Europe and Middle East Blood Gas and Electrolyte Analyzers Market: Snapshot

Blood gas and electrolyte analyzers have been subject to significant advancements over the years, witnessing a massive transformation from central laboratory applications to treatment for respiratory ailments and point-of-care diagnostic uses. Blood gas testing has been significant for critically ill patients for several years now and manufacturers of analyzers are conscious of the needs of the critical care testing, and offer devices that are easy-to-use and provide quick and accurate results. Moreover, manufacturers have focused on offering smaller sized, multi-parameter monitoring devices with expanding test menus due to increasing demand for advanced analyzers.

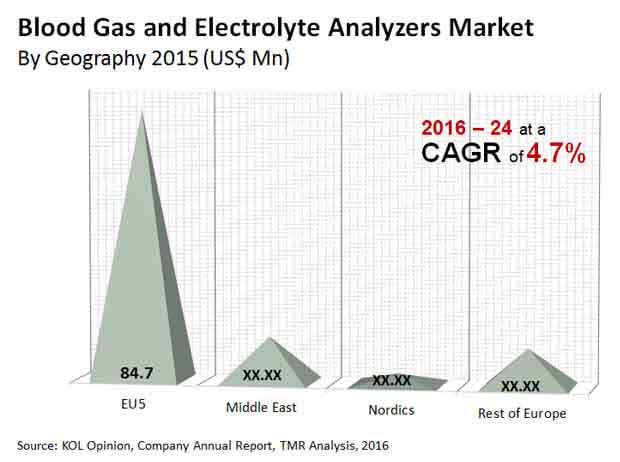

Transparency Market Research estimates that the Europe and Middle East market for blood gas and electrolyte analyzers will expand at a CAGR of 4.7% in terms of revenue from 2016 to 2024. Expanding at this pace, the market is expected to rise from a valuation of US$114.4 mn in 2015 to US$170.5 mn by 2024. In terms of volume, the market is exhibit a slightly higher 5.0% CAGR over the said period.

Time- and Cost-effective Portable Analyzers Gain Increased Focus

For the study, the blood gas and electrolyte analyzers market has been segmented based on modality, product type, end-user, and geography. Based on product modality, the market has been segmented into laboratory analyzers, benchtop analyzers, and portable analyzers. Of these, the segment of laboratory analyzers presently leads, holding a 38% of the market in 2015. The segment, however, is losing market owing to the dearth of skilled laboratory staff in many countries across Europe and the Middle East and the relatively slower nature of laboratory analyzers.

These factors have shifted the preference of consumers to portable analyzers that can be used in point-of-care sites. Portable blood gas and electrolyte analyzers are easy to transport and prove to be the most cost effective when employed in test locations with a low test volume per day. Owing to these factors, the segment of portable analyzers is expected to gain wider acceptance in Europe and Middle East and exhibit a more than 5% CAGR in terms of volume as well as revenue over the forecast period.

Market in EU5 Countries to Hold on to Maximum Share in Overall Market

Geographically, the market in Europe and Middle East has been segmented into three regions: EU5, Nordics, and Middle East. The market in the EU5 region accounted for a massive share of 74% of the EME blood gas and electrolyte analyzers market in 2015. The region is expected to retain its dominant stance in the market in the near future as well, chiefly owing to the sophisticated health care sector, with major focus on quality of care in countries in Europe. Europe is the second largest medical devices market, and is also identified as a rapidly growing point-of-care diagnostics market. Germany dominated the EU5 market with nearly 36% share in 2015 and is expected to be at the forefront in the next few years.

The Nordics region, comprising countries such as Denmark, Iceland, Finland, Norway, and Sweden, accounted for a minimal share in the market in 2015. The Middle East accounted for a moderate 12.4% share in the market in the said year. The region offers opportunities in the blood gas and electrolyte analyzers market due to growing prevalence of a number of diseases leading to increase in patient burden. In the past few years, countries in the Middle East have rapidly developed their health care sectors and are making significant investments to improve the quality of health care in order to become attractive destinations for medical tourism.

