Analysts’ Viewpoint on Electric Truck Chassis Market Scenario

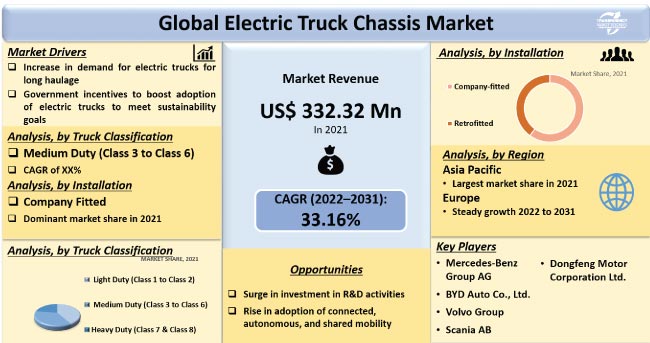

Rise in adoption and production of electric vehicles (EVs) is driving the global electric truck chassis market size. Long-haul electric trucks are gaining traction in major economies, as governments focus on reducing carbon emissions to meet their sustainability goals. Government funding and tax benefits are further boosting the adoption of electric trucks. Surge in demand for fast-charging or turbocharging stations is expected to boost the global market during the forecast period. Manufacturers are increasingly using lightweight materials to reduce production costs and propel the efficiency of battery pickup trucks. They are also launching new products to expand their revenue streams.

Chassis is a skeletal framework of a vehicle that supports all of its parts and subassemblies. It provides the vehicle its strength and rigidity. Carbon steel or aluminum alloy undergoes several processes, such as forging, stamping, and welding, to create the frame structure. The frame is made of structural elements called rails or beams in the case of a separate chassis. Double-axle chassis, tri-axle chassis, and four-axle chassis are a few types of electrically powered truck chassis. Steel is widely used to manufacture automotive chassis, as it is stronger, lightweight, and stiff.

The need for lightweight solutions has grown significantly, as governments focus on reducing CO2 emissions. The current generation of vehicles in Europe is 12% lighter than those in the previous generation. Asia Pacific and Latin America are witnessing a surge in the production of electric trucks. This, in turn, has prompted the development of strong and lightweight electric vehicle chassis made from aluminum and carbon fiber composites for mounting electric motors and batteries.

Freight trucks account for more than 20% of global GHG emissions, which has prompted governments across the globe to boost the adoption of electric variants. Electric freight trucks help reduce carbon emissions. Several OEMs and electric truck manufacturers are investing significantly in the R&D of lightweight materials for manufacturing electric vehicle skateboard chassis. Electric trucks offer several benefits over conventional IC engine trucks such as low maintenance costs and reduced emissions. Regulatory agencies across the globe are implementing stringent regulations to reduce emissions and air pollution levels. These factors are likely to fuel the adoption of electric trucks, thereby propelling the demand for electric truck chassis.

Based on truck classification, the global electric truck chassis market has been segmented into light duty (class 1 to class 2), medium duty (class 3 to class 6), and heavy duty (class 7 & class 8). The medium duty (class 3 to class 6) segment is expected to dominate the global market during the forecast period. Medium-sized electric trucks are used for transportation of goods over short distances. Rise in investment in infrastructure, logistics, transportation, construction, and e-commerce industries is expected to boost the demand for medium-sized electric trucks worldwide.

In terms of installation, the global electric truck chassis market has been bifurcated into company-fitted and retrofitted. The company-fitted segment is expected to account for major share of the market during the forecast period. Rise in government initiatives to phase out conventional trucks and replace them with zero-emission counterparts is prompting truck manufacturers to produce electric trucks. In the U.S., the State of New York expects to have 4,000 operating electric vehicles by 2025, up from 2,100 in 2020, with the resumption of the Clean Trucks Program in June 2020.

