Analysts’ Viewpoint on Electrophysiology Devices Market Scenario

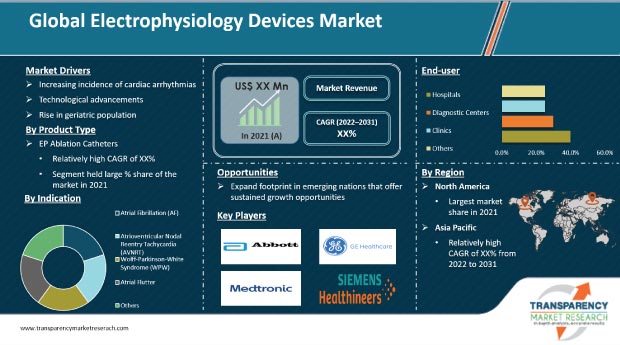

Developing countries such as Brazil, Russia, India, China, and South Africa are engaging in improving healthcare systems. The electrophysiology devices can be sold in large volumes in these markets, as these countries have a significantly large population affected by cardiovascular disorders. Rise in health awareness and unmet medical needs in Latin American countries, such as Mexico and others, are also projected to enhance the uptake of these devices during the forecast period. This, in turn, is anticipated to attract several leading companies such as Medtronic, Siemens, and Abbott to strengthen their presence in emerging economies. However, factors such as stringent regulatory approval process and lack of reimbursement policies are expected to restrain the global market over the next few years.

Overview of the Global Electrophysiology Devices Market

An increase in the incidence of cardiac arrhythmias, a surge in the geriatric population, technological advancements, and developing countries focusing on improving the healthcare infrastructure is expected to drive the global market from 2022 to 2031. China and India are the two most populated countries with a large patient pool and high purchasing power. The Government of India is investing in early-stage research & development to develop innovative health technologies.

Arrhythmias are a key indication for electrophysiology examination. Globally, an increase in the incidence of different types of arrhythmias, such as atrial fibrillation, atrial flutter, ventricular tachycardia, and atrial tachycardia, boosts the growth of the global electrophysiology devices market. The geriatric population and people with high blood pressure, diabetes, obesity, and other cardiovascular diseases are at a high risk of developing arrhythmias. This factor is projected to augment the global market. The National Center for Biotechnology Information (NCBI), the Centers for Disease Control and Prevention (CDC), and the ‘Sign Against Stroke in Atrial Fibrillation campaign by the Polish Foundation state that atrial fibrillation is a highly common form of arrhythmia, which affects more than 2.6 million people in the U.S., around 6 million in Europe, and nearly 8 million in China. The toll is anticipated to increase more than 2.5 times by 2050, due to the rise in the global geriatric population and changing lifestyle-related diseases. There is also increasing adoption of cardiac magnetic resonance imaging (MRI) in patients with arrhythmias. All these factors are expected to propel the demand for electrophysiology products during the forecast period.

Favorable healthcare reforms in various countries such as Japan, the U.S., China, and the U.K. have improved access to various diagnostic and treatment services. This has resulted in increased life expectancy. The geriatric population is susceptible to various ailments, such as abdominal disorders and cardiovascular diseases. Hence, electrophysiology devices are used to diagnose these disorders in the geriatric population.

According to the World Health Organization (WHO), the global geriatric population is projected to reach around 2.1 billion by 2050, which was around 1 billion in 2019. Moreover, the global geriatric population is likely to increase at a rapid pace in developed countries such as the U.S. and Japan. In addition, as stated by the U.S. Census Bureau, around 13% of the country’s population was 65 years & above in 2009, and it is estimated to increase at a rate of 20% by 2030.

The electrophysiology ablation catheters segment accounted for a prominent share of the global electrophysiology devices market in terms of revenue in 2021. The segment is projected to grow at a high CAGR from 2022 to 2031. The surge in the geriatric population is anticipated to increase the patient pool globally. This, in turn, is expected to drive the electrophysiology ablation catheter segment during the forecast period. According to the WHO, cardiovascular diseases (CVDs) is the key cause of death globally. An estimated 17.9 million people succumbed to CVDs in 2021, which represents nearly 32% of all global deaths. Of these deaths, an estimated 85% were due to coronary heart attack and stroke. The surge in the incidence of cardiovascular diseases in the geriatric population is likely to increase the demand for electrophysiology ablation catheters during the forecast period. In addition, electrophysiology lab equipment is expected to register a steady CAGR during the forecast period.

