Analysts’ Viewpoint

Growth in industries such as HVAC equipment, consumer appliances, automotive, mining, and industrial machinery is driving the demand for AC electric motors and DC electric motors. The electric motor business is estimated to grow at a steady pace during the forecast period, led by the increase in adoption of mechanization and automation in several industries.

Leading players in the global electric motor industry are focusing on developing innovative and highly-efficient electric motors to meet sustainability challenges. For instance, Turntide Technologies has developed a smart motor based on switched reluctance (SR) technology and smart power electronics to enable end-use industries to save costs and tackle climate change issues. Market players should focus on product development based on R&D in electric motor manufacturing to gain maximum revenue benefits.

An electric motor or electromagnetic motor is an electrical machine that converts energy into motion. These motors can be powered by direct current (DC) sources, such as batteries, or alternating current (AC) sources such as power grids, inverters, or electrical generators. Three-phase AC induction motors are primarily used in commercial or industrial setups due to their reliability and low cost.

Top electric motor manufacturing companies & suppliers are introducing different types of electric motors such as electric forklift motors, electromagnetic motors, single-phase electric motors, and high-torque electric motors to gain a competitive advantage. However, technical issues, electric component failure, and high installation and maintenance costs are likely to adversely affect market statistics in the near future.

Electric motors are used in various end-use industries such as HVAC equipment, automobile, packaging, mining, oil and gas, and industrial automation. These end-use industries are witnessing exponential growth due to rapid industrialization. This is driving the demand for industrial motors. Demand for heating, ventilation, and air conditioning is increasing due to rapid urbanization and the rise in disposable income of consumers in emerging economies.

According to the International Energy Agency (IEA), around 2/3rd of households across the world are estimated to have air conditioners by 2050. Together, China, India, and Indonesia are likely to account for 50% share.

Electric motors are used extensively in the automobile sector. Demand for electric vehicles has been rising across the globe due to the aim to reduce carbon emissions and surge in fuel prices. According to Catalyst research, 4.2 million electric vehicles (EVs) were sold worldwide in the first half of 2022.

Industrial DC motors such as electric forklift motors are used widely in the mining sector. Electric forklift motor offers benefits such as enhanced safety, improved performance, and high efficiency. An increase in demand for electric motors in various end-use industries is anticipated to fuel market expansion during the forecast period.

Energy consumption is expected to increase significantly by 2030. This is likely to adversely impact the environment. Therefore, regional and local governments are adopting measures to use energy-saving equipment in order to reduce electricity wastage.

According to the International Energy Agency, standard electric motors are expected to account for about 45.0% share of global electrical energy consumption in the world. Countries such as the U.S. and China and those in the European Union are implementing regulations to use advanced propulsion technology in order to meet energy efficiency requirements.

Energy-efficient motor (EEM) adopts improved motor design and high-quality materials to reduce motor energy losses, thus enhancing motor efficiency. The cost of energy is anticipated to increase in the near future due to environmental issues and the availability of limited resources. Electric motors account for a major share of electric energy in industries. Thus, the adoption of energy-efficient motors is projected to help save a significant amount of electricity. It would also help reduce the production of greenhouse gases and the total environmental cost of electricity generation.

A large amount of electrical energy is consumed by induction motors for irrigation and industrial purposes in developing economies. In India, the agriculture and industrial sectors are growing at a rapid pace. Similarly, electrical energy consumption is also increasing in the country. Hence, the Government of India is focusing on the usage of energy-efficient electric motors in the agriculture and industrial sectors.

Asia Pacific is anticipated to account for a significant market share during the forecast period owing to rapid urbanization, expansion in various end-use industries, and growth in national and local policies & programs to incorporate energy-saving machines in the region. Additionally, the presence of numerous manufacturers is likely to augment market development in the Asia Pacific. Strategies for the electric motors market keep evolving owing to the changing government policies and systematic adoption of technology in the region.

