Analysts’ Viewpoint

Demand for elevator motors across the globe is being driven by the expansion of commercial and residential buildings, particularly in emerging economies. Rapid urbanization and increase in investment by several governments in infrastructure development projects are augmenting the elevator motors market size. Elevator motors that take less space and provide quiet operations are being developed by high-speed elevator motor manufacturers for skyscrapers.

Market players are focusing on the launch of novel products by integrating new technologies to improve features and functionality of elevators. Collaboration and partnerships among technology firms, component suppliers, and lift manufacturers are fostering new avenues for innovation and accelerating the creation of innovative products and services. Elevator motor producers must abide by stringent regulatory requirements in various regions to fulfill the necessary safety, energy efficiency, and environmental standards.

Elevator motors are used in lifts to propel the lift car up and down. The elevator car moves up and down by means of the turning force that the lift motor produces, which is transferred to the rope winding drum to coil or unwind the rope. A geared or winding drum elevator has a hoist motor. Vertical conveyor motors move materials/products up or down a vertical shaft using a conveyor belt or other lifting devices.

Elevator technology is improving along with advancements in construction technology. Elevators are designed to travel farther, ascend more quickly, be quieter, and provide more comfort.

AC and DC lift motors are used in both residential and commercial lift elevators. Energy-efficient elevators that reduce emissions and energy consumption are in demand across the globe. This factor is projected to fuel elevator motors market development in the near future.

Demand for transportation motors is expected to rise consistently in the near future due to rapid urbanization, growth in the number of high-rise structures, and an increase in the need for better infrastructure.

Several cities across the globe are witnessing rapid growth in population as well as aging infrastructure. According to the World Economic Forum, the share of the global population residing in cities is projected to surge to 80% by 2050, from the current 55%. This is positively impacting the demand for elevators and other vertical transportation motors.

The elevator motors market demand is expanding rapidly in developing nations including India, China, and Southeast Asia, owing to the increase in urbanization, infrastructure development, and rise in demand for high-power elevator motors in commercial and residential buildings.

Furthermore, the increase in the need for modernization and retrofitting of outdated lift systems is offering lucrative elevator motors market opportunities for manufacturers. Manufacturers are focusing on incorporating innovative lift motor technologies that can be integrated with the existing infrastructure.

Elevators have become more reliable, efficient, and safe as a result of the development of destination control systems and energy-saving motors. Energy-saving and environmentally friendly lift motor systems are gaining popularity worldwide because they can lower energy use as well as carbon emissions. This is fueling the demand for advanced and high-performance motor technologies.

Elevator motor manufacturers are heavily investing in the development of advanced safety features to lower accidents and increase the reliability of passenger elevator motors. Modern buildings are increasingly incorporating smart elevators, which offer enhanced comfort, dependability, and energy efficiency. These elevators use sophisticated motor control systems, sensors, and data analytics. Thus, technological advancements are likely to fuel market expansion during the forecast period.

Top elevator motor manufacturers in the world are introducing new technologies while ensuring the safety of elevator users by adopting performance-based safety codes for elevators. For instance, ZIEHL-ABEGG SE’s advanced elevator machine, ZAtopx, combines low noise levels with consistent engine output with its innovative StPUGurt (steel and PU belt) design. The flexible gearless ZAtop model series has a high level of efficiency, small installation width, and narrow shaft dimensions.

As per the elevator motors market analysis, gearless elevator motors are anticipated to contribute to the growth of the global industry during the forecast period.

Gearless traction motors are more compact than geared lift motors since they don't have gears. They are employed for high-speed lifts but they can also be utilized at lower speeds for specific applications.

When compared to a geared motor, elevators without a machine room use a lot less energy. They save considerable expenses by using 70% to 80% less energy in real-time applications.

Moreover, gearless traction motors provide a quieter ride experience and are easy to maintain. These motors are especially crucial for high-speed elevators in tall buildings, as they have the ability to carry heavier loads and operate at faster speeds as compared to geared traction systems. This feature makes them ideal for modern skyscrapers and other high-rise buildings where efficiency and speed are crucial factors.

Gearless motors are more environment-friendly than geared systems, helping reduce a building's carbon footprint. Advances in technology are likely to make gearless traction systems even more efficient and affordable, which is estimated to further drive their popularity.

According to the elevator motors market forecast, North America is anticipated to account for a dominant share of the global industry during the forecast period, owing to increased infrastructure development, construction, and renovation activities in the region.