Asia Pacific is expected to dominate the global electric truck market during the forecast period. Surge in the production of electric trucks to meet sustainability goals is driving the market in the region. China, one of the largest automobile manufacturers worldwide, dominates the global electric truck market due to increase in government funding for the electrification of the transport sector in the country. According to a report by Nikkei, China exported nearly 500,000 EVs in 2021. Major electric truck chassis manufacturers in Asia Pacific are investing in R&D activities to enhance their market share. In October 2020, China’s BYD Auto Co., Ltd. and Hino Motors, a Japan-based truck maker, jointly announced the setting up of a new factory for developing battery-powered trucks and buses.

According to the electric truck chassis market forecast, North America and Europe held significant share of the market in 2021. Growth of the market in these regions can be ascribed to expansion of the electric vehicle component and infrastructure market. In 2021, Volvo Trucks received orders for more than 1,100 electric trucks worldwide. In February 2022, the company raised around US$ 230 Mn for the production of Volta Zero, its full-electric 16-ton commercial vehicle. In September 2022, Mercedes-Benz Group AG Truck, one of the world’s largest commercial vehicle manufacturers, unveiled the Mercedes-Benz eActros LongHaul - its first heavy-duty, battery-electric truck with a new e-axle and an extensive range of 500 km.

The global electric truck chassis market is in its initial phase and is controlled by established and new joint venture companies and others. Key companies are developing newer and advanced technologies to enhance their electric truck chassis market share. They are also adopting collaboration, partnership, and M&A strategies to stay competitive in the market. Tata Motors Limited, Infraprime Logistics Technologies Pvt. Ltd., Mercedes-Benz Group AG, Saturn EV Ltd., Mahindra & Mahindra Ltd., BYD Auto Co., Ltd., Volvo Group, PACCAR Inc., Scania AB, Navistar International Corporation, Dongfeng Motor Corporation Ltd., China FAW Group Corp., Ltd., VDL Groep, Nikola Corporation, Ford Motor Company, Ashok Leyland, and ISUZU Motor Ltd. are prominent entities operating in the market.

Key players have been profiled in the electric truck chassis market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 332.32 Mn |

|

Market Forecast Value in 2031 |

US$ 5.79 Bn |

|

Growth Rate (CAGR) |

33.16% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The electric truck chassis market was valued at US$ 332.32 Mn in 2021

The electric truck chassis market is expected to advance at a CAGR of 33.16% by 2031

The electric truck chassis market would be worth US$ 5.79 Bn in 2031

Rise in usage of lightweight materials and increase in demand for low-emission and long-range freight trucking

The medium duty (Class 3 to Class 6) segment accounted for majority share of the electric truck chassis market in 2021

Asia Pacific is anticipated to be the highly lucrative region of the global electric truck chassis market

Tata Motors Limited, Infraprime Logistics Technologies Pvt. Ltd., Mercedes-Benz Group AG, Saturn EV Ltd., Mahindra & Mahindra Ltd., BYD Auto Co., Ltd., Volvo Group, PACCAR Inc., Scania AB, Navistar International Corporation, Dongfeng Motor Corporation Ltd., China FAW Group Corp., Ltd., VDL Groep, Nikola Corporation, Ford Motor Company, Ashok Leyland, and ISUZU Motor Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Electric Truck Chassis Market

4. Global Electric Truck Chassis Market, by Consumption

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Consumption

4.2.1. Domestic

4.2.1.1. Sales in Country

4.2.1.2. Manufacturing in Country

4.2.2. International

4.2.2.1. Import in Country

4.2.2.2. Export from Country

5. Global Electric Truck Chassis Market, by Number of Axles

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Number of Axles

5.2.1. Double-axle Chassis

5.2.2. Tri-axle Chassis

5.2.3. Four-axle Chassis

5.2.4. Others (Five-axle Chassis, etc.)

6. Global Electric Truck Chassis Market, by Chassis Material

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Material

6.2.1. Aluminum Alloy

6.2.2. Mild Steel

6.2.3. High-speed Steel

6.2.4. Others (Carbon Fiber Composite, etc.)

7. Global Electric Truck Chassis Market, by Chassis Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Type

7.2.1. Backbone Chassis

7.2.2. Ladder Chassis

7.2.3. Monocoque Chassis

7.2.4. Modular Chassis

7.2.5. Others

8. Global Electric Truck Chassis Market, by Truck Classification

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Truck Classification

8.2.1. Light Duty (Class 1 to Class 2)

8.2.2. Medium Duty (Class 3 to Class 6)

8.2.3. Heavy Duty (Class 7 & Class 8)

9. Global Electric Truck Chassis Market, by Installation

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Installation

9.2.1. Company-fitted

9.2.2. Retrofitted

10. Global Electric Truck Chassis Market, by Region

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Electric Truck Chassis Market

