Analysts’ Viewpoint

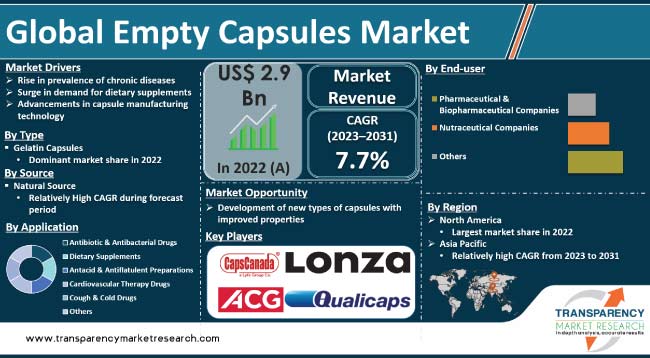

Rise in prevalence of chronic diseases and surge in demand for dietary supplements are key factors driving the global empty capsules market. Empty capsules are a convenient and easy way to take medications. They are less likely to cause side effects than other dosage forms. These factors are contributing to the rise in demand for empty capsules worldwide.

Advancements in capsule manufacturing technology are making it possible to produce empty capsules that are consistent in size, shape, and color. These new capsules are attracting several pharmaceutical and nutraceutical companies and creating incremental empty capsules business opportunities. Manufacturers are investing in R&D to boost their product portfolio. They are also focusing on improving their manufacturing processes to stay ahead of the competition.

Empty capsule is a small, hollow container made from a variety of materials, including gelatin, starch, and pullulan. They hold a variety of substances such as powders, liquids, and herbs. Empty capsules are often used by pharmaceutical companies to encapsulate drugs. They are also used by individuals to create their own custom supplements.

Empty capsules carry a number of advantages over traditional tablets. They are easier to swallow, especially for people facing difficulty swallowing pills. They also protect the contents from moisture and oxidation. Additionally, empty capsules can be filled with a variety of substances, thus allowing for greater flexibility in dosage and formulation.

Gelatin capsules and non-gelatin capsules are the common types of empty capsules. Gelatin capsules (hard and soft) are animal-based medicinal products with high collagen content. They are produced from pork and connective tissues of beef and chicken. Non-gelatin capsules are made from vegetable-derived materials such as hydroxypropyl methylcellulose (HPMC) and pullulan.

Prevalence of chronic diseases, including cardiovascular disorders, diabetes, respiratory illnesses, and gastrointestinal conditions, has been rising across the globe due to factors such as sedentary lifestyle, unhealthy diet, and aging population.

Empty capsule serves as a crucial solution for delivering various medications, supplements, and nutraceuticals. Increase in number of patients with chronic ailments is fueling the demand for efficient and targeted drug delivery systems.

Empty capsules offer several advantages, including accurate dosage and compatibility with different types of drugs. Therefore, these capsules are an ideal choice for formulating treatments for chronic conditions.

According to the WHO, chronic diseases account for 70% of all deaths worldwide. The United States Centers for Disease Control and Prevention (CDC) estimates that six in 10 adults in the U.S. have at least one chronic disease. The prevalence of diabetes has increased by 50% in adults in the U.S. since 1990. Thus, rise in burden of chronic diseases and inclination of the pharmaceutical sector toward innovative drug delivery methods are driving the global empty capsules market.

The healthcare sector is striving to meet the demands of an ever-growing patient population. Empty capsules are likely to play a vital role in revolutionizing drug administration and enhancing patient outcomes in the near future. However, stringent regulations, ethical concerns, fluctuation in raw material prices, and competition from other drug delivery systems are projected to hamper market statistics during the forecast period.

Empty capsules, primarily made from gelatin or vegetarian materials, are widely used in pharmaceutical and nutraceutical industries to encase medications, dietary supplements, and herbal formulations.

Over the years, innovations in capsule manufacturing technology have led to enhanced product quality, improved patient compliance, and increased customization possibilities, thus augmenting empty capsules market expansion.

Development of high-speed, automated capsule-filling machines is also boosting the demand for empty capsules. These state-of-the-art machines can efficiently fill thousands of capsules per minute, significantly increasing production capacity and reducing manufacturing costs. Such advancements have enabled pharmaceutical companies to streamline their production processes and meet the rise in demand for medicines more effectively.

