Analysts’ Viewpoint

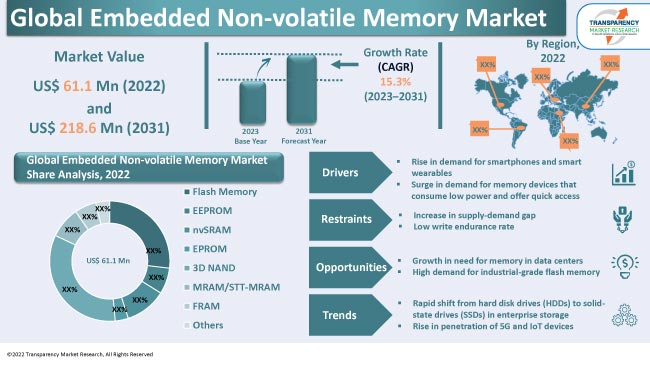

Increase in demand for smartphones and smart wearables is a significant factor driving the global embedded non-volatile memory market. Moreover, increase in need for memory devices that are fast, reliable, and consume low power is expected to augment the embedded non-volatile memory market demand during the forecast period. Embedded non-volatile memory (NVM) technologies are becoming increasingly popular due to their advantages such as reduced costs, enhanced performance, secure storage capability, and configurability.

Furthermore, applications of embedded NVM are rising in several end-use industries including consumer electronics, aerospace & defense, automotive, IT & telecommunication, healthcare, and media & entertainment. Rise in demand for industrial-grade flash memory and increase in penetration of 5G technology are creating value-grab embedded NVM market opportunities for participants. Manufacturers in the global market are focused on offering embedded NVMs that can be used in IoT-based devices.

Embedded non-volatile memory (eNVM) refers to a type of memory that is integrated directly into an integrated circuit or chip. It is designed to store information even when the power is turned off, making it a type of non-volatile memory. eNVM is commonly used to store firmware, calibration data, and other types of configuration data that need to be retained even when the device is powered down. It is often used in microcontrollers, digital signal processors, and other embedded systems.

Increase in demand for embedded non-volatile memory (NVM) in smartphones and smart wearables can be attributed to several factors including growth in usage of mobile devices, advancements in technology, and rise in need for faster access to data. Embedded NVM is a cost-effective solution that can enhance user experience.

Rise in adoption of smart electronic devices is driving demand for memory that can store more data and applications. Development of new and advanced technologies has enabled the creation of more complex and powerful applications, which require a larger memory capacity to function optimally. This is anticipated to positively fuel the demand for embedded non-volatile memory during the forecast period.

Devices that require less density, such as wearables, smart speakers, streaming media devices, printers, and IoT devices, highly prioritize the use of 3D NAND flash memory due to their excellent memory storage and performance capabilities. Samsung, a leading memory manufacturer in South Korea, is focused on the mass production of flash memories that can be extensively used in connected device applications.

Rise in adoption of IoT technology is boosting the demand for highly-efficient memory devices across the globe. These devices require memory that can rapidly store and access data, while consuming low power to extend the battery life of mobile devices. Consumers prefer electronic devices that offer fast and reliable performance. This has led to an increase in the demand for embedded NVM.

Manufacturers are developing new embedded memory technologies such as NAND flash, DRAM, and 3D XPoint. These technologies offer faster access speed and lower power consumption as compared to traditional memory technologies such as hard disk drives and static random-access memory (SRAM).

Additionally, manufacturers are also using advanced packaging technologies, such as system-in-package (SIP) and package-on-package (PoP) to integrate multiple memory chips into a single package, thereby reducing power consumption and increasing performance.

In terms of type, the global market has been classified into flash memory, EEPROM, nvSRAM, EPROM, 3D NAND, MRAM/STT-MRAM, FRAM, and others. The flash memory type segment held major share of the global market in 2022. This segment is anticipated to witness lucrative opportunities in the next few years.

Embedded non-volatile flash memory is faster than traditional disk-based storage, which makes it ideal for use in devices that require fast data access times. Additionally, it is durable, and able to withstand high temperatures, humidity, and other environmental factors.