11.1. Market Snapshot

11.2. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Consumption

11.2.1. Domestic

11.2.1.1. Sales in Country

11.2.1.2. Manufacturing in Country

11.2.2. International

11.2.2.1. Import in Country

11.2.2.2. Export from Country

11.3. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Number of Axles

11.3.1. Double-axle Chassis

11.3.2. Tri-axle Chassis

11.3.3. Four-axle Chassis

11.3.4. Others (Five-axle Chassis, etc.)

11.4. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Material

11.4.1. Aluminum Alloy

11.4.2. Mild Steel

11.4.3. High-speed Steel

11.4.4. Others (Carbon Fiber Composite, etc.)

11.5. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Type

11.5.1. Backbone Chassis

11.5.2. Ladder Chassis

11.5.3. Monocoque Chassis

11.5.4. Modular Chassis

11.5.5. Others

11.6. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Truck Classification

11.6.1. Light Duty (Class 1 to Class 2)

11.6.2. Medium Duty (Class 3 to Class 6)

11.6.3. Heavy Duty (Class 7 & Class 8)

11.7. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Installation

11.7.1. Company-fitted

11.7.2. Retrofitted

11.8. Key Country Analysis – North America Electric Truck Chassis Market Size Analysis & Forecast, 2017-2031

11.8.1. U.S.

11.8.2. Canada

11.8.3. Mexico

12. Europe Electric Truck Chassis Market

12.1. Market Snapshot

12.2. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Consumption

12.2.1. Domestic

12.2.1.1. Sales in Country

12.2.1.2. Manufacturing in Country

12.2.2. International

12.2.2.1. Import in Country

12.2.2.2. Export from Country

12.3. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Number of Axles

12.3.1. Double-axle Chassis

12.3.2. Tri-axle Chassis

12.3.3. Four-axle Chassis

12.3.4. Others (Five-axle Chassis, etc.)

12.4. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Material

12.4.1. Aluminum Alloy

12.4.2. Mild Steel

12.4.3. High-speed Steel

12.4.4. Others (Carbon Fiber Composite, etc.)

12.5. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Type

12.5.1. Backbone Chassis

12.5.2. Ladder Chassis

12.5.3. Monocoque Chassis

12.5.4. Modular Chassis

12.5.5. Others

12.6. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Truck Classification

12.6.1. Light Duty (Class 1 to Class 2)

12.6.2. Medium Duty (Class 3 to Class 6)

12.6.3. Heavy Duty (Class 7 & Class 8)

12.7. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Installation

12.7.1. Company-fitted

12.7.2. Retrofitted

12.8. Key Country Analysis – Europe Electric Truck Chassis Market Size Analysis & Forecast, 2017-2031

12.8.1. Germany

12.8.2. France

12.8.3. U.K.

12.8.4. Italy

12.8.5. Spain

12.8.6. Nordic Region

12.8.7. Rest of Europe

13. Asia Pacific Electric Truck Chassis Market

13.1. Market Snapshot

13.2. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Consumption

13.2.1. Domestic

13.2.1.1. Sales in Country

13.2.1.2. Manufacturing in Country

13.2.2. International

13.2.2.1. Import in Country

13.2.2.2. Export from Country

13.3. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Number of Axles

13.3.1. Double-axle Chassis

13.3.2. Tri-axle Chassis

13.3.3. Four-axle Chassis

13.3.4. Others (Five-axle Chassis, etc.)

13.4. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Material

13.4.1. Aluminum Alloy

13.4.2. Mild Steel

13.4.3. High-speed Steel

13.4.4. Others (Carbon Fiber Composite, etc.)

13.5. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Type

13.5.1. Backbone Chassis

13.5.2. Ladder Chassis

13.5.3. Monocoque Chassis

13.5.4. Modular Chassis

13.5.5. Others

13.6. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Truck Classification

13.6.1. Light Duty (Class 1 to Class 2)

13.6.2. Medium Duty (Class 3 to Class 6)

13.6.3. Heavy Duty (Class 7 & Class 8)

13.7. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Installation

13.7.1. Company-fitted

13.7.2. Retrofitted

13.8. Key Country Analysis – Asia Pacific Electric Truck Chassis Market Size Analysis & Forecast, 2017-2031

13.8.1. China

13.8.2. India

13.8.3. Japan

13.8.4. ASEAN Countries

13.8.5. South Korea

13.8.6. ANZ

13.8.7. Rest of Asia Pacific

14. Middle East & Africa Electric Truck Chassis Market

14.1. Market Snapshot

14.2. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Consumption

14.2.1. Domestic

14.2.1.1. Sales in Country

14.2.1.2. Manufacturing in Country

14.2.2. International

14.2.2.1. Import in Country

14.2.2.2. Export from Country

14.3. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Number of Axles

14.3.1. Double-axle Chassis

14.3.2. Tri-axle Chassis

14.3.3. Four-axle Chassis

14.3.4. Others (Five-axle Chassis, etc.)

14.4. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Material

14.4.1. Aluminum Alloy

14.4.2. Mild Steel

14.4.3. High-speed Steel

14.4.4. Others (Carbon Fiber Composite, etc.)

14.5. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Type

14.5.1. Backbone Chassis

14.5.2. Ladder Chassis

14.5.3. Monocoque Chassis

14.5.4. Modular Chassis

14.5.5. Others

14.6. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Truck Classification

14.6.1. Light Duty (Class 1 to Class 2)

14.6.2. Medium Duty (Class 3 to Class 6)

14.6.3. Heavy Duty (Class 7 & Class 8)

14.7. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Installation

14.7.1. Company-fitted

14.7.2. Retrofitted

14.8. Key Country Analysis – Middle East & Africa Electric Truck Chassis Market Size Analysis & Forecast, 2017-2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Turkey

