Players in the electronic records management solutions market are challenged with dynamic transitions in technology, competition, regulatory compliance, and profitability. The added pressure of zero room for inefficiency in the management operations of medium and large-scale enterprises has given rise to the demand for efficacious electronic records management solutions.

Currently, service providers operating in the electronic records management solutions market are offering cloud-based solutions to establish a centralized network to back up important documents and confidential information. By bringing a cloud-based centralized system in place, companies can promote the collaboration of various stakeholders in organization and promote transparency for important decision-making initiatives.

Transparency in document creation helps set up an audit trail that tracks the number of users operating the cloud-based electronic records management solutions system, feeds records, and streamlines the workflow. Cloud-based systems help break down the silos. For example, if the research and development (R&D) team develops their own combination of software to carry out their operations, then other teams such as sales and marketing are deprived of valuable information that is restricted to the R&D team. Thus, manufacturers in the electronic records management solutions market offer cloud-based solutions to break down walls and support true collaboration amongst authorized stakeholders.

The last few years have seen a wave of transformation in the banking, financial services, and insurance (BFSI) sector. Conventional banking operations are getting evolved into new-age and technologically-agile procedures in the electronic records management solutions market.

Document management solutions play a crucial role in the BFSI sector. The efficient management of several hard copies, financial statements, and loan agreements can become tedious with traditional record management practices. Thus, players in the electronic records management solutions market offer the BFSI sector with tremendous financial gains to avoid redundant paper-based and printing costs. Also, role-based access helps safeguard the sensitive information of individuals and avoids it from falling into the trap of malicious activities.

Other advantages empower users in the BFSI sector with speedy customer service. Since customers do not appreciate waiting in long queues, the automated workflow of electronic records management solutions reduce the time needed to complete the loop of several transactions. Electronic records management solutions also promote efficient teamwork by easily distributing responsibilities amongst employees who can simultaneously collaborate to carry out tasks. Thus, stakeholders in the electronic records management solutions market need to focus of streamlining audit trails for the BFSI sector.

Since the BFSI sector is a mine of sensitive customer information, security breaches and malicious use of database have always been the key risks in electronic records management solutions. Also, regulatory policies in the BFSI sector constantly keep changing and include complex clauses. This poses as a restraint for players in the electronic records management solutions market to constantly keep a tap on the frequently changing policies and develop efficacious systems that can adhere to the complex clauses of these regulatory norms. Thus, market players need to devise mechanisms and infrastructure to accelerate the process of building robust electronic records management solutions due to ever-changing regulatory policies.

Analysts’ Viewpoint

Analysts suggest that, manufacturers in the electronic records management solutions market can invest in cloud-based management systems as they can be installed at much lesser costs. Market players can also increase capacities to provide professional services and educate users on how they can use software-based systems to their full advantage, and help users in enterprises to automate their workflow.

Electronic records management solutions help stakeholders in the BFSI sector in achieving profitable gains. However, market players need to devise a mechanism where users can access information from cloud-based systems even when the host provider’s data center is undergoing technical maintenance. Players functioning in the electronic records management solutions market should focus on increasing the storage limits of cloud-based systems and provide value-add benefits such as enhanced customer onboarding, intuitive user interfaces, and architectural scalability to cater to the changing needs of customers.

Electronic Records Management Solutions Market in Brief

Electronic Records Management Solutions Market: Definition

Asia Pacific Electronic Records Management Solutions Market– Snapshot

Key Growth Drivers of the Electronic Records Management Solutions Market

Key Challenges Faced by Electronic Records Management Solutions Market Players

Electronic Records Management Solutions Market - Company Profiles

Major players operating in the global electronic records management solutions market and profiled in the report include Ideagen Plc, Alfresco Software, Inc, MasterControl, Inc, T-Systems International GmbH, and M-Files Corporation.