The elevator motors market in Asia Pacific is anticipated to grow at a rapid pace in the next few years due to rapid urbanization and a rise in building & construction activities in the region. Moreover, the surge in demand for high-rise buildings, an increase in the adoption of advanced technologies, and a rise in demand for energy-efficient elevator systems are contributing to the elevator motors market growth in the Asia Pacific.

As per the global elevator motors market report, manufacturers employ various strategies such as product innovation, partnerships, and acquisitions to remain competitive in the industry.

Changzhou Fulling Motor Co., Ltd, Columbus McKinnon Corporation, Global Partner Elevator, LEESON Electric Corporation, Nidec Motor Corporation, Schindler Elevator Corporation, Siemens AG, The General Electric Company, The Imperial Electric Company, and ZIEHL-ABEGG SE are the top elevator motors companies operating across the globe.

Key players have been profiled in the global elevator motor industry research report based on parameters such as product portfolio, recent developments, financial overview, business segments, company overview, and business strategies.

|

Attribute |

Detail |

|

Market Size Value in 2022 (Base Year) |

US$ 832.5 Mn |

|

Market Forecast Value in 2031 |

US$ 1.4 Bn |

|

Growth Rate (CAGR) |

6.0% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Mn/Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes drivers, restraints, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

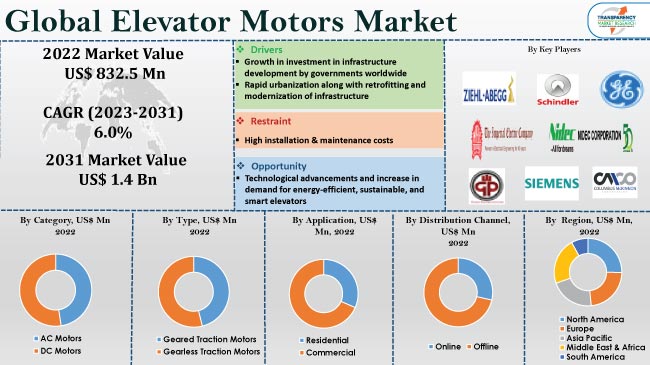

The global market was valued at US$ 832.5 Mn in 2022.

The CAGR is estimated to be 6.0% from 2023 to 2031.

Growth in investment in infrastructure development by governments worldwide and rapid urbanization along with retrofitting and modernization of infrastructure.

The gearless traction motors type segment accounted for major share in 2022.

North America is likely to be the most lucrative region during the forecast period.

Changzhou Fulling Motor Co., Ltd, Columbus McKinnon Corporation, Global Partner Elevator, LEESON Electric Corporation, Nidec Motor Corporation, Schindler Elevator Corporation, Siemens AG, The General Electric Company, The Imperial Electric Company, and ZIEHL-ABEGG SE.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Industry SWOT Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Regulatory Framework & Guidelines

5.9. Technology Overview

5.10. Global Elevator Motors Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Elevator Motors Market Analysis and Forecast, by Category

6.1. Elevator Motors Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

6.1.1. AC Motors

6.1.2. DC Motors

6.2. Incremental Opportunity, by Category

7. Global Elevator Motors Market Analysis and Forecast, by Type

7.1. Elevator Motors Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

7.1.1. Geared Traction Motors

7.1.2. Gearless Traction Motors

7.2. Incremental Opportunity, by Type

8. Global Elevator Motors Market Analysis and Forecast, by Application

8.1. Elevator Motors Market Size (US$ Mn and Thousand Units), by Application, 2017 - 2031

8.1.1. Residential

8.1.2. Commercial

8.2. Incremental Opportunity, by Application

9. Global Elevator Motors Market Analysis and Forecast, by Distribution Channel

9.1. Elevator Motors Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

9.1.1. Online

9.1.2. Offline

9.1.2.1. Direct Sales

9.1.2.2. Indirect Sales

9.2. Incremental Opportunity, by Distribution Channel

10. Global Elevator Motors Market Analysis and Forecast, by Region

10.1. Elevator Motors Market Size (US$ Mn and Thousand Units), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Elevator Motors Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (USD)