Technological breakthroughs have led to the emergence of innovative capsule materials such as plant-based or HPMC (Hydroxypropyl methylcellulose) capsules. These vegetarian-friendly alternatives cater to the growing demand for plant-based and vegan products, thus expanding the potential customer base for empty capsules in the nutraceutical sector.

Advancements in capsule design have contributed to improved drug delivery and therapeutic outcomes. Controlled-release capsules, for example, allow for sustained drug release over an extended period, thus reducing the frequency of medication intake and enhancing patient compliance. Such innovations are further fueling the empty capsules market demand.

As per the empty capsules market analysis, the dietary supplements application segment is expected to lead the global industry in the next few years. Changing consumer behavior, increase in awareness about health and wellness, and rise in focus on personalized nutrition are some of the factors driving the segment.

Rise in awareness about preventive healthcare is one of the key factors propelling the demand for dietary supplements. People are becoming more aware about the importance of maintaining a balanced diet and incorporating essential nutrients to support their overall well-being. Dietary supplements offer a convenient way to bridge nutritional gaps and fulfill specific health needs.

Growth in aging population is another significant factor driving the demand for dietary supplements, and consequently, empty capsules. As the elderly seek to maintain their health and vitality, they often opt for supplements to support their overall well-being and address specific health concerns. Empty capsules offer a practical solution for encapsulating custom formulations or personalized dosages tailored to individual needs.

Athletes, fitness enthusiasts, and bodybuilders often rely on dietary supplements to optimize performance, aid recovery, and achieve fitness goals. Convenience of empty capsules allows for the encapsulation of various powdered supplements, including protein powders, amino acids, and pre-workout formulas.

Empty pharmaceutical capsules provide a user-friendly, convenient, and versatile method for taking dietary supplements. This versatility makes it easier for consumers to incorporate supplements into their daily routines, thereby fueling the growth of the dietary supplements application segment.

According to the latest empty capsules market forecast, North America is projected to dominate the global landscape during the forecast period.

Increase in presence of some of the major pharmaceutical and nutraceutical companies is augmenting the demand for empty capsules in North America. Advanced healthcare infrastructure and R&D capabilities are driving innovation in pharmaceutical formulations that incorporate empty capsules, thus fueling market dynamics of the region.

Implementation of stringent regulations and quality standards in North America is ensuring the safety and efficacy of empty capsules, thus bolstering their market acceptance. The presence of established capsule manufacturers and contract manufacturing organizations (CMOs) is accelerating empty capsules industry growth in the region.

The empty capsules market size in Asia Pacific is anticipated to increase at a steady pace during the forecast period, owing to the growth in pharmaceutical and nutraceutical industries in China and India.

Leading players operating in the global market are ACG, Lonza Group Ltd., Qualicaps (Mitsubishi Chemical Group Corporation), Seoheung Co., Ltd., The Roxlor Group, Nectar Lifesciences Ltd., Medi-Caps Ltd., CapsCanada, and Natural Capsules Limited.

These companies are engaged in mergers & acquisitions, strategic collaborations, and new product launches to increase their empty capsules market share. Leading companies are also following the latest empty capsules market trends to avail lucrative revenue opportunities.

Prominent players have been profiled in the empty capsules market report based on parameters such as company overview, financial summary, business strategies, product portfolio, business segments, and latest developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 2.9 Bn |

|

Market Forecast Value in 2031 |

More than US$ 5.6 Bn |

|

Growth Rate (CAGR) |

7.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional-level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 2.9 Bn in 2022

It is projected to reach more than US$ 5.6 Bn by 2031

The CAGR is anticipated to be 7.7% from 2023 to 2031

The gelatin capsules type segment held the largest share in 2022

North America is anticipated to account for major share during the forecast period

ACG, Lonza Group Ltd., Qualicaps (Mitsubishi Chemical Group Corporation), Seoheung Co., Ltd., The Roxlor Group, Nectar Lifesciences Ltd., Medi-Caps Ltd., CapsCanada, and Natural Capsules Limited

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumption and Research Methodology

3. Executive Summary: Global Empty Capsules Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Empty Capsules Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Porter’s Five Force Analysis

