Analysts’ Viewpoint on EMEA Dismounted Soldier Systems Market Scenario

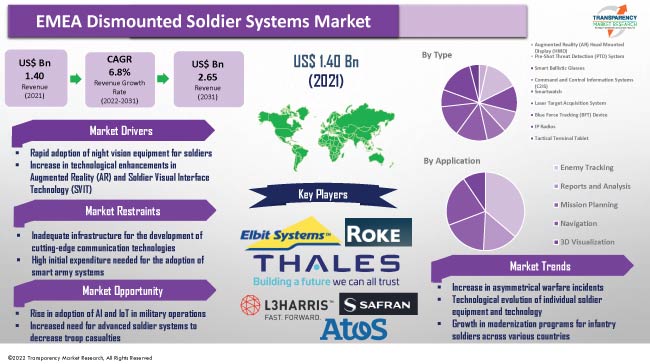

The EMEA dismounted soldier systems market is growing steadily due to the rise in advancements in future integrated soldier systems. The weight of batteries of different devices contributes significantly to the total weight carried by a soldier. Advanced dismounted soldier systems are catering to higher energy demand with minimum weight, as high weight influences the logistic burden. Future European dismounted soldier systems are expected to be influenced by advanced technologies in information and communication technology (ICT), artificial intelligence (AI), and cloud computing. Leading players are focusing on developing advanced soldier systems by following the latest trends in the dismounted soldier systems market and offering innovation in terms of lethality, mobility, power generation, protection, and training.

The term ‘dismounted soldier system’ refers to a set of items that a soldier uses to carry out the given task. These tools can be worn on a soldier’s body and head, stored in his knapsack, or attached to his weapon system. This system ensures a digital map view of the tactical situation, information regarding troop deployment, order reception and issuance, reporting and threat visualization, etc. The system for dismounted soldiers can operate autonomously. It is essential to reduce the weight of loads and improve army ergonomics in order to increase mobility. Dismounted soldier systems with integrated sensing & navigation and better multi-spectral sensors offer collaborative targeting and engagement. They also offer improved Fire Control Systems (FCS) for increased accuracy and lethality. This helps enhance the smart weapons market growth. In the medium to long term, it would be critical to utilize and rely on technology and unmanned systems due to challenges in recruiting enough military personnel in European countries owing to the aging population. Key dismounted soldier system players from Europe are now moving toward emerging economies such as India, Saudi Arabia, Turkey, and a few countries in the Middle East. Increase in adoption of fully integrated soldier systems, joint dismounted soldier systems, and battlefield management systems depicts the future of dismounted soldier systems.

Being able to see at night or in poor visibility situations such as fog or haze is a big tactical advantage in the battlefield. Soldiers wearing night vision equipment can identify and engage the enemy far more quickly than they could if they were only relying on their natural vision. They can also navigate around barriers and spot potential booby traps that are hidden under normal circumstances. Night vision equipment is becoming more affordable and widely available; however, it may fall into the hands of various terrorist organizations. Militaries of various countries seek to purchase newer and more powerful night vision equipment to maintain their technological edge. For instance, the U.S. Army's Family of Weapon Sights connects NVGs (night vision goggles) wirelessly to weapon-mounted thermal sights, enabling soldiers to quickly engage targets without switching between equipment.

Major companies are obtaining contracts for various night vision equipment to deliver end-to-end solutions that meet customers’ mission-critical needs. For instance, in December 2021, Thales Group launched XTRAIM, a new weapon sight offering day/night camouflage capabilities.

A soldier would not need to look "down" or "elsewhere" to obtain situational awareness (SA) information with the next-generation Augmented Reality (AR) Head Mounted Display (HMD); instead, the SA data and video would be brought into his field of view. The efficacy and capabilities of soldiers have risen due to the adoption of networked data and advanced weapon sights. The AR HMD technology has the potential to significantly improve a soldier's situational awareness, target identification and acquisition, and engagement.

Several players are developing advanced Augmented Reality (AR) devices for infantry military to gain a competitive edge in the market. For instance, in June 2021, Thermoteknix, a thermal imaging and night vision specialist, launched a new Augmented Reality (AR) Tactical Interface Module (ARTIM) with enhanced real-time data sharing capabilities, delivering superior night-time surveillance and combat capabilities to troops on the battleground.