11.5. Elevator Motors Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

11.5.1. AC Motors

11.5.2. DC Motors

11.6. Elevator Motors Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

11.6.1. Geared Traction Motors

11.6.2. Gearless Traction Motors

11.7. Elevator Motors Market Size (US$ Mn and Thousand Units), by Application, 2017 - 2031

11.7.1. Residential

11.7.2. Commercial

11.8. Elevator Motors Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

11.8.1. Online

11.8.2. Offline

11.8.2.1. Direct Sales

11.8.2.2. Indirect Sales

11.9. Elevator Motors Market Size (US$ Mn) (Thousand Units), by Country, 2017 - 2031

11.9.1. The U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Elevator Motors Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (USD)

12.5. Elevator Motors Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

12.5.1. AC Motors

12.5.2. DC Motors

12.6. Elevator Motors Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

12.6.1. Geared Traction Motors

12.6.2. Gearless Traction Motors

12.7. Elevator Motors Market Size (US$ Mn and Thousand Units), by Application, 2017 - 2031

12.7.1. Residential

12.7.2. Commercial

12.8. Elevator Motors Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

12.8.1. Online

12.8.2. Offline

12.8.2.1. Direct Sales

12.8.2.2. Indirect Sales

12.9. Elevator Motors Market Size (US$ Mn) (Thousand Units), by Country, 2017 - 2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Elevator Motors Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (USD)

13.5. Elevator Motors Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

13.5.1. AC Motors

13.5.2. DC Motors

13.6. Elevator Motors Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

13.6.1. Geared Traction Motors

13.6.2. Gearless Traction Motors

13.7. Elevator Motors Market Size (US$ Mn and Thousand Units), by Application, 2017 - 2031

13.7.1. Residential

13.7.2. Commercial

13.8. Elevator Motors Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

13.8.1. Online

13.8.2. Offline

13.8.2.1. Direct Sales

13.8.2.2. Indirect Sales

13.9. Elevator Motors Market Size (US$ Mn) (Thousand Units), by Country, 2017 - 2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Elevator Motors Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (USD)

14.5. Elevator Motors Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

14.5.1. AC Motors

14.5.2. DC Motors

14.6. Elevator Motors Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

14.6.1. Geared Traction Motors

14.6.2. Gearless Traction Motors

14.7. Elevator Motors Market Size (US$ Mn and Thousand Units), by Application, 2017 - 2031

14.7.1. Residential

14.7.2. Commercial

14.8. Elevator Motors Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

14.8.1. Online

14.8.2. Offline

14.8.2.1. Direct Sales

14.8.2.2. Indirect Sales

14.9. Elevator Motors Market Size (US$ Mn) (Thousand Units), by Country, 2017 - 2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Elevator Motors Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (USD)

15.5. Elevator Motors Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

15.5.1. AC Motors

15.5.2. DC Motors

15.6. Elevator Motors Market Size (US$ Mn and Thousand Units), by Type, 2017 - 2031

15.6.1. Geared Traction Motors

15.6.2. Gearless Traction Motors

15.7. Elevator Motors Market Size (US$ Mn and Thousand Units), by Application, 2017 - 2031

15.7.1. Residential

15.7.2. Commercial

15.8. Elevator Motors Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

15.8.1. Online

15.8.2. Offline

15.8.2.1. Direct Sales

15.8.2.2. Indirect Sales

15.9. Elevator Motors Market Size (US$ Mn) (Thousand Units), by Country, 2017 - 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), 2022

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

16.3.1. Changzhou Fulling Motor Co., Ltd

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Go-To-Market Strategy

16.3.2. Columbus McKinnon Corporation

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Go-To-Market Strategy

16.3.3. Global Partner Elevator

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Go-To-Market Strategy

16.3.4. LEESON Electric Corporation

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Go-To-Market Strategy

16.3.5. Nidec Motor Corporation

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Go-To-Market Strategy

16.3.6. Schindler Elevator Corporation

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Go-To-Market Strategy

16.3.7. Siemens AG

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Go-To-Market Strategy

16.3.8. The General Electric Company

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Go-To-Market Strategy

16.3.9. The Imperial Electric Company

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Go-To-Market Strategy

16.3.10. ZIEHL-ABEGG SE

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Go-To-Market Strategy

17. Go To Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Elevator Motors Market, by Category, Thousand Units, 2017-2031

Table 2: Global Elevator Motors Market, by Category, US$ Mn, 2017-2031

Table 3: Global Elevator Motors Market, by Type, Thousand Units, 2017-2031

Table 4: Global Elevator Motors Market, by Type, US$ Mn, 2017-2031

Table 5: Global Elevator Motors Market, by Application, Thousand Units, 2017-2031