14.8.4. Rest of Middle East & Africa

15. South America Electric Truck Chassis Market

15.1. Market Snapshot

15.2. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Consumption

15.2.1. Domestic

15.2.1.1. Sales in Country

15.2.1.2. Manufacturing in Country

15.2.2. International

15.2.2.1. Import in Country

15.2.2.2. Export from Country

15.3. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Number of Axles

15.3.1. Double-axle Chassis

15.3.2. Tri-axle Chassis

15.3.3. Four-axle Chassis

15.3.4. Others (Five-axle Chassis, etc.)

15.4. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Material

15.4.1. Aluminum Alloy

15.4.2. Mild Steel

15.4.3. High-speed Steel

15.4.4. Others (Carbon Fiber Composite, etc.)

15.5. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Chassis Type

15.5.1. Backbone Chassis

15.5.2. Ladder Chassis

15.5.3. Monocoque Chassis

15.5.4. Modular Chassis

15.5.5. Others

15.6. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Truck Classification

15.6.1. Light Duty (Class 1 to Class 2)

15.6.2. Medium Duty (Class 3 to Class 6)

15.6.3. Heavy Duty (Class 7 & Class 8)

15.7. Electric Truck Chassis Market Volume (Units), Value (US$ Mn) Analysis & Forecast, 2017-2031, by Installation

15.7.1. Company-fitted

15.7.2. Retrofitted

15.8. Key Country Analysis – South America Electric Truck Chassis Market Size Analysis & Forecast, 2017-2031

15.8.1. Brazil

15.8.2. Argentina

15.8.3. Rest of South America

16. Competitive Landscape

16.1. Company Share Analysis/ Brand Share Analysis, 2021

16.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

17. Company Profile/ Key Players

17.1. Tata Motors Limited

17.1.1. Company Overview

17.1.2. Company Footprints

17.1.3. Production Locations

17.1.4. Product Portfolio

17.1.5. Competitors & Customers

17.1.6. Subsidiaries & Parent Organization

17.1.7. Recent Developments

17.1.8. Financial Analysis

17.1.9. Profitability

17.1.10. Revenue Share

17.2. Infraprime Logistics Technologies Pvt. Ltd.

17.2.1. Company Overview

17.2.2. Company Footprints

17.2.3. Production Locations

17.2.4. Product Portfolio

17.2.5. Competitors & Customers

17.2.6. Subsidiaries & Parent Organization

17.2.7. Recent Developments

17.2.8. Financial Analysis

17.2.9. Profitability

17.2.10. Revenue Share

17.3. Mercedes-Benz Group AG

17.3.1. Company Overview

17.3.2. Company Footprints

17.3.3. Production Locations

17.3.4. Product Portfolio

17.3.5. Competitors & Customers

17.3.6. Subsidiaries & Parent Organization

17.3.7. Recent Developments

17.3.8. Financial Analysis

17.3.9. Profitability

17.3.10. Revenue Share

17.4. Saturn EV Ltd.

17.4.1. Company Overview

17.4.2. Company Footprints

17.4.3. Production Locations

17.4.4. Product Portfolio

17.4.5. Competitors & Customers

17.4.6. Subsidiaries & Parent Organization

17.4.7. Recent Developments

17.4.8. Financial Analysis

17.4.9. Profitability

17.4.10. Revenue Share

17.5. Mahindra & Mahindra Ltd.

17.5.1. Company Overview

17.5.2. Company Footprints

17.5.3. Production Locations

17.5.4. Product Portfolio

17.5.5. Competitors & Customers

17.5.6. Subsidiaries & Parent Organization

17.5.7. Recent Developments

17.5.8. Financial Analysis

17.5.9. Profitability

17.5.10. Revenue Share

17.6. BYD Auto Co., Ltd.

17.6.1. Company Overview

17.6.2. Company Footprints

17.6.3. Production Locations

17.6.4. Product Portfolio

17.6.5. Competitors & Customers

17.6.6. Subsidiaries & Parent Organization

17.6.7. Recent Developments

17.6.8. Financial Analysis

17.6.9. Profitability

17.6.10. Revenue Share

17.7. Volvo Group

17.7.1. Company Overview

17.7.2. Company Footprints

17.7.3. Production Locations

17.7.4. Product Portfolio

17.7.5. Competitors & Customers

17.7.6. Subsidiaries & Parent Organization

17.7.7. Recent Developments

17.7.8. Financial Analysis

17.7.9. Profitability

17.7.10. Revenue Share

17.8. PACCAR Inc.

17.8.1. Company Overview

17.8.2. Company Footprints

17.8.3. Production Locations

17.8.4. Product Portfolio

17.8.5. Competitors & Customers

17.8.6. Subsidiaries & Parent Organization

17.8.7. Recent Developments

17.8.8. Financial Analysis

17.8.9. Profitability

17.8.10. Revenue Share

17.9. Scania AB

17.9.1. Company Overview

17.9.2. Company Footprints

17.9.3. Production Locations

