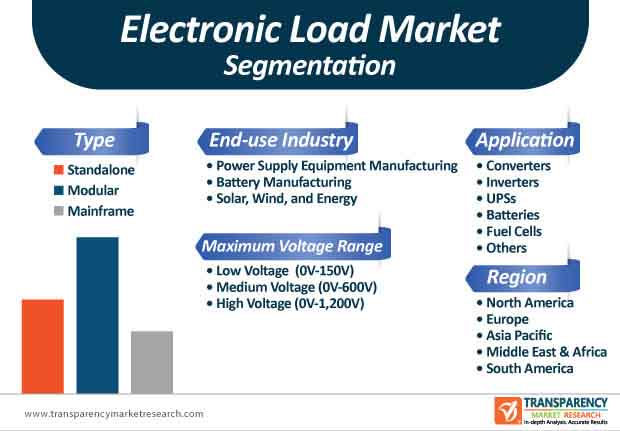

Companies are utilizing conventional MOSFET-based dissipative elements that allow electronic load devices to achieve a wide voltage-current operating range within a device’s maximum power rating. This is evident, since high voltage (0V – 1,200V) is expected to be a prominent maximum voltage range segment of the electronic load market. Hence, companies are focusing on heat management in electronic load devices to deploy high density programmable DC power supplies. For instance, Magna Power- an electronics manufacturer in the U.S., is increasing its efforts to boost the uptake of ALx Series MagnaLOAD devices with conservative cooling to ensure longer product life compared to conventional devices.

Manufacturers are increasing efforts to use Texas Instruments DSP control units across power processing stages in electronic load devices. Such technological improvements have catalyzed growth of the electronic load market, and help boost the credibility of emerging players in the global landscape. Unified digital control platforms and fully-digital control loops of these devices are catching the attention of end users.

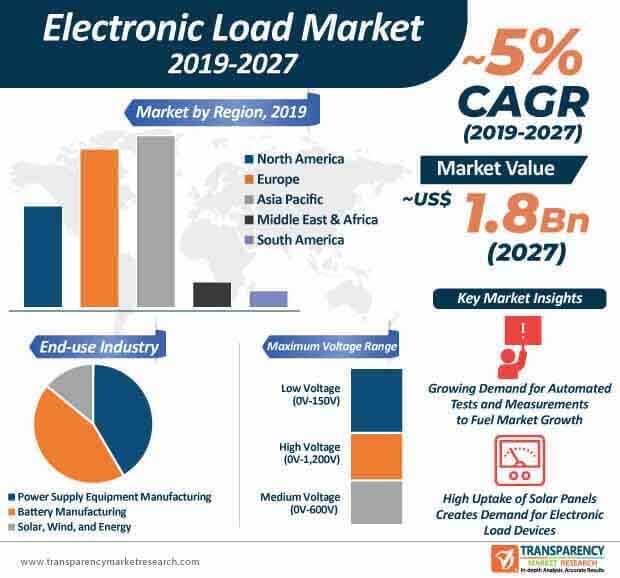

Next-gen software interface is one of the key drivers contributing to the growth of the electronic load market. Companies are introducing software interface that provide intuitive and user-friendly web-browser-based control over the activities of electronic load devices. Programming and measurement through software is gradually becoming mainstream in the electronic load market. This trend has focused on the convenience of end users in the battery manufacturing industry that can virtually control and monitor the software. As such, battery manufacturing end-use industry is anticipated to lead the electronic load market. The electronic load market is estimated to reach a value of ~US$ 1.8 Bn by the end of 2027.

Companies are adopting the server-client software model for access to electronic loads from any device or operating system. Technological advancements have helped companies to establish a network where end users can access the server from any electronic device such as desktops, tablets, and smartphones.

Manufacturers in the electronic load market are developing devices that offer versatile functionality in various end-use industries. They are increasing efforts to develop automated test equipment for power discharge testing. These automated equipment are witnessing high demand in power supply and energy industries. As such, power supply equipment manufacturing end-use industry is projected to witness considerable growth in the electronic load market.