In the largely consolidated competitive landscape of the EME blood gas and electrolyte analyzers market, some of the most impactful vendors are Abbott Laboratories, Nova Biomedical, Radiometer Medical ApS, Medica Corporation, ERBA Diagnostics Mannheim GmbH, Siemens Healthcare, Instrumentation Laboratories, and F. Hoffmann-La Roche Ltd.

Blood Gas and Electrolyte Analyzers Market to Derive Gains from Rise in Number of Patients with Infections

A critical ascent in the geriatric populace and the rising pervasiveness in persistent sickness are projected to upgrade the development of the European and Middle East market for blood gas and electrolyte analyzers in the following not many years. The rising demand for PoC analyzers and the decrease in the basic consideration costs are assessed to help the development of the general market in the following not many years. On the other side, the ominous repayment situation and the absence of information investigation programming are anticipated to confine the development of the market in the following not many years. Additionally, the perplexing translation and tasks of information is probably going to limit the development of the market soon. Regardless, the mechanical progressions and advancements are probably going to offer development openings for the market major parts in the following not many years.

Blood gas and electrolyte analyzers depend on critical progressions throughout the long term, witnessing a drastic change from focal research facility applications for the treatment of respiratory afflictions and point-of-care analytic employments. Blood gas testing has been huge for basically sick patients for quite a long while at this point and makers of analyzers are aware of the necessities of the basic consideration testing, and offer gadgets that are not difficult to-utilize and give speedy and precise outcomes. Additionally, makers are focusing on offering more modest measured, multi-boundary observing gadgets with expanding test menus because of expanding demand for cutting edge analyzers.

Development in number of patients being treated in NICUs, ICUs, and department for emergency, coupled with the ascend in patients experiencing ongoing infections; innovative progression in blood gas and electrolyte analyzers, and expansion in number of item endorsements are the main considerations that drive the market development. Be that as it may, intricacy engaged with the translation of blood examination information goes about as a limiting variable for the market development. Expansion in venture by significant clinical diagnostics monsters and improvement in the medical care offices in Asia-Pacific give development freedoms to the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Blood Gas and Electrolyte Analyzer Market

4. Market Overview

4.1. Introduction

4.1.1. Industry Evolution / Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Blood Gas and Electrolyte Analyzer Market Analysis and Forecasts, 2014-2024

4.3.1. Pricing - Actuals and Projections, 2014-2024 (US$ per Unit)

4.4. Porter’s Five Force Analysis

4.5. Market Outlook

4.6. Installed Base By Products

5. Europe Blood Gas and Electrolyte Analyzer Market Analysis and Forecasts, By Modality

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Modality

5.4.1. Standalone

5.4.2. Portable

5.4.3. Handheld

5.5. Modality Comparison Matrix

5.6. Market Attractiveness By Modality

6. Europe Blood Gas and Electrolyte Analyzer Market Analysis and Forecasts, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Product Type

6.4.1. Blood Gas Analyzer

6.4.2. Electrolyte Analyzer

6.4.3. Combination Analyzer

6.4.4. Consumables (Cartridges, Electrodes, Electrolytes)

6.5. Product Type Comparison Matrix

6.6. Market Attractiveness By Product Type

7. Europe Blood Gas and Electrolyte Analyzer Market Analysis and Forecasts, By End-User

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.3.1. Market Size (US$ Mn) and Volume (No. of Units) Forecast By End User