North America and Europe are anticipated to record considerable market progress in the near future, owing to the rise in demand for electric motors in several end-use industries such as industrial automation and automotive in these regions.

Prominent electric motor manufacturers are investing significantly in comprehensive research and development activities, primarily to introduce innovative products. Expansion of product portfolios and mergers & acquisitions are key strategies adopted by manufacturers.

ABB Group, Allied Motion Technologies Inc., Buhler Motor GmbH., Johnson Electric, Mitsubishi Heavy Industries, Nidec Corporation, Robert Bosch GmbH, Siemens AG, Toshiba Corporation, and WEG are the prominent entities operating in the global electric motors market.

Each of these players has been profiled in the market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

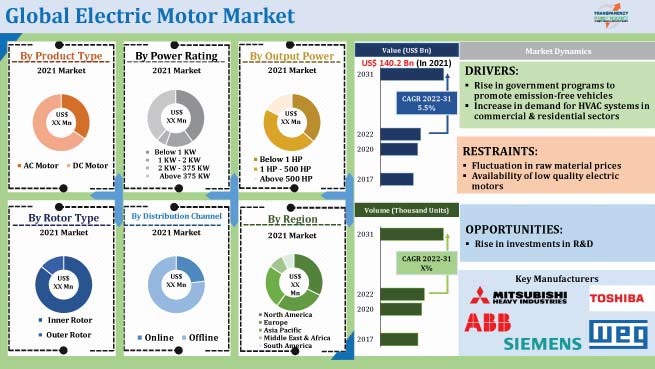

Market Size Value in 2021 |

US$ 140.2 Bn |

|

Market Forecast Value in 2031 |

US$ 237.9 Bn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at regional as well as country level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The electric motor industry was valued at US$ 140.2 Bn in 2021

The business is projected to grow at a CAGR of 5.5% from 2022 to 2031

Rise in government programs to promote emission-free vehicles and increase in demand for HVAC systems in commercial & residential sectors

The AC motor segment held major share of the global market in 2021 and is projected to maintain its share during the forecast period

Asia Pacific is likely to be the most lucrative region in the near future

ABB Group, Allied Motion Technologies Inc., Buhler Motor GmbH, Johnson Electric, Mitsubishi Heavy Industries, Nidec Corporation, Robert Bosch GmbH, Siemens AG, Toshiba Corporation, and WEG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Automotive Industry Overview

5.4.2. Electronics Product Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Product Standard and Regulation Framework

5.9. Technological Overview

5.10. Import Export Analysis

5.11. Global Electric Motor Market Analysis and Forecast, 2017 - 2031

5.11.1. Market Revenue Projection (US$ Bn)

5.11.2. Market Revenue Projection (Thousand Units)

6. Global Electric Motor Market Analysis and Forecast, By Product Type

6.1. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

6.1.1. AC Motor

6.1.1.1. Synchronous

6.1.1.2. Induction

6.1.2. DC Motor

6.1.2.1. Separately Excited

6.1.2.2. Self-excited

6.2. Incremental Opportunity, By Product Type

7. Global Electric Motor Market Analysis and Forecast, By Power Rating

7.1. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Power Rating, 2017 - 2031

7.1.1. Below 1 KW

7.1.2. 1 KW - 2 KW

7.1.3. 2 KW - 375 KW

7.1.4. Above 375 KW

7.2. Incremental Opportunity, By Power Rating

8. Global Electric Motor Market Analysis and Forecast, By Output Power

8.1. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Output Power, 2017 - 2031