In terms of type, the EMEA dismounted soldier systems market has been classified into Augmented Reality (AR) Head Mounted Display (HMD), Pre-Shot Threat Detection (PTD) system, smart ballistic glasses, Command and Control Information Systems (C2IS), smartwatch, laser target acquisition system, Blue Force Tracking (BFT) device, IP radios, tactical terminal tablet, and others. The tactical terminal tablet segment is expected to grow at the fastest CAGR during the forecast period. Tactical terminal tablet enables forces to dominate the battlefield by empowering soldiers with full dismounted situational awareness through net-centric integrated information systems. The device offers real-time situational awareness and can withstand harsh environmental conditions. It is lightweight, and available in wearable computer designs owing to the increase in technological advancements. It comprises an advanced multi-touch display, computing and communications components, built-in GPS, IMU and digital compass. The need for digital soldiers and tactical communications in the military sector is expected to drive the demand for tactical terminal tablets during the forecast period. Widespread deployment of such tablets in various critical mission applications is expected to augment the EMEA dismounted soldier systems market during the forecast period.

In terms of application, the EMEA dismounted soldier systems market has been classified into enemy tracking, reports and analysis, mission planning, navigation, and 3D visualization. The enemy tracking segment accounted for significant share of the market in 2021. It is estimated to maintain its share throughout the forecast period.

The target designator for enemy tracking enhances the safety and operational effectiveness of dismounted units in the field, providing the force commander with situational awareness and an up-to-date snapshot of the exact location of force members in the vicinity. Such devices can track four to 100 persons and support an extended range (up to several kilometers). Such devices can also offer accurate tracking when GPS is unavailable.

Europe held the largest share of the EMEA dismounted soldier systems market in 2021, owing to the presence of key market players, rise in adoption of technological advancements, and availability of lucrative opportunities for manufacturers in countries such as France, Germany, Russia, Turkey, the U.K., Israel, and Italy.

For nearly three decades, Germany has been striving to modernize the equipment used by its infantry soldiers. The IdZ (Infanterist der Zukunft) system is currently being developed, deployed, and adopted by the German Army. According to the SIPRI, Germany was the third largest military expenditure spender in Central and Western Europe in 2021; the country spent around US$ 56.0 Bn or 1.3% of its GDP on its military. The U.K. is making headway in the area of soldier modernization by deeply investigating and investing in unmanned systems, electronic warfare, and cyber capabilities, as well as by overhauling the C4ISR (command, control, communications, computers, intelligence, surveillance, and reconnaissance) equipment and structures used by the British military.

The EMEA dismounted soldier systems market is consolidated, with the presence of a few large-scale vendors that control majority of the share. Several companies are investing significantly in comprehensive research and development activities, including new product development. Expansion of product portfolios and mergers and acquisitions are the key marketing strategies for dismounted soldier systems adopted by market players.

ASELSAN A.Ş., Atos SE, Blackned GmbH, Elbit Systems Ltd., Instro Precision Limited, Roke, SAVOX Communications Oy Ab (Ltd.), Senop Oy, TELDAT Sp. z o.o. sp.k., Thales Group, Safran Electronics & Defense, L3Harris Technologies, Inc., Rheinmetall AG, Collins Aerospace, Excelitas Technologies Corp., and Teledyne FLIR LLC are the prominent players operating in the EMEA dismounted soldier systems market.

Each of these players has been profiled in the EMEA dismounted soldier systems market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.40 Bn |

|

Market Forecast Value in 2031 |

US$ 2.65 Bn |

|

Growth Rate (CAGR) |

6.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at EMEA as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The EMEA dismounted soldier systems was valued at US$ 1.40 Bn in 2021.

The EMEA dismounted soldier systems market is expected to grow at a CAGR of 6.8% by 2031.

The EMEA dismounted soldier systems market is projected to reach US$ 2.65 Bn by 2031.

ASELSAN A.Ş., Atos SE, Blackned GmbH, Elbit Systems Ltd., Instro Precision Limited, Roke, SAVOX Communications Oy Ab (Ltd.), Senop Oy, TELDAT Sp. z o.o. sp.k., Thales Group, Safran Electronics & Defense, L3Harris Technologies, Inc., Rheinmetall AG, Collins Aerospace, Excelitas Technologies Corp., and Teledyne FLIR LLC.

Russia accounted for approximately 26.6% share of the EMEA dismounted soldier systems market in 2021.

Based on type, the tactical terminal tablet segment held around 19.3% share of the EMEA dismounted soldier systems market in 2021.

