The global demand for electric traction systems has witnessed a steady rise in the past few years. Factors such as modernization of passenger railcars and growing urbanization, coupled with increase in electric locomotives, have primarily been the key driving forces for the market in the past few years. Furthermore, rise in induction of air-conditioned coaches has greatly increased the demand for electric traction systems, to complement the increased uptake of power. Significant transformation in railway connectivity, metro connectivity, and other rail-based transports are expected to further propel the market for electric traction systems in the near future.

Transparency Market Research estimates that the market, which was valued in terms of revenue US$342.94 bn in 2016, will reach US$426.54 bn by 2025, at a CAGR of 2.5% from 2017 to 2025.

On the basis of type, the market for electric traction systems has been segmented in the report into electric traction transformer, electric traction motor, electric traction generator, electric traction inverter, electric traction converters, and others.

Of these, the segment of electric traction motor accounted for a massive 63% of the global electric transformer market in 2016. Being one of the most important components of electric traction systems, traction motors find extensive demand across numerous applications. Traction motors act as the primary driving force for all railway vehicles, hence the massive share in the global market. However, the segment is expected to exhibit moderate growth over the forecast period, witnessing a slight decline in its present share in the global market by end of the forecast period.

However, the others segment, which covers the components of electric traction systems that are necessary for the proper functioning of all other traction system components and are required for installation, is expected to lead in terms of growth rate over the report’s forecast period. The growth in all the product segments have been promoting the growth of others segment. The segment is expected to exhibit a 3.5% CAGR over the forecast period, witnessing a substantial rise in its present share by the end of the forecast period.

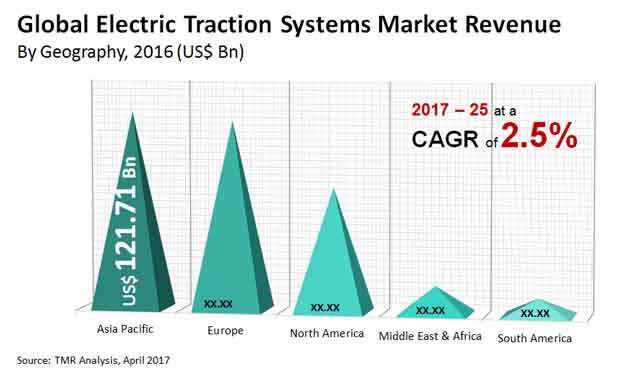

In terms of geography, the market for electric traction systems in Asia Pacific dominated the global market in 2016, accounting more over 35.0% of the global market. China and India held the dominant share in the Asia Pacific electric traction systems market in the said year, followed by Australia and Japan. Improvements in the transpiration infrastructure in the region, which includes metro rail systems, high speed bullet trains, hybrid electric vehicles, and railway connections, have remained key to the strong growth observed for electric traction systems in Asia Pacific. Over the next few years, the rising demand for rolling stock for narrow gauge and industrial railways, including diesel-electric, hybrid, and electric locomotives, will continue to contribute to the positive development of the electric traction systems in this region.

Europe held the second leading position in the global electric traction systems market in terms of revenue contribution in 2016. Russia and Commonwealth of Independent State (CIS) countries are leading the market for electric traction systems, followed by Germany. The market in the region is primarily driven by the gradual shift from diesel-based to diesel-electric locomotives and electric locomotives. Government initiatives toward improving the transportation system, especially railways fuel the growing demand for electric traction systems across Europe, apart from stringent regulations related to the emission of harmful gases from trains or any sort of vehicles.

Some of the leading players in the market are ABB, Ltd. (Switzerland), Alstom S.A., The KON?AR Group, Siemens AG, Delphi Automotive LLP, Voith GmbH , Mitsubishi Electric Corporation, Schneider Electric SE, The Curtiss-Wright Corporation, Prodrive Technologies, Toshiba Corporation, General Electric, Co., CG Power and Industrial Solutions Ltd., Bombardier Inc., American Traction Systems, VEM Group, Caterpillar Inc., TTM Rail - Transtech Melbourne Pty Ltd., Kawasaki Heavy Industries Ltd., Traktionssysteme Austria GmbH, Hyundai Rotem Company , Hitachi, Ltd., and Ansaldo Signalling.