8.1.1. Below 1 HP

8.1.2. 1 HP - 500 HP

8.1.3. Above 500 HP

8.2. Incremental Opportunity, By Output Power

9. Global Electric Motor Market Analysis and Forecast, By Rotor Type

9.1. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Rotor Type, 2017 - 2031

9.1.1. Inner Rotor

9.1.2. Outer Rotor

9.2. Incremental Opportunity, By Rotor Type

10. Global Electric Motor Market Analysis and Forecast, By Application

10.1. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

10.1.1. Automotive

10.1.2. Aerospace & Defense

10.1.3. Industrial Machinery

10.1.4. HVAC Equipment

10.1.5. Process Industry

10.1.6. Mining Industry

10.1.7. Others

10.2. Incremental Opportunity, By Application

11. Global Electric Motor Market Analysis and Forecast, By Distribution Channel

11.1. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

11.1.1. Online

11.1.2. Offline

11.1.2.1. Direct Sales

11.1.2.2. Indirect Sales

11.2. Incremental Opportunity, By Distribution Channel

12. North America Electric Motor Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.2.1. Demand Side Analysis

12.2.2. Supply Side Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Supplier Analysis

12.5. Macroeconomic Scenario

12.6. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

12.6.1. AC Motor

12.6.1.1. Synchronous

12.6.1.2. Induction

12.6.2. DC Motor

12.6.2.1. Separately Excited

12.6.2.2. Self-excited

12.7. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Power Rating, 2017 - 2031

12.7.1. Below 1 KW

12.7.2. 1 KW - 2 KW

12.7.3. 2 KW - 375 KW

12.7.4. Above 375 KW

12.8. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Output Power, 2017 - 2031

12.8.1. Below 1 HP

12.8.2. 1 HP - 500 HP

12.8.3. Above 500 HP

12.9. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Rotor Type, 2017 - 2031

12.9.1. Inner Rotor

12.9.2. Outer Rotor

12.10. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, Application, 2017 - 2031

12.10.1. Automotive

12.10.2. Aerospace & Defense

12.10.3. Industrial Machinery

12.10.4. HVAC Equipment

12.10.5. Process Industry

12.10.6. Mining Industry

12.10.7. Others

12.11. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.11.1. Online

12.11.2. Offline

12.11.2.1. Direct Sales

12.11.2.2. Indirect Sales

12.12. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

12.12.1. U.S.

12.12.2. Canada

12.12.3. Rest of North America

12.13. Incremental Opportunity Analysis

13. Europe Electric Motor Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.2.1. Demand Side Analysis

13.2.2. Supply Side Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Key Supplier Analysis

13.5. Macroeconomic Scenario

13.6. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

13.6.1. AC Motor

13.6.1.1. Synchronous

13.6.1.2. Induction

13.6.2. DC Motor

13.6.2.1. Separately Excited

13.6.2.2. Self-excited

13.7. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Power Rating, 2017 - 2031

13.7.1. Below 1 KW

13.7.2. 1 KW - 2 KW

13.7.3. 2 KW - 375 KW

13.7.4. Above 375 KW

13.8. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Output Power, 2017 - 2031

13.8.1. Below 1 HP

13.8.2. 1 HP - 500 HP

13.8.3. Above 500 HP

13.9. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Rotor Type, 2017 - 2031

13.9.1. Inner Rotor

13.9.2. Outer Rotor

13.10. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, Application , 2017 - 2031

13.10.1. Automotive

13.10.2. Aerospace & Defense

13.10.3. Industrial Machinery

13.10.4. HVAC Equipment

13.10.5. Process Industry

13.10.6. Mining Industry

13.10.7. Others

13.11. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.11.1. Online

13.11.2. Offline

13.11.2.1. Direct Sales

13.11.2.2. Indirect Sales

13.12. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

13.12.1. U.K.

13.12.2. Germany

13.12.3. France

13.12.4. Rest of Europe

13.13. Incremental Opportunity Analysis

14. Asia Pacific Electric Motor Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trend Analysis

14.2.1. Demand Side Analysis

14.2.2. Supply Side Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Supplier Analysis

14.5. Macroeconomic Scenario

14.6. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

14.6.1. AC Motor

14.6.1.1. Synchronous

14.6.1.2. Induction

14.6.2. DC Motor

14.6.2.1. Separately Excited

14.6.2.2. Self-excited

14.7. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Power Rating, 2017 - 2031