1. Preface

1.1. Market Scope

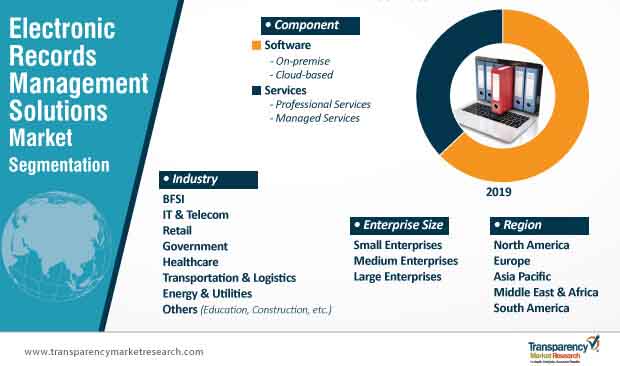

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary : Global Electronic Records Management Solutions Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Mn), 2013, 2019, 2027

4.3. Technology/Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. PESTEL Analysis

4.4.3. Ecosystem Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers & Restraints

4.5. Analysis of Electronic Records Management Solutions Standards

4.5.1. ISO 2709

4.5.2. ISO 15489

4.5.3. ISO 23950

4.5.4. ISO 32000

4.5.5. ISO 27001

4.6. Global Electronic Records Management Solutions Market Analysis and Forecast, 2017 - 2027

4.6.1. Market Revenue Analysis (US$ Mn)

4.6.1.1. Historic growth trends, 2013-2018

4.6.1.2. Forecast trends, 2019-2027

4.7. Market Opportunity Assessment – By Region (Global/North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.7.1. By Region/Country

4.7.2. By Component

4.7.3. By Enterprise Size

4.7.4. By Industry

4.8. Competitive Scenario and Trends

4.8.1. Electronic Records Management Solutions Market Concentration Rate

4.8.1.1. List of New Entrants

4.8.2. Mergers & Acquisitions, Expansions

4.9. Market Outlook

5. Global Electronic Records Management Solutions Market Analysis and Forecast, By Component

5.1. Overview and Definition

5.2. Key Segment Analysis

5.3. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

5.3.1. Software

5.3.1.1. On-premise

5.3.1.2. Cloud-based

5.3.2. Services

5.3.2.1. Professional Services

5.3.2.2. Managed Services

6. Global Electronic Records Management Solutions Market Analysis and Forecast, By Enterprise Size

6.1. Overview & Definition

6.2. Key Segment Analysis

6.3. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

6.3.1. Small Enterprises

6.3.2. Medium Enterprises

6.3.3. Large Enterprises

7. Global Electronic Records Management Solutions Market Analysis and Forecast, By Industry

7.1. Overview & Definition

7.2. Key Segment Analysis

7.3. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

7.3.1. BFSI

7.3.2. IT & Telecom

7.3.3. Retail

7.3.4. Government

7.3.5. Healthcare

7.3.6. Transportation & Logistics

7.3.7. Energy & Utilities

7.3.8. Others (Education, Construction, etc.)

8. Global Electronic Records Management Solutions Market Analysis and Forecast, by Region

8.1. Overview

8.2. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Electronic Records Management Solutions Market Analysis and Forecast