The worldwide interest for electric traction systems is on the rise since the past couple of years. Factors like modernization of traveler railcars and developing urbanization, combined with expansion in electric trains, have fundamentally been the key main impetuses for the market in the previous few years. Besides, ascend in acceptance of cooled mentors has extraordinarily expanded the interest for electric system frameworks, to supplement the expanded take-up of force. Huge change in rail line availability, metro network, and other rail-based vehicles are required to additionally impel the market for electric foothold frameworks sooner rather than later.

With the rapid growth of urbanization, modernization of traveler railcars, and the colossal ascent in the usage of electric trains, the global market for electric traction systems is generating revenues. The enduring rising in rail route traffic in creating and created economies is empowering railroad associations, government specialists, and moving stock makers to focus on modernizing traveler railcars. Plus, the ascent in prominence of AC mentors has additionally upheld the interest for electric traction systems, as force usage of vehicles increment to help ACs.

Demographically, the market for electric traction systems in Asia Pacific earned the largest share in the market in 2016. China and India held the predominant offer in the Asia Pacific electric traction systems market in the said year, trailed by Australia and Japan. Betterment of the transpiration infrastructure in this region, including metro rail systems, high velocity shot trains, half breed electric vehicles, and rail line associations, are key to the growth of this regional market for electric traction systems. In the near future, the rising interest for moving stock for tight check and mechanical rail lines, including diesel-electric, crossover, and electric trains, will keep on adding to the positive improvement of the electric traction systems in this district.

Asia Pacific is the leading region with the largest market share.

Increased rate of urbanization, modernization of passenger railcars, combined with the tremendous rise in the utilization of electric trains, have been the major drivers of the global market for electric traction systems.

The market is projected to reach US$426.54 Bn by 2025.

The market is projected to grow at a CAGR of 2.5% during the forecast period.

The Electric Traction Systems Market is studied from 2017 - 2025.

Section 1 Preface

Section 2 Assumptions and Research Methodology

2.1 Assumptions and Acronyms used

2.2 Research Methodology

Section 3 Executive Summary : Global Electric Traction Systems Market

3.1 Executive Summary

Section 4 Global Electric Traction Systems MarketOverview

4.1 Introduction

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunity

4.3 Global Electric Traction Systems Market Analysis and Forecast, 2016 - 2025

4.3.1 Description

4.4 Global Market Attractiveness Analysis (2016), By Type

4.5 Global Electric Traction Systems Market: Competitive Landscape (2016)

4.5.1 Market Positioning of Key Players , 2016

4.5.2 Competitive strategies adopted by leading players

4.6 Patent Analysis

Section 5 Global Electric Traction Systems Market Analysis, By Type 2016 - 2025

5.1 Global Electric Traction Systems Market, By Type: Definitions

5.2 Global Electric Traction Systems Market, By Type: Key Trends

5.3 Global Electric Traction Systems Market, By Type, 2016 Vs 2025

5.4 Global Electric Traction Systems Market Size and Forecast, By Type, 2016 – 2025

5.4.1 Electric Traction Transformer

5.4.2 Electric Traction Motor

5.4.3 Electric Traction Generator

5.4.4 Electric Traction Inverter

5.4.5 Electric Traction Converter

5.4.6 Others

Section 6 Global Electric Traction Systems Market Analysis, By End-use Indusrty2016 - 2025

6.1 Global Electric Traction Systems Market, By End-use Industry: Definitions

6.2 Global Electric Traction Systems Market, By End-use Industry: Key Trends

6.3 Global Electric Traction Systems Market, By End-use Industry, 2016 Vs 2025

6.4 Global Electric Traction Systems Market Size and Forecast, By End-use Industry,2016 – 2025

6.4.1 Automotive

6.4.2 Oil & Gas

6.4.3 Power Engineering/Electrical Engineering

6.4.4 Mining

6.4.5 Transportation

6.4.6 Others

6.4.5.1 Railways

6.4.5.2 Others

6.4.5.1 Railways By Type

Section 7 Global Electric Traction Systems Market Analysis, by Region 2016 – 2025