7.3.2. Hospitals

7.3.3. Diagnostic Centers

7.3.4. Ambulatory Surgical Centers

7.3.5. Clinics

7.4. End-User Comparison Matrix

7.5. Market Attractiveness By End-User

8. Europe Blood Gas and Electrolyte Analyzer Market Analysis and Forecasts, By Country

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Key Trends

8.4. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Modality

8.4.1. Standalone

8.4.2. Portable

8.4.3. Handheld

8.5. Market Size (US$ Mn) and Volume (Units) Forecast By Product Type

8.5.1. Blood Gas Analyzer

8.5.2. Electrolyte Analyzer

8.5.3. Combination Analyzer

8.5.4. Consumables (Cartridges, Electrodes, Electrolytes)

8.6. Market Size (US$ Mn) and Volume (Units) Forecast By End-User

8.6.1. Hospitals

8.6.2. Diagnostic Centers

8.6.3. Ambulatory Surgical Centers

8.6.4. Clinics

8.7. Market Attractiveness Analysis

8.7.1. By Modality

8.7.2. By Product Type

8.7.3. By End-User

8.8. U.K. Blood Gas and Electrolyte Analyzer Market Analysis and Forecast

8.8.1. Key Findings

8.8.2. Policies and Regulations

8.8.3. Price Trend Analysis

8.8.4. Key Trends

8.8.5. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Modality

8.8.5.1. Standalone

8.8.5.2. Portable

8.8.5.3. Handheld

8.8.6. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Product Type

8.8.6.1. Blood Gas Analyzer

8.8.6.2. Electrolyte Analyzer

8.8.6.3. Combination Analyzer

8.8.6.4. Consumables (Cartridges, Electrodes, Electrolytes)

8.8.7. Market Size (US$ Mn) and Volume (No. of Units) Forecast By End-User

8.8.7.1. Hospitals

8.8.7.2. Diagnostic Centers

8.8.7.3. Ambulatory Surgical Centers

8.8.7.4. Clinics

8.8.8. Market Attractiveness Analysis

8.8.8.1. By Modality

8.8.8.2. By Product Type

8.8.8.3. By End-User

8.9. France Blood Gas and Electrolyte Analyzer Market Analysis and Forecast

8.9.1. Key Findings

8.9.2. Policies and Regulations

8.9.3. Price Trend Analysis

8.9.4. Key Trends

8.9.5. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Product Type

8.9.5.1. Blood Gas Analyzer

8.9.5.2. Electrolyte Analyzer

8.9.5.3. Combination Analyzer

8.9.5.4. Consumables (Cartridges, Electrodes, Electrolytes)

8.9.6. Market Size (US$ Mn) and Volume (No. of Units) Forecast By End-User

8.9.6.1. Hospitals

8.9.6.2. Diagnostic Centers

8.9.6.3. Ambulatory Surgical Centers

8.9.6.4. Clinics

8.9.7. Market Attractiveness Analysis

8.9.7.1. By Modality

8.9.7.2. By Product Type

8.9.7.3. By End-User

8.10. Italy Blood Gas and Electrolyte Analyzer Market Analysis and Forecast

8.10.1. Key Findings

8.10.2. Policies and Regulations

8.10.3. Price Trend Analysis

8.10.4. Key Trends

8.10.5. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Product Type

8.10.5.1. Blood Gas Analyzer

8.10.5.2. Electrolyte Analyzer

8.10.5.3. Combination Analyzer

8.10.5.4. Consumables (Cartridges, Electrodes, Electrolytes)

8.10.6. Market Size (US$ Mn) and Volume (No. of Units) Forecast By End-User

8.10.6.1. Hospitals

8.10.6.2. Diagnostic Centers

8.10.6.3. Ambulatory Surgical Centers

8.10.6.4. Clinics

8.10.7. Market Attractiveness Analysis

8.10.7.1. By Modality

8.10.7.2. By Product Type

8.10.7.3. By End-User

8.11. Spain Blood Gas and Electrolyte Analyzer Market Analysis and Forecast

8.11.1. Key Findings

8.11.2. Policies and Regulations

8.11.3. Price Trend Analysis

8.11.4. Key Trends