The atrial fibrillation (AF) segment held the largest share of the global market in terms of revenue in 2021, and the trend is projected to continue during the forecast period. An increase in valvular heart diseases, high blood pressure, coronary artery disease, and cardiomyopathy, which are some of the most common risk factors for AF, is anticipated to drive the market during the forecast period.

The hospital's segment accounted for a significant market share in 2021. Hospitals in developed countries are consolidating. This has led to an increase in patient preference for hospitals. Moreover, patients favor hospitals, as these offer benefits such as free online counseling and guidance for electrophysiology devices. These factors are expected to drive the hospital segment. An increase in initiatives by governments and medical professional bodies to promote healthcare services in various countries is a key driver of the hospital segment.

North America accounted for the largest share of the global electrophysiology devices market in 2021, and the trend is projected to continue during the forecast period. Growth of the global market for electrophysiology devices in the region can be attributed to an increase in new product approvals, a rise in demand for electrophysiology devices, acquisitions, partnerships, or collaborations, and regional expansion by regional players in the U.S. and Canada. Europe was the second leading market for electrophysiology devices in 2021. The region has a well-established network of key players; hence, it offers fewer opportunities for new entrants. The Asia Pacific is an emerging market, with high growth potential. The market in the region is likely to grow at a CAGR of 9.1% during the forecast period.

The electrophysiology devices market report concludes with the company profiles section that includes key information about the key players in the global electrophysiology devices business. Market participants are adopting growth strategies such as new product development, product launches, product approval, agreements, partnerships, and mergers.

Some of the leading players analyzed in the report are Abbott Laboratories, Acutus Medical, Inc., F. Siemens AG, Nihon Kohden Corporation, Biosense Webster, Inc., Boston Scientific Corporation, GE Healthcare, Medtronic plc, Koninklijke Philips N.V., Biotronik SE & Co.KG, and Microport Scientific Corporation.

Each of these players has been profiled in the report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 6.7 Bn |

| Market Forecast Value in 2031 | US$ 14.8 Bn |

| Growth Rate (CAGR) | 8.2 % |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Bn for Value & Tons for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global market for electrophysiology devices was valued at US$ 6.7 Bn in 2021 and is projected to reach US$ 14.8 Bn by 2031.

The global market is expected to expand at a CAGR of 8.2% from 2022 to 2031.

Increase in incidence of cardiac arrhythmia and surge in geriatric population are likely to drive the global market.

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period.

The electrophysiology ablation catheters segment is anticipated to account for the largest share of the global market, in terms of revenue, in 2031.

GE Healthcare, Medtronic plc, Koninklijke Philips N.V., Biotronik, MicroPort Scientific Corporation, and Acutus Medical, Inc. are the prominent players in the global electrophysiology devices market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Electrophysiology Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Electrophysiology Devices Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Technological advancements

5.2. Key Industry Events

5.3. COVID-19 Impact

6. Global Electrophysiology Devices Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017-2031

6.3.1. Electrophysiology Ablation Catheters

6.3.1.1. Cryoablation Electrophysiology Catheters

6.3.1.2. Radiofrequency Ablation Catheters

6.3.1.2.1. Irrigated-tip Radiofrequency Ablation Catheters

6.3.1.2.2. Conventional Radiofrequency Ablation Catheters

6.3.1.3. Laser Ablation Systems

6.3.1.4. Microwave Ablation Systems

6.3.1.5. Navigational Advanced Mapping Accessories

6.3.2. Electrophysiology Diagnostic Catheters

6.3.2.1. Conventional Electrophysiology Diagnostic Catheters

6.3.2.1.1. Steerable Diagnostic Catheters

6.3.2.1.2. Fixed Diagnostic Catheters

6.3.2.2. Advanced Electrophysiology Diagnostic Catheters

6.3.2.3. Ultrasound Electrophysiology Diagnostic Catheters

6.3.3. Electrophysiology Laboratory Devices

6.3.4. Access Devices

6.3.5. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Electrophysiology Devices Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017-2031

7.3.1. Hospitals

7.3.2. Diagnostic Centers

7.3.3. Clinics

7.3.4. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Electrophysiology Devices Market Analysis and Forecast, by Indication

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Indication, 2017-2031

8.3.1. Atrial Fibrillation (AF)

8.3.2. Atrioventricular Nodal Reentry Tachycardia (AVNRT)

8.3.3. Wolff-Parkinson-White Syndrome (WPW)

8.3.4. Atrial Flutter

8.3.5. Others

8.4. Market Attractiveness Analysis, by Indication

9. Global Electrophysiology Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Electrophysiology Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017-2031