5.2. Regulation of Dietary Supplements, by Country

5.3. Innovation in Capsule Technology

5.4. Key Industry Events

5.5. COVID-19 Pandemic Impact on Industry

6. Global Empty Capsules Market Analysis and Forecast, by Source

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast by Source, 2017 - 2031

6.3.1. Porcine

6.3.2. Bovine

6.3.3. Marine

6.3.4. Natural

6.4. Market Attractiveness by Source

7. Global Empty Capsules Market Analysis and Forecast, by Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast by Type, 2017 - 2031

7.3.1. Gelatin Capsules

7.3.1.1. Hard Gelatin Capsules

7.3.1.2. Soft Gelatin Capsules

7.3.2. Non-gelatin Capsules

7.4. Market Attractiveness by Type

8. Global Empty Capsules Market Analysis and Forecast, by Functionality

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast by Functionality, 2017 - 2031

8.3.1. Immediate Release

8.3.2. Sustained Release

8.3.3. Delayed Release

8.4. Market Attractiveness by Functionality

9. Global Empty Capsules Market Analysis and Forecast, by Application

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast by Application, 2017 - 2031

9.3.1. Antibiotic & Antibacterial Drugs

9.3.2. Dietary Supplements

9.3.3. Antacid & Antiflatulent Preparations

9.3.4. Cardiovascular Therapy Drugs

9.3.5. Cough & Cold Drugs

9.3.6. Others (Antianemic Preparations, Anti-inflammatory Drugs, etc.)

9.4. Market Attractiveness by Application

10. Global Empty Capsules Market Analysis and Forecast, by End-user

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast by End-user, 2017 - 2031

