Analysts’ viewpoint on Electric Motorcycle and Scooter Market Scenario

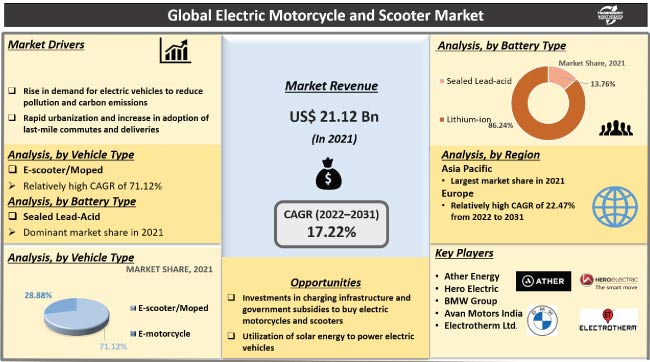

Rise in demand for eco-friendly and fuel-efficient vehicles is driving the global electric motorcycle and scooter market. Adoption of electric vehicles helps reduce carbon emissions and the dependence on fossil fuels. Demand for e-sports bikes is increasing among the young population. Key players operating in the market are offering cost-effective e-scooters and e-motorcycles with high performance and cutting-edge benefits to enhance their share. Players are also developing electric vehicles that are safe to drive on different types of roads and in all weather conditions. Sealed lead-acid and lithium-ion batteries are predominantly used to power electric motorcycles and scooters. Key players are increasingly offering batteries with high range and high-temperature resistance to boost their market share.

Electric scooters and motorcycles are two-wheeled vehicles powered by rechargeable batteries. They are used for daily commutes and last-mile deliveries. Electric scooters and motorcycles are also manufactured for cruising and racing purposes. An electric motor powers electric two-wheeler motorcycles instead of a fuel engine that runs on gasoline or diesel. The motor is powered by a rechargeable battery. The latest electric motorcycles and scooters in 2022 comprise plug-in charging options compared to earlier vehicles that were charged after removal of the battery. Electrification of vehicles is structurally transforming the transportation industry. Electric moped motorcycles run on a battery (i.e. lithium-ion battery) and DC motor to ensure adequate power transmission.

Increase in adoption of electric vehicles and rise in disposable income are contributing to the electric motorcycle market growth. Governments across the globe are offering subsidies to boost the demand for electric scooters and motorcycles. Implementation of stringent regulations for reducing pollution and vehicle emission is also leading to a rise in usage of electric vehicles. The Internal Combustion (IC) engine burns petrol or diesel, and generates carbon dioxide as a byproduct, which leads to air pollution. Thus, governments are enacting several norms and raising awareness among manufacturers and consumers to adopt electric vehicles in order to limit environmental pollution. The U.S., China, France, and Germany aim to reduce emission levels of vehicles by using advanced manufacturing and processing technologies.

Rapid urbanization and increase in demand for electric two-wheelers in urban areas are fueling the electric scooter market size. Most of the global population is shifting to urban areas for better opportunities. This migration is expected to boost the demand for electric vehicles for last-mile commutes and deliveries. Furthermore, the urban infrastructure in many cities is integrated with technologies that support the usage of electric mobility scooters.

Continuous increase in urban population is creating a gap between demand and supply of public transportation. This is creating opportunities for new players to develop cost-effective and safe electric vehicles. Players must focus on technological advancements in electric motorcycles to increase their operational efficiency.

In terms of vehicle type, the e-scooter/moped segment held major share of the global electric motorcycle and scooter market in 2021. Growth of the segment can be ascribed to the lower cost and ease of maintenance of e-scooters/mopeds than electric motorcycles. Size, weight, and cost of an e-scooter are lower than that of a motorcycle. E-scooters are also easy to maintain, which proves cost-effective for customers during aftersales service. The e-motorcycle segment is expected to grow significantly during the forecast period, owing to the rise in popularity of electric scooter sport bikes among the young generation due to their trendy look and performance.

Based on technology, the battery segment held dominant share of the global electric motorcycle and scooter market in 2021. The segment is expected to maintain its dominance during the forecast period. Battery technology is economical compared to the plug-in technology. This has led to an increase in its adoption in electric scooters and motorcycles.

The plug-in technology is gradually gaining traction in the market, as various governments are investing in charging infrastructure and charging stations. Expansion of the charging infrastructure helps overcome low performance and low range drawbacks of electric vehicles. Adoption of plug-in electric scooters is expected to surge in the near future, as companies such as Tata Power, Magenta, and Amara Raja are developing charging infrastructure in various countries across the globe.