10.2.1. Electrophysiology Ablation Catheters

10.2.1.1. Cryoablation Electrophysiology Catheters

10.2.1.2. Radiofrequency Ablation Catheters

10.2.1.2.1. Irrigated-tip Radiofrequency Ablation Catheters

10.2.1.2.2. Conventional Radiofrequency Ablation Catheters

10.2.1.3. Laser Ablation Systems

10.2.1.4. Microwave Ablation Systems

10.2.1.5. Navigational Advanced Mapping Accessories

10.2.2. Electrophysiology Diagnostic Catheters

10.2.2.1. Conventional Electrophysiology Diagnostic Catheters

10.2.2.1.1. Steerable Diagnostic Catheters

10.2.2.1.2. Fixed Diagnostic Catheters

10.2.2.2. Advanced Electrophysiology Diagnostic Catheters

10.2.2.3. Ultrasound Electrophysiology Diagnostic Catheters

10.2.3. Electrophysiology Laboratory Devices

10.2.4. Access Devices

10.2.5. Others

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Hospitals

10.3.2. Diagnostic Centers

10.3.3. Clinics

10.3.4. Others

10.4. Market Value Forecast, by Indication, 2017-2031

10.4.1. Atrial Fibrillation (AF)

10.4.2. Atrioventricular Nodal Reentry Tachycardia (AVNRT)

10.4.3. Wolff-Parkinson-White Syndrome (WPW)

10.4.4. Atrial Flutter

10.4.5. Others

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By End-user

10.6.3. By Indication

10.6.4. By Country

11. Europe Electrophysiology Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017-2031

11.2.1. Electrophysiology Ablation Catheters

11.2.1.1. Cryoablation Electrophysiology Catheters

11.2.1.2. Radiofrequency Ablation Catheters

11.2.1.2.1. Irrigated-tip Radiofrequency Ablation Catheters

11.2.1.2.2. Conventional Radiofrequency Ablation Catheters

11.2.1.3. Laser Ablation Systems

11.2.1.4. Microwave Ablation Systems

11.2.1.5. Navigational Advanced Mapping Accessories

11.2.2. Electrophysiology Diagnostic Catheters

11.2.2.1. Conventional Electrophysiology Diagnostic Catheters

11.2.2.1.1. Steerable Diagnostic Catheters

11.2.2.1.2. Fixed Diagnostic Catheters

11.2.2.2. Advanced Electrophysiology Diagnostic Catheters

11.2.2.3. Ultrasound Electrophysiology Diagnostic Catheters

11.2.3. Electrophysiology Laboratory Devices

11.2.4. Access Devices

11.2.5. Others

11.3. Market Value Forecast, by End-user, 2017-2031

11.3.1. Hospitals

11.3.2. Diagnostic Centers

11.3.3. Clinics

11.3.4. Others

11.4. Market Value Forecast, by Indication, 2017-2031

11.4.1. Atrial Fibrillation (AF)

11.4.2. Atrioventricular Nodal Reentry Tachycardia (AVNRT)

11.4.3. Wolff-Parkinson-White Syndrome (WPW)

11.4.4. Atrial Flutter

11.4.5. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By End-user

11.6.3. By Indication

11.6.4. By Country/Sub-region

12. Asia Pacific Electrophysiology Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017-2031

12.2.1. Electrophysiology Ablation Catheters

12.2.1.1. Cryoablation Electrophysiology Catheters

12.2.1.2. Radiofrequency Ablation Catheters

12.2.1.2.1. Irrigated-tip Radiofrequency Ablation Catheters

12.2.1.2.2. Conventional Radiofrequency Ablation Catheters

12.2.1.3. Laser Ablation Systems

12.2.1.4. Microwave Ablation Systems

12.2.1.5. Navigational Advanced Mapping Accessories

12.2.2. Electrophysiology Diagnostic Catheters

12.2.2.1. Conventional Electrophysiology Diagnostic Catheters

12.2.2.1.1. Steerable Diagnostic Catheters

12.2.2.1.2. Fixed Diagnostic Catheters

12.2.2.2. Advanced Electrophysiology Diagnostic Catheters

12.2.2.3. Ultrasound Electrophysiology Diagnostic Catheters

12.2.3. Electrophysiology Laboratory Devices

12.2.4. Access Devices

12.2.5. Others

12.3. Market Value Forecast, by End-user, 2017-2031

12.3.1. Hospitals

12.3.2. Diagnostic Centers

12.3.3. Clinics

12.3.4. Others

12.4. Market Value Forecast, by Indication, 2017-2031

12.4.1. Atrial Fibrillation (AF)

12.4.2. Atrioventricular Nodal Reentry Tachycardia (AVNRT)

12.4.3. Wolff-Parkinson-White Syndrome (WPW)

12.4.4. Atrial Flutter

12.4.5. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By End-user

12.6.3. By Indication

12.6.4. By Country/Sub-region

