EMEA free-to-air services market: Snapshot

The EMEA free-to-air services market is currently being driven by the speedy rate of adoption of digital technologies. The popularity of digital broadcasting and video-on-demand services are creating an ample demand for FTA services across the world and especially in the EMEA region. The EMEA free-to-air services market is also specifically being driven by the increasing proliferation of IPTV. However, the EMEA free-to-air services market is currently being restricted by the growing scope of piracy that digitization brings with it. The high rate of piracy is denying revenue to multiple players within the market and several of them are taking precautions to protect themselves from this loss of revenue.

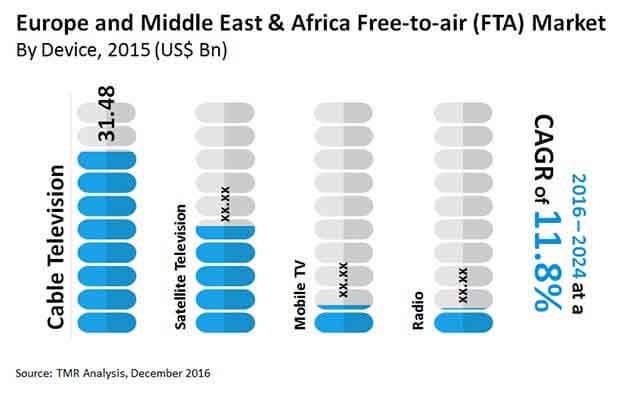

The EMEA free-to-air services market is expected to expand at a CAGR of 11.8% within a forecast period from 2016 to 2024, with regards to its value. At the end of 2015, the EMEA free-to-air services market was calculated at US$59.29 bn, and is expected to reach US$155.8 bn by the end of 2024.

Europe Poses Leading Demand for Free-to-air Services

Among the key regions within the EMEA free-to-air services market, Europe had held the top spot in 2015. Europe is also highly likely to continue leading the EMEA free-to-air services market over the coming years, primarily due to the earlier adoption of key services in the market. As a result, Europe holds a much larger presence of the leading players – especially digital broadcaster – in the EMEA free-to-air services market. The heavy demand for FTA services in Europe has created a massive scope of entry for providers of FTA services in the EMEA region. Germany has especially been a key contributor to Europe’s lead in the EMEA free-to-air services market over the recent past. All in all Europe is expected to show a very optimistic CAGR of 12.1% in the EMEA free-to-air services market, between 2016 and 2024.

Cable Television Takes up Lion’s Share in EMEA Free-to-air Services Market

The EMEA free-to-air services market has been segmented on the basis of devices, into cable television, satellite television, mobile television, and radio. Of these, the market was dominated by cable television in 2015 by taking up close to three-fourths of the market’s total value. It is also expected that cable television will remain the leading segment in the EMEA free-to-air services market for the immediate future, owing to cheaper and easier access and an already high user population. On the other hand, although satellite television held the second spot in the EMEA free-to-air services market in 2015 in terms of value, it is expected to expand at the leading CAGR between 2016 and 2024. A lot of nations in Europe have already taken to adopting digital TVs, further promoting the development and demand for satellite TV FTA services. The shift to digital TVs has allowed users to gain a better video quality and the highly demanded HD channel services.

The list of leading players in the EMEA free-to-air services market in and at points till 2015, includes BT Group Plc., British Broadcasting Corporation, ITV Plc., Deutsche Telekom AG, RTL Group, ProSiebenSat.1 Media SE, Rai Pubblicità, Eutelsat S.A., Sky Plc., and Mediaset SpA.

Increased Viewership of Digital content amidst COVID-19 Lockdown Restrictions Helping Growth of Free-to-Air (FTA) Service Market

The free-to-air (FTA) service market is projected to witness a promising CAGR through the assessment period of 2016-2024 on the back of the rising demand for digital content among a large chunk of the global populace. The entertainment industry has witnessed revolutionary advancements over the years. Based on these factors, the free-to-air service market will observe tremendous growth across the forecast period.

1.Preface

1.1.Market Definition and Scope

1.2.Market Segmentation

1.3.Key Research Objectives

1.4.Research Highlights

2.Assumptions and Research Methodology

3.Executive Summary : Europe and ME Free-to-air Market

4.Market Overview

4.1.Introduction

4.2.Key Market Indicators

4.3.Market Dynamics

4.3.1.Introduction

4.3.2.Key Market Indicators

4.3.3.Market Dynamics

4.4.Global Key Trends

4.5.Market Outlook

5.Europe Free-to-air Market Analysis and Forecast

5.1.Key Findings

5.2.Key Trends

5.3.Free-to-air Market Size (US$ Mn) Forecast By FTA Device, 2014 -2024

5.3.1.Satellite Television

5.3.2.Cable Television

5.3.3.Mobile TV

5.3.4.Radio

5.4.Free-to-air Market Size (US$ Mn ) and Forecast By Country

5.4.1.The U.K.

