endobronchial Ultrasound Biopsy Market Value Share, by End-user, 2022

Figure 08: Global Endobronchial Ultrasound Biopsy Market Value Share, by Region, 2022

Figure 09: Global Endobronchial Ultrasound Biopsy Market Value (US$ Mn) Forecast, 2023–2031

Figure 10: Global Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 11: Global Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Product, 2023-2031

Figure 12: Global Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 13: Global Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Application, 2023-2031

Figure 14: Global Endobronchial Ultrasound Biopsy Market Value Share Analysis, by End-user, 2022 and 2031

Figure 15: Global Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by End-user, 2022-2031

Figure 16: Global Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Region, 2022-2031

Figure 18: North America Endobronchial Ultrasound Biopsy Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Country, 2023–2031

Figure 20: North America Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Country, 2022 and 2031

Figure 21: North America Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 22: North America Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 23: North America Endobronchial Ultrasound Biopsy Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: North America Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Product, 2023–2031

Figure 25: North America Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Application, 2023–2031

Figure 26: North America Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by End-user, 2023–2031

Figure 27: Europe Endobronchial Ultrasound Biopsy Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Europe Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 30: Europe Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 31: Europe Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 32: Europe Endobronchial Ultrasound Biopsy Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Europe Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Product, 2023–2031

Figure 34: Europe Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Application, 2023–2031

Figure 35: Europe Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by End-user, 2023–2031

Figure 36: Asia Pacific Endobronchial Ultrasound Biopsy Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Asia Pacific Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 39: Asia Pacific Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 40: Asia Pacific Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 41: Asia Pacific Endobronchial Ultrasound Biopsy Market Value Share Analysis, by End-user, 2022 and 2031

Figure 42: Asia Pacific Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Product, 2023–2031

Figure 43: Asia Pacific Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Application, 2023–2031

Figure 44: Asia Pacific Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by End-user, 2023–2031

Figure 45: Latin America Endobronchial Ultrasound Biopsy Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 47: Latin America Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Latin America Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 49: Latin America Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 50: Latin America Endobronchial Ultrasound Biopsy Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Latin America Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Product, 2023–2031

Figure 52: Latin America Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Application, 2023–2031

Figure 53: Latin America Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by End-user, 2023–2031

Figure 54: Middle East & Africa Endobronchial Ultrasound Biopsy Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Middle East & Africa Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 57: Middle East & Africa Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 58: Middle East & Africa Endobronchial Ultrasound Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 59: Middle East & Africa Endobronchial Ultrasound Biopsy Market Value Share Analysis, by End-user, 2022 and 2031

Figure 60: Middle East & Africa Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Product, 2023–2031

Figure 61: Middle East & Africa Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by Application, 2023–2031

Figure 62: Middle East & Africa Endobronchial Ultrasound Biopsy Market Attractiveness Analysis, by End-user, 2023–2031