14.7.1. Below 1 KW

14.7.2. 1 KW - 2 KW

14.7.3. 2 KW - 375 KW

14.7.4. Above 375 KW

14.8. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Output Power, 2017 - 2031

14.8.1. Below 1 HP

14.8.2. 1 HP - 500 HP

14.8.3. Above 500 HP

14.9. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Rotor Type, 2017 - 2031

14.9.1. Inner Rotor

14.9.2. Outer Rotor

14.10. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, Application, 2017 - 2031

14.10.1. Automotive

14.10.2. Aerospace & Defense

14.10.3. Industrial Machinery

14.10.4. HVAC Equipment

14.10.5. Process Industry

14.10.6. Mining Industry

14.10.7. Others

14.11. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.11.1. Online

14.11.2. Offline

14.11.2.1. Direct Sales

14.11.2.2. Indirect Sales

14.12. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

14.12.1. China

14.12.2. India

14.12.3. Japan

14.12.4. Rest of Asia Pacific

14.13. Incremental Opportunity Analysis

15. Middle East & Africa Electric Motor Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Trend Analysis

15.2.1. Demand Side Analysis

15.2.2. Supply Side Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Supplier Analysis

15.5. Macroeconomic Scenario

15.6. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

15.6.1. AC Motor

15.6.1.1. Synchronous

15.6.1.2. Induction

15.6.2. DC Motor

15.6.2.1. Separately Excited

15.6.2.2. Self-excited

15.7. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Power Rating, 2017 - 2031

15.7.1. Below 1 KW

15.7.2. 1 KW - 2 KW

15.7.3. 2 KW - 375 KW

15.7.4. Above 375 KW

15.8. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Output Power, 2017 - 2031

15.8.1. Below 1 HP

15.8.2. 1 HP - 500 HP

15.8.3. Above 500 HP

15.9. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Rotor Type, 2017 - 2031

15.9.1. Inner Rotor

15.9.2. Outer Rotor

15.10. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, Application, 2017 - 2031

15.10.1. Automotive

15.10.2. Aerospace & Defense

15.10.3. Industrial Machinery

15.10.4. HVAC Equipment

15.10.5. Process Industry

15.10.6. Mining Industry

15.10.7. Others

15.11. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.11.1. Online

15.11.2. Offline1

15.11.2.1. Direct Sales

15.11.2.2. Indirect Sales

15.12. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

15.12.1. GCC

15.12.2. South Africa

15.12.3. Rest of Middle East & Africa

15.13. Incremental Opportunity Analysis

16. South America Electric Motor Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Trend Analysis

16.2.1. Demand Side Analysis

16.2.2. Supply Side Analysis

16.3. Price Trend Analysis

16.3.1. Weighted Average Price

16.4. Key Supplier Analysis

16.5. Macroeconomic Scenario

16.6. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

16.6.1. AC Motor

16.6.1.1. Synchronous

16.6.1.2. Induction

16.6.2. DC Motor

16.6.2.1. Separately Excited

16.6.2.2. Self-excited

16.7. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Power Rating, 2017 - 2031

16.7.1. Below 1 KW

16.7.2. 1 KW - 2 KW

16.7.3. 2 KW - 375 KW

16.7.4. Above 375 KW

16.8. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Output Power, 2017 - 2031

16.8.1. Below 1 HP

16.8.2. 1 HP - 500 HP

16.8.3. Above 500 HP

16.9. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Rotor Type, 2017 - 2031

16.9.1. Inner Rotor

16.9.2. Outer Rotor

16.10. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, Application, 2017 - 2031