The ever-growing energy industry including solar and wind energy, is creating a demand for electronic load devices to thoroughly test power sources of their products. Eco-friendly consumers are adopting home appliances that function on renewable energy such as solar panels and car batteries. Hence, companies in the market are developing programmable electronic loads that are increasingly replacing conventional resistors. Dynamic testing and rapid increasing and decreasing the load in repeatable fashion are some of the practices that stakeholders need to adopt in order to comply with quality and safety standards for their products.

Several devices today operate at higher voltages such as electric vehicle batteries, silicon-carbide semiconductors, and the likes. These devices have created a demand for electric loads (e-loads) to load them down during testing. However, scarcity of e-loads rated for these high voltages poses as a challenge for companies in the electronic load market. Hence, companies are increasing their production capacities to increase the availability of e-loads that are suited for high voltages.

Companies in the electronic load market are exploring untapped opportunities in electrochemistry to help end users carry out research on batteries and fuel cells. They are increasing research to design e-loads with modular designs and several operating modes for automated test and measurement. Manufacturers are increasing their design efforts to incorporate buttons and knobs for interactive use. They are also introducing USB interface options to carry out automated test and measurement. Moreover, manufacturers are increasing their production capabilities to develop e-loads that can connect with multiple loads to enhance the overall system power capacity.

Analysts’ Viewpoint

Advanced software interface has transformed the electronic load market landscape. Next-gen control technologies such as digital control platforms are becoming increasingly mainstream in the global market. Collaborative tie-ups with leading semiconductor companies such as Texas Instruments, in an effort to enhance power processing stages in e-load devices, is one of the strategic moves taken by emerging companies.

The demand for maximum voltage range e-load devices is witnessing an upward trend in the market. However, there still is a dearth of high voltage e-load devices that can be safely put in a series. Hence, companies are increasing their production capacities to increase the availability of high voltage e-loads.

Electronic Load Market: Overview

Increasing Investments in Power Supply Testing and Measurement Instruments: A Key Driver

Advancements in Design and Development of Open Source Programmable Electronic Loads: Latest Market Trend

Complex Design and High Costs Associated with Electronic Loads a Major Restraint for Global Market

Electronic Load Market: Competition Landscape

Electronic Load Market: Key Developments

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Electronic Load Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Regulations and Policies

4.4. Key Trends Analysis

4.5. Key Market Indicators

4.6. Global Electronic Load Market Analysis and Forecast, 2017–2027

4.6.1. Market Revenue Projection (US$ Mn)

4.6.2. Market Volume Projection (Million Units)

4.7. Porter’s Five Forces Analysis - Global Electronic Load Market

4.8. Value Chain Analysis - Global Electronic Load Market

4.9. Market Outlook

5. Global Electronic Load Market Analysis and Forecast, by Type

5.1. Overview & Definitions

5.2. Key Trends

5.3. Global Electronic Load Market Size (US$ Mn and Million Units) Forecast, by Type, 2017–2027

5.3.1. Stand-alone

5.3.2. Modular

5.3.3. Main-frame

5.4. Type Comparison Matrix

5.5. Global Electronic Load Market Attractiveness, by Type

6. Global Electronic Load Market Analysis and Forecast, by Max. Voltage Range

6.1. Overview & Definitions

6.2. Global Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2019–2027

6.2.1. Low Voltage (0V – 150V)

6.2.2. Medium Voltage (0V – 600V)

6.2.3. High Voltage (0V – 1,200V)

6.3. Max. Voltage Range Comparison Matrix

6.4. Global Electronic Load Market Attractiveness, by Max. Voltage Range

7. Global Electronic Load Market Analysis and Forecast, by Application

7.1. Overview & Definitions

7.2. Key Trends

7.3. Global Electronic Load Market Size (US$ Mn and Million Units) Forecast, by Application, 2017–2027

7.3.1. Converters

7.3.2. Inverters

7.3.3. UPSs

7.3.4. Batteries

7.3.5. Fuel Cells

7.3.6. Others

7.4. Application Comparison Matrix

7.5. Global Electronic Load Market Attractiveness, by Application

8. Global Electronic Load Market Analysis and Forecast, by End-use Industry

8.1. Overview & Definition

8.2. Key Trends

8.3. Global Electronic Load Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017–2027

8.3.1. Power Supply Equipment Manufacturers

8.3.2. Battery Manufacturers

8.3.3. Solar, Wind, and Energy Industries

8.4. End-use Industry Comparison Matrix

8.5. Global Electronic Load Market Attractiveness, by End-use Industry

9. Global Electronic Load Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Regulations and Policies

9.3. Global Electronic Load Market Value (US$ Mn) Forecast, by Region, 2017–2027

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Middle East & Africa

9.3.5. South America

9.4. Global Electronic Load Market Attractiveness, by Region

10. North America Electronic Load Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. North America Electronic Load Market Size (US$ Mn & Million Units) Forecast, by Type, 2017–2027