Embedded non-volatile flash memory is used in electronic devices where space is limited, such as in microcontrollers. It is also used in devices where data or code needs to be stored securely, such as in smart cards or encryption keys.

Based on end-use industry, the global embedded non-volatile memory market has been segmented into automotive, consumer electronics, IT & telecommunication, media & entertainment, aerospace & defense, and others.

As per the latest embedded NVM market research, the consumer electronics end-use industry segment dominated the global industry in 2022, and it is expected to account for major share in the near future.

Rise in demand for smartphones and smart wearable devices is fueling market statistics for embedded non-volatile memory. Technological advancements have led to the development of new and improved devices that are more efficient, faster, and more powerful than their predecessors. This has created a desire among consumers to upgrade their existing electronics, thereby fueling the demand for embedded NNM.

Demand for embedded non-volatile memory in consumer electronics applications is also being driven by various factors, including increased investment in technology research and development and intensified competition among industry players to improve the utilization of such memories.

As per the embedded NVM market analysis, Asia Pacific held major share of the global industry in 2022. This region is likely to dominate the global embedded non-volatile memory market during the forecast period.

Asia Pacific is a significant center for research and development in electronics and semiconductor technology, with several manufacturers operating in the region. Additionally, countries such as China, Japan, Taiwan, and South Korea present long-term opportunities for manufacturers due to the growth in various end-use industries including automotive and consumer electronics. This is a key factor contributing to the embedded NVM market development in Asia Pacific.

The embedded non-volatile memory market size in North America is projected to increase in the near future due to the presence of several prominent manufacturing corporations in the region that offer eNVM components for various industries. Rise in adoption of 5G and IoT devices in the region is expected to fuel embedded NVM market growth during the forecast period.

The global industry is highly fragmented with established players that control majority of the embedded non-volatile memory market share. According to the latest embedded NVM market forecast, several product manufacturers are implementing innovative strategies to create new growth opportunities. Some of the strategies include the expansion of product portfolios, investment in R&D, and mergers & acquisitions.

eMemory Technology Inc., Floadia Corporation, GlobalFoundries Inc., Infineon Technologies AG, Japan Semiconductor Corporation, Kilopass Technology, Inc., SK HYNIX INC., SMIC, Texas Instruments Incorporated, and Toshiba Electronic Devices & Storage Corporation are the prominent players operating in this market worldwide. These players are also engaged in following the latest embedded non-volatile memory market trends.

Key players have been profiled in the embedded non-volatile memory market report based on parameters such as company overview, business strategies, financial overview, product portfolio, recent developments, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 61.1 Mn |

|

Market Forecast Value in 2031 |

US$ 218.6 Mn |

|

Growth Rate (CAGR) |

15.3% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 61.1 Mn in 2022

It is expected to grow at a CAGR of 15.3% by 2031

The business would be worth US$ 218.6 Mn in 2031

The flash memory type segment is likely to hold major share during the forecast period

Shift from hard disk drives (HDDs) to solid-state drives (SSDs) in enterprise storage, and increase in penetration of 5G and IoT Devices

Asia Pacific is projected to be more attractive in the near future

eMemory Technology Inc., Floadia Corporation, Global Foundries, Infineon Technologies AG, Japan Semiconductor Corporation, Kilopass Technology, Inc., SK HYNIX INC., SMIC, Texas Instruments Incorporated, and Toshiba Electronic Devices & Storage Corporation

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Embedded Non-volatile Memory Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Memory Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Embedded Non-volatile Memory Market Analysis, by Type