7.1 Geographic Scenario, by Revenue

7.2 Global Electric Traction Systems Market Value Share Analysis, by Region

7.3 Global Electric Traction Systems Market Value Share Analysis, by Region 2016 Vs 2025

Section 8 North America Electric Traction Systems Market Analysis, 2016 - 2025

8.1 North America Electric Traction Systems Market: Overview

8.2 North America Electric Traction Systems Market, by Type

8.3 North America Electric Traction Systems Market, by End-use Industry

8.4 North America Electric Traction Systems Market, by Country

Section9 Europe Electric Traction Systems Market Analysis, 2016 - 2025

9.1 Europe Electric Traction Systems Market: Overview

9.2 Europe Electric Traction Systems Market, by Type

9.3 Europe Electric Traction Systems Market, by End-use Industry

9.4 Europe Electric Traction Systems Market, by Country

Section 10 Asia Pacific Electric Traction Systems Market Analysis, 2016 - 2025

10.1 Asia Pacific Electric Traction Systems Market: Overview

10.2 Asia Pacific Electric Traction Systems Market, by Type

10.3 Asia Pacific Electric Traction Systems Market, by End-use Industry

10.4 Asia Pacific Electric Traction Systems Market, by Country

Section 11 South America Electric Traction Systems Market Analysis, 2016 - 2025

11.1 South America Electric Traction Systems Market: Overview

11.2 South America Electric Traction Systems Market, by Type

11.3 South America Electric Traction Systems Market, by End-use Industry

11.4 South America Electric Traction Systems Market, by Country

Section 12 Middle East and Africa Electric Traction Systems Market Analysis, 2016 - 2025