10.3.1. Stand-alone

10.3.2. Modular

10.3.3. Main-frame

10.4. North America Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2017–2027

10.4.1. Low Voltage (0V – 150V)

10.4.2. Medium Voltage (0V – 600V)

10.4.3. High Voltage (0V – 1,200V)

10.5. North America Electronic Load Market Value (US$ Mn) Forecast, by Application, 2017–2027

10.5.1. Converters

10.5.2. Inverters

10.5.3. UPSs

10.5.4. Batteries

10.5.5. Fuel Cells

10.5.6. Others

10.6. North America Electronic Load Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

10.6.1. Power Supply Equipment Manufacturers

10.6.2. Battery Manufacturers

10.6.3. Solar, Wind, and Energy Industries

10.7. North America Electronic Load Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. North America Electronic Load Market Attractiveness Analysis

10.8.1. By Type

10.8.2. By Voltage Range

10.8.3. By Application

10.8.4. By End-use Industry

10.8.5. By Country/Sub-region

11. Europe Electronic Load Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Europe Electronic Load Market Size (US$ Mn & Million Units) Forecast, by Type, 2017–2027

11.3.1. Stand-alone

11.3.2. Modular

11.3.3. Main-frame

11.4. Europe Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2017–2027

11.4.1. Low Voltage (0V – 150V)

11.4.2. Medium Voltage (0V – 600V)

11.4.3. High Voltage (0V – 1,200V)

11.5. Europe Electronic Load Market Value (US$ Mn) Forecast, by Application, 2017–2027

11.5.1. Converters

11.5.2. Inverters

11.5.3. UPSs

11.5.4. Batteries

11.5.5. Fuel Cells

11.5.6. Others

11.6. Europe Electronic Load Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

11.6.1. Power Supply Equipment Manufacturers

11.6.2. Battery Manufacturers

11.6.3. Solar, Wind, and Energy Industries

11.7. Europe Electronic Load Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

11.7.1. Germany

11.7.2. U.K.

11.7.3. France

11.7.4. Rest of Europe

11.8. Europe Electronic Load Market Attractiveness Analysis

11.8.1. By Type

11.8.2. By Application

11.8.3. By Country/Sub-region

12. Asia Pacific Electronic Load Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Asia Pacific Electronic Load Market Size (US$ Mn & Million Units) Forecast, by Type, 2017–2027