8.11.5. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Product Type

8.11.5.1. Blood Gas Analyzer

8.11.5.2. Electrolyte Analyzer

8.11.5.3. Combination Analyzer

8.11.5.4. Consumables (Cartridges, Electrodes, Electrolytes)

8.11.6. Market Size (US$ Mn) and Volume (No. of Units) Forecast By End-User

8.11.6.1. Hospitals

8.11.6.2. Diagnostic Centers

8.11.6.3. Ambulatory Surgical Centers

8.11.6.4. Clinics

8.11.7. Market Attractiveness Analysis

8.11.7.1. By Modality

8.11.7.2. By Product Type

8.11.7.3. By End-User

8.12. Rest of Europe Blood Gas and Electrolyte Analyzer Market Analysis and Forecast

8.12.1. Key Findings

8.12.2. Policies and Regulations

8.12.3. Price Trend Analysis

8.12.4. Key Trends

8.12.5. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Product Type

8.12.5.1. Blood Gas Analyzer

8.12.5.2. Electrolyte Analyzer

8.12.5.3. Combination Analyzer

8.12.5.4. Consumables (Cartridges, Electrodes, Electrolytes)

8.12.6. Market Size (US$ Mn) and Volume (No. of Units) Forecast By End-User

8.12.6.1. Hospitals

8.12.6.2. Diagnostic Centers

8.12.6.3. Ambulatory Surgical Centers

8.12.6.4. Clinics

8.12.7. Market Attractiveness Analysis

8.12.7.1. By Modality

8.12.7.2. By Product Type

8.12.7.3. By End-User

9. Middle East Blood Gas and Electrolyte Analyzer Market Analysis and Forecasts, By Country

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Key Trends

9.4. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Product Type

9.4.1. Blood Gas Analyzer

9.4.2. Electrolyte Analyzer

9.4.3. Combination Analyzer

9.4.4. Consumables (Cartridges, Electrodes, Electrolytes)

9.5. Market Size (US$ Mn) and Volume (No. of Units) Forecast By End-User

9.5.1.1. Hospitals

9.5.1.2. Diagnostic Centers

9.5.1.3. Ambulatory Surgical Centers

9.5.1.4. Clinics

9.6. Market Attractiveness Analysis

9.6.1.1. By Modality

9.6.1.2. By Product Type

9.6.1.3. By End-User

9.7. Saudi Arabia Blood Gas and Electrolyte Analyzer Market Analysis and Forecast

9.7.1. Key Findings

9.7.2. Policies and Regulations

9.7.3. Price Trend Analysis

9.7.4. Key Trends

9.7.5. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Product Type

9.7.5.1. Blood Gas Analyzer

9.7.5.2. Electrolyte Analyzer

9.7.5.3. Combination Analyzer

9.7.5.4. Consumables (Cartridges, Electrodes, Electrolytes)

9.7.6. Market Size (US$ Mn) and Volume (No. of Units) Forecast By End-User

9.7.6.1. Hospitals

9.7.6.2. Diagnostic Centers

9.7.6.3. Ambulatory Surgical Centers

9.7.6.4. Clinics

9.7.7. Market Attractiveness Analysis

9.7.7.1. By Modality

9.7.7.2. By Product Type

9.7.7.3. By End-User

9.8. UAE Blood Gas and Electrolyte Analyzer Market Analysis and Forecast

9.8.1. Key Findings

9.8.2. Policies and Regulations

9.8.3. Price Trend Analysis

9.8.4. Key Trends

9.8.5. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Product Type

9.8.5.1. Blood Gas Analyzer

9.8.5.2. Electrolyte Analyzer

9.8.5.3. Combination Analyzer

9.8.5.4. Consumables (Cartridges, Electrodes, Electrolytes)

9.8.6. Market Size (US$ Mn) and Volume (No. of Units) Forecast By End-User

9.8.6.1. Hospitals

9.8.6.2. Diagnostic Centers

9.8.6.3. Ambulatory Surgical Centers

9.8.6.4. Clinics

9.8.7. Market Attractiveness Analysis

9.8.7.1. By Modality

9.8.7.2. By Product Type

9.8.7.3. By End-User

9.9. Turkey Blood Gas and Electrolyte Analyzer Market Analysis and Forecast