13. Latin America Electrophysiology Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017-2031

13.2.1. Electrophysiology Ablation Catheters

13.2.1.1. Cryoablation Electrophysiology Catheters

13.2.1.2. Radiofrequency Ablation Catheters

13.2.1.2.1. Irrigated-tip Radiofrequency Ablation Catheters

13.2.1.2.2. Conventional Radiofrequency Ablation Catheters

13.2.1.3. Laser Ablation Systems

13.2.1.4. Microwave Ablation Systems

13.2.1.5. Navigational Advanced Mapping Accessories

13.2.2. Electrophysiology Diagnostic Catheters

13.2.2.1. Conventional Electrophysiology Diagnostic Catheters

13.2.2.1.1. Steerable Diagnostic Catheters

13.2.2.1.2. Fixed Diagnostic Catheters

13.2.2.2. Advanced Electrophysiology Diagnostic Catheters

13.2.2.3. Ultrasound Electrophysiology Diagnostic Catheters

13.2.3. Electrophysiology Laboratory Devices

13.2.4. Access Devices

13.2.5. Others

13.3. Market Value Forecast, by End-user, 2017-2031

13.3.1. Hospitals

13.3.2. Diagnostic Centers

13.3.3. Clinics

13.3.4. Others

13.4. Market Value Forecast, by Indication, 2017-2031

13.4.1. Atrial Fibrillation (AF)

13.4.2. Atrioventricular Nodal Reentry Tachycardia (AVNRT)

13.4.3. Wolff-Parkinson-White Syndrome (WPW)

13.4.4. Atrial Flutter

13.4.5. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By End-user

13.6.3. By Indication

13.6.4. By Country/Sub-region

14. Middle East & Africa Electrophysiology Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017-2031

14.2.1. Electrophysiology Ablation Catheters

14.2.1.1. Cryoablation Electrophysiology Catheters

14.2.1.2. Radiofrequency Ablation Catheters

14.2.1.2.1. Irrigated-tip Radiofrequency Ablation Catheters

14.2.1.2.2. Conventional Radiofrequency Ablation Catheters

14.2.1.3. Laser Ablation Systems

14.2.1.4. Microwave Ablation Systems

14.2.1.5. Navigational Advanced Mapping Accessories

14.2.2. Electrophysiology Diagnostic Catheters

14.2.2.1. Conventional Electrophysiology Diagnostic Catheters

14.2.2.1.1. Steerable Diagnostic Catheters

14.2.2.1.2. Fixed Diagnostic Catheters

14.2.2.2. Advanced Electrophysiology Diagnostic Catheters

14.2.2.3. Ultrasound Electrophysiology Diagnostic Catheters

14.2.3. Electrophysiology Laboratory Devices

14.2.4. Access Devices

14.2.5. Others

14.3. Market Value Forecast, by End-user, 2017-2031

14.3.1. Hospitals

14.3.2. Diagnostic Centers

14.3.3. Clinics

14.3.4. Others

14.4. Market Value Forecast, by Indication, 2017-2031

14.4.1. Atrial Fibrillation (AF)

14.4.2. Atrioventricular Nodal Reentry Tachycardia (AVNRT)

14.4.3. Wolff-Parkinson-White Syndrome (WPW)

14.4.4. Atrial Flutter

14.4.5. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By End-user

14.6.3. By Indication

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Abbott Laboratories

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Acutus Medical, Inc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. F. Siemens AG

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Nihon Kohden Corporation

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Biosense Webster, Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Boston Scientific Corporation

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. GE Healthcare

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Medtronic plc

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Koninklijke Philips N.V.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Biotronik SE & Co.KG

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. Microport Scientific Corporation

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Strategic Overview

15.3.12. Other Players

List of Tables

Table 01: Global Electrophysiology Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 02: Global Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Ablation Catheters, 2017-2031

Table 03: Global Electrophysiology Devices Market Value (US$ Mn) Forecast, by Radiofrequency Ablation Catheters, 2017-2031