Electric scooter industry analysis predicts the dominance of Asia Pacific in the global electric motorcycle and scooter market in terms of volume, due to the rise in production and adoption of electric scooters and motorcycles in China. Implementation of stringent regulations to lower carbon emissions and availability of government subsidies to buy electric vehicles are expected to augment the demand for electric motorcycles and scooters in countries such as China Japan, India, and Taiwan.

Europe is also a prominent market for electric motorcycles and scooters. Sealed lead-acid is the most widely used battery in electric motorcycles and scooters in the region. North America holds considerable share of the market, owing to the presence of key manufacturers of electric motorcycles and scooters in the U.S. and Canada.

The global electric motorcycle and scooter market is fairly consolidated, with the largest players controlling majority of the share. Key players are significantly investing in research and development activities to enhance their market share. Expansion of product portfolios and mergers & acquisitions are major strategies adopted by market players. BMW Group, Electrotherm Ltd., Energica Motor Company, Harley Davidson, Hero Electric, Jiangsu Xinri E-vehicle Co. Ltd., KTM AG, Mahindra & Mahindra Ltd., NIU International, Piaggio Group, Vmoto Limited, Yadea Group Holding Ltd., Ampere Vehicles, Ather Energy, Avan Motors India, Avon Cycles, and Bajaj Auto Ltd. are prominent entities operating in the market.

Each of these players has been profiled in the global electric motorcycle and scooter market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 21.12 Bn |

|

Market Forecast Value in 2031 |

US$ 103.45 Bn |

|

Growth Rate (CAGR) |

17.22% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

Thousand Units for Volume US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, electric scooter industry analysis, electric scooter market size, electric motorcycle market growth etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The electric motorcycle and scooter market was valued at US$ 21.12 Bn in 2021.

The electric motorcycle and scooter market is expected to advance at a CAGR of 17.22% by 2031.

The electric motorcycle and scooter market is expected to reach US$ 103.45 Bn in 2031.

China is a prominent country for electric motorcycles and scooters due to its large population base and rise in demand for advanced transport infrastructure.

The e-scooter/moped segment accounted for the largest share of 70% of the electric motorcycle and scooter market in 2021.

Rise in adoption of plug-in technology and development of electric vehicles with high performance and durability.

Asia Pacific is the most lucrative region of the electric motorcycle and scooter market and is expected to maintain its dominance during the forecast period.

BMW Group, Electrotherm Ltd., Energica Motor Company, Harley Davidson, Hero Electric, Jiangsu Xinri E-vehicle Co. Ltd., KTM AG, Mahindra & Mahindra Ltd., NIU International, Piaggio Group, Vmoto Limited, Yadea Group Holding Ltd., Ampere Vehicles, Ather Energy, Avan Motors India, Avon Cycles, and Bajaj Auto Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Technology Roadmap

3. Industry Ecosystem Analysis

3.1. Value Chain Analysis

3.1.1. Component Manufacturer/ Battery Supplier

3.1.2. Technology Suppliers

3.1.3. Tier 1 Players

3.1.4. 0.5 Tier Players/ Technology Providers

3.2. Vendor Matrix

3.3. Gross Margin Analysis

4. Pricing Analysis

4.1. Cost Structure Analysis

4.2. Profit Margin Analysis

5. COVID-19 Impact Analysis – Electric Motorcycle and Scooter Market

6. Global Electric Motorcycle and Scooter Market, By Battery Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Battery Type