12.3.1. Stand-alone

12.3.2. Modular

12.3.3. Main-frame

12.4. Asia Pacific Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2017–2027

12.4.1. Low Voltage (0V – 150V)

12.4.2. Medium Voltage (0V – 600V)

12.4.3. High Voltage (0V – 1,200V)

12.5. Asia Pacific Electronic Load Market Value (US$ Mn) Forecast, by Application, 2017–2027

12.5.1. Converters

12.5.2. Inverters

12.5.3. UPSs

12.5.4. Batteries

12.5.5. Fuel Cells

12.5.6. Others

12.6. Asia Pacific Electronic Load Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

12.6.1. Power Supply Equipment Manufacturers

12.6.2. Battery Manufacturers

12.6.3. Solar, Wind, and Energy Industries

12.7. Asia Pacific Electronic Load Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. Rest of Asia Pacific

12.8. Asia Pacific Electronic Load Market Attractiveness Analysis

12.8.1. By Type

12.8.2. By Voltage Range

12.8.3. By Application

12.8.4. By End-use Industry

12.8.5. By Country/Sub-region

13. Middle East & Africa Electronic Load Market Analysis and Forecast

13.1. Key Findings

13.2. Key Trends

13.3. Middle East & Africa Electronic Load Market Size (US$ Mn & Million Units) Forecast, by Type, 2017–2027

13.3.1. Stand-alone

13.3.2. Modular

13.3.3. Main-frame

13.4. Middle East & Africa Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2017–2027

13.4.1. Low Voltage (0V – 150V)

13.4.2. Medium Voltage (0V – 600V)

13.4.3. High Voltage (0V – 1,200V)

13.5. Middle East & Africa Electronic Load Market Value (US$ Mn) Forecast, by Application, 2017–2027

13.5.1. Converters

13.5.2. Inverters

13.5.3. UPSs

13.5.4. Batteries

13.5.5. Fuel Cells

13.5.6. Others

13.6. Middle East & Africa Electronic Load Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

13.6.1. Power Supply Equipment Manufacturers

13.6.2. Battery Manufacturers

13.6.3. Solar, Wind, and Energy Industries

13.7. Middle East & Africa Electronic Load Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

13.7.1. UAE

13.7.2. Saudi Arabia

13.7.3. Israel

13.7.4. Rest of Middle East & Africa

13.8. Middle East & Africa Electronic Load Market Attractiveness Analysis

13.8.1. By Type

13.8.2. By Voltage Range

13.8.3. By Application

13.8.4. By End-use Industry

13.8.5. By Country/Sub-region

14. South America Electronic Load Market Analysis and Forecast

14.1. Key Findings

14.2. Key Trends

14.3. South America Electronic Load Market Size (US$ Mn & Million Units) Forecast, by Type, 2017–2027

14.3.1. Stand-alone

14.3.2. Modular

14.3.3. Main-frame

14.4. South America Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2017–2027

14.4.1. Low Voltage (0V – 150V)

14.4.2. Medium Voltage (0V – 600V)

14.4.3. High Voltage (0V – 1,200V)

14.5. South America Electronic Load Market Value (US$ Mn) Forecast, by Application, 2017–2027

14.5.1. Converters

14.5.2. Inverters

14.5.3. UPSs

14.5.4. Batteries

14.5.5. Fuel Cells

14.5.6. Others

14.6. South America Electronic Load Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

14.6.1. Power Supply Equipment Manufacturers

14.6.2. Battery Manufacturers

14.6.3. Solar, Wind, and Energy Industries

14.7. South America Electronic Load Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

14.7.1. Brazil

14.7.2. Rest of South America

14.8. South America Electronic Load Market Attractiveness Analysis

14.8.1. By Type

14.8.2. By Voltage Range

14.8.3. By Application

14.8.4. By End-use Industry

14.8.5. By Country/Sub-region

15. Competition Landscape

15.1. Market Players – Competition Matrix

15.2. Global Electronic Load Market Share Analysis, by Company (2018)

15.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Recent Developments, Strategy)