Table 6: Global Elevator Motors Market, by Application, US$ Mn, 2017-2031

Table 7: Global Elevator Motors Market, by Distribution Channel, Thousand Units, 2017-2031

Table 8: Global Elevator Motors Market, by Distribution Channel, US$ Mn, 2017-2031

Table 9: Global Elevator Motors Market, by Region, Thousand Units, 2017-2031

Table 10: Global Elevator Motors Market, by Region, US$ Mn, 2017-2031

Table 11: North America Elevator Motors Market, by Category, Thousand Units, 2017-2031

Table 12: North America Elevator Motors Market, by Category, US$ Mn, 2017-2031

Table 13: North America Elevator Motors Market, by Type, Thousand Units, 2017-2031

Table 14: North America Elevator Motors Market, by Type, US$ Mn, 2017-2031

Table 15: North America Elevator Motors Market, by Application, Thousand Units, 2017-2031

Table 16: North America Elevator Motors Market, by Application, US$ Mn, 2017-2031

Table 17: North America Elevator Motors Market, by Distribution Channel, Thousand Units, 2017-2031

Table 18: North America Elevator Motors Market, by Distribution Channel, US$ Mn, 2017-2031

Table 19: North America Elevator Motors Market, by Country, Thousand Units, 2017-2031

Table 20: North America Elevator Motors Market, by Country, US$ Mn, 2017-2031

Table 21: Europe Elevator Motors Market, by Category, Thousand Units, 2017-2031

Table 22: Europe Elevator Motors Market, by Category, US$ Mn, 2017-2031

Table 23: Europe Elevator Motors Market, by Type, Thousand Units, 2017-2031

Table 24: Europe Elevator Motors Market, by Type, US$ Mn, 2017-2031

Table 25: Europe Elevator Motors Market, by Application, Thousand Units, 2017-2031

Table 26: Europe Elevator Motors Market, by Application, US$ Mn, 2017-2031

Table 27: Europe Elevator Motors Market, by Distribution Channel, Thousand Units, 2017-2031

Table 28: Europe Elevator Motors Market, by Distribution Channel, US$ Mn, 2017-2031

Table 29: Europe Elevator Motors Market, by Country, Thousand Units, 2017-2031

Table 30: Europe Elevator Motors Market, by Country, US$ Mn, 2017-2031

Table 31: Asia Pacific Elevator Motors Market, by Category, Thousand Units, 2017-2031

Table 32: Asia Pacific Elevator Motors Market, by Category, US$ Mn, 2017-2031

Table 33: Asia Pacific Elevator Motors Market, by Type, Thousand Units, 2017-2031

Table 34: Asia Pacific Elevator Motors Market, by Type, US$ Mn, 2017-2031

Table 35: Asia Pacific Elevator Motors Market, by Application, Thousand Units, 2017-2031

Table 36: Asia Pacific Elevator Motors Market, by Application, US$ Mn, 2017-2031

Table 37: Asia Pacific Elevator Motors Market, by Distribution Channel, Thousand Units, 2017-2031

Table 38: Asia Pacific Elevator Motors Market, by Distribution Channel, US$ Mn, 2017-2031

Table 39: Asia Pacific Elevator Motors Market, by Country, Thousand Units, 2017-2031

Table 40: Asia Pacific Elevator Motors Market, by Country, US$ Mn, 2017-2031

Table 41: Middle East & Africa Elevator Motors Market, by Category, Thousand Units, 2017-2031

Table 42: Middle East & Africa Elevator Motors Market, by Category, US$ Mn, 2017-2031

Table 43: Middle East & Africa Elevator Motors Market, by Type, Thousand Units, 2017-2031

Table 44: Middle East & Africa Elevator Motors Market, by Type, US$ Mn, 2017-2031

Table 45: Middle East & Africa Elevator Motors Market, by Application, Thousand Units, 2017-2031

Table 46: Middle East & Africa Elevator Motors Market, by Application, US$ Mn, 2017-2031

Table 47: Middle East & Africa Elevator Motors Market, by Distribution Channel, Thousand Units, 2017-2031

Table 48: Middle East & Africa Elevator Motors Market, by Distribution Channel, US$ Mn, 2017-2031

Table 49: Middle East & Africa Elevator Motors Market, by Country, Thousand Units, 2017-2031