9.9.1. Key Findings

9.9.2. Policies and Regulations

9.9.3. Price Trend Analysis

9.9.4. Key Trends

9.9.5. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Product Type

9.9.5.1. Blood Gas Analyzer

9.9.5.2. Electrolyte Analyzer

9.9.5.3. Combination Analyzer

9.9.5.4. Consumables (Cartridges, Electrodes, Electrolytes)

9.9.6. Market Size (US$ Mn) and Volume (No. of Units) Forecast By End-User

9.9.6.1. Hospitals

9.9.6.2. Diagnostic Centers

9.9.6.3. Ambulatory Surgical Centers

9.9.6.4. Clinics

9.9.7. Market Attractiveness Analysis

9.9.7.1. By Modality

9.9.7.2. By Product Type

9.9.7.3. By End-User

9.10. Rest of Middle East Blood Gas and Electrolyte Analyzer Market Analysis and Forecast

9.10.1. Key Findings

9.10.2. Policies and Regulations

9.10.3. Price Trend Analysis

9.10.4. Key Trends

9.10.5. Market Size (US$ Mn) and Volume (No. of Units) Forecast By Product Type

9.10.5.1. Blood Gas Analyzer

9.10.5.2. Electrolyte Analyzer

9.10.5.3. Combination Analyzer

9.10.5.4. Consumables (Cartridges, Electrodes, Electrolytes)

9.10.6. Market Size (US$ Mn) and Volume (No. of Units) Forecast By End-User

9.10.6.1. Hospitals

9.10.6.2. Diagnostic Centers

9.10.6.3. Ambulatory Surgical Centers

9.10.6.4. Clinics

9.10.7. Market Attractiveness Analysis

9.10.7.1. By Modality

9.10.7.2. By Product Type

9.10.7.3. By End-User

10. Competition Landscape

10.1. Market Player – Competition Matrix (By Tier and Size of companies)

10.2. Market Share Analysis By Company (2015)

10.3. Company Profiles

10.3.1. Abbott Point of Care Inc.

10.3.1.1. Business Overview

10.3.1.2. Financials

10.3.1.3. Product Portfolio

10.3.1.4. SWOT Analysis

10.3.1.5. Business Strategies

10.3.2. F. Hoffmann-La Roche Ltd.

10.3.2.1. Business Overview

10.3.2.2. Financials

10.3.2.3. Product Portfolio

10.3.2.4. SWOT Analysis

10.3.2.5. Business Strategies

10.3.3. Alere, Inc.

10.3.3.1. Business Overview

10.3.3.2. Financials

10.3.3.3. Product Portfolio

10.3.3.4. SWOT Analysis

10.3.3.5. Business Strategies

10.3.4. Erba Mannheim

10.3.4.1. Business Overview

10.3.4.2. Financials

10.3.4.3. Product Portfolio

10.3.4.4. SWOT Analysis

10.3.4.5. Business Strategies

10.3.5. Medica Corporation

10.3.5.1. Business Overview

10.3.5.2. Financials

10.3.5.3. Product Portfolio

10.3.5.4. SWOT Analysis

10.3.5.5. Business Strategies

10.3.6. Nova Biomedical

10.3.6.1. Business Overview

10.3.6.2. Financials

10.3.6.3. Product Portfolio

10.3.6.4. SWOT Analysis

10.3.6.5. Business Strategies

10.3.7. Radiometer Medical ApS

10.3.7.1. Business Overview

10.3.7.2. Financials

10.3.7.3. Product Portfolio

10.3.7.4. SWOT Analysis

10.3.7.5. Business Strategies

10.3.8. Roche Diagnostics

10.3.8.1. Business Overview

10.3.8.2. Financials

10.3.8.3. Product Portfolio

10.3.8.4. SWOT Analysis

10.3.8.5. Business Strategies

10.3.9. Siemens Healthcare

10.3.9.1. Business Overview

10.3.9.2. Financials

10.3.9.3. Product Portfolio

10.3.9.4. SWOT Analysis

10.3.9.5. Business Strategies

10.3.10. Instrumentation Laboratories (Werfen)

10.3.10.1. Business Overview

10.3.10.2. Financials

10.3.10.3. Product Portfolio

10.3.10.4. SWOT Analysis

10.3.10.5. Business Strategies

List of Tables

Table 01: Europe Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 02: Europe Market, Size (US$ Mn) and Volume (Units) Forecast, By Product , 2016–2024