10.3.1. Pharmaceutical & Biopharmaceutical Companies

10.3.2. Nutraceutical Companies

10.3.3. Others

10.4. Market Attractiveness by End-user

11. Global Empty Capsules Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness by Country/Region

12. North America Empty Capsules Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast by Source, 2017 - 2031

12.2.1. Porcine

12.2.2. Bovine

12.2.3. Marine

12.2.4. Natural

12.3. Market Value Forecast by Type, 2017 - 2031

12.3.1. Gelatin Capsules

12.3.1.1. Hard Gelatin Capsules

12.3.1.2. Soft Gelatin Capsules

12.3.2. Non-gelatin Capsules

12.4. Market Value Forecast by Functionality, 2017 - 2031

12.4.1. Immediate Release

12.4.2. Sustained Release

12.4.3. Delayed Release

12.5. Market Value Forecast by Application, 2017 - 2031

12.5.1. Antibiotic & Antibacterial Drugs

12.5.2. Dietary Supplements

12.5.3. Antacid & Antiflatulent Preparations

12.5.4. Cardiovascular Therapy Drugs

12.5.5. Cough & Cold Drugs

12.5.6. Others (Antianemic Preparations, Anti-inflammatory Drugs, etc.)

12.6. Market Value Forecast by End-User, 2017 - 2031

12.6.1. Pharmaceutical & Biopharmaceutical Companies

12.6.2. Nutraceutical Companies

12.6.3. Others

12.7. Market Value Forecast by Country, 2017 - 2031

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. by Source

12.8.2. by Type

12.8.3. by Functionality

12.8.4. by Application

12.8.5. by End-user

12.8.6. by Country

13. Europe Empty Capsules Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast by Source, 2017 - 2031

13.2.1. Porcine

13.2.2. Bovine

13.2.3. Marine

13.2.4. Natural

13.3. Market Value Forecast by Type, 2017 - 2031

13.3.1. Gelatin Capsules

13.3.1.1. Hard Gelatin Capsules

13.3.1.2. Soft Gelatin Capsules

13.3.2. Non-gelatin Capsules

13.4. Market Value Forecast by Functionality, 2017 - 2031

13.4.1. Immediate Release

13.4.2. Sustained Release

13.4.3. Delayed Release

13.5. Market Value Forecast by Application, 2017 - 2031

13.5.1. Antibiotic & Antibacterial Drugs

13.5.2. Dietary Supplements

13.5.3. Antacid & Antiflatulent Preparations

13.5.4. Cardiovascular Therapy Drugs

13.5.5. Cough & Cold Drugs

13.5.6. Others (Antianemic Preparations, Anti-inflammatory Drugs, etc.)

13.6. Market Value Forecast by End-User, 2017 - 2031

13.6.1. Pharmaceutical & Biopharmaceutical Companies

13.6.2. Nutraceutical Companies

13.6.3. Others

13.7. Market Value Forecast by Country/Sub-region, 2017 - 2031

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. by Source

13.8.2. by Type

13.8.3. by Functionality

13.8.4. by Application

13.8.5. by End-user

13.8.6. by Country/Sub-region

14. Asia Pacific Empty Capsules Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast by Source, 2017 - 2031

14.2.1. Porcine

14.2.2. Bovine

14.2.3. Marine

14.2.4. Natural

14.3. Market Value Forecast by Type, 2017 - 2031

14.3.1. Gelatin Capsules

14.3.1.1. Hard Gelatin Capsules

14.3.1.2. Soft Gelatin Capsules

14.3.2. Non-gelatin Capsules

14.4. Market Value Forecast by Functionality, 2017 - 2031

14.4.1. Immediate Release

14.4.2. Sustained Release

14.4.3. Delayed Release

14.5. Market Value Forecast by Application, 2017 - 2031

14.5.1. Antibiotic & Antibacterial Drugs

14.5.2. Dietary Supplements

14.5.3. Antacid & Antiflatulent Preparations

14.5.4. Cardiovascular Therapy Drugs

14.5.5. Cough & Cold Drugs

14.5.6. Others (Antianemic Preparations, Anti-inflammatory Drugs, etc.)

14.6. Market Value Forecast by End-user, 2017 - 2031

14.6.1. Pharmaceutical & Biopharmaceutical Companies

14.6.2. Nutraceutical Companies

14.6.3. Others

14.7. Market Value Forecast by Country/Sub-region, 2017 - 2031

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. by Source

14.8.2. by Type

14.8.3. by Functionality

14.8.4. by Application

14.8.5. by End-user

14.8.6. by Country/Sub-region

15. Latin America Empty Capsules Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast by Source, 2017 - 2031

15.2.1. Porcine

15.2.2. Bovine

15.2.3. Marine

15.2.4. Natural

15.3. Market Value Forecast by Type, 2017 - 2031

15.3.1. Gelatin Capsules

15.3.1.1. Hard Gelatin Capsules

15.3.1.2. Soft Gelatin Capsules

15.3.2. Non-gelatin Capsules

15.4. Market Value Forecast by Functionality, 2017 - 2031

15.4.1. Immediate Release

15.4.2. Sustained Release

15.4.3. Delayed Release

15.5. Market Value Forecast by Application, 2017 - 2031

15.5.1. Antibiotic & Antibacterial Drugs

15.5.2. Dietary Supplements

15.5.3. Antacid & Antiflatulent Preparations

15.5.4. Cardiovascular Therapy Drugs

15.5.5. Cough & Cold Drugs

15.5.6. Others (Antianemic Preparations, Anti-inflammatory Drugs, etc.)

15.6. Market Value Forecast by End-user, 2017 - 2031

15.6.1. Pharmaceutical & Biopharmaceutical Companies

15.6.2. Nutraceutical Companies

15.6.3. Others

15.7. Market Value Forecast by Country/Sub-region, 2017 - 2031

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. by Source

15.8.2. by Type

15.8.3. by Functionality

15.8.4. by Application

15.8.5. by End-user

15.8.6. by Country/Sub-region