17.9.4. Product Portfolio

17.9.5. Competitors & Customers

17.9.6. Subsidiaries & Parent Organization

17.9.7. Recent Developments

17.9.8. Financial Analysis

17.9.9. Profitability

17.9.10. Revenue Share

17.10. Navistar International Corporation

17.10.1. Company Overview

17.10.2. Company Footprints

17.10.3. Production Locations

17.10.4. Product Portfolio

17.10.5. Competitors & Customers

17.10.6. Subsidiaries & Parent Organization

17.10.7. Recent Developments

17.10.8. Financial Analysis

17.10.9. Profitability

17.10.10. Revenue Share

17.11. Dongfeng Motor Corporation Ltd.

17.11.1. Company Overview

17.11.2. Company Footprints

17.11.3. Production Locations

17.11.4. Product Portfolio

17.11.5. Competitors & Customers

17.11.6. Subsidiaries & Parent Organization

17.11.7. Recent Developments

17.11.8. Financial Analysis

17.11.9. Profitability

17.11.10. Revenue Share

17.12. China FAW Group Corp., Ltd.

17.12.1. Company Overview

17.12.2. Company Footprints

17.12.3. Production Locations

17.12.4. Product Portfolio

17.12.5. Competitors & Customers

17.12.6. Subsidiaries & Parent Organization

17.12.7. Recent Developments

17.12.8. Financial Analysis

17.12.9. Profitability

17.12.10. Revenue Share

17.13. VDL Groep

17.13.1. Company Overview

17.13.2. Company Footprints

17.13.3. Production Locations

17.13.4. Product Portfolio

17.13.5. Competitors & Customers

17.13.6. Subsidiaries & Parent Organization

17.13.7. Recent Developments

17.13.8. Financial Analysis

17.13.9. Profitability

17.13.10. Revenue Share

17.14. Nikola Corporation

17.14.1. Company Overview

17.14.2. Company Footprints

17.14.3. Production Locations

17.14.4. Product Portfolio

17.14.5. Competitors & Customers

17.14.6. Subsidiaries & Parent Organization

17.14.7. Recent Developments

17.14.8. Financial Analysis

17.14.9. Profitability

17.14.10. Revenue Share

17.15. Ford Motor Company

17.15.1. Company Overview

17.15.2. Company Footprints

17.15.3. Production Locations

17.15.4. Product Portfolio

17.15.5. Competitors & Customers

17.15.6. Subsidiaries & Parent Organization

17.15.7. Recent Developments

17.15.8. Financial Analysis

17.15.9. Profitability

17.15.10. Revenue Share

17.16. Ashok Leyland

17.16.1. Company Overview

17.16.2. Company Footprints

17.16.3. Production Locations

17.16.4. Product Portfolio

17.16.5. Competitors & Customers

17.16.6. Subsidiaries & Parent Organization

17.16.7. Recent Developments

17.16.8. Financial Analysis

17.16.9. Profitability

17.16.10. Revenue Share

17.17. Isuzu Motors Ltd.

17.17.1. Company Overview

17.17.2. Company Footprints

17.17.3. Production Locations

17.17.4. Product Portfolio

17.17.5. Competitors & Customers

17.17.6. Subsidiaries & Parent Organization

17.17.7. Recent Developments

17.17.8. Financial Analysis

17.17.9. Profitability

17.17.10. Revenue Share

17.18. Other Key Players

List of Tables

Table 1: Global Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Table 2: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Table 3: Global Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Table 4: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Table 5: Global Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 6: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Table 7: Global Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Table 8: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Table 9: Global Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Table 10: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Table 11: Global Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Table 12: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Table 13: Global Electric Truck Chassis Market Volume (Units) Forecast, by Region, 2017-2031

Table 14: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 15: North America Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Table 16: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Table 17: North America Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Table 18: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Table 19: North America Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 20: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Table 21: North America Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Table 22: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Table 23: North America Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Table 24: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Table 25: North America Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Table 26: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Table 27: North America Electric Truck Chassis Market Volume (Units) Forecast, by Country, 2017-2031

Table 28: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 29: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Table 30: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Table 31: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Table 32: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Table 33: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 34: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Table 35: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Table 36: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Table 37: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Table 38: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Table 39: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Table 40: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Table 41: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Table 42: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 43: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Table 44: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Table 45: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Table 46: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Table 47: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 48: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Table 49: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Table 50: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Table 51: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Table 52: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Table 53: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Table 54: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Table 55: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Table 56: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 57: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Table 58: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Table 59: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Table 60: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Table 61: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 62: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Table 63: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Table 64: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Table 65: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Table 66: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Table 67: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Table 68: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Table 69: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Table 70: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 71: South America Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Table 72: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Table 73: South America Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Table 74: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Table 75: South America Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Table 76: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Table 77: South America Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Table 78: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Table 79: South America Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Table 80: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Table 81: South America Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Table 82: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Table 83: South America Electric Truck Chassis Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Table 84: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 1: Global Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Figure 2: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Figure 3: Global Electric Truck Chassis Market, Incremental Opportunity, by Consumption, Value (US$ Mn), 2022-2031