Table 03: Europe Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016–2024

Table 04: EU5 Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Modality ,

Table 05: EU5 Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016–2024

Table 06: EU5 Market Size (US$ Mn) and Volume (Units) Forecast, By End-user,

Table 07: EU5 Market Size (US$ Mn) and Volume (Units) Forecast, By Country, 2016–2024

Table 08: Germany Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Modality , 2016–2024

Table 09: Germany Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016–2024

Table 10: Germany Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016–2024

Table 11: U.K. Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Modality , 2016 – 2024

Table 12: U.K. Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016–2024

Table 13: U.K. Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016 – 2024

Table 14: France Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 15: France Market Size (US$ Mn) and Volume (Units) Forecast,

Table 16: France Market Size (US$ Mn) and Volume (Units) Forecast,

Table 17: Italy Market Size (US$ Mn) and Volume (Units) Forecast, By Modality, 2016 – 2024

Table 18: Italy Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016 – 2024

Table 19: Italy Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016–2024

Table 20: Spain Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Modality, 2016 – 2024

Table 21: Spain Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016 – 2024

Table 22: Spain Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016–2024

Table 23: Nordics Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 24: Nordics Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016–2024

Table 25: Nordics Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 26: Nordics Market Size (US$ Mn) and Volume (Units) Forecast, By Country, 2016–2024

Table 27: Denmark Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 28: Denmark Market Size (US$ Mn) and Volume (Units) Forecast,

Table 29: Denmark Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016–2024

Table 30: Finland Market Size (US$ Mn) and Volume (Units) Forecast,

Table 31: Finland Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016–2024

Table 32: Finland Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016–2024

Table 33: Iceland Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 34: Iceland Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016 – 2024

Table 35: Iceland Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016 – 2024

Table 36: Norway Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Modality, 2016–2024

Table 37: Norway Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016 – 2024

Table 38: Norway Market Size (US$ Mn) and Volume (Units) Forecast,

Table 39: Sweden Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 40: Sweden Market Size (US$ Mn) and Volume (Units) Forecast,

Table 41: Sweden Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 42: RoE Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Modality, 2016 – 2024

Table 43: RoE Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016 – 2024

Table 44: RoE Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016–2024

Table 45: Middle East Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Modality , 2016–2024

Table 46: Middle East Market Size (US$ Mn) and Volume (Units) Forecast,

Table 47: Middle East Market Size (US$ Mn) and Volume (Units) Forecast,

Table 48: Middle East Market Size (US$ Mn) and Volume (Units) Forecast,

Table 49: Saudi Arabia Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 50: Saudi Arabia Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 51: Saudi Arabia Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016–2024

Table 52: UAE Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Modality, 2016–2024

Table 53: UAE Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016–2024

Table 54: UAE Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016–2024

Table 55: Turkey Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 56: Turkey Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016–2024

Table 57: Turkey Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast,

Table 58: Rest of Middle East Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Modality, 2016–2024

Table 59: Rest of Middle East Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By Product, 2016 – 2024

Table 60: Rest of Middle East Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, By End-user, 2016 – 2024

List of Figures

Figure 01: Europe Blood Gas and Electrolyte Analyzers Market Size (US$ Mn) and Volume (Units) Forecast, 2016–2024

Figure 02: EU5 Blood Gas and Electrolyte Analyzers Price Difference (US$) By Product, 2015

Figure 03: Nordics Blood Gas and Electrolyte Analyzers Price Difference (US$) By Product, 2015

Figure 04: Middle East Blood Gas and Electrolyte Analyzers Price Difference (US$) By Product, 2015