16. Middle East & Africa Empty Capsules Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast by Source, 2017 - 2031

16.2.1. Porcine

16.2.2. Bovine

16.2.3. Marine

16.2.4. Natural

16.3. Market Value Forecast by Type, 2017 - 2031

16.3.1. Gelatin Capsules

16.3.1.1. Hard Gelatin Capsules

16.3.1.2. Soft Gelatin Capsules

16.3.2. Non-gelatin Capsules

16.4. Market Value Forecast by Functionality, 2017 - 2031

16.4.1. Immediate Release

16.4.2. Sustained Release

16.4.3. Delayed Release

16.5. Market Value Forecast by Application, 2017 - 2031

16.5.1. Antibiotic & Antibacterial Drugs

16.5.2. Dietary Supplements

16.5.3. Antacid & Antiflatulent Preparations

16.5.4. Cardiovascular Therapy Drugs

16.5.5. Cough & Cold Drugs

16.5.6. Others (Antianemic Preparations, Anti-inflammatory Drugs, etc.)

16.6. Market Value Forecast by End-user, 2017 - 2031

16.6.1. Pharmaceutical & Biopharmaceutical Companies

16.6.2. Nutraceutical Companies

16.6.3. Others

16.7. Market Value Forecast by Country/Sub-region, 2017 - 2031

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. by Source

16.8.2. by Type

16.8.3. by Functionality

16.8.4. by Application

16.8.5. by End-user

16.8.6. by Country/Sub-region

17. Competition Landscape

17.1. Market Player - Competition Matrix (by Tier and Size of companies)

17.2. Market Share Analysis by Company (2022)

17.3. Company Profiles

17.3.1. ACG

17.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.1.2. Product Portfolio

17.3.1.3. Financial Overview

17.3.1.4. SWOT Analysis

17.3.1.5. Strategic Overview

17.3.2. Lonza Group Ltd.

17.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.2.2. Product Portfolio

17.3.2.3. Financial Overview

17.3.2.4. SWOT Analysis

17.3.2.5. Strategic Overview

17.3.3. Qualicaps (Mitsubishi Chemical Group Corporation)

17.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.3.2. Product Portfolio

17.3.3.3. Financial Overview

17.3.3.4. SWOT Analysis

17.3.3.5. Strategic Overview

17.3.4. Seoheung Co., Ltd.

17.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.4.2. Product Portfolio

17.3.4.3. Financial Overview

17.3.4.4. SWOT Analysis

17.3.4.5. Strategic Overview

17.3.5. The Roxlor Group

17.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.5.2. Product Portfolio

17.3.5.3. Financial Overview

17.3.5.4. SWOT Analysis

17.3.5.5. Strategic Overview

17.3.6. Nectar Lifesciences Ltd

17.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.6.2. Product Portfolio

17.3.6.3. Financial Overview

17.3.6.4. SWOT Analysis

17.3.6.5. Strategic Overview

17.3.7. Medi-Caps Ltd.

17.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.7.2. Product Portfolio

17.3.7.3. Financial Overview

17.3.7.4. SWOT Analysis

17.3.7.5. Strategic Overview

17.3.8. CapsCanada

17.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.8.2. Product Portfolio

17.3.8.3. Financial Overview

17.3.8.4. SWOT Analysis

17.3.8.5. Strategic Overview

17.3.9. Natural Capsules Limited

17.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.9.2. Product Portfolio

17.3.9.3. Financial Overview

17.3.9.4. SWOT Analysis

17.3.9.5. Strategic Overview

List of Tables

Table 01: Global Empty Capsules Market Value (US$ Mn) Forecast, by Source, 2017-2031

Table 02: Global Empty Capsules Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 03: Global Empty Capsules Market Value (US$ Mn) Forecast, by Functionality, 2017-2031

Table 04: Global Empty Capsules Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 05: Global Empty Capsules Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 06: Global Empty Capsules Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 07: North America Empty Capsules Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 08: North America Empty Capsules Market Value (US$ Mn) Forecast, by Source, 2017-2031

Table 09: North America Empty Capsules Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 10: North America Empty Capsules Market Value (US$ Mn) Forecast, by Functionality, 2017-2031

Table 11: North America Empty Capsules Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 12: North America Empty Capsules Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Europe Empty Capsules Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Europe Empty Capsules Market Value (US$ Mn) Forecast, by Source, 2017-2031

Table 15: Europe Empty Capsules Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 16: Europe Empty Capsules Market Value (US$ Mn) Forecast, by Functionality, 2017-2031

Table 17: Europe Empty Capsules Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 18: Europe Empty Capsules Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 19: Asia Pacific Empty Capsules Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 20: Asia Pacific Empty Capsules Market Value (US$ Mn) Forecast, by Source, 2017-2031

Table 21: Asia Pacific Empty Capsules Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 22: Asia Pacific Empty Capsules Market Value (US$ Mn) Forecast, by Functionality, 2017-2031