Table 04: Global Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Diagnostic Catheters, 2017-2031

Table 05: Global Electrophysiology Devices Market Value (US$ Mn) Forecast, by Conventional Electrophysiology Diagnostic Catheters, 2017-2031

Table 06: Global Electrophysiology Devices Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 07: Global Electrophysiology Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 08: Global Electrophysiology Devices Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 09: North America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 10: North America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 11: North America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Ablation Catheters, 2017-2031

Table 12: North America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Radiofrequency Ablation Catheters, 2017-2031

Table 13: North America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Diagnostic Catheters, 2017-2031

Table 14: North America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Conventional Electrophysiology Diagnostic Catheters, 2017-2031

Table 15: North America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 16: North America Electrophysiology Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 17: Europe Electrophysiology Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Europe Electrophysiology Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 19: Europe Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Ablation Catheters, 2017-2031

Table 20: Europe Electrophysiology Devices Market Value (US$ Mn) Forecast, by Radiofrequency Ablation Catheters, 2017-2031

Table 21: Europe Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Diagnostic Catheters, 2017-2031

Table 22: Europe Electrophysiology Devices Market Value (US$ Mn) Forecast, by Conventional Electrophysiology Diagnostic Catheters, 2017-2031

Table 23: Europe Electrophysiology Devices Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 24: Europe Electrophysiology Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 25: Asia Pacific electrophysiology devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 26: Asia Pacific Electrophysiology Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 27: Asia Pacific Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Ablation Catheters, 2017-2031

Table 28: Asia Pacific Electrophysiology Devices Market Value (US$ Mn) Forecast, by Radiofrequency Ablation Catheters, 2017-2031

Table 29: Asia Pacific Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Diagnostic Catheters, 2017-2031

Table 30: Asia Pacific Electrophysiology Devices Market Value (US$ Mn) Forecast, by Conventional Electrophysiology Diagnostic Catheters, 2017-2031

Table 31: Asia Pacific Electrophysiology Devices Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 32: Asia Pacific Electrophysiology Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 33: Latin America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 34: Latin America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 35: Latin America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Ablation Catheters, 2017-2031

Table 36: Latin America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Radiofrequency Ablation Catheters, 2017-2031

Table 37: Latin America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Diagnostic Catheters, 2017-2031

Table 38: Latin America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Conventional Electrophysiology Diagnostic Catheters, 2017-2031

Table 39: Latin America Electrophysiology Devices Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 40: Latin America Electrophysiology Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 41: Middle East & Africa Electrophysiology Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 42: Middle East & Africa Electrophysiology Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 43: Middle East & Africa Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Ablation Catheters, 2017-2031

Table 44: Middle East & Africa Electrophysiology Devices Market Value (US$ Mn) Forecast, by Radiofrequency Ablation Catheters, 2017-2031

Table 45: Middle East & Africa Electrophysiology Devices Market Value (US$ Mn) Forecast, by Electrophysiology Diagnostic Catheters, 2017-2031

Table 46: Middle East & Africa Electrophysiology Devices Market Value (US$ Mn) Forecast, by Conventional Electrophysiology Diagnostic Catheters, 2017-2031

Table 47: Middle East & Africa Electrophysiology Devices Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 48: Middle East & Africa Electrophysiology Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Electrophysiology Devices Market Value (US$ Bn) and Distribution, by Region, 2021 and 2031

Figure 02: Market Snapshot of Global Electrophysiology Devices Market

Figure 03: Global Electrophysiology Devices Market Value (US$ Bn) Forecast, 2017-2031

Figure 04: Global Electrophysiology Devices Market Value Share, by Region, 2018

Figure 05: Global Electrophysiology Devices Market Value Share, by Product Type, 2018

Figure 06: Global Electrophysiology Devices Market Value Share, by Indication, 2018

Figure 07: Global Electrophysiology Devices Market Value Share, by End-user, 2018

Figure 08: Global Electrophysiology Devices Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 09: Global Electrophysiology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 10: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Electrophysiology Ablation Catheters, 2017-2031

Figure 11: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Electrophysiology Diagnostic Catheters, 2017-2031

Figure 12: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Electrophysiology Laboratory Devices, 2017-2031

Figure 13: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Access Devices, 2017-2031

Figure 14: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017-2031

Figure 15: Global Electrophysiology Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 16: Global Electrophysiology Devices Market Attractiveness Analysis, by Indication, 2022-2031

Figure 17: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Atrial Fibrillation, 2017-2031

Figure 18: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Atrioventricular Nodal Re-entry Tachycardia, 2017-2031