9.1. Key Findings

9.2. Impact Analysis of Drivers and Restraints

9.3. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

9.3.1. Software

9.3.1.1. On-premise

9.3.1.2. Cloud-based

9.3.2. Services

9.3.2.1. Professional Services

9.3.2.2. Managed Services

9.4. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

9.4.1. Small Enterprises

9.4.2. Medium Enterprises

9.4.3. Large Enterprises

9.5. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

9.5.1. BFSI

9.5.2. IT & Telecom

9.5.3. Retail

9.5.4. Government

9.5.5. Healthcare

9.5.6. Transportation & Logistics

9.5.7. Energy & Utilities

9.5.8. Others (Education, Construction, etc.)

9.6. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Mexico

9.6.4. Rest of North America

10. Europe Electronic Records Management Solutions Market Analysis and Forecast

10.1. Key Findings

10.2. Impact Analysis of Drivers and Restraints

10.3. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

10.3.1. Software

10.3.1.1. On-premise

10.3.1.2. Cloud-based

10.3.2. Services

10.3.2.1. Professional Services

10.3.2.2. Managed Services

10.4. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

10.4.1. Small Enterprises

10.4.2. Medium Enterprises

10.4.3. Large Enterprises

10.5. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

10.5.1. BFSI

10.5.2. IT & Telecom

10.5.3. Retail

10.5.4. Government

10.5.5. Healthcare

10.5.6. Transportation & Logistics

10.5.7. Energy & Utilities

10.5.8. Others (Education, Construction, etc.)

10.6. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

10.6.1. Germany

10.6.2. U.K.

10.6.3. France

10.6.4. Russia

10.6.5. Italy

10.6.6. Spain

10.6.7. Nordics

10.6.8. Rest of Europe

11. Asia Pacific Electronic Records Management Solutions Market Analysis and Forecast

11.1. Key Findings

11.2. Impact Analysis of Drivers and Restraints

11.3. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

11.3.1. Software

11.3.1.1. On-premise

11.3.1.2. Cloud-based

11.3.2. Services

11.3.2.1. Professional Services

11.3.2.2. Managed Services

11.4. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

11.4.1. Small Enterprises

11.4.2. Medium Enterprises

11.4.3. Large Enterprises

11.5. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

11.5.1. BFSI

11.5.2. IT & Telecom

11.5.3. Retail

11.5.4. Government

11.5.5. Healthcare

11.5.6. Transportation & Logistics

11.5.7. Energy & Utilities

11.5.8. Others (Education, Construction, etc.)

11.6. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. Australia

11.6.5. Singapore

11.6.6. Malaysia

11.6.7. South Korea

11.6.8. Rest of Asia Pacific

12. Middle East & Africa (MEA) Electronic Records Management Solutions Market Analysis and Forecast

12.1. Key Findings

12.2. Impact Analysis of Drivers and Restraints

12.3. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

12.3.1. Software

12.3.1.1. On-premise

12.3.1.2. Cloud-based

12.3.2. Services

12.3.2.1. Professional Services

12.3.2.2. Managed Services

12.4. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

12.4.1. Small Enterprises

12.4.2. Medium Enterprises

12.4.3. Large Enterprises

12.5. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

12.5.1. BFSI

12.5.2. IT & Telecom

12.5.3. Retail

12.5.4. Government

12.5.5. Healthcare

12.5.6. Transportation & Logistics

12.5.7. Energy & Utilities

12.5.8. Others (Education, Construction, etc.)

12.6. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

12.6.1. UAE

12.6.2. Saudi Arabia

12.6.3. South Africa

12.6.4. Rest of Middle East & Africa

13. South America Electronic Records Management Solutions Market Analysis and Forecast

13.1. Key Findings

13.2. Impact Analysis of Drivers and Restraints

13.3. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

13.3.1. Software

13.3.1.1. On-premise

13.3.1.2. Cloud-based

13.3.2. Services

13.3.2.1. Professional Services

13.3.2.2. Managed Services

13.4. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Enterprise Size, 2017 - 2027

13.4.1. Small Enterprise

13.4.2. Medium Enterprises

13.4.3. Large Enterprises

13.5. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Industry, 2017 - 2027

13.5.1. BFSI

13.5.2. IT & Telecom

13.5.3. Retail

13.5.4. Government

13.5.5. Healthcare

13.5.6. Transportation & Logistics

13.5.7. Energy & Utilities

13.5.8. Others (Education, Construction, etc.)

13.6. Electronic Records Management Solutions Market Size (US$ Mn) Forecast, By Country & Sub-region, 2017 - 2027

13.6.1. Brazil

13.6.2. Rest of South America

14. Competition Landscape

14.1. Market Player – Competition Matrix

14.2. Market Revenue Share Analysis (%), By Company (2018)

14.3. Regional Presence (Intensity Map)

15. Company Profiles(Details – Basic Overview, Sales Area/Geographical Presence, Key Competitors, Strategy)

15.1. Alfresco Software, Inc

15.1.1. Business Overview

15.1.2. Geographical Presence

15.1.3. Revenue

15.1.4. Strategy

15.2. Epicor Software Corporation

15.2.1. Business Overview

15.2.2. Geographical Presence

15.2.3. Revenue

15.2.4. Strategy

15.3. Hyland Software, Inc.

15.3.1. Business Overview

15.3.2. Geographical Presence

15.3.3. Revenue

15.3.4. Strategy

15.4. IdeagenPlc

15.4.1. Business Overview

15.4.2. Geographical Presence

15.4.3. Revenue

15.4.4. Strategy

15.5. MasterControl, Inc

15.5.1. Business Overview

15.5.2. Geographical Presence

15.5.3. Revenue

15.5.4. Strategy

15.6. M-Files Corporation

15.6.1. Business Overview

15.6.2. Geographical Presence

15.6.3. Revenue

15.6.4. Strategy

15.7. Microsoft Corporation

15.7.1. Business Overview

15.7.2. Geographical Presence

15.7.3. Revenue

15.7.4. Strategy

15.8. OpenText Corporation

15.8.1. Business Overview

15.8.2. Geographical Presence

15.8.3. Revenue

15.8.4. Strategy

15.9. Oracle Corporation

15.9.1. Business Overview

15.9.2. Geographical Presence

15.9.3. Revenue

15.9.4. Strategy

15.10. T-Systems International GmbH

15.10.1. Business Overview

15.10.2. Geographical Presence

15.10.3. Revenue

15.10.4. Strategy

16. Key Takeaways

List of Tables

Table 1: Global Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Component, 2017 - 2027