12.1 Middle East and Africa Electric Traction Systems Market: Overview

12.2 Middle East and Africa Electric Traction Systems Market, by Type

12.3 Middle East and Africa Electric Traction Systems Market, by End-use Industry

12.4 Middle East and Africa Electric Traction Systems Market, by Country

Section 13 Company Profiles

13.1 ABB, Ltd.

13.1.1 Company Details

13.1.2 Company Description

13.1.3 Business Overview

13.1.4 SWOT Analysis

13.1.5 Financial Overview

13.1.6 Strategic Overview

13.2 Alstom SA

13.2.1 Company Details

13.2.2 Company Description

13.2.3 Business Overview

13.2.4 SWOT Analysis

13.2.5 Financial Overview

13.2.6 Strategic Overview

13.3 The KON?AR Group

13.3.1 Company Details

13.3.2 Company Description

13.3.3 Business Overview

13.3.4 SWOT Analysis

13.3.5 Financial Overview

13.3.6 Strategic Overview

13.4 Siemens AG

13.4.1 Company Details

13.4.2 Company Description

13.4.3 Business Overview

13.4.4 SWOT Analysis

13.4.5 Financial Overview

13.4.6 Strategic Overview

13.5 Delphi Automotive LLP

13.5.1 Company Details

13.5.2 Company Description

13.5.3 Business Overview

13.5.4 SWOT Analysis

13.5.5 Financial Overview

13.5.6 Strategic Overview

13.6 Voith GmbH

13.6.1 Company Details

13.6.2 Company Description

13.6.3 Business Overview

13.6.4 SWOT Analysis

13.6.5 Financial Overview

13.6.6 Strategic Overview

13.7 Mitsubishi Electric Corporation

13.7.1 Company Details

13.7.2 Company Description

13.7.3 Business Overview

13.7.4 SWOT Analysis

13.7.5 Financial Overview

13.7.6 Strategic Overview

13.8 Curtiss-Wright Corporation

13.8.1 Company Details

13.8.2 Company Description

13.8.3 Business Overview

13.8.4 SWOT Analysis

13.8.5 Financial Overview

13.8.6 Strategic Overview

13.9 Prodrive Technologies

13.9.1 Company Details

13.9.2 Company Description

13.9.3 Business Overview

13.9.4 SWOT Analysis

13.9.5 Financial Overview

13.9.6 Strategic Overview

13.10 Toshiba Corporation

13.10.1 Company Details

13.10.2 Company Description

13.10.3 Business Overview

13.10.4 SWOT Analysis

13.10.5 Financial Overview

13.10.6 Strategic Overview

13.11 General Electric, Co.

13.11.1 Company Details

13.11.2 Company Description

13.11.3 Business Overview

13.11.4 SWOT Analysis

13.11.5 Financial Overview

13.11.6 Strategic Overview

13.12 CG Power and Industrial Solutions Ltd.

13.12.1 Company Details

13.12.2 Company Description

13.12.3 Business Overview

13.12.4 SWOT Analysis

13.12.5 Financial Overview

13.12.6 Strategic Overview

13.13 Bombardier Inc.

13.13.1 Company Details

13.13.2 Company Description

13.13.3 Business Overview

13.13.4 SWOT Analysis

13.13.5 Financial Overview

13.13.6 Strategic Overview

13.14 American Traction Systems

13.14.1 Company Details

13.14.2 Company Description

13.14.3 Business Overview

13.14.4 SWOT Analysis

13.14.5 Financial Overview

13.14.6 Strategic Overview

13.15 VEM Group

13.15.1 Company Details

13.15.2 Company Description

13.15.3 Business Overview

13.15.4 SWOT Analysis

13.15.5 Financial Overview

13.15.6 Strategic Overview

13.16 Caterpillar Inc.

13.16.1 Company Details

13.16.2 Company Description

13.16.3 Business Overview

13.16.4 SWOT Analysis

13.16.5 Financial Overview

13.16.6 Strategic Overview

13.17 TTM Rail - Transtech Melbourne Pty Ltd

13.17.1 Company Details

13.17.2 Company Description

13.17.3 Business Overview

13.17.4 SWOT Analysis

13.17.5 Financial Overview

13.17.6 Strategic Overview

13.18 Kawasaki Heavy Industries Ltd.

13.18.1 Company Details

13.18.2 Company Description

13.18.3 Business Overview

13.18.4 SWOT Analysis

13.18.5 Financial Overview

13.18.6 Strategic Overview

13.19 Traktionssysteme Austria GmbH

13.19.1 Company Details

13.19.2 Company Description

13.19.3 Business Overview

13.19.4 SWOT Analysis

13.19.5 Financial Overview

13.19.6 Strategic Overview

13.20 Hyundai Rotem Company

13.20.1 Company Details

13.20.2 Company Description

13.20.3 Business Overview

13.20.4 SWOT Analysis

13.20.5 Financial Overview

13.20.6 Strategic Overview

13.21 Hitachi, Ltd.

13.21.1 Company Details

13.21.2 Company Description

13.21.3 Business Overview

13.21.4 SWOT Analysis

13.21.5 Financial Overview

13.21.6 Strategic Overview

13.22 Ansaldo Signalling and Transportation Systems

13.22.1 Company Details

13.22.2 Company Description

13.22.3 Business Overview

13.22.4 SWOT Analysis

13.22.5 Financial Overview

13.22.6 Strategic Overview

13.23 Skoda Transpiration a.s.

13.23.1 Company Details

13.23.2 Company Description

13.23.3 Business Overview

13.23.4 SWOT Analysis

13.23.5 Financial Overview

13.23.6 Strategic Overview

13.24 Wabtec Corporation

13.24.1 Company Details

13.24.2 Company Description

13.24.3 Business Overview

13.24.4 SWOT Analysis

13.24.5 Financial Overview

13.24.6 Strategic Overview

13.25 Schneider Electric SE

13.25.1 Company Details

13.25.2 Company Description

13.25.3 Business Overview

13.25.4 SWOT Analysis

13.25.5 Financial Overview

13.25.6 Strategic Overview

List of Tables

TABLE 01 Number of Patents, by Region, 2011–2016

TABLE 02 Global Electric Traction Systems Market Size and Forecast, by Type, 2016 – 2025