Figure 05: Installed Base Analysis

Figure 06: New Sale and Replacement Analysis

Figure 07: Europe Blood Gas and Electrolyte Analyzers Market Value Share Analysis, By Modality, 2016 and 2024

Figure 08: 5.4.1 Laboratory Blood Gas and Electrolyte Analyzers Market Revenue

Figure 09: 5.4.2 Benchtop Blood Gas and Electrolyte Analyzers Market Revenue

Figure 10: 5.4.3 Portable Blood Gas and Electrolyte Analyzers Market Revenue

Figure 11: Europe Blood Gas and Electrolyte Analyzers Market Attractiveness Analysis By Modality

Figure 12: Europe Blood Gas and Electrolyte Analyzers Market Value Share Analysis, By Product, 2016 and 2024

Figure 13: 6.4.1 Europe Blood Gas Analyzers Market Revenue

Figure 14: 6.4.2 Europe Electrolyte Analyzers Market Revenue

Figure 15: 6.4.3 Europe Combination Analyzers Market Revenue

Figure 16: 6.4.4 Europe Consumables Market Revenue

Figure 17: Europe Blood Gas and Electrolyte Analyzers Market Attractiveness Analysis By Product

Figure 18: Europe Blood Gas and Electrolyte Analyzers Market Value Share Analysis By End-user, 2016 and 2024

Figure 19: 7.5.1 Europe Blood Gas and Electrolyte Analyzers Market , Hospitals Market Revenue

Figure 20: 7.5.2 Europe Blood Gas and Electrolyte Analyzers Market , Diagnostic Centers Market Revenue

Figure 21: 7.5.3 Europe Blood Gas and Electrolyte Analyzers Market , Ambulatory Surgical Centers

Figure 22: 7.5.4 Europe Blood Gas and Electrolyte Analyzers Market , Clinics Market Revenue

Figure 23: Europe Blood Gas and Electrolyte Analyzers Market, By End-user

Figure 24: Europe Blood Gas and Electrolyte Analyzers Market Value Share Analysis By Region, 2016 and 2024

Figure 25: Europe Market Attractiveness Analysis, By Region

Figure 26: Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 27: Market Attractiveness Analysis By Country

Figure 28: EU5 Blood Gas and Electrolyte Analyzers Market Value Share Analysis, By Modality, 2016 and 2024

Figure 29: EU5 Blood Gas and Electrolyte Analyzers Value Share Analysis, By Product, 2016 and 2024

Figure 30: EU5 Blood Gas and Electrolyte Analyzers Market Value Share Analysis, By End-user, 2016 and 2024

Figure 31: EU5 Blood Gas and Electrolyte Analyzers Market Value Share Analysis By Country, 2016 and 2024

Figure 32: Nordics Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 33: Market Attractiveness Analysis By Country

Figure 34: Nordics Blood Gas and Electrolyte Analyzers Market Value Share Analysis, By Modality, 2016 and 2024

Figure 35: Nordics Blood Gas and Electrolyte Analyzers Value Share Analysis, By Product, 2016 and 2024

Figure 36: Nordics Blood Gas and Electrolyte Analyzers Market Value Share Analysis, By End-user, 2016 and 2024

Figure 37: Nordics Blood Gas and Electrolyte Analyzers Market Value Share Analysis By Country, 2016 and 2024

Figure 38: Middle East Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 39: Middle East Market Attractiveness Analysis By Country

Figure 40: Middle East Blood Gas and Electrolyte Analyzers Value Share Analysis, By Modality, 2016 and 2024

Figure 41: Middle East Blood Gas and Electrolyte Analyzers Market Value Share Analysis, By Product, 2016 and 2024

Figure 42: Middle East Blood Gas and Electrolyte Analyzers Market Value Share Analysis, By End-User, 2016 and 2024

Figure 43: Middle East Blood Gas and Electrolyte Analyzers Market Value Share Analysis By Country, 2016 and 2024

Figure 44: Europe Blood Gas and Electrolyte Analyzers Market Share Analysis By Company (2015)