16.10.1. Automotive

16.10.2. Aerospace & Defense

16.10.3. Industrial Machinery

16.10.4. HVAC Equipment

16.10.5. Process Industry

16.10.6. Mining Industry

16.10.7. Others

16.11. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

16.11.1. Online

16.11.2. Offline

16.11.2.1. Direct Sales

16.11.2.2. Indirect Sales

16.12. Electric Motor Market Size (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

16.12.1. Brazil

16.12.2. Rest of South America

16.13. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Share % - 2021

17.3. Company Profiles (Details – Company Overview, Product Portfolio, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

17.3.1. ABB Group

17.3.1.1. Company Overview

17.3.1.2. Product Portfolio

17.3.1.3. Sales Area/Geographical Presence

17.3.1.4. Revenue

17.3.1.5. Strategy & Business Overview

17.3.2. Allied Motion Technologies Inc.

17.3.2.1. Company Overview

17.3.2.2. Product Portfolio

17.3.2.3. Sales Area/Geographical Presence

17.3.2.4. Revenue

17.3.2.5. Strategy & Business Overview

17.3.3. Buhler Motor GmbH.

17.3.3.1. Company Overview

17.3.3.2. Product Portfolio

17.3.3.3. Sales Area/Geographical Presence

17.3.3.4. Revenue

17.3.3.5. Strategy & Business Overview

17.3.4. Johnson Electric

17.3.4.1. Company Overview

17.3.4.2. Product Portfolio

17.3.4.3. Sales Area/Geographical Presence

17.3.4.4. Revenue

17.3.4.5. Strategy & Business Overview

17.3.5. Mitsubishi Heavy Industries

17.3.5.1. Company Overview

17.3.5.2. Product Portfolio

17.3.5.3. Sales Area/Geographical Presence

17.3.5.4. Revenue

17.3.5.5. Strategy & Business Overview

17.3.6. Nidec Corporation

17.3.6.1. Company Overview

17.3.6.2. Product Portfolio

17.3.6.3. Sales Area/Geographical Presence

17.3.6.4. Revenue

17.3.6.5. Strategy & Business Overview

17.3.7. Robert Bosch GmbH

17.3.7.1. Company Overview

17.3.7.2. Product Portfolio

17.3.7.3. Sales Area/Geographical Presence

17.3.7.4. Revenue

17.3.7.5. Strategy & Business Overview

17.3.8. Siemens AG

17.3.8.1. Company Overview

17.3.8.2. Product Portfolio

17.3.8.3. Sales Area/Geographical Presence

17.3.8.4. Revenue

17.3.8.5. Strategy & Business Overview

17.3.9. Toshiba Corporation

17.3.9.1. Company Overview

17.3.9.2. Product Portfolio

17.3.9.3. Sales Area/Geographical Presence

17.3.9.4. Revenue

17.3.9.5. Strategy & Business Overview

17.3.10. WEG

17.3.10.1. Company Overview

17.3.10.2. Product Portfolio

17.3.10.3. Sales Area/Geographical Presence

17.3.10.4. Revenue

17.3.10.5. Strategy & Business Overview

18. Key Takeaway

18.1. Identification of Potential Market Spaces

18.1.1. By Product Type

18.1.2. By Power Rating

18.1.3. By Output Power

18.1.4. By Rotor Type

18.1.5. By Application

18.1.6. By Distribution Channel

18.1.7. By Region

18.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 2: Global Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 3: Global Electric Motor Market Value (US$ Bn), by Power Ratings, 2017-2031

Table 4: Global Electric Motor Market Volume (Thousand Units), by Power Ratings 2017-2031

Table 5: Global Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Table 6: Global Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Table 7: Global Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Table 8: Global Electric Motor Market Volume (Thousand Units), by Rotor Type 2017-2031

Table 9: Global Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Table 10: Global Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Table 11: Global Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 12: Global Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 13: Global Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Table 14: Global Electric Motor Market Volume (Thousand Units), by Region 2017-2031

Table 15: North America Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 16: North America Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 17: North America Electric Motor Market Value (US$ Bn), by Power Ratings, 2017-2031

Table 18: North America Electric Motor Market Volume (Thousand Units), by Power Ratings 2017-2031