Figure 4: Global Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Figure 5: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Figure 6: Global Electric Truck Chassis Market, Incremental Opportunity, by Number of Axles, Value (US$ Mn), 2022-2031

Figure 7: Global Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 8: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Figure 9: Global Electric Truck Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Mn), 2022-2031

Figure 10: Global Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Figure 11: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Figure 12: Global Electric Truck Chassis Market, Incremental Opportunity, by Chassis Type, Value (US$ Mn), 2022-2031

Figure 13: Global Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Figure 14: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Figure 15: Global Electric Truck Chassis Market, Incremental Opportunity, by Truck Classification, Value (US$ Mn), 2022-2031

Figure 16: Global Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Figure 17: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Figure 18: Global Electric Truck Chassis Market, Incremental Opportunity, by Installation, Value (US$ Mn), 2022-2031

Figure 19: Global Electric Truck Chassis Market Volume (Units) Forecast, by Region, 2017-2031

Figure 20: Global Electric Truck Chassis Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 21: Global Electric Truck Chassis Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022-2031

Figure 22: North America Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Figure 23: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Figure 24: North America Electric Truck Chassis Market, Incremental Opportunity, by Consumption, Value (US$ Mn), 2022-2031

Figure 25: North America Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Figure 26: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Figure 27: North America Electric Truck Chassis Market, Incremental Opportunity, by Number of Axles, Value (US$ Mn), 2022-2031

Figure 28: North America Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 29: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Figure 30: North America Electric Truck Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Mn), 2022-2031

Figure 31: North America Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Figure 32: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Figure 33: North America Electric Truck Chassis Market, Incremental Opportunity, by Chassis Type, Value (US$ Mn), 2022-2031

Figure 34: North America Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Figure 35: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Figure 36: North America Electric Truck Chassis Market, Incremental Opportunity, by Truck Classification, Value (US$ Mn), 2022-2031

Figure 37: North America Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Figure 38: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Figure 39: North America Electric Truck Chassis Market, Incremental Opportunity, by Installation, Value (US$ Mn), 2022-2031

Figure 40: North America Electric Truck Chassis Market Volume (Units) Forecast, by Country, 2017-2031

Figure 41: North America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 42: North America Electric Truck Chassis Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 43: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Figure 44: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Figure 45: Europe Electric Truck Chassis Market, Incremental Opportunity, by Consumption, Value (US$ Mn), 2022-2031

Figure 46: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Figure 47: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Figure 48: Europe Electric Truck Chassis Market, Incremental Opportunity, by Number of Axles, Value (US$ Mn), 2022-2031

Figure 49: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 50: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Figure 51: Europe Electric Truck Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Mn), 2022-2031

Figure 52: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Figure 53: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Figure 54: Europe Electric Truck Chassis Market, Incremental Opportunity, by Chassis Type, Value (US$ Mn), 2022-2031

Figure 55: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Figure 56: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Figure 57: Europe Electric Truck Chassis Market, Incremental Opportunity, by Truck Classification, Value (US$ Mn), 2022-2031

Figure 58: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Figure 59: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Figure 60: Europe Electric Truck Chassis Market, Incremental Opportunity, by Installation, Value (US$ Mn), 2022-2031

Figure 61: Europe Electric Truck Chassis Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Figure 62: Europe Electric Truck Chassis Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 63: Europe Electric Truck Chassis Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031

Figure 64: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Figure 65: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Figure 66: Asia Pacific Electric Truck Chassis Market, Incremental Opportunity, by Consumption, Value (US$ Mn), 2022-2031

Figure 67: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Figure 68: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Figure 69: Asia Pacific Electric Truck Chassis Market, Incremental Opportunity, by Number of Axles, Value (US$ Mn), 2022-2031