5.4.2.Germany

5.4.3.France

5.4.4.Rest of Europe

5.5.Free-to-air Market Attractiveness Analysis

5.5.1.By FTA Devices

5.5.2.By Country

6.Middle East Free-to-air Market Analysis and Forecast

6.1.Key Findings

6.2.Key Trends

6.3.Free-to-air Market Size (US$ Mn) Forecast By FTA Device, 2014 -2024

6.3.1.Satellite Television

6.3.2.Cable Television

6.3.3.Mobile TV

6.3.4.Radio

6.4.Free-to-air Market Size (US$ Mn) Forecast By Country, 2014 – 2024

6.4.1.UAE

6.4.2.Saudi Arabia

6.4.3.South Africa

6.4.4.Nigeria

6.4.5.Rest of MEA

6.5.Free-to-air Market Attractiveness Analysis

6.5.1.By FTA Devices

6.5.2.By Country

7.Competition Landscape

7.1.Market Player – Competition Matrix

7.2.Market Positioning Analysis By Company (2015)

7.3.Company Profiles (Details – Overview, Financials, Recent Developments, SWOT Analysis, Strategy)

7.3.1.British Broadcasting Corporation

7.3.1.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

7.3.1.2.Company Description

7.3.1.3.SWOT Analysis

7.3.1.4.Strategic Overview

7.3.2. BT Group Plc

7.3.2.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

7.3.2.2.Company Description

7.3.2.3.SWOT Analysis

7.3.2.4.Strategic Overview

7.3.3. Deutsche Telekom AG

7.3.3.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

7.3.3.2.Company Description

7.3.3.3.SWOT Analysis

7.3.3.4.Strategic Overview

7.3.4. Eutelsat S

7.3.4.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

7.3.4.2.Company Description

7.3.4.3.SWOT Analysis

7.3.4.4.Strategic Overview

7.3.5. ITV Plc

7.3.5.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

7.3.5.2.Company Description

7.3.5.3.SWOT Analysis

7.3.5.4.Strategic Overview

7.3.6. Mediaset SpA

7.3.6.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

7.3.6.2.Company Description

7.3.6.3.SWOT Analysis

7.3.6.4.Strategic Overview

7.3.7. ProSiebenSat

7.3.7.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

7.3.7.2.Company Description

7.3.7.3.SWOT Analysis

7.3.7.4.Strategic Overview

7.3.8. Rai Pubblicità

7.3.8.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

7.3.8.2.Company Description

7.3.8.3.SWOT Analysis

7.3.8.4.Strategic Overview

7.3.9. RTL Group

7.3.9.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

7.3.9.2.Company Description

7.3.9.3.SWOT Analysis

7.3.9.4.Strategic Overview

7.3.10. Sky Plc

7.3.10.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

7.3.10.2.Company Description

7.3.10.3.SWOT Analysis

7.3.10.4.Strategic Overview

8.Key Takeaways

List of Table

Table 01: EMEA Market Size Forecast, By FTA Device, 2014–2024 (US$ Bn)

Table 02: EMEA Market Size Forecast, By Region, 2014–2024 (US$ Bn)

Table 03: Europe Market Size Forecast, By FTA Device, 2014–2024 (US$ Bn)

Table 04: Europe Market Size Forecast, By Country, 2014–2024 (US$ Bn)

Table 05: Middle East & Africa Market Size Forecast, By FTA Device, 2014–2024 (US$ Bn)

Table 06: Middle East & Africa Market Size Forecast, By Country, 2014–2024 (US$ Bn)

List of Figures

Figure 01: Europe & MEA Free-to-Air (FTA) Service Market Size (US$ Bn) Forecast, 2014 – 2024

Figure 02: Europe & MEA Free-to-Air (FTA) Service Market Y-o-Y Growth Projection, 2014 – 2024

Figure 03: EMEA Free-To-Air Market Service Value Share Analysis, By FTA Device, 2016 and 2024

Figure 04: EMEA Free-To-Air Service Market Value Share Analysis, By FTA Device, 2016 and 2024

Figure 05: Europe Free-to-Air (FTA) Service Market Size (US$ Bn) Forecast, 2014 – 2024

Figure 06: Europe Free-to-Air (FTA) Service Market Y-o-Y Growth Projection, 2014 – 2024

Figure 07: Europe Free-To-Air Service Market Value Share Analysis, By FTA Device, 2016 and 2024

Figure 08: Europe Free-To-Air Service Market Value Share Analysis, By Country, 2016 and 2024

Figure 09: Europe Free to Air Services Market Attractiveness Analysis, By FTA Devices

Figure 10: Europe Free to Air Services Market Attractiveness Analysis By Country

Figure 11: MEA Free-to-Air (FTA) Service Market Size (US$ Bn) Forecast, 2014 – 2024

Figure 12: MEA Free-to-Air (FTA) Service Market Y-o-Y Growth Projection, 2014 – 2024

Figure 13: Middle East & Africa Free-To-Air Service Market Value Share, By FTA Device, 2016 and 2024

Figure 14: Middle East & Africa Free-To-Air Service Market Value Share Analysis, By Country, 2016 and 2024

Figure 15: MEA Free to Air Services Market Attractiveness Analysis, By FTA Devices

Figure 16: MEA Free to Air Services Market Attractiveness Analysis By Country

Figure 17: EMEA FTA Service Market Share Analysis (2015)