15.3.1. AMETEK. Inc.

15.3.1.1. Overview

15.3.1.2. Financials

15.3.1.3. SWOT Analysis

15.3.1.4. Recent Developments

15.3.1.5. Strategy

15.3.2. B&K Precision Corporation

15.3.2.1. Overview

15.3.2.2. Financials

15.3.2.3. SWOT Analysis

15.3.2.4. Recent Developments

15.3.2.5. Strategy

15.3.3. Chroma Systems Solutions, Inc.

15.3.3.1. Overview

15.3.3.2. Financials

15.3.3.3. SWOT Analysis

15.3.3.4. Recent Developments

15.3.3.5. Strategy

15.3.4. EA Elektro-Automatik

15.3.4.1. Overview

15.3.4.2. Financials

15.3.4.3. SWOT Analysis

15.3.4.4. Recent Developments

15.3.4.5. Strategy

15.3.5. Itech Electronic Co. Ltd

15.3.5.1. Overview

15.3.5.2. Financials

15.3.5.3. SWOT Analysis

15.3.5.4. Recent Developments

15.3.5.5. Strategy

15.3.6. Keysight Technologies

15.3.6.1. Overview

15.3.6.2. Financials

15.3.6.3. SWOT Analysis

15.3.6.4. Recent Developments

15.3.6.5. Strategy

15.3.7. KIKUSUI ELECTRONICS CORPORATION

15.3.7.1. Overview

15.3.7.2. Financials

15.3.7.3. SWOT Analysis

15.3.7.4. Recent Developments

15.3.7.5. Strategy

15.3.8. Spellman High Voltage Electronics Corporation

15.3.8.1. Overview

15.3.8.2. Financials

15.3.8.3. SWOT Analysis

15.3.8.4. Recent Developments

15.3.8.5. Strategy

15.3.9. Tektronix, Inc.

15.3.9.1. Overview

15.3.9.2. Financials

15.3.9.3. SWOT Analysis

15.3.9.4. Recent Developments

15.3.9.5. Strategy

15.3.10. Texas Instruments Incorporated

15.3.10.1. Overview

15.3.10.2. Financials

15.3.10.3. SWOT Analysis

15.3.10.4. Recent Developments

15.3.10.5. Strategy

16. Key Takeaways

List of Tables

Table 01: Global Electronic Load Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 02: Global Electronic Load Market Volume (Thousand Units) Forecast, by Type, 2017–2027

Table 03: Global Electronic Load Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 04: Global Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2017–2027

Table 05: Global Electronic Load Market Volume (Thousand Units) Forecast, by Max. Voltage Range, 2017–2027

Table 06: Global Electronic Load Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 07: Global Electronic Load Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 08: Global Electronic Load Market Volume (Thousand Units) Forecast, by Region, 2017–2027

Table 09: North America Electronic Load Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 10: North America Electronic Load Market Volume (Thousand Units) Forecast, by Type, 2017–2027

Table 11: North America Electronic Load Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 12: North America Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2017–2027

Table 13: North America Electronic Load Market Volume (Thousand Units) Forecast, by Max. Voltage Range, 2017–2027

Table 14: North America Electronic Load Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 15: North America Electronic Load Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: North America Electronic Load Market Volume (Thousand Units) Forecast, by Country/Sub-region, 2017–2027

Table 17: Europe Electronic Load Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 18: Europe Electronic Load Market Volume (Thousand Units) Forecast, by Type, 2017–2027

Table 19: Europe Electronic Load Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 20: Europe Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2017–2027

Table 21: Europe Electronic Load Market Volume (Thousand Units) Forecast, by Max. Voltage Range, 2017–2027

Table 22: Europe Electronic Load Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 23: Europe Electronic Load Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 24: Europe Electronic Load Market Volume (Thousand Units) Forecast, by Country/Sub-region, 2017–2027

Table 25: Asia Pacific Electronic Load Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 26: Asia Pacific Electronic Load Market Volume (Thousand Units) Forecast, by Type, 2017–2027

Table 27: Asia Pacific Electronic Load Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 28: Asia Pacific Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2017–2027

Table 29: Asia Pacific Electronic Load Market Volume (Thousand Units) Forecast, by Max. Voltage Range, 2017–2027

Table 30: Asia Pacific Electronic Load Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 31: Asia Pacific Electronic Load Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 32: Asia Pacific Electronic Load Market Volume (Thousand Units) Forecast, by Country/Sub-region, 2017–2027

Table 33: Middle East & Africa Electronic Load Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 34: Middle East & Africa Electronic Load Market Volume (Thousand Units) Forecast, by Type, 2017–2027

Table 35: Middle East & Africa Electronic Load Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 36: Middle East & Africa Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2017–2027

Table 37: Middle East & Africa Electronic Load Market Volume (Thousand Units) Forecast, by Max. Voltage Range, 2017–2027

Table 38: Middle East & Africa Electronic Load Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 39: Middle East & Africa Electronic Load Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 40: Middle East & Africa Electronic Load Market Volume (Thousand Units) Forecast, by Country/Sub-region, 2017–2027

Table 41: South Africa Electronic Load Market Value (US$ Mn) Forecast, by Type, 2017–2027

Table 42: South Africa Electronic Load Market Volume (Thousand Units) Forecast, by Type, 2017–2027

Table 43: South Africa Electronic Load Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 44: South Africa Electronic Load Market Value (US$ Mn) Forecast, by Max. Voltage Range, 2017–2027

Table 45: South Africa Electronic Load Market Volume (Thousand Units) Forecast, by Max. Voltage Range, 2017–2027

Table 46: South Africa Electronic Load Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 47: South Africa Electronic Load Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 48: South Africa Electronic Load Market Volume (Thousand Units) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Fig. 01: Global Electronic Load Market Overview (US$ Mn)

Fig. 02: Global Electronic Load Market, by Type (2018)

Fig. 03: Global Electronic Load Market, by Application (2018)

Fig. 04: Global Electronic Load Market, by Max. Voltage Range (2018)