Table 19: North America Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Table 20: North America Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Table 21: North America Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Table 22: North America Electric Motor Market Volume (Thousand Units), by Rotor Type 2017-2031

Table 23: North America Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Table 24: North America Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Table 25: North America Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 26: North America Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 27: North America Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Table 28: North America Electric Motor Market Volume (Thousand Units), by Region 2017-2031

Table 29: Europe Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 30: Europe Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 31: Europe Electric Motor Market Value (US$ Bn), by Power Ratings, 2017-2031

Table 32: Europe Electric Motor Market Volume (Thousand Units), by Power Ratings 2017-2031

Table 33: Europe Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Table 34: Europe Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Table 35: Europe Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Table 36: Europe Electric Motor Market Volume (Thousand Units), by Rotor Type 2017-2031

Table 37: Europe Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Table 38: Europe Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Table 39: Europe Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 40: Europe Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 41: Europe Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Table 42: Europe Electric Motor Market Volume (Thousand Units), by Region 2017-2031

Table 43: Asia Pacific Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 44: Asia Pacific Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 45: Asia Pacific Electric Motor Market Value (US$ Bn), by Power Ratings, 2017-2031

Table 46: Asia Pacific Electric Motor Market Volume (Thousand Units), by Power Ratings 2017-2031

Table 47: Asia Pacific Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Table 48: Asia Pacific Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Table 49: Asia Pacific Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Table 50: Asia Pacific Electric Motor Market Volume (Thousand Units), by Rotor Type 2017-2031

Table 51: Asia Pacific Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Table 52: Asia Pacific Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Table 53: Asia Pacific Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 54: Asia Pacific Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 55: Asia Pacific Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Table 56: Asia Pacific Electric Motor Market Volume (Thousand Units), by Region 2017-2031

Table 57: Middle East & Africa Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 58: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 59: Middle East & Africa Electric Motor Market Value (US$ Bn), by Power Ratings, 2017-2031

Table 60: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Power Ratings 2017-2031

Table 61: Middle East & Africa Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Table 62: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Table 63: Middle East & Africa Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Table 64: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Rotor Type2017-2031

Table 65: Middle East & Africa Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Table 66: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Table 67: Middle East & Africa Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 68: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 69: Middle East & Africa Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Table 70: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Region 2017-2031

Table 71: South America Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 72: South America Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 73: South America Electric Motor Market Value (US$ Bn), by Power Ratings, 2017-2031

Table 74: South America Electric Motor Market Volume (Thousand Units), by Power Ratings 2017-2031

Table 75: South America Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Table 76: South America Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Table 77: South America Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Table 78: South America Electric Motor Market Volume (Thousand Units), by Rotor Type 2017-2031

Table 79: South America Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Table 80: South America Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Table 81: South America Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 82: South America Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 83: South America Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Table 84: South America Electric Motor Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 2: Global Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 3: Global Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2022-2031

Figure 4: Global Electric Motor Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 5: Global Electric Motor Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 6: Global Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2022-2031

Figure 7: Global Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Figure 8: Global Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Figure 9: Global Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Output Power, 2022-2031

Figure 10: Global Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Figure 11: Global Electric Motor Market Volume (Thousand Units), by Rotor Type 2017-2031

Figure 12: Global Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Rotor Type, 2022-2031

Figure 13: Global Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Figure 14: Global Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Figure 15: Global Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2022-2031

Figure 16: Global Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 17: Global Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 18: Global Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2022-2031

Figure 19: Global Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 20: Global Electric Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 21: Global Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2022-2031

Figure 22: North America Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 23: North America Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 24: North America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2022-2031

Figure 25: North America Electric Motor Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 26: North America Electric Motor Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 27: North America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2022-2031

Figure 28: North America Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Figure 29: North America Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Figure 30: North America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Output Power, 2022-2031

Figure 31: North America Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Figure 32: North America Electric Motor Market Volume (Thousand Units), by Rotor Type 2017-2031

Figure 33: North America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Rotor Type, 2022-2031

Figure 34: North America Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Figure 35: North America Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Figure 36: North America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2022-2031