Increase in asymmetrical warfare incidents, technological evolution of individual soldier equipment and technology, development of Integrated Visual Augmentation System (IVAS), and growth in modernization program of infantry soldiers across various countries.

Europe is a more lucrative region of the EMEA dismounted soldier systems market.

1. Preface

1.1. Market Introduction

1.2. Market and Segment Definitions

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. EMEA Dismounted Soldier Systems Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – C4ISR Application Industry Overview

4.2. Ecosystem Analysis

4.3. Dismounted Soldier System’s Emerging Technologies and Solution Analysis

4.3.1. Smartphone-based Battlefield Visualization System

4.3.2. Optomechanical Thermal Imaging

4.3.3. Interoperable Data Gateway

4.3.4. Unmanned Ground Vehicles (UGVs)

4.3.5. Virtual Battle Lab

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. EMEA Dismounted Soldier Systems Market Analysis, By Type

5.1. Dismounted Soldier Systems Market Size (US$ Mn) Analysis & Forecast, By Type, 2017–2031

5.1.1. Augmented Reality (AR) Head Mounted Display (HMD)

5.1.2. Pre-Shot Threat Detection (PTD) System

5.1.3. Smart Ballistic Glasses

5.1.4. Command and Control Information Systems (C2IS)

5.1.5. Smartwatch

5.1.6. Laser Target Acquisition System

5.1.7. Blue Force Tracking (BFT) Device

5.1.8. IP Radios

5.1.9. Tactical Terminal Tablet

5.1.10. Others (Joystick, Load Carriage, and Protection [LCP], etc.)

5.2. Market Attractiveness Analysis, By Type

6. EMEA Dismounted Soldier Systems Market Analysis, By Application

6.1. Dismounted Soldier Systems Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

6.1.1. Enemy Tracking

6.1.2. Reports and Analysis

6.1.3. Mission Planning

6.1.4. Navigation

6.1.5. 3D Visualization

6.2. Market Attractiveness Analysis, By Application

7. EMEA Dismounted Soldier Systems Market Analysis and Forecast, By Region

7.1. Dismounted Soldier Systems Market Size (US$ Mn) Analysis & Forecast, By Region, 2017–2031

7.1.1. Europe

7.1.2. Middle East & Africa

7.2. Market Attractiveness Analysis, By Region

8. Europe Dismounted Soldier Systems Market Analysis and Forecast

8.1. Market Snapshot

8.2. Drivers and Restraints: Impact Analysis

8.3. Dismounted Soldier Systems Market Size (US$ Mn) Analysis & Forecast, By Type, 2017–2031

8.3.1. Augmented Reality (AR) Head Mounted Display (HMD)

8.3.2. Pre-Shot Threat Detection (PTD) System

8.3.3. Smart Ballistic Glasses

8.3.4. Command and Control Information Systems (C2IS)

8.3.5. Smartwatch

8.3.6. Laser Target Acquisition System

8.3.7. Blue Force Tracking (BFT) Device

8.3.8. IP Radios

8.3.9. Tactical Terminal Tablet

8.3.10. Others (Joystick, Load Carriage, and Protection (LCP), etc.)

8.4. Dismounted Soldier Systems Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

8.4.1. Enemy Tracking

8.4.2. Reports and Analysis

8.4.3. Mission Planning

8.4.4. Navigation

8.4.5. 3D Visualization

8.5. Dismounted Soldier Systems Market Size (US$ Mn) Analysis & Forecast, By Country and Sub-region, 2017–2031

8.5.1. Germany

8.5.2. France

8.5.3. UK

8.5.4. Poland

8.5.5. Ukraine

8.5.6. Russia

8.5.7. Turkey

8.5.8. Rest of Europe

8.6. Market Attractiveness Analysis

8.6.1. By Type

8.6.2. By Application

8.6.3. By Country/Sub-region

9. Middle East & Africa Dismounted Soldier Systems Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Dismounted Soldier Systems Market Size (US$ Mn) Analysis & Forecast, By Type, 2017–2031