Fig. 05: Global Electronic Load Market, by End-use Industry (2018)

Fig. 06: Global Electronic Load Market Value (US$ Mn) Forecast, 2018–2027

Fig. 07: Global Electronic Load Market Volume (Thousand Units) Forecast, 2018–2027

Fig. 08: Global Electronic Load Market Value Share Analysis, by Type, 2019 and 2027

Fig. 09: Global Electronic Load Market, by Stand-alone

Fig. 10: Global Electronic Load Market, by Modular

Fig. 11: Global Electronic Load Market, by Main-frame

Fig. 12: Global Electronic Load Market Comparison Matrix, by Type

Fig. 13: Global Electronic Load Market Attractiveness Analysis, by Type

Fig. 14: Global Electronic Load Market Value Share Analysis, by Application, 2019 and 2027

Fig. 15: Global Electronic Load Market, by Converters

Fig. 16: Global Electronic Load Market, by Inverters

Fig. 17: Global Electronic Load Market, by UPSs

Fig. 18: Global Electronic Load Market, by Batteries

Fig. 19: Global Electronic Load Market, by Fuel Cells

Fig. 20: Global Electronic Load Market, by Others

Fig. 21: Global Electronic Load Market Comparison Matrix, by Application

Fig. 22: Global Electronic Load Market Attractiveness Analysis, by Application

Fig. 23: Global Electronic Load Market Value Share Analysis, by Max. Voltage Range, 2019 and 2027

Fig. 24: Global Electronic Load Market, by High Voltage Electronic Load (0V – 1,200V)

Fig. 25: Global Electronic Load Market, by Medium Voltage (0V – 600V)

Fig. 26: Global Electronic Load Market, by Low Voltage Electronic Load (0V – 150V)

Fig. 27: Global Electronic Load Market Comparison Matrix, by Application

Fig. 28: Global Electronic Load Market Attractiveness Analysis, by Max. Voltage Range

Fig. 29: Global Electronic Load Market Value Share Analysis, by End-use Industry, 2019 and 2027

Fig. 30: Global Electronic Load Market, by Power Supply Equipment Manufacturers

Fig. 31: Global Electronic Load Market, by Battery Manufacturing

Fig. 32: Global Electronic Load Market, by Solar, Wind, and Energy Industries

Fig. 33: Global Electronic Load Market Comparison Matrix, by End-use Industry

Fig. 34: Global Electronic Load Market Attractiveness Analysis, by End-use Industry

Fig. 35: Global Electronic Load Market Attractiveness Analysis, by Region

Fig. 36: North America Electronic Load Market Value (US$ Mn) Forecast, 2017–2027

Fig. 37: North America Electronic Load Market Size Y-o-Y Growth Projection, 2017–2027

Fig. 38: North America Electronic Load Market Value Share Analysis, by Type, 2019 and 2027

Fig. 39: North America Electronic Load Market Value Share Analysis, by Application, 2019 and 2027

Fig. 40: North America Electronic Load Market Value Share Analysis, by Max. Voltage Range, 2019 and 2027

Fig. 41 : North America Electronic Load Market Value Share Analysis, by End-use Industry, 2019 and 2027

Fig. 42: North America Electronic Load Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Fig. 43: North America Electronic Load Market Attractiveness Analysis, by Type

Fig. 44: North America Electronic Load Market Attractiveness Analysis, by Application

Fig. 45: North America Electronic Load Market Attractiveness Analysis, by Max. Voltage Range

Fig. 46: North America Electronic Load Market Attractiveness Analysis, by End-use Industry

Fig. 47: North America Electronic Load Market Attractiveness Analysis, by Country/Sub-region

Fig. 48: Europe Electronic Load Market Value (US$ Mn) Forecast, 2017–2027

Fig. 49: Europe Electronic Load Market Size Y-o-Y Growth Projection, 2017–2027

Fig. 50: Europe Electronic Load Market Value Share Analysis, by Type, 2019 and 2027

Fig. 51: Europe Electronic Load Market Value Share Analysis, by Application, 2019 and 2027

Fig. 52: Europe Electronic Load Market Value Share Analysis, by Max. Voltage Range, 2019 and 2027

Fig. 53: Europe Electronic Load Market Value Share Analysis, by End-use Industry, 2019 and 2027