6.2.1. Sealed Lead-acid

6.2.2. Lithium-ion

7. Global Electric Motorcycle and Scooter Market, By Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

7.2.1. E-scooter/Moped

7.2.2. E-motorcycle

8. Global Electric Motorcycle and Scooter Market, By Range

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Range

8.2.1. Below 75 Miles

8.2.2. 75–100 Miles

8.2.3. Above 100 Miles

9. Global Electric Motorcycle and Scooter Market, By Technology

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Technology

9.2.1. Plug-in

9.2.2. Battery

10. Global Electric Motorcycle and Scooter Market, By Voltage Type

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Voltage Type

10.2.1. 36 V

10.2.2. 48 V

10.2.3. 60 V

10.2.4. 72 V

10.2.5. 98 V

11. Global Electric Motorcycle and Scooter Market, By Vehicle Class

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Class

11.2.1. Premium/ Luxury

11.2.2. Economy

12. Global Electric Motorcycle and Scooter Market, by Region

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Middle East & Africa

12.2.5. Latin America

13. North America Electric Motorcycle and Scooter Market

13.1. Market Snapshot

13.2. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Battery Type

13.2.1. Sealed Lead-acid

13.2.2. Lithium-ion

13.3. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.3.1. E-scooter/Moped

13.3.2. E-motorcycle

13.4. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Range

13.4.1. Below 75 Miles

13.4.2. 75–100 Miles

13.4.3. Above 100 Miles

13.5. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Technology

13.5.1. Plug-in

13.5.2. Battery

13.6. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Voltage Type

13.6.1. 36 V

13.6.2. 48 V

13.6.3. 60 V

13.6.4. 72 V

13.6.5. 98 V

13.7. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Class

13.7.1. Premium/ Luxury

13.7.2. Economy

13.8. Key Country Analysis – North America Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031

13.8.1. U.S.

13.8.2. Canada

14. Europe Electric Motorcycle and Scooter Market

14.1. Market Snapshot

14.2. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Battery Type

14.2.1. Sealed Lead-acid

14.2.2. Lithium-ion

14.3. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

14.3.1. E-scooter/Moped

14.3.2. E-motorcycle

14.4. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Range

14.4.1. Below 75 Miles

14.4.2. 75–100 Miles

14.4.3. Above 100 Miles

14.5. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Technology

14.5.1. Plug-in

14.5.2. Battery

14.6. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Voltage Type

14.6.1. 36 V

14.6.2. 48 V

14.6.3. 60 V

14.6.4. 72 V

14.6.5. 98 V

14.7. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Class

14.7.1. Premium/ Luxury

14.7.2. Economy

14.8. Key Country Analysis – Europe Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031

14.8.1. Germany

14.8.2. U. K.

14.8.3. France

14.8.4. Italy

14.8.5. Spain

14.8.6. Nordic Countries

14.8.7. Russia & CIS

14.8.8. Rest of Europe

15. Asia Pacific Electric Motorcycle and Scooter Market

15.1. Market Snapshot

15.2. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Battery Type

15.2.1. Sealed Lead-acid

15.2.2. Lithium-ion

15.3. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

15.3.1. E-scooter/Moped

15.3.2. E-motorcycle

15.4. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Range

15.4.1. Below 75 Miles

15.4.2. 75–100 Miles

15.4.3. Above 100 Miles

15.5. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Technology

15.5.1. Plug-in

15.5.2. Battery

15.6. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Voltage Type

15.6.1. 36 V

15.6.2. 48 V

15.6.3. 60 V

15.6.4. 72 V

15.6.5. 98 V

15.7. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Class

15.7.1. Premium/ Luxury

15.7.2. Economy

15.8. Key Country Analysis – Asia Pacific Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031

15.8.1. China

15.8.2. India

15.8.3. Japan

15.8.4. ASEAN Countrie

15.8.5. South Korea

15.8.6. ANZ

15.8.7. Rest of Asia Pacific

16. Middle East & Africa Electric Motorcycle and Scooter Market

16.1. Market Snapshot

16.2. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Battery Type

16.2.1. Sealed Lead-acid

16.2.2. Lithium-ion

16.3. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

16.3.1. E-scooter/Moped

16.3.2. E-motorcycle

16.4. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Range

16.4.1. Below 75 Miles

16.4.2. 75–100 Miles

16.4.3. Above 100 Miles

16.5. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Technology

16.5.1. Plug-in

16.5.2. Battery

16.6. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Voltage Type

16.6.1. 36 V

16.6.2. 48 V

16.6.3. 60 V

16.6.4. 72 V

16.6.5. 98 V

16.7. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Class

16.7.1. Premium/ Luxury

16.7.2. Economy

16.8. Key Country Analysis – Middle East & Africa Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031

16.8.1. GCC

16.8.2. South Africa

16.8.3. Turkey

16.8.4. Rest of Middle East & Africa

17. Latin America Electric Motorcycle and Scooter Market

17.1. Market Snapshot

17.2. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Battery Type

17.2.1. Sealed Lead-acid

17.2.2. Lithium-ion

17.3. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

17.3.1. E-scooter/Moped

17.3.2. E-motorcycle

17.4. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Range

17.4.1. Below 75 Miles

17.4.2. 75–100 Miles

17.4.3. Above 100 Miles

17.5. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Technology

17.5.1. Plug-in

17.5.2. Battery