9.3.1. Augmented Reality (AR) Head Mounted Display (HMD)

9.3.2. Pre-Shot Threat Detection (PTD) System

9.3.3. Smart Ballistic Glasses

9.3.4. Command and Control Information Systems (C2IS)

9.3.5. Smartwatch

9.3.6. Laser Target Acquisition System

9.3.7. Blue Force Tracking (BFT) Device

9.3.8. IP Radios

9.3.9. Tactical Terminal Tablet

9.3.10. Others (Joystick, Load Carriage, and Protection (LCP), etc.)

9.4. Dismounted Soldier Systems Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

9.4.1. Enemy Tracking

9.4.2. Reports and Analysis

9.4.3. Mission Planning

9.4.4. Navigation

9.4.5. 3D Visualization

9.5. Dismounted Soldier Systems Market Size (US$ Mn) Analysis & Forecast, By Country and Sub-region, 2017–2031

9.5.1. GCC

9.5.2. Israel

9.5.3. Rest of Middle East & Africa

9.6. Market Attractiveness Analysis

9.6.1. By Type

9.6.2. By Application

9.6.3. By Country/Sub-region

10. Competition Assessment

10.1. EMEA Dismounted Soldier Systems Market Competition Matrix - a Dashboard View

10.1.1. EMEA Dismounted Soldier Systems Market Company Share Analysis, by Value (2021)

10.1.2. Technological Differentiator

11. Company Profiles (Manufacturers/Suppliers)

11.1. ASELSAN A.S.

11.1.1. Overview

11.1.2. Product Portfolio

11.1.3. Sales Footprint

11.1.4. Key Subsidiaries or Distributors

11.1.5. Strategy and Recent Developments

11.1.6. Key Financials

11.2. Atos SE

11.2.1. Overview

11.2.2. Product Portfolio

11.2.3. Sales Footprint

11.2.4. Key Subsidiaries or Distributors

11.2.5. Strategy and Recent Developments

11.2.6. Key Financials

11.3. Blackned GmbH

11.3.1. Overview

11.3.2. Product Portfolio

11.3.3. Sales Footprint

11.3.4. Key Subsidiaries or Distributors

11.3.5. Strategy and Recent Developments

11.3.6. Key Financials

11.4. Elbit Systems Ltd.

11.4.1. Overview

11.4.2. Product Portfolio

11.4.3. Sales Footprint

11.4.4. Key Subsidiaries or Distributors

11.4.5. Strategy and Recent Developments

11.4.6. Key Financials

11.5. INSTRO PRECISION LIMITED

11.5.1. Overview

11.5.2. Product Portfolio

11.5.3. Sales Footprint

11.5.4. Key Subsidiaries or Distributors

11.5.5. Strategy and Recent Developments

11.5.6. Key Financials

11.6. Roke

11.6.1. Overview

11.6.2. Product Portfolio

11.6.3. Sales Footprint

11.6.4. Key Subsidiaries or Distributors

11.6.5. Strategy and Recent Developments

11.6.6. Key Financials

11.7. SAVOX Communications Oy Ab (Ltd.)

11.7.1. Overview

11.7.2. Product Portfolio

11.7.3. Sales Footprint

11.7.4. Key Subsidiaries or Distributors

11.7.5. Strategy and Recent Developments

11.7.6. Key Financials

11.8. Senop Oy

11.8.1. Overview

11.8.2. Product Portfolio

11.8.3. Sales Footprint

11.8.4. Key Subsidiaries or Distributors

11.8.5. Strategy and Recent Developments

11.8.6. Key Financials

11.9. TELDAT Sp. z o.o. sp.k.

11.9.1. Overview

11.9.2. Product Portfolio

11.9.3. Sales Footprint

11.9.4. Key Subsidiaries or Distributors

11.9.5. Strategy and Recent Developments

11.9.6. Key Financials

11.10. Thales Group

11.10.1. Overview

11.10.2. Product Portfolio

11.10.3. Sales Footprint

11.10.4. Key Subsidiaries or Distributors

11.10.5. Strategy and Recent Developments

11.10.6. Key Financials

11.11. Safran Electronics & Defense

11.11.1. Overview

11.11.2. Product Portfolio

11.11.3. Sales Footprint

11.11.4. Key Subsidiaries or Distributors

11.11.5. Strategy and Recent Developments

11.11.6. Key Financials

11.12. L3Harris Technologies, Inc.

11.12.1. Overview

11.12.2. Product Portfolio

11.12.3. Sales Footprint

11.12.4. Key Subsidiaries or Distributors

11.12.5. Strategy and Recent Developments

11.12.6. Key Financials

11.13. Rheinmetall AG

11.13.1. Overview

11.13.2. Product Portfolio

11.13.3. Sales Footprint

11.13.4. Key Subsidiaries or Distributors

11.13.5. Strategy and Recent Developments

11.13.6. Key Financials

11.14. Collins Aerospace

11.14.1. Overview

11.14.2. Product Portfolio

11.14.3. Sales Footprint

11.14.4. Key Subsidiaries or Distributors

11.14.5. Strategy and Recent Developments

11.14.6. Key Financials

11.15. Excelitas Technologies Corp.

11.15.1. Overview

11.15.2. Product Portfolio

11.15.3. Sales Footprint

11.15.4. Key Subsidiaries or Distributors

11.15.5. Strategy and Recent Developments

11.15.6. Key Financials

11.16. Teledyne FLIR LLC

11.16.1. Overview

11.16.2. Product Portfolio

11.16.3. Sales Footprint

11.16.4. Key Subsidiaries or Distributors