Figure 37: North America Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 38: North America Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 39: North America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2022-2031

Figure 40: North America Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 41: North America Electric Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 42: North America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2022-2031

Figure 43: Europe Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 44: Europe Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 45: Europe Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2022-2031

Figure 46: Europe Electric Motor Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 47: Europe Electric Motor Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 48: Europe Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2022-2031

Figure 49: Europe Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Figure 50: Europe Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Figure 51: Europe Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Output Power, 2022-2031

Figure 52: Europe Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Figure 53: Europe Electric Motor Market Volume (Thousand Units), by Rotor Type 2017-2031

Figure 54: Europe Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Rotor Type, 2022-2031

Figure 55: Europe Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Figure 56: Europe Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Figure 57: Europe Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2022-2031

Figure 58: Europe Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 59: Europe Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 60: Europe Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2022-2031

Figure 61: Europe Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 62: Europe Electric Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 63: Europe Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2022-2031

Figure 64: Asia Pacific Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 65: Asia Pacific Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 66: Asia Pacific Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2022-2031

Figure 67: Asia Pacific Electric Motor Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 68: Asia Pacific Electric Motor Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 69: Asia Pacific Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2022-2031

Figure 70: Asia Pacific Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Figure 71: Asia Pacific Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Figure 72: Asia Pacific Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Output Power, 2022-2031

Figure 73: Asia Pacific Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Figure 74: Asia Pacific Electric Motor Market Volume (Thousand Units), by Rotor Type 2017-2031

Figure 75: Asia Pacific Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Rotor Type, 2022-2031

Figure 76: Asia Pacific Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Figure 77: Asia Pacific Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Figure 78: Asia Pacific Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2022-2031

Figure 79: Asia Pacific Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 80: Asia Pacific Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 81: Asia Pacific Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2022-2031

Figure 82: Asia Pacific Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 83: Asia Pacific Electric Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 84: Asia Pacific Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2022-2031

Figure 85: Middle East & Africa Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 86: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 87: Middle East & Africa Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2022-2031

Figure 88: Middle East & Africa Electric Motor Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 89: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 90: Middle East & Africa Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2022-2031

Figure 91: Middle East & Africa Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Figure 92: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Figure 93: Middle East & Africa Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Output Power, 2022-2031

Figure 94: Middle East & Africa Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Figure 95: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Rotor Type 2017-2031

Figure 96: Middle East & Africa Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Rotor Type, 2022-2031

Figure 97: Middle East & Africa Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Figure 98: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Figure 99: Middle East & Africa Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2022-2031

Figure 100: Middle East & Africa Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 101: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 102: Middle East & Africa Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2022-2031

Figure 103: Middle East & Africa Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 104: Middle East & Africa Electric Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 105: Middle East & Africa Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2022-2031

Figure 106: South America Electric Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 107: South America Electric Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 108: South America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2022-2031

Figure 109: South America Electric Motor Market Value (US$ Bn), by Power Rating, 2017-2031

Figure 110: South America Electric Motor Market Volume (Thousand Units), by Power Rating 2017-2031

Figure 111: South America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Power Rating, 2022-2031

Figure 112: South America Electric Motor Market Value (US$ Bn), by Output Power, 2017-2031

Figure 113: South America Electric Motor Market Volume (Thousand Units), by Output Power 2017-2031

Figure 114: South America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Output Power, 2022-2031

Figure 115: South America Electric Motor Market Value (US$ Bn), by Rotor Type, 2017-2031

Figure 116: South America Electric Motor Market Volume (Thousand Units), by Rotor Type 2017-2031

Figure 117: South America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Rotor Type, 2022-2031

Figure 118: South America Electric Motor Market Value (US$ Bn), by Application, 2017-2031

Figure 119: South America Electric Motor Market Volume (Thousand Units), by Application 2017-2031

Figure 120: South America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2022-2031

Figure 121: South America Electric Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 122: South America Electric Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 123: South America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2022-2031

Figure 124: South America Electric Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 125: South America Electric Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 126: South America Electric Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2022-2031