Figure 70: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 71: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Figure 72: Asia Pacific Electric Truck Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Mn), 2022-2031

Figure 73: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Figure 74: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Figure 75: Asia Pacific Electric Truck Chassis Market, Incremental Opportunity, by Chassis Type, Value (US$ Mn), 2022-2031

Figure 76: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Figure 77: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Figure 78: Asia Pacific Electric Truck Chassis Market, Incremental Opportunity, by Truck Classification, Value (US$ Mn), 2022-2031

Figure 79: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Figure 80: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Figure 81: Asia Pacific Electric Truck Chassis Market, Incremental Opportunity, by Installation, Value (US$ Mn), 2022-2031

Figure 82: Asia Pacific Electric Truck Chassis Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Figure 83: Asia Pacific Electric Truck Chassis Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 84: Asia Pacific Electric Truck Chassis Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031

Figure 85: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Figure 86: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Figure 87: Middle East & Africa Electric Truck Chassis Market, Incremental Opportunity, by Consumption, Value (US$ Mn), 2022-2031

Figure 88: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Figure 89: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Figure 90: Middle East & Africa Electric Truck Chassis Market, Incremental Opportunity, by Number of Axles, Value (US$ Mn), 2022-2031

Figure 91: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 92: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Figure 93: Middle East & Africa Electric Truck Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Mn), 2022-2031

Figure 94: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Figure 95: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Figure 96: Middle East & Africa Electric Truck Chassis Market, Incremental Opportunity, by Chassis Type, Value (US$ Mn), 2022-2031

Figure 97: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Figure 98: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Figure 99: Middle East & Africa Electric Truck Chassis Market, Incremental Opportunity, by Truck Classification, Value (US$ Mn), 2022-2031

Figure 100: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Figure 101: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Figure 102: Middle East & Africa Electric Truck Chassis Market, Incremental Opportunity, by Installation, Value (US$ Mn), 2022-2031

Figure 103: Middle East & Africa Electric Truck Chassis Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Figure 104: Middle East & Africa Electric Truck Chassis Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 105: Middle East & Africa Electric Truck Chassis Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031

Figure 106: South America Electric Truck Chassis Market Volume (Units) Forecast, by Consumption, 2017-2031

Figure 107: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Consumption, 2017-2031

Figure 108: South America Electric Truck Chassis Market, Incremental Opportunity, by Consumption, Value (US$ Mn), 2022-2031

Figure 109: South America Electric Truck Chassis Market Volume (Units) Forecast, by Number of Axles, 2017-2031

Figure 110: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Number of Axles, 2017-2031

Figure 111: South America Electric Truck Chassis Market, Incremental Opportunity, by Number of Axles, Value (US$ Mn), 2022-2031

Figure 112: South America Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Material, 2017-2031

Figure 113: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Material, 2017-2031

Figure 114: South America Electric Truck Chassis Market, Incremental Opportunity, by Chassis Material, Value (US$ Mn), 2022-2031

Figure 115: South America Electric Truck Chassis Market Volume (Units) Forecast, by Chassis Type, 2017-2031

Figure 116: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Chassis Type, 2017-2031

Figure 117: South America Electric Truck Chassis Market, Incremental Opportunity, by Chassis Type, Value (US$ Mn), 2022-2031

Figure 118: South America Electric Truck Chassis Market Volume (Units) Forecast, by Truck Classification, 2017-2031

Figure 119: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Truck Classification, 2017-2031

Figure 120: South America Electric Truck Chassis Market, Incremental Opportunity, by Truck Classification, Value (US$ Mn), 2022-2031

Figure 121: South America Electric Truck Chassis Market Volume (Units) Forecast, by Installation, 2017-2031

Figure 122: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Installation, 2017-2031

Figure 123: South America Electric Truck Chassis Market, Incremental Opportunity, by Installation, Value (US$ Mn), 2022-2031

Figure 124: South America Electric Truck Chassis Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Figure 125: South America Electric Truck Chassis Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 126: South America Electric Truck Chassis Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031