11.16.5. Strategy and Recent Developments

11.16.6. Key Financials

12. Recommendation

12.1. Opportunity Assessment

12.1.1. By Type

12.1.2. By Application

12.1.3. By Region

List of Tables

Table 1: EMEA Dismounted Soldier Systems Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 2: EMEA Dismounted Soldier Systems Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 3: EMEA Dismounted Soldier Systems Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Table 4: Europe Dismounted Soldier Systems Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 5: Europe Dismounted Soldier Systems Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 6: Europe Dismounted Soldier Systems Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 7: Middle East & Africa Dismounted Soldier Systems Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 8: Middle East & Africa Dismounted Soldier Systems Market Size & Forecast, by Application, Value (US$ Mn), 2017-2031

Table 9: Middle East and Africa Dismounted Soldier Systems Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

List of Figures

Figure 1: EMEA Dismounted Soldier Systems Market, Year-on-Year Growth, EMEA Overview, 2022–2031

Figure 2: EMEA Dismounted Soldier Systems Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 3: EMEA Dismounted Soldier Systems Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 4: EMEA Dismounted Soldier Systems Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022–2031

Figure 5: EMEA Dismounted Soldier Systems Market Share Analysis, by Type, 2022 and 2031

Figure 6: EMEA Dismounted Soldier Systems Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 7: EMEA Dismounted Soldier Systems Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022–2031

Figure 8: EMEA Dismounted Soldier Systems Market Share Analysis, by Application, 2022 and 2031

Figure 9: EMEA Dismounted Soldier Systems Market Projections by Region, Value (US$ Mn), 2017-2031

Figure 10: EMEA Dismounted Soldier Systems Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022–2031

Figure 11: EMEA Dismounted Soldier Systems Market Share Analysis, by Region, 2022 and 2031

Figure 12: Europe Dismounted Soldier Systems Market, Year-on-Year Growth, Overview, 2022–2031

Figure 13: Europe Dismounted Soldier Systems Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 14: Europe Dismounted Soldier Systems Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 15: Europe Dismounted Soldier Systems Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022–2031

Figure 16: Europe Dismounted Soldier Systems Market Share Analysis, by Type, 2022 and 2031

Figure 17: Europe Dismounted Soldier Systems Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 18: Europe Dismounted Soldier Systems Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022–2031

Figure 19: Europe Dismounted Soldier Systems Market Share Analysis, by Application, 2022 and 2031

Figure 20: Europe Dismounted Soldier Systems Market Projections by Country, Value (US$ Mn), 2017-2031

Figure 21: Europe Dismounted Soldier Systems Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022–2031

Figure 22: Europe Dismounted Soldier Systems Market Share Analysis, by Country, 2022 and 2031

Figure 23: Middle East & Africa Dismounted Soldier Systems Market, Year-on-Year Growth, Overview, 2022–2031

Figure 24: Middle East & Africa Dismounted Soldier Systems Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 25: Middle East & Africa Dismounted Soldier Systems Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 26: Middle East & Africa Dismounted Soldier Systems Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022–2031

Figure 27: Middle East & Africa Dismounted Soldier Systems Market Share Analysis, by Type, 2022 and 2031

Figure 28: Middle East & Africa Dismounted Soldier Systems Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 29: Middle East & Africa Dismounted Soldier Systems Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022–2031

Figure 30: Middle East & Africa Dismounted Soldier Systems Market Share Analysis, by Application, 2022 and 2031

Figure 31: Middle East and Africa Dismounted Soldier Systems Market Projections by Country, Value (US$ Mn), 2017-2031

Figure 32: Middle East and Africa Dismounted Soldier Systems Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022–2031

Figure 33: Middle East and Africa Dismounted Soldier Systems Market Share Analysis, by Country, 2022 and 2031