17.6. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Voltage Type

17.6.1. 36 V

17.6.2. 48 V

17.6.3. 60 V

17.6.4. 72 V

17.6.5. 98 V

17.7. Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031, By Vehicle Class

17.7.1. Premium/ Luxury

17.7.2. Economy

17.8. Key Country Analysis – Latin America Electric Motorcycle and Scooter Market Size Analysis & Forecast, 2017-2031

17.8.1. Brazil

17.8.2. Mexico

17.8.3. Argentina

17.8.4. Rest of Latin America

18. Competitive Landscape

18.1. Company Share Analysis/ Brand Share Analysis, 2021

18.2. Pricing Comparison Among Key Players

18.3. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

19. Company Profile/ Key Players

19.1. Company

19.1.1. BMW Group

19.1.1.1. Company Overview

19.1.1.2. Company Footprints

19.1.1.3. Production Locations

19.1.1.4. Product Portfolio

19.1.1.5. Competitors & Customers

19.1.1.6. Subsidiaries & Parent Organization

19.1.1.7. Recent Developments

19.1.1.8. Financial Analysis

19.1.1.9. Profitability

19.1.1.10. Revenue Share

19.1.2. Electrotherm Ltd.

19.1.2.1. Company Overview

19.1.2.2. Company Footprints

19.1.2.3. Production Locations

19.1.2.4. Product Portfolio

19.1.2.5. Competitors & Customers

19.1.2.6. Subsidiaries & Parent Organization

19.1.2.7. Recent Developments

19.1.2.8. Financial Analysis

19.1.2.9. Profitability

19.1.2.10. Revenue Share

19.1.3. Energica Motor Company

19.1.3.1. Company Overview

19.1.3.2. Company Footprints

19.1.3.3. Production Locations

19.1.3.4. Product Portfolio

19.1.3.5. Competitors & Customers

19.1.3.6. Subsidiaries & Parent Organization

19.1.3.7. Recent Developments

19.1.3.8. Financial Analysis

19.1.3.9. Profitability

19.1.3.10. Revenue Share

19.1.4. Harley Davidson

19.1.4.1. Company Overview

19.1.4.2. Company Footprints

19.1.4.3. Production Locations

19.1.4.4. Product Portfolio

19.1.4.5. Competitors & Customers

19.1.4.6. Subsidiaries & Parent Organization

19.1.4.7. Recent Developments

19.1.4.8. Financial Analysis

19.1.4.9. Profitability

19.1.4.10. Revenue Share

19.1.5. Hero Electric

19.1.5.1. Company Overview

19.1.5.2. Company Footprints

19.1.5.3. Production Locations

19.1.5.4. Product Portfolio

19.1.5.5. Competitors & Customers

19.1.5.6. Subsidiaries & Parent Organization

19.1.5.7. Recent Developments

19.1.5.8. Financial Analysis

19.1.5.9. Profitability

19.1.5.10. Revenue Share

19.1.6. Jiangsu Xinri E-vehicle Co. Ltd.

19.1.6.1. Company Overview

19.1.6.2. Company Footprints

19.1.6.3. Production Locations

19.1.6.4. Product Portfolio

19.1.6.5. Competitors & Customers

19.1.6.6. Subsidiaries & Parent Organization

19.1.6.7. Recent Developments

19.1.6.8. Financial Analysis

19.1.6.9. Profitability

19.1.6.10. Revenue Share

19.1.7. KTM AG

19.1.7.1. Company Overview

19.1.7.2. Company Footprints

19.1.7.3. Production Locations

19.1.7.4. Product Portfolio

19.1.7.5. Competitors & Customers

19.1.7.6. Subsidiaries & Parent Organization

19.1.7.7. Recent Developments

19.1.7.8. Financial Analysis

19.1.7.9. Profitability

19.1.7.10. Revenue Share

19.1.8. Mahindra & Mahindra Ltd.

19.1.8.1. Company Overview

19.1.8.2. Company Footprints

19.1.8.3. Production Locations

19.1.8.4. Product Portfolio

19.1.8.5. Competitors & Customers

19.1.8.6. Subsidiaries & Parent Organization

19.1.8.7. Recent Developments

19.1.8.8. Financial Analysis

19.1.8.9. Profitability

19.1.8.10. Revenue Share

19.1.9. NIU International

19.1.9.1. Company Overview

19.1.9.2. Company Footprints

19.1.9.3. Production Locations

19.1.9.4. Product Portfolio

19.1.9.5. Competitors & Customers

19.1.9.6. Subsidiaries & Parent Organization

19.1.9.7. Recent Developments

19.1.9.8. Financial Analysis

19.1.9.9. Profitability

19.1.9.10. Revenue Share

19.1.10. Piaggio Group

19.1.10.1. Company Overview

19.1.10.2. Company Footprints

19.1.10.3. Production Locations

19.1.10.4. Product Portfolio

19.1.10.5. Competitors & Customers

19.1.10.6. Subsidiaries & Parent Organization

19.1.10.7. Recent Developments

19.1.10.8. Financial Analysis

19.1.10.9. Profitability

19.1.10.10. Revenue Share

19.1.11. Vmoto Limited

19.1.11.1. Company Overview

19.1.11.2. Company Footprints

19.1.11.3. Production Locations

19.1.11.4. Product Portfolio

19.1.11.5. Competitors & Customers

19.1.11.6. Subsidiaries & Parent Organization

19.1.11.7. Recent Developments

19.1.11.8. Financial Analysis

19.1.11.9. Profitability

19.1.11.10. Revenue Share

19.1.12. Yadea Group Holding Ltd.

19.1.12.1. Company Overview

19.1.12.2. Company Footprints

19.1.12.3. Production Locations

19.1.12.4. Product Portfolio

19.1.12.5. Competitors & Customers

19.1.12.6. Subsidiaries & Parent Organization

19.1.12.7. Recent Developments

19.1.12.8. Financial Analysis

19.1.12.9. Profitability

19.1.12.10. Revenue Share

19.2. Others

19.2.1. North America

19.2.1.1. Zero Motorcycles

19.2.1.2. Z Electric Vehicle

19.2.2. Europe

19.2.2.1. Cezeta

19.2.2.2. Govecs Group

19.2.2.3. Johammer E-Mobility GmbH

19.2.3. Asia

19.2.3.1. Aima Technology Group Co. Ltd.

19.2.3.2. Ampere Vehicles

19.2.3.3. Ather Energy

19.2.3.4. Avan Motors India

19.2.3.5. Avon Cycles

19.2.3.6. Bajaj Auto Ltd.

19.2.3.7. Dongguan Tailing Electric Vehicle Co., Ltd.

19.2.3.8. Emflux Motors

19.2.3.9. Gogoro Inc.

19.2.3.10. Honda Motor Co. Ltd.

19.2.3.11. Okinawa Auto Tech Pvt. Ltd.

19.2.3.12. Shandong Incalcu Electric Vehicle Co., Ltd.

19.2.3.13. Terra Motors Corporation

19.2.3.14. TVS Motor Company

19.2.3.15. Twenty Two Motors Private Limited

19.2.3.16. Zhejiang Luyuan Electric Vehicle Co., Ltd.

List of Tables