Table 50: Middle East & Africa Elevator Motors Market, by Country, US$ Mn, 2017-2031

Table 51: South America Elevator Motors Market, by Category, Thousand Units, 2017-2031

Table 52: South America Elevator Motors Market, by Category, US$ Mn, 2017-2031

Table 53: South America Elevator Motors Market, by Type, Thousand Units, 2017-2031

Table 54: South America Elevator Motors Market, by Type, US$ Mn, 2017-2031

Table 55: South America Elevator Motors Market, by Application, Thousand Units, 2017-2031

Table 56: South America Elevator Motors Market, by Application, US$ Mn, 2017-2031

Table 57: South America Elevator Motors Market, by Distribution Channel, Thousand Units, 2017-2031

Table 58: South America Elevator Motors Market, by Distribution Channel, US$ Mn, 2017-2031

Table 59: South America Elevator Motors Market, by Country, Thousand Units, 2017-2031

Table 60: South America Elevator Motors Market, by Country, US$ Mn, 2017-2031

List of Figures

Figure 1: Global Elevator Motors Market Projections by Category, Thousand Units, 2017-2031

Figure 2: Global Elevator Motors Market Projections by Category, US$ Mn, 2017-2031

Figure 3: Global Elevator Motors Market, Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 4: Global Elevator Motors Market Projections by Type, Thousand Units, 2017-2031

Figure 5: Global Elevator Motors Market Projections by Type, US$ Mn, 2017-2031

Figure 6: Global Elevator Motors Market, Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 7: Global Elevator Motors Market Projections by Application, Thousand Units, 2017-2031

Figure 8: Global Elevator Motors Market Projections by Application, US$ Mn, 2017-2031

Figure 9: Global Elevator Motors Market, Incremental Opportunity, by Application, US$ Mn, 2017-2031

Figure 10: Global Elevator Motors Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 11: Global Elevator Motors Market Projections by Distribution Channel, US$ Mn, 2017-2031

Figure 12: Global Elevator Motors Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 13: Global Elevator Motors Market Projections by Region, Thousand Units, 2017-2031

Figure 14: Global Elevator Motors Market Projections by Region, US$ Mn, 2017-2031

Figure 15: Global Elevator Motors Market, Incremental Opportunity, by Region, US$ Mn, 2017-2031

Figure 16: North America Elevator Motors Market Projections by Category, Thousand Units, 2017-2031

Figure 17: North America Elevator Motors Market Projections by Category, US$ Mn, 2017-2031

Figure 18: North America Elevator Motors Market, Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 19: North America Elevator Motors Market Projections by Type, Thousand Units, 2017-2031

Figure 20: North America Elevator Motors Market Projections by Type, US$ Mn, 2017-2031

Figure 21: North America Elevator Motors Market, Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 22: North America Elevator Motors Market Projections by Application, Thousand Units, 2017-2031

Figure 23: North America Elevator Motors Market Projections by Application, US$ Mn, 2017-2031

Figure 24: North America Elevator Motors Market, Incremental Opportunity, by Application, US$ Mn, 2017-2031

Figure 25: North America Elevator Motors Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 26: North America Elevator Motors Market Projections by Distribution Channel, US$ Mn, 2017-2031

Figure 27: North America Elevator Motors Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 28: North America Elevator Motors Market Projections by Country, Thousand Units, 2017-2031

Figure 29: North America Elevator Motors Market Projections by Country, US$ Mn, 2017-2031

Figure 30: North America Elevator Motors Market, Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 31: Europe Elevator Motors Market Projections by Category, Thousand Units, 2017-2031

Figure 32: Europe Elevator Motors Market Projections by Category, US$ Mn, 2017-2031

Figure 33: Europe Elevator Motors Market, Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 34: Europe Elevator Motors Market Projections by Type, Thousand Units, 2017-2031

Figure 35: Europe Elevator Motors Market Projections by Type, US$ Mn, 2017-2031

Figure 36: Europe Elevator Motors Market, Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 37: Europe Elevator Motors Market Projections by Application, Thousand Units, 2017-2031

Figure 38: Europe Elevator Motors Market Projections by Application, US$ Mn, 2017-2031

Figure 39: Europe Elevator Motors Market, Incremental Opportunity, by Application, US$ Mn, 2017-2031

Figure 40: Europe Elevator Motors Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 41: Europe Elevator Motors Market Projections by Distribution Channel, US$ Mn, 2017-2031