Table 2: Global Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Enterprise Size, 2017 - 2027

Table 3: Global Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Industry, 2017 - 2027

Table 4: Global Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Region, 2017 - 2027

Table 5: North America Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Component, 2017 - 2027

Table 6: North America Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Enterprise Size, 2017 - 2027

Table 7: North America Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Industry, 2017 - 2027

Table 8: North America Electronic Records Management Solutions Market Analysis and Forecast, By Country, 2017 - 2027

Table 9: Europe Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Component, 2017 - 2027

Table 10: Europe Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Enterprise Size, 2017 - 2027

Table 11: Europe Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Industry, 2017 - 2027

Table 12: Europe Electronic Records Management Solutions Market Analysis and Forecast, By Country, 2017 - 2027

Table 13: Asia Pacific Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Component, 2017 - 2027

Table 14: Asia Pacific Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Enterprise Size, 2017 - 2027

Table 15: Asia Pacific Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Industry, 2017 - 2027

Table 16: Asia Pacific Electronic Records Management Solutions Market Analysis and Forecast, By Country, 2017 - 2027

Table 17: Middle East & Africa Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Component, 2017 - 2027

Table 18: Middle East & Africa Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Enterprise Size, 2017 - 2027

Table 19: Middle East & Africa Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Industry, 2017 - 2027

Table 20: MEA Electronic Records Management Solutions Market Analysis and Forecast, By Country, 2017 - 2027

Table 21: South America Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Component, 2017 - 2027

Table 22: South America Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Enterprise Size, 2017 - 2027

Table 23: South America Electronic Records Management Solutions Market Analysis and Forecast (US$ Mn), By Industry, 2017 - 2027

Table 24: South America Electronic Records Management Solutions Market Analysis and Forecast, By Country, 2017 - 2027

List of Figures

Figure 1: Global Electronic Records Management Solutions Market Size (US$ Mn) Forecast, 2017–2027

Figure 2: Top Segment Analysis

Figure 3: GDP (US$ Bn), Top Countries (2014 – 2020)

Figure 4: Top Economies GDP Landscape, 2018

Figure 5: Major Countries Average GDP Contribution, by Industry, 2018

Figure 6: Global ICT Spending (US$ Bn), Regional Contribution, 2019E

Figure 7: Global ICT Spending (%), by Region, 2019E

Figure 8: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019E

Figure 9: Global ICT Spending (%), by Type, 2019E

Figure 10: Electronic Records Management Solutions Market Size (US$ Mn) Forecast, 2013 – 2018

Figure 11: Global Electronic Records Management Solutions Market Y-o-Y Growth (Value %), 2013 – 2018

Figure 12: Electronic Records Management Solutions Market Size (US$ Mn) Forecast, 2019 - 2027

Figure 13: Global Electronic Records Management Solutions Market Y-o-Y Growth (Value %), 2019 - 2027

Figure 14: Global Electronic Records Management Solutions Market Attractiveness Analysis, by Region

Figure 15: Global Electronic Records Management Solutions Market Attractiveness Rating, by Region

Figure 16: Global Electronic Records Management Solutions Market Attractiveness Analysis, by Enterprise Size

Figure 17: Global Electronic Records Management Solutions Market Attractiveness Rating, by Enterprise Size

Figure 18: Global Electronic Records Management Solutions Market Attractiveness Analysis, by Industry

Figure 19: Global Electronic Records Management Solutions Market Attractiveness Rating, by Industry

Figure 20: Global Electronic Records Management Solutions Market Value Share, by Component (2019)

Figure 21: Global Electronic Records Management Solutions Market Value Share, by Component (2027)

Figure 22: Global Electronic Records Management Solutions Market Value Share, by Enterprise Size (2019)