Fig. 54: Europe Electronic Load Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Fig. 55: Europe Electronic Load Market Attractiveness Analysis, by Type

Fig. 56: Europe Electronic Load Market Attractiveness Analysis, by Application

Fig. 57: Europe Electronic Load Market Attractiveness Analysis, by Max. Voltage Range

Fig. 58: Europe Electronic Load Market Attractiveness Analysis, by End-use Industry

Fig. 59: Europe Electronic Load Market Attractiveness Analysis, by Country/Sub-region

Fig. 60: Asia Pacific Electronic Load Market Value (US$ Mn) Forecast, 2017–2027

Fig. 61: Asia Pacific Electronic Load Market Size Y-o-Y Growth Projection, 2017–2027

Fig. 62: Asia Pacific Electronic Load Market Value Share Analysis, by Type, 2019 and 2027

Fig. 63: Asia Pacific Electronic Load Market Value Share Analysis, by Application, 2019 and 2027

Fig. 64: Asia Pacific Electronic Load Market Value Share Analysis, by Max. Voltage Range, 2019 and 2027

Fig. 65: Asia Pacific Electronic Load Market Value Share Analysis, by End-use Industry, 2019 and 2027

Fig. 66: Asia Pacific Electronic Load Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Fig. 67: Asia Pacific Electronic Load Market Attractiveness Analysis, by Type

Fig. 68: Asia Pacific Electronic Load Market Attractiveness Analysis, by Application

Fig. 69: Asia Pacific Electronic Load Market Attractiveness Analysis, by Max. Voltage Range

Fig. 70: Asia Pacific Electronic Load Market Attractiveness Analysis, by End-use Industry

Fig. 71: Asia Pacific Electronic Load Market Attractiveness Analysis, by Country/Sub-region

Fig. 72: Middle East & Africa Electronic Load Market Value (US$ Mn) Forecast, 2017–2027

Fig. 73: Middle East & Africa Electronic Load Market Size Y-o-Y Growth Projection, 2017–2027

Fig. 74: Middle East & Africa Electronic Load Market Value Share Analysis, by Type, 2019 and 2027

Fig. 75: Middle East & Africa Electronic Load Market Value Share Analysis, by Application, 2019 and 2027

Fig. 76: Middle East & Africa Electronic Load Market Value Share Analysis, by Max. Voltage Range, 2019 and 2027

Fig. 77: Middle East & Africa Electronic Load Market Value Share Analysis, by End-use Industry, 2019 and 2027

Fig. 78: Middle East & Africa Electronic Load Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Fig. 79: Middle East & Africa Electronic Load Market Attractiveness Analysis, by Type

Fig. 80: Middle East & Africa Electronic Load Market Attractiveness Analysis, by Application

Fig. 81: Middle East & Africa Electronic Load Market Attractiveness Analysis, by Max. Voltage Range

Fig. 82: Middle East & Africa Electronic Load Market Attractiveness Analysis, by End-use Industry

Fig. 83: Middle East & Africa Electronic Load Market Attractiveness Analysis, by Country/Sub-region

Fig. 84: South Africa Electronic Load Market Value (US$ Mn) Forecast, 2017–2027

Fig. 85: South Africa Electronic Load Market Size Y-o-Y Growth Projection, 2017–2027

Fig. 86: South Africa Electronic Load Market Value Share Analysis, by Type, 2019 and 2027

Fig. 87: South Africa Electronic Load Market Value Share Analysis, by Application, 2019 and 2027

Fig. 88: South Africa Electronic Load Market Value Share Analysis, by Max. Voltage Range, 2019 and 2027

Fig. 89: South Africa Electronic Load Market Value Share Analysis, by End-use Industry, 2019 and 2027

Fig. 90: South Africa Electronic Load Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Fig. 91: South Africa Electronic Load Market Attractiveness Analysis, by Type

Fig. 92: South Africa Electronic Load Market Attractiveness Analysis, by Application

Fig. 93: South Africa Electronic Load Market Attractiveness Analysis, by Max. Voltage Range

Fig. 94: South Africa Electronic Load Market Attractiveness Analysis, by End-use Industry

Fig. 95: South Africa Electronic Load Market Attractiveness Analysis, by Country/Sub-region