Table 1: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Table 2: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 3: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Table 4: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Table 5: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Table 6: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Table 7: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Table 8: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Table 9: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Table 10: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 11: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Table 12: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Table 13: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Table 14: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 15: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Table 16: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 17: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Table 18: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Table 19: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Table 20: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Table 21: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Table 22: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Table 23: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Table 24: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 25: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Table 26: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Table 27: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 28: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 29: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Table 30: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 31: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Table 32: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Table 33: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Table 34: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Table 35: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Table 36: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Table 37: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Table 38: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 39: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Table 40: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Table 41: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 42: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 43: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Table 44: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 45: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Table 46: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Table 47: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Table 48: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Table 49: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Table 50: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Table 51: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Table 52: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 53: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Table 54: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Table 55: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 56: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 57: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Table 58: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 59: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Table 60: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Table 61: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Table 62: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Table 63: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Table 64: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Table 65: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Table 66: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 67: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Table 68: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Table 69: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 70: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 71: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Table 72: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 73: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Table 74: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Table 75: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Table 76: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Table 77: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Table 78: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Table 79: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Table 80: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 81: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Table 82: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Table 83: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 84: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Figure 2: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 3: Global Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 4: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Figure 5: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Figure 6: Global Electric Motorcycle and Scooter Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2022‒2031

Figure 7: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Figure 8: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Figure 9: Global Electric Motorcycle and Scooter Market, Incremental Opportunity, by Range, Value (US$ Bn), 2022‒2031