Figure 23: Global Electronic Records Management Solutions Market Value Share, by Enterprise Size (2027)

Figure 24: Global Electronic Records Management Solutions Market Value Share, by Industry (2019)

Figure 25: Global Electronic Records Management Solutions Market Value Share, by Industry (2027)

Figure 26: Global Electronic Records Management Solutions Market Value Share, by Region (2019)

Figure 27: Global Electronic Records Management Solutions Market Value Share, by Region (2027)

Figure 28: Global Electronic Records Management Solutions Market Share Analysis, by Component (2019)

Figure 29: Global Electronic Records Management Solutions Market Share Analysis, by Component (2027)

Figure 30: Global Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 31: Global Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 32: Global Electronic Records Management Solutions Market Share Analysis, by Industry (2019)

Figure 33: Global Electronic Records Management Solutions Market Share Analysis, by Industry (2027)

Figure 34: Global Electronic Records Management Solutions Market Share Analysis, by Region (2019)

Figure 35: Global Electronic Records Management Solutions Market Share Analysis, by Region (2027)

Figure 36: North America Electronic Records Management Solutions Market Share Analysis, by Component (2019)

Figure 37: North America Electronic Records Management Solutions Market Share Analysis, by Component (2027)

Figure 38: North America Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 39: North America Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 40: North America Electronic Records Management Solutions Market Share Analysis, by Industry (2019)

Figure 41: North America Electronic Records Management Solutions Market Share Analysis, by Industry (2027)

Figure 42: North America Electronic Records Management Solutions Market Share Analysis, by Country (2019)

Figure 43: North America Electronic Records Management Solutions Market Share Analysis, by Country (2027)

Figure 44: Europe Electronic Records Management Solutions Market Share Analysis, by Component (2019)

Figure 45: Europe Electronic Records Management Solutions Market Share Analysis, by Component (2027)

Figure 46: Europe Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 47: Europe Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 48: Europe Electronic Records Management Solutions Market Share Analysis, by Industry (2019)

Figure 49: Europe Electronic Records Management Solutions Market Share Analysis, by Industry (2027)

Figure 50: Europe Electronic Records Management Solutions Market Share Analysis, by Country (2019)

Figure 51: Europe Electronic Records Management Solutions Market Share Analysis, by Country (2027)

Figure 52: Asia Pacific Electronic Records Management Solutions Market Share Analysis, by Component (2019)

Figure 53: Asia Pacific Electronic Records Management Solutions Market Share Analysis, by Component (2027)

Figure 54: Asia Pacific Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 55: Asia Pacific Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 56: Asia Pacific Electronic Records Management Solutions Market Share Analysis, by Industry (2019)

Figure 57: Asia Pacific Electronic Records Management Solutions Market Share Analysis, by Industry (2027)

Figure 58: Asia Pacific Electronic Records Management Solutions Market Share Analysis, by Country (2019)

Figure 59: Asia Pacific Electronic Records Management Solutions Market Share Analysis, by Country (2027)

Figure 60: Middle East & Africa Electronic Records Management Solutions Market Share Analysis, by Component (2019)

Figure 61: Middle East & Africa Electronic Records Management Solutions Market Share Analysis, by Component (2027)

Figure 62: Middle East & Africa Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 63: Middle East & Africa Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 64: Middle East & Africa Electronic Records Management Solutions Market Share Analysis, by Industry (2019)

Figure 65: Middle East & Africa Electronic Records Management Solutions Market Share Analysis, by Industry (2027)

Figure 66: MEA Electronic Records Management Solutions Market Share Analysis, by Country (2019)

Figure 67: MEA Electronic Records Management Solutions Market Share Analysis, by Country (2027)

Figure 68: South America Electronic Records Management Solutions Market Share Analysis, by Component (2019)

Figure 69: South America Electronic Records Management Solutions Market Share Analysis, by Component (2027)

Figure 70: South America Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 71: South America Electronic Records Management Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 72: South America Electronic Records Management Solutions Market Share Analysis, by Industry (2019)

Figure 73: South America Electronic Records Management Solutions Market Share Analysis, by Industry (2027)

Figure 74: South America Electronic Records Management Solutions Market Share Analysis, by Country (2019)

Figure 75: South America Electronic Records Management Solutions Market Share Analysis, by Country (2027)

Figure 76: Market Share Analysis (2018)

Figure 77: Competition Matrix (2018)