TABLE 03 Global Electric Traction Systems Market Size and Forecast, by End Use Industry, 2016 – 2025

TABLE 04 Global Electric Traction Systems Market Size and Forecast, by Transportation, 2016 – 2025

TABLE 05 Global Electric Traction Systems Market Size and Forecast, Railways by Type, 2016 – 2025

TABLE 06 North America Electric Traction Systems Market Size (USD Bn) Forecast, by Type, 2016–2025

TABLE 07 North America Electric Traction Systems Market Size (USD Bn) Forecast, by End-use Industry, 2016 – 2025

TABLE 08 North America Electric Traction Systems Market Size (USD Bn) Forecast, by Transportation, 2016–2025

TABLE 09 North America Electric Traction Systems Market Size (USD Bn) Forecast, by Railways, by Type, 2016–2025

TABLE 10 North America Electric Traction Systems Market Size (USD Bn) Forecast, by Country, 2016–2025

TABLE 11 Europe Electric Traction Systems Market Size (USD Bn) Forecast, by Type, 2016–2025

TABLE 12 Europe Electric Traction Systems Market Size (USD Bn) Forecast, by End-use Industry, 2016 – 2025

TABLE 13 Europe Electric Traction Systems Market Size (USD Bn) Forecast, by Transportation, 2016–2025

TABLE 14 Europe Electric Traction Systems Market Size (USD Bn) Forecast, by Railways, by Type, 2016–2025

TABLE 15 Europe Electric Traction Systems Market Size (USD Bn) Forecast, by Country, 2016–2025

TABLE 16 Asia Pacific Electric Traction Systems Market Size (USD Bn) Forecast, by Type, 2016–2025

TABLE 17 Asia Pacific Electric Traction Systems Market Size (USD Bn) Forecast, by End-use Industry, 2016 – 2025

TABLE 18 Asia Pacific Electric Traction Systems Market Size (USD Bn) Forecast, by Transportation, 2016–2025

TABLE 19 Asia Pacific Electric Traction Systems Market Size (USD Bn) Forecast, by Railways, by Type, 2016–2025

TABLE 20 Asia Pacific Electric Traction Systems Market Size (USD Bn) Forecast, by Country, 2016–2025

TABLE 21 South America Electric Traction Systems Market Size (USD Bn) Forecast, by Type, 2016–2025

TABLE 22 South America Electric Traction Systems Market Size (USD Bn) Forecast, by End-use Industry, 2016 – 2025

TABLE 23 South America Electric Traction Systems Market Size (USD Bn) Forecast, by Transportation, 2016–2025

TABLE 24 South America Electric Traction Systems Market Size (USD Bn) Forecast, by Railways, by Type, 2016–2025

TABLE 25 South America Electric Traction Systems Market Size (USD Bn) Forecast, by Country, 2016–2025

TABLE 26 Middle East & Africa Electric Traction Systems Market Size (USD Bn) Forecast, by Type, 2016–2025

TABLE 27 Middle East & Africa Electric Traction Systems Market Size (USD Bn) Forecast, by End-use Industry, 2016 – 2025

TABLE 28 Middle East & Africa Electric Traction Systems Market Size (USD Bn) Forecast, by Transportation, 2016–2025

TABLE 29 Middle East & Africa Electric Traction Systems Market Size (USD Bn) Forecast, by Railways, by Type, 2016–2025

TABLE 30 Middle East & Africa Electric Traction Systems Market Size (USD Bn) Forecast, by Country, 2016–2025

List of Figures

FIG. 01 Global Electric Traction Systems Market Analysis and Forecast, 2016 – 2025 (USD Bn)

FIG. 02 Global Electric Traction Systems Market: Market Attractiveness Analysis (2016), By Type

FIG. 03 Global Electric Traction Systems Market: Competitive Landscape (2016)