Table 23: Asia Pacific Empty Capsules Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 24: Asia Pacific Empty Capsules Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 25: Latin America Empty Capsules Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 26: Latin America Empty Capsules Market Value (US$ Mn) Forecast, by Source, 2017-2031

Table 27: Latin America Empty Capsules Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 28: Latin America Empty Capsules Market Value (US$ Mn) Forecast, by Functionality, 2017-2031

Table 29: Latin America Empty Capsules Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 30: Latin America Empty Capsules Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 31: Latin America Empty Capsules Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 32: Middle East & Africa Empty Capsules Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 33: Middle East & Africa Empty Capsules Market Value (US$ Mn) Forecast, by Source, 2017-2031

Table 34: Middle East & Africa Empty Capsules Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 35: Middle East & Africa Empty Capsules Market Value (US$ Mn) Forecast, by Functionality, 2017-2031

Table 36: Middle East & Africa Empty Capsules Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 37: Middle East & Africa Empty Capsules Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Empty Capsules Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Empty Capsules Market Value Share Analysis, by Source, 2022 and 2031

Figure 03: Global Empty Capsules Market Attractiveness Analysis, by Source, 2023-2031

Figure 04: Global Empty Capsules Market Value Share Analysis, by Type, 2022 and 2031

Figure 05: Global Empty Capsules Market Attractiveness Analysis, by Type, 2023-2031

Figure 06: Global Empty Capsules Market Value Share Analysis, by Functionality, 2022 and 2031

Figure 07: Global Empty Capsules Market Attractiveness Analysis, by Functionality, 2023-2031

Figure 08: Global Empty Capsules Market Value Share Analysis, by Application, 2022 and 2031

Figure 09: Global Empty Capsules Market Attractiveness Analysis, by Application, 2023-2031

Figure 10: Global Empty Capsules Market Value Share Analysis, by End-user, 2022 and 2031

Figure 11: Global Empty Capsules Market Attractiveness Analysis, by End-user, 2023-2031

Figure 12: Global Empty Capsules Market Value Share Analysis, by Region, 2022 and 2031

Figure 13: Global Empty Capsules Market Attractiveness Analysis, by Region, 2023-2031

Figure 14: North America Empty Capsules Market Value (US$ Mn) Forecast, 2017-2031

Figure 15: North America Empty Capsules Market Value Share Analysis, by Country, 2022 and 2031

Figure 16: North America Empty Capsules Market Attractiveness Analysis, by Country, 2023-2031

Figure 17: North America Empty Capsules Market Value Share Analysis, by Source, 2022 and 2031

Figure 18: North America Empty Capsules Market Attractiveness Analysis, by Source, 2023-2031

Figure 19: North America Empty Capsules Market Value Share Analysis, by Type, 2022 and 2031

Figure 20: North America Empty Capsules Market Attractiveness Analysis, by Type, 2023-2031

Figure 21: North America Empty Capsules Market Value Share Analysis, by Functionality, 2022 and 2031

Figure 22: North America Empty Capsules Market Attractiveness Analysis, by Functionality, 2023-2031

Figure 23: North America Empty Capsules Market Value Share Analysis, by Application, 2022 and 2031

Figure 24: North America Empty Capsules Market Attractiveness Analysis, by Application, 2023-2031

Figure 25: North America Empty Capsules Market Value Share Analysis, by End-user, 2022 and 2031

Figure 26: North America Empty Capsules Market Attractiveness Analysis, by End-user, 2023-2031

Figure 27: Europe Empty Capsules Market Value (US$ Mn) Forecast, 2017-2031

Figure 28: Europe Empty Capsules Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 29: Europe Empty Capsules Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 30: Europe Empty Capsules Market Value Share Analysis, by Source, 2022 and 2031

Figure 31: Europe Empty Capsules Market Attractiveness Analysis, by Source, 2023-2031

Figure 32: Europe Empty Capsules Market Value Share Analysis, by Type, 2022 and 2031

Figure 33: Europe Empty Capsules Market Attractiveness Analysis, by Type, 2023-2031

Figure 34: Europe Empty Capsules Market Value Share Analysis, by Functionality, 2022 and 2031

Figure 35: Europe Empty Capsules Market Attractiveness Analysis, by Functionality, 2023-2031

Figure 36: Europe Empty Capsules Market Value Share Analysis, by Application, 2022 and 2031