Figure 19: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Wolff-Parkinson-White Syndrome, 2017-2031

Figure 20: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Atrial Flutter, 2017-2031

Figure 21: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017-2031

Figure 22: Global Electrophysiology Devices Market Value Share Analysis, by End-user, 2017 and 2026

Figure 23: Global Electrophysiology Devices Market Attractiveness Analysis, by End-user, 2018-2026

Figure 24: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Hospitals, 2017-2031

Figure 25: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Diagnostic Centers, 2017-2031

Figure 26: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Clinics, 2017-2031

Figure 27: Global Electrophysiology Devices Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2017-2031

Figure 28: Global Electrophysiology Devices Market Value Share (%), by Region, 2021 and 2031

Figure 29: Global Electrophysiology Devices Market Attractiveness Analysis, by Region, 2022-2031

Figure 30: North America Electrophysiology Devices Market Value (US$ Bn) Forecast, 2017-2031

Figure 31: North America Electrophysiology Devices Market Value Share (%), by Country, 2021 and 2031

Figure 32: North America Electrophysiology Devices Market Attractiveness Analysis, by Country, 2022-2031

Figure 33: North America Electrophysiology Devices Market Value Share (%), by Product Type, 2021 and 2031

Figure 34: North America Electrophysiology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 35: North America Electrophysiology Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 36: North America Electrophysiology Devices Market Attractiveness Analysis, by Indication, 2022-2031

Figure 37: North America Electrophysiology Devices Market Value Share (%), by End-user, 2021 and 2031

Figure 38: North America Electrophysiology Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 39: Europe Electrophysiology Devices Market Value (US$ Bn) Forecast, 2017-2031

Figure 40: Europe Electrophysiology Devices Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 41: Europe Electrophysiology Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 42: Europe Electrophysiology Devices Market Value Share (%), by Product Type, 2021 and 2031

Figure 43: Europe Electrophysiology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 44: Europe Electrophysiology Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 45: Europe Electrophysiology Devices Market Attractiveness Analysis, by Indication, 2022-2031

Figure 46: Europe Electrophysiology Devices Market Value Share (%), by End-user, 2021 and 2031

Figure 47: Europe Electrophysiology Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 48: Asia Pacific Electrophysiology Devices Market Value (US$ Bn) Forecast, 2017-2031

Figure 49: Asia Pacific Electrophysiology Devices Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 50: Asia Pacific Electrophysiology Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 51: Asia Pacific Electrophysiology Devices Market Value Share (%), by Product Type, 2021 and 2031

Figure 52: Asia Pacific Electrophysiology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 53: Asia Pacific Electrophysiology Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 54: Asia Pacific Electrophysiology Devices Market Attractiveness Analysis, by Indication, 2022-2031

Figure 55: Asia Pacific Electrophysiology Devices Market Value Share (%), by End-user, 2021 and 2031

Figure 56: Asia Pacific Electrophysiology Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 57: Latin America Electrophysiology Devices Market Value (US$ Bn) Forecast, 2017-2031

Figure 58: Latin America Electrophysiology Devices Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 59: Latin America Electrophysiology Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 60: Latin America Electrophysiology Devices Market Value Share (%), by Product Type, 2021 and 2031

Figure 61: Latin America Electrophysiology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 62: Latin America Electrophysiology Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 63: Latin America Electrophysiology Devices Market Attractiveness Analysis, by Indication, 2022-2031

Figure 64: Latin America Electrophysiology Devices Market Value Share (%), by End-user, 2021 and 2031

Figure 65: Latin America Electrophysiology Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 66: Middle East & Africa Electrophysiology Devices Market Value (US$ Bn) Forecast, 2017-2031

Figure 67: Middle East & Africa Electrophysiology Devices Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 68: Middle East & Africa Electrophysiology Devices Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 69: Middle East & Africa Electrophysiology Devices Market Value Share (%), by Product Type, 2021 and 2031

Figure 70: Middle East & Africa Electrophysiology Devices Market Attractiveness Analysis, by Product Type, 2022-2031

Figure 71: Middle East & Africa Electrophysiology Devices Market Value Share Analysis, by Indication, 2021 and 2031

Figure 72: Middle East & Africa Electrophysiology Devices Market Attractiveness Analysis, by Indication, 2022-2031

Figure 73: Middle East & Africa Electrophysiology Devices Market Value Share (%), by End-user, 2021 and 2031

Figure 74: Middle East & Africa Electrophysiology Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 75: Global Electrophysiology Devices Market Share, by Company, 2021