FIG. 04 Number of Patents Filed Globally, 2011–2016

FIG. 05 Global Electric Traction Systems Market, by Type, 2016 Vs 2025

FIG. 06 Global Electric Traction Systems Market Size and Forecast, by Electric Traction Transformer, 2016-2025 (USD Bn)

FIG. 07 Global Electric Traction Systems Market Size and Forecast, by Electric Traction Motor, 2016-2025 (USD Bn)

FIG. 08 Global Electric Traction Systems Market Size and Forecast, by Electric Traction Generator, 2016-2025 (USD Bn

FIG. 09 Global Electric Traction Systems Market Size and Forecast, by Electric Traction Inverter, 2016-2025 (USD Bn)

FIG. 10 Global Electric Traction Systems Market Size and Forecast, by Electric Traction Converter, 2016-2025 (USD Bn)

FIG. 11 Global Electric Traction Systems Market Size and Forecast, by Others, 2016-2025 (USD Bn)

FIG. 12 Global Electric Traction Systems Market, by End Use Industry, 2016 Vs 2025

FIG. 13 Global Electric Traction Systems Market Size and Forecast, by Automotive, 2016-2025 (USD Bn)

FIG. 14 Global Electric Traction Systems Market Size and Forecast, by Oil & Gas, 2016-2025 (USD Bn)

FIG. 15 Global Electric Traction Systems Market Size and Forecast, by Power Engineering / Electrical Engineering, 2016-2025 (USD Bn)

FIG. 16 Global Electric Traction Systems Market Size and Forecast, by Mining, 2016-2025 (USD Bn)

FIG. 17 Global Electric Traction Systems Market Size and Forecast, by Mining, 2016-2025 (USD Bn

FIG. 18 Global Electric Traction Systems Market Size and Forecast, by Mining, 2016-2025 (USD Bn)

FIG. 19 Global Electric Traction Systems Market Size and Forecast, Transportation by Railways, 2016-2025 (USD Bn)

FIG. 20 Global Electric Traction Systems Market Size and Forecast, Transportation by Others, 2016-2025 (USD Bn)

FIG. 21 Global Electric Traction Systems Market, Railways by Type, 2016 Vs 2025

FIG. 22 Global Electric Traction Systems Market Value Share Analysis, by Region, 2016 Vs 2025

FIG. 23 North America Electric Traction Systems Market Revenue Share Analysis, by Type, 2016 and 2025

FIG. 24 North America Electric Traction Systems Market Revenue Share Analysis, by End-use Industry, 2016 and 2025

FIG. 25 North America Electric Traction Systems Market Revenue Share Analysis, by Country, 2016 and 2025

FIG. 26 Europe Electric Traction Systems Market Revenue Share Analysis, by Type, 2016 and 2025

FIG. 27 Europe Electric Traction Systems Market Revenue Share Analysis, by End-use Industry, 2016 and 2025

FIG. 28 Europe Electric Traction Systems Market Revenue Share Analysis, by Country, 2016 and 2025

FIG. 29 Asia Pacific Electric Traction Systems Market Revenue Share Analysis, by Type, 2016 and 2025

FIG. 30 Asia Pacific Electric Traction Systems Market Revenue Share Analysis, by End-use Industry, 2016 and 2025

FIG. 31 Asia Pacific Electric Traction Systems Market Revenue Share Analysis, by Country, 2016 and 2025

FIG. 32 South America Electric Traction Systems Market Revenue Share Analysis, by Type, 2016 and 2025

FIG. 33 South America Electric Traction Systems Market Revenue Share Analysis, by End-use Industry, 2016 and 2025

FIG. 34 South America Electric Traction Systems Market Revenue Share Analysis, by Country, 2016 and 2025

FIG. 35 Middle East & Africa Electric Traction Systems Market Revenue Share Analysis, by Type, 2016 and 2025

FIG. 36 Middle East & Africa Electric Traction Systems Market Revenue Share Analysis, by End-use Industry, 2016 and 2025

FIG. 37 Middle East & Africa Electric Traction Systems Market Revenue Share Analysis, by Country, 2016 and 2025