Figure 37: Europe Empty Capsules Market Attractiveness Analysis, by Application, 2023-2031

Figure 38: Europe Empty Capsules Market Value Share Analysis, by End-user, 2022 and 2031

Figure 39: Europe Empty Capsules Market Attractiveness Analysis, by End-user, 2023-2031

Figure 40: Asia Pacific Empty Capsules Market Value (US$ Mn) Forecast, 2017-2031

Figure 41: Asia Pacific Empty Capsules Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Asia Pacific Empty Capsules Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 43: Asia Pacific Empty Capsules Market Value Share Analysis, by Source, 2022 and 2031

Figure 44: Asia Pacific Empty Capsules Market Attractiveness Analysis, by Source, 2023-2031

Figure 45: Asia Pacific Empty Capsules Market Value Share Analysis, by Type, 2022 and 2031

Figure 46: Asia Pacific Empty Capsules Market Attractiveness Analysis, by Type, 2023-2031

Figure 47: Asia Pacific Empty Capsules Market Value Share Analysis, by Functionality, 2022 and 2031

Figure 48: Asia Pacific Empty Capsules Market Attractiveness Analysis, by Functionality, 2023-2031

Figure 49: Asia Pacific Empty Capsules Market Value Share Analysis, by Application, 2022 and 2031

Figure 50: Asia Pacific Empty Capsules Market Attractiveness Analysis, by Application, 2023-2031

Figure 51: Asia Pacific Empty Capsules Market Value Share Analysis, by End-user, 2022 and 2031

Figure 52: Asia Pacific Empty Capsules Market Attractiveness Analysis, by End-user, 2023-2031

Figure 53: Latin America Empty Capsules Market Value (US$ Mn) Forecast, 2017-2031

Figure 54: Latin America Empty Capsules Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 55: Latin America Empty Capsules Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 56: Latin America Empty Capsules Market Value Share Analysis, by Source, 2022 and 2031

Figure 57: Latin America Empty Capsules Market Attractiveness Analysis, by Source, 2023-2031

Figure 58: Latin America Empty Capsules Market Value Share Analysis, by Type, 2022 and 2031

Figure 59: Latin America Empty Capsules Market Attractiveness Analysis, by Type, 2023-2031

Figure 60: Latin America Empty Capsules Market Value Share Analysis, by Functionality, 2022 and 2031

Figure 61: Latin America Empty Capsules Market Attractiveness Analysis, by Functionality, 2023-2031

Figure 62: Latin America Empty Capsules Market Value Share Analysis, by Application, 2022 and 2031

Figure 63: Latin America Empty Capsules Market Attractiveness Analysis, by Application, 2023-2031

Figure 64: Latin America Empty Capsules Market Value Share Analysis, by End-user, 2022 and 2031

Figure 65: Latin America Empty Capsules Market Attractiveness Analysis, by End-user, 2023-2031

Figure 66: Middle East & Africa Empty Capsules Market Value (US$ Mn) Forecast, 2017-2031

Figure 67: Middle East & Africa Empty Capsules Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 68: Middle East & Africa Empty Capsules Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 69: Middle East & Africa Empty Capsules Market Value Share Analysis, by Source, 2022 and 2031

Figure 70: Middle East & Africa Empty Capsules Market Attractiveness Analysis, by Source, 2023-2031

Figure 71: Middle East & Africa Empty Capsules Market Value Share Analysis, by Type, 2022 and 2031

Figure 72: Middle East & Africa Empty Capsules Market Attractiveness Analysis, by Type, 2023-2031

Figure 73: Middle East & Africa Empty Capsules Market Value Share Analysis, by Functionality, 2022 and 2031

Figure 74: Middle East & Africa Empty Capsules Market Attractiveness Analysis, by Functionality, 2023-2031

Figure 75: Middle East & Africa Empty Capsules Market Value Share Analysis, by Application, 2022 and 2031

Figure 76: Middle East & Africa Empty Capsules Market Attractiveness Analysis, by Application, 2023-2031

Figure 77: Middle East & Africa Empty Capsules Market Value Share Analysis, by End-user, 2022 and 2031

Figure 78: Middle East & Africa Empty Capsules Market Attractiveness Analysis, by End-user, 2023-2031