Figure 10: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Figure 11: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Figure 12: Global Electric Motorcycle and Scooter Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2022‒2031

Figure 13: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Figure 14: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 15: Global Electric Motorcycle and Scooter Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 16: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Figure 17: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Figure 18: Global Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Class Value (US$ Bn), 2022‒2031

Figure 19: Global Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Figure 20: Global Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Figure 21: Global Electric Motorcycle and Scooter Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022‒2031

Figure 22: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Figure 23: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 24: North America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 25: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Figure 26: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Figure 27: North America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2022‒2031

Figure 28: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Figure 29: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Figure 30: North America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Range, Value (US$ Bn), 2022‒2031

Figure 31: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Figure 32: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Figure 33: North America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2022‒2031

Figure 34: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Figure 35: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 36: North America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 37: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Figure 38: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Figure 39: North America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Class Value (US$ Bn), 2022‒2031

Figure 40: North America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 41: North America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 42: North America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 43: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Figure 44: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 45: Europe Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 46: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Figure 47: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Figure 48: Europe Electric Motorcycle and Scooter Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2022‒2031

Figure 49: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Figure 50: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Figure 51: Europe Electric Motorcycle and Scooter Market, Incremental Opportunity, by Range, Value (US$ Bn), 2022‒2031

Figure 52: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Figure 53: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Figure 54: Europe Electric Motorcycle and Scooter Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2022‒2031

Figure 55: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Figure 56: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 57: Europe Electric Motorcycle and Scooter Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 58: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Figure 59: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Figure 60: Europe Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Class Value (US$ Bn), 2022‒2031

Figure 61: Europe Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 62: Europe Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 63: Europe Electric Motorcycle and Scooter Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 64: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Figure 65: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 66: Asia Pacific Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 67: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Figure 68: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Figure 69: Asia Pacific Electric Motorcycle and Scooter Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2022‒2031

Figure 70: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Figure 71: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Figure 72: Asia Pacific Electric Motorcycle and Scooter Market, Incremental Opportunity, by Range, Value (US$ Bn), 2022‒2031

Figure 73: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Figure 74: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Figure 75: Asia Pacific Electric Motorcycle and Scooter Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2022‒2031

Figure 76: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Figure 77: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 78: Asia Pacific Electric Motorcycle and Scooter Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 79: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Figure 80: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Figure 81: Asia Pacific Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Class Value (US$ Bn), 2022‒2031

Figure 82: Asia Pacific Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 83: Asia Pacific Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 84: Asia Pacific Electric Motorcycle and Scooter Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 85: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Figure 86: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 87: Middle East & Africa Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 88: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Figure 89: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Figure 90: Middle East & Africa Electric Motorcycle and Scooter Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2022‒2031

Figure 91: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Figure 92: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Figure 93: Middle East & Africa Electric Motorcycle and Scooter Market, Incremental Opportunity, by Range, Value (US$ Bn), 2022‒2031

Figure 94: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Figure 95: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Figure 96: Middle East & Africa Electric Motorcycle and Scooter Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2022‒2031

Figure 97: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Figure 98: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 99: Middle East & Africa Electric Motorcycle and Scooter Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 100: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Figure 101: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Figure 102: Middle East & Africa Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Class Value (US$ Bn), 2022‒2031

Figure 103: Middle East & Africa Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 104: Middle East & Africa Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 105: Middle East & Africa Electric Motorcycle and Scooter Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 106: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017‒2031

Figure 107: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 108: Latin America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 109: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Battery Type, 2017‒2031

Figure 110: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Battery Type, 2017‒2031

Figure 111: Latin America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Battery Type, Value (US$ Bn), 2022‒2031

Figure 112: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Range, 2017‒2031

Figure 113: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Range, 2017‒2031

Figure 114: Latin America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Range, Value (US$ Bn), 2022‒2031

Figure 115: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Voltage Type, 2017‒2031

Figure 116: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Voltage Type, 2017‒2031

Figure 117: Latin America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2022‒2031

Figure 118: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Technology, 2017‒2031

Figure 119: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 120: Latin America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 121: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Vehicle Class, 2017‒2031

Figure 122: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Vehicle Class 2017‒2031

Figure 123: Latin America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Vehicle Class Value (US$ Bn), 2022‒2031

Figure 124: Latin America Electric Motorcycle and Scooter Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 125: Latin America Electric Motorcycle and Scooter Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 126: Latin America Electric Motorcycle and Scooter Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031