5.1. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

5.1.1. Flash Memory

5.1.2. EEPROM

5.1.3. nvSRAM

5.1.4. EPROM

5.1.5. 3D NAND

5.1.6. MRAM/STT-MRAM

5.1.7. FRAM

5.1.8. Others

5.2. Market Attractiveness Analysis, by Type

6. Global Embedded Non-volatile Memory Market Analysis, by End-use Industry

6.1. Embedded Non-volatile Memory Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

6.1.1. Automotive

6.1.2. Consumer Electronics

6.1.3. IT & Telecommunication

6.1.4. Media & Entertainment

6.1.5. Aerospace & Defense

6.1.6. Others

6.2. Market Attractiveness Analysis, by End-use Industry

7. Global Embedded Non-volatile Memory Market Analysis and Forecast, by Region

7.1. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

7.2. Market Attractiveness Analysis, by Region

8. North America Embedded Non-volatile Memory Market Analysis and Forecast

8.1. Market Snapshot

8.2. Drivers and Restraints: Impact Analysis

8.3. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

8.3.1. Flash Memory

8.3.2. EEPROM

8.3.3. nvSRAM

8.3.4. EPROM

8.3.5. 3D NAND

8.3.6. MRAM/STT-MRAM

8.3.7. FRAM

8.3.8. Others

8.4. Embedded Non-volatile Memory Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

8.4.1. Automotive

8.4.2. Consumer Electronics

8.4.3. IT & Telecommunication

8.4.4. Media & Entertainment

8.4.5. Aerospace & Defense

8.4.6. Others

8.5. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

8.5.1. The U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. Market Attractiveness Analysis

8.6.1. By Type

8.6.2. By End-use Industry

8.6.3. By Country/Sub-region

9. Europe Embedded Non-volatile Memory Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

9.3.1. Flash Memory

9.3.2. EEPROM

9.3.3. nvSRAM

9.3.4. EPROM

9.3.5. 3D NAND

9.3.6. MRAM/STT-MRAM

9.3.7. FRAM

9.3.8. Others

9.4. Embedded Non-volatile Memory Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

9.4.1. Automotive

9.4.2. Consumer Electronics

9.4.3. IT & Telecommunication

9.4.4. Media & Entertainment

9.4.5. Aerospace & Defense

9.4.6. Others

9.5. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.5.1. The U.K.

9.5.2. Germany

9.5.3. France

9.5.4. Rest of Europe

9.6. Market Attractiveness Analysis

9.6.1. By Type

9.6.2. By End-use Industry

9.6.3. By Country/Sub-region

10. Asia Pacific Embedded Non-volatile Memory Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

10.3.1. Flash Memory

10.3.2. EEPROM

10.3.3. nvSRAM

10.3.4. EPROM

10.3.5. 3D NAND

10.3.6. MRAM/STT-MRAM

10.3.7. FRAM

10.3.8. Others

10.4. Embedded Non-volatile Memory Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

10.4.1. Automotive

10.4.2. Consumer Electronics

10.4.3. IT & Telecommunication

10.4.4. Media & Entertainment

10.4.5. Aerospace & Defense

10.4.6. Others

10.5. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. South Korea

10.5.5. ASEAN

10.5.6. Rest of Asia Pacific

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By End-use Industry

10.6.3. By Country/Sub-region

11. Middle East & Africa Embedded Non-volatile Memory Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

11.3.1. Flash Memory

11.3.2. EEPROM

11.3.3. nvSRAM

11.3.4. EPROM

11.3.5. 3D NAND

11.3.6. MRAM/STT-MRAM

11.3.7. FRAM

11.3.8. Others

11.4. Embedded Non-volatile Memory Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.4.1. Automotive

11.4.2. Consumer Electronics

11.4.3. IT & Telecommunication

11.4.4. Media & Entertainment

11.4.5. Aerospace & Defense

11.4.6. Others

11.5. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.5.1. GCC

11.5.2. South Africa

11.5.3. Rest of the Middle East & Africa

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By End-use Industry

11.6.3. By Country/Sub-region

12. South America Embedded Non-volatile Memory Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

12.3.1. Flash Memory

12.3.2. EEPROM

12.3.3. nvSRAM

12.3.4. EPROM

12.3.5. 3D NAND

12.3.6. MRAM/STT-MRAM

12.3.7. FRAM

12.3.8. Others

12.4. Embedded Non-volatile Memory Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

12.4.1. Automotive

12.4.2. Consumer Electronics

12.4.3. IT & Telecommunication

12.4.4. Media & Entertainment

12.4.5. Aerospace & Defense

12.4.6. Others

12.5. Embedded Non-volatile Memory Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.5.1. Brazil

12.5.2. Rest of South America

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By End-use Industry

12.6.3. By Country/Sub-region

13. Competition Assessment

13.1. Global Embedded Non-volatile Memory Market Competition Matrix - a Dashboard View

13.1.1. Global Embedded Non-volatile Memory Market Company Share Analysis, by Value (2022)

13.1.2. Technological Differentiator

14. Company Profiles (Global Manufacturers/Suppliers)

14.1. eMemory Technology Inc.