Figure 42: Europe Elevator Motors Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 43: Europe Elevator Motors Market Projections by Country, Thousand Units, 2017-2031

Figure 44: Europe Elevator Motors Market Projections by Country, US$ Mn, 2017-2031

Figure 45: Europe Elevator Motors Market, Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 46: Asia Pacific Elevator Motors Market Projections by Category, Thousand Units, 2017-2031

Figure 47: Asia Pacific Elevator Motors Market Projections by Category, US$ Mn, 2017-2031

Figure 48: Asia Pacific Elevator Motors Market, Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 49: Asia Pacific Elevator Motors Market Projections by Type, Thousand Units, 2017-2031

Figure 50: Asia Pacific Elevator Motors Market Projections by Type, US$ Mn, 2017-2031

Figure 51: Asia Pacific Elevator Motors Market, Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 52: Asia Pacific Elevator Motors Market Projections by Application, Thousand Units, 2017-2031

Figure 53: Asia Pacific Elevator Motors Market Projections by Application, US$ Mn, 2017-2031

Figure 54: Asia Pacific Elevator Motors Market, Incremental Opportunity, by Application, US$ Mn, 2017-2031

Figure 55: Asia Pacific Elevator Motors Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 56: Asia Pacific Elevator Motors Market Projections by Distribution Channel, US$ Mn, 2017-2031

Figure 57: Asia Pacific Elevator Motors Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 58: Asia Pacific Elevator Motors Market Projections by Country, Thousand Units, 2017-2031

Figure 59: Asia Pacific Elevator Motors Market Projections by Country, US$ Mn, 2017-2031

Figure 60: Asia Pacific Elevator Motors Market, Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 61: Middle East & Africa Elevator Motors Market Projections by Category, Thousand Units, 2017-2031

Figure 62: Middle East & Africa Elevator Motors Market Projections by Category, US$ Mn, 2017-2031

Figure 63: Middle East & Africa Elevator Motors Market, Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 64: Middle East & Africa Elevator Motors Market Projections by Type, Thousand Units, 2017-2031

Figure 65: Middle East & Africa Elevator Motors Market Projections by Type, US$ Mn, 2017-2031

Figure 66: Middle East & Africa Elevator Motors Market, Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 67: Middle East & Africa Elevator Motors Market Projections by Application, Thousand Units, 2017-2031

Figure 68: Middle East & Africa Elevator Motors Market Projections by Application, US$ Mn, 2017-2031

Figure 69: Middle East & Africa Elevator Motors Market, Incremental Opportunity, by Application, US$ Mn, 2017-2031

Figure 70: Middle East & Africa Elevator Motors Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 71: Middle East & Africa Elevator Motors Market Projections by Distribution Channel, US$ Mn, 2017-2031

Figure 72: Middle East & Africa Elevator Motors Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 73: Middle East & Africa Elevator Motors Market Projections by Country, Thousand Units, 2017-2031

Figure 74: Middle East & Africa Elevator Motors Market Projections by Country, US$ Mn, 2017-2031

Figure 75: Middle East & Africa Elevator Motors Market, Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 76: South America Elevator Motors Market Projections by Category, Thousand Units, 2017-2031

Figure 77: South America Elevator Motors Market Projections by Category, US$ Mn, 2017-2031

Figure 78: South America Elevator Motors Market, Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 79: South America Elevator Motors Market Projections by Type, Thousand Units, 2017-2031

Figure 80: South America Elevator Motors Market Projections by Type, US$ Mn, 2017-2031

Figure 81: South America Elevator Motors Market, Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 82: South America Elevator Motors Market Projections by Application, Thousand Units, 2017-2031

Figure 83: South America Elevator Motors Market Projections by Application, US$ Mn, 2017-2031

Figure 84: South America Elevator Motors Market, Incremental Opportunity, by Application, US$ Mn, 2017-2031

Figure 85: South America Elevator Motors Market Projections by Distribution Channel, Thousand Units, 2017-2031

Figure 86: South America Elevator Motors Market Projections by Distribution Channel, US$ Mn, 2017-2031

Figure 87: South America Elevator Motors Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 88: South America Elevator Motors Market Projections by Country, Thousand Units, 2017-2031

Figure 89: South America Elevator Motors Market Projections by Country, US$ Mn, 2017-2031

Figure 90: South America Elevator Motors Market, Incremental Opportunity, by Country, US$ Mn, 2017-2031