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. Floadia Corporation

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. Global Foundries

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. Infineon Technologies AG

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. Japan Semiconductor Corporation

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. Kilopass Technology, Inc.

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. SK HYNIX INC.

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. SMIC

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. Texas Instruments Incorporated

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. Toshiba Electronic Devices & Storage Corporation

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

15. Go to Market Strategy

15.1. Identification of Potential Market Spaces

15.2. Understanding Buying Process of Customers

15.3. Preferred Sales & Marketing Strategy

List of Tables

Table 01: Global Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 02: Global Embedded Non-volatile Memory Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 03: Global Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 04: Global Embedded Non-volatile Memory Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Table 05: Global Embedded Non-volatile Memory Market Size & Forecast, by Region, Volume (Million Units), 2017-2031

Table 06: North America Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 07: North America Embedded Non-volatile Memory Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 08: North America Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 09: North America Embedded Non-volatile Memory Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 10: North America Embedded Non-volatile Memory Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 11: Europe Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 12: Europe Embedded Non-volatile Memory Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 13: Europe Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 14: Europe Embedded Non-volatile Memory Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 15: Europe Embedded Non-volatile Memory Market Size & Forecast, by Region, Volume (Million Units), 2017-2031

Table 16: Asia Pacific Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 17: Asia Pacific Embedded Non-volatile Memory Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 18: Asia Pacific Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 19: Asia Pacific Embedded Non-volatile Memory Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 20: Asia Pacific Embedded Non-volatile Memory Market Size & Forecast, by Region, Volume (Million Units), 2017-2031

Table 21: Middle East & Africa Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 22: Middle East & Africa Embedded Non-volatile Memory Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 23: Middle East & Africa Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 24: Middle East & Africa Embedded Non-volatile Memory Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 25: Middle East & Africa Embedded Non-volatile Memory Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 26: South America Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 27: South America Embedded Non-volatile Memory Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 28: South America Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 29: South America Embedded Non-volatile Memory Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 30: South America Embedded Non-volatile Memory Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

List of Figures

Figure 01: Global Embedded Non-volatile Memory Price Trend Analysis (Average Price, US$)

Figure 02: Global Embedded Non-volatile Memory Market, Value (US$ Mn), 2017-2031

Figure 03: Global Embedded Non-volatile Memory Market, Value (US$ Mn), 2017-2031

Figure 04: Global Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 05: Global Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 06: Global Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 07: Global Embedded Non-volatile Memory Market Attractiveness, By Type, Value (US$ Mn), 2021-2031

Figure 08: Global Embedded Non-volatile Memory Market Share Analysis, by Type, 2021 & 2031

Figure 09: Global Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 10: Global Embedded Non-volatile Memory Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 11: Global Embedded Non-volatile Memory Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 12: Global Embedded Non-volatile Memory Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Figure 13: Global Embedded Non-volatile Memory Market Attractiveness, By Region, Value (US$ Mn), 2021-2031

Figure 14: Global Embedded Non-volatile Memory Market Size & Forecast, by Region, Value (US$ Mn), 2021-2031

Figure 15: North America Embedded Non-volatile Memory Market, Value (US$ Mn), 2017-2031

Figure 16: North America Embedded Non-volatile Memory Market, Value (US$ Mn), 2017-2031

Figure 17: North America Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 18: North America Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 19: North America Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 20: North America Embedded Non-volatile Memory Market Attractiveness, By Type, Value (US$ Mn), 2021-2031

Figure 21: North America Embedded Non-volatile Memory Market Share Analysis, by Type, 2021 & 2031

Figure 22: North America Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 23: North America Embedded Non-volatile Memory Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 24: North America Embedded Non-volatile Memory Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 25: North America Embedded Non-volatile Memory Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 26: North America Embedded Non-volatile Memory Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 27: North America Embedded Non-volatile Memory Market Share Analysis, by Country, 2021 & 2031

Figure 28: Europe Embedded Non-volatile Memory, Value (US$ Mn), 2017-2031

Figure 29: Europe Embedded Non-volatile Memory Market, Value (US$ Mn), 2017-2031

Figure 30: Europe Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 31: Europe Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 32: Europe Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 33: Europe Embedded Non-volatile Memory Market Attractiveness, By Type, Value (US$ Mn), 2021-2031

Figure 34: Europe Embedded Non-volatile Memory Market Share Analysis, by Type, 2021 & 2031

Figure 35: Europe Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 36: Europe Embedded Non-volatile Memory Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 37: Europe Embedded Non-volatile Memory Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 38: Europe Embedded Non-volatile Memory Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 39: Europe Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 40: Europe Embedded Non-volatile Memory Market Share Analysis, by Country, 2021 and 2031

Figure 41: Asia Pacific Embedded Non-volatile Memory Market, Value (US$ Mn), 2017-2031

Figure 42: Asia Pacific Embedded Non-volatile Memory Market, Value (US$ Mn), 2017-2031

Figure 43: Asia Pacific Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 44: Asia Pacific Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 45: Asia Pacific Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 46: Asia Pacific Embedded Non-volatile Memory Market Attractiveness, By Type, Value (US$ Mn), 2021-2031

Figure 47: Asia Pacific Embedded Non-volatile Memory Market Share Analysis, by Type, 2021 & 2031

Figure 48: Asia Pacific Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 49: Asia Pacific Embedded Non-volatile Memory Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 50: Asia Pacific Embedded Non-volatile Memory Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 51: Asia Pacific Embedded Non-volatile Memory Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 52: Asia Pacific Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 53: Asia Pacific Embedded Non-volatile Memory Market Share Analysis, by Country, 2021 and 2031

Figure 54: Middle East & Africa Embedded Non-volatile Memory Market, Value (US$ Mn), 2017-2031

Figure 55: Middle East & Africa Embedded Non-volatile Memory Market, Value (US$ Mn), 2017-2031

Figure 56: Middle East & Africa Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 57: Middle East & Africa Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 58: Middle East & Africa Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 59: Middle East & Africa Embedded Non-volatile Memory Market Attractiveness, By Type, Value (US$ Mn), 2021-2031

Figure 60: Middle East & Africa Embedded Non-volatile Memory Market Share Analysis, by Type, 2021 & 2031

Figure 61: Middle East & Africa Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 62: Middle East & Africa Embedded Non-volatile Memory Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 63: Middle East & Africa Embedded Non-volatile Memory Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 64: Middle East & Africa Embedded Non-volatile Memory Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 65: Middle East & Africa Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 66: Middle East & Africa Embedded Non-volatile Memory Market Share Analysis, by Country, 2021 and 2031

Figure 67: South America Embedded Non-volatile Memory Market, Value (US$ Mn), 2017-2031

Figure 68: South America Embedded Non-volatile Memory Market, Value (US$ Mn), 2017-2031

Figure 69: South America Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 70: South America Embedded Non-volatile Memory Market, Volume (Million Units), 2017-2031

Figure 71: South America Embedded Non-volatile Memory Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 72: South America Embedded Non-volatile Memory Market Attractiveness, By Type, Value (US$ Mn), 2021-2031

Figure 73: South America Embedded Non-volatile Memory Market Share Analysis, by Type, 2021 & 2031

Figure 74: South America Embedded Non-volatile Memory Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 75: South America Embedded Non-volatile Memory Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 76: South America Embedded Non-volatile Memory Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 77: South America Embedded Non-volatile Memory Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 78: South America Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 79: South America Embedded Non-volatile Memory Market Share Analysis, by Country, 2021 and 2031

Figure 80: Global Embedded Non-volatile Memory Market Share Analysis, by Company